false

0001858685

0001858685

2024-01-29

2024-01-29

0001858685

BFRI:CommonStockParValue0.001PerShareMember

2024-01-29

2024-01-29

0001858685

BFRI:PreferredStockPurchaseRightsMember

2024-01-29

2024-01-29

0001858685

BFRI:WarrantsToPurchaseCommonStockMember

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 29, 2024

Biofrontera

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40943 |

|

47-3765675 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

120

Presidential Way, Suite 330

Woburn,

Massachusetts |

|

01801 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (781) 245-1325

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

BFRI |

|

The

Nasdaq Stock Market LLC |

| Preferred

Stock Purchase Rights |

|

|

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase common stock |

|

BFRIW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”) (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

On

January 29, 2024, Biofrontera Inc. (the “Company”) entered into an amendment and restatement (the “Amendment”),

effective January 26, 2024, of an Addendum (the “Addendum”), entered into on December 12, 2023, to its Amended and

Restated License and Supply Agreement, dated as of June 16, 2021 (as previously amended, the “LSA”), by and among the Company,

Biofrontera Pharma GmbH (“Pharma”), and Biofrontera Bioscience GmbH (“Bioscience”). The Amendment modifies a

schedule of payments in relation to various financial obligations among the Company, Pharma, Bioscience, and Biofrontera AG (the parent

company of Pharma and Bioscience), including terms relating to payments by the Company to Pharma for purchases of Licensed Products (as

that term is defined in the LSA) under the LSA previously agreed to in the Addendum. Among other things, the Addendum provides that payment

that was due from the Company on January 31, 2024 has been deferred to February 29, 2024.

This

description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment,

a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01 Other Events.

On February 2, 2024, an institutional investor

exercised pre-funded warrants (the “Exercise”) to purchase 888,000 shares of the Company’s common stock, par

value $0.001 per share. The warrants had been issued to the institutional investor pursuant to a public offering (the “Public

Offering”) previously reported on the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission

on November 2, 2023. As a result of the Exercise, all pre-funded warrants issued in the Public Offering have now been exercised.

Following the Exercise, the

total number of the Company’s outstanding shares is 2,572,628.

| Item

9.01 |

Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

February

2, 2024

(Date) |

|

Biofrontera

Inc.

(Registrant) |

| |

|

|

| |

By: |

/s/

E. Fred Leffler III |

| |

|

E.

Fred Leffler III |

| |

|

Chief

Financial Officer |

Exhibit

10.1

Amended

and Restated Addendum to

Amended

and Restated License and Supply Agreement

This

Amended and Restated Addendum to Amended and Restated License and Supply Agreement (the “Amended Addendum”) is made effective

as of January 26, 2024, by and between Biofrontera AG (“AG”), Biofrontera Pharma GmbH (“PHARMA”), and Biofrontera

Bioscience GmbH (“BIOSCIENCE”), each a German corporation/company with its principal offices at Hemmelrather Weg 201, 51377

Leverkusen, Germany, and Biofrontera Inc., a Delaware corporation with its principal place of business at 120 Presidential Way, Woburn,

MA 01801, USA (“INC”). AG, PHARMA, BIOSCIENCE, and INC may collectively be referred to as the “Parties” or individually

as a “Party.” Capitalized terms used but not defined herein shall have the meanings assigned to them in the Agreement, as

defined below.

Recitals

Whereas,

PHARMA, BIOSCIENCE, and INC have entered into an Amended and Restated License and Supply Agreement, dated as of June 16, 2021, as amended

by that certain Corrected Amendment to Amended and Restated License and Supply Agreement, dated as of October 8, 2021 (collectively,

the “Agreement”);

Whereas,

the Parties added additional terms to the Agreement in regard to certain mutual payment obligations between the Parties on December 5,

2023 by executing a certain Addendum to Amended and Restated License and Supply Agreement (the “Addendum”),

Whereas,

the parties wish to modify and restate the terms of the Addendum as described below; and

Now,

therefore, in consideration of the foregoing and the agreements contained herein, the Parties hereto, intending to be legally bound hereby,

agree as follows:

Agreement

| 1. | Payment

Obligations. This Addendum pertains to the payment of the following obligations of each

of the Parties (collectively, the “Payment Obligations”): |

| |

a. |

INC’s

payment of Invoice No. DARM00429 to PHARMA; |

| |

|

|

| |

b. |

INC’s

payment of Invoice No. AR01207 (as adjusted to reflect termination of IT services on December 19, 2022) to PHARMA; |

| |

|

|

| |

c. |

INC’s

payment of Invoices No DARM0043, DARM00444, DARM00484 to PHARMA; |

| |

|

|

| |

d. |

INC’s

payment of invoices No TAR01584 and No.TAR01593 (services issues) to BIOSCIENCE; |

| |

|

|

| |

e. |

BIOSCIENCE’s

payment of Invoice Nos. BioSci 2023-Q3, BioSci 2023-10, and BioSci 2023-09 to INC; |

| |

|

|

| |

f. |

INC’s

payment of an invoice to be issued by PHARMA in relation to PO #11440 (for the purchase of Ameluz); |

| |

g. |

AG’s

reimbursement of its 50% share of the “Third Installment” payment under a certain “Amended Settlement Allocation

Agreement” between INC and AG dated March 31, 2023 to INC; |

| |

|

|

| |

h. |

INC’s

payment of the purchase price variance as described in Section 6.5 of the Agreement for the year ending December 31, 2023 (“2023

PPV”) to PHARMA; |

| |

|

|

| |

i. |

INC’s

payments of invoices to be issued by PHARMA in relation to POs #11272, #11305, and #11154; and |

| |

|

|

| |

j. |

BIOSCIENCE’s

payment of invoices to be issued by INC in relation to clinical services provided to BIOSCIENCE in Q4 2023. |

| 2. | Payment

Schedule. To satisfy the Payment Obligations in full, the Parties agree to the following

payment schedule (collectively, the “Payment Schedule”): |

| |

a. |

On

or before December 20, 2023, INC will pay to PHARMA $2.791M towards DARM0043, DARM00444, DARM00484 and DARM00429. |

| |

|

i. |

This

sum shall be reduced by any outstanding payments from BIOSCIENCE to INC under Invoice Nos. BioSci 2023-Q3, BioSci 2023-10, and BioSci

2023-09 (currently, approximately $137K). |

| |

b. |

On

or before February 29, 2024, INC will pay to PHARMA i) the remainder owed under DARM00429 (approximately $1.4-1.6M), and ii) the

full amount owed under the invoice to be issued by PHARMA in relation to PO # 11440 (estimated at approximately $2.9M). |

| |

|

i. |

On

January 31, 2024, the outstanding sum owed by INC to PHARMA under Section 2(b) above shall be reduced by any outstanding reimbursement

from AG to INC for AG’s 50% share of the “Third Installment” payment under the “Amended Settlement Allocation

Agreement” between INC and AG dated March 31, 2023 (currently, $2.815M) and any outstanding payments from BIOSCIENCE to INC

in relation to clinical services provided to BIOSCIENCE in Q4 2023. Upon this reduction of these amounts owed by INC to PHARMA on

January 31, 2024, the payment obligations by AG and Bioscience to INC referenced in this Section 2(b)(i) shall be deemed to be satisfied

in full. |

| |

c. |

On

or before February 29, 2024, INC will pay to AG invoice AR01207 and to Bioscience invoices No TAR01584 and No.TAR01593. |

| |

|

|

| |

d. |

On

or before April 30, 2024, INC will pay to PHARMA the agreed upon 2023 PPV and any invoices issued by PHARMA in relation to POs #11272,

#11305, and #11154. |

| |

|

i. |

These

payments shall be contingent on INC and PHARMA’s agreement on the 2023 PPV and PHARMA’s timely delivery of the products

described in POs #11272, #11305, and #11154. |

| |

e. |

For

all remaining purchases of “Licensed Products” (as defined by the Agreement) by INC in 2024, INC shall make payment to

PHARMA within the standard payment term described in Section 6.1 of the Agreement. However, if INC fails to make payment in accordance

with Section 6.1 of the Agreement for any reason, INC shall pay the overdue amount to PHARMA within thirty (30) additional days,

in addition to interest calculated in accordance with Section 4.1(d) of the Agreement. |

| |

|

|

| |

|

For

purposes of clarification, for all remaining purchases of Licensed Products by INC in 2024, INC shall not have any rights to any

cure period provided in Section 16.3 other than as set forth in this paragraph 2(d). |

| |

a. |

The

Parties agree that INC’s timely completion of payments described in the Payment Schedule will effectively satisfy the Payment

Obligations, in full. As such, so long as INC makes timely payments under the Payment Schedule, AG shall have no grounds to invoke

the provisions of Section 16.3 of the Agreement or otherwise consider INC to be in breach of the Agreement due to non-payment of

any Payment Obligations. |

| |

|

|

| |

|

Notwithstanding

the foregoing, any failure by INC to timely make any payments for “Licensed Products” as defined by the Agreement under

the Payment Schedule shall constitute a material breach pursuant to the Agreement and shall entitle AG to enforce any rights under

the Agreement, including any rights of termination pursuant to Section 16.3 of the Agreement, immediately upon such failure by INC

to make timely payment as defined by Section 2 of this Addendum, irrespective of any cure period provided in Section 16.3 of the

Agreement. |

| |

|

|

| |

b. |

This

Addendum shall only serve to supplement, amend, and/or modify the Agreement to the extent specifically provided herein. All terms,

conditions, provisions, exhibits and references of and to the Agreement that are not specifically supplemented, amended, and/or modified

herein shall remain in full force and effect and shall not be altered by any provisions herein contained. |

IN

WITNESS WHEREOF, the Parties have executed this Addendum to Amended and Restated License and Supply Agreement as of the date first set

forth above.

| BIOFRONTERA

AG |

|

BIOFRONTERA

INC. |

| |

|

|

|

|

| BIOFRONTERA

PHARMA GmbH |

|

BIOFRONTERA

BIOSCIENCE GmbH |

| |

|

|

|

|

| By:

|

/s/

Pilar de la Huerta |

|

By:

|

/s/

Hermann Luebbert |

| Name:

|

Pilar

de la Huerta |

|

Name: |

Hermann

Luebbert |

| Title:

|

Chief

Financial Officer - Biofrontera AG |

|

Title:

|

Chief

Executive Officer |

| |

Managing

Director – Biofrontera Pharma GmbH |

|

|

Managing

Director - Biofrontera Bioscience GmbH |

| |

|

|

|

|

| Date: |

28.01.24 |

|

Date: |

29.01.2024 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BFRI_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BFRI_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BFRI_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

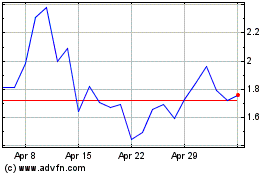

Biofrontera (NASDAQ:BFRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biofrontera (NASDAQ:BFRI)

Historical Stock Chart

From Apr 2023 to Apr 2024