0001729944

false

--12-31

0001729944

2023-09-06

2023-09-06

0001729944

BACK:CommonStockParValue0.001PerShareMember

2023-09-06

2023-09-06

0001729944

BACK:WarrantsToPurchaseCommonStockMember

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 6, 2023

IMAC

Holdings, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-38797 |

|

83-0784691 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 3401

Mallory Lane, Suite 100, Franklin, Tennessee |

|

37067 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (844) 266-4622

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.001 per share |

|

BACK |

|

NASDAQ

Capital Market |

| Warrants

to Purchase Common Stock |

|

IMACW |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CURRENT

REPORT ON FORM 8-K

IMAC

Holdings, Inc. (the “Company”)

September

6, 2023

| Item

3.01 |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As

previously reported, on September 21, 2022, the Company received a written notice from the Listing Qualifications Department of The Nasdaq

Stock Market LLC (“Nasdaq”) notifying the Company that it was not in compliance with the minimum bid price requirement

set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market. Specifically, Nasdaq Listing Rule 5550(a)(2)

requires listed securities to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”),

and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues

for a period of 30 consecutive business days. The Company was provided 180 calendar days, or until March 20, 2023, to regain compliance

with the Minimum Bid Price Requirement.

The

Company did not regain compliance with the Minimum Bid Price Requirement by March 20, 2023; however, on March 23, 2023, the Company received

a letter from Nasdaq granting the Company’s request for a 180-day extension to regain compliance with the Minimum Bid Price Requirement

(the “Extension Notice”). If at any time prior to September 18, 2023, the closing bid price of the Company’s

common stock is at or above $1.00 for a minimum of 10 consecutive business days, Nasdaq will notify the Company that it is in compliance

with the Minimum Bid Price Requirement and the matter will be closed.

On

September 6, 2023, the Company received a written notice from Nasdaq’s Listing Qualifications Department (the “September

2023 Notice”) notifying that, because the bid price for the Company’s voting common stock, par value $0.001 per share

(the “Common Stock”) and warrants (the “Warrants”), had closed at $0.10 or less for the preceding

ten consecutive trading days, in contravention of Nasdaq Listing Rule 5810(c)(3)(A)(iii), the Company’s securities were subject

to delisting unless the Company requested a hearing before the Nasdaq Hearings Panel (the “Panel”) no later than September

13, 2023 to appeal Nasdaq’s decision.

The

Company intends to timely request a hearing before the Panel to appeal Nasdaq’s delisting determination. Such request will stay

any further delisting action by Nasdaq pending the Panel’s decision. There are no assurances that a stay will be granted or that

a favorable decision will be obtained.

The

Company, by filing this Form 8-K, discloses its receipt of the notification from Nasdaq in accordance with Listing Rule 5810(b).

The

September 2023 Notice has no immediate effect on the listing or trading of the Company’s Common Stock and Warrants, which will

continue to trade on The Nasdaq Capital Market under the symbol “BACK” and “IMACW,” respectively.

| Item

5.03 |

Amendments

to Articles Of Incorporation or Bylaws; Change in Fiscal Year. |

On

August 30, 2023, pursuant to the approval provided by the stockholders of the Company at the Company’s 2023 annual meeting of stockholders

held on July 5, 2023 (the “Meeting”), the Company’s Board of Directors approved an amendment to the Company’s

Certificate of Incorporation (the “Amendment”) to effectuate a reverse stock split of the Company’s Common Stock,

affecting the issued and outstanding number of such shares by a ratio of one-for-thirty (the “Reverse Stock Split”).

The

Company filed the Amendment to its Certificate of Incorporation with the State of Delaware effectuating the Reverse Stock Split on September

6, 2023. The Reverse Stock Split became effective in the State of Delaware at 11:59 P.M. ET on Thursday, September 7, 2023.

Beginning

with the opening of trading on September 8, 2023, the Common Stock traded on The Nasdaq Capital Market on a split-adjusted basis under

a new CUSIP number 44967K302. As a result of the Reverse Stock Split, each thirty (30) shares of Common Stock issued and outstanding

prior to the Reverse Stock Split will be converted into one (1) share of Common Stock, with no change in authorized shares or par value

per share, and the number of shares of Common Stock outstanding will be reduced from 33,017,757 shares to approximately 1.1 million shares.

The number of shares of Common Stock outstanding reported in the Company’s latest Quarterly Report filed on Form 10-Q for the quarter

ended June 30, 2023 inadvertently reported a greater number of shares. No fractional shares will be issued as a result of the Reverse

Stock Split. Fractional shares that would have resulted from the Reverse Stock Split will be rounded up to the next whole number. All

options, warrants, and any other similar instruments, convertible into, or exchangeable or exercisable for, shares of Common Stock will

be proportionally adjusted.

The

foregoing description does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amendment,

which is attached hereto as Exhibit 3.1, and incorporated herein by reference.

| Item

7.01 |

Regulation

FD Disclosure. |

On

September 7, 2023, the Company issued a press release announcing the one-for-thirty Reverse Stock Split, a copy of which press release

is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

In

accordance with General Instruction B.2 of Form 8-K, the information under this item, Exhibit 99.1 shall not be deemed

filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference

in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed solely

to satisfy the requirements of Regulation FD.

The

Securities and Exchange Commission encourages registrants to disclose forward-looking information so that investors can better understand

the future prospects of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain

these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current

Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words or phrases

such as “expects,” “should,” “will,” and similar words or phrases. These statements are subject to

inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this Current

Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented

within.

| Item

9.01. |

Financial

Statements and Exhibits. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

September 8, 2023 |

IMAC

HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Jeffrey S. Ervin |

| |

Name: |

Jeffrey

S. Ervin |

| |

Title: |

Chief

Executive Officer |

Exhibit 3.1

State

of Delaware

Secretary

of State

Division

of Corporations

Delivered

11:58 AM 09/06/2023

FILED

11:58 AM 09/06/2023

SR

20233426193 - File Number 6898979 |

|

|

CERTIFICATE

OF AMENDMENT

TO THE

CERTIFICATE OF INCORPORATION

OF

IMAC HOLDINGS, INC.

IMAC

HOLDINGS, INC., a corporation duly organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”),

does hereby certify that:

1.

The name of the corporation is: IMAC Holdings, Inc. (the “Corporation”). The original Certificate of Incorporation

of the Corporation was filed with the Secretary of State of the State of Delaware on May 23, 2018 (the “Certificate of Incorporation”).

2.

This amendment to the Certificate of Incorporation effected by this Certificate of Amendment is to reflect a reverse stock split, with

a ratio of 1-for-30, of the Corporation’s Common Stock, par value $0.001 per share, so that each thirty (30) issued and outstanding

shares or treasury shares of the Corporation’s Common Stock will become one (1) issued and outstanding share or treasury share

of the Corporation’s Common Stock.

3.

Pursuant to Section 242 of the DGCL, to accomplish the foregoing amendment, this Certificate of Amendment to the Certificate of Incorporation

amends and restates Section “4.1 Authorized Capital Stock” of Article IV of the Certificate of Incorporation

to read in its entirety as follows:

“4.1

Authorized Capital Stock. The aggregate number of shares of capital stock that the Corporation is authorized to issue is Sixty-Five

Million (65,000,000), of which Sixty Million (60,000,000) shares are common stock having a par value of $0.001 per share (the “Common

Stock”), and Five Million (5,000,000) shares are preferred stock having a par value of $0.001 per share (the “Preferred

Stock”).

Simultaneously

with this Certificate of Amendment to the Corporation’s Certificate of Incorporation becoming effective pursuant to the General

Corporation Law of the State of Delaware (the “Effective Time”), every thirty (30) shares of Common Stock of the Corporation

issued and outstanding or held as treasury shares immediately prior to the Effective Time (the “Old Common Stock”)

shall automatically be reclassified and continued, without any action on the part of the holder thereof (the “Reverse Split”),

as one (1) share of post-Reverse Split Common Stock (the “New Common Stock”). The Corporation shall round up any fractional

shares of New Common Stock, on account of the Reverse Split, to the nearest whole share of Common Stock.

Each

stock certificate that immediately prior to the Effective Time represented shares of the Old Common Stock shall, from and after the Effective

Time, be exchanged for a stock certificate that represents that number of shares of New Common Stock into which the shares of Old Common

Stock represented by such certificate shall have been reclassified; provided however, that the Reverse Split will occur without any further

action on the part of the stockholders and without regard to the date or dates on which certificates formerly representing shares of

Old Common Stock are physically surrendered. Upon the consummation of the Reverse Split, each certificate formerly representing shares

of Old Common Stock, until surrendered and exchanged for a certificate representing shares of New Common Stock will be deemed for all

corporate purposes to evidence ownership of the resulting number of shares of New Common Stock.”

4.

That an annual meeting of stockholders of the Corporation was duly called and held, upon notice in accordance with Section 222 of the

DGCL, at which meeting the necessary number of shares as required by applicable law was voted in favor of the Certificate of Amendment.

5.

That said Certificate of Amendment was duly adopted in accordance with the provisions of Section 242 of the DGCL.

6.

The foregoing amendment shall be effective as of 11:59 p.m., Eastern Time, on September 7, 2023.

IN

WITNESS WHEREOF, IMAC Holdings, Inc. has caused this Certificate of Amendment to be signed by Jeffrey S. Ervin, its Chief Executive Officer,

this 6th day of September 2023.

| |

IMAC

HOLDINGS, INC. |

| |

|

| |

By: |

/s/

Jeffrey S. Ervin |

| |

Name: |

Jeffrey

S. Ervin |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

IMAC

Holdings, Inc. Announces 1-for-30 Reverse Stock Split

Franklin,

TN – September 7, 2023 (Globe Newswire) – IMAC Holdings, Inc. (Nasdaq:

BACK) (“IMAC” or the “Company”) today announced a reverse stock split of its outstanding shares of common stock

at a ratio of 1-for-30 (the “Reverse Split”) and that it had filed a Certificate of Amendment to the Company’s Certificate

of Incorporation in order to effect the Reverse Split. The Reverse Split will be effective after the market closes on September 7, 2023.

Beginning with the opening of trading on September 8, 2023, the Company’s common stock will continue to trade on The Nasdaq Capital

Market under the symbol “BACK,” but will trade on a split-adjusted basis under a new CUSIP number, 44967K302.

The

stockholders of the Company approved the Reverse Split at the Company’s 2023 annual meeting of stockholders held on July 5, 2023.

In connection with approving the Reverse Split, the Company’s stockholders granted authority to the Company’s Board of Directors

(the “Board”) to determine, at its discretion, a ratio within the range of 1-for-15 to 1-for-30, at which to effectuate the

Reverse Split. The Reverse Split was approved by the Board on August 30, 2023. The Reverse Split is expected to enable the Company to

meet the Nasdaq Listing Rule that requires a minimum closing bid price of $1.00 per share of the Company’s common stock in order

to continue the listing of the common stock on the Nasdaq Capital Market.

As

a result of the Reverse Split, every 30 pre-split shares of common stock outstanding will automatically combine into one new share of

common stock without any action on the part of the holders and with no change in the par value per share of $0.001. The Reverse Split

will proportionately reduce the number of shares of common stock available for issuance under the Company’s incentive compensation

plan and proportionately reduce the number of shares of common stock issuable upon the exercise or conversion of stock options, warrants,

restricted stock units and other convertible preferred stock outstanding immediately prior to the effectiveness of the Reverse Split.

The

Reverse Split reduces the number of shares of the Company’s outstanding common stock from approximately 33 million pre-Reverse

Split shares to approximately 1.1 million post-Reverse Split shares. No fractional shares will be issued as a result of the Reverse Split.

Fractional shares that would have resulted from the Reverse Split will be rounded up to the next whole number.

Equity

Stock Transfer LLC (“EST”) is acting as the exchange agent for the Reverse Split. EST will provide instructions to stockholders

regarding the process for exchanging their pre-split stock certificates for post-split stock certificates. Additional information about

the Reverse Split can be found in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on

May 11, 2023, a copy of which is available at www.sec.gov and on the Company’s website.

About

IMAC Holdings, Inc.

IMAC

owns and manages health and wellness centers that deliver sports medicine, orthopedic care, and restorative joint and tissue therapies

for movement restricting pain and neurodegenerative diseases. IMAC is comprised of two business segments: outpatient medical centers

and a clinical research division. With treatments to address both young and aging populations, IMAC owns or manages outpatient medical

clinics that deliver regenerative rehabilitation services as a minimally invasive approach to acute and chronic musculoskeletal and neurological

health problems. IMAC’s research division is currently conducting a Phase I clinical trial evaluating a mesenchymal stem cell therapy

candidate for bradykinesia due to Parkinson’s disease. For more information visit www.imacregeneration.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally include statements that

are predictive in nature and depend upon or refer to future events or conditions, and include words such as “believes,” “plans,”

“anticipates,” “projects,” “estimates,” “expects,” “intends,” “strategy,”

“future,” “opportunity,” “may,” “will,” “should,” “could,” “potential,”

or similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based

on current beliefs and assumptions that are subject to risks and uncertainties. Forward-looking statements speak only as of the date

they are made, and the Company undertakes no obligation to update any of them publicly in light of new information or future events.

Actual results could differ materially from those contained in any forward-looking statement as a result of various factors. More information,

including potential risk factors, that could affect the Company’s business and financial results are included in the Company’s

filings with the Securities and Exchange Commission, including, but not limited to, the Company’s Forms 10-K, 10-Q and 8-K. All

filings are available at www.sec.gov and on the Company’s website at www.imacregeneration.com.

IMAC

Investor Contact:

jeff@imacholdings.com

v3.23.2

Cover

|

Sep. 06, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 06, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-38797

|

| Entity Registrant Name |

IMAC

Holdings, Inc.

|

| Entity Central Index Key |

0001729944

|

| Entity Tax Identification Number |

83-0784691

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3401

Mallory Lane

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Franklin

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37067

|

| City Area Code |

(844)

|

| Local Phone Number |

266-4622

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

BACK

|

| Security Exchange Name |

NASDAQ

|

| Warrants to Purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to Purchase Common Stock

|

| Trading Symbol |

IMACW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BACK_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BACK_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

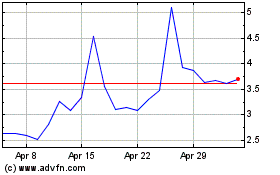

IMAC (NASDAQ:BACK)

Historical Stock Chart

From Mar 2024 to Apr 2024

IMAC (NASDAQ:BACK)

Historical Stock Chart

From Apr 2023 to Apr 2024