false

0001460602

0001460602

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 16, 2024

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416 |

|

98-0583166

|

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation |

|

Number)

|

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class | |

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS

|

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Amendment

to November 2023 Securities Purchase Agreement

On

January 16, 2024, the Company and the purchaser of the shares of Common Stock and Pre-Funded Warrants (the “November 2023 Investor”)

under that certain Securities Purchase Agreement, dated as of November 8, 2023, between the Company and the November 2023 Investor (the

“November 2023 Purchase Agreement”) entered into an amendment to the November 2023 Purchase Agreement (the “Amendment”).

Pursuant to the Amendment, the November 2023 Investor agreed to (i) amend the November 2023 Purchase Agreement to delete Section 4.9

(Subsequent Equity Sales) in its entirety, (ii) waive any applicable rights and remedies under the November 2023 Purchase Agreement with

respect to Section 4.9 thereto and (iii) terminate all rights, obligations and remedies (including the obligation to issue 750,000 warrants)

under the Term Sheet, dated as of November 8, 2023, entered into by the Company and the November 2023 Investor. In consideration for

the foregoing, the Company agreed to make a cash payment of $277,500 (the “Cash Payment”) to the November 2023 Investor within

thirty (30) days of the date of the Amendment. If such Cash Payment is not made within such thirty (30) days, the Company shall pay to

the November 2023 Investor the following: (i) a cash penalty of 20% of the Cash Payment and (ii) the warrants issuable pursuant to the

Term Sheet.

The

foregoing summary of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by, such document

attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

ORGENESIS

INC. |

| |

|

|

| Date:

January 22, 2024 |

By:

|

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary

|

Exhibit 10.1

AMENDMENT AGREEMENT

This Amendment Agreement (the

“Amendment”), dated as of January 16, 2024, is by and among Orgenesis Inc., a Nevada corporation (the “Company”),

and the holder constituting a majority-in-interest of the shares of Common Stock and Pre-Funded Warrants issued pursuant to that certain

Securities Purchase Agreement dated as of November 8, 2023, by and among the Company and the purchaser identified on the signature pages

thereto (the “Investor”) (the “November 2023 Purchase Agreement”). Capitalized terms used and not otherwise defined

herein shall have the meanings set forth for such terms in November 2023 Purchase Agreement.

WHEREAS, the Company and the Investor

are a party to the November 2023 Purchase Agreement; and

WHEREAS, pursuant to the November

2023 Purchase Agreement, the Company issued to the Investor (i) 1,410,256 shares (the “Shares”) of common stock, par value

$0.0001 per share, of the Company (“Common Stock”), and (ii) warrants exercisable for 1,410,256 shares of Common Stock (the

“Pre-Funded Warrants” and, together with the Shares, the “Securities”); and

WHEREAS, pursuant to Section 4.9(a)

of the November 2023 Purchase Agreement, the Company agreed that, without the prior consent of the Investor, prior to February 8, 2024,

it would not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell,

grant any option, right, or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of capital

stock of the Company or any securities convertible into or exercisable or exchangeable for shares of capital stock of the Company, except

pursuant to certain exceptions; and

WHEREAS, on November 7, 2023,

the Company and an affiliate of the Investor entered into a Term Sheet for an Equity Line of Credit (the “Term Sheet”); and

WHEREAS, Section 5.5 of the November

2023 Purchase Agreement provides that no provision of the November 2023 Purchase Agreement may be waived, modified, supplemented or amended

except in a written instrument signed, in the case of an amendment, by the Company and the purchasers holding at least 50.1% in interest

of the Shares and Pre-funded Warrants based on the initial Subscription Amounts thereunder, or, in the case of a waiver, by the party

against whom enforcement of any such waived provision is sought; and

WHEREAS, the Investor constitutes

the holder with greater than 50.1% in interest of the Shares and Pre-funded Warrants; and

WHEREAS, in consideration for

the Investor agreeing to (i) amend the November 2023 Purchase Agreement to delete Section 4.9 in its entirety, (ii) waive any applicable

rights and remedies under the November 2023 Purchase Agreement with respect to Section 4.9 thereto and (iii) terminate all rights, obligations

and remedies under the Term Sheet, the Company shall agree to make a cash payment to Investor in the amount of $277,500 (the “Cash

Payment”) within thirty (30) days of the date of this Amendment; and

WHEREAS, the Company and the Investor

desire to amend the November 2023 Purchase Agreement and to reflect the foregoing.

NOW THEREFORE, the parties hereto,

each intending to be legally bound, and in consideration of the mutual covenants and acts set forth herein, agree as follows:

1. Amendment and Termination. Investor hereby

agrees to (i) amend the November 2023 Purchase Agreement to delete Section 4.9 in its entirety, (ii) waive any applicable rights and remedies

under the November 2023 Purchase Agreement with respect to Section 4.9 thereto and (iii) terminate all rights, obligations and remedies

under the Term Sheet.

2. Consideration. In consideration for the

agreement of the terms set forth in Section 1 above, the Company hereby agrees to make the Cash Payment to the Investor within thirty

(30) days of the date of this Amendment. If such Cash Payment is not made within such thirty (30) days, the Company shall pay to the Investor

the following: (i) a cash penalty of 20% of the Cash Payment and (ii) the warrants issuable pursuant to the Term Sheet.

3. Release. In exchange for the consideration

detailed in Section 2 above, the Investor for itself, its administrators, representatives, successors and assigns (the “Investor

Releasors”) agrees to release any and all claims it may have against the Company and its predecessors and successors in interest,

affiliates, representatives, subsidiaries, parents, divisions, claims managers, heirs, assigns, insurers, re-insurers, shareholders, creditors,

liquidators, administrators, executors, former and present directors and officers, all employees, principals, agents or registered representatives

(“Company Related Persons and Entities”) from any and all manner of action and actions, cause and causes of action, suits,

proceedings, arbitrations, claims, grievances, debts, sums of money, claims for attorney fees, interest, expenses and costs, covenants,

contracts, controversies, agreements, promises, damages, losses, and demands of any nature whatsoever, known or unknown, suspected or

unsuspected, in law or in equity, civil or criminal, vested or contingent, which the Investor ever had or now has or asserts against the

Company and/or the Company Related Persons and Entities, for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning

of the world to the date hereof, concerning or related to Section 4.9 of the November 2023 Purchase Agreement and the Term Sheet (the

“Released Claims”).

4. Counterparts; Facsimile Signatures. This

Amendment may be executed or consented to in counterparts, each of which shall be deemed an original and all of which taken together shall

constitute one and the same instrument. This Amendment may be executed and delivered by facsimile or electronically and, upon such delivery,

the facsimile or electronically transmitted signature will be deemed to have the same effect as if the original signature had been delivered

to the other party.

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be executed by the undersigned, thereunto duly authorized, as of the date first set forth above.

| |

ORGENESIS INC. |

| |

|

| |

|

| |

Name: |

| |

Title: |

[Investor Signature Page Follows]

IN WITNESS WHEREOF, the Investor

has caused this Amendment to be executed by the undersigned, thereunto duly authorized, as of the date first set forth above.

| |

|

| [Print Name of Holder] |

|

| |

|

| |

|

| [Signature] |

|

| Name: |

|

| Title: |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

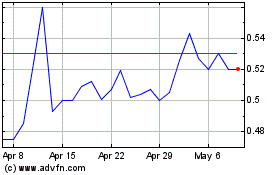

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Apr 2023 to Apr 2024