Form 8-K - Current report

February 28 2024 - 5:00PM

Edgar (US Regulatory)

0001403475FALSE00014034752024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 22, 2024

Bank of Marin Bancorp

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

California | 001-33572 | 20-8859754 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

504 Redwood Blvd., Suite 100, Novato, CA | 94947 |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 763-4520

Not Applicable

(Former name or former address, if changes since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

| ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to 12(b) of the Act: |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, no par value and attached Share Purchase Rights | BMRC | The Nasdaq Stock Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Section 5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(b) Retirement of Director Bank of Marin Bancorp (Nasdaq: BMRC) has announced the retirement of Robert Heller from the Company’s Boards of Directors. Mr. Heller joined the Boards in 2005 and on February 22, 2024 notified the Boards of Directors of his retirement effective May 13, 2024. During his nearly 20-year tenure, Mr. Heller invested his time and expertise as a member of the board’s Asset/Liability, Audit, Compensation, and Nominating & Governance committees, and served as chair of the Wealth Management & Trust committee from 2008 until 2021.

The Press Release is attached as Exhibit 99.1 and incorporated herein by reference.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description | |

| | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: | February 28, 2024 | | BANK OF MARIN BANCORP |

| | | By: | /s/ Tani Girton |

| | | | Tani Girton |

| | | | Executive Vice President |

| | | | and Chief Financial Officer |

Exhibit 99.1

| | | | | |

| |

| FOR IMMEDIATE RELEASE | MEDIA CONTACT: |

| Yahaira Garcia-Perea |

| Marketing & Corporate Communications Manager |

| 916-823-7214 | YahairaGarcia-Perea@bankofmarin.com |

Bank of Marin Bancorp Announces Retirement of Robert Heller

from Board of Directors

NOVATO, CA – February 28, 2024 – Bank of Marin Bancorp (NASDAQ: BMRC) and Bank of Marin, its wholly owned subsidiary, announce the retirement of Robert Heller from its board of directors effective May 13, 2024. Heller joined both Bank of Marin Bancorp and Bank of Marin boards in 2005.

“It has been a great pleasure to serve on the boards of Bank of Marin and Bank of Marin Bancorp, the preeminent community banking institution of northern California, for the last two decades. During this time, the Bank grew its assets five-fold while maintaining a pristine credit quality and paying consistent dividends to its shareholders,” said Heller. “The Bank showed by its strength and resilience the true value that a local community bank brings to the local economy.”

During his nearly 20-year tenure, Heller invested his time and expertise as a member of the board’s Asset/Liability, Audit, Compensation, and Nominating & Governance committees, and served as chair of the Wealth Management & Trust committee from 2008 until 2021.

“Bob’s leadership and professional experience as an economics professor, member of the Board of Governors of the Federal Reserve System, and a corporate executive brought a unique perspective that provided us sage and sound guidance during the banking crises in 2008 and 2023, and every year in between,” said Willie McDevitt, Chair, Bank of Marin Bancorp. “We are honored to have had Bob’s leadership and friendship during the Bank’s growth over the past 19 years. We wish him well in his retirement and thank him for his years of service.”

Born in Cologne, Germany, Heller earned his bachelor's degree from Parsons College, a master’s degree from University of Minnesota, and his doctorate from University of California, Berkeley. He has served on boards of various business and civic organizations—including chairman of Marin General Hospital—and has authored seven books and hundreds of articles on economics, finance, and business.

About Bank of Marin Bancorp

Founded in 1990 and headquartered in Novato, Bank of Marin is the wholly owned subsidiary of Bank of Marin Bancorp (Nasdaq: BMRC). A leading business and community bank in Northern California, with assets of $3.8 billion as of December 31, 2023. Bank of Marin has 27 retail branches and eight commercial banking offices located across 10 counties. Bank of Marin provides commercial banking, personal banking, and wealth management and trust services. Specializing in providing legendary service to its customers and investing in its local communities, Bank of Marin has consistently been ranked one of the “Top Corporate Philanthropists" by the San Francisco Business Times and one of the “Best Places to Work” by the North Bay Business Journal. Bank of Marin Bancorp is included in the Russell 2000 Small-Cap Index and Nasdaq ABA Community Bank Index. For more information, go to www.bankofmarin.com.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

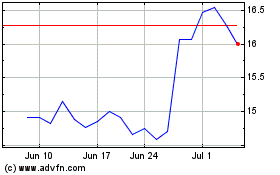

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

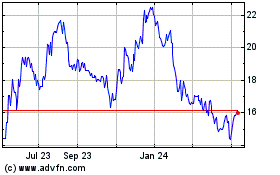

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Apr 2023 to Apr 2024