TIDMAPOL

Apollon Formularies PLC / EPIC: APOL / Market: AQUIS / Sector: Biotechnology

29 September 2023

APOLLON FORMULARIES PLC

("Apollon" or the "Company")

Interim Results

Apollon Formularies plc (AQUIS: APOL, "Apollon" or the "Company"), a UK based

international medical cannabis pharmaceutical company trading on Aquis Stock

Exchange, is pleased to report its interim results for the period ended 30 June

2023.

I am pleased to provide shareholders with Apollon's unaudited interim results

for the six months ended 30 June 2023 and update on the progress that the

Company has made, and continues to make, as it takes steps to transition towards

serving a wider global market. Building on the success of 2022, we achieved some

important milestones in new international jurisdictions in the first half of

2023.

Intellectual Property Licensing

During the first quarter, Apollon has focused on licensing its intellectual

Property (IP) portfolio along with its proprietary formulations and patient

protocols to international strategic partners.

In January 2023, Apollon announced that it had granted an exclusive Licensing

Agreement with Global Hemp Group (CSE: GHG) for North America (USA, Canada and

Mexico). Under the terms of this exclusive license agreement, Global Hemp Group

paid Apollon a fee of USD$250,000 (CAD$341,000) and issued 10 million common

shares in GHG to Apollon for a total consideration of CAD$491,000. In addition,

GHG will pay Apollon an ongoing royalty of 10% of gross revenue derived from sub

-licenses and products stemming from this exclusive license agreement.

Subsequently, GHG extended its exclusive license agreement to include the

European Union with extension to Morocco and Israel under the same royalty

terms. GHG has completed and announced its first US sublicense under this

agreement.

Post-Period

In July 2023, Apollon announced the granting of an exclusive license agreement

to PureCann Pty Ltd., for the territory of South Africa. Under the terms of this

agreement, PureCann paid Apollon an upfront exclusive license fee of £100,000.

In addition, PureCann will pay Apollon an ongoing royalty of 6% on gross sales

from products stemming from this exclusive license agreement. The license

agreement with PureCann allows for continued expansion into Africa, which

represents a significant development for the Company as it provides access to

South Africa and the Southern African Development Community (SADC), comprising

of 16 member states with the potential to reach over 350 million people and

eventually the entire African continent as more countries legalise medicinal

cannabis with an extended addressable market of over 1.4 billion people.

PureCann intends to roll out a significant dispensary network providing cannabis

based medicinal products with Apollon products forming the cornerstone of their

business. Apollon stands to benefit greatly from PureCann's current network

where Purecann has contractual agreements with multiple GACP/GMP cultivators,

where together we would have access to high-quality low-cost biomass reducing

input costs dramatically across the production chain. PureCann also has access

to two GMP extraction facilities meaning they can fully produce a complete range

of certified cannabis based medicinal products'(CBMP's) for use locally within

South Africa, but also for export markets within Africa with medium term goals

to export back into Europe where together we would have a competitive advantage

on cost across the board from plant to patient.

In September 2023, the Company signed a letter of intent with Supernature Co.,

Ltd for an Exclusive License Agreement for Thailand. Both Apollon and

Supernature are currently working on the terms of the final Exclusive Licence

Agreement which will be announced to the market in due course.

Asset Purchase

On September 12, 2023, Apollon announced a new executed binding Letter of Intent

("LOI") with Sproutly Canada, Inc. (CSE: SPR). Sproutly is a Canadian public

company specialising in proprietary natural biologics drug discovery utilising a

proprietary technique known as Aqueous Phytorecovery Process (APP), which

extracts high-quality phytonutrients in their complete and proportional

profiles. As applied to cannabis, APP can produce water-soluble cannabis

solutions that can be stably formulated into medicinal products and traditional

beverages without the use of artificial chemical and/or physical means to keep

the cannabinoids dissolved in the water base.

The combination of Apollon's AI based therapeutic product formulation with

demonstrated success in pre-clinical and clinical testing, clinical trial

capability, manufacturing and production laboratories, with Sproutly's APP

technology and natural water-soluble ingredients, creates a unique opportunity

to develop, new natural biologic therapeutic products with increased

bioavailability, faster therapeutic response times, lower patient dose

requirements and increased product shelf life.

The binding LOI, allows Sproutly to acquire the assets of Apollon pursuant to an

Asset Purchase Agreement. In exchange for the assets of Apollon, Sproutly will

issue to Apollon a sufficient number of Sproutly shares so that Apollon will own

49% of the enlarged share capital of Sproutly, post-transaction. If the

transaction takes place with the number of outstanding Sproutly shares as are

currently in issue, and at an anticipated deemed price of CAD$0.02 (the price at

which the trading of common shares of Sproutly was suspended), the effective

valuation of the Apollon's assets will be CAD$7million (approximately

£4.2million). If the number of Sproutly shares increases between now and the

date of the transaction, the number of shares to be issued to Apollon will

increase accordingly.

Sproutly and Apollon have granted each other a 60-day option to conduct due

diligence, following which, if agreed to by both companies, the asset

acquisition will be completed. The due diligence period may be shortened by

mutual agreement. It is understood by the parties that Sproutly must complete

one or more audits and take other legal and regulatory steps (the "Steps") to

again become active and trading on the Canadian Securities Exchange ("CSE"). The

Steps will proceed simultaneously with the due diligence period and the

preparation and finalisation of necessary transaction agreements for a closing

(the "Closing") of the transaction.

Outlook

The first half of 2023 was a busy and successful period for Apollon, and we are

excited about the Company's prospects as we look towards 2024.

We are working extensively on ways in which to access the global market, by

expanding our current capabilities to contract manufacturing in international

GMP facilities in addition to the manufacturing, production operations and

export opportunities we have currently in Jamaica. The Company is working

closely with our international partners to produce and distribute Apollon's

proprietary formulations. We will keep the market updated with any new

developments.

We would like to thank our shareholders for their continued support and

investment as we continue to work towards our goal of becoming the premier

global medical cannabis and medicinal mushroom company in oncology and chronic

pain.

Financials

For the six-month period ended 30 June 2023 the Group is reporting a loss of

£763,796 (six months ended 30 June 2022: loss £212,436).

The interim report was approved by the Board of Directors and the above

responsibility statement was signed on its behalf by:

Stephen D Barnhill M.D

Chairman

29 September 2023

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside

information for the purposes of Article 7 of Regulation (EU) No 596/2014 until

the release of this announcement.

The Directors of the Group accept responsibility for the contents of this

announcement.

For further information please visit www.apollon.org.uk or contact:

Apollon Formularies

Tel: +44 771 198 0221

Stene Jacobs stene@apollon.org.uk

Peterhouse Capital Limited (Corporate Adviser)

Tel: +44 207 220 9795

Guy Miller gm@peterhousecapital.com

BlytheRay (Financial PR/IR-London)

Tel: +44 207 138 3204

Tim Blythe/Megan Ray apollon@blytheray.com

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Notes 6 months to 30 6 months to 30

June 2023 June 2022

Unaudited£ Unaudited£

Continuing operations

Revenue 47,551 165,053

Administration (450,625) (535,889)

expenses

Foreign exchange (91,533) 203,786

Operating loss (494,607) (167,050)

Share on loss from - (45,386)

associate

Other gains/(losses) 8 (273,171) -

Finance costs 3,982 -

Loss before tax for (763,796) (212,436)

the period

Tax - -

Loss for the period (763,796) (212,436)

Total comprehensive (763,796) (212,436)

income for the period

Total comprehensive (763,796) (212,436)

income for the period

attributable to equity

holders

Earnings per share

from continuing

operations

attributable to the

equity owners of the

parent

Basic and diluted 5 (0.1)p (0.03)p

(pence per share)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Notes As at30 June As at31 As at30 June

2023 December 2022 2022

Unaudited£ Audited£ Unaudited£

Non-Current

Assets

Intangible 7 - - 384,056

Assets

Available for 8 15,485 - -

Sale

Investments

Investments in 6 2,829,140 2,996,788 2,625,721

associate

2,844,625 2,996,788 3,009,777

Current Assets

Trade and other 677,267 593,262 645,283

receivables

Cash and cash 50,934 389 2,653

equivalents

728,201 593,651 647,936

Asset held for 7 384,056 384,056 -

Sale

Total Assets 3,956,882 3,974,495 3,657,713

Current

Liabilities

Trade and other 9 1,842,475 1,096,292 619,442

payables

1,842,475 1,096,292 619,442

Total 1,842,475 1,096,292 619,442

Liabilities

Net Assets 2,114,407 2,878,203 3,038,271

Equity

Share premium 54,671,250 54,671,250 54,338,863

Share option 85,363 85,363 85,363

reserve

Reverse (47,030,385) (47,030,385) (47,030,385)

acquisition

reserve

Retained losses (5,611,821) (4,848,025) (4,355,570)

Total Equity 2,114,407 2,878,203 3,038,271

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

Note Share Share Reverse Retained Total

premium£ option Acquisition losses£ equity£

reserve£ Reserve£

Balance as at 54,050,764 85,363 (47,030,385) (4,143,134) 2,962,608

1

January 2022

Loss for the - - - (212,436) (212,436)

period

Other

comprehensive

income for

the year

Items that

may

be

subsequently

reclassified

to

profit or

loss

Total - - - (212,436) (212,436)

comprehensive

income for

the year

Share issue 288,099 - - - 288,099

Total 288,099 - - - 288,099

transactions

with

owners,

recognised in

equity

Balance as at 54,338,863 85,363 (47,030,385) (4,355,570) 3,038,271

30 June 2022

Balance as at 54,671,250 85,363 (47,030,385) (4,848,025) 2,878,203

1

January 2023

Loss for the - - - (763,796) (763,796)

period

Other

comprehensive

income for

the year

Items that

may

be

subsequently

reclassified

to

profit or

loss

Total - - - (763,796) (763,796)

comprehensive

income for

the year

Total - - - - -

transactions

with

owners,

recognised in

equity

Balance as at 54,671,250 85,363 (47,030,385) (5,611,821) 2,114,407

30 June 2023

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Notes 6 months to 30 6 months to 30

June June 2022

2023Unaudited£ Unaudited£

Cash flows from operating

activities

Operating loss (763,796) (212,436)

Adjustments for:

Loss from associate - 45,386

Finance costs 10 5,856 -

Decrease in trade and (87,005) (284,626)

other receivables

Increase/(decrease) in 722,658 440,469

trade and other payables

Foreign exchange 91,533 (203,786)

Net cash used in (30,754) (214,993)

operations

Cash flows from investing

activities

Proceeds from sale of 8 13,147 -

investments

Loans granted (to)/from 76,115 (87,340)

associate

Net cash used in investing 89,262 (87,340)

activities

Cash flows from financing

activities

Loan repaid to director 10 (7,963) -

Net cash generated from (7,963) -

financing activities

Net (decrease)/increase in 50,545 (302,333)

cash and cash equivalents

Cash and cash equivalents 389 304,986

at beginning of period

Cash and cash equivalents 50,934 2,653

at end of period

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

Apollon Formularies Plc is a medicinal cannabis pharmaceutical company

incorporated and registered in the Isle of Man. The Company's registered office

is Quayside House, 6 Hope Street, Castletown, Isle of Man, IM9 1AS. The

Company's ordinary shares are traded on the Aquis Exchange Growth Market as

operated by Aquis Stock Exchange Ltd ("AQUIS").

2. Basis of Preparation

The condensed interim financial statements have been prepared in accordance with

the Aquis Growth Market Rulebook. As permitted, the Company has chosen not to

adopt IAS 34 "Interim Financial Statements" in preparing this interim financial

information. The condensed consolidated interim financial statements should be

read in conjunction with the annual financial statements for the year ended 31

December 2022. The interim financial statements have been prepared in accordance

with UK adopted International Accounting Standards.

The interim financial information set out above does not constitute statutory

accounts within the meaning of the Companies Act 2006. It has been prepared on a

going concern basis in accordance with the recognition and measurement criteria

of UK adopted International Accounting Standards.

Statutory financial statements for the period ended 31 December 2022 were

approved by the Board of Directors on 30 June 2023. The report of the auditors

on those financial statements was unqualified. The condensed interim financial

statements are unaudited and have not been reviewed by the Company's auditor.

Going concern

The preparation of financial statements requires an assessment on the validity

of the going concern assumption. The Directors have reviewed projections for a

period of at least 12 months from the date of approval of the financial

statements as well as potential opportunities. Any potential shortfalls in

funding have been identified and the steps to which Directors are able to

mitigate such scenarios and/or defer or curtail discretionary expenditures

should these be required have been considered.

The Directors are aware that the Group's ability to remain a going concern for

at least 12 months from the approval of these financial statements is dependent

on the Group's ability to raise further equity and/or debt finance. This is

expected to happen within the going concern period of the next 12 months.

In approving the financial statements, the Board has recognised that these

circumstances create a level of uncertainty. However, having made enquiries and

considered the uncertainties outlined above, the Directors have a reasonable

expectation that the Group will continue to be able to raise finance as required

over this period to enable it to continue in operation and existence for the

foreseeable future. Accordingly, the Board believes it is appropriate to adopt

the going concern basis in the preparation of the financial statements.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The

key risks that could affect the Group's medium term performance and the factors

that mitigate those risks have not substantially changed from those set out in

the Group's 2022 Annual Report and Financial Statements, a copy of which is

available on the Group's website: www.apollon.org.uk. The key financial risks

are market risk, exchange rate risk, liquidity risk and credit risk.

Critical accounting estimates

The preparation of condensed interim financial statements requires management to

make estimates and assumptions that affect the reported amounts of assets and

liabilities at the end of the reporting period. Significant items subject to

such estimates are set out in Note 2 of the Group's 2022 Annual Report and

Financial Statements. The nature and amounts of such estimates have not changed

significantly during the interim period.

3. Accounting Policies

The same accounting policies, presentation and methods of computation are

followed in the interim consolidated financial information as were applied in

the Group's latest annual audited financial statements except for Intangible

assets and those that relate to new standards and interpretations effective for

the first time for periods beginning on (or after) 1 January 2023 and will be

adopted in the 2023 annual financial statements.

A number of new standards, amendments and became effective on 1 January 2023 and

have been adopted by the Group. None of these standards have materially affected

the Group.

3.1 Basis of preparation of financial statements

The Group Financial Statements consolidate the Financial Statements of the

Company and its subsidiaries made up to 30 June 2023. Subsidiaries are entities

over which the Group has control. Control is achieved when the Group is exposed,

or has rights, to variable returns from its involvement with the investee and

has the ability to affect those returns through its power over the investee.

Generally, there is a presumption that a majority of voting rights result in

control. To support this presumption and when the Group has less than a majority

of the voting or similar rights of an investee, the Group considers all relevant

facts and circumstances in assessing whether it has power over an investee,

including:

· The contractual arrangement with the other vote holders of the investee;

· Rights arising from other contractual arrangements; and

· The Group's voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if facts and

circumstances indicate that there are changes to one or more of the three

elements of control. Subsidiaries are fully consolidated from the date on which

control is transferred to the Group. They are deconsolidated from the date that

control ceases. Assets, liabilities, income and expenses of a subsidiary

acquired or disposed of during the period are included in the Group Financial

Statements from the date the Group gains control until the date the Group ceases

to control the subsidiary.

Investments in Group undertakings are stated at cost, which is the fair value of

the consideration paid, less any impairment provision. The financial statements

of the subsidiary are prepared for the same reporting period as the Group. When

necessary, adjustments are made to bring the accounting policies in line with

those of the Group.

Where necessary, adjustments are made to the Financial Statements of

subsidiaries to bring the accounting policies used in line with those used by

other members of the Group. All significant intercompany transactions and

balances between Group enterprises are eliminated on consolidation.

3.2 Intangible assets

Intangible asset expenditure relates to patents and associated data acquired.

Intangible assets are only capitalised if the costs can be measured reliably and

will generate future economic benefits in the form of cashflows to the Group.

Intangible assets are not subject to amortisation but are assessed annually for

impairment. The assessment is carried out by allocating the patent assets to

cash generating units ("CGU's"), which are based on specific projects. The CGU's

are then assessed for impairment using a variety of methods including those

specified in IAS 36.

Whenever the patent assets in cash generating units does not lead to the desired

research outcome and the Group has decided to discontinue such activities of

that unit, the associated expenditures are written off to the Statement of

Comprehensive Income.

The Group is not income generating as yet and therefore there has been no

amortization since acquisition. Patents and associated data will be amortized

when the Group starts generating revenue relating to the assets.

1.

3. Asset held for sale

Asset are classified as assets held for sale when their carrying amount is to be

recovered principally through a sale transaction and a sale is considered highly

probable. They are stated at the lower of carrying amount and fair value less

costs to sell.

1.

4. Intellectual property (IP)

IP assets (comprising patents) acquired by the Group as a result of a business

combination are initially recognised at fair value or as a purchase at cost and

are capitalised.

Internally generated IP costs are written off as incurred except where IAS 38

criteria, as described in research and development above, would require such

costs to be capitalised.

The Group's view is that capitalised IP assets have a finite useful life and to

that extent they should be amortised over their respective unexpired periods

with provision made for impairment when required. Capitalised IP assets are not

amortised until the Group is generating an economic return from the underlying

asset and as such no amortisation has been incurred to date as the products to

which they relate are not ready to be sold on the open market. When the trials

are completed and the products attain the necessary accreditation and clearance

from the regulators, the Group will assess the estimated useful economic like

and the IP will be amortised using the straight-line method over their estimated

useful economic lives.

4. Dividends

No dividend has been declared or paid by the Group during the six months ended

30 June 2023 (six months ended 30 June 2022: £nil).

5. Earnings per Share

The calculation of loss per share is based on a retained loss of £763,796 for

the six months ended 30 June 2023 (six months ended 30 June 2022: £212,436) and

the weighted average number of shares in issue in the period ended 30 June 2023

of 771,191,266 (six months ended 30 June 2022: 748,713,039).

No diluted earnings per share is presented for the six months ended 30 June 2023

or six months ended 30 June 2022 as the effect on the exercise of share options

would be to decrease the loss per share.

6. Associate

On 28 September 2018, the Legal Subsidiary acquired a right to receive a 49%

equity interest in Apollon Formularies Jamaica Limited ("Apollon Jamaica"), a

company incorporated in Jamaica, upon approval by the Cannabis Licensing

Authority (CLA) of Jamaica for Company to so own such equity in a medically

licensed cannabis company. In the interim, the Company entered into a contract

with Apollon Jamaica whereby the Company receives 95% of the net profits of

Apollon Jamaica. The Legal Subsidiary also entered into a contract with its

shareholder, Stephen D. Barnhill, M.D., who is the person presently recognised

as the owner of such 49% equity interest in Apollon Jamaica, that he: (i)

pledges to assign such equity to Company upon CLA approval of Company being an

owner, (ii) commits to vote the equity he holds in Apollon Jamaica in accordance

with such assignment obligation to the extent permitted by law, and (iii) will

participate as a director of Apollon Jamaica and act when voting in a way that

is consistent with such equity commitments to the Company to the extent

permitted by law.

Apollon Jamaica is accounted for as an associate because the Legal Subsidiary

has significant influence over it, has a representative serving as a director

who participates in its policy-making process, and has engaged in material

transactions with it that includes loans and a right to receive 95% of its

profits.

These factors have been determined to be sufficient to meet the requirements of

IAS 28 even though the Company does not presently own any equity in Apollon

Jamaica and, once it does, will only receive a 49% share of the return on

investment (which will come from the 5% net income) and only have 49% voting

rights.

As an associate, Apollon Jamaica is accounted for on an equity accounting basis.

The carrying value of the investment in the associate is determined as follows:

30 June 2023£

Investment in associate

At beginning of period -

Share of loss in associate -

At end of period -

Loans to Associate

At beginning of period 2,996,788

Loans granted from associate (76,115)

Foreign exchange (91,533)

At end of period 2,829,140

Total 2,829,140

The Company's share of Apollon Jamaica result for the year was a loss of £5,035

(2022: loss of £45,386) of a total loss of £10,275 (2022: total loss of

£92,624). The share of the loss in associate for the period ended 30 June 2023

is restricted to the carried forward investment in associate and has therefore

been recognised as £nil. As a result, the remaining investment balance carried

forward from the period ended 31 December 2022 remains at £nil.

7. Asset Held for Sale

Following the mutual termination of the proposed asset disposal to Global Hemp

Group, on 12 September 2023, the Company entered into a binding letter of intent

("LOI") with Sproutly Canada, Inc. ("Sproutly").

Under the terms of the LOI, Sproutly will acquire all the Assets of Apollon

Formularies plc, other than cash, cash equivalents, and accounts receivables,

for a payment of 350,000,000 Sproutly common shares at a deemed price of C$0.02

per share, for a total consideration of C$7,000,000. If the number of Sproutly

shares increases between now and the date of the transaction, the number of

shares to be issued to Apollon will increase accordingly.

Sproutly and Apollon have granted each other a 60-day option to conduct due

diligence, following which, if agreed to by both companies, the asset

acquisition will be completed. The due diligence period may be shortened by

mutual agreement.

The value of Asset Held for Sale is the expected sale proceeds from Sproutly,

being the total consideration of shares and cash, converted into pounds sterling

using the exchange rates on 12 September 2023 being C$0.58.

8. Available for sale investment

The movement in available for sale investments during the period was as follows:

Available for sale investments £

Balance as at 1 January 2023 -

10,000,000 shares in Global Hemp Group Plc 301,803

Sale of Global Hemp Group Plc Shares (13,147)

Fair value adjustment (273,171)

As at 30 June 2023 15,485

9. Trade and Other Payables

Current: 30 June 2023£ 30 June 2022£

Trade payables 1,113,012 503,509

Directors Loan (note 10) 152,305 -

Tax and payroll 19,976 19,976

Other creditors 557,182 95,957

1,842,475 619,442

The carrying amounts of the Group's trade and other payables are denominated in

pounds sterling.

10. Director Loan

During the year ended 31 December 2022, the Company entered into a loan

agreement with Director Roderick McIllree. The term of the loan is 12 months

(extendable for an additional 12 months by mutual agreement) and bears an

interest rate of 8% pa. Roderick McIllree is also a shareholder of the Company.

At as 30 June 2023, the Company owes Roderick McIllree £152,305.

30 June 2023£

Opening balance 154,412

Loans granted 6,000

Loans repaid (13,963)

Interest 5,856

Closing balance 152,305

11. Events after the reporting date

On 12 September 2023, the Group entered into a binding letter of intent ("LOI")

with Sproutly Canada, Inc. ("Sproutly"), Under the terms of the LOI, Sproutly

will acquire all the Assets of Apollon Formularies plc, for a payment of

350,000,000 Sproutly common shares at a deemed price of C$0.02 per share, for a

total consideration of C$7,000,000. If the number of Sproutly shares increases

between now and the date of the transaction, the number of shares to be issued

to Apollon will increase accordingly.

12. Approval of interim financial statements

The Condensed interim financial statements were approved by the Board of

Directors on 29 September 2023.

**ENDS**

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

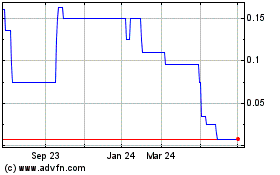

Apollon Formularies (AQSE:APOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

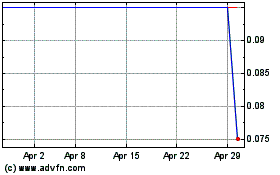

Apollon Formularies (AQSE:APOL)

Historical Stock Chart

From Apr 2023 to Apr 2024