Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

January 31 2024 - 8:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Amendment No. 1)

Tender Offer Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

MakeMyTrip

Limited

(Name of Subject Company (Issuer) and Filing Person (as Offeror))

0.00% Convertible Senior Notes due 2028

(Title of Class of Securities)

56087F AB0

(CUSIP Number

of Class of Securities)

Mohit Kabra

Group Chief Financial Officer

19th Floor, Building No. 5

DLF Cyber City

Gurugram,

India, 122002

Telephone: (+91-124) 439-5000

(Name, address and telephone number of person authorized to receive notices and communication on behalf of the filing person)

Copy to:

Rajiv

Gupta

Stacey Wong

Latham & Watkins LLP

9 Raffles Place

#42-02

Republic Plaza

Singapore 048619

+65 6536 1161

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer:

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

EXPLANATORY NOTE

This Amendment No. 1 amends and supplements the Tender Offer Statement on Schedule TO initially filed with the U.S. Securities and Exchange

Commission (the “SEC”) on January 17, 2024 (together with any amendments and supplements thereto, the “Schedule TO”) by MakeMyTrip Limited, a Mauritius company (the “Company,” “we,” “us” or

“our”), to repurchase, at the election of each holder (the “Holder”) of its 0.00% Convertible Senior Notes due 2028 (the “Notes”) on February 15, 2024 (which is approximately three years after the Notes were initially

issued), all of such Holder’s Notes or any portion thereof that is an integral multiple of US$1,000 principal amount, upon the terms and subject to the conditions set forth in the repurchase right notice, dated January 17, 2024 (together with

any amendments or supplements thereto, the “Repurchase Right Notice”), filed as Exhibit (a)(1) to the Schedule TO, and in the related Press Release (together with any amendments or supplements thereto, the “Press Release”), filed

as Exhibit (a)(5)(A) to the Schedule TO.

Only those items that are amended are reported in this Amendment No. 1. Except as specifically

provided herein, the information set forth in the Schedule TO, the Repurchase Right Notice and Press Release remains unchanged and this Amendment No. 1 does not modify any of the information previously reported on Schedule TO and in the Repurchase

Right Notice and Press Release. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Schedule TO. You should read this Amendment No. 1 together with the Schedule TO, the Repurchase Right Notice and Press

Release.

Repurchase Right Notice

The Repurchase Right Notice and the corresponding Items 1 through 9, of Schedule TO into which such information is incorporated by reference

are hereby amended as follows:

| 1. |

On page 1 of the Repurchase Right Notice the last sentence in the second paragraph is hereby amended and

restated as follows: “To exercise its Repurchase Right, a Holder must deliver a Repurchase Notice (as further described in this Repurchase Right Notice) at any time between 9:00 a.m., New York City time, on Thursday, January 18, 2024

and 11:59 p.m. Eastern Time (the “Expiration Time”) on Tuesday, February 13, 2024 (the “Expiration Date”), which is the second Business Day immediately preceding the Repurchase Date.” Additionally, all references

to “5:00 p.m. New York City time, on the Expiration Date” shall be read as references to “the Expiration Time, on the Expiration Date”, and the Expiration Time, on the Expiration Date is 11:59 p.m. Eastern Time on Tuesday,

February 13, 2024. |

| 2. |

On the top of page 5 of the Repurchase Right Notice in the first paragraph under section “Summary Term

Sheet,” the second sentence is hereby amended and restated as follows: “To understand the Repurchase Right fully and for a more detailed description of the terms of the Repurchase Right, we urge you to carefully read the remainder of this

Repurchase Right Notice.” |

| 3. |

On page 14 of the Notice of Repurchase, in the section “Important Information Concerning the Repurchase

Right,” under the caption “4. Right of Withdrawal,” the first sentence in the fourth paragraph is hereby amended and restated as follows: “In addition, pursuant to Rule 13e-4(f)(2)(ii) promulgated under the Securities Exchange

Act of 1934 (the “Exchange Act”), Holders are advised that if they timely surrender Notes for purchase under the Repurchase Right, they are also permitted to withdraw such Notes on Wednesday, March 13, 2024 (New York City time) in the

event that we have not yet accepted the Notes for payment as of that time.” |

| 4. |

On page 14 of the Notice of Repurchase, in the section “Important Information Concerning the Repurchase

Right,” under the caption “4. Right of Withdrawal,” the following qualifier is added to the end of the last paragraph: “Holders are not foreclosed from challenging our determination in a court of competent jurisdiction in

accordance with the procedures set forth in Section 17.05 (“Submission to Jurisdiction; Service of Process”) of the Indenture.” |

| 5. |

On page 14 of the Notice of Repurchase, in the section “Important Information Concerning the Repurchase

Right,” under the caption “7. Plans or Proposals of the Company,” the first sentence is hereby amended and revised as follows: “Neither the Company nor its directors and executive officers currently has any plans, proposals, or

negotiations that relate to or which would result in:” |

| 6. |

On page 15 of the Notice of Repurchase, in the section “Important Information Concerning the Repurchase

Right,” under the caption “9. Agreements Involving the Company’s Securities,” the disclosure is hereby amended and revised as follows: |

“The Company has entered into the following agreement relating to the Notes:

Except as described in “Item 6. Directors, Senior Management and Employees — B. Compensation” in the Company’s

Annual Report on Form 20-F dated July 25, 2023 and the section titled “Repurchases of Shares and Convertible Notes” in the Company’s earnings release on Form 6-K dated January 23, 2024, which are hereby incorporated by

reference:

| |

(a) |

there are no agreements between the Company and any other person with respect to any other securities issued by

the Company; and |

| |

(b) |

the Company is not aware of any agreements between any directors or executive officers of the Company and any

other person with respect to any other securities issued by the Company.” |

| 7. |

On page 17 of the Notice of Repurchase, in the section “Important Information Concerning the Repurchase

Right,” under the caption “11. Additional Information.” the first paragraph is hereby amended and revised as follows: “The Company is subject to the reporting and other informational requirements of the Exchange Act and, in

accordance therewith, files reports and other information with the SEC. Such material may be accessed electronically by means of the SEC’s home page on the Internet at http://www.sec.gov.” |

Item 12. Exhibits.

The following

exhibits are included or incorporated by reference in this Schedule TO:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

|

Incorporation by Reference |

|

| |

|

|

|

Form |

|

|

File Number |

|

|

Exhibit

No. |

|

Filing Date |

|

| (a)(1) |

|

Repurchase Right Notice, dated January 17, 2024. |

|

|

SC TO-I |

|

|

|

005-85619 |

|

|

(a)(1) |

|

|

January 17, 2024 |

|

| (a)(5)(A) |

|

Press Release issued by the Company, dated January 17, 2024 |

|

|

SC TO-I |

|

|

|

005-85619 |

|

|

(a)(5)(A) |

|

|

January 17, 2024 |

|

| (b) |

|

Not Applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (d) |

|

Indenture, dated as of February

9, 2021, between the Company and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 99.1 to the Company’s Form 6-K (File No.

001-34837) as filed with the Securities and Exchange Commission on February 9, 2021). |

|

|

6-K |

|

|

|

001-34837 |

|

|

99.1 |

|

|

February 9, 2021 |

|

| (g) |

|

Not Applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (h) |

|

Not Applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 107 |

|

Filing Fee Table. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

Date: January 31, 2024

|

|

|

| MakeMyTrip Limited |

|

|

| By: |

|

/s/ Rajesh Magow |

| Name: |

|

Rajesh Magow |

| Title: |

|

Group Chief Executive Officer |

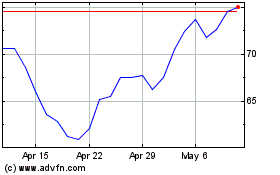

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Apr 2024 to May 2024

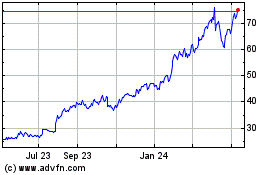

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From May 2023 to May 2024