FALSE000093541900009354192023-12-142023-12-14

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 14, 2023

RCI HOSPITALITY HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Texas | 001-13992 | 76-0458229 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

10737 Cutten Road

Houston, Texas 77066

(Address of Principal Executive Offices, Including Zip Code)

(281) 397-6730

(Issuer’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | RICK | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On December 14, 2023, we issued a press release announcing the filing of our annual report on Form 10-K for the fiscal year ended September 30, 2023 and announced results for the fiscal year and quarter ended September 30, 2023. Also on December 14, 2023, we will hold a conference call to discuss these results and related matters. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K.

This information shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| | |

| Date: December 14, 2023 | By: | /s/ Eric Langan |

| | Eric Langan |

| | President and Chief Executive Officer |

RCI Reports 4Q23 & FY23 Results; X Spaces Call at 4:30 PM ET Today; Meet Management at 7 PM ET Tonight

HOUSTON—December 14, 2023—RCI Hospitality Holdings, Inc. (Nasdaq: RICK) today reported results for the fiscal 2023 fourth quarter and year ended September 30, 2023. The company also filed its Form 10-K.

| | | | | | | | | | | | | | |

| Summary Financials (in millions except EPS) | 4Q23 | 4Q22 | FY23 | FY22 |

| Total revenues | $75.3 | $71.4 | $293.8 | $267.6 |

| Other charges (gains), net | $9.9 | ($0.9) | $15.6 | $0.5 |

| EPS | $0.23 | $1.15 | $3.13 | $4.91 |

Non-GAAP EPS1 | $1.11 | $1.49 | $4.90 | $5.38 |

| Net cash from operating activities | $12.1 | $17.8 | $59.1 | $64.5 |

Free cash flow1 | $11.1 | $14.5 | $53.2 | $58.92 |

| Net income attributable to RCIHH common stockholders | $2.2 | $10.6 | $29.2 | $46.0 |

Adjusted EBITDA1 | $20.2 | $24.2 | $85.0 | $86.7 |

| Weighted average shares used in computing EPS – basic and diluted | 9.42 | 9.25 | 9.34 | 9.38 |

Share Repurchases

As of December 8, 2023, we had repurchased 37,954 common shares for $2.1 million or an average of $54.59 per share in 1Q24 and had $14.6 million in remaining stock repurchase authorization. In FY23, RCI repurchased 34,086 common shares for $2.2 million or an average of $65.22 per share.

CEO Comment

Eric Langan, President and CEO, said: “As we previously reported, business was soft during 4Q23 due to the current uncertain economy as well as tough comparisons to last year’s post-Covid bounce. However, our capital allocation strategy continues to produce strong, long-term results.”

“EPS was $0.23 for 4Q23 and $3.13 for FY23, which were impacted by non-cash impairment charges of $9.3 million and $12.6 million, respectively. On a non-GAAP basis, EPS was $1.11 for 4Q23 and $4.90 for FY23. Total revenues increased 5.4% year-over-year for 4Q23 and 9.8% for FY23. Both periods benefited from acquisitions, which helped offset lower same-store sales year-over-year, but not all of the margin decline.”

“Looking at the big picture, proforma FY23 same-store sales increased 9.0% compared to pre-Covid FY19, with Nightclubs +8.3% and Bombshells +12.6%.3 From year-end FY15, when we initiated our capital allocation strategy, through FY23, we have generated compound annual growth of 10.2% for total revenues, 12.1% for adjusted EBITDA, and 17.2% for free cash flow.”

“Subsequent to 4Q23, we continued to move ahead with our strategies and plans, buying back more shares depending on market conditions, opening Bombshells Stafford, and working on potential acquisitions. We believe year-over-year comparisons should become easier in FY24.”

Conference Call at 4:30 PM ET Today

•X Spaces: https://x.com/i/spaces/1rmxPMjzYkdKN (to ask questions during Q&A, you need to use a mobile phone)

•Telephone (listen only): Toll Free: 888-506-0062, International: 973-528-0011, Participant Access Code: 631531

•Webcast (listen only), Slides & Replay: https://www.webcaster4.com/Webcast/Page/2209/49519

Meet Management at 7:00 PM ET Tonight

•Investors are invited to Meet Management at one of RCI’s top revenue generating clubs

•Rick’s Cabaret New York, 50 W 33rd St, New York, NY 10001

•RSVP your contact information to gary.fishman@anreder.com by 5:00 PM ET today

1 See “Non-GAAP Financial Measures” below, 2 FY22 free cash flow included receipt of $2.2M tax refund, 3 The proforma same-store sales calculation includes sales for reporting units that qualify in accordance with our same store sales definition

4Q23 Results (Comparisons are to 4Q22 unless indicated otherwise)

•Nightclubs Segment: Revenues were $60.9 million compared to $56.6 million. The $4.3 million increase primarily reflected the benefit of newly acquired and remodeled clubs, which more than offset the decline in same-store sales.4 By revenue type, alcoholic beverages increased 17.2%, food and merchandise 15.9%, and other 8.1%, while service declined 2.0%. The differing growth rates primarily reflected a higher alcohol and lower service sales mix from the newly acquired Baby Dolls-Chicas Locas clubs as well as lower same-store sales. 4Q23 also included other charges, net (mainly impairments) and SOB license amortization of $9.5 million compared to $1.1 million. Operating income was $12.1 million (19.8% of revenues) compared to $22.5 million (39.7% of revenues). On a Non-GAAP basis, operating income was $21.6 million (35.4% of revenues) compared to $23.6 million (41.6% of revenues).

•Bombshells Segment: Revenues were $13.6 million compared to $14.0 million. The $452 thousand decline primarily reflected lower same-store sales, partially offset by a $1.6 million increase from newly acquired locations.4 4Q23 also included other charges, net and amortization of $239 thousand. Operating income was $1.2 million (8.7% of revenues) compared to $2.2 million (15.5% of revenues). On a Non-GAAP basis, operating income was $1.4 million (10.4% of revenues) compared to $2.2 million (15.5% of revenues).

•Other Segment: Revenues were approximately level at $727 thousand. 4Q23 included other charges, net (mainly impairments) of $969 thousand. Operating income was a loss of $793 thousand compared to a profit of $216 thousand. On a Non-GAAP basis, operating income was $176 thousand compared to $277 thousand.

•Consolidated operating margin was 7.5% of revenues compared to 25.2% and 22.4% compared to 30.0% non-GAAP. The GAAP and non-GAAP differences reflected 4Q22’s unusually high operating leverage (the third highest in the last five years), which included a $1.0 million legal credit. The GAAP difference also reflected other charges, net of $9.9 million in 4Q23 compared to other gains, net of $890 thousand in 4Q22.

•Interest expense was 5.6% of revenues compared to 4.8% reflecting higher average debt mostly from seller-financed promissory notes related to FY22-23 acquisitions.

•Income tax was a benefit of $0.6 million compared to an expense of $4.0 million. For the year, the Effective Tax Rate was 19.0% compared to 23.4%. The FY23 ETR reflected higher federal state credits that offset a higher portion of income subjected to state income taxes.

•Weighted average shares outstanding increased 1.8% year over year due to shares used in the 2Q23 Baby Dolls-Chicas Locas acquisition, partially offset by subsequent share buybacks.

•Debt was $239.8 million at 9/30/23 compared to $243.8 million at 6/30/23. The difference primarily reflected scheduled paydowns.

4 See our October 10, 2023 news release on 4Q23 sales for more details

Non-GAAP Financial Measures

In addition to our financial information presented in accordance with GAAP, management uses certain non-GAAP financial measures, within the meaning of the SEC Regulation G, to clarify and enhance understanding of past performance and prospects for the future. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in or excluded from the most directly comparable measure calculated and presented in accordance with GAAP. We monitor non-GAAP financial measures because it describes the operating performance of the Company and helps management and investors gauge our ability to generate cash flow, excluding (or including) some items that management believes are not representative of the ongoing business operations of the Company, but are included in (or excluded from) the most directly comparable measures calculated and presented in accordance with GAAP. Relative to each of the non-GAAP financial measures, we further set forth our rationale as follows:

•Non-GAAP Operating Income and Non-GAAP Operating Margin. We calculate non-GAAP operating income and non-GAAP operating margin by excluding the following items from income from operations and operating margin: (a) amortization of intangibles, (b) impairment of assets, (c) gains or losses on sale of businesses and assets, (d) gains or losses on insurance, (e) settlement of lawsuits, (f) costs and charges related to debt refinancing, and (g) stock-based compensation. We believe that excluding these items assists investors in evaluating period-over-period changes in our operating income and operating margin without the impact of items that are not a result of our day-to-day business and operations.

•Non-GAAP Net Income and Non-GAAP Net Income per Diluted Share. We calculate non-GAAP net income and non-GAAP net income per diluted share by excluding or including certain items to net income attributable to RCIHH common stockholders and diluted earnings per share. Adjustment items are: (a) amortization of intangibles, (b) impairment of assets, (c) gains or losses on sale of businesses and assets, (d) gains or losses on insurance, (e) unrealized loss on equity securities, (f) settlement of lawsuits, (g) gain on debt extinguishment, (h) costs and charges related to debt refinancing, (i) stock-based compensation, (j) the income tax effect of the above-described adjustments, and (k) change in deferred tax asset valuation allowance. Included in the income tax effect of the above adjustments is the net effect of the non-GAAP provision for income taxes, calculated at 20.6%, 22.8%, and 13.5% effective tax rate of the pre-tax non-GAAP income before taxes for 2023, 2022, and 2021, respectively, and the GAAP income tax expense. We believe that excluding and including such items help management and investors better understand our operating activities.

•Adjusted EBITDA. We calculate adjusted EBITDA by excluding the following items from net income attributable to RCIHH common stockholders: (a) depreciation and amortization, (b) income tax expense (benefit), (c) net interest expense, (d) gains or losses on sale of businesses and assets, (e) gains or losses on insurance, (f) unrealized gains or losses on equity securities, (g) impairment of assets, (h) settlement of lawsuits, (i) gain on debt extinguishment, and (j) stock-based compensation. We believe that adjusting for such items helps management and investors better understand our operating activities. Adjusted EBITDA provides a core operational performance measurement that compares results

without the need to adjust for federal, state and local taxes which have considerable variation between domestic jurisdictions. The results are, therefore, without consideration of financing alternatives of capital employed. We use adjusted EBITDA as one guideline to assess the unleveraged performance return on our investments. Adjusted EBITDA multiple is also used as a target benchmark for our acquisitions of nightclubs.

•We also use certain non-GAAP cash flow measures such as free cash flow. Free cash flow is derived from net cash provided by operating activities less maintenance capital expenditures. We use free cash flow as the baseline for the implementation of our capital allocation strategy.

About RCI Hospitality Holdings, Inc. (Nasdaq: RICK) (X: @RCIHHinc)

With more than 60 locations, RCI Hospitality Holdings, Inc., through its subsidiaries, is the country’s leading company in adult nightclubs and sports bars-restaurants. See all our brands at www.rcihospitality.com.

Forward-Looking Statements

This press release may contain forward-looking statements that involve a number of risks and uncertainties that could cause the company's actual results to differ materially from those indicated, including, but not limited to, the risks and uncertainties associated with (i) operating and managing an adult entertainment or restaurant business, (ii) the business climates in cities where it operates, (iii) the success or lack thereof in launching and building the company's businesses, (iv) cyber security, (v) conditions relevant to real estate transactions, (vi) the impact of the COVID-19 pandemic, and (vii) numerous other factors such as laws governing the operation of adult entertainment or restaurant businesses, competition and dependence on key personnel. For more detailed discussion of such factors and certain risks and uncertainties, see RCI's annual report on Form 10-K for the year ended September 30, 2023, as well as its other filings with the U.S. Securities and Exchange Commission. The company has no obligation to update or revise the forward-looking statements to reflect the occurrence of future events or circumstances.

Media & Investor Contacts

Gary Fishman and Steven Anreder at 212-532-3232 or gary.fishman@anreder.com and steven.anreder@anreder.com

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| CONSOLIDATED STATEMENTS OF INCOME |

| (in thousands, except per share, number of shares and percentage data) |

| | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Twelve Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Amount | | % of Revenue | | Amount | | % of Revenue | | Amount | | % of Revenue | | Amount | | % of Revenue |

| Revenues | | | | | | | | | | | | | | | |

| Sales of alcoholic beverages | $ | 33,325 | | | 44.3 | % | | $ | 29,812 | | | 41.8 | % | | $ | 127,262 | | | 43.3 | % | | $ | 113,316 | | | 42.3 | % |

| Sales of food and merchandise | 11,149 | | | 14.8 | % | | 10,666 | | | 14.9 | % | | 43,906 | | | 14.9 | % | | 44,294 | | | 16.6 | % |

| Service revenues | 25,661 | | | 34.1 | % | | 26,067 | | | 36.5 | % | | 103,577 | | | 35.3 | % | | 93,888 | | | 35.1 | % |

| Other | 5,115 | | | 6.8 | % | | 4,833 | | | 6.8 | % | | 19,045 | | | 6.5 | % | | 16,122 | | | 6.0 | % |

| Total revenues | 75,250 | | | 100.0 | % | | 71,378 | | | 100.0 | % | | 293,790 | | | 100.0 | % | | 267,620 | | | 100.0 | % |

| Operating expenses | | | | | | | | | | | | | | | |

| Cost of goods sold | | | | | | | | | | | | | | | |

| Alcoholic beverages sold | 6,155 | | | 18.5 | % | | 5,248 | | | 17.6 | % | | 23,291 | | | 18.3 | % | | 20,155 | | | 17.8 | % |

| Food and merchandise sold | 4,000 | | | 35.9 | % | | 3,781 | | | 35.4 | % | | 15,429 | | | 35.1 | % | | 15,537 | | | 35.1 | % |

| Service and other | 191 | | | 0.6 | % | | 147 | | | 0.5 | % | | 282 | | | 0.2 | % | | 317 | | | 0.3 | % |

| Total cost of goods sold (exclusive of items shown below) | 10,346 | | | 13.7 | % | | 9,176 | | | 12.9 | % | | 39,002 | | | 13.3 | % | | 36,009 | | | 13.5 | % |

| Salaries and wages | 20,818 | | | 27.7 | % | | 18,025 | | | 25.3 | % | | 79,500 | | | 27.1 | % | | 68,447 | | | 25.6 | % |

| Selling, general and administrative | 24,463 | | | 32.5 | % | | 22,352 | | | 31.3 | % | | 93,024 | | | 31.7 | % | | 78,847 | | | 29.5 | % |

| Depreciation and amortization | 4,043 | | | 5.4 | % | | 4,755 | | | 6.7 | % | | 15,151 | | | 5.2 | % | | 12,391 | | | 4.6 | % |

| Other charges, net | 9,936 | | | 13.2 | % | | (890) | | | (1.2) | % | | 15,629 | | | 5.3 | % | | 467 | | | 0.2 | % |

| Total operating expenses | 69,606 | | | 92.5 | % | | 53,418 | | | 74.8 | % | | 242,306 | | | 82.5 | % | | 196,161 | | | 73.3 | % |

| Income from operations | 5,644 | | | 7.5 | % | | 17,960 | | | 25.2 | % | | 51,484 | | | 17.5 | % | | 71,459 | | | 26.7 | % |

| Other income (expenses) | | | | | | | | | | | | | | | |

| Interest expense | (4,246) | | | (5.6) | % | | (3,454) | | | (4.8) | % | | (15,926) | | | (5.4) | % | | (11,950) | | | (4.5) | % |

| Interest income | 120 | | | 0.2 | % | | 90 | | | 0.1 | % | | 388 | | | 0.1 | % | | 411 | | | 0.2 | % |

| Non-operating gains, net | — | | | — | % | | — | | | — | % | | — | | | — | % | | 211 | | | 0.1 | % |

| Income before income taxes | 1,518 | | | 2.0 | % | | 14,596 | | | 20.4 | % | | 35,946 | | | 12.2 | % | | 60,131 | | | 22.5 | % |

| Income tax expense (benefit) | (601) | | | (0.8) | % | | 4,015 | | | 5.6 | % | | 6,846 | | | 2.3 | % | | 14,071 | | | 5.3 | % |

| Net income | 2,119 | | | 2.8 | % | | 10,581 | | | 14.8 | % | | 29,100 | | | 9.9 | % | | 46,060 | | | 17.2 | % |

| Net loss (income) attributable to noncontrolling interests | 72 | | | 0.1 | % | | 31 | | | — | % | | 146 | | | — | % | | (19) | | | — | % |

| Net income attributable to RCIHH common shareholders | $ | 2,191 | | | 2.9 | % | | $ | 10,612 | | | 14.9 | % | | $ | 29,246 | | | 10.0 | % | | $ | 46,041 | | | 17.2 | % |

| | | | | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | | | | | |

| Basic and diluted | $ | 0.23 | | | | | $ | 1.15 | | | | | $ | 3.13 | | | | | $ | 4.91 | | | |

| | | | | | | | | | | | | | | |

| Weighted average shares used in computing earnings per share | | | | | | | | | | | | | | | |

| Basic and diluted | 9,417,166 | | | | 9,249,864 | | | | 9,335,983 | | | | 9,383,445 | | |

| | | | | | | | | | | | | | | |

| Dividends per share | $ | 0.06 | | | | | $ | 0.05 | | | | | $ | 0.23 | | | | | $ | 0.19 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| NON-GAAP FINANCIAL MEASURES |

| (in thousands, except per share and percentage data) |

| | | | | | | |

| For the Three Months Ended | | For the Twelve Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Reconciliation of GAAP net income to Adjusted EBITDA | | | | | | | |

| Net income attributable to RCIHH common stockholders | $ | 2,191 | | | $ | 10,612 | | | $ | 29,246 | | | $ | 46,041 | |

| Income tax expense | (601) | | | 4,015 | | | 6,846 | | | 14,071 | |

| Interest expense, net | 4,126 | | | 3,364 | | | 15,538 | | | 11,539 | |

| Settlement of lawsuits | 576 | | | 708 | | | 3,759 | | | 1,417 | |

| Impairment of assets | 9,336 | | | 166 | | | 12,629 | | | 1,888 | |

| Loss (gain) on sale of businesses and assets | 10 | | | (1,709) | | | (682) | | | (2,375) | |

| Depreciation and amortization | 4,043 | | | 4,755 | | | 15,151 | | | 12,391 | |

| Unrealized loss on equity securities | — | | | (1) | | | — | | | — | |

| Gain on debt extinguishment | — | | | — | | | — | | | (138) | |

| Loss (gain) on insurance | 14 | | | (55) | | | (77) | | | (463) | |

| Stock-based compensation | 471 | | | 2,353 | | | 2,588 | | | 2,353 | |

| Adjusted EBITDA | $ | 20,166 | | | $ | 24,208 | | | $ | 84,998 | | | $ | 86,724 | |

| | | | | | | |

| Reconciliation of GAAP net income to non-GAAP net income | | | | | | | |

| Net income attributable to RCIHH common stockholders | $ | 2,191 | | | $ | 10,612 | | | $ | 29,246 | | | $ | 46,041 | |

| Amortization of intangibles | 806 | | | 1,994 | | | 3,528 | | | 2,118 | |

| Settlement of lawsuits | 576 | | | 708 | | | 3,759 | | | 1,417 | |

| Impairment of assets | 9,336 | | | 166 | | | 12,629 | | | 1,888 | |

| Loss (gain) on sale of businesses and assets | 10 | | | (1,709) | | | (682) | | | (2,375) | |

| Unrealized loss on equity securities | — | | | (1) | | | — | | | — | |

| Gain on debt extinguishment | — | | | — | | | — | | | (138) | |

| Loss (gain) on insurance | 14 | | | (55) | | | (77) | | | (463) | |

| Stock-based compensation | 471 | | | 2,353 | | | 2,588 | | | 2,353 | |

| Change in deferred tax asset valuation allowance | (176) | | | 343 | | | (176) | | | 343 | |

| Net income tax effect | (2,810) | | | (670) | | | (5,068) | | | (729) | |

| Non-GAAP net income | $ | 10,418 | | | $ | 13,741 | | | $ | 45,747 | | | $ | 50,455 | |

| | | | | | | |

| Reconciliation of GAAP diluted earnings per share to non-GAAP diluted earnings per share | | | | | | | |

| Diluted shares | 9,417,166 | | 9,249,864 | | 9,335,983 | | 9,383,445 |

| GAAP diluted earnings per share | $ | 0.23 | | | $ | 1.15 | | | $ | 3.13 | | | $ | 4.91 | |

| Amortization of intangibles | 0.09 | | | 0.22 | | | 0.38 | | | 0.23 | |

| Settlement of lawsuits | 0.06 | | | 0.08 | | | 0.40 | | | 0.15 | |

| Impairment of assets | 0.99 | | | 0.02 | | | 1.35 | | | 0.20 | |

| Loss (gain) on sale of businesses and assets | — | | | (0.18) | | | (0.07) | | | (0.25) | |

| Unrealized loss on equity securities | — | | | — | | | — | | | — | |

| Gain on debt extinguishment | — | | | — | | | — | | | (0.01) | |

| Loss (gain) on insurance | — | | | (0.01) | | | (0.01) | | | (0.05) | |

| Stock-based compensation | 0.05 | | | 0.25 | | | 0.28 | | | 0.25 | |

| Change in deferred tax asset valuation allowance | (0.02) | | | 0.04 | | | (0.02) | | | 0.04 | |

| Net income tax effect | (0.30) | | | (0.07) | | | (0.54) | | | (0.08) | |

| Non-GAAP diluted earnings per share | $ | 1.11 | | | $ | 1.49 | | | $ | 4.90 | | | $ | 5.38 | |

| | | | | | | |

| Reconciliation of GAAP operating income to non-GAAP operating income | | | | | | | |

| Income from operations | $ | 5,644 | | | $ | 17,960 | | | $ | 51,484 | | | $ | 71,459 | |

| Amortization of intangibles | 806 | | | 1,994 | | | 3,528 | | | 2,118 | |

| Settlement of lawsuits | 576 | | | 708 | | | 3,759 | | | 1,417 | |

| Impairment of assets | 9,336 | | | 166 | | | 12,629 | | | 1,888 | |

| Loss (gain) on sale of businesses and assets | 10 | | | (1,709) | | | (682) | | | (2,375) | |

| Loss (gain) on insurance | 14 | | | (55) | | | (77) | | | (463) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | 471 | | | 2,353 | | | 2,588 | | | 2,353 | |

| Non-GAAP operating income | $ | 16,857 | | | $ | 21,417 | | | $ | 73,229 | | | $ | 76,397 | |

| | | | | | | |

| Reconciliation of GAAP operating margin to non-GAAP operating margin | | | | | | | |

| Income from operations | 7.5 | % | | 25.2 | % | | 17.5 | % | | 26.7 | % |

| Amortization of intangibles | 1.1 | % | | 2.8 | % | | 1.2 | % | | 0.8 | % |

| Settlement of lawsuits | 0.8 | % | | 1.0 | % | | 1.3 | % | | 0.5 | % |

| Impairment of assets | 12.4 | % | | 0.2 | % | | 4.3 | % | | 0.7 | % |

| Loss (gain) on sale of businesses and assets | — | % | | (2.4) | % | | (0.2) | % | | (0.9) | % |

| Loss (gain) on insurance | — | % | | (0.1) | % | | — | % | | (0.2) | % |

| Stock-based compensation | 0.6 | % | | 3.3 | % | | 0.9 | % | | 0.9 | % |

| Non-GAAP operating margin | 22.4 | % | | 30.0 | % | | 24.9 | % | | 28.5 | % |

| | | | | | | |

| Reconciliation of net cash provided by operating activities to free cash flow | | | | | | | |

| Net cash provided by operating activities | $ | 12,126 | | | $ | 17,755 | | | $ | 59,130 | | | $ | 64,509 | |

| Less: Maintenance capital expenditures | 1,005 | | | 3,213 | | | 5,954 | | | 5,598 | |

| Free cash flow | $ | 11,121 | | | $ | 14,542 | | | $ | 53,176 | | | $ | 58,911 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| SEGMENT INFORMATION |

| (in thousands) |

| | | | | | | |

| For the Three Months Ended | | For the Twelve Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Revenues | | | | | | | |

| Nightclubs | $ | 60,943 | | | $ | 56,612 | | | $ | 236,748 | | | $ | 206,251 | |

| Bombshells | 13,580 | | | 14,032 | | | 55,723 | | | 59,925 | |

| Other | 727 | | | 734 | | | 1,319 | | | 1,444 | |

| $ | 75,250 | | | $ | 71,378 | | | $ | 293,790 | | | $ | 267,620 | |

| | | | | | | |

| Income (loss) from operations | | | | | | | |

| Nightclubs | $ | 12,060 | | | $ | 22,477 | | | $ | 73,187 | | | $ | 82,798 | |

| Bombshells | 1,179 | | | 2,169 | | | 6,502 | | | 11,504 | |

| Other | (793) | | | 216 | | | (1,446) | | | 57 | |

| Corporate | (6,802) | | | (6,902) | | | (26,759) | | | (22,900) | |

| $ | 5,644 | | | $ | 17,960 | | | $ | 51,484 | | | $ | 71,459 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| NON-GAAP SEGMENT INFORMATION |

| ($ in thousands) |

| | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, 2023 | | For the Three Months Ended September 30, 2022 |

| Nightclubs | | Bombshells | | Other | | Corporate | | Total | | Nightclubs | | Bombshells | | Other | | Corporate | | Total |

| Income (loss) from operations | $ | 12,060 | | | $ | 1,179 | | | $ | (793) | | | $ | (6,802) | | | $ | 5,644 | | | $ | 22,477 | | | $ | 2,169 | | | $ | 216 | | | $ | (6,902) | | | $ | 17,960 | |

| Amortization of intangibles | 617 | | | 30 | | | 155 | | | 4 | | | 806 | | | 1,925 | | | 1 | | | 61 | | | 7 | | | 1,994 | |

| Settlement of lawsuits | 378 | | | 198 | | | — | | | — | | | 576 | | | 709 | | | — | | | — | | | (1) | | | 708 | |

| Impairment of assets | 8,522 | | | — | | | 814 | | | — | | | 9,336 | | | 166 | | | — | | | — | | | — | | | 166 | |

| Loss (gain) on sale of businesses and assets | — | | | 11 | | | — | | | (1) | | | 10 | | | (1,666) | | | — | | | — | | | (43) | | | (1,709) | |

| Loss (gain) on insurance | — | | | — | | | — | | | 14 | | | 14 | | | (55) | | | — | | | — | | | — | | | (55) | |

| Stock-based compensation | — | | | — | | | — | | | 471 | | | 471 | | | — | | | — | | | — | | | 2,353 | | | 2,353 | |

| Non-GAAP operating income (loss) | $ | 21,577 | | | $ | 1,418 | | | $ | 176 | | | $ | (6,314) | | | $ | 16,857 | | | $ | 23,556 | | | $ | 2,170 | | | $ | 277 | | | $ | (4,586) | | | $ | 21,417 | |

| | | | | | | | | | | | | | | | | | | |

| GAAP operating margin | 19.8 | % | | 8.7 | % | | (109.1) | % | | (9.0) | % | | 7.5 | % | | 39.7 | % | | 15.5 | % | | 29.4 | % | | (9.7) | % | | 25.2 | % |

| Non-GAAP operating margin | 35.4 | % | | 10.4 | % | | 24.2 | % | | (8.4) | % | | 22.4 | % | | 41.6 | % | | 15.5 | % | | 37.7 | % | | (6.4) | % | | 30.0 | % |

| | | | | | | | | | | | | | | | | | | |

| For the Twelve Months Ended September 30, 2023 | | For the Twelve Months Ended September 30, 2022 |

| Nightclubs | | Bombshells | | Other | | Corporate | | Total | | Nightclubs | | Bombshells | | Other | | Corporate | | Total |

| Income (loss) from operations | $ | 73,187 | | | $ | 6,502 | | | $ | (1,446) | | | $ | (26,759) | | | $ | 51,484 | | | $ | 82,798 | | | $ | 11,504 | | | $ | 57 | | | $ | (22,900) | | | $ | 71,459 | |

| Amortization of intangibles | 2,497 | | | 530 | | | 484 | | | 17 | | | 3,528 | | | 2,042 | | | 6 | | | 61 | | | 9 | | | 2,118 | |

| Settlement of lawsuits | 3,552 | | | 207 | | | — | | | — | | | 3,759 | | | 1,287 | | | 18 | | | — | | | 112 | | | 1,417 | |

| Impairment of assets | 11,815 | | | — | | | 814 | | | — | | | 12,629 | | | 1,238 | | | 650 | | | — | | | — | | | 1,888 | |

| Loss (gain) on sale of businesses and assets | (734) | | | 77 | | | — | | | (25) | | | (682) | | | (2,010) | | | 17 | | | — | | | (382) | | | (2,375) | |

| Gain on insurance | (48) | | | — | | | — | | | (29) | | | (77) | | | (463) | | | — | | | — | | | — | | | (463) | |

| Stock-based compensation | — | | | — | | | — | | | 2,588 | | | 2,588 | | | — | | | — | | | — | | | 2,353 | | | 2,353 | |

| Non-GAAP operating income (loss) | $ | 90,269 | | | $ | 7,316 | | | $ | (148) | | | $ | (24,208) | | | $ | 73,229 | | | $ | 84,892 | | | $ | 12,195 | | | $ | 118 | | | $ | (20,808) | | | $ | 76,397 | |

| | | | | | | | | | | | | | | | | | | |

| GAAP operating margin | 30.9 | % | | 11.7 | % | | (109.6) | % | | (9.1) | % | | 17.5 | % | | 40.1 | % | | 19.2 | % | | 3.9 | % | | (8.6) | % | | 26.7 | % |

| Non-GAAP operating margin | 38.1 | % | | 13.1 | % | | (11.2) | % | | (8.2) | % | | 24.9 | % | | 41.2 | % | | 20.4 | % | | 8.2 | % | | (7.8) | % | | 28.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in thousands) |

| | | | | | | |

| For the Three Months Ended | | For the Twelve Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | |

| Net income (loss) | $ | 2,119 | | | $ | 10,581 | | | $ | 29,100 | | | $ | 46,060 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 4,043 | | | 4,755 | | | 15,151 | | | 12,391 | |

| Deferred tax expense (benefit) | (991) | | | 3,489 | | | (1,781) | | | 3,080 | |

| Loss (gain) on sale of businesses and assets | 2 | | | (1,688) | | | (870) | | | (2,970) | |

| Impairment of assets | 9,336 | | | 166 | | | 12,629 | | | 1,888 | |

| Amortization and writeoff of debt discount and issuance costs | 162 | | | 115 | | | 615 | | | 314 | |

| Doubtful accounts expense (reversal) on notes receivable | — | | | — | | | — | | | 753 | |

| Unrealized gain on equity securities | — | | | (1) | | | — | | | — | |

| Loss (gain) on insurance | 14 | | | (55) | | | (77) | | | (463) | |

| Noncash lease expense | 752 | | | 882 | | | 2,978 | | | 2,607 | |

| Stock-based compensation expense | 471 | | | 2,353 | | | 2,588 | | | 2,353 | |

| Gain on debt extinguishment | — | | | — | | | — | | | (83) | |

| Changes in operating assets and liabilities, net of business acquisitions: | | | | | | | |

| Accounts receivable | (3,863) | | | (3,586) | | | (2,383) | | | (175) | |

| Inventories | 98 | | | (62) | | | 177 | | | (554) | |

| Prepaid expenses, other current, and other assets | 3,236 | | | 3,658 | | | (366) | | | 387 | |

| Accounts payable, accrued, and other liabilities | (3,253) | | | (2,852) | | | 1,369 | | | (1,079) | |

| Net cash provided by operating activities | 12,126 | | | 17,755 | | | 59,130 | | | 64,509 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | |

| Proceeds from sale of businesses and assets | 1,434 | | | 6,058 | | | 4,245 | | | 10,669 | |

| Proceeds from notes receivable | 59 | | | 55 | | | 229 | | | 182 | |

| Proceeds from insurance | (5) | | | 133 | | | 86 | | | 648 | |

| Payments for property and equipment and intangible assets | (9,265) | | | (6,830) | | | (40,384) | | | (24,003) | |

| Acquisition of businesses, net of cash acquired | — | | | (10,991) | | | (29,000) | | | (55,293) | |

| Net cash used in investing activities | (7,777) | | | (11,575) | | | (64,824) | | | (67,797) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| Proceeds from debt obligations | — | | | — | | | 11,595 | | | 35,820 | |

| Payments on debt obligations | (4,219) | | | (4,180) | | | (15,650) | | | (14,894) | |

| Purchase of treasury stock | (2,125) | | | (3,040) | | | (2,223) | | | (15,097) | |

| Payment of dividends | (566) | | | (462) | | | (2,146) | | | (1,784) | |

| Payment of loan origination costs | — | | | (18) | | | (239) | | | (463) | |

| Share in return of investment by noncontrolling partner | — | | | — | | | (600) | | | — | |

| Net cash provided by (used in) financing activities | (6,910) | | | (7,700) | | | (9,263) | | | 3,582 | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | (2,561) | | | (1,520) | | | (14,957) | | | 294 | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 23,584 | | | 37,500 | | | 35,980 | | | 35,686 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 21,023 | | | $ | 35,980 | | | $ | 21,023 | | | $ | 35,980 | |

| | | | | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (in thousands) |

| | | |

| September 30, 2023 | | September 30, 2022 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 21,023 | | | $ | 35,980 | |

| Accounts receivable, net | 9,846 | | | 8,510 | |

| Current portion of notes receivable | 249 | | | 230 | |

| Inventories | 4,412 | | | 3,893 | |

| Prepaid expenses and other current assets | 1,943 | | | 1,499 | |

| Assets held for sale | — | | | 1,049 | |

| Total current assets | 37,473 | | | 51,161 | |

| Property and equipment, net | 282,705 | | | 224,615 | |

| Operating lease right-of-use assets, net | 34,931 | | | 37,048 | |

| Notes receivable, net of current portion | 4,443 | | | 4,691 | |

| Goodwill | 70,772 | | | 67,767 | |

| Intangibles, net | 179,145 | | | 144,049 | |

| Other assets | 1,415 | | | 1,407 | |

| Total assets | $ | 610,884 | | | $ | 530,738 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 6,111 | | | $ | 5,482 | |

| Accrued liabilities | 16,051 | | | 11,328 | |

| Current portion of debt obligations, net | 22,843 | | | 11,896 | |

| Current portion of operating lease liabilities | 2,977 | | | 2,795 | |

| Total current liabilities | 47,982 | | | 31,501 | |

| Deferred tax liability, net | 29,143 | | | 30,562 | |

| Debt, net of current portion and debt discount and issuance costs | 216,908 | | | 190,567 | |

| Operating lease liabilities, net of current portion | 35,175 | | | 36,001 | |

| Other long-term liabilities | 352 | | | 349 | |

| Total liabilities | 329,560 | | | 288,980 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Equity | | | |

| Preferred stock | — | | | — | |

| Common stock | 94 | | | 92 | |

| Additional paid-in capital | 80,437 | | | 67,227 | |

| Retained earnings | 201,050 | | | 173,950 | |

| Total RCIHH stockholders' equity | 281,581 | | | 241,269 | |

| Noncontrolling interests | (257) | | | 489 | |

| Total equity | 281,324 | | | 241,758 | |

| Total liabilities and equity | $ | 610,884 | | | $ | 530,738 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

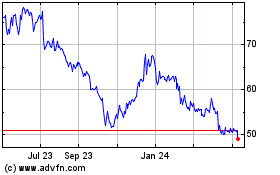

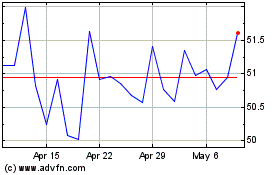

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Mar 2024 to Apr 2024

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Apr 2023 to Apr 2024