0001562463false00015624632023-12-192023-12-190001562463us-gaap:CommonStockMember2023-12-192023-12-190001562463inbk:A60FixedToFloatingSubordinatedNotesDue2029Member2023-12-192023-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 19, 2023

| | | | | | | | | | | | | | |

| First Internet Bancorp |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | |

| Indiana |

| (State or Other Jurisdiction of Incorporation) |

| | | | |

| 001-35750 | | 20-3489991 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 8701 E. 116th Street | | 46038 |

Fishers, Indiana | |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

(317) 532-7900 |

| (Registrant's Telephone Number, Including Area Code) |

| | | | |

| | | | |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, without par value | | INBK | | The Nasdaq Stock Market LLC |

| 6.0% Fixed to Floating Subordinated Notes due 2029 | | INBKZ | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure

On December 19, 2023, First Internet Bancorp issued a press release announcing a quarterly cash dividend of $0.06 per common share. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

The information contained in this Item 7.01 and Exhibit 99.1 hereto is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events

On December 18, 2023, the Board of Directors of the Company extended the Company’s existing stock repurchase program, which had been set to expire on December 31, 2023, through and including December 31, 2024. The stock repurchase program authorizes the repurchase of the Company's outstanding common stock from time to time on the open market or in privately negotiated transactions. A copy of a press release announcing the stock repurchase program is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

The stock repurchase program may be modified, suspended or discontinued at any time and does not commit the Company to repurchase shares of its common stock. The actual number and value of the shares to be purchased will depend on the performance of the Company’s stock price and other market conditions. Repurchases under the program may also be made pursuant to a Rule 10b5-1 plan, which, if adopted by the Company, would permit shares to be repurchased in accordance with pre-determined criteria when the Company might otherwise be prohibited from doing so under insider trading laws or because of self-imposed trading blackout periods.

The information contained in this Item 8.01 and Exhibit 99.1 hereto is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | | | | |

| Number | | Description | | Method of filing |

| | | | Furnished electronically |

| 104 | | Cover Page Interactive Data File (embedded in the cover page formatted in inline XBRL) | | |

Cautionary Note Regarding Forward-Looking Statements

This Report includes “forward-looking statements” within the meanings of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, including statements with respect to the stock repurchase program and timing and methods of executing the same. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking statements presented in this Report are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this Report. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Factors that may cause actual results to differ materially from those made or suggested by the forward-looking statements contained in this Report include those identified in the Company’s most recent annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. Any forward-looking statements presented herein are made only as of the date of this Report, and the Company does not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Dated: | December 19, 2023 |

| | | | |

| | FIRST INTERNET BANCORP |

| | | | |

| | By: | /s/ Kenneth J. Lovik |

| | | Kenneth J. Lovik, Executive Vice President & Chief Financial Officer |

First Internet Bancorp to Pay Cash Dividend; Extends Stock Repurchase Program

Fishers, Indiana, December 19, 2023 – The Board of Directors of First Internet Bancorp (the “Company”) (Nasdaq: INBK) has declared a quarterly cash dividend of $0.06 per common share. The dividend will be payable on January 16, 2024 to shareholders of record at the close of business on December 29, 2023.

The declaration and amount of any future cash dividends will be subject to the sole discretion of the Board of Directors and will depend upon many factors, including the Company’s results of operations, financial condition, capital requirements, regulatory and contractual restrictions, business strategy and other factors deemed relevant by the Board of Directors.

In addition, the Board of the Company has extended the term of the Company’s existing stock repurchase program (the “Program”) through December 31, 2024. The Program, which was previously set to expire on December 31, 2023, was announced in December 2022 and authorized the Company to acquire up to $25.0 million in shares of its common stock from time to time in the open market or in privately negotiated transactions. The Program does not obligate the Company to repurchase shares of its common stock, and there is no assurance that it will do so. Any repurchases are subject to compliance with applicable laws and regulations. Repurchases will be conducted in consideration of general market and economic conditions as well as the financial and regulatory condition of the Company and First Internet Bank. The Program may be modified, suspended or discontinued at any time.

About First Internet Bancorp

First Internet Bancorp is a financial holding company with assets of $5.2 billion as of September 30, 2023. The Company’s subsidiary, First Internet Bank, opened for business in 1999 as an industry pioneer in the branchless delivery of banking services. First Internet Bank provides consumer and small business deposit, SBA financing, franchise finance, consumer loans, and specialty finance services nationally as well as commercial real estate loans, construction loans, commercial and industrial loans, and treasury management services on a regional basis. First Internet Bancorp’s common stock trades on the Nasdaq Global Select Market under the symbol “INBK”. Additional information about the Company is available at www.firstinternetbancorp.com and additional information about First Internet Bank, including its products and services, is available at www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements with respect to the Company’s stock repurchase program and timing and methods of executing the same. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking statements presented in this release are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this release. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Factors that may cause actual results to differ materially from those made or suggested by the forward-looking statements contained in this release include those identified in the Company’s most recent annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. All statements in this press release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events.

| | | | | | | | | | | |

| Contact Information: | | | |

| Investors/Analysts | | Media | |

| Paula Deemer | | BLASTmedia for First Internet Bank | |

| Director of Corporate Administration | Ryan Hecker |

| (317) 428-4628 | | firstib@blastmedia.com | |

| investors@firstib.com | | | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_ClassOfStockLineItems |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=inbk_A60FixedToFloatingSubordinatedNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

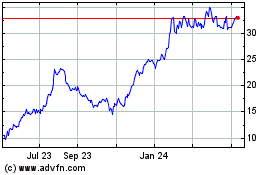

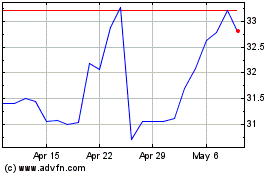

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Apr 2023 to Apr 2024