false

0001512499

0001512499

2023-11-02

2023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2023

LINDBLAD EXPEDITIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35898

|

|

27-4749725

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

96 Morton Street, 9th Floor, New York, New York

|

|

10014

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number including area code: (212) 261-9000

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

| |

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

LIND

|

|

The NASDAQ Stock Market LLC

|

| |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 .425)

|

|

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, the Company issued a press release announcing its financial results for its third quarter ended September 30, 2023.

This Item 2.02 and the press release attached hereto are being furnished by the Company pursuant to Item 2.02 “Results of Operations and Financial Condition.” In accordance with General Instruction B.2 of Form 8-K, the information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference into any of the Company’s filings with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LINDBLAD EXPEDITIONS HOLDINGS, INC.

(registrant)

|

| |

|

|

November 2, 2023

|

By:

|

/s/ Craig I. Felenstein

|

| |

|

Craig I. Felenstein, Chief Financial Officer

|

Exhibit 99.1

Lindblad Expeditions Holdings, Inc. Reports

2023 Third Quarter Financial Results

Third Quarter 2023 Highlights:

|

●

|

Total revenues increased 22% to $176.0 million

|

| |

|

|

●

|

Net income available to stockholders increased $14.3 million to $4.5 million

|

| |

|

|

●

|

Adjusted EBITDA increased 83% to $34.0 million

|

| |

|

|

●

|

Lindblad segment available guest nights increased 21%

|

| |

|

|

●

|

Net yield per available guest night increased 9% to $1,110 and occupancy was 81%

|

| |

|

|

●

|

Strong reservations for future travel with bookings for 2023 42% ahead of bookings for 2019 at the same point in 2019

|

NEW YORK, November 2, 2023 – Lindblad Expeditions Holdings, Inc. (NASDAQ: LIND; the “Company” or “Lindblad”), a global provider of expedition cruises and adventure travel experiences, today reported financial results for the third quarter ended September 30, 2023.

Sven Lindblad, Chief Executive Officer, said “Lindblad delivered record third quarter results as we continue to ramp operations and begin to meaningfully leverage the expanded earnings potential of the Company. The increased fleet capacity and diversified land offerings we have strategically invested in over the last several years provide an unparalleled opportunity to capitalize on the growing demand for experiential travel. At the same time, we have been committed to significantly upgrading our technological footprint and overall infrastructure, to help us maximize that opportunity and further support future growth initiatives. Overall, as we continue to navigate the complex short-term operating environment, we are excited by the momentum across our platform and look forward to building on that success in the months and years ahead. Our focus today remains the same as it has been for the last five decades, providing unmatched high quality, authentic and immersive travel experiences in the world’s most remarkable destinations.”

THIRD QUARTER RESULTS

Tour Revenues

Third quarter tour revenues of $176.0 million increased $31.2 million, or 22%, as compared to the same period in 2022. The increase was driven by a $25.0 million increase at the Lindblad segment and a $6.2 million increase at the Land Experiences segment.

Lindblad segment tour revenues of $108.8 million increased 25.0 million, or 30%, compared to the third quarter a year ago primarily due to a 21% increase in available guest nights as we continued to ramp operations. The year-on-year growth was also driven by a 9% increase in net yield per available guest night to $1,110 due to increased pricing and broader fleet utilization, while occupancy levels were in-line with a year ago at 81%.

Land Experiences tour revenues of $67.2 million increased $6.2 million, or 10%, compared to the third quarter a year ago primarily due to additional departures and higher pricing.

Net Income

Net income available to stockholders for the third quarter was $4.5 million, $0.08 per diluted share, as compared with net loss available to stockholders of $9.8 million, $0.18 per diluted share, in the third quarter of 2022. The $14.3 million improvement primarily reflects the ramp in operations, partially offset by a $3.1 million increase in interest expense due to additional borrowings and higher rates and a $1.3 million increase in stock-based compensation.

Adjusted EBITDA

Third quarter Adjusted EBITDA of $34.0 million increased $15.4 million, or 83%, as compared to the same period in 2022 driven by a $15.2 million increase at the Lindblad segment and a $0.1 million increase at the Land Experiences segment.

Lindblad segment Adjusted EBITDA of $20.1 million increased $15.2 million as compared to the same period in 2022, primarily due to increased tour revenues, partially offset by higher cost of tours and personnel costs related to the ramp in operations, increased commissions related to the revenue and bookings growth and higher marketing spend to drive future bookings.

Land Experiences segment Adjusted EBITDA of $13.8 million increased $0.1 million as compared to the same period in 2022, as increased tour revenues was mostly offset by higher cost of tours and increased personnel costs related to the ramp in operations, increased commissions related to the revenue and bookings growth and higher marketing costs to drive future bookings.

| |

|

For the three months ended

September 30,

|

|

|

For the nine months ended

September 30,

|

|

|

(In thousands)

|

|

2023

|

|

|

2022

|

|

|

Change

|

|

|

%

|

|

|

2023

|

|

|

2022

|

|

|

Change

|

|

|

%

|

|

|

Tour revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lindblad

|

|

$ |

108,750 |

|

|

$ |

83,741 |

|

|

$ |

25,009 |

|

|

|

30 |

% |

|

$ |

311,660 |

|

|

$ |

198,063 |

|

|

$ |

113,597 |

|

|

|

57 |

% |

|

Land Experiences

|

|

|

67,239 |

|

|

|

61,042 |

|

|

|

6,197 |

|

|

|

10 |

% |

|

|

132,523 |

|

|

|

105,477 |

|

|

|

27,046 |

|

|

|

26 |

% |

|

Total tour revenues

|

|

$ |

175,989 |

|

|

$ |

144,783 |

|

|

$ |

31,206 |

|

|

|

22 |

% |

|

$ |

444,183 |

|

|

$ |

303,540 |

|

|

$ |

140,643 |

|

|

|

46 |

% |

|

Operating income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lindblad

|

|

$ |

7,501 |

|

|

$ |

(7,142 |

) |

|

$ |

14,643 |

|

|

|

NM |

|

|

$ |

8,576 |

|

|

$ |

(60,380 |

) |

|

$ |

68,956 |

|

|

|

NM |

|

|

Land Experiences

|

|

|

12,975 |

|

|

|

12,950 |

|

|

|

25 |

|

|

|

0 |

% |

|

|

15,868 |

|

|

|

12,629 |

|

|

|

3,239 |

|

|

|

26 |

% |

|

Total operating loss

|

|

$ |

20,476 |

|

|

$ |

5,808 |

|

|

$ |

14,668 |

|

|

|

NM |

|

|

$ |

24,444 |

|

|

$ |

(47,751 |

) |

|

$ |

72,195 |

|

|

|

NM |

|

|

Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lindblad

|

|

$ |

20,119 |

|

|

$ |

4,889 |

|

|

$ |

15,230 |

|

|

|

NM |

|

|

$ |

48,887 |

|

|

$ |

(23,560 |

) |

|

$ |

72,447 |

|

|

|

NM |

|

|

Land Experiences

|

|

|

13,831 |

|

|

|

13,699 |

|

|

|

132 |

|

|

|

1 |

% |

|

|

18,472 |

|

|

|

14,735 |

|

|

|

3,737 |

|

|

|

25 |

% |

|

Total adjusted EBITDA

|

|

$ |

33,950 |

|

|

$ |

18,588 |

|

|

$ |

15,362 |

|

|

|

83 |

% |

|

$ |

67,359 |

|

|

$ |

(8,825 |

) |

|

$ |

76,184 |

|

|

|

NM |

|

Balance Sheet and Liquidity

The Company’s cash and cash equivalents, restricted cash and short-term securities were $204.8 million as of September 30, 2023, as compared with $129.6 million as of December 31, 2022. The increase primarily reflects $61.0 million in net cash from financing activities primarily related to the May issuance of $275.0 million of 9.00% senior secured notes and $35.3 million in cash from operations due to the strong operating performance and increased bookings for future travel, partially offset by $22.7 million in cash used in purchasing property and equipment, predominantly related to maintenance on existing vessels and investments in our digital initiatives.

During May, the Company issued $275.0 million of 9.00% senior secured notes, maturing 2028, with proceeds used primarily to pay the outstanding borrowings under the Company's previously existing export credit agreements. The senior secured notes are guaranteed on a senior secured basis by the Company and certain of the Company’s subsidiaries and are collateralized by certain of the Company’s assets.

As of September 30, 2023, the Company had a total debt position of $635.1 million and was in compliance with all of its applicable debt covenants.

FINANCIAL OUTLOOK

The Company’s current expectations for the full year 2023 are as follows:

|

●

|

Tour revenues of $550 - $575 million

|

|

●

|

Adjusted EBITDA of $70 - $80 million

|

The Company has substantial advance reservations for future travel with strong gross bookings, partially offset by short-term cancellations. As of October 30, 2023, Lindblad segment bookings for travel during 2023 have increased 42% as compared with bookings for 2019 as of the same date in 2019.

STOCK REPURCHASE PLAN

The Company currently has a $35.0 million stock repurchase plan in place. As of October 30, 2023, the Company had repurchased 875,218 shares and 6.0 million warrants under the plan for a total of $23.0 million and had $12.0 million remaining under the plan. As of October 30, 2023, there were 53.4 million shares common stock outstanding.

NON-GAAP FINANCIAL MEASURES

The Company uses a variety of operational and financial metrics, including non-GAAP financial measures such as Adjusted EBITDA, Occupancy, Net Yields and Net Cruise Costs, to enable it to analyze its performance and financial condition. The Company utilizes these financial measures to manage its business on a day-to-day basis and believes that they are the most relevant measures of performance. Some of these measures are commonly used in the cruise and tourism industry to evaluate performance. The Company believes these non-GAAP measures provide expanded insight to assess revenue and cost performance, in addition to the standard GAAP-based financial measures. There are no specific rules or regulations for determining non-GAAP measures, and as such, they may not be comparable to measures used by other companies within the industry.

The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The definitions of non-GAAP financial measures along with a reconciliation of non-GAAP financial information to GAAP are included in the supplemental financial schedules.

Conference Call Information

The Company has scheduled a conference call at 8:30 a.m. Eastern Time on November 2, 2023, to discuss the earnings of the Company. The conference call can be accessed by dialing 833-470-1428 (United States), 1-929-526-1599 (International). The Access Code is 299201. A replay of the call will be available at the Company’s investor relations website, investors.expeditions.com.

About Lindblad Expeditions Holdings, Inc.

Lindblad Expeditions Holdings, Inc. is an expedition travel company that focuses on ship-based voyages through its Lindblad Expeditions brand and land-based travel through its subsidiaries, Natural Habitat, Inc. (“Natural Habitat”), Off the Beaten Path LLC (“Off the Beaten Path”), DuVine Cycling + Adventure Co. (“DuVine”), and Classic Journeys, LLC (“Classic Journeys”).

Lindblad Expeditions works in partnership with National Geographic to inspire people to explore and care about the planet. The organizations work in tandem to produce innovative marine expedition programs and promote conservation and sustainable tourism around the world. The partnership’s educationally oriented voyages allow guests to interact with and learn from leading scientists, naturalists and researchers while discovering stunning natural environments, above and below the sea, through state-of-the-art exploration tools.

Natural Habitat partners with the World Wildlife Fund to offer and promote conservation and sustainable travel that directly protects nature. Natural Habitat’s adventures include polar bear tours in Churchill, Canada, Alaskan grizzly bear adventures and African safaris.

Classic Journeys is a luxury cultural walking tour company that operates a portfolio of curated tours centered around cinematic walks led by expert local guides. Classic Journeys offers active small-group and private custom journeys in over 50 countries around the world.

DuVine designs and leads luxury bike tours in the world’s most amazing destinations, from Italy’s sun-bleached villages and the medieval towns of Provence to Portugal’s Douro Valley and the vineyards of Napa, California. Guests bike, eat, drink, and sleep their way through these regions and many more while sampling the finest cuisine, hotels, and wine.

Off the Beaten Path is an outdoor, active travel company offering guided small group adventures and private custom journeys that connect travelers with the wild nature and authentic culture of their destinations. Off the Beaten Path’s trips extend across the globe, with a focus on exceptional national park experiences in the Rocky Mountains, Desert Southwest, and Alaska.

Forward Looking Statements

Certain matters discussed in this press release are “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements include the Company’s financial projections and may also generally be identified as such because the context of such statements will include words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or words of similar import. Similarly, statements that describe the Company’s financial guidance or future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause results to differ materially from those expected. Many of these risks and uncertainties are currently amplified by, and will continue to be amplified by, or in the future may be amplified by, the COVID-19 outbreak. It is not possible to predict or identify all such risks. There may be additional risks that we consider immaterial or which are unknown. These factors include, but are not limited to, the following: (i) events and conditions around the world, including war and other military actions, such as the Israel-Hamas war, the current conflict between Russia and Ukraine, inflation, higher fuel prices, higher interest rates and other general concerns about the state of the economy or other events impacting the ability or desire of people to travel; (ii) suspended operations, cancelling or rescheduling of voyages and other potential disruptions to our business and operations related to the COVID-19 virus, the Russia-Ukraine conflict, political unrest in destinations we visit, outbreak of disease in any destination we visit or another unexpected event; (iii) the Israel-Hamas war, impacts of inflation, the COVID-19 virus and/or the Russia-Ukraine conflict on our financial condition, liquidity, results of operations, cash flows, employees, plans and growth; (iv) increases in fuel prices, changes in fuels consumed and availability of fuel supply in the geographies in which we operate or in general; (v) the impacts of inflation and negative economic conditions or negative economic outlooks on the demand for expedition travel; (vi) the loss of key employees, our inability to recruit or retain qualified shoreside and shipboard employees and increased labor costs; (vii) the impacts of delays or cost overruns with respect to anticipated or unanticipated drydock, maintenance, modifications or other required construction related to any of our vessels; (viii) unscheduled disruptions in our business due to travel restrictions, weather events, mechanical failures, pandemics or other events; (ix) any change in state classifications of our workforce; (x) changes adversely affecting the business in which we are engaged; (xi) management of our growth and our ability to execute on our planned growth, including our ability to successfully integrate acquisitions; (xii) our business strategy and plans; (xiii) our ability to maintain or renew (on favorable terms or at all) our relationship with National Geographic and/or World Wildlife Fund; (xiv) compliance with new and existing laws and regulations, including environmental regulations and travel advisories and restrictions; (xv) compliance with the financial and/or operating covenants in our debt arrangements; (xvi) the impact of severe or unusual weather conditions, including climate change, on our business; (xvii) adverse publicity regarding the travel and cruise industry in general; (xviii) loss of business due to competition; (xix) the inability to meet or achieve our sustainability related goals, aspirations, initiatives, and our public statements and disclosures regarding them; (xx) the result of future financing efforts; and (xxi) those risks described in the Company’s filings with the SEC. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only as of the date of this press release, and the Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. More detailed information about factors that may affect the Company’s performance may be found in its filings with the SEC, which are available at http://www.sec.gov or at http://www.expeditions.com in the Investor Relations section of the Company’s website.

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

|

|

Condensed Consolidated Balance Sheets

|

|

(In thousands, except share and per share data)

|

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

(unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

168,015 |

|

|

$ |

87,177 |

|

|

Restricted cash

|

|

|

36,802 |

|

|

|

28,847 |

|

|

Short-term securities

|

|

|

- |

|

|

|

13,591 |

|

|

Marine operating supplies

|

|

|

6,528 |

|

|

|

9,961 |

|

|

Inventories

|

|

|

3,087 |

|

|

|

1,965 |

|

|

Prepaid expenses and other current assets

|

|

|

44,722 |

|

|

|

41,778 |

|

|

Total current assets

|

|

|

259,154 |

|

|

|

183,319 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

530,337 |

|

|

|

539,406 |

|

|

Goodwill

|

|

|

42,017 |

|

|

|

42,017 |

|

|

Intangibles, net

|

|

|

9,864 |

|

|

|

11,219 |

|

|

Deferred tax asset

|

|

|

2,305 |

|

|

|

2,167 |

|

|

Right-to-use lease assets

|

|

|

3,271 |

|

|

|

4,345 |

|

|

Other long-term assets

|

|

|

4,657 |

|

|

|

5,502 |

|

|

Total assets

|

|

$ |

851,605 |

|

|

$ |

787,975 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Unearned passenger revenues

|

|

$ |

250,568 |

|

|

$ |

245,101 |

|

|

Accounts payable and accrued expenses

|

|

|

66,701 |

|

|

|

71,019 |

|

|

Long-term debt - current

|

|

|

46 |

|

|

|

23,337 |

|

|

Lease liabilities - current

|

|

|

1,718 |

|

|

|

1,663 |

|

|

Total current liabilities

|

|

|

319,033 |

|

|

|

341,120 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, less current portion

|

|

|

620,888 |

|

|

|

529,452 |

|

|

Deferred tax liabilities

|

|

|

1,454 |

|

|

|

- |

|

|

Lease liabilities

|

|

|

1,807 |

|

|

|

2,961 |

|

|

Other long-term liabilities

|

|

|

89 |

|

|

|

88 |

|

|

Total liabilities

|

|

|

943,271 |

|

|

|

873,621 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

- |

|

|

|

- |

|

|

Series A redeemable convertible preferred stock, 165,000 shares authorized; 62,000 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively

|

|

|

72,397 |

|

|

|

69,143 |

|

|

Redeemable noncontrolling interests

|

|

|

34,232 |

|

|

|

27,886 |

|

| |

|

|

106,629 |

|

|

|

97,029 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 1,000,000 shares authorized; 62,000 Series A shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively

|

|

|

- |

|

|

|

- |

|

|

Common stock, $0.0001 par value, 200,000,000 shares authorized; 53,379,750 and 53,177,437 issued, 53,321,818 and 53,110,132 outstanding as of September 30, 2023 and December 31, 2022, respectively

|

|

|

5 |

|

|

|

5 |

|

|

Additional paid-in capital

|

|

|

92,549 |

|

|

|

83,850 |

|

|

Accumulated deficit

|

|

|

(290,849 |

) |

|

|

(266,530 |

) |

|

Total stockholders' deficit

|

|

|

(198,295 |

) |

|

|

(182,675 |

) |

|

Total liabilities, mezzanine equity and stockholders' deficit

|

|

$ |

851,605 |

|

|

$ |

787,975 |

|

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except share and per share data)

(unaudited)

|

| |

|

For the three months ended September 30,

|

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tour revenues

|

|

$ |

175,989 |

|

|

$ |

144,783 |

|

|

$ |

444,183 |

|

|

$ |

303,540 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of tours

|

|

|

95,590 |

|

|

|

87,576 |

|

|

|

245,293 |

|

|

|

208,023 |

|

|

General and administrative

|

|

|

30,015 |

|

|

|

24,535 |

|

|

|

85,589 |

|

|

|

68,882 |

|

|

Selling and marketing

|

|

|

19,387 |

|

|

|

16,025 |

|

|

|

55,197 |

|

|

|

41,193 |

|

|

Depreciation and amortization

|

|

|

10,521 |

|

|

|

10,839 |

|

|

|

33,660 |

|

|

|

33,193 |

|

|

Total operating expenses

|

|

|

155,513 |

|

|

|

138,975 |

|

|

|

419,739 |

|

|

|

351,291 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

20,476 |

|

|

|

5,808 |

|

|

|

24,444 |

|

|

|

(47,751 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(11,482 |

) |

|

|

(8,369 |

) |

|

|

(33,593 |

) |

|

|

(26,500 |

) |

|

(Loss) gain on foreign currency

|

|

|

(455 |

) |

|

|

(872 |

) |

|

|

46 |

|

|

|

(1,417 |

) |

|

Other (expense) income

|

|

|

(77 |

) |

|

|

(333 |

) |

|

|

(3,773 |

) |

|

|

84 |

|

|

Total other expense

|

|

|

(12,014 |

) |

|

|

(9,574 |

) |

|

|

(37,320 |

) |

|

|

(27,833 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

8,462 |

|

|

|

(3,766 |

) |

|

|

(12,876 |

) |

|

|

(75,584 |

) |

|

Income tax expense

|

|

|

3 |

|

|

|

1,732 |

|

|

|

1,587 |

|

|

|

619 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

8,459 |

|

|

|

(5,498 |

) |

|

|

(14,463 |

) |

|

|

(76,203 |

) |

|

Net income attributable to noncontrolling interest

|

|

|

2,821 |

|

|

|

3,228 |

|

|

|

3,742 |

|

|

|

3,000 |

|

|

Net income (loss) attributable to Lindblad Expeditions Holdings, Inc.

|

|

|

5,638 |

|

|

|

(8,726 |

) |

|

|

(18,205 |

) |

|

|

(79,203 |

) |

|

Series A redeemable convertible preferred stock dividend

|

|

|

1,098 |

|

|

|

1,036 |

|

|

|

3,255 |

|

|

|

3,618 |

|

|

Net income (loss) available to stockholders

|

|

$ |

4,540 |

|

|

$ |

(9,762 |

) |

|

$ |

(21,460 |

) |

|

$ |

(82,821 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

53,309,336 |

|

|

|

53,045,329 |

|

|

|

53,227,642 |

|

|

|

51,665,912 |

|

|

Diluted

|

|

|

53,401,799 |

|

|

|

53,045,329 |

|

|

|

53,227,642 |

|

|

|

51,665,912 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Undistributed income (loss) per share available to stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.08 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.60 |

) |

|

Diluted

|

|

$ |

0.08 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.60 |

) |

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

|

|

Condensed Consolidated Statements of Cash Flows

|

|

(In thousands)

(unaudited)

|

| |

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash Flows From Operating Activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(14,463 |

) |

|

$ |

(76,203 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

33,660 |

|

|

|

33,193 |

|

|

Amortization of deferred financing costs and other, net

|

|

|

2,444 |

|

|

|

1,988 |

|

|

Amortization of right-to-use lease assets

|

|

|

1,074 |

|

|

|

626 |

|

|

Stock-based compensation

|

|

|

9,245 |

|

|

|

5,283 |

|

|

Deferred income taxes

|

|

|

1,241 |

|

|

|

759 |

|

|

Change in fair value of contingent acquisition consideration

|

|

|

- |

|

|

|

111 |

|

|

(Gain) loss on foreign currency

|

|

|

(46 |

) |

|

|

1,417 |

|

|

Write-off of unamortized issuance costs related to debt refinancing

|

|

|

3,860 |

|

|

|

9,004 |

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Marine operating supplies and inventories

|

|

|

2,311 |

|

|

|

(1,195 |

) |

|

Prepaid expenses and other current assets

|

|

|

(2,944 |

) |

|

|

(19,575 |

) |

|

Unearned passenger revenues

|

|

|

5,467 |

|

|

|

34,407 |

|

|

Other long-term assets

|

|

|

(1,165 |

) |

|

|

3,242 |

|

|

Other long-term liabilities

|

|

|

- |

|

|

|

844 |

|

|

Accounts payable and accrued expenses

|

|

|

(4,272 |

) |

|

|

7,526 |

|

|

Operating lease liabilities

|

|

|

(1,099 |

) |

|

|

(658 |

) |

|

Net cash provided by operating activities

|

|

|

35,313 |

|

|

|

769 |

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(22,723 |

) |

|

|

(29,566 |

) |

|

Sale of short-term securities

|

|

|

15,163 |

|

|

|

- |

|

|

Net cash used in investing activities

|

|

|

(7,560 |

) |

|

|

(29,566 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from long-term debt

|

|

|

275,000 |

|

|

|

360,000 |

|

|

Repayments of long-term debt

|

|

|

(205,704 |

) |

|

|

(346,301 |

) |

|

Payment of deferred financing costs

|

|

|

(7,455 |

) |

|

|

(10,859 |

) |

|

Repurchase under stock-based compensation plans and related tax impacts

|

|

|

(801 |

) |

|

|

(766 |

) |

|

Net cash provided by financing activities

|

|

|

61,040 |

|

|

|

2,074 |

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash

|

|

|

88,793 |

|

|

|

(26,723 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period

|

|

|

116,024 |

|

|

|

172,693 |

|

| |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at end of period

|

|

$ |

204,817 |

|

|

$ |

145,970 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid during the period:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$ |

30,369 |

|

|

$ |

22,159 |

|

|

Income taxes

|

|

|

388 |

|

|

|

226 |

|

|

Non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Non-cash preferred stock dividend

|

|

|

3,255 |

|

|

|

3,618 |

|

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

|

|

Supplemental Financial Schedules

|

|

(In thousands)

|

|

(unaudited)

|

|

Reconciliation of Net Income (Loss) to Adjusted EBITDA Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30,

|

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income (loss)

|

|

$ |

8,459 |

|

|

$ |

(5,498 |

) |

|

$ |

(14,463 |

) |

|

$ |

(76,203 |

) |

|

Interest expense, net

|

|

|

11,482 |

|

|

|

8,369 |

|

|

|

33,593 |

|

|

|

26,500 |

|

|

Income tax expense

|

|

|

3 |

|

|

|

1,732 |

|

|

|

1,587 |

|

|

|

619 |

|

|

Depreciation and amortization

|

|

|

10,521 |

|

|

|

10,839 |

|

|

|

33,660 |

|

|

|

33,193 |

|

|

Loss (gain) on foreign currency

|

|

|

455 |

|

|

|

872 |

|

|

|

(46 |

) |

|

|

1,417 |

|

|

Other expense (income)

|

|

|

77 |

|

|

|

333 |

|

|

|

3,773 |

|

|

|

(84 |

) |

|

Stock-based compensation

|

|

|

2,953 |

|

|

|

1,632 |

|

|

|

9,245 |

|

|

|

5,283 |

|

|

Other

|

|

|

- |

|

|

|

309 |

|

|

|

10 |

|

|

|

450 |

|

|

Adjusted EBITDA

|

|

$ |

33,950 |

|

|

$ |

18,588 |

|

|

$ |

67,359 |

|

|

$ |

(8,825 |

) |

|

Reconciliation of Operating (Loss) Income to Adjusted EBITDA Lindblad Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30,

|

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Operating income (loss)

|

|

$ |

7,501 |

|

|

$ |

(7,142 |

) |

|

$ |

8,576 |

|

|

$ |

(60,380 |

) |

|

Depreciation and amortization

|

|

|

9,665 |

|

|

|

10,090 |

|

|

|

31,155 |

|

|

|

31,087 |

|

|

Stock-based compensation

|

|

|

2,953 |

|

|

|

1,632 |

|

|

|

9,146 |

|

|

|

5,283 |

|

|

Other

|

|

|

- |

|

|

|

309 |

|

|

|

10 |

|

|

|

450 |

|

|

Adjusted EBITDA

|

|

$ |

20,119 |

|

|

$ |

4,889 |

|

|

$ |

48,887 |

|

|

$ |

(23,560 |

) |

|

Land Experiences Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30,

|

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Operating income

|

|

$ |

12,975 |

|

|

$ |

12,950 |

|

|

$ |

15,868 |

|

|

$ |

12,629 |

|

|

Depreciation and amortization

|

|

|

856 |

|

|

|

749 |

|

|

|

2,505 |

|

|

|

2,106 |

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

99 |

|

|

|

- |

|

|

Adjusted EBITDA

|

|

$ |

13,831 |

|

|

$ |

13,699 |

|

|

$ |

18,472 |

|

|

$ |

14,735 |

|

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

|

|

Supplemental Financial Schedules

|

|

(In thousands, except for Available Guest Nights,

Gross Yield, Net Yield and guest metrics)

|

|

(unaudited)

|

|

Reconciliation of Free Cash Flow to Net Cash Provided by Operating Activities

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Net cash provided by operating activities

|

|

$ |

35,313 |

|

|

$ |

769 |

|

|

Less: purchases of property and equipment

|

|

|

(22,723 |

) |

|

|

(29,566 |

) |

|

Free Cash Flow

|

|

$ |

12,590 |

|

|

$ |

(28,797 |

) |

| |

|

For the three months ended

September 30,

|

|

|

For the nine months ended

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Available Guest Nights

|

|

|

85,959 |

|

|

|

70,995 |

|

|

|

243,329 |

|

|

|

174,954 |

|

|

Guest Nights Sold

|

|

|

69,903 |

|

|

|

57,229 |

|

|

|

192,052 |

|

|

|

130,826 |

|

|

Occupancy

|

|

|

81 |

% |

|

|

81 |

% |

|

|

79 |

% |

|

|

75 |

% |

|

Maximum Guests

|

|

|

10,613 |

|

|

|

8,826 |

|

|

|

29,113 |

|

|

|

21,785 |

|

|

Number of Guests

|

|

|

8,910 |

|

|

|

7,225 |

|

|

|

23,648 |

|

|

|

16,656 |

|

|

Voyages

|

|

|

129 |

|

|

|

114 |

|

|

|

359 |

|

|

|

302 |

|

|

Calculation of Gross and Net Yield per Available Guest Night

|

|

For the three months ended

September 30,

|

|

|

For the nine months ended

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Guest ticket revenues

|

|

$ |

94,751 |

|

|

$ |

73,700 |

|

|

$ |

273,653 |

|

|

$ |

174,762 |

|

|

Other tour revenue

|

|

|

13,999 |

|

|

|

10,041 |

|

|

|

38,007 |

|

|

|

23,301 |

|

|

Tour Revenues

|

|

|

108,750 |

|

|

|

83,741 |

|

|

|

311,660 |

|

|

|

198,063 |

|

|

Less: Commissions

|

|

|

(6,732 |

) |

|

|

(5,728 |

) |

|

|

(19,996 |

) |

|

|

(14,381 |

) |

|

Less: Other tour expenses

|

|

|

(6,569 |

) |

|

|

(6,030 |

) |

|

|

(19,296 |

) |

|

|

(21,025 |

) |

|

Net Yield

|

|

$ |

95,449 |

|

|

$ |

71,983 |

|

|

$ |

272,368 |

|

|

$ |

162,657 |

|

|

Available Guest Nights

|

|

|

85,959 |

|

|

|

70,995 |

|

|

|

243,329 |

|

|

|

174,954 |

|

|

Gross Yield per Available Guest Night

|

|

$ |

1,265 |

|

|

$ |

1,180 |

|

|

$ |

1,281 |

|

|

$ |

1,132 |

|

|

Net Yield per Available Guest Night

|

|

|

1,110 |

|

|

|

1,014 |

|

|

|

1,119 |

|

|

|

930 |

|

|

LINDBLAD EXPEDITIONS HOLDINGS, INC. AND SUBSIDIARIES

|

|

Supplemental Financial Schedules

|

|

(In thousands, except for Available Guest Nights,

Gross and Net Cruise cost Per Available Guest Night and guest metrics)

|

|

(unaudited)

|

|

Calculation of Gross Cruise Cost and Net Cruise Cost Lindblad Segment

|

|

For the three months ended September 30,

|

|

|

For the nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Cost of tours

|

|

$ |

55,021 |

|

|

$ |

51,296 |

|

|

$ |

167,392 |

|

|

$ |

145,251 |

|

|

Plus: Selling and marketing

|

|

|

15,441 |

|

|

|

12,626 |

|

|

|

44,163 |

|

|

|

33,618 |

|

|

Plus: General and administrative

|

|

|

21,122 |

|

|

|

16,871 |

|

|

|

60,374 |

|

|

|

48,487 |

|

|

Gross Cruise Cost

|

|

|

91,584 |

|

|

|

80,793 |

|

|

|

271,929 |

|

|

|

227,356 |

|

|

Less: Commissions

|

|

|

(6,732 |

) |

|

|

(5,728 |

) |

|

|

(19,996 |

) |

|

|

(14,381 |

) |

|

Less: Other tour expenses

|

|

|

(6,569 |

) |

|

|

(6,030 |

) |

|

|

(19,296 |

) |

|

|

(21,025 |

) |

|

Net Cruise Cost

|

|

|

78,283 |

|

|

|

69,035 |

|

|

|

232,637 |

|

|

|

191,950 |

|

|

Less: Fuel Expense

|

|

|

(5,434 |

) |

|

|

(8,933 |

) |

|

|

(19,939 |

) |

|

|

(21,419 |

) |

|

Net Cruise Cost Excluding Fuel

|

|

|

72,849 |

|

|

|

60,102 |

|

|

|

212,698 |

|

|

|

170,531 |

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

(2,953 |

) |

|

|

(1,632 |

) |

|

|

(9,146 |

) |

|

|

(5,283 |

) |

|

Other

|

|

|

- |

|

|

|

(309 |

) |

|

|

(10 |

) |

|

|

(450 |

) |

|

Adjusted Net Cruise Cost Excluding Fuel

|

|

$ |

69,896 |

|

|

$ |

58,161 |

|

|

$ |

203,542 |

|

|

$ |

164,798 |

|

|

Adjusted Net Cruise Cost

|

|

$ |

75,330 |

|

|

$ |

67,094 |

|

|

$ |

223,481 |

|

|

$ |

186,217 |

|

|

Available Guest Nights

|

|

|

85,959 |

|

|

|

70,995 |

|

|

|

243,329 |

|

|

|

174,954 |

|

|

Gross Cruise Cost per Available Guest Night

|

|

$ |

1,065 |

|

|

$ |

1,138 |

|

|

$ |

1,118 |

|

|

$ |

1,300 |

|

|

Net Cruise Cost per Available Guest Night

|

|

|

911 |

|

|

|

972 |

|

|

|

956 |

|

|

|

1,097 |

|

|

Net Cruise Cost Excluding Fuel per Available Guest Night

|

|

|

847 |

|

|

|

847 |

|

|

|

874 |

|

|

|

975 |

|

|

Adjusted Net Cruise Cost Excluding Fuel per Available Guest Night

|

|

|

813 |

|

|

|

819 |

|

|

|

836 |

|

|

|

942 |

|

|

Adjusted Net Cruise Cost per Available Guest Night

|

|

|

876 |

|

|

|

945 |

|

|

|

918 |

|

|

|

1,064 |

|

Reconciliation of 2023 Adjusted EBITDA guidance:

|

(In millions)

|

|

Full Year 2023

|

|

|

Income before income taxes

|

|

$ |

(39 |

)

|

|

|

to |

|

|

$ |

(29 |

)

|

|

Depreciation and amortization

|

|

|

45 |

|

|

|

to |

|

|

|

45 |

|

|

Interest expense, net

|

|

|

49 |

|

|

|

to |

|

|

|

49 |

|

|

Stock-based compensation

|

|

|

11 |

|

|

|

to |

|

|

|

11 |

|

|

Other

|

|

|

4 |

|

|

|

to |

|

|

|

4 |

|

|

Adjusted EBITDA

|

|

$ |

70 |

|

|

|

to |

|

|

$ |

80 |

|

A reconciliation of net income to Adjusted EBITDA is not provided because the Company cannot estimate or predict with reasonable certainty certain discrete tax items, which could significantly impact that financial measure.

Operational and Financial Metrics

Adjusted EBITDA is net income (loss) excluding depreciation and amortization, net interest expense, other income (expense), income tax (expense) benefit, (gain) loss on foreign currency, (gain) loss on transfer of assets, reorganization costs, and other supplemental adjustments. Other supplemental adjustments include certain non-operating items such as stock-based compensation, executive severance costs, the National Geographic fee amortization, debt refinancing costs, acquisition-related expenses and other non-recurring charges. We believe Adjusted EBITDA, when considered along with other performance measures, is a useful measure as it reflects certain operating drivers of the business, such as sales growth, operating costs, selling and administrative expense, and other operating income and expense. We believe Adjusted EBITDA helps provide a more complete understanding of the underlying operating results and trends and an enhanced overall understanding of our financial performance and prospects for the future. Adjusted EBITDA is not intended to be a measure of liquidity or cash flows from operations or a measure comparable to net income as it does not take into account certain requirements, such as unearned passenger revenues, capital expenditures and related depreciation, principal and interest payments, and tax payments. Our use of Adjusted EBITDA may not be comparable to other companies within the industry.

The following metrics apply to the Lindblad segment:

Adjusted Net Cruise Cost represents Net Cruise Cost adjusted for Non-GAAP other supplemental adjustments which include certain non-operating items such as stock-based compensation, the National Geographic fee amortization and acquisition-related expenses.

Available Guest Nights is a measurement of capacity available for sale and represents double occupancy per cabin (except single occupancy for a single capacity cabin) multiplied by the number of cruise days for the period. We also record the number of guest nights available on our limited land programs in this definition.

Gross Cruise Cost represents the sum of cost of tours plus selling and marketing expenses, and general and administrative expenses.

Gross Yield per Available Guest Night represents tour revenues divided by Available Guest Nights.

Guest Nights Sold represents the number of guests carried for the period multiplied by the number of nights sailed within the period.

Maximum Guests is a measure of capacity and represents the maximum number of guests in a period and is based on double occupancy per cabin (except single occupancy for a single capacity cabin).

Net Cruise Cost represents Gross Cruise Cost excluding commissions and certain other direct costs of guest ticket revenues and other tour revenues.

Net Cruise Cost Excluding Fuel represents Net Cruise Cost excluding fuel costs.

Net Yield represents tour revenues less commissions and direct costs of other tour revenues.

Net Yield per Available Guest Night represents Net Yield divided by Available Guest Nights.

Number of Guests represents the number of guests that travel with us in a period.

Occupancy is calculated by dividing Guest Nights Sold by Available Guest Nights.

Voyages represent the number of ship expeditions completed during the period.

v3.23.3

Document And Entity Information

|

Nov. 02, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

LINDBLAD EXPEDITIONS HOLDINGS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 02, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35898

|

| Entity, Tax Identification Number |

27-4749725

|

| Entity, Address, Address Line One |

96 Morton Street, 9th Floor

|

| Entity, Address, City or Town |

New York

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

10014

|

| City Area Code |

212

|

| Local Phone Number |

261-9000

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LIND

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001512499

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

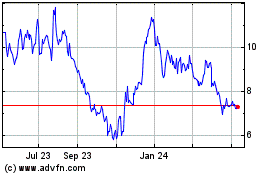

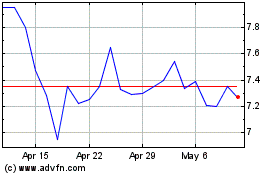

Lindblad Expeditions (NASDAQ:LIND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lindblad Expeditions (NASDAQ:LIND)

Historical Stock Chart

From Apr 2023 to Apr 2024