TEN, Ltd (TEN) (NYSE: TNP) (the “Company”) today reported results

(unaudited) for the six months and second quarter ended June 30,

2023.

SIX MONTHS 2023 SUMMARY

RESULTSWith tanker markets remaining strong, primarily

spurred by favorable supply and demand fundamentals and favorable

trade dislocations caused by the war in the Ukraine continuing and

with no signs of abating, TEN, in the first half of 2023, generated

voyage revenues of $482.7 million from $366.4 million in the

equivalent period of 2022 or 32% higher.

Operating income more than quadrupled to $281.7

million, which included a gain on vessel sales of $81.2 million

after the timely sale of eight older MR and handysize product

tankers in the first quarter of 2023.

Reflecting the good momentum in the tanker

markets, which continues to positively impact both operations and

asset values, net income experienced a near fivefold increase from

the 2022 first half level of $51.7 million and reached $237.2

million.

On the back of enhanced transportation needs for

long-haul trades and with a still considerable portion of the fleet

operating in spot trades, fleet utilization in the first six months

of 2023 amounted to a strong 95.3%, despite six vessels, including

two DP2 shuttle tankers, undergoing dry-dockings during the

period.

The average Time Charter Equivalent (TCE) in the

2023 first six-month period reached $40,182 per vessel per day, 64%

higher from $24,529 in the 2022 first half.

Adjusted Earnings Before Interest Tax

Depreciation & Amortization (EBITDA) more than doubled to

$275.2 million from $133.3 million in the 2022 first six months, a

107% increase.

Positive fleet performance and the free cash

generated by vessel sales, resulted in TEN’s cash reserves

increasing to $534.1 million as at June 30, 2023.

Bank debt during the first six months of the

year continued its downward trajectory and settled at $1.38 billion

at June 30, 2023, $35 million lower from the December 31, 2022

level.

Interest and finance costs in the first half of

2023 reached $48.8 million, impacted by continuing higher global

interest rates and the new loans for the acquisition of the DP2

shuttle tanker Porto and the VLCC Dias I in the second half of

2022. This cost was mitigated with interest income for the first

six months of 2023 increasing to about $7.0 million from $0.4

million in the same period of 2022.

Daily operating expenses per vessel during the

2023 first six months averaged $9,349.

Depreciation and amortization costs combined

were at $70.4 million compared to $67.5 million in the 2022 first

half period driven by prior year dry-dockings.

Q2 2023 SUMMARY RESULTS TEN,

whilst operating on average seven vessels less than in the 2022

second quarter, generated $4.8 million more in voyage revenues

compared to last year’s same quarter and reached $221.4

million.

The resulting operating income climbed to $82.6

million, $25.2 million higher than the 2022 equivalent quarter. Net

income experienced a 31% increase to reach $60.6 million from $46.2

million in the 2022 second quarter which also included a small $0.3

million gain on vessels sale.

Adjusted EBITDA for the second quarter of 2023

recorded a 32% increase from the 2022 equivalent period and settled

at $120.2 million.

Fleet utilization, despite a number of scheduled

dry-dockings, remained high at 94.2% compared to 93.6% in the

second quarter of 2022.

Daily average TCE per vessel, following the

market momentum, increased to $38,353 from $29,278, 31% higher from

the 2022 second quarter, while operating expenses were contained to

$9,492 per vessel per day.

Overall, voyage expenses during the 2023 second

quarter fell approximately 38% from the 2022 second quarter due to

lower bunker costs while total vessel operating expenses remained

at about the same levels as the 2022 second quarter, as did

depreciation and amortization.

Interest and finance costs in the second quarter

of 2023, continuing to be impacted by high interest rates globally,

settled at $24.3 million, which was also mitigated by interest

income reaching $4.1 million from just $0.2 million in the same

period of 2022.

SUBSEQUENT EVENTSIn the third

quarter of 2023 the Company redeemed in full $88.0 million of its

publicly traded 8.75% Series D Cumulative Redeemable Perpetual

Preferred Shares and $19.4 million of a privately placed perpetual

preferred instrument, carrying a coupon of 7.50%, for a total of

$107.4 million with annual cash savings of over $9.0 million.

Inclusive of the prior redemptions of Series B and Series C

Perpetual Preferred Shares and privately placed preferred

instruments, the Company has, in aggregate, redeemed a total of

$211 million of preferred shares with annual cash savings of about

$18.0 million.

New and extended time charter business at

renewed rates increases revenue backlog to over $1.5 billion -

Average contract duration close to three years.

In August 2023, the Company signed newbuilding

contracts for the construction of two scrubber-fitted MR product

tankers with expected delivery in the first quarter of 2026.

DIVIDEND – COMMON SHARES -

OTHERAs previously announced, TEN will distribute to

common shareholders, a second semi-annual dividend of $0.30 per

share in December 2023 following the $0.30 per share payment in

June 2023 which together with an additional special dividend of

$0.40 per common share, increase total distributions for this year

to $1.00, bringing total common stock dividend payments for 2023 to

approximately $30 million.

Payment for the special dividend is scheduled

for October 26, 2023, to shareholders of record on October 20,

2023.

Inclusive of this upcoming payment, TEN has

provided common shareholders $528 million in dividends, equating to

over $25 million per annum, since its 2002 NYSE listing.

The Company’s authority to issue common stock

under its last At-The-Market program has expired and has not been

renewed and therefore it is no longer available for use.

CORPORATE STRATEGY &

OUTLOOKWhile management took advantage of the historical

high asset prices and divested eight of its older product tankers

at significant profits this year it has used its healthy cash

reserves to pay increased amounts of common stock dividends and

redeem preferred shares, aggregating to $138 million, as well as

invest in green energy vessels.

Along with sound cash balances, bank debt

reduction and further green vessel investments, capital allocation

shall continue to be the cornerstone of TEN’s balance sheet

management.

“Taking advantage of the positive environment in

the tanker market the Company has timely monetized a big part of

its first-generation tankers and has reinvested the proceeds for

new and environmentally friendly vessels, common share dividend

distributions and a significant reduction of its preferred shares,”

Mr. George Saroglou, President and COO of TEN commented. “The

recent appetite from our major clients for accretive long-term

business, particularly in the LNG and tanker segments, has given us

the comfort to secure over $1.5 billion in forward revenues and

ensure continuity in providing healthy returns and increased

dividends to our shareholders,” Mr. Saroglou concluded.

ABOUT TENTEN, founded in 1993

and celebrating this year 30 years as a public company, is one of

the first and most established public shipping companies in the

world. TEN’s diversified energy fleet currently consists of 68

double-hull vessels, including four dual-fuel LNG powered aframax

vessels, two DP2 shuttle tankers, two scrubber-fitted suezmax

vessels and two scrubber-fitted MR product tankers under

construction, constituting a mix of crude tankers, product tankers

and LNG carriers, totaling 8.4 million dwt.

Conference Call Details:As

announced previously, today, Thursday, September 7, 2023 at 10:00

a.m. Eastern Time, TEN will host a conference call to review the

results as well as management's outlook for the business. The call,

which will be hosted by TEN's senior management, may contain

information beyond what is included in the earnings press

release.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers:

877-405-1226 (US Toll-Free Dial In) or +1 201-689-7823 (US and

Standard International Dial In). Please quote “Tsakos” to the

operator and/or conference ID 13740947. Click here for additional

participant International Toll-Free access numbers.

Alternatively, participants can register for the

call using the call me option for a faster connection to join the

conference call. You can enter your phone number and let the system

call you right away. Click here for the call me option.

Simultaneous Slides and Audio

Webcast:There will also be a live, and then archived,

webcast of the conference call and accompanying slides, available

through the Company’s website. To listen to the archived audio

file, visit our website www.tenn.gr and click on Webcasts &

Presentations under our Investor Relations page. Participants to

the live webcast should register on the website approximately 10

minutes prior to the start of the webcast.

TEN’s CURRENT GROWTH PROGRAM

|

# |

Name |

Type |

Delivery |

Status |

Employment |

|

1 |

TBN |

Aframax Dual Fuel |

Q3 2023* |

Under Construction |

Yes |

|

2 |

TBN |

Aframax Dual Fuel |

Q4 2023* |

Under Construction |

Yes |

|

3 |

TBN |

Aframax Dual Fuel |

Q1 2024* |

Under Construction |

Yes |

|

4 |

TBN |

Aframax Dual Fuel |

Q1 2024* |

Under Construction |

Yes |

|

5 |

TBN |

DP2 Shuttle Tanker |

Q2 2025* |

Under Construction |

Yes |

|

6 |

TBN |

DP2 Shuttle Tanker |

Q2 2025* |

Under Construction |

Yes |

|

7 |

TBN |

Suezmax – Scrubber Fitted |

Q2 2025* |

Under Construction |

Under Discussion |

|

8 |

TBN |

Suezmax – Scrubber Fitted |

Q4 2025* |

Under Construction |

Under Discussion |

|

9 |

TBN |

MR – Scrubber Fitted |

Q1 2026* |

Under Construction |

Under Discussion |

|

10 |

TBN |

MR – Scrubber Fitted |

Q1 2026* |

Under Construction |

Under Discussion |

*Expected delivery as per shipbuilding

contracts

ABOUT FORWARD-LOOKING

STATEMENTS Except for the historical information contained

herein, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those

predicted by such forward-looking statements. TEN undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

For further information, please contact:

CompanyTsakos Energy

Navigation, Ltd. George SaroglouCOO+30210 94 07

710gsaroglou@tenn.gr

Investor Relations /

MediaCapital Link, Inc. Nicolas Bornozis Markella Kara+212

661 7566ten@capitallink.com

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TSAKOS ENERGY NAVIGATION LIMITED AND

SUBSIDIARIES |

|

Selected Consolidated Financial and Other Data |

|

(In Thousands of U.S. Dollars, except share, per share and fleet

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

|

June 30 (unaudited) |

|

|

June 30 (unaudited) |

|

|

STATEMENT OF OPERATIONS DATA |

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage revenues |

$ |

221,454 |

|

|

|

$ |

216,699 |

|

|

$ |

482,667 |

|

|

|

$ |

366,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

38,892 |

|

|

|

|

62,738 |

|

|

|

84,789 |

|

|

|

|

110,941 |

|

|

|

Charter hire expense |

|

5,731 |

|

|

|

|

8,711 |

|

|

|

12,522 |

|

|

|

|

17,326 |

|

|

|

Vessel operating expenses |

|

46,669 |

|

|

|

|

46,630 |

|

|

|

94,943 |

|

|

|

|

89,804 |

|

|

|

Depreciation and amortization |

|

35,264 |

|

|

|

|

34,168 |

|

|

|

70,403 |

|

|

|

|

67,518 |

|

|

|

General and administrative expenses |

|

12,336 |

|

|

|

|

7,383 |

|

|

|

19,493 |

|

|

|

|

14,177 |

|

|

|

Gains on sale of vessels |

|

- |

|

|

|

|

(299 |

) |

|

|

(81,198 |

) |

|

|

|

(299 |

) |

|

|

Total expenses |

|

138,892 |

|

|

|

|

159,331 |

|

|

|

200,952 |

|

|

|

|

299,467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

82,562 |

|

|

|

|

57,368 |

|

|

|

281,715 |

|

|

|

|

66,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and finance costs, net |

|

(24,334 |

) |

|

|

|

(10,992 |

) |

|

|

(48,848 |

) |

|

|

|

(14,292 |

) |

|

|

Interest income |

|

4,125 |

|

|

|

|

226 |

|

|

|

6,888 |

|

|

|

|

416 |

|

|

|

Other, net |

|

(241 |

) |

|

|

|

349 |

|

|

|

(180 |

) |

|

|

|

182 |

|

|

|

Total other expenses, net |

|

(20,450 |

) |

|

|

|

(10,417 |

) |

|

|

(42,140 |

) |

|

|

|

(13,694 |

) |

|

|

Net income |

|

62,112 |

|

|

|

|

46,951 |

|

|

|

239,575 |

|

|

|

|

53,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income attributable to the noncontrolling interest |

|

(1,471 |

) |

|

|

|

(726 |

) |

|

|

(2,379 |

) |

|

|

|

(1,499 |

) |

|

|

Net income attributable to Tsakos Energy Navigation

Limited |

$ |

60,641 |

|

|

|

$ |

46,225 |

|

|

$ |

237,196 |

|

|

|

$ |

51,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of preferred dividends |

|

(8,673 |

) |

|

|

|

(8,704 |

) |

|

|

(17,347 |

) |

|

|

|

(17,377 |

) |

|

|

Undistributed income to Series G participants |

|

- |

|

|

|

|

(370 |

) |

|

|

- |

|

|

|

|

(353 |

) |

|

|

Deemed dividend on Series D preferred shares |

|

(3,256 |

) |

|

|

|

- |

|

|

|

(3,256 |

) |

|

|

|

- |

|

|

|

Net income attributable to common stockholders of Tsakos

Energy Navigation Limited |

$ |

48,712 |

|

|

|

$ |

37,151 |

|

|

$ |

216,594 |

|

|

|

$ |

34,013 |

|

|

|

Earnings per share, basic and diluted |

$ |

1.65 |

|

|

|

$ |

1.31 |

|

|

$ |

7.34 |

|

|

|

$ |

1.26 |

|

|

|

Weighted average number of common shares, basic |

|

29,505,603 |

|

|

|

|

28,398,404 |

|

|

|

29,505,603 |

|

|

|

|

26,992,886 |

|

|

|

Weighted average number of common shares, diluted |

|

29,505,603 |

|

|

|

|

28,704,595 |

|

|

|

29,505,603 |

|

|

|

|

27,299,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

BALANCE SHEET DATA |

|

June 30 |

|

|

|

December 31 |

|

|

|

|

|

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

| |

Cash |

|

534,094 |

|

|

|

|

309,439 |

|

|

|

|

|

|

|

|

| |

Other assets |

|

226,811 |

|

|

|

|

371,911 |

|

|

|

|

|

|

|

|

| |

Vessels, net |

|

2,544,453 |

|

|

|

|

2,580,575 |

|

|

|

|

|

|

|

|

| |

Advances for vessels under construction |

|

143,997 |

|

|

|

|

46,650 |

|

|

|

|

|

|

|

|

| |

Total assets |

$ |

3,449,355 |

|

|

|

$ |

3,308,575 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Debt and other financial liabilities, net of deferred finance

costs |

|

1,538,086 |

|

|

|

|

1,577,877 |

|

|

|

|

|

|

|

|

| |

Other liabilities |

|

276,138 |

|

|

|

|

207,779 |

|

|

|

|

|

|

|

|

| |

Stockholders' equity |

|

1,635,131 |

|

|

|

|

1,522,919 |

|

|

|

|

|

|

|

|

| |

Total liabilities and stockholders' equity |

$ |

3,449,355 |

|

|

|

$ |

3,308,575 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended |

|

|

Six months ended |

| |

OTHER FINANCIAL DATA |

|

June 30 |

|

|

June 30 |

| |

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

| |

Net cash provided by operating activities |

$ |

143,496 |

|

|

|

$ |

49,267 |

|

|

$ |

258,502 |

|

|

|

$ |

73,553 |

|

| |

Net cash (used in) provided by investing activities |

$ |

(49,298 |

) |

|

|

$ |

14,040 |

|

|

$ |

37,025 |

|

|

|

$ |

(144,159 |

) |

| |

Net cash (used in) provided by financing activities |

$ |

(35,786 |

) |

|

|

$ |

(34,476 |

) |

|

$ |

(70,872 |

) |

|

|

$ |

115,205 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TCE per ship per day |

$ |

38,353 |

|

|

|

$ |

29,278 |

|

|

$ |

40,182 |

|

|

|

$ |

24,529 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating expenses per ship per day |

$ |

9,492 |

|

|

|

$ |

8,367 |

|

|

$ |

9,349 |

|

|

|

$ |

8,056 |

|

| |

Vessel overhead costs per ship per day |

$ |

2,337 |

|

|

|

$ |

1,244 |

|

|

$ |

1,793 |

|

|

|

$ |

1,195 |

|

| |

|

|

11,829 |

|

|

|

|

9,611 |

|

|

|

11,142 |

|

|

|

|

9,251 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLEET DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average number of vessels during period |

|

58.0 |

|

|

|

|

65.2 |

|

|

|

60.1 |

|

|

|

|

65.5 |

|

|

|

Number of vessels at end of period |

|

58.0 |

|

|

|

|

65.0 |

|

|

|

58.0 |

|

|

|

|

65.0 |

|

|

|

Average age of fleet at end of period |

Years |

10.5 |

|

|

|

|

10.5 |

|

|

|

10.5 |

|

|

|

|

10.5 |

|

|

|

Dwt at end of period (in thousands) |

|

7,178 |

|

|

|

|

7,185 |

|

|

|

7,178 |

|

|

|

|

7,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter employment - fixed rate |

Days |

2,308 |

|

|

|

|

2,021 |

|

|

|

4,585 |

|

|

|

|

3,968 |

|

|

|

Time charter and pool employment - variable rate |

Days |

1,554 |

|

|

|

|

1,921 |

|

|

|

3,355 |

|

|

|

|

3,798 |

|

|

|

Period employment coa at market rates |

Days |

86 |

|

|

|

|

133 |

|

|

|

147 |

|

|

|

|

223 |

|

|

|

Spot voyage employment at market rates |

Days |

1,024 |

|

|

|

|

1,478 |

|

|

|

2,276 |

|

|

|

|

3,095 |

|

|

|

Total operating days |

|

4,972 |

|

|

|

|

5,553 |

|

|

|

10,363 |

|

|

|

|

11,084 |

|

|

|

Total available days |

|

5,278 |

|

|

|

|

5,935 |

|

|

|

10,872 |

|

|

|

|

11,864 |

|

|

|

Utilization |

|

94.2 |

% |

|

|

|

93.6 |

% |

|

|

95.3 |

% |

|

|

|

93.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Measures |

|

|

Reconciliation of Net income to Adjusted

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

|

June 30 |

|

|

June 30 |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Tsakos Energy Navigation Limited |

$ |

60,641 |

|

|

|

$ |

46,225 |

|

|

$ |

237,196 |

|

|

|

$ |

51,743 |

|

|

|

Depreciation and amortization |

|

35,264 |

|

|

|

|

34,168 |

|

|

|

70,403 |

|

|

|

|

67,518 |

|

|

|

Interest Expense |

|

24,334 |

|

|

|

|

10,992 |

|

|

|

48,848 |

|

|

|

|

14,292 |

|

|

|

Gains on sale of vessels |

|

- |

|

|

|

|

(299 |

) |

|

|

(81,198 |

) |

|

|

|

(299 |

) |

|

|

Adjusted EBITDA |

$ |

120,239 |

|

|

|

$ |

91,086 |

|

|

$ |

275,249 |

|

|

|

$ |

133,254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The Company reports

its financial results in accordance with U.S. generally accepted

accounting principles (GAAP). However, management believes that

certain non-GAAP measures used within the financial community may

provide users of this financial information additional meaningful

comparisons between current results and results in prior operating

periods as well as comparisons between the performance of Shipping

Companies. Management also uses these non-GAAP financial measures

in making financial, operating and planning decisions and in

evaluating the Company’s performance. We are using the following

Non-GAAP measures: |

| |

|

| |

(i) TCE which

represents voyage revenue less voyage expenses is divided by the

number of operating days less 117 days lost for the second quarter

and 281 days for the first half of 2023 and 170 days for the prior

year quarter of 2022 and 374 days for first half of 2022,

respectively, as a result of calculating revenue on a loading to

discharge basis. |

| |

(ii) Vessel

overhead costs are General & Administrative expenses, which

also include Management fees, Stock compensation expense and

Management incentive award. |

| |

(iii) Operating

expenses per ship per day which exclude Management fees, General

& Administrative expenses, Stock compensation expense and

Management incentive award. |

| |

(iv) Adjusted

EBITDA. See above for reconciliation to net income. |

| |

Non-GAAP financial

measures should be viewed in addition to and not as an alternative

for, the Company’s reported results prepared in accordance with

GAAP. |

| |

The Company does

not incur corporation tax. |

|

|

|

|

|

|

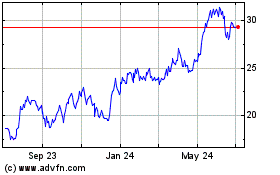

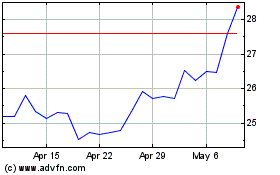

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Apr 2023 to Apr 2024