0001536394

false

0001536394

2023-09-29

2023-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

September 29, 2023

(Date of earliest event reported)

U.S. Lighting Group, Inc.

(Exact name of registrant as specified in its charter)

| Florida |

|

000-55689 |

|

46-3556776 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 1148 E 222nd Steet, Euclid, Ohio 44117 |

| (Address of principal executive offices) (Zip Code) |

216-896-7000

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Although US Lighting Group, Inc. (“USLG” or “we”)

is generating revenues and achieved a profit for the first quarter of 2023, we continue to experience capital shortages while expanding

Cortes Campers production. To help address these capital needs, Anthony R. Corpora, our chief executive officer, and Michael A. Coates,

corporate controller, generously volunteered to take out personal loans and make those funds available to USLG.

On August 17, 2023, Mr. Corpora obtained a personal loan in the

original principal amount of $89,000 from SoFi Bank, N.A. and provided these funds to USLG to support USLG’s operations. On August

17, 2023, Mr. Corpora executed a loan agreement with SoFi Bank evidencing the loan in the original principal amount of $89,000, bearing

annual interest of 18.36%, and with 48 monthly payments of $2,631.53 commencing on September 17, 2023 with the final payment on August

17, 2027 (the “Corpora SoFi loan”).

On August 29, 2023, Mr. Coates obtained a personal loan in the

original principal amount of $75,000 less a loan origination fee of $4,500 from SoFi Bank, N.A. and provided these funds to USLG to support

USLG’s operations. On August 29, 2023, Mr. Coates executed a loan agreement with SoFi Bank evidencing the loan in the original

principal amount of $75,000, bearing annual interest of 13.35%, and with 60 monthly payments of $1,724.11 commencing on October 5, 2023

with the final payment on September 5, 2028 (the “Coates SoFi loan”).

On September 1, 2023, Mr. Coates obtained a personal loan in the

original principal amount of $77,250 from Pinnacle Bank, N.A. and provided these funds to USLG to support USLG’s operations. On

September 1, 2023, Mr. Coates executed an unsecured promissory note payable to Pinnacle Bank evidencing the loan in the original

principal amount of $77,250, bearing annual interest of 19.49%, and with 84 monthly payments of $1,691.79 commencing on October 1, 2023

with the final payment on September 1, 2030 (the “Coates Pinnacle loan”).

On September 29, 2023, we entered into unsecured “pass-through”

promissory notes with Messer. Corpora and Coates that provide for repayment to them on the same terms as the Corpora SoFi loan and

the Coates SoFi and Pinacle loans, without markup or profit (the “officer notes”).

The officer notes are filed as exhibits to this Current Report on Form

8-K. The description above is qualified in its entirety by reference to the full text of the notes.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure included under Item 1.01 above regarding the officer

notes with Messer. Corpora and Coates is incorporated by reference to this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

US Lighting Group, Inc. |

| |

|

| Dated September 29, 2023 |

/s/ Anthony R. Corpora |

| |

By Anthony R. Corpora |

| |

Chief Executive Officer |

3

Exhibit 10.1

Unsecured Promissory Note

Euclid, Ohio

September 29, 2023

For

Value Received, US Lighting Group, Inc., a Florida corporation (“USLG”), promises to pay to Anthony R. Corpora

(the “Corpora”), a resident of the State of Ohio, in lawful money of the United States of America, the principal sum

of $89,000 with interest as provided for in this unsecured promissory note (this “Note”).

Background. On August

17, 2023, Corpora obtained a personal loan in the original principal amount of $89,000 from SoFi Bank, N.A. and provided these funds to

USLG to support USLG’s operations. On August 17, 2023, Corpora executed a loan agreement with SoFi Bank evidencing the SoFi Bank

loan in the original principal amount of $89,000, bearing annual interest of 18.36%, and with 48 monthly payments of $2,631.53 commencing

on September 17, 2023 with the final payment on August 17, 2027 (the “SoFi loan”). The SoFi loan may be prepaid at

any time without penalty.

Capitalized Terms. Capitalized

terms not otherwise defined in this Note shall have the same meaning provided in the SoFi loan.

Limits of Liability.

Corpora is the chief executive officer of USLG, and Corpora funded this Note with borrowings under the SoFi loan. However, USLG has no

obligations under the SoFi loan and has not guaranteed Corpora’s obligations under the SoFi loan. As a result, USLG is only obligated

to make the payments to Corpora required by this Note. So long as USLG is not in Default (as defined below) under this Note, Corpora shall

make all payments required on the SoFi loan.

Interest. All amounts

outstanding under this Note shall bear interest at the rate of interest paid by Corpora under the SoFi loan, without any additions, profit,

or mark up by Corpora. Interest shall accrue as described in the SoFi loan.

Monthly Payments. Unless

USLG is in Default (as defined below) or as otherwise specifically provided for in this Note, USLG will make 48 monthly payments of $2,631.53

commencing on September 17, 2023 with the final payment on August 17, 2027 as described in the SoFi loan.

Prepayment. USLG may

prepay this Note at any time without penalty so long as the SoFi loan may be prepaid without penalty.

Fees. USLG shall pay

Corpora for any fees incurred by Corpora to obtain the SoFi loan.

Default. USLG shall be

in default under this Note if it fails to meet any of its obligations contained in this Note and after written notice by Corpora to USLG

of the failure, USLG does not cure that failure within three business days of the written notice (“Default”). In Corpora’s

sole discretion, Corpora can waive a Default, and such waiver shall not be construed as a waiver of any other provision of this Note or

as a future waiver of any prior or subsequent failure or Default of USLG. USLG shall have an ongoing obligation under this Note to immediately

notify Corpora in writing of any failure of USLG to meet any obligation herein and to immediately take steps to correct such failure.

In the event of Default, all amounts outstanding under this Note are due and payable immediately upon written demand by Corpora. If USLG’s

Default causes a default under the SoFi loan, then USLG shall pay to Corpora all amounts incurred by Corpora as a result of the SoFi loan

default.

Bankruptcy. Notwithstanding

anything herein to the contrary, upon the commencement of any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors,

dissolution, insolvency, receivership or liquidation or similar proceeding of any jurisdiction relating to USLG, all amounts owed by USLG

to Corpora in connection with this Note shall become immediately due and payable without presentment, demand, protest or notice of any

kind.

No Setoff. All payments

under this Note shall be made without setoff, counterclaim or deduction of any kind. Any amount owing by USLG to Corpora shall not be

reduced in any way by any outstanding obligations of Corpora to USLG, whether such obligations are monetary or otherwise.

Bank Account. Payments

of principal of and interest with respect to this Note are to be made to Corpora or to such account as Corpora shall designate from time-to-time.

Waiver and Amendment.

USLG hereby waives diligence, presentment, demand, protest and notice of any kind whatsoever. No delay on the part of Corpora in the exercise

of any right, power or remedy shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or remedy

preclude any other or further exercise thereof, or the exercise of any other right, power or remedy. No amendment, modification or waiver

of, or consent with respect to, any provision of this Note shall in any event be effective against Corpora or USLG unless the same shall

be in writing and signed and delivered by such party.

Governing Law. This Note shall be governed

by, and construed in accordance with, the laws of the State of Ohio without giving effect to any provision that would require the application

of any other jurisdiction’s laws.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Signature page to Unsecured Promissory Note

|

US Lighting Group, Inc.

|

|

|

| |

|

|

| /s/ Donald

O. Retreage, Jr. |

|

/s/ Anthony

R. Corpora |

| By |

Donald O. Retreage, Jr., CFO |

|

Anthony R. Corpora, individually |

3

Exhibit 10.2

Unsecured Promissory Note

Euclid, Ohio

September 29, 2023

For

Value Received, US Lighting Group, Inc., a Florida corporation (“USLG”), promises to pay to Michael A. Coates

(the “Coates”), a resident of the State of Ohio, in lawful money of the United States of America, the principal sum

of $75,000 with interest as provided for in this unsecured promissory note (this “Note”).

Background. On August

29, 2023, Coates obtained a personal loan in the original principal amount of $75,000 less a loan origination fee of $4,500 from SoFi

Bank, N.A. and provided these funds to USLG to support USLG’s operations. On August 29, 2023, Coates executed a loan agreement with

SoFi Bank evidencing the SoFi Bank loan in the original principal amount of $75,000, bearing annual interest of 13.35%, and with 60 monthly

payments of $1,724.11 commencing on October 5, 2023 with the final payment on September 5, 2028 (the “SoFi loan”).

The SoFi loan may be prepaid at any time without penalty.

Capitalized Terms. Capitalized

terms not otherwise defined in this Note shall have the same meaning provided in the SoFi loan.

Limits of Liability.

Coates is the controller of USLG, and Coates funded this Note with borrowings under the SoFi loan. However, USLG has no obligations under

the SoFi loan and has not guaranteed Coates’s obligations under the SoFi loan. As a result, USLG is only obligated to make the payments

to Coates required by this Note. So long as USLG is not in Default (as defined below) under this Note, Coates shall make all payments

required on the SoFi loan.

Interest. All amounts

outstanding under this Note shall bear interest at the rate of interest paid by Coates under the SoFi loan, without any additions, profit,

or mark up by Coates. Interest shall accrue as described in the SoFi loan.

Monthly Payments. Unless

USLG is in Default (as defined below) or as otherwise specifically provided for in this Note, USLG will make 60 monthly payments of $1,724.11

commencing on October 5, 2023 with the final payment on September 5, 2028 as described in the SoFi loan.

Prepayment. USLG may

prepay this Note at any time without penalty so long as the SoFi loan may be prepaid without penalty.

Fees. USLG shall pay

Coates for any fees incurred by Coates to obtain the SoFi loan.

Default. USLG shall be

in default under this Note if it fails to meet any of its obligations contained in this Note and after written notice by Coates to USLG

of the failure, USLG does not cure that failure within three business days of the written notice (“Default”). In Coates’s

sole discretion, Coates can waive a Default, and such waiver shall not be construed as a waiver of any other provision of this Note or

as a future waiver of any prior or subsequent failure or Default of USLG. USLG shall have an ongoing obligation under this Note to immediately

notify Coates in writing of any failure of USLG to meet any obligation herein and to immediately take steps to correct such failure. In

the event of Default, all amounts outstanding under this Note are due and payable immediately upon written demand by Coates. If USLG’s

Default causes a default under the SoFi loan, then USLG shall pay to Coates all amounts incurred by Coates as a result of the SoFi loan

default.

Bankruptcy. Notwithstanding

anything herein to the contrary, upon the commencement of any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors,

dissolution, insolvency, receivership or liquidation or similar proceeding of any jurisdiction relating to USLG, all amounts owed by USLG

to Coates in connection with this Note shall become immediately due and payable without presentment, demand, protest or notice of any

kind.

No Setoff. All payments

under this Note shall be made without setoff, counterclaim or deduction of any kind. Any amount owing by USLG to Coates shall not be reduced

in any way by any outstanding obligations of Coates to USLG, whether such obligations are monetary or otherwise.

Bank Account. Payments

of principal of and interest with respect to this Note are to be made to Coates or to such account as Coates shall designate from time-to-time.

Waiver and Amendment.

USLG hereby waives diligence, presentment, demand, protest and notice of any kind whatsoever. No delay on the part of Coates in the exercise

of any right, power or remedy shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or remedy

preclude any other or further exercise thereof, or the exercise of any other right, power or remedy. No amendment, modification or waiver

of, or consent with respect to, any provision of this Note shall in any event be effective against Coates or USLG unless the same shall

be in writing and signed and delivered by such party.

Governing Law. This Note shall be governed

by, and construed in accordance with, the laws of the State of Ohio without giving effect to any provision that would require the application

of any other jurisdiction’s laws.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Signature page to Unsecured Promissory

Note

| US Lighting Group, Inc. |

|

|

| |

|

|

|

/s/

Donald O. Retreage, Jr. |

|

/s/

Michael A. Coates |

| By |

Donald O. Retreage, Jr., CFO |

|

Michael A. Coates, individually |

3

Exhibit 10.3

Unsecured

Promissory Note

Euclid,

Ohio

September

29, 2023

For

Value Received, US Lighting Group, Inc., a Florida corporation

(“USLG”), promises to pay to Michael A. Coates (the “Coates”), a resident of the State of Ohio,

in lawful money of the United States of America, the principal sum of $77,250 with interest as provided for in this unsecured promissory

note (this “Note”).

Background.

On September 1, 2023, Coates obtained a personal loan in the original principal amount of $77,250 from Pinnacle Bank, N.A. and provided

these funds to USLG to support USLG’s operations. On September 1, 2023, Coates executed an unsecured promissory note payable to

Pinnacle Bank evidencing the Pinnacle Bank loan in the original principal amount of $77,250, bearing annual interest of 19.49%, and with

84 monthly payments of $1,691.79 commencing on October 1, 2023 with the final payment on September 1, 2030 (the “Pinnacle loan”).

The Pinnacle loan may be prepaid at any time without penalty.

Capitalized

Terms. Capitalized terms not otherwise defined in this Note shall have the same meaning provided in the Pinnacle loan.

Limits

of Liability. Coates is the controller of USLG, and Coates funded this Note with borrowings under the Pinnacle loan. However, USLG

has no obligations under the Pinnacle loan and has not guaranteed Coates’s obligations under the Pinnacle loan. As a result, USLG

is only obligated to make the payments to Coates required by this Note. So long as USLG is not in Default (as defined below) under this

Note, Coates shall make all payments required on the Pinnacle loan.

Interest.

All amounts outstanding under this Note shall bear interest at the rate of interest paid by Coates under the Pinnacle loan, without

any additions, profit, or mark up by Coates. Interest shall accrue as described in the Pinnacle loan.

Monthly

Payments. Unless USLG is in Default (as defined below) or as otherwise specifically provided for in this Note, USLG will make 84

monthly payments of $1,691.79 commencing on October 1, 2023 with the final payment on September 1, 2030 as described in the Pinnacle

loan.

Prepayment.

USLG may prepay this Note at any time without penalty so long as the Pinnacle loan may be prepaid without penalty.

Fees.

USLG shall pay Coates for any fees incurred by Coates to obtain the Pinnacle loan.

Default.

USLG shall be in default under this Note if it fails to meet any of its obligations contained in this Note and after written notice

by Coates to USLG of the failure, USLG does not cure that failure within three business days of the written notice (“Default”).

In Coates’s sole discretion, Coates can waive a Default, and such waiver shall not be construed as a waiver of any other provision

of this Note or as a future waiver of any prior or subsequent failure or Default of USLG. USLG shall have an ongoing obligation under

this Note to immediately notify Coates in writing of any failure of USLG to meet any obligation herein and to immediately take steps

to correct such failure. In the event of Default, all amounts outstanding under this Note are due and payable immediately upon written

demand by Coates. If USLG’s Default causes a default under the Pinnacle loan, then USLG shall pay to Coates all amounts incurred

by Coates as a result of the Pinnacle loan default.

Bankruptcy.

Notwithstanding anything herein to the contrary, upon the commencement of any bankruptcy, reorganization, arrangement, adjustment

of debt, relief of debtors, dissolution, insolvency, receivership or liquidation or similar proceeding of any jurisdiction relating to

USLG, all amounts owed by USLG to Coates in connection with this Note shall become immediately due and payable without presentment, demand,

protest or notice of any kind.

No

Setoff. All payments under this Note shall be made without setoff, counterclaim or deduction of any kind. Any amount owing by USLG

to Coates shall not be reduced in any way by any outstanding obligations of Coates to USLG, whether such obligations are monetary or

otherwise.

Bank

Account. Payments of principal of and interest with respect to this Note are to be made to Coates or to such account as Coates shall

designate from time-to-time.

Waiver

and Amendment. USLG hereby waives diligence, presentment, demand, protest and notice of any kind whatsoever. No delay on the part

of Coates in the exercise of any right, power or remedy shall operate as a waiver thereof, nor shall any single or partial exercise of

any right, power or remedy preclude any other or further exercise thereof, or the exercise of any other right, power or remedy. No amendment,

modification or waiver of, or consent with respect to, any provision of this Note shall in any event be effective against Coates or USLG

unless the same shall be in writing and signed and delivered by such party.

Governing

Law. This Note shall be governed by, and construed in accordance with, the laws of the State of Ohio without giving effect to any

provision that would require the application of any other jurisdiction’s laws.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

Signature

page to Unsecured Promissory Note

| US Lighting

Group, Inc. |

|

|

| |

|

|

|

/s/

Donald O. Retreage, Jr. |

|

/s/

Michael A. Coates |

| By Donald O. Retreage, Jr.,

CFO |

|

Michael A. Coates, individually |

3

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

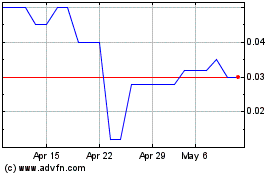

US Lighting (PK) (USOTC:USLG)

Historical Stock Chart

From Apr 2024 to May 2024

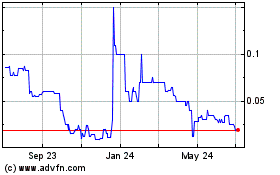

US Lighting (PK) (USOTC:USLG)

Historical Stock Chart

From May 2023 to May 2024