false0000718332NASDAQ00007183322024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2024

Rave Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

|

Missouri

|

0-12919

|

45-3189287

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

3551 Plano Parkway, The Colony, Texas

|

|

75056

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (469) 384-5000

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

RAVE

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition

|

On February 1, 2024, Rave Restaurant Group, Inc. issued a press release discussing financial results of its second fiscal quarter

ended December 24, 2023, a copy of which is attached as Exhibit 99.1 hereto.

| Item 9.01 |

Financial Statements and Exhibits

|

|

99.1 |

Rave Restaurant Group, Inc. press release dated February 1, 2024.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

Rave Restaurant Group, Inc.

|

| |

|

|

|

Date: February 1, 2024

|

By:

|

/s/ JOHANNES Z. VILJOEN

|

| |

|

Johannes Z. Viljoen

|

| |

|

Interim Head of Finance

|

| |

|

(principal financial officer)

|

Exhibit 99.1

February 1, 2024

RAVE Restaurant Group, Inc. Reports Second Quarter Results

Dallas, Texas – RAVE

Restaurant Group, Inc. (NASDAQ: RAVE) today reported financial results for the second quarter of fiscal 2024 ended December 24, 2023.

Second Quarter Highlights:

| |

•

|

The Company recorded net income of $0.6 million for the second quarter of fiscal 2024 compared to net income of $0.3 million for the same period of the prior

year.

|

| |

•

|

Income before taxes increased 10.7% to $0.5 million for the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

Total revenue decreased slightly by $0.1 million to $2.8 million for the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

Adjusted EBITDA remained stable at $0.6 million for the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

Pizza Inn domestic comparable store retail sales increased 7.0% in the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

Pie Five domestic comparable store retail sales increased 0.8% in the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

On a fully diluted basis, net income increased by $0.02 to $0.04 per share for the second quarter of fiscal 2024 compared to the same period of the prior year.

|

|

• |

Cash and cash equivalents were $5.3 million at December 24, 2023.

|

|

• |

Pizza Inn domestic unit count finished at 112.

|

|

• |

Pizza Inn international unit count finished at 18.

|

|

• |

Pie Five domestic unit count finished at 24.

|

“Following a strong Q1, we’ve hit our 15th consecutive quarter of profitability with steady same-store sales growth at both Pizza Inn and Pie Five in Q2,” said

Brandon Solano, Chief Executive Officer of RAVE Restaurant Group, Inc. “This fiscal quarter, we focused on our unwavering commitment to maintain tight cost control, which has been a cornerstone of our success. Our disciplined financial approach has

allowed us to effectively navigate the competitive landscape, while our commitment to operational efficiency has positioned us for continued success in the ever-evolving market."

“Despite a slight decrease in total revenue, we saw steady profit growth with net income reaching $0.6 million compared to $0.3 million in the same period

last year," Solano continued. “This is a testament to the dedication of our team and the effectiveness of our financial strategies, positioning us for sustained growth and shareholder value."

"We're also thrilled to welcome three new Pie Five franchisees into our family, taking over locations throughout Texas,” said Solano. “Their partnership underscores the attractiveness of our brand and continued confidence in our business model. Even in the face of varying same-store sales, including Pizza Inn's impressive 7.0% increase and Pie Five's

solid 0.8% growth in Q2, our strategic initiatives have contributed to our overall positive financial performance."

On reimaging, Solano noted, “We’ve embarked on a significant journey to reimagine our stores, and I’m excited to announce 10 more Pizza Inn restaurants are

set to begin the process, which elevates both the aesthetics and functionality. These dramatic updates reflect our commitment to enhancing the overall experience for both our franchise partners and guests, and we’ve been pleased to see strong results

from the completed prototype in Asheboro, NC. We anticipate completing most of these transformations before the end of the fiscal year."

“As part of our strategic vision, we've strengthened our organization by continuing to invest in key areas such as analytics, development and IT,” Solano

stated. “The addition of team members to these functional areas reflects our commitment to innovation and growth.”

Non-GAAP Financial Measures

The Company’s financial statements are prepared in accordance with United States generally accepted accounting principles (“GAAP”). However, the Company

also presents and discusses certain non-GAAP financial measures that it believes are useful to investors as measures of operating performance. Management may also use such non-GAAP financial measures in evaluating the effectiveness of business

strategies and for planning and budgeting purposes. However, these non-GAAP financial measures should not be viewed as an alternative or substitute for its financial statements prepared in accordance with generally accepted accounting principles.

The Company considers EBITDA and Adjusted EBITDA to be important supplemental measures of operating performance that are commonly used by securities

analysts, investors and other parties interested in our industry. The Company believes that EBITDA is helpful to investors in evaluating its results of operations without the impact of expenses affected by financing methods, accounting methods and the

tax environment. The Company believes that Adjusted EBITDA provides additional useful information to investors by excluding non-operational or non-recurring expenses to provide a measure of operating performance that is more comparable from period to

period. Management also uses these non-GAAP financial measures for evaluating operating performance, assessing the effectiveness of business strategies, projecting future capital needs, budgeting and other planning purposes.

“EBITDA” represents earnings before interest, taxes, depreciation and amortization. “Adjusted EBITDA” represents earnings before interest, taxes,

depreciation and amortization, stock compensation expense, severance, gain/loss on sale of assets, costs related to impairment and other lease charges, franchise default and closed store revenue/expense, and closed and non-operating store costs. A

reconciliation of these non-GAAP financial measures to net income is included with the accompanying financial statements.

Note Regarding Forward Looking Statements

Certain statements in this press release, other than historical information, may be considered forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, and are intended to be covered by the safe harbors created thereby. These forward-looking statements are based on current expectations that involve numerous risks, uncertainties and assumptions. Assumptions relating to

these forward-looking statements involve judgments with respect to, among other things, the effectiveness of our cost cutting measures, the timing to complete as well as the continued returns on our reimaging initiatives, the strength of our

development pipeline, as well as future economic, competitive and market conditions, regulatory framework and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of RAVE

Restaurant Group, Inc. Although the assumptions underlying these forward-looking statements are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that any forward-looking statements will

prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of such information should not be regarded as a representation that the objectives and plans of RAVE Restaurant Group, Inc. will

be achieved.

About RAVE Restaurant Group, Inc.

Dallas-based RAVE Restaurant Group [NASDAQ: RAVE] has inspired restaurant innovation and countless customer smiles with its trailblazing pizza concepts. The Company

franchises, licenses and supplies Pie Five and Pizza Inn restaurants operating domestically and internationally. The Pizza Inn experience is unlike your typical buffet. Since 1958, Pizza Inn's house-made dough, house-shredded 100% whole milk mozzarella

cheese, fresh ingredients and house-made signature sauce combined with friendly service solidified the brand to become America's favorite hometown pizza place. This, in addition to its small-town vibe, are the hallmarks of Pizza Inn restaurants. In

2011, RAVE introduced Pie Five Pizza, pioneering a fast-casual pizza brand that transformed the classic pizzeria into a concept offering personalization, sophisticated ingredients and speed. Pie Five's craft pizzas are baked fresh daily and feature

house-made ingredients, creative recipes and craveable crust creations. For more information, visit www.raverg.com, and follow on Instagram @pizzainn and @piefivepizza.

Contact:

Investor Relations

RAVE Restaurant Group, Inc.

469-384-5000

RAVE RESTAURANT GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share amounts)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

December 24,

2023

|

|

|

December 25,

2022

|

|

|

December 24,

2023

|

|

|

December 25,

2022

|

|

|

REVENUES:

|

|

$

|

2,792

|

|

|

$

|

2,866

|

|

|

$

|

5,881

|

|

|

$

|

5,871

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COSTS AND EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

1,341

|

|

|

|

1,453

|

|

|

|

2,660

|

|

|

|

2,796

|

|

|

Franchise expenses

|

|

|

844

|

|

|

|

867

|

|

|

|

2,016

|

|

|

|

2,069

|

|

|

Impairment of long-lived assets and other lease charges

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5

|

|

|

Bad debt expense

|

|

|

10

|

|

|

|

5

|

|

|

|

35

|

|

|

|

9

|

|

|

Interest expense

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1

|

|

|

Depreciation and amortization expense

|

|

|

57

|

|

|

|

53

|

|

|

|

112

|

|

|

|

104

|

|

|

Total costs and expenses

|

|

|

2,252

|

|

|

|

2,378

|

|

|

|

4,823

|

|

|

|

4,984

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE TAXES

|

|

|

540

|

|

|

|

488

|

|

|

|

1,058

|

|

|

|

887

|

|

|

Income tax benefit (expense)

|

|

|

13

|

|

|

|

(140

|

)

|

|

|

(119

|

)

|

|

|

(232

|

)

|

|

NET INCOME

|

|

$

|

553

|

|

|

$

|

348

|

|

|

$

|

939

|

|

|

$

|

655

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME PER SHARE OF COMMON STOCK - BASIC:

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

$

|

0.07

|

|

|

$

|

0.04

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME PER SHARE OF COMMON STOCK - DILUTED:

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

$

|

0.07

|

|

|

$

|

0.04

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic

|

|

|

14,444

|

|

|

|

16,351

|

|

|

|

14,299

|

|

|

|

16,491

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - diluted

|

|

|

14,465

|

|

|

|

16,351

|

|

|

|

14,319

|

|

|

|

16,491

|

|

RAVE RESTAURANT GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share amounts)

(Unaudited)

| |

|

December 24,

2023

|

|

|

June 25,

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

5,306

|

|

|

$

|

5,328

|

|

|

Accounts receivable, less allowance for bad debts of $23 and $58, respectively

|

|

|

1,193

|

|

|

|

1,145

|

|

|

Notes receivable, current

|

|

|

82

|

|

|

|

105

|

|

|

Assets held for sale

|

|

|

37

|

|

|

|

19

|

|

|

Deferred contract charges, current

|

|

|

30

|

|

|

|

33

|

|

|

Prepaid expenses and other current assets

|

|

|

458

|

|

|

|

204

|

|

|

Total current assets

|

|

|

7,106

|

|

|

|

6,834

|

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

208

|

|

|

|

258

|

|

|

Operating lease right of use assets, net

|

|

|

1,008

|

|

|

|

1,227

|

|

|

Intangible assets definite-lived, net

|

|

|

294

|

|

|

|

328

|

|

|

Notes receivable, net of current portion

|

|

|

61

|

|

|

|

28

|

|

|

Deferred tax asset, net

|

|

|

5,271

|

|

|

|

5,342

|

|

|

Deferred contract charges, net of current portion

|

|

|

212

|

|

|

|

220

|

|

|

Total assets

|

|

$

|

14,160

|

|

|

$

|

14,237

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable - trade

|

|

$

|

653

|

|

|

$

|

502

|

|

|

Accrued expenses

|

|

|

449

|

|

|

|

891

|

|

|

Operating lease liabilities, current

|

|

|

432

|

|

|

|

463

|

|

|

Deferred revenues, current

|

|

|

163

|

|

|

|

342

|

|

|

Total current liabilities

|

|

|

1,697

|

|

|

|

2,198

|

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities, net of current portion

|

|

|

740

|

|

|

|

958

|

|

|

Deferred revenues, net of current portion

|

|

|

622

|

|

|

|

690

|

|

|

Total liabilities

|

|

|

3,059

|

|

|

|

3,846

|

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES (SEE NOTE C)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value; authorized 26,000,000 shares; issued 25,522,171 and 25,090,058 shares, respectively;

outstanding 14,586,566 and 14,154,453 shares, respectively

|

|

|

255

|

|

|

|

251

|

|

|

Additional paid-in capital

|

|

|

37,496

|

|

|

|

37,729

|

|

|

Retained earnings

|

|

|

3,378

|

|

|

|

2,439

|

|

|

Treasury stock, at cost

|

|

|

|

|

|

|

|

|

|

Shares in treasury: 10,935,605 and 10,935,605 respectively

|

|

|

(30,028

|

)

|

|

|

(30,028

|

)

|

|

Total shareholders' equity

|

|

|

11,101

|

|

|

|

10,391

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$

|

14,160

|

|

|

$

|

14,237

|

|

RAVE RESTAURANT GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| |

|

Six Months Ended

|

|

| |

|

December 24,

2023

|

|

|

December 25,

2022

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net income

|

|

$

|

939

|

|

|

$

|

655

|

|

|

Adjustments to reconcile net income to cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Impairment of long-lived assets and other lease charges

|

|

|

—

|

|

|

|

5

|

|

|

Stock-based compensation expense

|

|

|

82

|

|

|

|

173

|

|

|

Depreciation and amortization

|

|

|

70

|

|

|

|

70

|

|

|

Amortization of operating right of use assets

|

|

|

219

|

|

|

|

217

|

|

|

Amortization of intangible assets definite-lived

|

|

|

42

|

|

|

|

34

|

|

|

Allowance for bad debts

|

|

|

35

|

|

|

|

9

|

|

|

Deferred income tax

|

|

|

71

|

|

|

|

182

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(69

|

)

|

|

|

696

|

|

|

Notes receivable

|

|

|

(54

|

)

|

|

|

14

|

|

|

Deferred contract charges

|

|

|

11

|

|

|

|

2

|

|

|

Prepaid expenses and other current assets

|

|

|

(254

|

)

|

|

|

41

|

|

|

Accounts payable - trade

|

|

|

151

|

|

|

|

(91

|

)

|

|

Accrued expenses

|

|

|

(442

|

)

|

|

|

(675

|

)

|

|

Operating lease liabilities

|

|

|

(249

|

)

|

|

|

(241

|

)

|

|

Deferred revenues

|

|

|

(247

|

)

|

|

|

(299

|

)

|

|

Cash provided by operating activities

|

|

|

305

|

|

|

|

792

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Payments received on notes receivable

|

|

|

30

|

|

|

|

60

|

|

|

Purchase of intangible assets definite-lived

|

|

|

(8

|

)

|

|

|

(114

|

)

|

|

Purchase of property and equipment

|

|

|

(38

|

)

|

|

|

(23

|

)

|

|

Cash used in investing activities

|

|

|

(16

|

)

|

|

|

(77

|

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchase of treasury stock

|

|

|

—

|

|

|

|

(4,979

|

)

|

|

Taxes paid on issuance of restricted stock units

|

|

|

(311

|

)

|

|

|

—

|

|

|

Payments on short term loan

|

|

|

—

|

|

|

|

(30

|

)

|

|

Cash used in financing activities

|

|

|

(311

|

)

|

|

|

(5,009

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(22

|

)

|

|

|

(4,294

|

)

|

|

Cash and cash equivalents, beginning of period

|

|

|

5,328

|

|

|

|

7,723

|

|

|

Cash and cash equivalents, end of period

|

|

$

|

5,306

|

|

|

$

|

3,429

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

CASH (REFUNDED)/PAID FOR:

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

$

|

(4

|

)

|

|

$

|

91

|

|

RAVE RESTAURANT GROUP, INC.

ADJUSTED EBITDA

(In thousands)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

December 24,

2023

|

|

|

December 25,

2022

|

|

|

December 24,

2023

|

|

|

December 25,

2022

|

|

|

Net income

|

|

$

|

553

|

|

|

$

|

348

|

|

|

$

|

939

|

|

|

$

|

655

|

|

|

Interest expense

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1

|

|

|

Income taxes

|

|

|

(13

|

)

|

|

|

140

|

|

|

|

119

|

|

|

|

232

|

|

|

Depreciation and amortization

|

|

|

57

|

|

|

|

53

|

|

|

|

112

|

|

|

|

104

|

|

|

EBITDA

|

|

$

|

597

|

|

|

$

|

541

|

|

|

$

|

1,170

|

|

|

$

|

992

|

|

|

Stock-based compensation expense

|

|

|

3

|

|

|

|

87

|

|

|

|

82

|

|

|

|

173

|

|

|

Severance

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Impairment of long-lived assets and other lease charges

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5

|

|

|

Franchisee default and closed store revenue

|

|

|

(18

|

)

|

|

|

(13

|

)

|

|

|

(82

|

)

|

|

|

(13

|

)

|

|

Closed and non-operating store costs

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Adjusted EBITDA

|

|

$

|

582

|

|

|

$

|

615

|

|

|

$

|

1,170

|

|

|

$

|

1,157

|

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

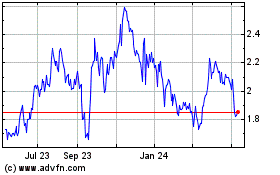

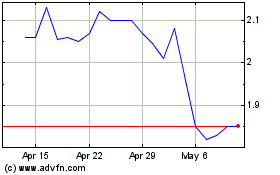

Rave Restaurant (NASDAQ:RAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rave Restaurant (NASDAQ:RAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024