false

0001016504

0001016504

2023-11-09

2023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

November 9, 2023

________________

INTEGRATED BIOPHARMA, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Delaware

(STATE OR OTHER JURISDICTION OF INCORPORATION)

|

001-31668

|

22-2407475

|

|

(COMMISSION FILE NUMBER)

|

(I.R.S. EMPLOYER IDENTIFICATION NO.)

|

225 Long Avenue

Hillside, New Jersey 07205

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(973) 926-0816

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

None

|

None

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, Integrated Biopharma, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby incorporated by reference into this Item 2.02.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

EXHIBIT INDEX

| |

|

|

|

Exhibit

|

|

Description

|

| |

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INTEGRATED BIOPHARMA, INC.

|

| |

|

|

Date: November 9, 2023

|

By: /s/ Dina L Masi

|

| |

Dina L Masi

|

| |

Chief Financial Officer

|

Exhibit 99.1

NEWS RELEASE for November 9, 2023

Contact: Dina Masi, CFO

Integrated BioPharma, Inc.

investors@ibiopharma.com

888.319.6962

Integrated BioPharma Reports Results for its Quarter Ended September 30, 2023

HILLSIDE, NEW JERSEY (November 9, 2023) - Integrated BioPharma, Inc. (OTCQX: INBP) (the “Company” or “INBP”) reports its financial results for the quarter ended September 30, 2023.

Revenue for the quarter ended September 30, 2023 was $12.9 million compared to $12.3 million for the quarter ended September 30, 2022, an increase of $0.6 million or approximately 4.9%. The Company had an operating loss for the quarter ended September 30, 2023 of approximately $54,000 compared to operating income of approximately $30,000 for the quarter ended September 30, 2022.

For the quarter ended September 30, 2023, the Company had a net loss of approximately $59,000 or $0.00 per share of common stock, compared with a net loss of $35,000 or $0.00 per share of common stock for the quarter ended September 30, 2022. The Company’s diluted net income per share of common stock for the quarters ended September 30, 2023 and 2022 were each $0.00 per share of common stock.

“Our revenue increased by approximately 5% in the quarter ended September 30, 2023 from the quarter ended September 30, 2022 and our revenue from our two largest customers in our Contract Manufacturing Segment represented approximately 91% and 85% of total revenue in the quarters ended September 30, 2023 and 2022, respectively,” stated the Co-Chief Executive Officers of the Company, Riva Sheppard and Christina Kay.

A summary of our financial results for the three months ended September 30, 2023 and 2022 follows:

|

INTEGRATED BIOPHARMA, INC. AND SUBSIDIARIES

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

|

|

| |

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Total revenue

|

|

$ |

12,915 |

|

|

$ |

12,326 |

|

|

Cost of sales

|

|

|

12,083 |

|

|

|

11,329 |

|

|

Gross profit

|

|

|

832 |

|

|

|

997 |

|

|

Selling and administrative expenses

|

|

|

886 |

|

|

|

967 |

|

|

Operating (loss) income

|

|

|

(54 |

) |

|

|

30 |

|

|

Other income (expense), net (1)

|

|

|

8 |

|

|

|

(14 |

) |

| |

|

|

|

|

|

|

|

|

|

(Loss) income before income taxes

|

|

|

(46 |

) |

|

|

16 |

|

|

Income tax expense, net

|

|

|

(13 |

) |

|

|

(51 |

) |

|

Net loss

|

|

|

(59 |

) |

|

$ |

(35 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

Weighted average common shares outstanding - basic and diluted

|

|

|

29,965,914 |

|

|

|

29,949,610 |

|

(1) Includes interest expense of $13 in each period.

About Integrated BioPharma Inc. (INBP)

Integrated BioPharma, Inc. (“INBP”) is engaged primarily in the business of manufacturing, distributing, marketing and sales of vitamins, nutritional supplements and herbal products. Further information is available at ir.ibiopharma.com.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions, that, if they never materialize or prove incorrect, could cause the results of INBP to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements generally are identified by the words “expects,” “anticipates,” believes,” intends,” “estimates,” “should,” “would,” “strategy,” “plan” and similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements and are not guarantees of future performance. Such statements speak only as of the date hereof, are subject to change and should not be relied upon for investment purposes. INBP undertakes no obligation to revise or update any statements for any reasons. The risks, uncertainties and assumptions include, among others, changes in general economic and business conditions; loss of market share through competition; introduction of competing products by other companies; the timing of regulatory approval and the introduction of new products by INBP; changes in industry capacity; pressure on prices from competition or from purchasers of INBP’s products; regulatory changes in the pharmaceutical manufacturing industry and nutraceutical industry; regulatory obstacles to the introduction of new technologies or products that are important to INBP; availability of qualified personnel; the loss of any significant customers or suppliers; the impact of the war in Ukraine; the impact of the Israel-Hamas war; the tightened labor markets and inflation; and other risks and uncertainties described in the section entitled “Risk Factors” in INBP’s most recent Annual Report on Form 10-K and its subsequent Quarterly Reports on Form 10-Q. Accordingly, INBP cannot give assurance that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of INBP.

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

INTEGRATED BIOPHARMA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 09, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-31668

|

| Entity, Tax Identification Number |

22-2407475

|

| Entity, Address, Address Line One |

225 Long Avenue

|

| Entity, Address, City or Town |

Hillside

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07205

|

| City Area Code |

973

|

| Local Phone Number |

926-0816

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001016504

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

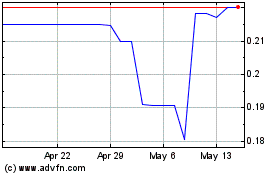

Integrated BioPharma (QX) (USOTC:INBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

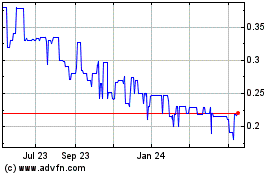

Integrated BioPharma (QX) (USOTC:INBP)

Historical Stock Chart

From Apr 2023 to Apr 2024