UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of December 2023

Commission File Number: 001-41066

Sono Group N.V.

(Registrant’s name)

Waldmeisterstrasse 76

80935 Munich

Germany

(Address of principal executive offices)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Convening of annual general meeting of shareholders of Sono Group N.V.

On December 13, 2023, Sono Group N.V. (“Sono N.V.”) convened the annual general

meeting of shareholders to be held on December 29, 2023 (the “AGM”). Exhibit 99.1 attached hereto includes a copy of the convening

notice, including agenda and explanatory notes, for the AGM. Exhibit 99.2 attached hereto includes a copy of the voting proxy for the

AGM.

Creditors’ meeting scheduled in connection with the self-administration proceedings

of Sono Motors GmbH

The insolvency court of the local court of Munich, Germany (the “Court”) has scheduled

the meeting of the creditors of Sono Motors GmbH, the subsidiary of Sono N.V. (“Sono GmbH”and together with Sono N.V., the

“companies”), in connection with Sono GmbH’s self-administration proceedings before the Court. At the meeting, which

is scheduled for December 21, 2023, Sono GmbH’s plan under the German Insolvency Code (Insolvenzordnung) will be discussed

and submitted for a vote by its creditors. The plan, submitted to the Court on December 7, 2023, sets out how Sono GmbH intends to restructure

its debt and procure the inflow of new money, including in connection with the planned investment from YA II PN, Ltd. (“Yorkville”),

and subsequently exit its self-administration proceedings. If Sono GmbH’s creditors vote in favor of the plan with the required

majorities, the plan will require the Court’s confirmation before it can become legally binding.

If the Court confirms the plan, Sono GmbH’s implementation of

the plan will remain subject to any appeals that may be filed by its creditors in the 14-day period following the Court’s confirmation

and to the closing of the planned investment from Yorkville (the “Closing”). Closing is currently expected in late January

2024, and is subject to the satisfaction of certain conditions precedent, including Sono N.V.’s filing of this Annual Report on

Form 20-F for the year ended December 31, 2022, Sono N.V.’s submission of its interim balance sheet and income statement as of June

30, 2023 on Form 6-K to the Securities and Exchange Commission (“SEC”), Sono GmbH’s plan under the German Insolvency

Code becoming legally binding, and the withdrawal of Sono N.V.’s application for its preliminary self-administration proceedings.

Additional information and background on the companies’ respective self-administration

proceedings and the planned transaction with Yorkville may be found in Sono N.V.’s Form 6-Ks submitted to the SEC on May 15, 2023,

May 22, 2023, June 12, 2023, September 7, 2023, September 29, 2023, October 30, 2023 and November 27, 2023.

About This Document

The information included in this Form 6-K shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Forward-Looking Statements

This document includes forward-looking statements. The words "expect", "anticipate",

"intend", "plan", "estimate", "aim", "forecast", "project", "target",

“will” and similar expressions (or their negative) identify certain of these forward-looking statements. These forward-looking

statements are statements regarding the intentions, beliefs, or current expectations of the companies. Forward-looking statements involve

inherent known and unknown risks, uncertainties, and contingencies because they relate to events and depend on circumstances that may

or may not occur in the future and may cause the actual results, performance, or achievements of the companies to be materially different

from those expressed or implied by such forward looking statements. These risks, uncertainties and assumptions include, but are not limited

to, risks, uncertainties and assumptions with respect to: the companies’ expectations regarding their respective self-administration

proceedings, the outcome of which, if they are approved, is uncertain; the companies’ ability to maintain relationships with lenders,

suppliers, service providers, customers, employees and other third parties as a result of the self-administration proceedings and the

related increased performance and credit risks associated with their constrained liquidity position and capital structure; our ability

to access the external funding required to successfully restructure their business, including by successfully fulfilling the conditions

precedent to the closing of the Yorkville investment so as to gain access to the funding offered in such transaction; and the length of

time that the companies would operate under their respective self-administration proceedings. Many of these risks and uncertainties relate

to factors that are beyond Sono N.V.’s ability to control or estimate precisely, such as the actions of courts, regulators and other

factors.

Readers should therefore not place undue reliance on these statements, particularly not in connection with any contract or investment

decision. Except as required by law, Sono N.V. assumes no obligation to update any such forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Sono Group N.V. |

| |

|

|

| |

|

|

| |

By |

/s/ Jona Christians |

| |

|

Name: |

Jona Christians |

| |

|

Title: |

Chief Executive Officer and Member of the Management Board

|

| |

|

|

|

| |

|

|

|

| |

By |

/s/ Torsten Kiedel |

| |

|

Name: |

Torsten Kiedel |

| |

|

Title: |

Chief Financial Officer and Member of the Management Board |

|

December 14, 2023

Exhibit 99.1

CONVENING NOTICE

Dear Shareholder,

On behalf of the management board of Sono Group N.V. (the Company), we kindly invite

you to the annual general meeting of the Company, to be held on December 29, 2023, at 3.00 p.m. Amsterdam time at the offices of Dentons

Europe LLP, fifth floor, Gustav Mahlerplein 2, 1082 MA, Amsterdam, the Netherlands (the AGM). The AGM shall be held in English.

The agenda for the AGM is as follows:

| 2. | Discussion on the (financial) performance of the Company in the year 2022 (discussion item) |

| 3. | Discussion of the Company's dividend and reservation policy (discussion item) |

| 4. | Appointment of PricewaterhouseCoopers Accountants N.V. as the external auditor of the Company's annual accounts 2023 (voting item) |

| 5. | Appointment of Sandra Vogt-Sasse as a member of the Supervisory Board (voting item) |

| 6. | Appointment of Thomas Wiedermann as a member of the Supervisory Board (voting item) |

| 7. | Appointment of Martin Sabbione as a member of the Supervisory Board (voting item) |

| 8. | Authorization of the Management Board, for a period of 18 months after the date of AGM or until the next annual general meeting (whichever

comes first), as the body authorised to issue ordinary shares and grant rights to subscribe for ordinary shares, up to a maximum of 10%

of the nominal issued capital as per the AGM (voting item) |

| 9. | Authorization of the Management Board, for a period of 18 months after the date of AGM or until the next annual general meeting (whichever

comes first), as the body authorised to limit or exclude pre-emption rights in relation to any share issue or granting of rights to subscribe

for shares under the authorization mentioned in agenda item 8 (voting item) |

No business shall be voted on at the AGM, except such items as included in the above-mentioned

agenda.

The procedures for attendance, registration, representation and voting at the AGM are described

below and should be read in conjunction with the convening notice.

The record date for the AGM is December 1, 2023 (the Record Date). Those who are shareholders

of the Company, or who otherwise have voting rights and/or meeting rights with respect to shares in the Company's capital, on the Record

Date and who are recorded as such in the Company's shareholders' register or in the register maintained by the Company's U.S. transfer

agent (the Registers) may attend and, if relevant, vote at the AGM (Persons with Meeting Rights), irrespective of changes

to their shareholdings or rights after the Record Date.

Those who beneficially own shares in the Company's capital in an account at a bank, a financial

institution, an account holder or other financial intermediary (the Beneficial Owners) on the Record Date, must also have their

financial intermediary or their agent with whom the underlying shares are on deposit issue a proxy to them which confirms they are authorized

to take part in and vote at the AGM.

Persons with Meeting Rights and Beneficial Owners who wish to attend the AGM, in person or represented

by proxy, must notify the Company in writing of their intention to attend the AGM (an Attendance Notice) no later than 6:00 a.m.

Amsterdam time on the fifth day prior to the meeting, i.e. December 24, 2023 (the Cut-off Time). Persons with Meeting Rights and

Beneficial Owners must enclose with their Attendance Notice (i) proof of their (beneficial) ownership of the relevant underlying shares

in the Company's capital on the Record Date, such as a recent account statement (ii) a proof of identity, (iii) if relevant, a duly signed

proxy from the relevant shareholder who is registered in either of the Registers as the holder of those underlying shares on the Record

Date, and (iv) if relevant, the duly signed Proxy Form (as defined hereinafter) (collectively, the Entitlement Documents).

Persons with Meeting Rights and Beneficial Owners who will not attend in person may also have

themselves represented at the AGM through the use of a written or electronically recorded proxy authorizing Mr. J.-M.P. Hermans, civil

law notary and partner of Dentons Europe LLP, in Amsterdam, the Netherlands (the Proxy Form). The template Proxy Form can be downloaded

from the Company's website (https://ir.sonomotors.com/corporate-governance).

The Company recommends shareholders to vote by Proxy Form.

Any Attendance Notice and Entitlement Documents to be sent to the Company as part of the procedures

described above must be provided via regular mail or e-mail to:

Sono Group N.V.

c/o D. Lisitsyn

Waldmeisterstrasse 76

80935 Munich

Germany

(corporateoffice@sonomotors.com)

Registration for admission to the AGM will take place at the registration desk at the meeting

venue between 2.00 p.m. Amsterdam time and the commencement of the AGM on December 29, 2023. It is not possible to register after this

time.

Any Attendance Notice and Entitlement Documents received by the Company after the Cut-off Time

may be ignored. Persons with Meeting Rights, Beneficial Owners and proxyholders who have not complied with the procedures described above

may be refused entry to the AGM.

As of December 1, 2023, the Company has issued 105,667,115 ordinary shares, with a par value

of €0.06 and 3,000,000 high-voting shares with a par value of €1.50. Neither the Company nor any of its subsidiaries holds any

shares in the capital of the Company. Each ordinary share confers the right to cast one (1) vote. Each high voting share confers the right

to cast twenty-five (25) votes. The total number of voting rights attached to the issued and outstanding shares that may be exercised

at the AGM is 180,667,115.

EXPLANATORY NOTES TO THE AGENDA

| 2. | Discussion of the (financial) performance of the Company in the year 2022 (discussion item) |

The Company is in the course of preparing an annual report on Form 20-F (the Form

20-F) for its financial year 2022. The financial statements for the financial year 2022 prepared in accordance with IFRS included

therein are expected to be audited by PricewaterhouseCoopers and once finalized and audited will be made available on the Company’s

website (https://ir.sonomotors.com/financial-information) and will be filed on Form 20-F with the U.S. Securities and Exchange Commission

(the SEC). The current aim is to complete the filing of the 20-F on December 22, 2023.

Although the financial reporting on Form 20-F may not qualify as the Dutch statutory

annual accounts of the Company, this reporting provides for an overview of the financial performance of the Company. The Company aims

to publish the Dutch statutory annual accounts for 2023 in the first quarter of 2024 and aims to convene an extraordinary general meeting

to discuss and, if the general meeting approves, adopt such Dutch statutory annual accounts.

In light of the planned filing of the Form 20-F, the Management Board proposes to

discuss the (financial) performance of the Company in the year 2022 on that basis.

| 3. | Discussion of the Company's dividend and reservation policy (discussion item) |

The Company has never paid or declared any cash dividends on its shares, and the

Company does not anticipate paying any cash dividends on its shares in the foreseeable future.

| 4. | Appointment of PricewaterhouseCoopers Accountants N.V. as the external auditor of the Company's annual accounts 2023 (voting item) |

Under Dutch law, the Company's general meeting is, in principle, the corporate body

authorized to annually appoint the external independent auditor for the audit of the Company's annual accounts.

It is proposed to appoint PricewaterhouseCoopers Accountants N.V. (PwC) as

the external independent (Dutch) auditor for the audit of the Company's annual accounts for the financial year ending December 31, 2023,

thereby ratifying and confirming the instruction of PwC in respect of the financial year ending December 31, 2023.

For completeness sake, it is noted that PwC (and its group companies) will also

be asked to audit the financial statements for the financial year 2023 prepared in accordance with IFRS and to be included in the Form

20-F to be filed with the SEC for the financial year 2023.

| 5. | Appointment of Sandra Vogt-Sasse as a member of the Supervisory Board (voting item) |

The Supervisory Board has made a binding nomination to appoint Sandra Vogt-Sasse

as a member of the Supervisory Board from the moment immediately after the AGM up to and including the end of the annual general meeting

of shareholders of the Company to be held in 2027.

Ms. Vogt-Sasse was appointed as an interim supervisory director under article 23.4

of the Articles of Association as of September 11, 2023.

| Full name |

Sandra Vogt-Sasse |

| Age |

54 |

| Profession |

Self-employed auditor, tax consultant and Managing Director of SAVOSA GmbH Steuerberatungsgesellschaft. Ms. Vogt-Sasse also is a supervisory board member of Deutsche Börse Commodities GmbH, Germany. |

| Number of shares held in the capital of the Company |

Ms. Vogt-Sasse does not hold any shares in the Company's share capital. |

| Brief description of precedent roles to the extent of interest for the role of supervisory director |

Until 2020, Ms. Vogt-Sasse worked for Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft for many years, first as an employee, then as a freelancer. Her focus is on advising companies on economic issues, auditing, and quality control in accordance with § 57a WPO. |

| Other supervisory board roles |

As mentioned, she also is a supervisory board member of a company closely linked to the capital market through its products and services. |

| Reasons for nomination |

Working experience with companies in financial difficulties and supervisory experiences with a company closely linked to the capital market. |

| Compensation |

Contingent upon her appointment as supervisory director of the Company, Sandra Vogt-Sasse will receive compensation for her services as a supervisory director consistent with the compensation package approved by the Company's general meeting. |

| 6. | Appointment of Thomas Wiedermann as supervisory director of the Company (voting item) |

The Supervisory Board has made a binding nomination to appoint Thomas Wiedermann

as a supervisory director of the Company from the moment immediately after the AGM up to and including the end of the annual general meeting

of shareholders of the Company to be held in 2027.

Mr Wiedermann was appointed as an interim supervisory director under article 23.4

of the Articles of Association as of September 11, 2023.

| Full name |

Thomas Wiedermann |

| Age |

60 |

| Profession |

Mr. Wiedermann is currently Managing Partner of Dankwardt Holding GmbH. |

| Number of shares held in the capital of the Company |

Mr. Wiedermann does not hold any shares in the Company's share capital. |

| Brief description of precedent roles to the extent of interest for the role of supervisory director |

Mr. Wiedermann is currently Managing Partner of Dankwardt Holding GmbH. Prior to that, he worked as an independent interim manager (CRO, CFO, CEO, CRSO, CSO) in various industries for international, medium-sized companies. The focus of his work includes restructuring and process optimization along the entire value chain as well as achieving sustainable revenue and earnings growth by focusing on and expanding strategic business areas. Mr. Wiedermann holds degrees in electrical engineering (TU Munich) and business administration (LMU Munich). |

| Other supervisory board roles |

Chairman of the supervisory board for Dockweiler AG |

| Reasons for nomination |

Many years of experience in restructuring and process optimization along the entire value chain as well as achieving sustainable revenue and earnings growth by focusing on and expanding strategic business areas. |

| Compensation |

Contingent upon his appointment as supervisory director of the Company, Thomas Wiedermann will receive compensation for his services as a supervisory director consistent with the compensation package approved by the Company's general meeting. |

| 7. | Appointment of Martin Sabbione as supervisory director of the Company (voting item) |

The Supervisory Board has made a binding nomination to appoint Martin Sabbione as

a supervisory director of the Company from the date of the AGM for a period ending at the end of the annual general meeting of shareholders

of the Company to be held in 2027. Mr. Sabbione was appointed as an interim supervisory director under article 23.4 of the Articles of

Association as of September 11, 2023.

| Full name |

Martin Sabbione |

| Age |

43 |

| Profession |

Mr. Sabbione is currently Senior Head of Controlling at Volkswagen Group Charging GmbH. |

| Number of shares held in the capital of the Company |

Mr. Sabbione does not hold any shares in the Company's share capital. |

| Brief description of precedent roles to the extent of interest for the role of supervisory director |

Mr. Sabbione founded multiple startups in the cleantech and healthcare spaces and previously held positions as CFO of Sono Motors GmbH and Head of Investment at WiWin GmbH & Co, KG. Mr. Sabbione is an experienced senior finance manager with a focus on scaling businesses and is passionate about sustainability, the mobility and energy transition, and innovations in healthcare. |

| Other supervisory board roles |

None. |

| Reasons for nomination |

Experience in start-ups, in funding and in mobility sector. |

| Compensation |

Contingent upon his appointment as supervisory director of the Company, Martin Sabbione will receive compensation for his services as a supervisory director consistent with the compensation package approved by the Company's general meeting. |

| 8. | Authorization of the Management Board, for a period of 18 months after the date of AGM or until the next annual general meeting

(whichever comes first), as the body authorised to issue ordinary shares and grant rights to subscribe for ordinary shares, up to a maximum

of 10% of the nominal issued capital as per the AGM (voting item) |

The current authorization of the Management Board to issue shares and/or grant rights

to subscribe for shares is unlimited. As this is deemed too broad, it is proposed by the Management Board to limit the existing authority

to an authority to issue ordinary shares and/or grant rights to subscribe for ordinary shares representing up to 10% of the nominal issued

capital as per the AGM.

| 9. | Authorization of the Management Board, for a period of 18 months after the date of AGM or until the next annual general meeting

(whichever comes first), as the body authorised to limit or exclude pre-emption rights in relation to any share issue or granting of rights

to subscribe for shares under the authorization mentioned in agenda item 8 (voting item) |

The Management Board proposes to grant the Management Board the authority to limit

the pre-emptive rights in relation to any shares issue or granting of right to subscribe for shares, resolved by the Management Board

under the authorization mentioned in agenda item 8.

***

4

Exhibit 99.2

VOTING PROXY

THE UNDERSIGNED:

acting on behalf of (only to be completed if relevant)

(the "Principal").

DECLARES AS FOLLOWS:

| 1. | The Principal hereby registers for the annual general meeting of shareholders of Sono Group N.V. (the

"Company") to be held on December 29, 2023 at 3.00pm Amsterdam time at the offices of Dentons Europe LLP, Amsterdam,

the Netherlands, at Gustav Mahlerplein 2, fifth floor, 1082 MA Amsterdam, the Netherlands (the "AGM") and, for purposes

of being represented at the AGM, grants a power of attorney to Mr. J.-M.P. Hermans, civil law notary and partner of Dentons Europe LLP,

in Amsterdam, the Netherlands, or any substitute to be appointed by him (the "Proxyholder"). |

| 2. | The scope of this power of attorney extends to the performance of the following acts on behalf of the

Principal at the AGM: |

| a. | to exercise the voting rights of the Principal in accordance with paragraph 3 below; and |

| b. | to exercise any other right of the Principal which the Principal would be allowed to exercise at the AGM. |

| 3. | This power of attorney shall be used by the Proxyholder to exercise the Principal's voting rights in the

manner directed as set forth below. If no choice is specified in respect of the sole voting item on the agenda, the Proxyholder shall

vote "FOR" such agenda item. |

| Agenda item (voting item) |

FOR |

AGAINST |

ABSTAIN |

|

Appointment of PricewaterhouseCoopers Accountants N.V. as the external

auditor of the Company's annual accounts 2023 (voting item)

|

|

|

|

|

Appointment of Sandra Vogt-Sasse as a member of the Supervisory Board (voting

item)

|

|

|

|

|

Appointment of Thomas Wiedermann as a member of the Supervisory Board (voting

item)

|

|

|

|

|

Appointment of Martin Sabbione as a member of the Supervisory Board (voting

item)

|

|

|

|

|

Authorization of the Management Board, for a period of 18 months after

the date of AGM or until the next annual general meeting (whichever comes first), as the body authorised to issue ordinary shares and

grant rights to subscribe for ordinary shares, up to a maximum of 10% of the nominal issued capital as per the AGM (voting item)

|

|

|

|

|

Authorization of the Management Board, for a period of 18 months after

the date of AGM or until the next annual general meeting (whichever comes first), as the body authorised to limit or exclude pre-emption

rights in relation to any share issue or granting of rights to subscribe for shares under the authorization mentioned in proposal 8 (voting

item)

|

|

|

|

| 4. | This power of attorney is granted with full power of substitution. |

| 5. | The relationship between the Principal and the Proxyholder under this power of attorney is governed exclusively

by the laws of the Netherlands. |

SIGN HERE

Please return this signed proxy via regular mail or e-mail, no later than 6.00 am on December

24, 2023, to:

Sono Group N.V.

c/o D. Lisitsyn

Waldmeisterstrasse 76

80935 Munich

Germany

(corporateoffice@sonomotors.com)

If the Principal is a (beneficial) owner of shares in the Company's capital, please enclose:

| (i) | proof of (beneficial) ownership of the underlying shares on the record date, such as a recent account statement; |

| (ii) | proof of identity; and |

| (ii) | if relevant, a signed proxy from the relevant holder of those underlying shares on the record date for the AGM (record date being

December 1, 2023). |

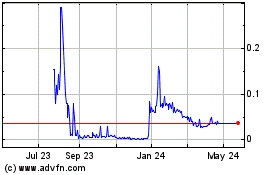

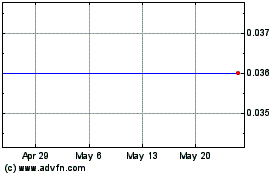

Sono Group NV (PK) (USOTC:SEVCQ)

Historical Stock Chart

From Apr 2024 to May 2024

Sono Group NV (PK) (USOTC:SEVCQ)

Historical Stock Chart

From May 2023 to May 2024