false

0001464790

0001464790

2023-12-13

2023-12-13

0001464790

RILY:CommonStockParValue0.0001PerShareMember

2023-12-13

2023-12-13

0001464790

RILY:DepositarySharesEachRepresenting11000thinterestina6.875Member

2023-12-13

2023-12-13

0001464790

RILY:DepositarySharesEachRepresenting11000thfractionalinterestina7.375Member

2023-12-13

2023-12-13

0001464790

RILY:Sec6.75SeniorNotesDue2024Member

2023-12-13

2023-12-13

0001464790

RILY:Sec6.375SeniorNotesDue2025Member

2023-12-13

2023-12-13

0001464790

RILY:Sec5.00SeniorNotesDue2026Member

2023-12-13

2023-12-13

0001464790

RILY:Sec5.50SeniorNotesDue2026Member

2023-12-13

2023-12-13

0001464790

RILY:Sec6.50SeniorNotesDue2026Member

2023-12-13

2023-12-13

0001464790

RILY:Sec5.25SeniorNotesDue2028Member

2023-12-13

2023-12-13

0001464790

RILY:Sec6.00SeniorNotesDue2028Member

2023-12-13

2023-12-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): December 13, 2023

B. RILEY FINANCIAL, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-37503 |

|

27-0223495 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

11100 Santa Monica Blvd.,

Suite 800

Los Angeles, CA 90025

310-966-1444

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

RILY |

|

Nasdaq Global Market |

| Depositary

Shares (each representing a 1/1000th interest in a 6.875%

Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) |

|

RILYP |

|

Nasdaq Global Market |

| Depositary

Shares, each representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative

Perpetual Preferred Stock |

|

RILYL |

|

Nasdaq Global Market |

| 6.75% Senior Notes due 2024 |

|

RILYO |

|

Nasdaq Global Market |

| 6.375% Senior Notes due 2025 |

|

RILYM |

|

Nasdaq Global Market |

| 5.00% Senior Notes due 2026 |

|

RILYG |

|

Nasdaq Global Market |

| 5.50% Senior Notes due 2026 |

|

RILYK |

|

Nasdaq Global Market |

| 6.50% Senior Notes due 2026 |

|

RILYN |

|

Nasdaq Global Market |

| 5.25% Senior Notes due 2028 |

|

RILYZ |

|

Nasdaq Global Market |

| 6.00% Senior Notes due 2028 |

|

RILYT |

|

Nasdaq Global Market |

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 13, 2023, B.

Riley Financial, Inc. (the “Company”) held its previously announced Analyst and Investor Day. The slides used in

conjunction with the presentation are attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth

in this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of such section. The information in this Current Report, including Exhibit 99.1 attached hereto, shall not be

incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing to this Current Report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

B. Riley Financial, Inc. |

| |

|

|

| |

By: |

/s/ Phillip J. Ahn |

| |

Name: |

Phillip J. Ahn |

| |

Title: |

Chief Financial Officer and Chief Operating Officer |

Date:

December 13, 2023

2

Exhibit 99.1

1 Investor Overview D e c e m b e r 1 3 , 2 0 23

Forward - looking Statements Statements made in this presentation that are not descriptions of historical facts are forward - looking statements that are based on management’s current expectations and assumptions and are subject to risks and uncertainties . If such risks or uncertainties materialize or such assumptions prove incorrect, our business, operating results, financial condition, and stock price could be materially negatively affected . You should not place undue reliance on such forward - looking statements, which are based on the information currently available to us and speak only as of the date of this press release . Such forward - looking statements include, but are not limited to, statements regarding our excitement and the expected growth of our business segments . Factors that could cause such actual results to differ materially from those contemplated or implied by such forward - looking statements include, without limitation, the risks described from time to time in B . Riley Financial, Inc . ’s periodic filings with the SEC, including, without limitation, the risks described in B . Riley Financial, Inc . ’s Annual Report on Form 10 - K for the year ended December 31 , 2022 under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” (as applicable) and our Quarterly Reports on Form 10 - Q for the quarters ended March 31 , 2023 , June 30 , 2023 and September 30 , 2023 . These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward - looking statements . These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward - looking statements . All information is current as of the date this presentation is published, and B . Riley Financial undertakes no duty to update this information . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities . Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933 , as amended . Use of Non - GAAP Financial Measures 2 Certain of the information set forth herein, including operating revenues, adjusted EBITDA, operating adjusted EBITDA, and investment adjusted EBITDA, may be considered non - GAAP financial measures . B . Riley Financial believes this information is useful to investors because it provides a basis for measuring the Company's available capital resources, the operating performance of its business and its revenues and cash flow, (i) excluding in the case of operating revenues, trading income (loss) and fair value adjustments on loans, (ii) excluding in the case of adjusted EBITDA, net interest expense, provisions for or benefit from income taxes, depreciation, amortization, fair value adjustment, restructuring charge, gain on extinguishment of loans, impairment of trade names, stock - based compensation and transaction and other expenses, (iii) excluding in the case of operating adjusted EBITDA, aforementioned adjustments for adjusted EBITDA, as well as trading income (loss) and fair value adjustments on loans, realized and unrealized gains (losses) on investments, and other investment related expenses, and (iv) in the case of investment adjusted EBITDA this includes trading income (loss) and fair value adjustments on loans and realized and unrealized gains (losses) on investments, net of other investment related expenses, that would normally be included in the most directly comparable measures calculated and presented in accordance with Generally Accepted Accounting Principles ("GAAP") . In the Capital Markets segment, non - GAAP measures also include operating adjusted EBITDA, FI Spread, and CEF income, which is comprised of operating adjusted EBITDA plus revenue and expenses from Fixed Income and Committed Equity Facilities (CEF) . In addition, the Company's management uses these non - GAAP financial measures along with the most directly comparable GAAP financial measures in evaluating the Company's operating performance, capital resources and cash flow . Non - GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non - financial measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies . Reconciliation of non - GAAP measures included herein to their most directly comparable GAAP measures can be found in the appendices to this presentation and on B . Riley Financial, Inc . ’s website at https : //ir . brileyfin . com/

Welcome and Agenda 27 - Year Track Record of Doing Right for Our Clients & Investors 1. Diverse & Integrated Platform of Operating Businesses 2. Proprietary Approach to Investing Across the Middle Market 3. WHAT YOU’LL HEAR TODAY 3

01 B. RILEY FINANCIAL AT - A - GLANCE

Bryant Riley Co - founder, Chairman, Co - CEO, B. Riley Financial Tom Kelleher C o - f oun d e r , C o - C E O , B. Riley Financial Phil Ahn CFO and COO, B. Riley Financial Legacy Great American Group since 2010 Dan Shribman CIO, B. Riley Financial since 2019 President, Principal Investments since 2018 Andy Moore CEO, B. Riley Securities Legacy B. Riley & Co. since 2006 Jimmy Baker President, B. Riley Securities Legacy B. Riley & Co. since 2010 Ian Ratner Co - CEO, Advisory Services Legacy GlassRatner since 2001 Mike Marchlik Co - CEO, Advisory Services Legacy Great American Appraisal since 1996 Mikel Williams CEO, Targus since 2016 Former director BRF 2015 - 2022 Former CEO, DDi Corp. 2005 - 2012 Nick Capuano CIO, Principal Investments (brands) since 2009 Kenny Young President, B. Riley Financial CEO, Principal Investments since 2016 CEO, Babcock & Wilcox since 2018 Former BRF director from 2015 - 2016 CEO, LCC 2008 - 2015 Ananth Veluppillai COO, Principal Investments (communications) since 2016 Michael Mullen CEO, B. Riley Wealth Legacy National Holdings since 2008 Scott Carpenter CEO, Retail, Wholesale & Industrial Solutions Legacy Great American Group since 1997 Chuck Hastings Chairman, B. Riley Wealth Legacy B. Riley & Co. since 2013 Alan Forman EVP & General Counsel since 2015 Long - Tenured Leadership Michael Jerbich President, B. Riley Real Estate since 2020 Tim Shilling EVP, Retail, Wholesale & Industrial Solutions since 2021 B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 5

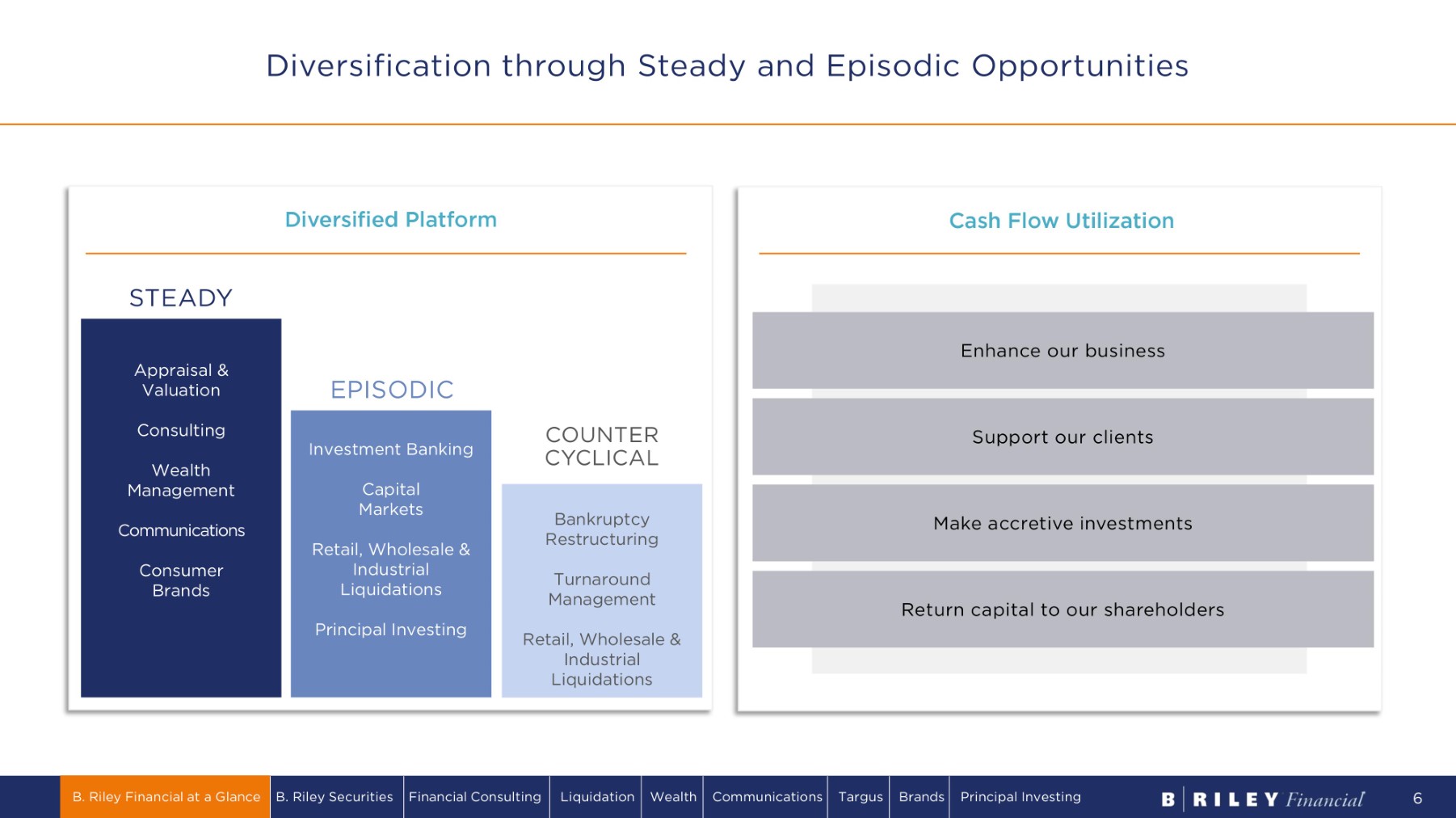

Diversification through Steady and Episodic Opportunities Diversified Platform S TEA D Y EPISODIC C O U N T E R C Y CL I CA L Appraisal & Valuation C o n s u lti n g Wealth M a n a g emen t Investment Banking Capital M ark e t s Communications Retail, Wholesale & Consumer Industrial Brands Liquidations Principal Investing Bankruptcy R e s tr u c t u r i n g Turnaround M a n a g emen t Retail, Wholesale & Industrial Liquidations Support our clients Make accretive investments Cash Flow Utilization Enhance our business Return capital to our shareholders B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 6

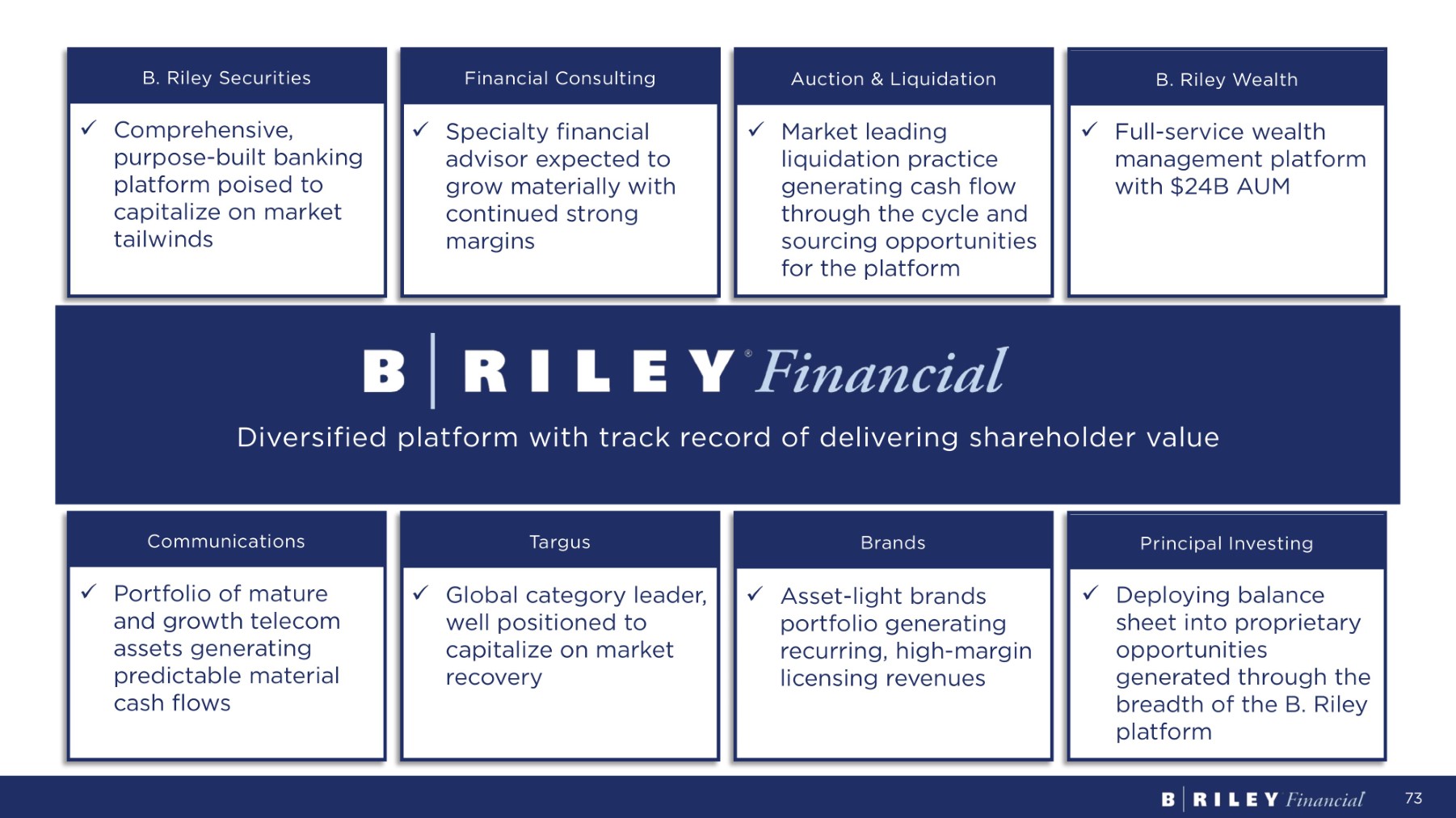

B. Riley Financial Overview We have purpose - built our B. Riley platform with complementary operating businesses designed to enhance each other B. Riley Wealth Full - service wealth management platform at the end of a multi - year turnaround and poised for growth in clients, AUM, and cash flow generation with multiple layers of strategic value B. Riley Securities Ideally positioned to benefit from the return of capital markets and M&A activity after two decades of consistent growth in market share Financial Consulting High growth, capital light consulting business benefitting from scale of broader platform and quickly becoming an acquiror of choice in the industry B. Riley Financial Auction & Liquidation Highly cash flow generative asset through the cycle with unique ability to source interesting opportunities for the overall platform B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 7

B. Riley Financial Overview (continued) B. Riley opportunistically employs its balance sheet as an active investor across public and private markets Brands Cash flow generative assets purchased at low multiples with potential upside on continued increases in the value of the IP Communications Our first non - financial services take - private – United Online in 2016 – began with the thesis of buying highly cash flow generative, predictable revenue at a low multiple to complement other more episodic business lines. Our communications vertical has expanded through four additional acquisitions, generating significant cash flow on limited capital investment Targus Acquired in 2022 with the view that its through - cycle stability, market position, and strong cash flow characteristics supplement B. Riley’s cash - generating communications and brand investments B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 8 Principal Investing

Market Maker in Over 1,400 Equity Securities O v e r 1,600 Appraisals Completed in 2023 Over 4,300 Retail Store Closures since 2020 $64B Underwritten Banking Transaction Value since 2020 $24B Wealth Management AUM ~400 Companies Covered by Equity Research B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 9

02 B. RILEY SECURITIES

Advisory Purpose - built to help our clients outperform throughout market cycles M&A Representation Private Markets Advisory Restructuring Advisory Brokerage B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 11 Institutional Sales & Trading Research Corporate Access Securities Lending Capital Markets Equity Capital Markets Debt Capital Markets

Expanding B. Riley Securities’ (“BRS”) Capabilities ▪ Established M&A advisory capabilities ▪ Completed first underwritten transaction ▪ Meaningfully grew retail network via acquisition of National Holdings ▪ Expanded investor universe through establishment of Financial Sponsor Group ▪ Added venture - stage capital raising capability via establishment of B. Riley Venture Capital to expand merchant banking framework ▪ Expanded M&A capabilities via FocalPoint acquisition ▪ Added talented leadership & execution staff ▪ Diversified existing Capital Markets business & expanded Private Markets capabilities Founded research - focused small - cap platform ▪ Led proliferation of $25 par market across industry sectors ▪ Created differentiated Committed Equity Facility (“CEF”) product ▪ Established Restructuring capabilities ▪ Expanded Capital Markets capabilities, including ATMs, & enhanced industry coverage via FBR & Co. acquisition ▪ Acquired retail network via Wunderlich acquisition 2023 + 2022 2021 2020 2016 - 2017 2006 - 2010 1997 Built a comprehensive, differentiated platform that addresses the full spectrum of client needs B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 12 ▪ Leverage positions of market leadership ▪ Deepen industry vertical expertise ▪ Broaden geographic presence ▪ Expand private credit capabilities

Broad institutional investor reach and deep expertise across research coverage ~400 companies under equity research coverage 1,000+ institutional investors covered Market maker in 1,400+ equity securities Our annual flagship conference, industry - specific conferences, and non - deal roadshows bring together hundreds of differentiated institutional investors and small - cap companies in events throughout the country Figures noted are approximations based upon the latest available data. 60+ sales and trading professionals Institutional Brokerage & Equity Research B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 13

Equity Capital Markets | Debt Capital Markets Trailing 3 Years By the Numbers (1) Total transaction value = cumulative deal value (bookrun, lead managed, and co - managed transactions) (2) Cumulative led transaction deal value (public IPO, FO, and convert offerings) ~$64B in total underwritten transaction value (1) #2 Sales Agent in at - the - market offerings (4) Led 30+ private debt transactions, raising ~$3.0B Led 30+ unsecured notes and preferred equity offerings, raising $3.0B+ Led 70+ IPO and FO transactions, raising $7.0B+ (2) #1 Small - Cap Underwriter Outside “Bulge Bracket” Firms (3) Leading Middle - Market Platform (3) Source: Dealogic. Pricing Date 10/1/2020 – 9/30/2023, Deal Type = IPO, FO, Rank Eligible. SEC registered. Exchange Nationality = USA. Market Cap. $100MM - $1.5B. Deal Price >= $1.00. Excludes SPAC IPOs and Healthcare transactions. (4) Based on number of ATMs filed. 300+ ATMs over time span B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 14

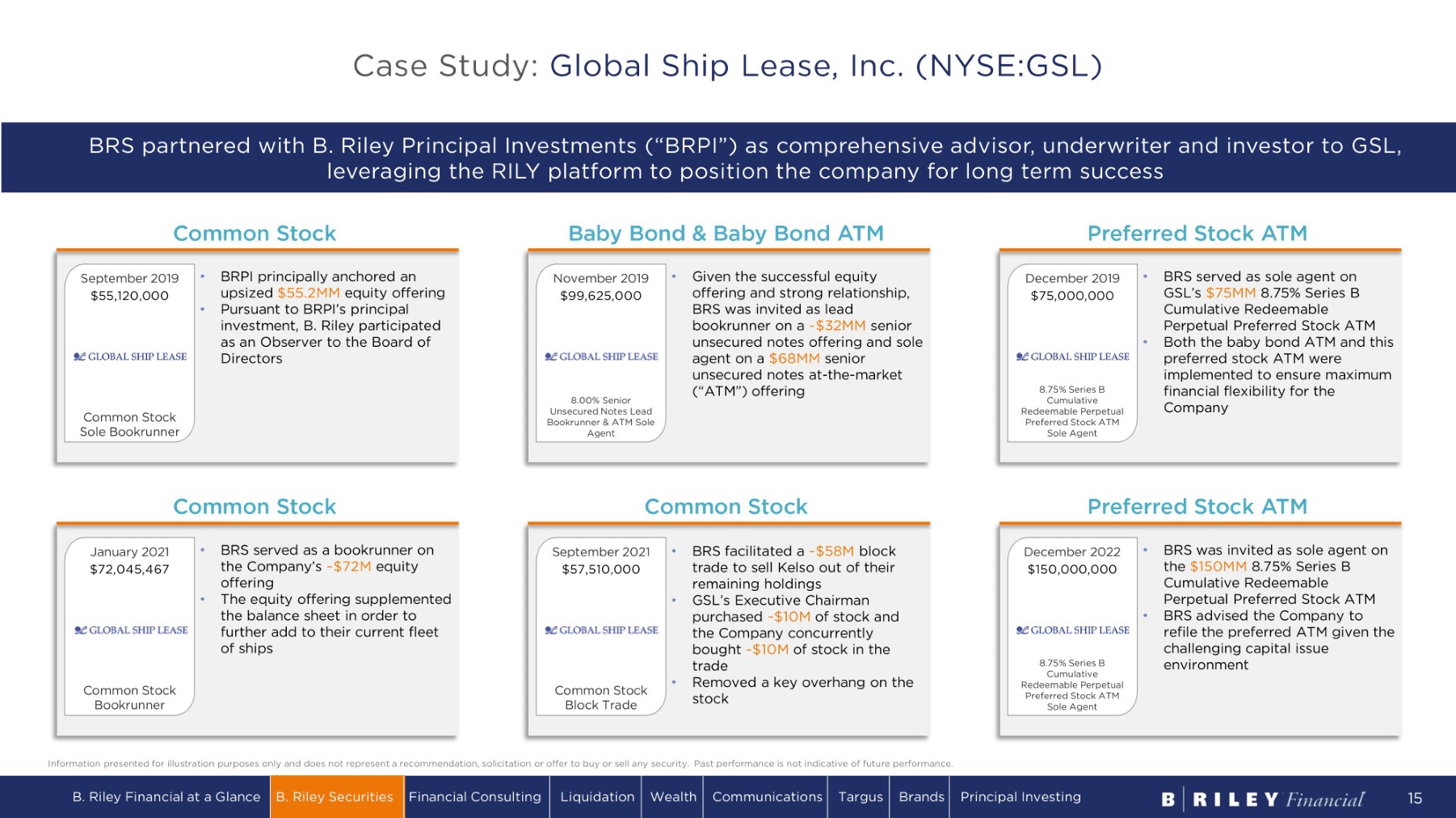

Information presented for illustration purposes only and does not represent a recommendation, solicitation or offer to buy or sell any security. Past performance is not indicative of future performance. Case Study: Global Ship Lease, Inc. (NYSE:GSL) BRPI principally anchored an upsized $55.2MM equity offering • Pursuant to BRPI’s principal investment, B. Riley participated as an Observer to the Board of Directors September 2019 • $55,120,000 Common Stock S o le B ook r unn e r • BRS served as a bookrunner on the Company’s ~$72M equity offering • The equity offering supplemented the balance sheet in order to further add to their current fleet of ships C o m m on S t oc k J a nu a r y 2 0 21 $72,045,467 C o m m o n S t ock Bookrunner BRS facilitated a ~ $ 58 M block trade to sell Kelso out of their remaining holdings • GSL’s Executive Chairman purchased ~$10M of stock and the Company concurrently bought ~$10M of stock in the trade • Removed a key overhang on the stock C o m m on S t oc k S e p t e m b e r 2 0 2 1 • $57,510,000 C o m m o n S t ock Block Trade Given the successful equity offering and strong relationship, BRS was invited as lead bookrunner on a ~$32MM senior unsecured notes offering and sole agent on a $68MM senior unsecured notes at - the - market (“ATM”) offering November 2019 • $99,625,000 8.00% Senior Unsecured Notes Lead Bookrunner & ATM Sole Agent BRS was invited as sole agent on the $150MM 8.75% Series B Cumulative Redeemable Perpetual Preferred Stock ATM • BRS advised the Company to refile the preferred ATM given the challenging capital issue environment Preferred Stock ATM December 2022 • $150,000,000 8.75% Series B Cumulative R e d ee m a b l e P e r p e t u a l Preferred Stock ATM Sole Agent BRS served as sole agent on GSL’s $75MM 8.75% Series B Cumulative Redeemable Perpetual Preferred Stock ATM • Both the baby bond ATM and this preferred stock ATM were implemented to ensure maximum financial flexibility for the Company BRS partnered with B. Riley Principal Investments (“BRPI”) as comprehensive advisor, underwriter and investor to GSL, leveraging the RILY platform to position the company for long term success Common Stock Baby Bond & Baby Bond ATM Preferred Stock ATM December 2019 • $75,000,000 8.75% Series B Cumulative R e d ee m a b l e P e r p e t u a l Preferred Stock ATM Sole Agent B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 1 5

Creating a Diversified, Comprehensive Platform • M&A advisory • Equity capital markets • Research coverage • Share buybacks • Corporate access • ATMs & CEFs • Debt capital markets • SPAC IPO & advisory • Fixed income • Restructuring & r e c a p i t a li z a t i o ns • Private markets T e c hn ol o g y, Media & Telecom C o ns u m e r Ge n e r a li s t • M&A advisory • Burgeoning equity capital markets • Small - cap research coverage • Share buybacks • Co r p o r a t e a cc e ss 2015 Capabilities 2023 Capabilities ~40 Senior P r o d u c e r s (1) (1) Producers include investment banking calling officers, sales traders and publishing research analysts Bu s i n e ss Services Business & F i n a n c i a l Services B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 16 D i v e r s i f ie d Industrials Energy & Natural Resources Healthcare Real E s t a te G e n e r a li s t Technology, Media & Telecom C on s u m e r >130 Senior P r o d u c e r s (1)

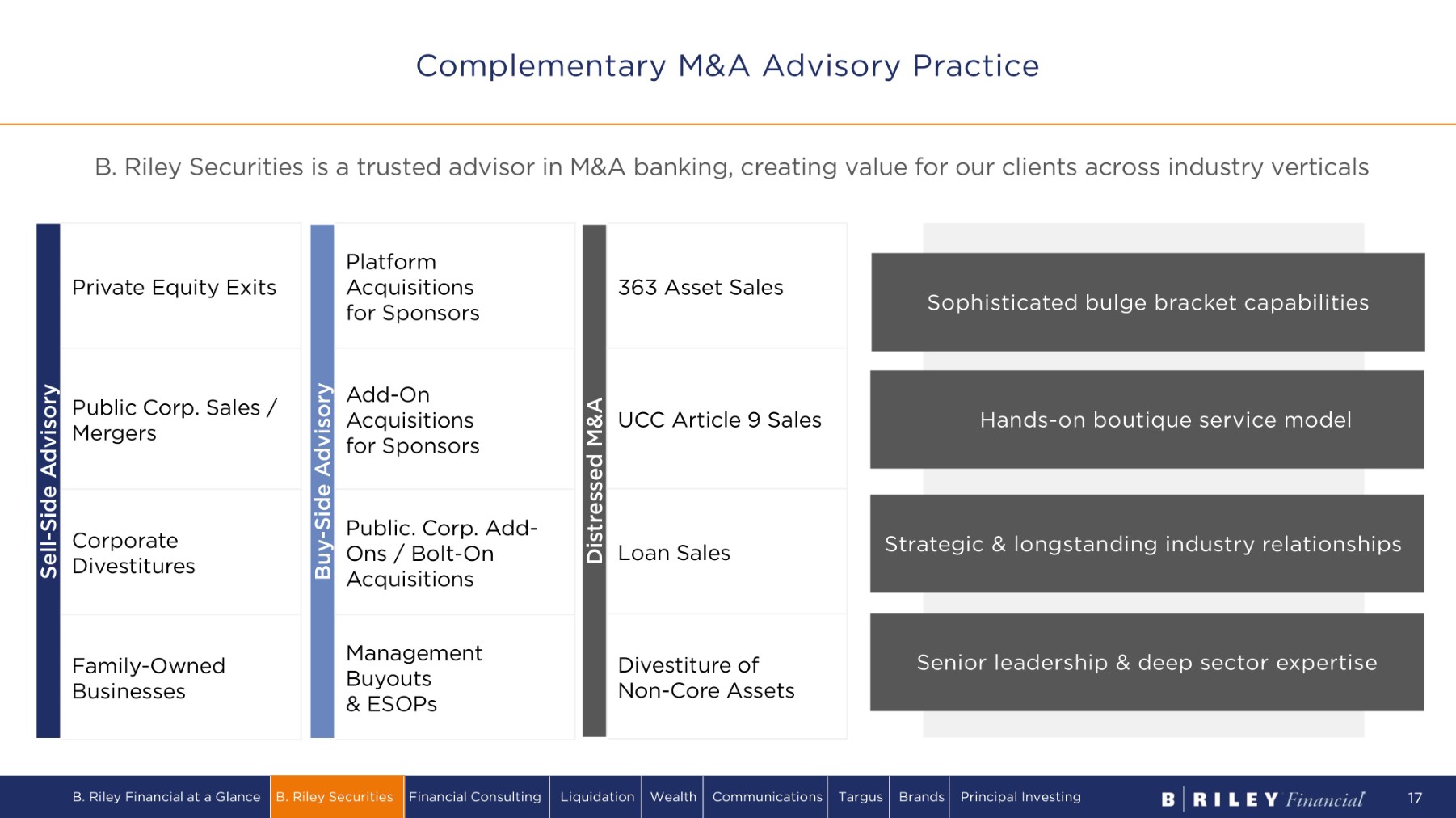

B. Riley Securities is a trusted advisor in M&A banking, creating value for our clients across industry verticals Private Equity Exits Sell - Side Advisory Public Corp. Sales / Mergers Corporate D i v e s t i tu r es F a m il y - O w n e d Businesses 363 Asset Sales Distressed M&A Platform Acquisitions for Sponsors Buy - Side Advisory UCC Article 9 Sales Add - On Acquisitions for Sponsors Loan Sales Public. Corp. Add - Ons / Bolt - On Acquisitions Divestiture of Non - Core Assets M a n ag emen t Buyouts & ESOPs Hands - on boutique service model Strategic & longstanding industry relationships Senior leadership & deep sector expertise Sophisticated bulge bracket capabilities Complementary M&A Advisory Practice B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 17

B. Riley Securities is uniquely positioned to solve complex capital needs across the entire capital structure Diverse transactional experience Longstanding relationships with key capital providers Innovative, creative & flexible private capital solutions Seamless & efficient facilitation of transactions Robust Private Markets Capabilities Growth Equity / Pre - IPO Private P la c ements Refinancings / Recaps T r a n s act i on T y p es Turnaround / Bridge Loans L e v e r ag ed Buyouts M a n ag emen t Buyouts A c q u i s i t io n Financing Restructurings inc. Plans of Reorganization B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 18 M e zz a n i ne Debt Asset Based Loans Security Types Private C o n v ert i bl e Debt Senior Secured Term Loans Private P r e f er r ed Stock Second Lien Loans Exit Financing DIP Financing

Top Small Cap Underwriters Trailing 3 - Year 2019 (1) % Lead No. $MM Bookrunner Rank 69% 143 $7 , 711 . 1 Morgan Stanley 1 40% 134 $5,509.0 JPMorgan 2 39% 101 $4,628.8 Goldman Sachs 3 29% 104 $4 ,2 11 . 7 Citi 4 33% 97 $3,171.9 BofA Securities 5 32% 93 $3,065.0 Barclays 6 34% 91 $ 3, 0 3 4 . 7 UBS 7 28% 144 $2,854.2 Stifel 8 40% 62 $2,687.8 Credit Suisse 9 24% 104 $2,118.2 Piper Sandler 10 28% 112 $1 ,9 71 . 8 R aym on d J ames 11 6% 77 $1,682.0 RBC Capital Markets 12 12% 60 $1,607.6 Deutsche Bank 13 20% 56 $1 , 544 . 5 J e f fe r i es LL C 14 14% 44 $1 , 10 8.4 Wells Fargo 15 19% 105 $977.7 B Riley Securities 16 16% 38 $ 9 05 . 1 Wells Fargo 17 21% 47 $857.8 Stephens 18 9% 54 $7 9 5 . 1 Robert W Baird & Co 19 11% 62 $7 68.3 William Blair 20 Top Small Cap Underwriters Trailing 3 - Year 2021 (1) % Lead No. $MM Bookrunner Rank 57% 98 $4 , 740 . 1 Morgan Stanley 1 51% 90 $4 , 4 26.2 JPMorgan 2 34% 94 $3,868.5 BofA Securities 3 45% 73 $3,824.8 Goldman Sachs 4 36% 64 $2,678.8 Citi 5 35% 63 $ 2, 4 36.5 Credit Suisse 6 40% 96 $ 2 , 2 03 . 3 B Riley Securities 7 38% 61 $2,134.8 J e f fe r i es LL C 8 21% 109 $2,065.7 Stifel 9 28% 60 $1,982.4 Barclays 10 28% 54 $1,350.1 Wells Fargo 11 17% 84 $1,290.1 R aym on d J ames 12 10% 58 $1 , 0 58.0 William Blair 13 16% 37 $ 9 04 . 0 RBC Capital Markets 14 7% 41 $ 8 55 . 7 UBS 15 25% 84 $ 8 0 9.5 Roth Capital Partners 16 39% 41 $ 8 07 . 5 Oppenheimer 17 10% 29 $7 36. 7 Deutsche Bank 18 18% 39 $705.3 BMO Capital Markets 19 7% 55 $ 68 5 .0 JMP Securities LLC 20 Top Small Cap Underwriters Trailing 3 - Year 3Q23 (1) % Lead No. $MM Bookrunner Rank 60% 63 $3,452.5 JPMorgan 1 45% 76 $3,014.7 BofA Securities 2 51% 63 $2,725.8 Morgan Stanley 3 44% 50 $2,309.3 Goldman Sachs 4 44% 81 $2,216.7 B Riley Securities 5 35% 57 $1,888.4 J e f fe r i es LL C 6 18% 83 $1,574.6 Stifel 7 28% 39 $1,443.6 Barclays 8 31% 45 $1,222.1 Citi 9 15% 40 $870.8 William Blair 10 22% 37 $852.1 Wells Fargo 11 15% 53 $739.8 R aym on d J ames 12 18% 33 $729.5 RBC Capital Markets 13 30% 20 $614.7 Credit Suisse 14 30% 30 $611.6 BMO Capital Markets 15 37% 30 $593.6 Oppenheimer 16 21% 67 $592.9 Roth Capital Partners 17 14% 42 $582.9 Piper Sandler 18 7% 28 $581.1 UBS 19 21% 28 $559.8 TD Securities 20 BRS ranks in the top 5 of small - cap un d e r w r i t e r s since 2022 ( 1 ) (1) Source: Dealogic. Representative of trailing 3 - year underwritten offerings as of 12/31/19, 12/31/21 and 9/30/23, respectively. Deal Type = IPO, FO, Rank Eligible. SEC registered. Exchange Nationality = USA. Market Cap. $100MM - $1.5B. Deal Price >= $1.00. Excludes SPAC IPOs and Healthcare transactions. BRS breaks into the top 20 small - cap underwriters in 2019 (1) Market Share Ascent in Equity Capital Markets B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 19

Top Small - Cap Underwriters Trailing 12 Months (1) R ank B oo k r un ne r Deal Value ($MM) # of D e a l s # Led 1 B Riley Securities $ 44 3 . 4 17 8 2 S t if el $ 2 8 0 . 3 16 1 3 BofA Securities $ 51 3. 5 15 9 4 Roth Capital Partners $8 6. 7 15 2 5 Goldman Sachs $ 6 0 4 . 0 14 5 6 B ar c lay s $ 66 0 . 2 1 3 5 7 J ef f er ies $ 4 7 1.8 1 3 4 8 C i t i $ 3 76 . 8 12 6 9 J P M o r g a n $74 0 . 6 11 8 10 Raymond James $ 16 2. 3 11 1 11 Truist Financial Corp $ 111. 6 11 0 12 Morgan Stanley $ 3 67. 9 1 0 5 13 RBC Capital Markets $ 2 0 2. 9 1 0 2 14 T D C owe n $ 19 8 . 0 1 0 4 15 Piper Sandler $ 11 0 . 6 9 0 16 BMO Capital Markets $8 7. 6 8 3 17 K ey B an c $ 7 5 . 7 8 0 18 William Blair $ 16 7 . 1 7 1 19 U B S $ 1 0 7 . 1 6 2 20 O pp en h ei m er $80 . 7 5 1 Purpose - Built Capabilities to Capture Current Market Tailwinds Pent - up Dem a n d Positive Macro Backdrop $406B+ of pending debt maturities of Russell 2000 companies in the next 3 years (2) Significant looming secondary supply Equity capital markets expected to accelerate with a healthy pipeline in 2024 Leader in Opportunistic Access to Capital Markets BRS has led small - cap underwriters in a challenging market environment and is poised to capitalize on multiple anticipated growth drivers over the next several years (1) Source: Dealogic. Pricing Date 10/1/2022 – 9/30/2023, Deal Type = FO, Rank Eligible. SEC registered. Exchange Nationality = USA. Market Cap. $100MM - $1.5B. Deal Price >= $1.00. Excludes Healthcare transactions. (2) Source: CapitalIQ. Representative of Russell 2000 companies as of 6/30/23 with debt maturities between 1/1/2024 and 12/31/2026. BofA Securities B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 20 $ 4 9 0 . 1 14 9 Top Small - Cap Follow - On Underwriters Trailing 12 Months (1) # Led # of D ea l s Deal Value ($MM) Bookrunner Rank 8 17 $443.4 B Riley Securities Inc 1 2 5 13 $530.6 Goldman Sachs 3 4 13 $471.8 Jefferies 4 1 13 $178.0 Stifel 5 5 11 $558.7 Barclays 6 6 11 $342.6 Citi 7 8 10 $667.2 JPMorgan 8 5 10 $367.9 Morgan Stanley 9 4 10 $198.0 TD Securities 10 2 9 $189.1 RBC Capital Markets 11 0 9 $85.5 Truist Financial Corp 12 0 8 $98.3 Piper Sandler 13 1 8 $86.8 Raymond James 14 0 8 $75.7 KeyBanc 15 1 7 $167.1 William Blair 16 3 7 $80.6 BMO Capital Markets 17 2 6 $107.1 UBS 18 1 5 $80.7 Oppenheimer 19 0 3 $73.6 Evercore Inc 20

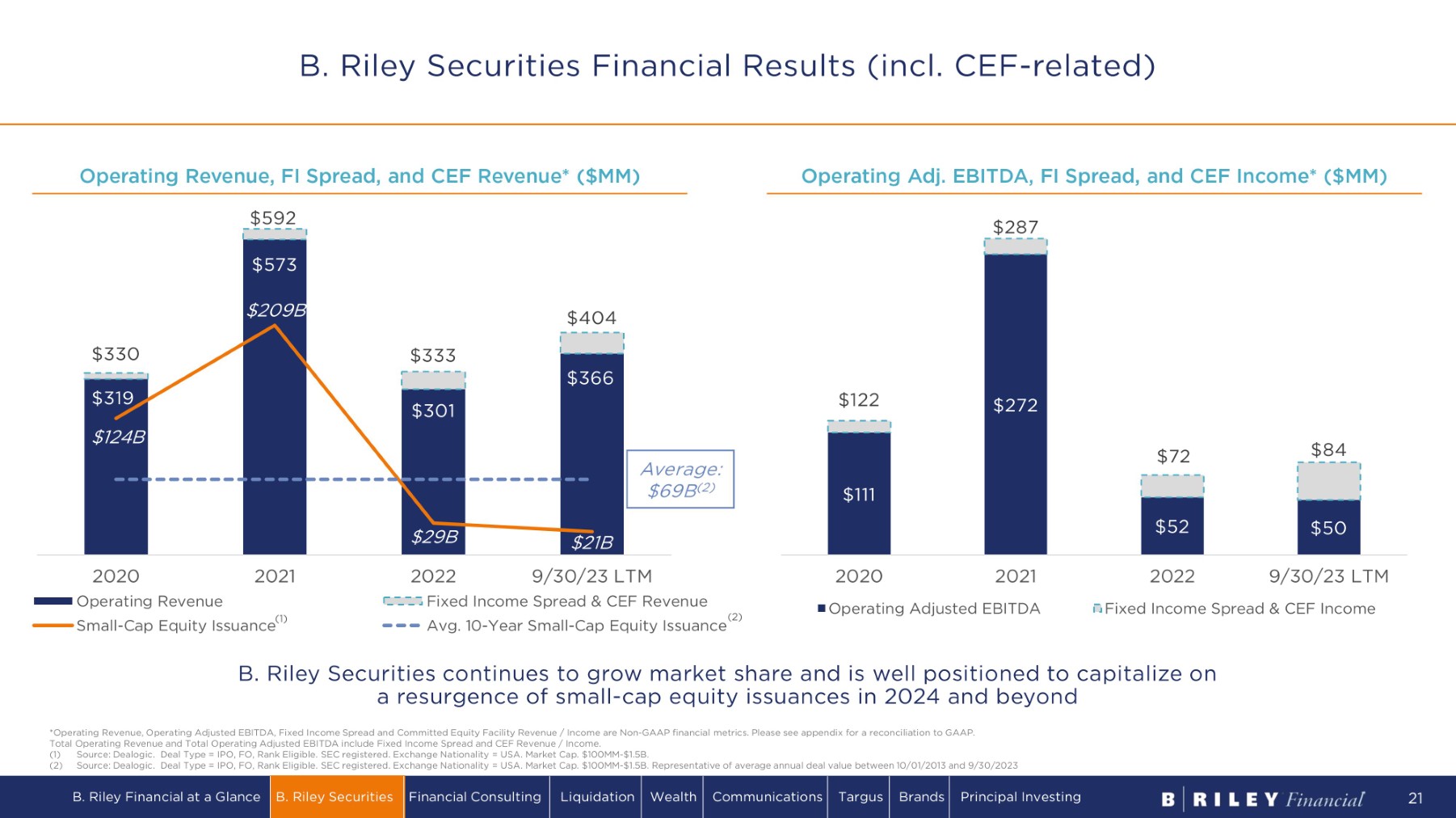

Operating Revenue, FI Spread, and CEF Revenue* ($MM) Operating Adj. EBITDA, FI Spread, and CEF Income* ($MM) *Operating Revenue, Operating Adjusted EBITDA, Fixed Income Spread and Committed Equity Facility Revenue / Income are Non - GAAP financial metrics. Please see appendix for a reconciliation to GAAP. Total Operating Revenue and Total Operating Adjusted EBITDA include Fixed Income Spread and CEF Revenue / Income. (1) Source: Dealogic. Deal Type = IPO, FO, Rank Eligible. SEC registered. Exchange Nationality = USA. Market Cap. $100MM - $1.5B. (2) Source: Dealogic. Deal Type = IPO, FO, Rank Eligible. SEC registered. Exchange Nationality = USA. Market Cap. $100MM - $1.5B. Representative of average annual deal value between 10/01/2013 and 9/30/2023 B. Riley Securities continues to grow market share and is well positioned to capitalize on a resurgence of small - cap equity issuances in 2024 and beyond $ 3 1 9 $301 $366 $ 330 $ 592 $ 333 $ 4 0 4 $ 1 2 4 B $573 $ 2 0 9 B $29B $21B 2022 9/30/23 LTM Fixed Income Spread & CEF Revenue 2020 2021 Operating Revenue Small - Cap Equity Issuance (1) Avg. 10 - Year Small - Cap Equity Issuance (2) $111 $272 $ 52 $ 5 0 $ 1 2 2 $ 287 $72 $ 8 4 2020 2021 Operating Adjusted EBITDA 2022 9/30/23 LTM Fixed Income Spread & CEF Income Average: $69B (2) B. Riley Securities Financial Results (incl. CEF - related) B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 21

03 FINANCIAL CONSULTING

Appraisal & Valuation C o m p li a n c e , Risk & Resilience Forensic Accounting & Litigation Support R e s t r u c t u r i ng & Turnaround Management Operations M a n a g e m e nt T r an s a c t i on Support (including QoE) Interim M a n a g e m e nt & Executive Search Real Estate ▪ Provide clients a full continuum of specialty financial advisory services and solutions ▪ Unprecedented combination of highly specialized capabilities and seasoned professionals with deep industry expertise ▪ Trusted partner to attorneys, lenders, private equity sponsors, and companies, helping to resolve critical matters at all stages of a company's business life cycle o National go - to firm for valuation and appraisal services for the asset - based lending community o Forensic accounting and litigation support for bet - the - company, big ticket litigation o Restructuring and turnaround services for complex and high - profile matters from Wall Street to Main Street ▪ Immense opportunity for continued organic growth within the consulting service practice and broader B. Riley Financial Primary Service Lines Bringing Clarity to Complex Business Challenges Financial Consulting Overview B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 23

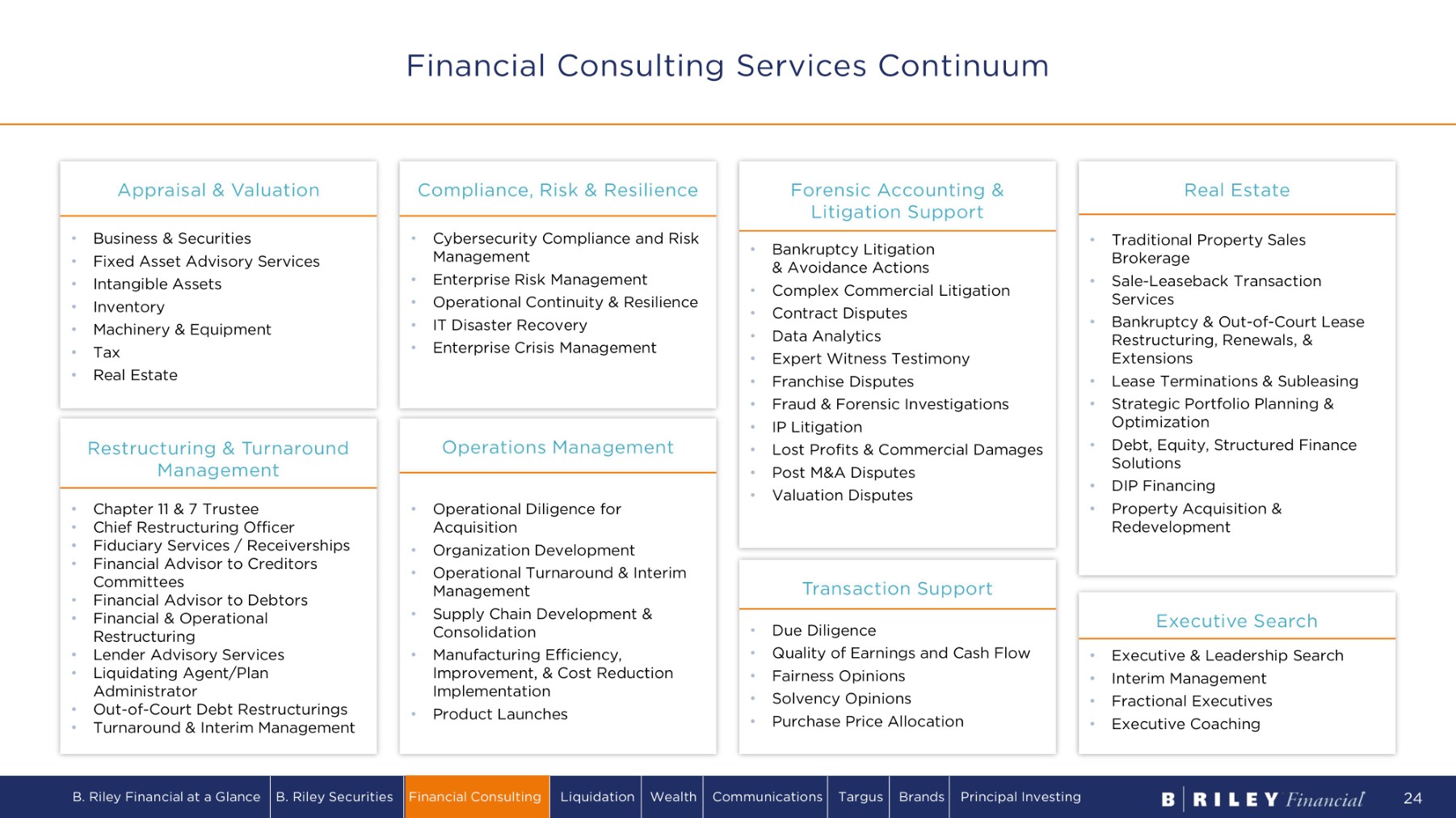

Financial Consulting Services Continuum • Business & Securities • Fixed Asset Advisory Services • Intangible Assets • Inventory • Machinery & Equipment • Tax • Real Estate Appraisal & Valuation • C h ap t e r 11 & 7 T r u s t e e • Chief Restructuring Officer • Fiduciary Services / Receiverships • Financial Advisor to Creditors Committees • Financial Advisor to Debtors • Financial & Operational Restructuring • Lender Advisory Services • Liquidating Agent/Plan Administrator • Out - of - Court Debt Restructurings • Turnaround & Interim Management Restructuring & Turnaround Management • Cybersecurity Compliance and Risk Management • Enterprise Risk Management • Operational Continuity & Resilience • IT Disaster Recovery • Enterprise Crisis Management Compliance, Risk & Resilience • Operational Diligence for Acquisition • Organization Development • Operational Turnaround & Interim Management • Supply Chain Development & Consolidation • Manufacturing Efficiency, Improvement, & Cost Reduction Implementation • Product Launches Operations Management • Bankruptcy Litigation & Avoidance Actions • Complex Commercial Litigation • Contract Disputes • Data Analytics • Expert Witness Testimony • Franchise Disputes • Fraud & Forensic Investigations • IP Litigation • Lost Profits & Commercial Damages • Post M&A Disputes • Valuation Disputes Forensic Accounting & Litigation Support • Due Diligence • Quality of Earnings and Cash Flow • Fairness Opinions • Solvency Opinions • Purchase Price Allocation Transaction Support • Executive & Leadership Search • Interim Management • Fractional Executives • Executive Coaching Executive Search • Traditional Property Sales Brokerage • Sale - Leaseback Transaction Services • Bankruptcy & Out - of - Court Lease Restructuring, Renewals, & Extensions • Lease Terminations & Subleasing • Strategic Portfolio Planning & Optimization • Debt, Equity, Structured Finance Solutions • DIP Financing • Property Acquisition & Redevelopment Real Estate B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 24

Platform Built through Organic and Inorganic Growth Acquired GlassRatner, a leading national financial advisory services firm focused on Bankruptcy & Turnaround Management, Forensic Accounting and Litigation Support, and Financial Due Diligence ▪ Acquired corporate division of Farber, establishing foothold in Canadian restructuring market and adding Executive Search practice ▪ Acquired Anderson Bauman Tourtellot Vos (ABTV), expanding market leadership in Southeast/N. Carolina ▪ Acquired Crawford & Winiarski (C&W), expanding forensic consulting in Detroit/Midwest Acquired Appraisal Division through merger with Great American Group ▪ Formed dedicated Real Estate brokerage and advisory division, focused on distressed real estate ▪ Added Alderney Advisors, an Automotive Restructuring firm, establishing a Detroit restructuring office ▪ Added Operations Management practice through acquisition of Anchor Resource Management ▪ Established Mexico presence; enhanced LatAm, xBorder, and South Florida practices ▪ Established Compliance, Risk, & Resilience consulting practice in 2021 ▪ Achieved record revenue in the Appraisal Division in 2022 2024+ 2023 2020 - 2022 2018 2014 Immense opportunity for continued organic growth within the consulting service practice and the larger B. Riley Financial platform B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 25 ▪ Expand Interim Management & Executive Search ▪ Strong Corporate Bankruptcy Outlook ▪ Continue to Deepen Industry Vertical Expertise

APRIL 2023 Financial Advisor to the Official Committee of Unsecured Creditors 429 - Bed Long Island Continuing Care Retirement Community MAY 2023 Chief Restructuring Officer Multi - Location Indoor Vertical Farming Grower/Distributor MAY 2023 Financial Advisor to the Official Committee of Unsecured Creditors Healthcare Technology Company Providing Online Prescriptions and Medical Services For Women JULY 2023 Chief Restructuring Officer Real Estate Development JULY 2023 Chief Restructuring Officer Burger King Franchisee (93 Restaurants) AUGUST 2023 Debtor’s Exclusive Real Estate Advisor $65M Bankruptcy Sale 15 - Property Portfolio (626.5 AC / ~5.0M SF) MARCH 2022 Financial Advisor to the Debtor 495 Unit Houston - Based Continuing Care Retirement Community APRIL 2022 Financial Advisor to Company Construction Equipment Rental and Sales MAY 2022 Chief Restructuring Officer Ti e r 1 Aut o m o t i ve , Aer o s p a ce and DOD Supplier DECEMBER 2022 Financial Advisor to the Respirator Committee 3M Subsidiary Involved in Mass Tort Litigation Related to Defective Products FEBRUARY 2023 Financial Advisor to Debtor Retail Energy Provider MARCH 2023 Chief Restructuring Officer Two 45 Unit Assisted Living Memory Care Facilities OCTOBER 2021 Financial Advisor to Senior Secured Creditor Multi - Site Grain Elevator with Soybean Crush OCTOBER 2021 Chief Restructuring Officer Sale of Tahoe Joe’s Steak Houses OCTOBER 2021 Financial Advisor to the Company in Connection with a Sale to Quikrete, Inc. Leading Manufacturer of Concrete Blocks and Masonry Supplies in the Southwest DECEMBER 2021 Chief Restructuring Officer Equipment Sales and Rental DECEMBER 2021 Chief Liquidating Officer Tier 2 Automotive Supplier JANUARY 2022 Financial and Operations Advisor Ti e r 1 Aut o m o t i v e S u ppli er Leading Restructuring Advisor – Representative Assignments B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 26

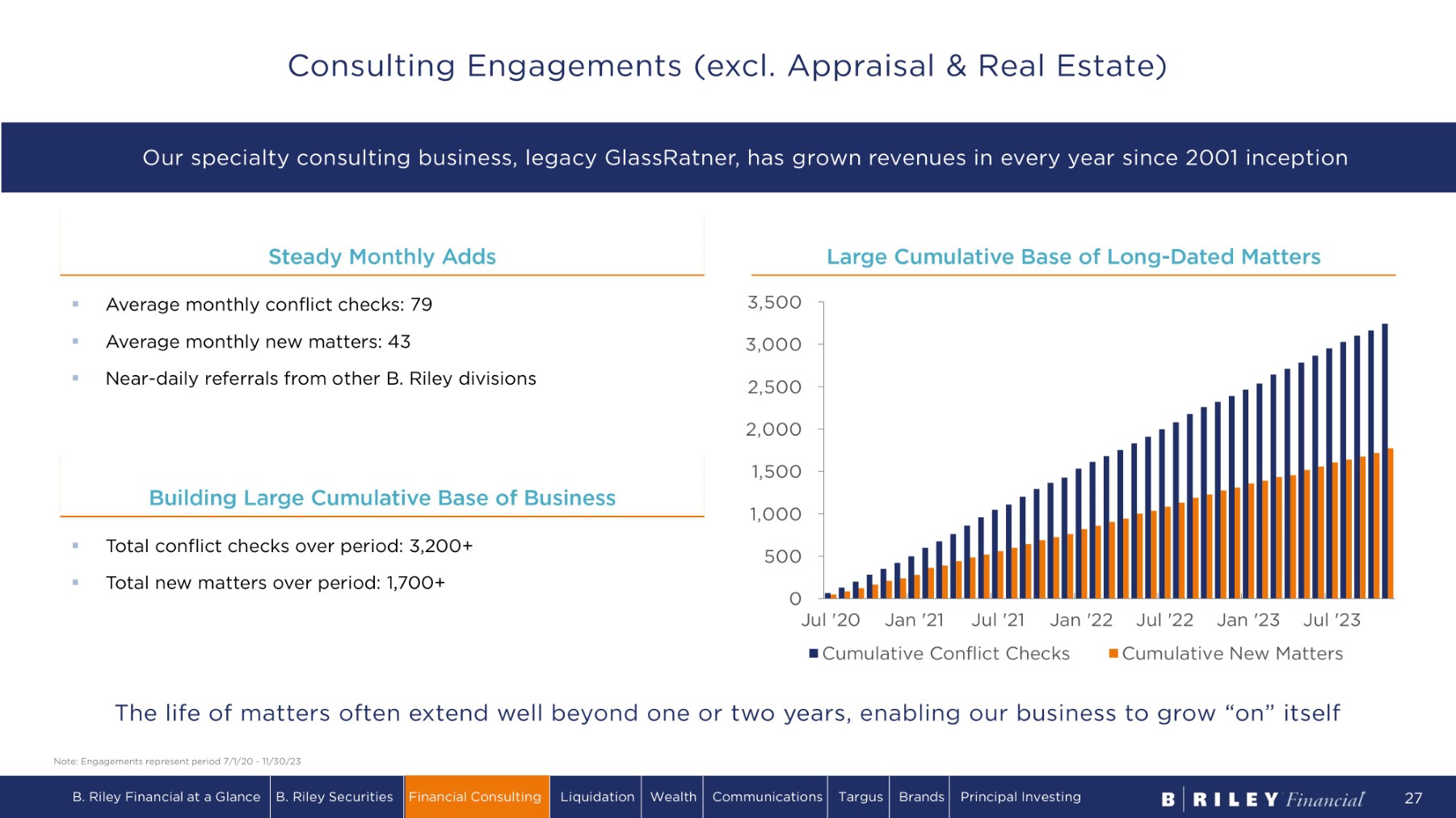

Steady Monthly Adds Large Cumulative Base of Long - Dated Matters Note: Engagements represent period 7/1/20 - 11/30/23 0 Jul '20 Jan '21 Jul '21 5 00 1 ,000 2 ,000 1 ,5 00 2 ,5 00 3 ,0 0 0 3 ,5 00 Jan '22 Jul '22 Jan '23 Jul '23 Cumulative Conflict Checks Cumulative New Matters The life of matters often extend well beyond one or two years, enabling our business to grow “on” itself ▪ Average monthly conflict checks: 79 ▪ Average monthly new matters: 43 ▪ Near - daily referrals from other B. Riley divisions ▪ Total conflict checks over period: 3,200+ ▪ Total new matters over period: 1,700+ Building Large Cumulative Base of Business Our specialty consulting business, legacy GlassRatner, has grown revenues in every year since 2001 inception B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 27 Consulting Engagements (excl. Appraisal & Real Estate)

Inventory Machinery & Equipment Business Valuation Intangible Assets Financial Reporting Real Estate Tax Field Exam ~67% of appraisal engagements are repeat customers 1,100+ Unique clients under engagement/year 1,600+ Valuation assignments completed in 2023 110MM+ Square feet inspected in 2022 $120B+ Assets appraised annually Figures noted are approximations based upon the latest available data. Trusted Provider to the Largest, Most Active ABL Lenders Complete Valuation Practice – Market Leader in ABL Space B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 28 Dedicated Valuation Experts Across Industries, Disciplines

• One - stop shop for clients, bundling appraisals with services across the B. Riley platform, including financial restructuring, operational improvement, liquidation services, and investment banking • Deep roster of long - tenured industry experts, allowing for true specialization • Trusted provider to blue chip client base on their largest, most critical deals • Engine and beneficiary of near - daily business referrals within the B. Riley ecosystem • Non - cyclical demand for appraisal services drives steady financial performance • Poised to capitalize on current long - term market trends toward direct - and asset - based lending • Supplementing core inventory and machinery appraisal business with expanded capabilities in field exams and corporate valuation services, including business valuation, financial reporting, intangible assets, and real estate valuation Market Leadership in Appraisal Services Drives Steady, Predictable Cash Flows Appraisal Business Highlights B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 29

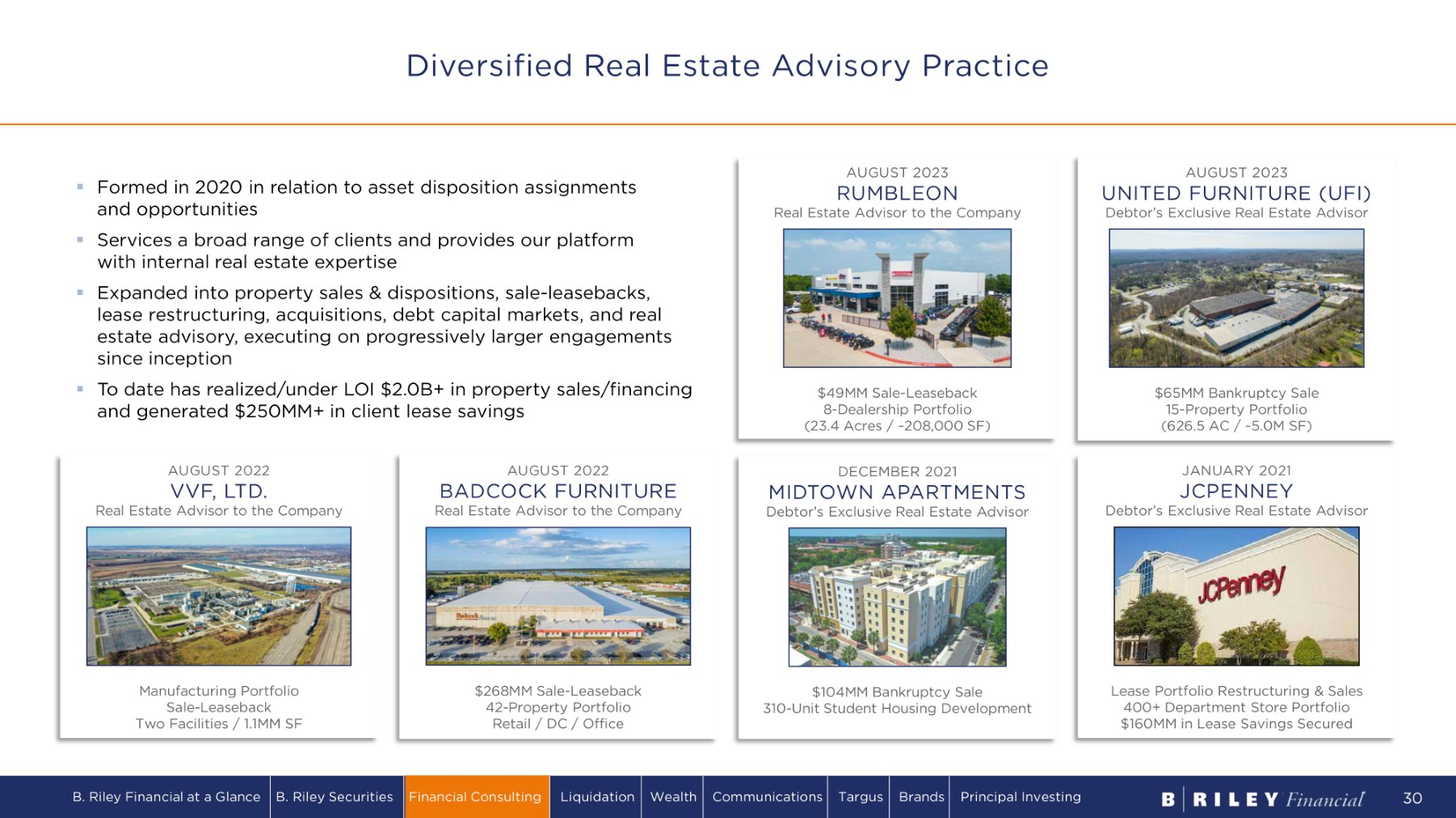

▪ Formed in 2020 in relation to asset disposition assignments and opportunities ▪ Services a broad range of clients and provides our platform with internal real estate expertise ▪ Expanded into property sales & dispositions, sale - leasebacks, lease restructuring, acquisitions, debt capital markets, and real estate advisory, executing on progressively larger engagements since inception ▪ To date has realized/under LOI $2.0B+ in property sales/financing and generated $250MM+ in client lease savings AUGUST 2023 UNITED FURNITURE (UFI) Debtor’s Exclusive Real Estate Advisor $65MM Bankruptcy Sale 15 - Property Portfolio (626.5 AC / ~5.0M SF) AUGUST 2023 RUMBLEON Real Estate Advisor to the Company $49MM Sale - Leaseback 8 - Dealership Portfolio (23.4 Acres / ~208,000 SF) AUGUST 2022 BADCOCK FURNITURE Real Estate Advisor to the Company $268MM Sale - Leaseback 42 - Property Portfolio Retail / DC / Office AUGUST 2022 VVF, LTD. Real Estate Advisor to the Company Manufacturing Portfolio Sale - Leaseback Two Facilities / 1.1MM SF JANUARY 2021 JCPENNEY Debtor’s Exclusive Real Estate Advisor Lease Portfolio Restructuring & Sales 400+ Department Store Portfolio $160MM in Lease Savings Secured DECEMBER 2021 MIDTOWN APARTMENTS Debtor’s Exclusive Real Estate Advisor $104MM Bankruptcy Sale 310 - Unit Student Housing Development Diversified Real Estate Advisory Practice B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 30

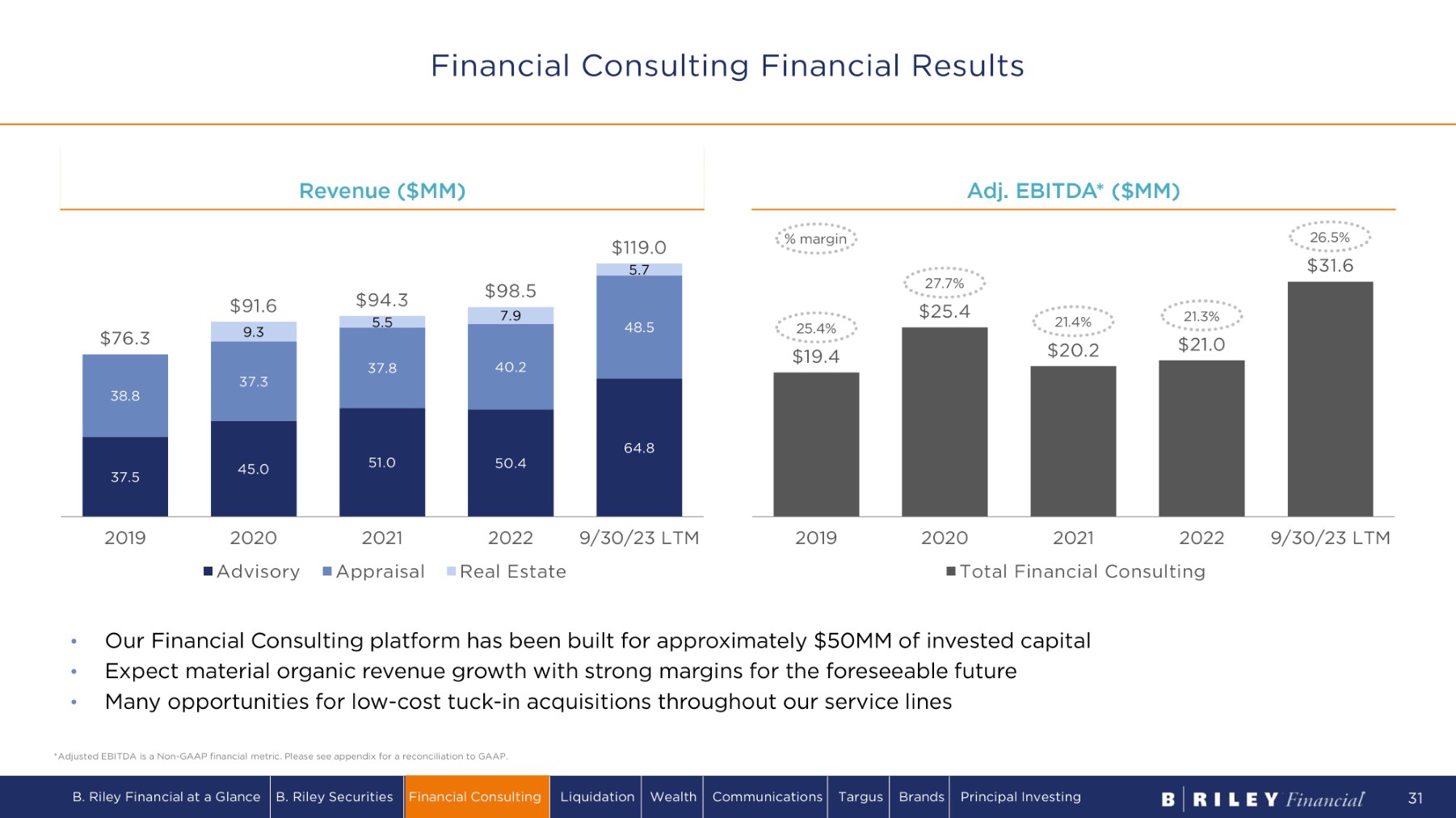

$ 1 9 . 4 $ 2 5 . 4 $ 2 0 . 2 $ 2 1 .0 2 0 1 9 9/30/23 LTM 2 0 20 2 0 21 2 0 22 Total Financial Consulting R e v e n u e ( $ MM) A d j . E B I T D A * ( $ MM ) • Our Financial Consulting platform has been built for approximately $50MM of invested capital • Expect material organic revenue growth with strong margins for the foreseeable future • Many opportunities for low - cost tuck - in acquisitions throughout our service lines *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. 2 7 . 7 % 2 1 .4 % 2 1 . 3 % 26.5% $ 3 1 . 6 % m a r g i n 37.5 45.0 5 1 .0 5 0 .4 64.8 38.8 37.3 37.8 40.2 48.5 9.3 5 .5 7.9 5.7 $ 7 6 . 3 $ 9 1 . 6 $ 9 4 . 3 $9 8 . 5 $119.0 2 0 1 9 2020 A d v i s o r y 2021 Appraisal 2022 Real Estate 9/30/23 LTM 25 . 4 % Financial Consulting Financial Results B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 31

04 AUCTION AND LIQUIDATION

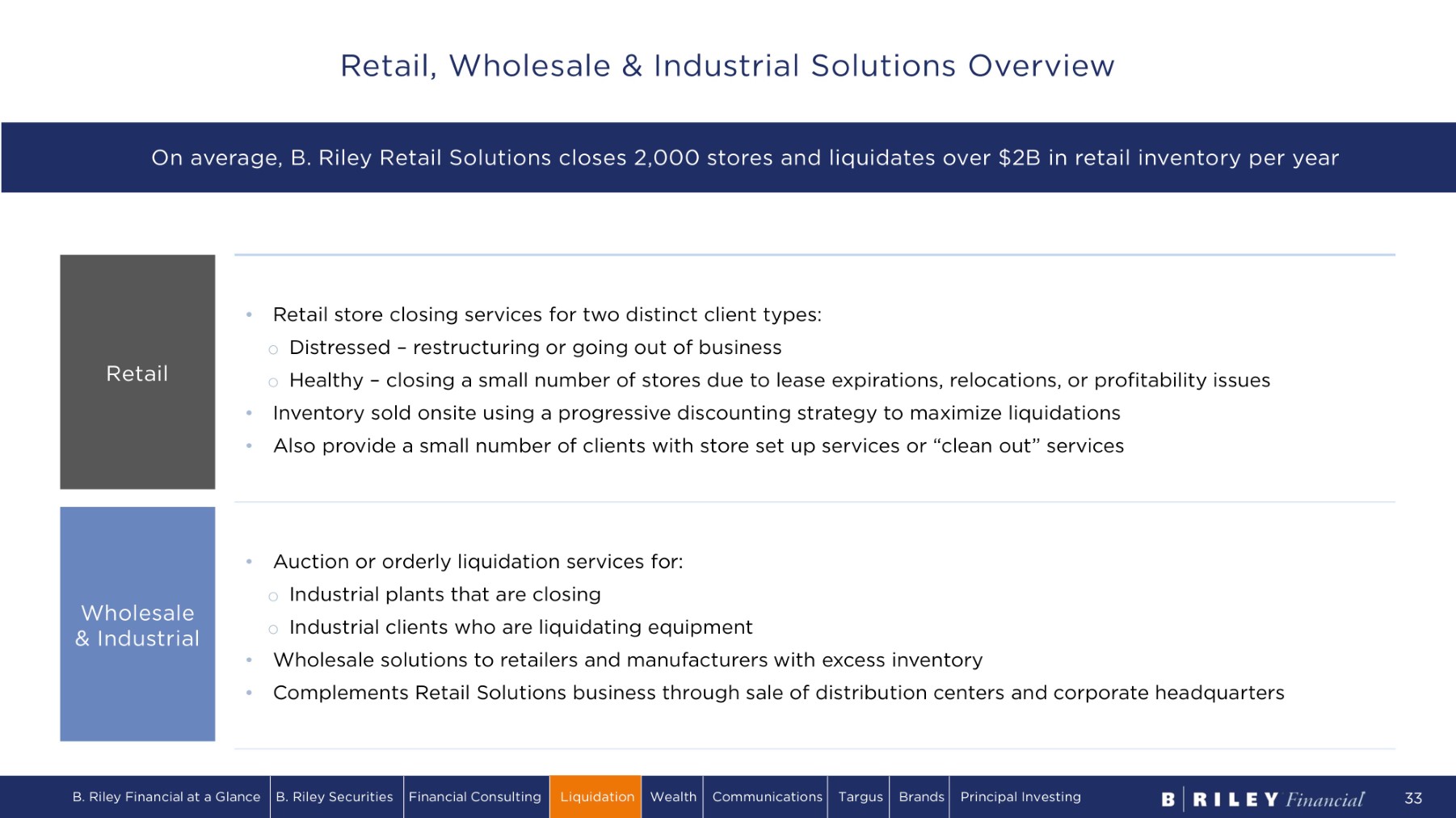

• Retail store closing services for two distinct client types: o Distressed – restructuring or going out of business o Healthy – closing a small number of stores due to lease expirations, relocations, or profitability issues • Inventory sold onsite using a progressive discounting strategy to maximize liquidations • Also provide a small number of clients with store set up services or “clean out” services • Auction or orderly liquidation services for: o Industrial plants that are closing o Industrial clients who are liquidating equipment • Wholesale solutions to retailers and manufacturers with excess inventory • Complements Retail Solutions business through sale of distribution centers and corporate headquarters Retail Wholesale & Industrial On average, B. Riley Retail Solutions closes 2,000 stores and liquidates over $2B in retail inventory per year B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 33 Retail, Wholesale & Industrial Solutions Overview

Representative Client Engagements Since Inception Figures noted are approximations based upon the latest available data. Over $5.5B Total value of assets liquidated since 2020 Over 4,300 S tore closures conducted since 2020 Over $47B Retail inventory liquidated since inception Leading Operator of Large - Scale Retail Liquidations B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 34

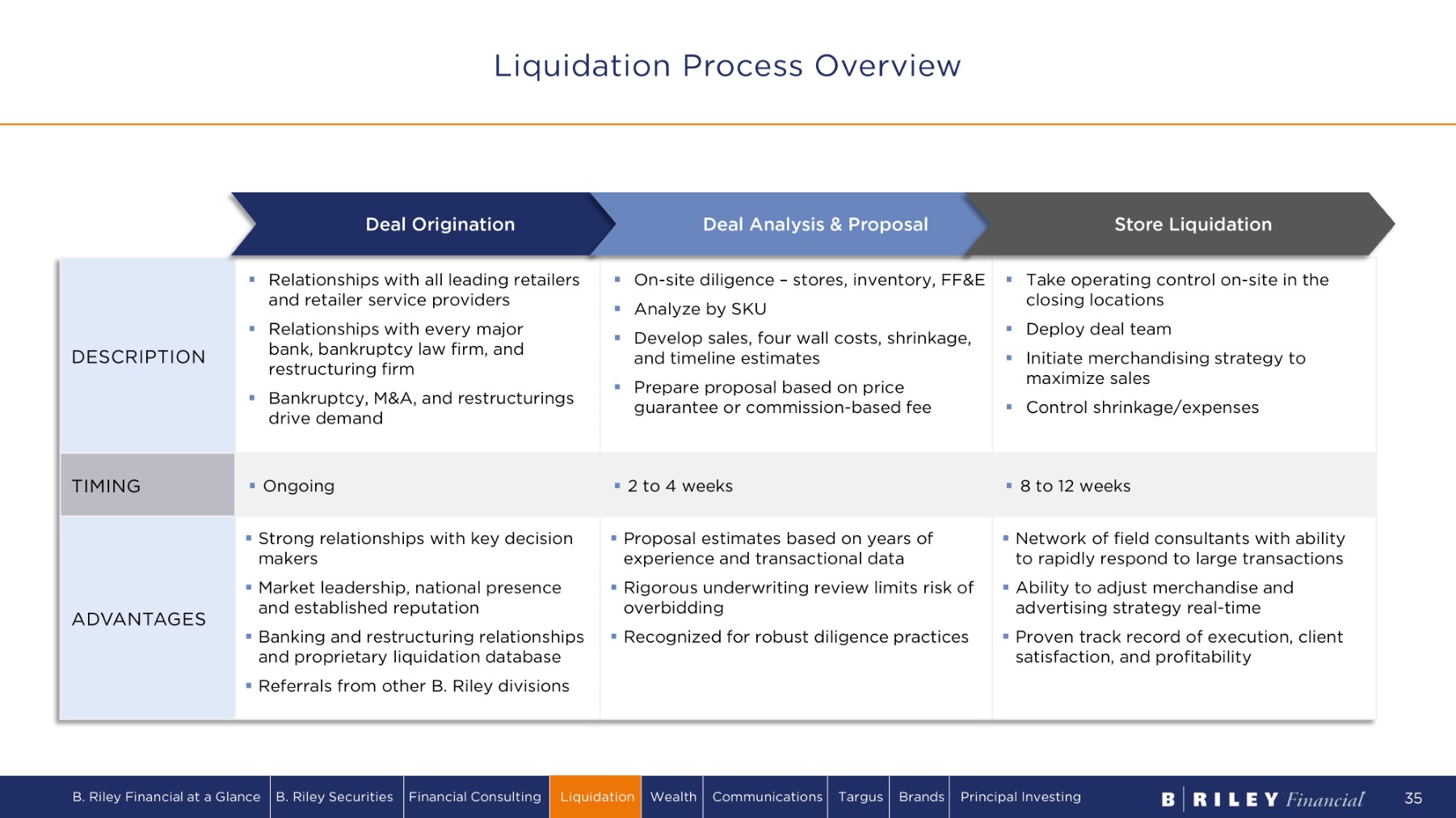

▪ Take operating control on - site in the closing locations ▪ Deploy deal team ▪ Initiate merchandising strategy to maximize sales ▪ Control shrinkage/expenses ▪ On - site diligence – stores, inventory, FF&E ▪ Analyze by SKU ▪ Develop sales, four wall costs, shrinkage, and timeline estimates ▪ Prepare proposal based on price guarantee or commission - based fee ▪ Relationships with all leading retailers and retailer service providers ▪ Relationships with every major bank, bankruptcy law firm, and restructuring firm ▪ Bankruptcy, M&A, and restructurings drive demand DESCRIPTION ▪ 8 t o 12 w ee k s ▪ 2 to 4 weeks ▪ Ongoing TIMING ▪ Network of field consultants with ability to rapidly respond to large transactions ▪ Ability to adjust merchandise and advertising strategy real - time ▪ Proven track record of execution, client satisfaction, and profitability ▪ Proposal estimates based on years of experience and transactional data ▪ Rigorous underwriting review limits risk of overbidding ▪ Recognized for robust diligence practices ▪ Strong relationships with key decision makers ▪ Market leadership, national presence and established reputation ▪ Banking and restructuring relationships and proprietary liquidation database ▪ Referrals from other B. Riley divisions ADVANTAGES De a l O r i gi na ti o n De a l Ana l y si s & P r o po sa l S t o r e L i qui da ti o n Liquidation Process Overview B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 35

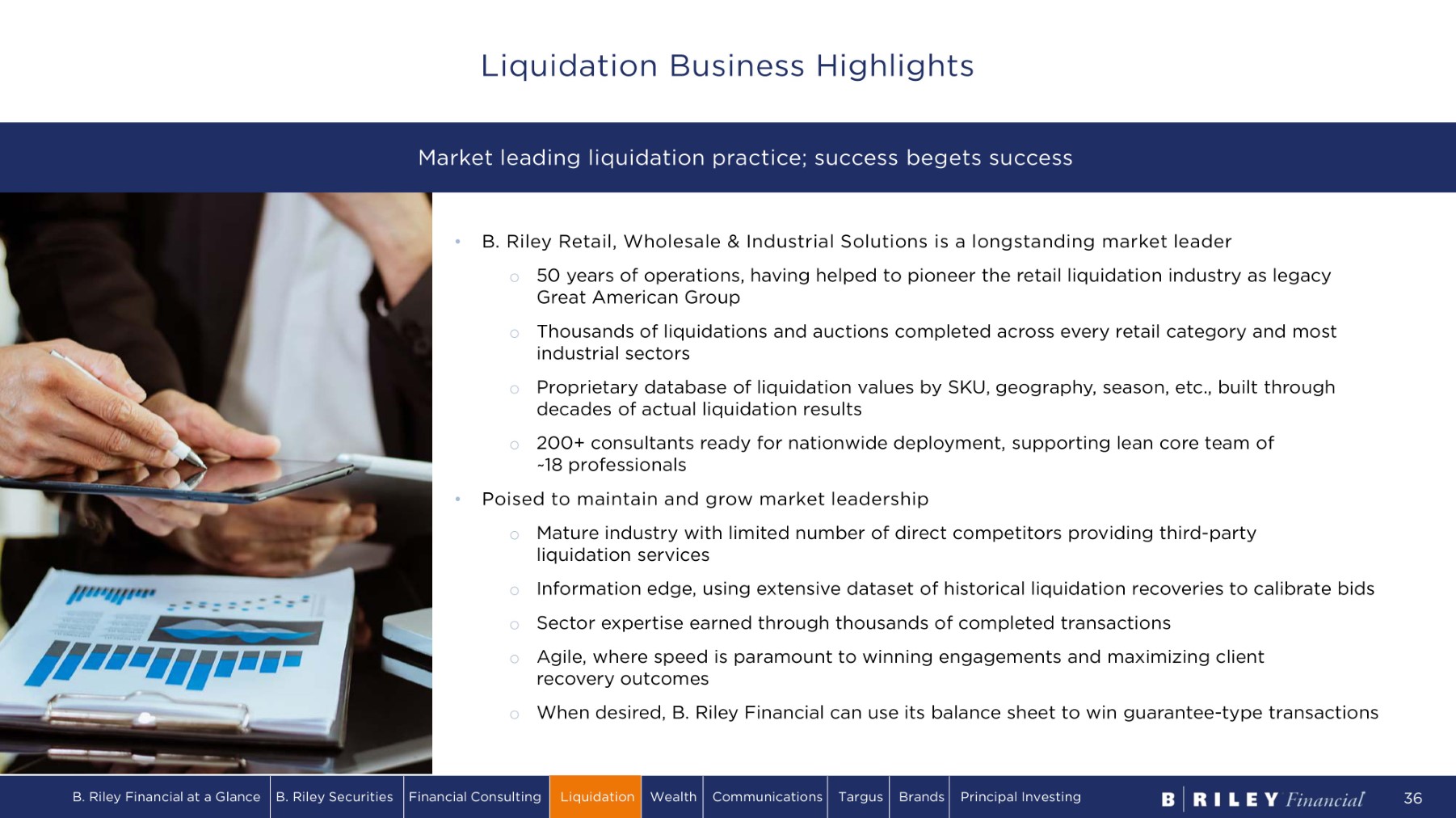

• B. Riley Retail, Wholesale & Industrial Solutions is a longstanding market leader o 50 years of operations, having helped to pioneer the retail liquidation industry as legacy Great American Group o Thousands of liquidations and auctions completed across every retail category and most industrial sectors o Proprietary database of liquidation values by SKU, geography, season, etc., built through decades of actual liquidation results o 200+ consultants ready for nationwide deployment, supporting lean core team of ~ 1 8 p r o f e s s i o n a ls • Poised to maintain and grow market leadership o Mature industry with limited number of direct competitors providing third - party liquidation services o Information edge, using extensive dataset of historical liquidation recoveries to calibrate bids o Sector expertise earned through thousands of completed transactions o Agile, where speed is paramount to winning engagements and maximizing client recovery outcomes o When desired, B. Riley Financial can use its balance sheet to win guarantee - type transactions Market leading liquidation practice; success begets success Liquidation Business Highlights B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 36

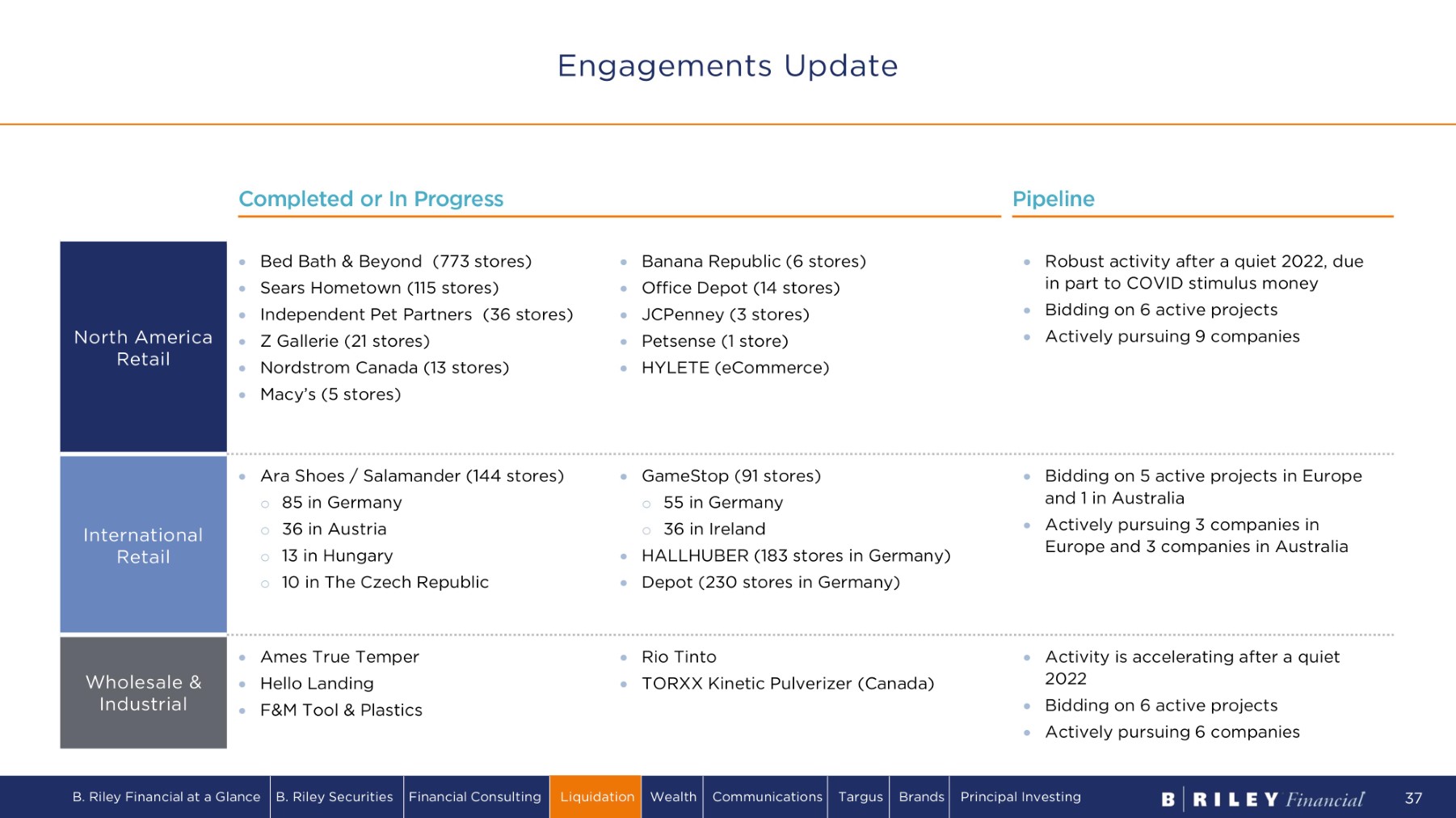

Pipeline C o mpl e t e d o r I n P r o g r e s s Robust activity after a quiet 2022, due in part to COVID stimulus money Bidding on 6 active projects Actively pursuing 9 companies Banana Republic (6 stores) Office Depot (14 stores) JCPenney (3 stores) Petsense (1 store) HYLETE (eCommerce) Bed Bath & Beyond (773 stores) Sears Hometown (115 stores) Independent Pet Partners (36 stores) Z Gallerie (21 stores) Nordstrom Canada (13 stores) Macy’s (5 stores) North America Retail Bidding on 5 active projects in Europe a nd 1 i n Aus tralia Actively pursuing 3 companies in Europe and 3 companies in Australia GameStop (91 stores) o 55 in Germany o 36 in Ireland HALLHUBER (183 stores in Germany) Depot (230 stores in Germany) Ara Shoes / Salamander (144 stores) o 85 in Germany o 36 in Austria o 13 i n Hun gar y o 10 in The Czech Republic I n t er n a ti on a l Retail Activity is accelerating after a quiet 2022 Bidding on 6 active projects Actively pursuing 6 companies Rio Tinto TORXX Kinetic Pulverizer (Canada) Ames True Temper Hello Landing F&M Tool & Plastics Wholesale & Industrial Engagements Update B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 37

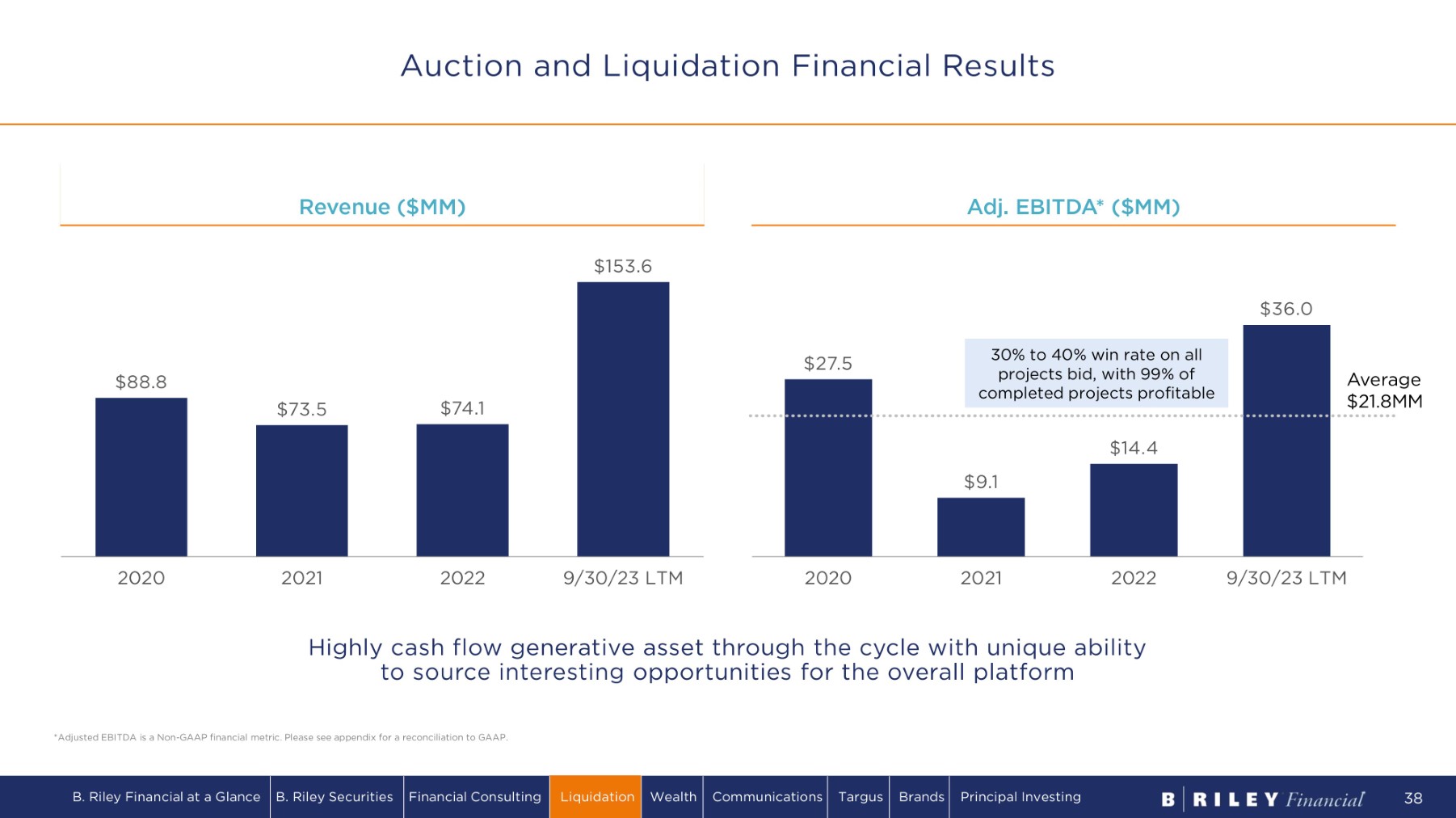

Auction and Liquidation Financial Results R e v e n u e ( $ MM) $ 88 . 8 $ 7 3 . 5 $ 7 4 . 1 $ 1 53 . 6 2 0 20 2 0 21 2 0 22 9/30/23 LTM A d j . E B I T D A * ( $ MM ) $ 2 7 . 5 $9 .1 $14.4 $ 3 6 .0 2 0 20 2 0 21 2 0 22 9/30/23 LTM Highly cash flow generative asset through the cycle with unique ability to source interesting opportunities for the overall platform Average $ 2 1 . 8 MM 30% to 40% win rate on all projects bid, with 99% of completed projects profitable *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 38

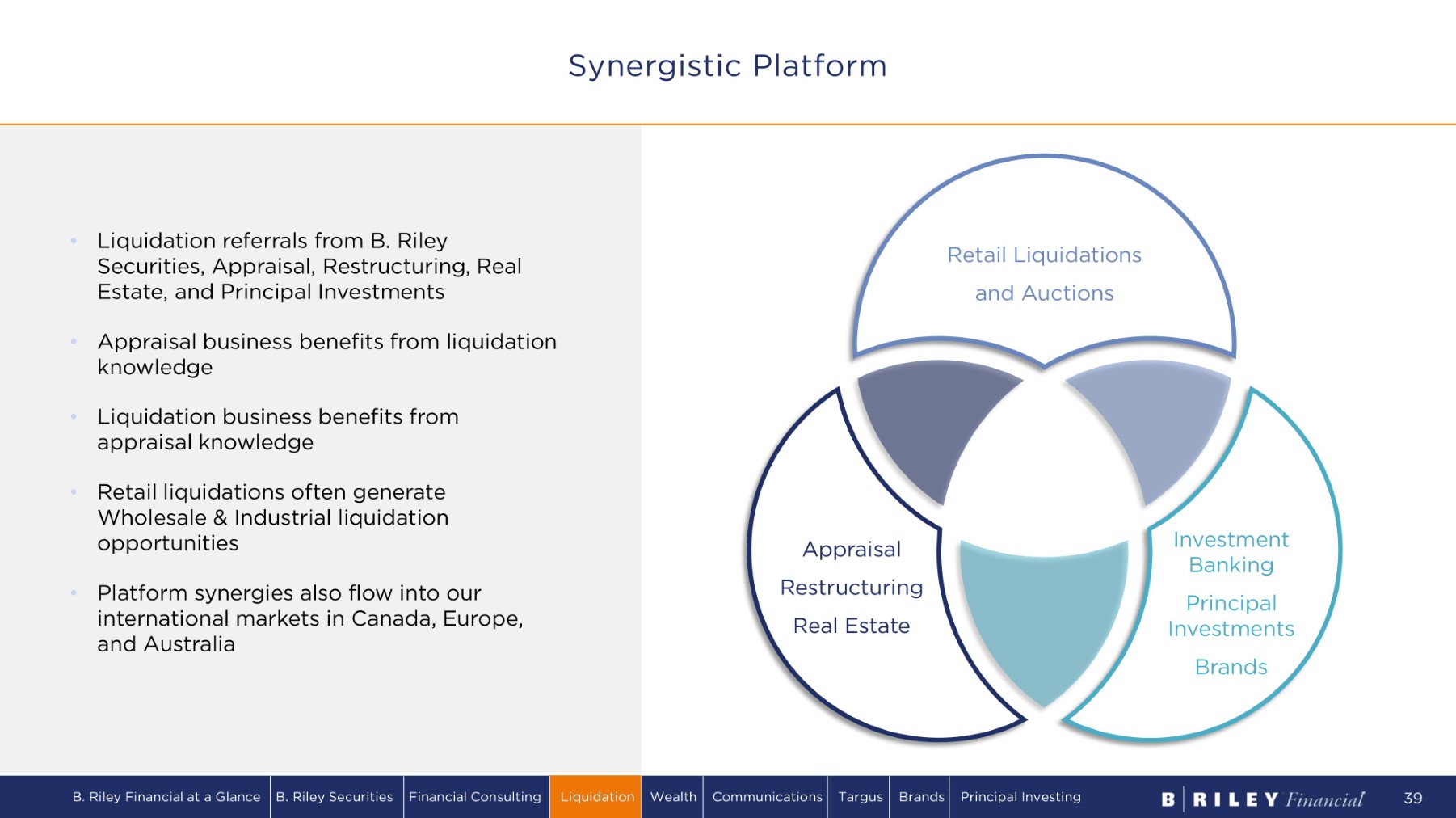

• Liquidation referrals from B. Riley Securities, Appraisal, Restructuring, Real Estate, and Principal Investments • Appraisal business benefits from liquidation knowledge • Liquidation business benefits from appraisal knowledge • Retail liquidations often generate Wholesale & Industrial liquidation opportunities • Platform synergies also flow into our international markets in Canada, Europe, and Australia Retail Liquidations and Auctions I n v e s tmen t Banking Principal I n v e s tmen ts Brands Appraisal R e s tr u c tu r i n g Real Estate Synergistic Platform B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 39

05 B. RILEY WEALTH

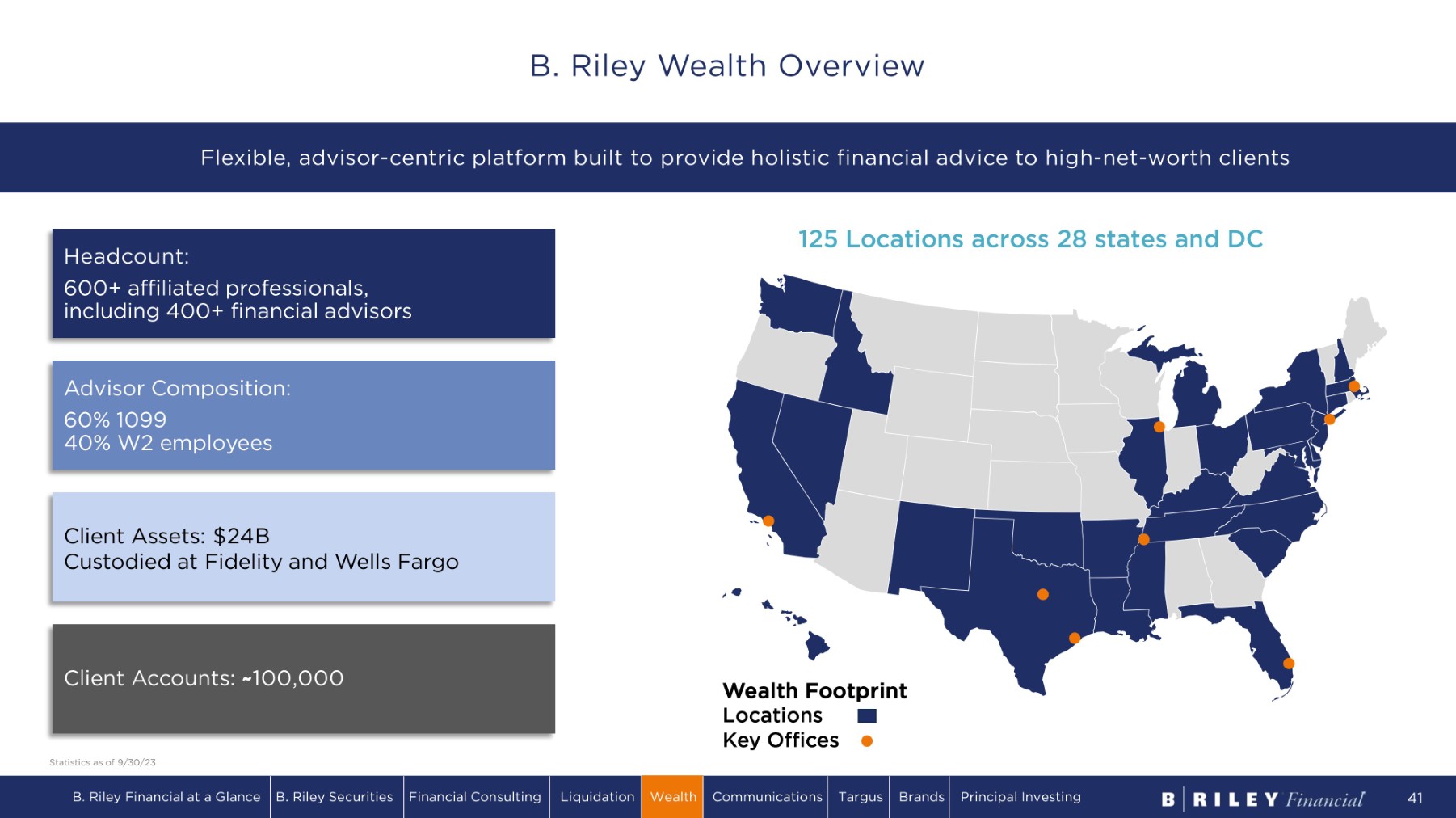

1 2 5 L o ca ti o n s a cr o s s 2 8 s t a t e s a n d DC Advisor Composition: 60% 1099 40% W2 employees Headcount: 600+ affiliated professionals, including 400+ financial advisors Client Assets: $24B Custodied at Fidelity and Wells Fargo Client Accounts: ~ 100,000 Wealth Footprint Locations K e y O ff i c e s Flexible, advisor - centric platform built to provide holistic financial advice to high - net - worth clients B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 41 B. Riley Wealth Overview Statistics as of 9/30/23

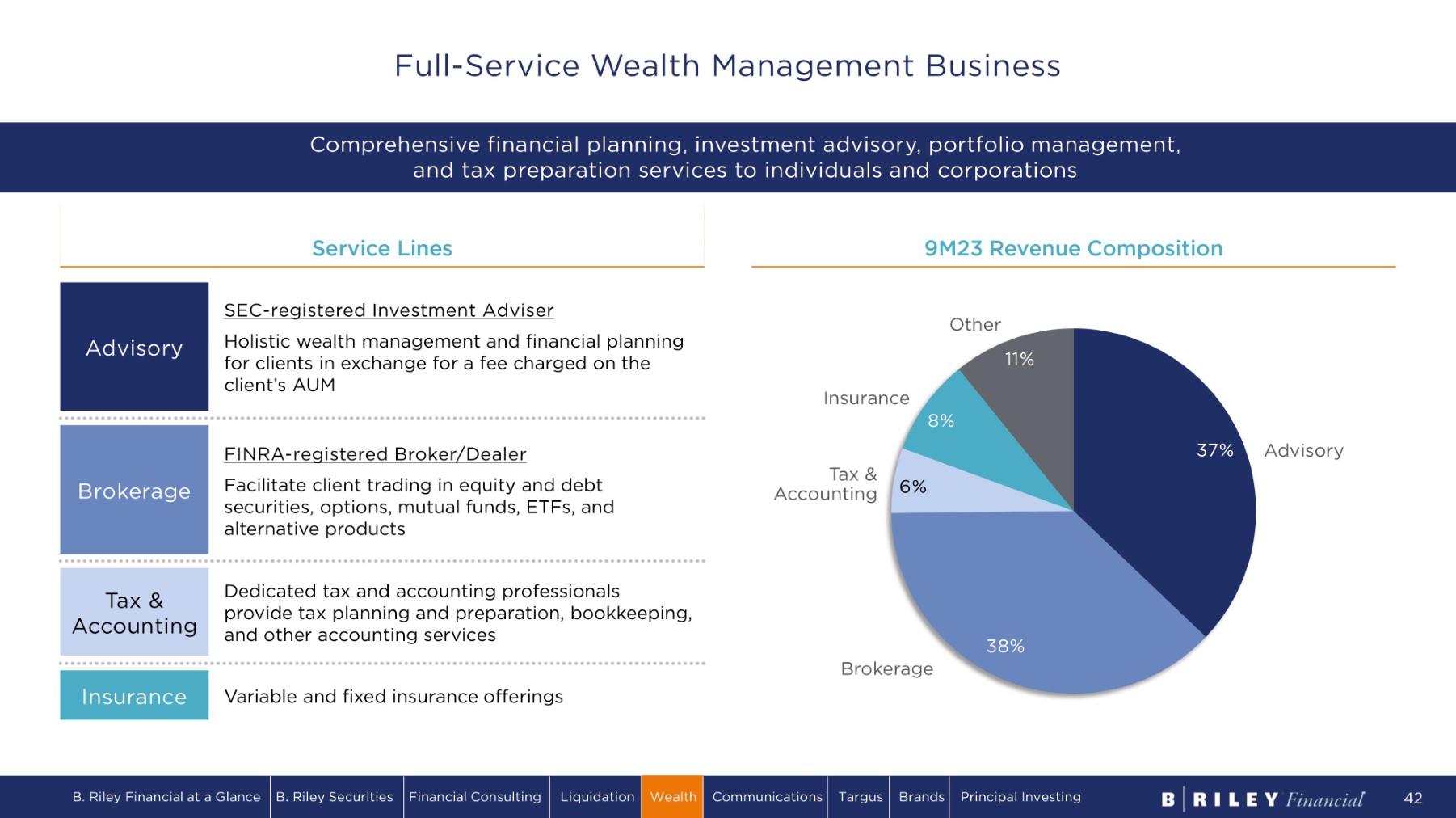

Advisory SEC - registered Investment Adviser Holistic wealth management and financial planning for clients in exchange for a fee charged on the client’s AUM Brokerage FINRA - registered Broker/Dealer Facilitate client trading in equity and debt securities, options, mutual funds, ETFs, and alternative products Tax & A cc o un t i n g Dedicated tax and accounting professionals provide tax planning and preparation, bookkeeping, and other accounting services Insurance Variable and fixed insurance offerings S e r v i c e L i n es 9 M 2 3 R e v e n u e C o m p o si t i o n 3 7 % 3 8 % 6% 8% 11% A d v i s o r y B r o k e r a g e Tax & A cc oun t i ng Insurance O t h e r Comprehensive financial planning, investment advisory, portfolio management, and tax preparation services to individuals and corporations B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 42 Full - Service Wealth Management Business

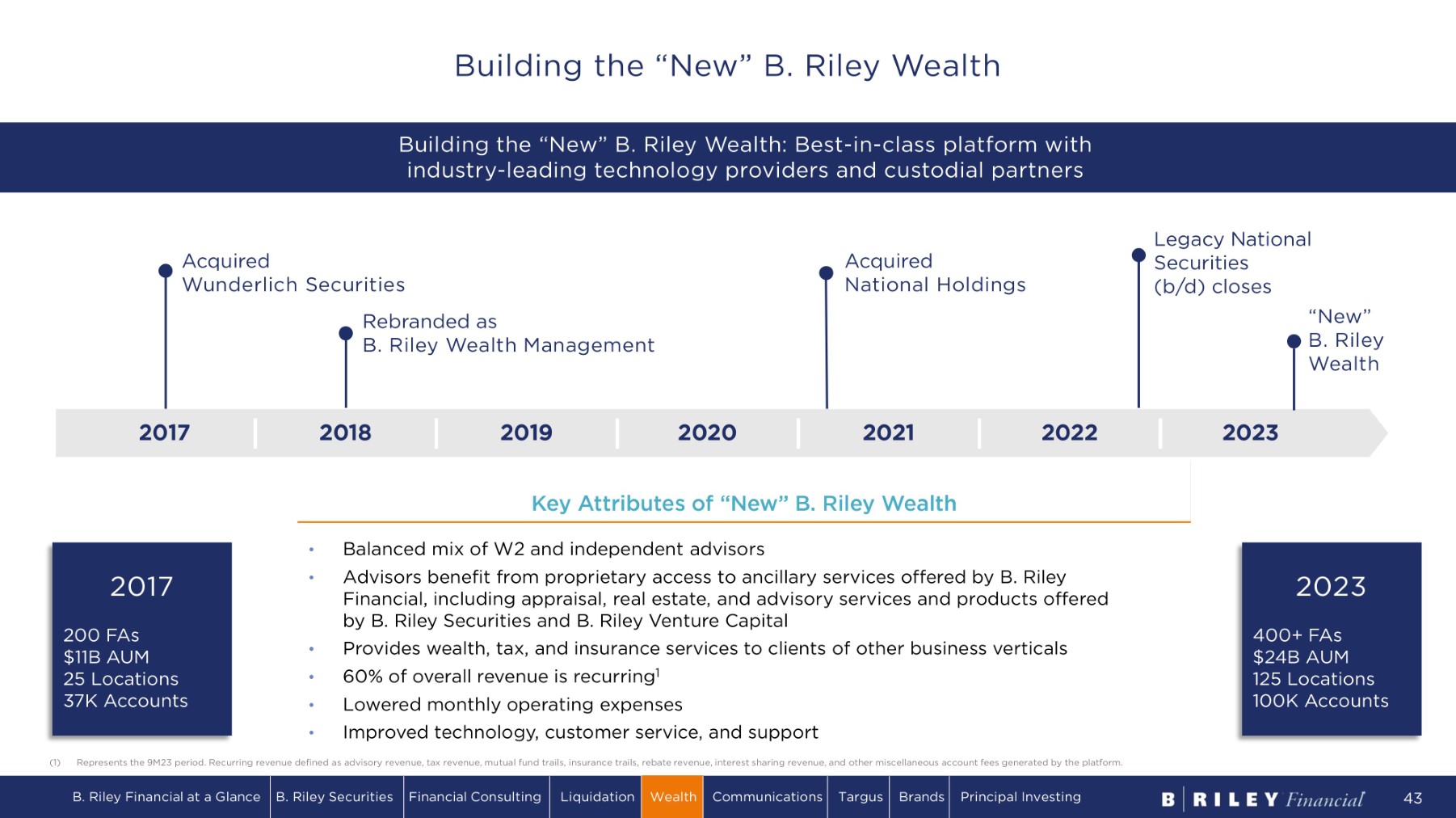

2023 2022 2021 2020 2019 2018 2017 Acquired National Holdings Acquired Wunderlich Securities Rebranded as B. Riley Wealth Management Legacy National Securities (b/d) closes “ N e w ” B. Riley Wealth • Balanced mix of W2 and independent advisors • Advisors benefit from proprietary access to ancillary services offered by B. Riley Financial, including appraisal, real estate, and advisory services and products offered by B. Riley Securities and B. Riley Venture Capital • Provides wealth, tax, and insurance services to clients of other business verticals • 60% of overall revenue is recurring 1 • Lowered monthly operating expenses • Improved technology, customer service, and support 2017 200 FAs $ 11B A UM 25 Locations 37K Accounts 2023 400+ FAs $24B AUM 125 Locations 100K Accounts Key Attributes of “New” B. Riley Wealth (1) Represents the 9M23 period. Recurring revenue defined as advisory revenue, tax revenue, mutual fund trails, insurance trails, rebate revenue, interest sharing revenue, and other miscellaneous account fees generated by the platform. Building the “New” B. Riley Wealth: Best - in - class platform with industry - leading technology providers and custodial partners B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 43 Building the “New” B. Riley Wealth

Headcount $148.9 $ 7 3 .1 $ 3 8 2 .0 $234.3 5 1 % 33% 55% 6 0 % 2 0 20 2021 Revenue 2 0 22 9 M23 % Recurring Revenue ($MM) 177 690 449 4 2 8 103 523 222 212 2 8 0 1 , 2 13 6 7 1 6 4 0 2 0 20 2 0 21 2 0 22 Financial Advisors 9 / 3 0 /2 3 Other B. Riley Wealth with $24B of AUM is ready to return to growth and is capable of generating 10% Adj. EBITDA margins Adj. EBITDA* ($MM) $ 5 . 9 $ 22 . 1 $ 6 .2 2 0 20 9 M23 ( $ 1 0. 0 ) 2021 2022 Adj. EBITDA A c qu i r e d National Holdings Feb 2021 Recurring revenue now covers ~70% of Adj. EBITDA breakeven Upside when capital markets activity i m p ro v e s Executed integration playbook, emphasizing recurring revenue and removing $30MM of indirect expenses. $195.1 LTM *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. LTM refers to twelve months ended 9/30/23 Wealth Financial Results B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 44

06 COMMUNICATIONS

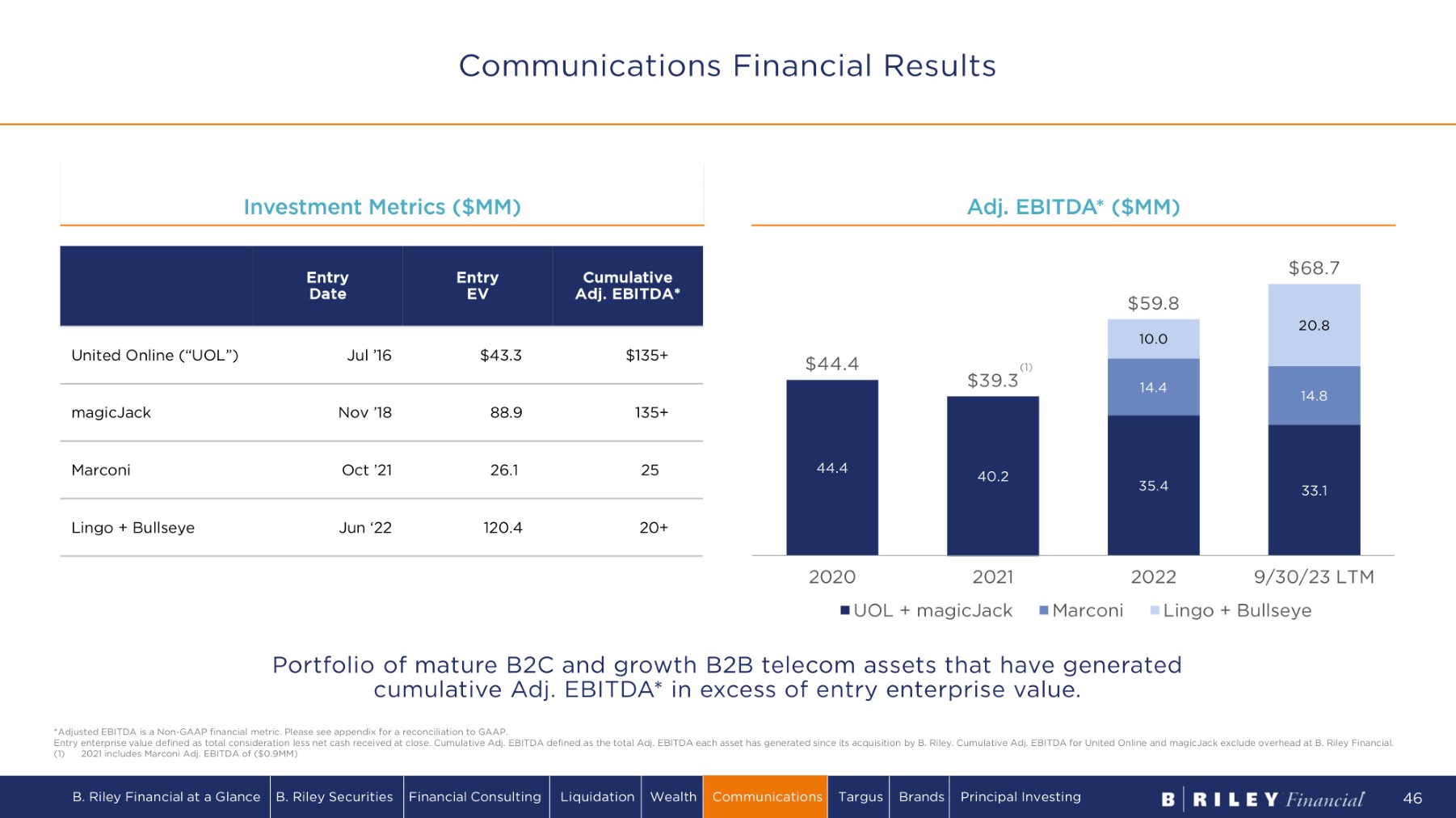

44.4 40.2 35.4 33.1 14.4 14.8 10.0 20.8 $ 44. 4 $ 3 9 . 3 $ 5 9 . 8 $ 6 8 .7 2020 2021 UO L + m a g i c Ja c k M a r c o ni 2022 9/30/23 LTM Lingo + Bullseye A d j . E B I T D A * ( $ MM ) Cumulative Adj. EBITDA* E n t r y EV E n t r y Date $135+ $43.3 Jul ’16 United Online (“UOL”) 135+ 88.9 Nov ’18 magicJack 25 26.1 Oct ’21 Marconi 20+ 120.4 Jun ‘22 Lingo + Bullseye I n v e s t m e n t M e t r i c s ( $ MM ) Portfolio of mature B2C and growth B2B telecom assets that have generated cumulative Adj. EBITDA* in excess of entry enterprise value. *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. Entry enterprise value defined as total consideration less net cash received at close. Cumulative Adj. EBITDA defined as the total Adj. EBITDA each asset has generated since its acquisition by B. Riley. Cumulative Adj. EBITDA for United Online and magicJack exclude overhead at B. Riley Financial. (1) 2021 includes Marconi Adj. EBITDA of ($0.9MM) ( 1 ) Communications Financial Results B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 46

Marconi Wireless magicJack United Online July 2016 Internet access provider; Provides email, broadband, DSL and dial - up services under the NetZero and Juno brands. Nov 2018 Voice over Internet Protocol (VoIP) phone service provider. Provides subscription services and devices to consumers and small businesses. Oct 2021 Mobile virtual network operator (MVNO). Provides mobile services, including voice, text, and data services and devices to consumers. Aug 2022 Award - winning single source communications and cloud technology provider. Provides unified communications to SMB and Enterprise markets. Lingo acquired BullsEye Telecom in August 2022. $ 3 2 MM S eg m e n t R ev e n u e FY 2016 L i n g o May 2022 Global unified communications (UC) and managed service provider. Provides IP - based Cloud voice, data and other UC technologies to small - to - medium sized businesses (SMBs) and consumers. BullsEye Telecom $344MM S eg m e n t Revenue LTM Sep 2023 Marconi W i re l e s s Operationally Focused Control Investments Offer Free Cash Flow Communications Portfolio B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 47

Mature B2C Telecom Marconi ▪ Provider of paid mail, internet, voice over IP (VoIP), and mobile communication services to consumers ▪ Predictable net subscriber decline ▪ Adj. EBITDA* margins 40%+ with de minimis capex ▪ On ~$160MM of entry enterprise value, these assets have generated ~$300MM in cumulative Adj. EBITDA* ▪ Expect meaningful cash distributions to continue over the next 5+ years *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. Entry enterprise value defined as total consideration less net cash received at close. Cumulative Adj. EBITDA for United Online and magicJack exclude overhead at B. Riley Financial. Growth B2B Telecom ▪ Re - seller of voice, VoIP, broadband, security, and collaboration tools like Microsoft Teams, under a single billing solution across all locations for Enterprise and Small - Medium businesses in the US ▪ $200MM+ of annual revenue with stable to moderate growth ▪ Platform for rolling up smaller UCaaS assets with significant synergies Communications Overview B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 48

0 7 T A R GUS

▪ Acquired Targus in October 2022 ▪ Leading brand share in key product categories in the U.S. and abroad ▪ Serves Fortune 1000 companies with global footprint in 100 countries 1 00 % ownership B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 50 • B. Riley acquired Targus in October 2022, attracted to its stability, market position, and strong FCF characteristics • Targus is the world’s largest non - OEM independent provider of carrying cases and docks, and a market leader in other accessories for laptops and tablets • Well positioned to serve the office, home, and mobile workforce of the future o Multiple robust distribution channels (wholesale, retail, OEM, and ecommerce) o Extensive and high - quality supply chain • We expect Targus to return to normalized financial performance o Demand rose in 2021 and 2022 as work - from - home movement elevated Targus products to long - term workforce productivity staples o Demand cooled in 1H2023, with overall PC market shipments down 30% YoY o We believe Targus is well positioned to benefit from a renewed purchasing cycle driven by aging hardware and demand for next generation technology o Industry appears to be at the early stages of a recovery Targus Overview

R e v e n u e ( $ MM) 330.9 9 . 9 77.8 257 . 0 $ 33 0.7 $ 35 3. 6 $ 40 8 .8 $ 2 66 . 9 2 0 20 2 0 21 A d j . E B I T D A * ( $ MM ) 2022 9/30/23 LTM Pre - B. Riley acquisition on 10/18/22 Well positioned to capitalize on market recovery, driving a return to normalized financial performance *Adjusted EBITDA is a Non - GAAP financial metric. Please see appendix for a reconciliation to GAAP. Revenue and Adj. EBITDA for periods prior to acquisition by B. Riley are as prepared by Targus, shown to communicate underlying business trends, not for reconciliation to B. Riley Financial consolidated financials. 2020 and 2021 are shown pro forma for Targus’ May 2021 acquisition of Hyper. 2022 includes 1/1/22 - 10/17/22 under prior ownership, during which Targus generated $330.9MM in revenue and $40.9MM in Adj. EBITDA. Subsequent to its acquisition by B. Riley on 10/18/22, Targus generated $77.8MM in revenue and $10.7MM in Adj. EBITDA for the period 10/18/22 – 12/31/22. 9/30/23 LTM includes 10/1/22 - 10/17/22 under prior ownership, during which Targus generated $9.9MM in revenue and ($0.4)MM in Adj. EBITDA. Subsequent to its acquisition by B. Riley on 10/18/22, Targus generated $257.0MM in revenue and $14.0MM in Adj. EBITDA for the period 10/18/22 – 9/30/23. 40.9 10.7 14.0 (0.4) $ 4 1 .7 $ 3 7 . 0 $ 5 1 . 6 $ 1 3 .7 2 0 20 2 0 21 2 0 22 9/30/23 LTM B. Riley ownership Prior to acquisition 10/18/22 Prior to acquisition 10/18/22 Targus Financial Results B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 51

08 B RAN D S

Six Brands October 2019 $116MM invested 80% owned ▪ Purchased the IP from the prior owner and operator, Bluestar Alliance . ▪ These brands are mature, relatively steady, and sold through full - and off - price B&M channels. Hurley October 2019 $67.5MM invested 43% owned ▪ Purchased as a divestiture from Nike. ▪ Since late 2019 it has nearly completely repaid our invested capital. Justice November 2020 $30MM invested 41% owned ▪ Purchased during Ascena Retail Group’s bankruptcy. ▪ Since late 2020 has returned approximately two thirds of our invested capital. Scotch and Soda March 2023 $12MM invested 10% owned ▪ Purchased out of its own bankruptcy process in the Netherlands. ▪ In less than a year of ownership, has returned over a quarter of our invested capital. • Our operating partner, Bluestar Alliance, licenses the use of these brands to a wide base of apparel manufacturers, each of whom focuses on a particular category of goods and pays a royalty based on their wholesale revenue. The licensees agree to multi - year contracts and pay a guaranteed minimum royalty (“GMR”) to hold the right to their segment. • Operating expenses for this unit are very low and often > 80% of the royalty income flows to EBITDA for distribution to shareholders Brands Overview 2023 2020 2019 B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 53

Net Inv e s t m e n t ( 1 ) Cumulative Di s t r ib u t io n s Investment Ownership E n t r y Date $67.8 $48.2 $116.0 80.0% Oct ’19 Six Brands 0.5 67.0 67.5 42.9% Oct ’19 Hurley 10.1 19.9 30.0 40.9% Nov ’20 Justice 8.7 3.3 12.0 10.3% Mar ’23 Scotch & Soda $87.1 $138.4 $225.5 Total 10.7 12.8 1 2 .8 1 2 .2 18.7 13.1 18.0 22.1 2.8 10.0 9.8 $3.3 $ 2 9 . 4 $ 2 8 . 6 $ 4 0 . 8 $4 7 . 5 2020 Six Brands 2021 H u r l e y 2 0 22 Justice 9/30/23 LTM Scotch & Soda I n v e s t m e n t M e t r i c s ( $ MM ) Distributions ($MM) Brands portfolio is owned for net investment of ~1.8x LTM distributions, with ~60% of investment returned Distributions represent cash wired from the joint ventures to B. Riley. Distributions approximate B. Riley’s pro rata share of each joint venture’s EBITDA. (1) Net investment defined as investment less cumulative distributions Brands Financial Results B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 54

09 PRINCIPAL INVESTING

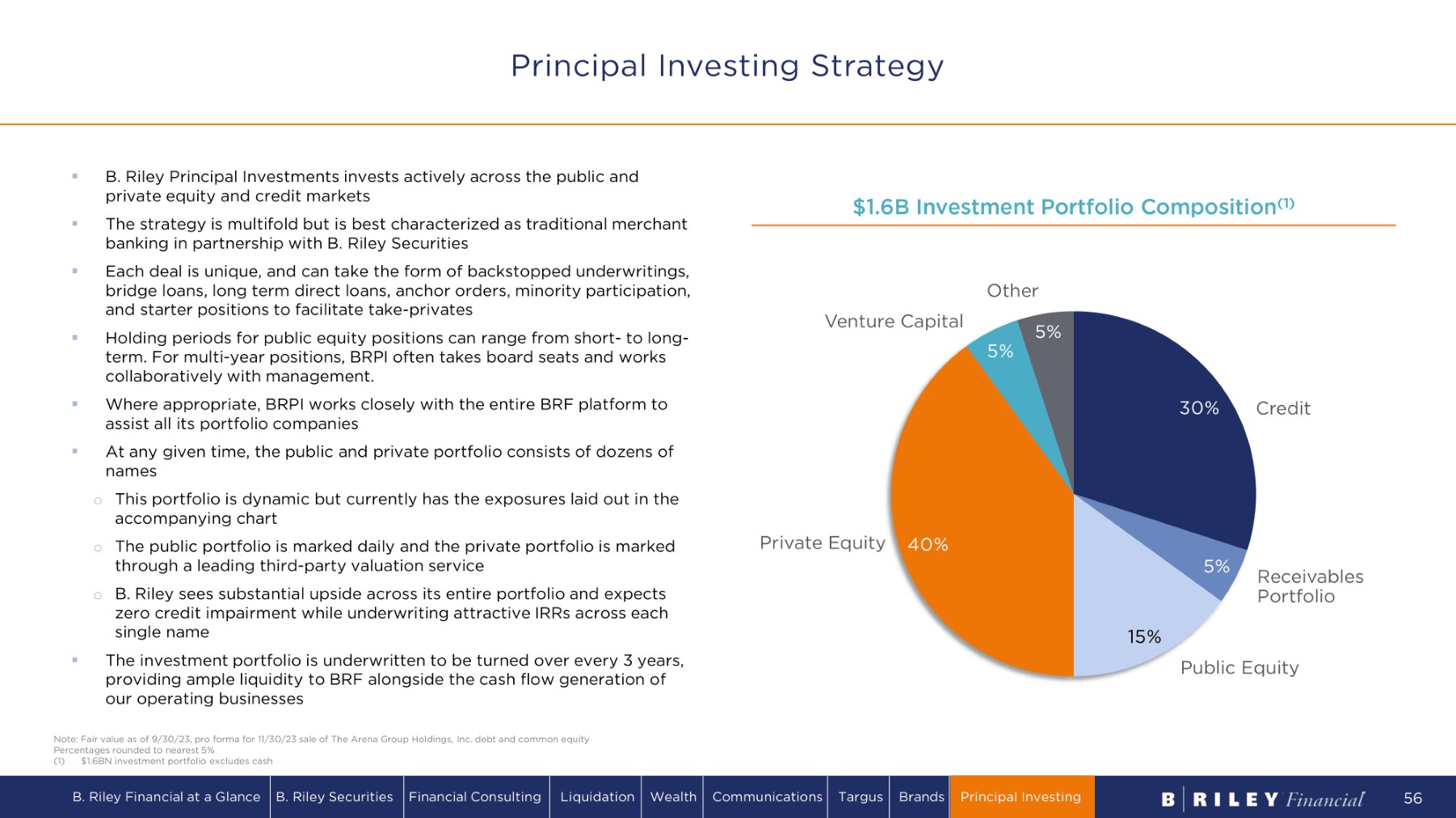

▪ B. Riley Principal Investments invests actively across the public and private equity and credit markets ▪ The strategy is multifold but is best characterized as traditional merchant banking in partnership with B. Riley Securities ▪ Each deal is unique, and can take the form of backstopped underwritings, bridge loans, long term direct loans, anchor orders, minority participation, and starter positions to facilitate take - privates ▪ Holding periods for public equity positions can range from short - to long - term. For multi - year positions, BRPI often takes board seats and works collaboratively with management. ▪ Where appropriate, BRPI works closely with the entire BRF platform to assist all its portfolio companies ▪ At any given time, the public and private portfolio consists of dozens of names o This portfolio is dynamic but currently has the exposures laid out in the accompanying chart o The public portfolio is marked daily and the private portfolio is marked through a leading third - party valuation service o B . Riley sees substantial upside across its entire portfolio and expects zero credit impairment while underwriting attractive IRRs across each single name ▪ The investment portfolio is underwritten to be turned over every 3 years, providing ample liquidity to BRF alongside the cash flow generation of our operating businesses $ 1 . 6 B I n v e s t m e n t P o r tf o li o C o m p o si t i o n ( 1 ) 3 0% 5% 1 5% 4 0% 5% 5% C r e d i t R e c ei v a b l es Portfolio Public Equity Private Equity Venture Capital O t h e r Principal Investing Strategy Note: Fair value as of 9/30/23, pro forma for 11/30/23 sale of The Arena Group Holdings, Inc. debt and common equity Percentages rounded to nearest 5% (1) $1.6BN investment portfolio excludes cash B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 56

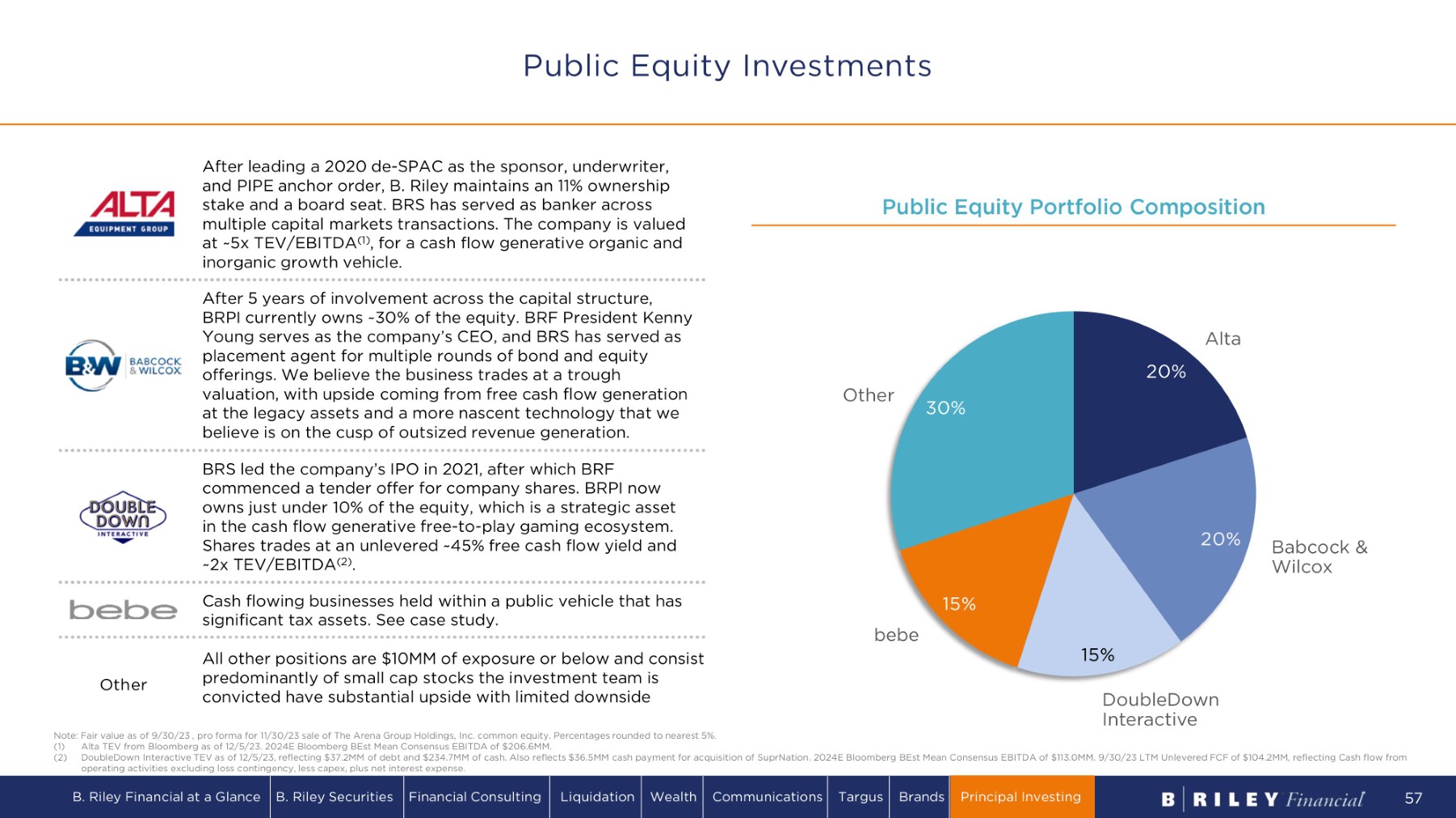

Public Equity Portfolio Composition 2 0% 2 0% 1 5% 1 5% 3 0% A l ta Babcock & Wilcox D o u b l eD o w n Interactive bebe O t h e r After 5 years of involvement across the capital structure, BRPI currently owns ~30% of the equity. BRF President Kenny Young serves as the company’s CEO, and BRS has served as placement agent for multiple rounds of bond and equity offerings. We believe the business trades at a trough valuation, with upside coming from free cash flow generation at the legacy assets and a more nascent technology that we believe is on the cusp of outsized revenue generation. BRS led the company’s IPO in 2021, after which BRF commenced a tender offer for company shares. BRPI now owns just under 10% of the equity, which is a strategic asset in the cash flow generative free - to - play gaming ecosystem. Shares trades at an unlevered ~45% free cash flow yield and ~2x TEV/EBITDA (2) . After leading a 2020 de - SPAC as the sponsor, underwriter, and PIPE anchor order, B. Riley maintains an 11% ownership stake and a board seat. BRS has served as banker across multiple capital markets transactions. The company is valued at ~5x TEV/EBITDA (1) , for a cash flow generative organic and inorganic growth vehicle. Cash flowing businesses held within a public vehicle that has significant tax assets. See case study. All other positions are $10MM of exposure or below and consist predominantly of small cap stocks the investment team is convicted have substantial upside with limited downside O t h er Note: Fair value as of 9/30/23 , pro forma for 11/30/23 sale of The Arena Group Holdings, Inc. common equity. Percentages rounded to nearest 5%. (1) Alta TEV from Bloomberg as of 12/5/23. 2024E Bloomberg BEst Mean Consensus EBITDA of $206.6MM. (2) DoubleDown Interactive TEV as of 12/5/23, reflecting $37.2MM of debt and $234.7MM of cash. Also reflects $36.5MM cash payment for acquisition of SuprNation. 2024E Bloomberg BEst Mean Consensus EBITDA of $113.0MM. 9/30/23 LTM Unlevered FCF of $104.2MM, reflecting Cash flow from operating activities excluding loss contingency, less capex, plus net interest expense. Public Equity Investments B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 57

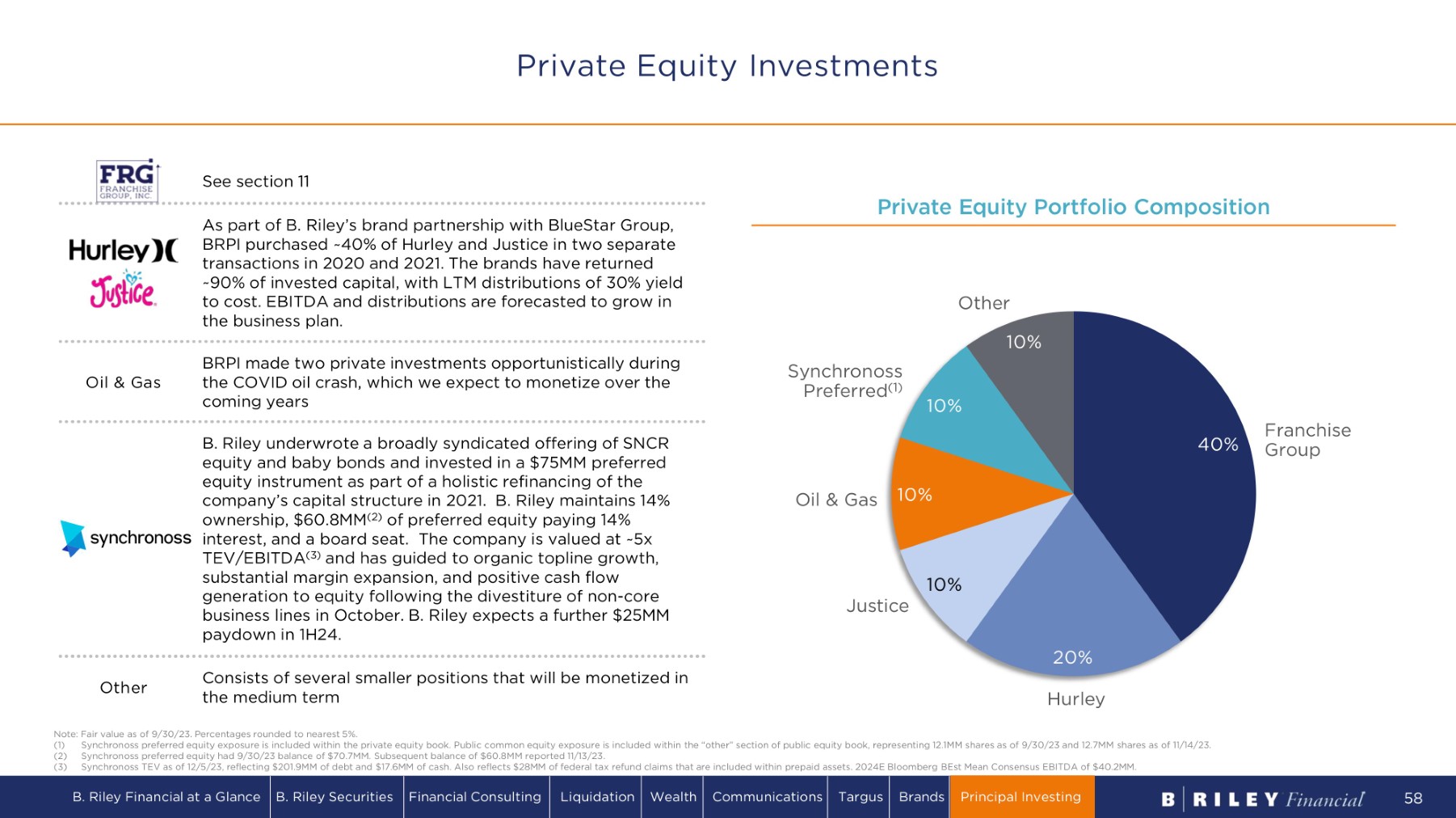

Private Equity Portfolio Composition As part of B . Riley’s brand partnership with BlueStar Group, BRPI purchased ~ 40 % of Hurley and Justice in two separate transactions in 2020 and 2021 . The brands have returned ~90% of invested capital, with LTM distributions of 30% yield to cost. EBITDA and distributions are forecasted to grow in the business plan. BRPI made two private investments opportunistically during the COVID oil crash, which we expect to monetize over the coming years See section 11 B. Riley underwrote a broadly syndicated offering of SNCR equity and baby bonds and invested in a $75MM preferred equity instrument as part of a holistic refinancing of the company’s capital structure in 2021. B. Riley maintains 14% ownership, $60.8MM (2) of preferred equity paying 14% interest, and a board seat. The company is valued at ~5x TEV/EBITDA (3) and has guided to organic topline growth, substantial margin expansion, and positive cash flow generation to equity following the divestiture of non - core business lines in October. B. Riley expects a further $25MM paydown in 1H24. Note: Fair value as of 9/30/23. Percentages rounded to nearest 5%. Synchronoss preferred equity exposure is included within the private equity book. Public common equity exposure is included within the “other” section of public equity book, representing 12.1MM shares as of 9/30/23 and 12.7MM shares as of 11/14/23. (1) (2) Synchronoss preferred equity had 9/30/23 balance of $70.7MM. Subsequent balance of $60.8MM reported 11/13/23. (3) Synchronoss TEV as of 12/5/23, reflecting $201.9MM of debt and $17.6MM of cash. Also reflects $28MM of federal tax refund claims that are included within prepaid assets. 2024E Bloomberg BEst Mean Consensus EBITDA of $40.2MM. Consists of several smaller positions that will be monetized in the medium term O t h er Oil & Gas 4 0% 2 0% 1 0% 1 0% 1 0% 1 0% F ra n c h i s e Group H u r l ey J u s t i c e Oil & Gas S y n c h r ono s s P r e f e r r e d ( 1 ) O t h e r Private Equity Investments B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 58

Credit Portfolio Composition 35 % 2 0% 1 5% 1 0% 5% 5% V i n t a ge HY Bonds / Pref E x e l a 1 0% Core Scientific C a di z Receivables Portfolio O t h e r Mostly a portfolio of stressed high - yield credit that we expect to provide $25MM+ of future P&L plus coupons Exela investment has generated 30%+ IRRs since inception. Two - thirds of this position is comprised of asset - backed loans with low probability of default. One - third of our exposure is marked at a ~20% haircut to publicly traded securities on a look - through basis. Vintage and Brian Kahn has been a profitable relationship for the firm, most notably via the original FRG transactions and the Badcock Receivables portfolio (see both case studies for detail). The $201MM secured Vintage loan bears PIK interest of 12% and matures in 2027. The vast majority of the collateral are shares of FRG. Expected to emerge from bankruptcy in Jan 2024. B. Riley’s sub debt is marked at $42MM vs. expected equity value post - emergence of $66MM. Despite the default, at current equity prices, B. Riley will make money on this loan. Our receivables portfolio is comprised of 3 separate transactions, 2 of which are outlined in the Badcock Receivables Case Study. Gross IRRs in the portfolio have been 25%+ and we expect the portfolio to be fully monetized within the next 18 months. Receivables V i n t a g e HY Bonds / Pref Since 2019, B. Riley has made 53 total loans. 38 (69%) have been paid back with a weighted average IRR of 12.7%. 15 loans remain outstanding with the notable examples outlined here. Note: Fair value as of 9/30/23, pro forma for 11/30/23 sale of The Arena Group Holdings, Inc. debt Top of capital structure and well covered on asset value basis Credit Investments Percentages rounded to nearest 5% B. Riley Financial at a Glance B. Riley Securities Financial Consulting Liquidation Wealth Communications Targus Brands Principal Investing 59

10 FRANCHISE GROUP

Vintage Capital Historical Value Creation in Collaboration with B. Riley Liberty Tax Acquisition and Formation of FRG (2018 – 2019) • Aug - 18: Vintage Capital, led by Brian Kahn, and B. Riley acquire majority position in Liberty Tax for $8.54 per share • Jul - 19: Liberty Tax and Buddy’s Home Furnishings (Vintage Capital asset) merge • Sept - 19: Liberty Tax renamed Franchise Group, Inc. (FRG) Innovative Financing Structures and Company Privatization (2021 – 2023) • Dec - 21: Sells $400MM Badcock receivables portfolio to B. Riley • Mar - 22: Completes $268MM sale - leaseback of Badcock real estate; B. Riley serves as Advisor • Oct - 22: Sells $148MM Badcock receivables portfolio to B. Riley • 4Q - 22 to 1Q - 23: Sells $377MM Badcock receivables portfolio to B. Riley in four transactions • May - 23: FRG announces take - private at $30 per share transaction led by Brian Kahn and management; B. Riley provides equity commitment Expanding Platform of Franchised and Franchisable Businesses (2019 – 2021) • Dec - 19: Acquires the Vitamin Shoppe; debt financing arranged by B. Riley • Feb - 20: Acquires American Freight; B. Riley provides loan commitment and partial guarantee • Jun - 20: Raises $112.3MM in follow - on equity offering led by B. Riley • Nov - 20: Refranchises 47 Buddy’s locations to bebe stores, Inc., an affiliate of B. Riley • Jan - 21: Raises $75MM in preferred stock offering led by B. Riley • Mar - 21: Acquires Pet Supplies Plus; B. Riley serves as financial advisor • Jul - 21: Sells Liberty Tax to NextPoint for ~$249MM total consideration at closing • Sept - 21: Acquires Sylvan Learning, Inc. • Nov - 21: Acquires W.S. Badcock Corporation 61

FRG Transaction Summary Capital structure as of 12/12/23. Debt principal as of 12/12/2023. Cash Balance as of 11/30/23. Current Capital Structure ($MM) C u r r en t D e b t O u t s t a n d i ng Transaction Background ▪ On August 21, 2023, B. Riley led the equity financing to facilitate the management - led acquisition of Franchise Group, Inc. ▪ B. Riley helped build the Company since its inception and is deeply familiar with the asset base and management team. Post the acquisition, B. Riley has ownership of 31% and board representation. 62 Capital Structure $319.6 Management Rollover 281.1 RILY 301.9 Others 902.6 Total Equity 2,013.5 (+) Debt (57.2) ( - ) Cash 2,858.9 Enterprise Value % ($MM) Tranche SOFR + 10.00% $475.0 Holdco SOFR + 4.75% 1,095.0 First Lien SOFR + 10.00% 125.0 Second Lien SOFR + 2.00% 318.5 ABL $2,013.5 Total

Underwriting Sum of the Parts Valuation Multiple Implied EV High Median Low Valuation metric ($MM) $1,148 10.0x 8.5x 7.0x $135 2022A Adj. EBITDA Vitamin Shoppe 168 13.0x 12.0x 11.0x 14 2022A Adj. EBITDA Sylvan Learning Centers 160 11.0x 10.0x 9.0x 16 2022A Adj. EBITDA Buddy’s 2,220 13.0x 12.0x 11.0x 185 2026E Adj. EBITDA Pet Supplies Plus 1,904 9.0x 8.0x 7.0x 238 2026E Adj. EBITDA American Freight 390 7.0x 6.0x 5.0x 65 2026E Adj. EBITDA Badcock $5,990 Total 63 The valuation metrics underlying the chart represent projections at July 2023, on the basis of which B. Riley underwrote the deal. While projections for individual business units may have changed over time, B. Riley continues to believe that the overall enterprise values represented in the chart are reasonable estimates. 2022A Adj. EBITDA was consistent with B. Riley’s expectations for 2023E Adj. EBITDA at the time of underwriting, July 2023. 2026E Adj. EBITDA estimates represent B. Riley’s projections at the time of underwriting, July 2023.

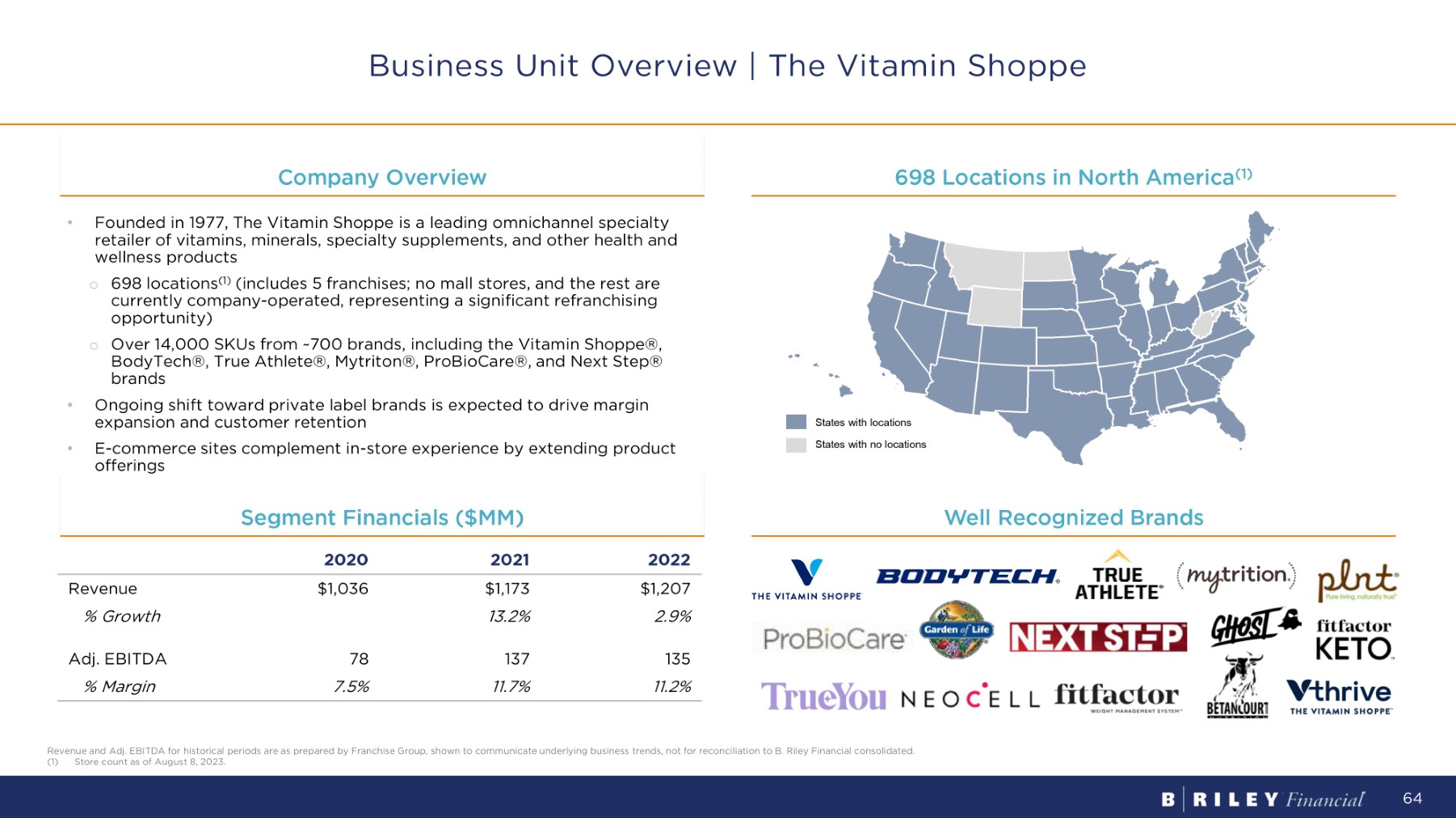

C o m p a n y O v e r v i e w 698 Locations in North America (1) Business Unit Overview | The Vitamin Shoppe 2022 2021 2020 $1,207 $1,173 $1,036 Revenue 2.9% 13.2% % G r o wt h 135 137 78 Adj. EBITDA 11.2% 11.7% 7.5% % M a rg i n Segment Financials ($MM) Well Recognized Brands • Founded in 1977, The Vitamin Shoppe is a leading omnichannel specialty retailer of vitamins, minerals, specialty supplements, and other health and wellness products o 698 locations ( 1 ) (includes 5 franchises ; no mall stores, and the rest are currently company - operated, representing a significant refranchising opportunity) o Over 14 , 000 SKUs from ~ 700 brands, including the Vitamin Shoppe®, BodyTech®, True Athlete®, Mytriton®, ProBioCare®, and Next Step® brands • Ongoing shift toward private label brands is expected to drive margin expansion and customer retention • E - commerce sites complement in - store experience by extending product offerings States with locations States with no locations Revenue and Adj. EBITDA for historical periods are as prepared by Franchise Group, shown to communicate underlying business trends, not for reconciliation to B. Riley Financial consolidated. (1) Store count as of August 8, 2023. 64

E du c a tio n Level Description Service Pre - K to Grade 12 Highly personalized learning plan developed with specific goals unique to each child’s needs ▪ Reading, math, writing, and study skills ▪ Homework help ▪ State test prep SylvanSync & Personalized Tutoring G r a d es 9 - 12 Support for the college bound student, with learning t a il o re d t o i n di v id u a l a d v a n c emen t g oa ls in a 1 : 1 or small group class setting ▪ SAT and ACT prep ▪ AP prep ▪ Course for credit ▪ College coaching College P re p ara t i on Pre - K to Grade 8 Fun, hands - on after school classes, weekend workshops, and developmental camps ▪ Math, science, and engineering ▪ STEM camps ▪ Robotics ▪ Coding STEM Pre - K to Grade 9 Small group, intervention - focused programs to remediate specific skill deficits in math and reading ▪ Math (K - Algebra) ▪ Reading (K - 8) Ace It! Suite of Services Business Unit Overview | Sylvan Learning Centers 2022 2021 2020 $42 $38 $26 Revenue 10.8% 45.8% % G r o wt h 14 12 6 Adj. EBITDA 33.1% 31.4% 22.9% % M a rg i n Segment Financials ($MM) Company Overview Revenue and Adj. EBITDA for historical periods are as prepared by Franchise Group, shown to communicate underlying business trends, not for reconciliation to B. Riley Financial consolidated. (1) Store count as of August 8, 2023. 65 ▪ Founded in 1979 , Sylvan Learning Centers is a leading omnichannel tutoring franchisor for PreK - 12 students and families, with over 700 locations in 49 states in the U . S . and 7 countries worldwide ( 1 ) ▪ Sylvan addresses the full range of remedial to advanced student needs with a broad variety of academic curriculums ▪ The business has the ability to provide a range of services, including on - premises, online, one - on - one, and in - group tutoring ▪ 99 % of the centers are franchised ; there are only 5 corporate locations