FALSE000173882700017388272023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 9, 2023

_____________________

KLX ENERGY SERVICES HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

_____________________

| | | | | | | | |

| Delaware | 001-38609 | 36-4904146 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 3040 Post Oak Boulevard, 15th Floor Houston, Texas 77056 (Address of Principal Executive Offices, and Zip Code) | |

| | |

| (832) 844-1015 (Registrant’s Telephone Number, Including Area Code) | |

| | |

| (Former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | |

| | Trading | | Name of each exchange |

Title of each class | | symbol(s) | | on which registered |

| Common Stock, $0.01 Par Value | | KLXE | | The Nasdaq Global Select Market |

_____________________

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operations and Financial Condition

On August 9, 2023, KLX Energy Services Holdings, Inc. (“KLXE” or the “Company”) issued a press release (the “Press Release”) to report its financial results for the second quarter ended June 30, 2023. KLXE is hereby furnishing the Press Release, which is included as Exhibit 99.1 hereto, pursuant to Item 2.02 of Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 2.02, and including Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure

The information set forth under Item 2.02 above is incorporated by reference into this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| KLX Energy Services Holdings, Inc. |

| | |

| By: | /s/ Keefer M. Lehner |

| Name: | Keefer M. Lehner |

| Title: | Chief Financial Officer, Executive Vice President |

| Date: | August 9, 2023 |

NEWS RELEASE

Contacts:

KLX Energy Services Holdings, Inc.

Keefer M. Lehner, EVP & CFO

832-930-8066

IR@klxenergy.com

Dennard Lascar Investor Relations

Ken Dennard / Natalie Hairston

713-529-6600

KLXE@dennardlascar.com

KLX ENERGY SERVICES HOLDINGS, INC. REPORTS SECOND QUARTER 2023 RESULTS

Regional and Product Service Line diversification drives higher adjusted EBITDA, adjusted EBITDA margin and free cash flow

HOUSTON, TX - August 9, 2023 - KLX Energy Services Holdings, Inc. (Nasdaq: KLXE) (“KLX”, the “Company”, “we”, “us” or “our”) today reported financial results for the second quarter ended June 30, 2023. Note that the first quarter 2023 results include only a partial month impact post closing the acquisition of Greene’s Energy Group, LLC (“Greene’s”) on March 8, 2023.

Second Quarter 2023 Financial and Operational Highlights

•Revenue of $234.0 million

•Net income of $11.4 million, net income margin of 4.9%, diluted earnings per share of $0.71

•Adjusted net income of $13.1 million and adjusted diluted earnings per share of $0.81

•Adjusted EBITDA of $39.7 million, increased 4% sequentially

•Adjusted EBITDA margin of 17.0%, increased 7% sequentially

•Cash balance of $82.1 million, increased $42.5 million sequentially and $50.6 million compared to Q2 2022

•Ended the quarter with $143.7 million of available liquidity, consisting of $82.1 million of cash and $61.6 million of available borrowing capacity under the June 2023 ABL Facility borrowing base certificate

•Ended the quarter with a total debt balance of $283.8 million and reduced net debt 17% sequentially, ending the quarter with a net debt balance of $201.7 million and a LTM Net Leverage Ratio of 1.3x

•Amended, extended and upsized our asset-based revolving credit facility (the “ABL Facility”)

•Integration of Greene's acquisition is substantially complete

See “Non-GAAP Financial Measures” at the end of this release for a discussion of adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) margin, adjusted diluted earnings per share, levered and unlevered free cash flow, net working capital, net debt, net leverage ratio and their reconciliation to the most directly comparable financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We have not provided reconciliations of our future expectations as to adjusted EBITDA or adjusted EBITDA margin as such reconciliation is not available without unreasonable efforts.

Chris Baker, KLX President and Chief Executive Officer, stated, “We are pleased with our second quarter performance, despite a weakening macro environment driven by continued commodity price volatility and rig count declines. KLX experienced a lower

topline decline when compared to the rig count decline, and we saw strong results and improvements in net income, adjusted net income, adjusted EBITDA, and adjusted EBITDA margin. In addition, we generated $47.3 million in levered free cash flow during the second quarter and reduced net debt 17% sequentially. We attribute this performance to the strength of our team in the field and our regional and product line diversification. Despite an almost 11% rig count decline, we saw a rotation to and strength in our comprehensive suite of Completion and Production & Intervention product lines.

“Additionally, we are pleased to have substantially completed our integration of the Greene’s acquisition,” said Baker. “This four-month integration process has been exceptional, and this acquisition strengthens our position as a diverse, scaled and technologically differentiated market leader in the pressure control space. We believe this transaction is a blueprint by which KLX can pursue additional consolidation opportunities. Strategically, we will continue to focus on free cash flow generation, net debt reduction and accretive consolidation.

“Looking to the future, we remain constructive on the U.S. onshore drilling, completion and production markets in which we operate. Commodity prices have shown recent strength and are at levels which should ultimately drive meaningful improvement in customer results and underlying activity. We expect some operators to begin to ramp their drilling and completion activities in late 2023 and into 2024,” concluded Baker.

Second Quarter 2023 Financial Results

Revenue for the second quarter of 2023 totaled $234.0 million, a decrease of 2% compared to first quarter 2023 revenue of $239.6 million. The slight sequential decrease in revenue reflects the slowdown in activity in our Rocky Mountains and Northeast/Mid-Con business segments. On a product line basis, drilling, completion, production and intervention services contributed approximately 24.7%, 53.6%, 12.2% and 9.5%, respectively, to revenues for the second quarter 2023.

Net income for the second quarter of 2023 was $11.4 million, compared to first quarter 2023 net income of $9.4 million. Adjusted net income for the second quarter of 2023 was $13.1 million, compared to first quarter 2023 adjusted net income of $11.5 million. Adjusted EBITDA for the second quarter of 2023 increased 4% sequentially to $39.7 million, compared to first quarter 2023 adjusted EBITDA of $38.2 million. Adjusted EBITDA margin for the second quarter of 2023 was 17.0%, which is the strongest quarterly adjusted EBITDA margin since the second quarter of 2019. The sequential and year-over-year increase in net income and adjusted EBITDA was driven by a shift in product service mix, a full quarterly impact from the Greene’s acquisition and the roll-off of payroll and unemployment taxes that have an outsized burden on the first quarter cost structure.

Second Quarter 2023 Segment Results

The Company reports revenue, operating income and adjusted EBITDA through three geographic business segments: Rocky Mountains, Southwest and Northeast/Mid-Con.

•Rocky Mountains: Revenue, operating income and adjusted EBITDA for the Rocky Mountains segment was $66.4 million, $11.9 million and $17.0 million, respectively, for the second quarter of 2023. Second quarter revenue represents a 2% decrease over the first quarter of 2023 largely driven by an increase in activity in the Bakken offset by a decrease in activity in the DJ Basin and Wyoming. Segment operating income and adjusted EBITDA increased 21% and 10% sequentially, driven by reduced seasonality and white space; a shift in product service mix, with a greater contribution

from frac rentals, pressure pumping and rentals; and the roll-off of payroll and unemployment taxes that have an outsized burden on first quarter 2023 margins.

•Southwest: Revenue, operating income and adjusted EBITDA for the Southwest segment, which includes the Permian and South Texas, was $86.3 million, $8.1 million and $14.8 million, respectively, for the second quarter of 2023. Second quarter revenue represents a 18% increase over the first quarter of 2023 largely driven by a shift in product service mix and a full quarter contribution from Greene’s.

•Northeast/Mid-Con: Revenue, operating income and adjusted EBITDA for the Northeast/Mid-Con segment was $81.3 million, $12.6 million and $18.0 million, respectively, for the second quarter of 2023. Second quarter revenue represents a 17% decrease over the first quarter of 2023 and operating income and adjusted EBITDA declined 33% and 24% respectively, largely due to increased white space for our drilling and completions businesses and a 48% decrease in Haynesville completions revenue but was partially offset by a shift towards more pump-only work in our frac service line.

The following is a tabular summary of revenue, operating income (loss) and adjusted EBITDA (loss) for the second quarter ended June 30, 2023, the first quarter ended March 31, 2023 and the second quarter ended June 30, 2022 ($ in millions).

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | |

| Revenue: | | | | | | | | |

| Rocky Mountains | | $ | 66.4 | | | $ | 67.9 | | | $ | 53.1 | | | |

| Southwest | | 86.3 | | | 73.4 | | | 60.0 | | | |

| Northeast/Mid-Con | | 81.3 | | | 98.3 | | | 71.3 | | | |

| Total Revenue | | $ | 234.0 | | | $ | 239.6 | | | $ | 184.4 | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | |

| Operating income (loss): | | | | | | | | |

| Rocky Mountains | | $ | 11.9 | | | $ | 9.8 | | | $ | 4.0 | | | |

| Southwest | | 8.1 | | | 4.8 | | | 2.0 | | | |

| Northeast/Mid-Con | | 12.6 | | | 18.7 | | | 7.3 | | | |

| Corporate and other | | (13.0) | | | (14.4) | | | (11.9) | | | |

| Total operating income | | $ | 19.6 | | | $ | 18.9 | | | $ | 1.4 | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | |

| Adjusted EBITDA (loss) | | | | | | | | |

| Rocky Mountains | | $ | 17.0 | | | $ | 15.5 | | | $ | 9.3 | | | |

| Southwest | | 14.8 | | | 10.2 | | | 6.4 | | | |

| Northeast/Mid-Con | | 18.0 | | | 23.7 | | | 11.1 | | | |

| Segment Total | | 49.8 | | | 49.4 | | | 26.8 | | | |

| Corporate and other | | (10.1) | | | (11.2) | | | (9.4) | | | |

Total adjusted EBITDA(1) | | $ | 39.7 | | | $ | 38.2 | | | $ | 17.4 | | | |

(1) Excludes one-time costs, as defined in the Reconciliation of Consolidated Net Income (Loss) to adjusted EBITDA (loss) table below, non-cash compensation expense and non-cash asset impairment expense.

ABL Amendment

On June 20, 2023, the Company entered into a Fourth Amendment to the ABL Facility, with certain of its subsidiaries party thereto, as guarantors, with JPMorgan Chase Bank, N.A., as administrative agent, collateral agent and an issuing lender, and the other lenders and issuing lenders party thereto from time to time (the “ABL Amendment”).

The ABL Amendment, among other things, (i) extends the maturity date of the ABL Facility from September 15, 2024 to the earlier of (A) September 15, 2025 or (B) August 1, 2025, if the Company's senior secured notes are still outstanding as of such date and (ii) increases the revolving credit commitment by 20%, from $100 million to $120 million.

Balance Sheet and Liquidity

Total debt outstanding as of June 30, 2023 was $283.8 million. As of June 30, 2023, cash and cash equivalents totaled $82.1 million. Available liquidity as of June 30, 2023 was $143.7 million, including availability of $61.6 million on the June 2023 ABL Facility borrowing base certificate. The senior secured notes bear interest at an annual rate of 11.5%, payable semi-annually in arrears on May 1st and November 1st. Accrued interest as of June 30, 2023 was $4.5 million for the senior secured notes and $0.1 million related to the ABL Facility.

Net working capital as of June 30, 2023 was $76.1 million, which was down 34% from March 31, 2023 levels. The decrease in net working capital was driven largely by a normalization of our days sales outstanding and days payables outstanding relative to the first quarter of 2023, when we experienced customers slow paying at the end of the quarter, accelerated vendor payments in preparation for a system implementation project and incremental payrolls.

KLX sold no shares under our at-the-market offering program in both the second quarter and six months ended June 2023.

Other Financial Information

Capital expenditures were $16.2 million during the second quarter of 2023. Capital spending during the second quarter was driven primarily by maintenance capital expenditures across our segments. As of June 30, 2023, we had $2.3 million of assets held for sale related to real property and equipment in the Rocky Mountains and Southwest segments.

Greene’s Integration

KLX’s integration of Greene’s was substantially complete as of the date of this release. We expect to realize the full annualized impact of the $2 to $3 million in annual synergies beginning in August 2023.

2023 Guidance

In light of current market conditions, the Company is deferring capital projects and lowering full year capital spending guidance to approximately $45 to $55 million from $60 to $70 million. Correspondingly, the Company is updating the full year guidance below. The below summary of Company guidance is current as of the time provided and subject to change.

•Third quarter 2023 revenue of $215 million to $230 million

•Third quarter 2023 adjusted EBITDA margin of 14% to 16%

•Full year 2023 revenue range of $900 million to $950 million

•Full year 2023 adjusted EBITDA margin of 15% to 17%

Conference Call Information

KLX has scheduled a conference call for 9:00 a.m. Central Time (10:00 a.m. Eastern Time) on Thursday, August 10, 2023, to review reported results. You may access the call by telephone at 1-201-389-0867 and ask for the KLX 2023 Second Quarter Conference Call at least 10 minutes prior to the start time. The webcast of the call may also be accessed through the Investor Relations section of the Company’s website at https://investor.klxenergy.com/events-and-presentations/events. For those who cannot listen to the live call, a replay of the call can be accessed on the Company’s website for 90 days and will be available by telephone through August 24, 2023, at 1-201-612-7415, access code 13738976#. Please submit any questions for management prior to the call via email to KLXE@dennardlascar.com.

About KLX Energy Services Holdings, Inc.

KLX is a growth-oriented provider of diversified oilfield services to leading onshore oil and natural gas exploration and production companies operating in both conventional and unconventional plays in all of the active major basins throughout the United States. The Company delivers mission critical oilfield services focused on drilling, completion, production, and intervention activities for technically demanding wells from over 60 service and support facilities located throughout the United States. KLX’s complementary suite of proprietary products and specialized services is supported by technically skilled personnel and a broad portfolio of innovative in-house manufacturing, repair and maintenance capabilities. More information is available at www.klxenergy.com.

Forward-Looking Statements and Cautionary Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information to investors. This news release (and any oral statements made regarding the subjects of this release, including on the conference call announced herein) includes forward-looking statements that reflect our current expectations and projections about our future results, performance and prospects. Forward-looking statements include all statements that are not historical in nature and are not current facts. When used in this news release (and any oral statements made regarding the subjects of this release, including on the conference call announced herein), the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could,” “will” or the negative of these terms or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events with respect to, among other things: our operating cash flows; the availability of capital and our liquidity; our ability to renew and refinance our debt; our future revenue, income and operating performance; our ability to sustain and improve our utilization, revenue and margins; our ability to maintain acceptable pricing for our services; future capital expenditures; our ability to finance equipment, working capital and capital expenditures; our ability to execute our long-term growth strategy and to integrate our acquisitions; our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements; and the timing and success of strategic initiatives and special projects.

Forward-looking statements are not assurances of future performance and actual results could differ materially from our historical experience and our present expectations or projections. These forward-looking statements are based on management’s current expectations and beliefs, forecasts for our existing operations, experience, expectations and perception of historical trends, current conditions, anticipated future developments and their effect on us and other factors believed to be appropriate. Although management believes the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Our forward-looking statements involve significant risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risks associated with the following: a decline in demand for our services, including due to the COVID-19 pandemic, declining commodity prices, overcapacity and other competitive factors affecting our industry; the cyclical nature and volatility of the oil and gas industry, which impacts the level of exploration, production and development activity and spending patterns by oil and natural gas exploration and production companies; a decline in, or substantial volatility of, crude oil and gas commodity prices, which generally leads to decreased spending by our customers

and negatively impacts drilling, completion and production activity; inflation; increases in interest rates; the ongoing war in Ukraine and its continuing effects on global trade; supply chain issues; and other risks and uncertainties listed in our filings with the U.S. Securities and Exchange Commission, including our Current Reports on Form 8-K that we file from time to time, Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by law.

KLX Energy Services Holdings, Inc.

Condensed Consolidated Statements of Operations

(In millions of U.S. dollars and shares, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Revenues | $ | 234.0 | | | $ | 239.6 | | | $ | 184.4 | |

| Costs and expenses: | | | | | |

| Cost of sales | 173.3 | | | 180.9 | | | 150.9 | |

| Depreciation and amortization | 17.6 | | | 16.5 | | | 14.0 | |

| Selling, general and administrative | 22.0 | | | 26.2 | | | 18.0 | |

| Research and development costs | 0.3 | | | 0.3 | | | 0.1 | |

| | | | | |

| Bargain purchase gain | 1.2 | | | (3.2) | | | — | |

| Operating income | 19.6 | | | 18.9 | | | 1.4 | |

| Non-operating expense: | | | | | |

| Interest expense, net | 8.5 | | | 9.3 | | | 8.7 | |

| Net income (loss) before income tax | 11.1 | | | 9.6 | | | (7.3) | |

| Income tax expense | (0.3) | | | 0.2 | | | 0.2 | |

| Net income (loss) | $ | 11.4 | | | $ | 9.4 | | | $ | (7.5) | |

| | | | | |

| Net income (loss) per common share: | | | | | |

| Basic | $ | 0.71 | | | $ | 0.66 | | | $ | (0.67) | |

| Diluted | $ | 0.71 | | | $ | 0.65 | | | $ | (0.67) | |

| | | | | |

| Weighted average common shares: | | | | | |

| Basic | 16.0 | | | 14.2 | | | 11.2 | |

| Diluted | 16.1 | | | 14.4 | | | 11.2 | |

KLX Energy Services Holdings, Inc.

Condensed Consolidated Balance Sheets

(In millions of U.S. dollars and shares, except per share data)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 82.1 | | | $ | 57.4 | |

Accounts receivable–trade, net of allowance of $6.1 and $5.7 | 161.8 | | | 154.3 | |

| Inventories, net | 31.0 | | | 25.7 | |

| Prepaid expenses and other current assets | 13.6 | | | 17.3 | |

| Total current assets | 288.5 | | | 254.7 | |

| | | |

| Property and equipment, net | 199.0 | | | 168.1 | |

| Operating lease assets | 32.1 | | | 37.4 | |

| Intangible assets, net | 2.0 | | | 2.1 | |

| Other assets | 4.9 | | | 3.6 | |

| Total assets | $ | 526.5 | | | $ | 465.9 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

| Current liabilities: | | | |

| Accounts payable | $ | 96.8 | | | $ | 84.2 | |

| Accrued interest | 4.7 | | | 4.8 | |

| Accrued liabilities | 33.5 | | | 41.0 | |

| Current portion of operating lease obligations | 14.4 | | | 14.2 | |

| Current portion of finance lease obligations | 13.2 | | | 10.2 | |

| Total current liabilities | 162.6 | | | 154.4 | |

| Long-term debt | 283.8 | | | 283.4 | |

| Long-term operating lease obligations | 17.1 | | | 22.8 | |

| Long-term finance lease obligations | 22.8 | | | 20.3 | |

| Other non-current liabilities | 0.5 | | | 0.8 | |

| | | |

| Commitments, contingencies and off-balance sheet arrangements | | | |

| Stockholders’ equity (deficit): | | | |

| Common stock, $0.01 par value; 110.0 authorized; 16.8 and 14.3 issued | 0.1 | | | 0.1 | |

| Additional paid-in capital | 552.7 | | | 517.3 | |

| Treasury stock, at cost, 0.4 shares and 0.4 shares | (5.3) | | | (4.6) | |

| Accumulated deficit | (507.8) | | | (528.6) | |

| Total stockholders’ equity (deficit) | 39.7 | | | (15.8) | |

| Total liabilities and stockholders' equity | $ | 526.5 | | | $ | 465.9 | |

KLX Energy Services Holdings, Inc.

Additional Selected Operating Data

(Unaudited)

Non-GAAP Financial Measures

This release includes adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) margin, adjusted diluted earnings per share, unlevered and levered free cash flow, net working capital, net debt and net leverage ratio measures. Each of the metrics are “non-GAAP financial measures” as defined in Regulation G of the Securities Exchange Act of 1934.

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA is not a measure of net earnings or cash flows as determined by GAAP. We define adjusted EBITDA as net earnings (loss) before interest, taxes, depreciation and amortization, further adjusted for (i) goodwill and/or long-lived asset impairment charges, (ii) stock-based compensation expense, (iii) restructuring charges, (iv) transaction and integration costs related to acquisitions, (v) costs incurred related to the COVID-19 pandemic and (vi) other expenses or charges to exclude certain items that we believe are not reflective of the ongoing performance of our business. Adjusted EBITDA is used to calculate the Company’s leverage ratio, consistent with the terms of the Company’s ABL Facility.

We believe adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above in arriving at adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP, or as an indicator of our operating performance or liquidity. Certain items excluded from adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of adjusted EBITDA. Our computations of adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA margin is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA margin is not a measure of net earnings or cash flows as determined by GAAP. Adjusted EBITDA margin is defined as the quotient of adjusted EBITDA and total revenue. We believe adjusted EBITDA margin is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, as a percentage of revenues.

We define adjusted net income (loss) as consolidated net income (loss) adjusted for (i) goodwill and/or long-lived asset impairment charges, (ii) restructuring charges, (iii) transaction and integration costs related to acquisitions, (iv) costs incurred related to the COVID-19 pandemic and (v) other expenses or charges to exclude certain items that we believe are not reflective of the ongoing performance of our business. We believe adjusted net income (loss) is useful because it allows us to exclude non-recurring items in evaluating our operating performance.

We define adjusted net income (loss) margin as the quotient of adjusted net income (loss) and total revenue. We believe adjusted net income (loss) margin is useful because it allows us to exclude non-recurring items in evaluating our operating performance.

We define adjusted diluted earnings per share as the quotient of adjusted net income (loss) and diluted weighted average common shares. We believe that adjusted diluted earnings per share provides useful information to investors because it allows us to exclude non-recurring items in evaluating our operating performance on a diluted per share basis.

We define unlevered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment plus interest expense. Our management uses unlevered free cash flow to assess the Company’s liquidity and ability to repay maturing debt, fund operations and make additional investments. We believe that unlevered free cash flow provides useful information to investors because it is an important indicator of the Company’s liquidity, including its ability to reduce net debt, make strategic investments and repurchase stock.

We define levered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment. Our management uses levered free cash flow to assess the Company’s liquidity and ability to repay maturing debt, fund operations and make additional investments. We believe that levered free cash flow provides useful information to investors because it is an important indicator of the Company’s liquidity, including its ability to reduce net debt, make strategic investments and repurchase stock.

Net working capital is calculated as current assets, excluding cash, less current liabilities, excluding accrued interest and finance lease obligations. We believe that net working capital provides useful information to investors because it is an important indicator of the Company’s liquidity.

We define net debt as total debt less cash and cash equivalents. We believe that net debt provides useful information to investors because it is an important indicator of the Company’s indebtedness.

We define net leverage ratio as net debt divided by quarterly annualized adjusted EBITDA or adjusted EBITDA over the last twelve months. We believe that net leverage ratio provides useful information to investors because it is an important indicator of the Company’s indebtedness in relation to its operating performance.

The following tables present a reconciliation of the non-GAAP financial measures of adjusted EBITDA and adjusted EBITDA margin to the most directly comparable GAAP financial measure for the periods indicated:

KLX Energy Services Holdings, Inc.

Reconciliation of Consolidated Net Income (Loss) to Adjusted EBITDA

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

Consolidated net income (loss)(2) | $ | 11.4 | | | $ | 9.4 | | | $ | (7.5) | |

| Income tax expense | (0.3) | | | 0.2 | | | 0.2 | |

| Interest expense, net | 8.5 | | | 9.3 | | | 8.7 | |

| Operating income | 19.6 | | | 18.9 | | | 1.4 | |

| Bargain purchase gain | 1.2 | | | (3.2) | | | — | |

| | | | | |

One-time costs(1) | 0.5 | | | 5.3 | | | 1.2 | |

| Adjusted operating income | 21.3 | | | 21.0 | | | 2.6 | |

| Depreciation and amortization | 17.6 | | | 16.5 | | | 14.0 | |

| Non-cash compensation | 0.8 | | | 0.7 | | | 0.8 | |

| Adjusted EBITDA | $ | 39.7 | | | $ | 38.2 | | | $ | 17.4 | |

*Previously announced quarterly numbers may not sum to the year-end total due to rounding.

(1) The one-time costs during the second quarter of 2023 relate to $0.3 in professional costs related to the Greene’s acquisition and $0.2 in severance.

(2) Quarterly cost of sales includes $2.1 of lease expense associated with five coiled tubing unit leases.

KLX Energy Services Holdings, Inc.

Consolidated Net Income (Loss) Margin(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Consolidated net income (loss) | $ | 11.4 | | | $ | 9.4 | | | $ | (7.5) | |

Revenue | 234.0 | | | 239.6 | | | 184.4 | |

Consolidated net income (loss) margin percentage | 4.9 | % | | 3.9 | % | | (4.1) | % |

(1) Consolidated net income (loss) margin is defined as the quotient of consolidated net income (loss) and total revenue.

KLX Energy Services Holdings, Inc.

Consolidated Adjusted EBITDA Margin(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

Adjusted EBITDA | $ | 39.7 | | | $ | 38.2 | | | $ | 17.4 | |

Revenue | 234.0 | | | 239.6 | | | 184.4 | |

Adjusted EBITDA Margin Percentage | 17.0 | % | | 15.9 | % | | 9.4 | % |

(1) Adjusted EBITDA margin is defined as the quotient of adjusted EBITDA and total revenue. Adjusted EBITDA is operating income excluding one-time costs (as defined in the Reconciliation of Consolidated Net Income (Loss) to adjusted EBITDA table above), depreciation and amortization expense, non-cash compensation expense and non-cash asset impairment expense.

Reconciliation of Rocky Mountains Operating Income to Adjusted EBITDA

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Rocky Mountains operating income | $ | 11.9 | | | $ | 9.8 | | | $ | 4.0 | |

| | | | | |

| | | | | |

One-time costs(1) | — | | | — | | | 0.1 | |

| Adjusted operating income | 11.9 | | | 9.8 | | | 4.1 | |

| Depreciation and amortization expense | 5.1 | | | 5.7 | | | 5.2 | |

| | | | | |

| Rocky Mountains adjusted EBITDA | $ | 17.0 | | | $ | 15.5 | | | $ | 9.3 | |

(1) One-time costs are defined in the Reconciliation of Consolidated Net Income (Loss) to adjusted EBITDA table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges.

Reconciliation of Southwest Operating Income to Adjusted EBITDA

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | | | |

| Southwest operating income | $ | 8.1 | | | $ | 4.8 | | | $ | 2.0 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

One-time costs(1) | — | | | — | | | (0.2) | | | | | |

| Adjusted operating income | 8.1 | | | 4.8 | | | 1.8 | | | | | |

| Depreciation and amortization expense | 6.7 | | | 5.4 | | | 4.6 | | | | | |

| | | | | | | | | |

| Southwest adjusted EBITDA | $ | 14.8 | | | $ | 10.2 | | | $ | 6.4 | | | | | |

(1) One-time costs are defined in the Reconciliation of Consolidated Net Income (Loss) to adjusted EBITDA table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges.

Reconciliation of Northeast/Mid-Con Operating Income to Adjusted EBITDA

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | | | |

| Northeast/Mid-Con operating income | $ | 12.6 | | | $ | 18.7 | | | $ | 7.3 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

One-time costs(1) | — | | | — | | | 0.1 | | | | | |

| Adjusted operating income | 12.6 | | | 18.7 | | | 7.4 | | | | | |

| Depreciation and amortization expense | 5.4 | | | 5.0 | | | 3.6 | | | | | |

| Non-cash compensation | — | | | — | | | 0.1 | | | | | |

| Northeast/Mid-Con adjusted EBITDA | $ | 18.0 | | | $ | 23.7 | | | $ | 11.1 | | | | | |

(1) One-time costs are defined in the Reconciliation of Consolidated Net Income (Loss) to adjusted EBITDA table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges.

KLX Energy Services Holdings, Inc.

Segment Operating Income Margin(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

Rocky Mountains | | | | | |

| Operating income | $ | 11.9 | | | $ | 9.8 | | | $ | 4.0 | |

| Revenue | 66.4 | | | 67.9 | | | 53.1 | |

| Segment operating income margin percentage | 17.9 | % | | 14.4 | % | | 7.5 | % |

Southwest | | | | | |

| Operating income | 8.1 | | | 4.8 | | | 2.0 | |

| Revenue | 86.3 | | | 73.4 | | | 60.0 | |

| Segment operating income margin percentage | 9.4 | % | | 6.5 | % | | 3.3 | % |

Northeast/Mid-Con | | | | | |

| Operating income | 12.6 | | | 18.7 | | | 7.3 | |

| Revenue | 81.3 | | | 98.3 | | | 71.3 | |

| Segment operating income margin percentage | 15.5 | % | | 19.0 | % | | 10.2 | % |

(1) Segment operating income margin is defined as the quotient of segment operating income and segment revenue.

KLX Energy Services Holdings, Inc.

Segment Adjusted EBITDA Margin(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

Rocky Mountains | | | | | |

Adjusted EBITDA | $ | 17.0 | | | $ | 15.5 | | | $ | 9.3 | |

Revenue | 66.4 | | | 67.9 | | | 53.1 | |

Adjusted EBITDA Margin Percentage | 25.6 | % | | 22.8 | % | | 17.5 | % |

| | | | | |

Southwest | | | | | |

Adjusted EBITDA | 14.8 | | | 10.2 | | | 6.4 | |

Revenue | 86.3 | | | 73.4 | | | 60.0 | |

Adjusted EBITDA Margin Percentage | 17.1 | % | | 13.9 | % | | 10.7 | % |

| | | | | |

Northeast/Mid-Con | | | | | |

Adjusted EBITDA | 18.0 | | | 23.7 | | | 11.1 | |

Revenue | 81.3 | | | 98.3 | | | 71.3 | |

Adjusted EBITDA Margin Percentage | 22.1 | % | | 24.1 | % | | 15.6 | % |

(1) Segment adjusted EBITDA margin is defined as the quotient of segment adjusted EBITDA and total segment revenue. Segment adjusted EBITDA is segment operating income excluding one-time costs (as defined above), non-cash compensation expense and non-cash asset impairment expense.

The following tables present a reconciliation of the non-GAAP financial measure of adjusted net income (loss), adjusted net income (loss) margin and adjusted diluted earnings per share to the most directly comparable GAAP financial measure for the periods indicated:

KLX Energy Services Holdings, Inc.

Reconciliation of Consolidated Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Diluted Earnings per Share

(In millions of U.S. dollars and shares, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

Consolidated net income (loss)(2) | $ | 11.4 | | | $ | 9.4 | | | $ | (7.5) | |

| Bargain purchase gain | 1.2 | | | (3.2) | | | — | |

| | | | | |

One-time costs(1) | 0.5 | | | 5.3 | | | 1.2 | |

| Adjusted net income (loss) | $ | 13.1 | | | $ | 11.5 | | | $ | (6.3) | |

| Diluted weighted average common shares | 16.1 | | | 14.4 | | | 11.2 | |

Adjusted diluted earnings per share(3) | $ | 0.81 | | | $ | 0.80 | | | $ | (0.56) | |

*Previously announced quarterly numbers may not sum to the year-end total due to rounding.

(1) The one-time costs during the second quarter of 2023 relate to $0.3 in professional costs related to the Greene’s acquisition and $0.2 in severance.

(2) Quarterly cost of sales includes $2.1 of lease expense associated with five coiled tubing unit leases.

(3) Adjusted diluted earnings per share is defined as the quotient of adjusted net income (loss) and diluted weighted average common shares.

KLX Energy Services Holdings, Inc.

Adjusted Net Income (Loss) Margin(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Adjusted net income (loss) | $ | 13.1 | | | $ | 11.5 | | | $ | (6.3) | |

Revenue | 234.0 | | | 239.6 | | | 184.4 | |

Adjusted net income (loss) margin percentage | 5.6 | % | | 4.8 | % | | (3.4) | % |

(1) Adjusted net income (loss) margin is defined as the quotient of adjusted net income (loss) and total revenue.

The following table presents a reconciliation of the non-GAAP financial measure of free cash flow to the most directly comparable GAAP financial measure for the periods indicated:

KLX Energy Services Holdings, Inc.

Reconciliation of Net Cash Flow Provided by (Used in) Operating Activities to Free Cash Flow

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | | | |

| Net cash flow provided by (used in) operating activities | $ | 60.0 | | | $ | (8.6) | | | $ | (8.4) | | | | | |

| Capital expenditures | (16.2) | | | (10.3) | | | (7.8) | | | | | |

| Proceeds from sale of property and equipment | 3.5 | | | 5.0 | | | 3.9 | | | | | |

| Levered free cash flow | $ | 47.3 | | | $ | (13.9) | | | $ | (12.3) | | | | | |

| Add: Interest expense | 8.5 | | | 9.3 | | | 8.7 | | | | | |

| Unlevered free cash flow | $ | 55.8 | | | $ | (4.6) | | | $ | (3.6) | | | | | |

The following table presents a reconciliation of the non-GAAP financial measure of net working capital to the most directly comparable GAAP financial measure for the periods indicated:

KLX Energy Services Holdings, Inc.

Reconciliation of Current Assets and Current Liabilities to Net Working Capital

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| As of | | |

| June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | | | | | |

| Current assets | $ | 288.5 | | | $ | 277.2 | | | $ | 254.7 | | | | | | | |

| Less: Cash | 82.1 | | | 39.6 | | | 57.4 | | | | | | | |

| Net current assets | 206.4 | | | 237.6 | | | 197.3 | | | | | | | |

| Current liabilities | 162.6 | | | 160.7 | | | 154.4 | | | | | | | |

| Less: Accrued interest | 4.7 | | | 11.7 | | | 4.8 | | | | | | | |

| Less: Operating lease obligations | 14.4 | | | 14.3 | | | 14.2 | | | | | | | |

| Less: Finance lease obligations | 13.2 | | | 12.2 | | | 10.2 | | | | | | | |

| Net current liabilities | 130.3 | | | 122.5 | | | 125.2 | | | | | | | |

| Net working capital | $ | 76.1 | | | $ | 115.1 | | | $ | 72.1 | | | | | | | |

The following table presents a reconciliation of the non-GAAP financial measure of net debt:

KLX Energy Services Holdings, Inc.

Reconciliation of Net Debt(1)

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2023 | | As of March 31, 2023 | | As of December 31, 2022 | | |

| Total Debt | $ | 283.8 | | | $ | 283.6 | | | $ | 283.4 | | | | | |

| Cash | 82.1 | | | 39.6 | | | 57.4 | | | | | |

| Net Debt | $ | 201.7 | | | $ | 244.0 | | | $ | 226.0 | | | | | |

(1) Net debt is defined as total debt less cash and cash equivalents.

The following table presents a reconciliation of the non-GAAP financial measure of net leverage ratio:

KLX Energy Services Holdings, Inc.

Reconciliation of Net Leverage Ratio(1)

(In millions of U.S. dollars)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | |

| Quarter Annualized | | Last Twelve Months | | | | |

| | As of June 30, 2023 | | As of March 31, 2023 | | Ended June 30, 2023 | | | | |

| Adjusted EBITDA | $ | 39.7 | | | $ | 38.2 | | | $ | 152.3 | | | | | |

| Multiply by four quarters | 4 | | | 4 | | | N/A | | | | |

| Annualized Adjusted EBITDA | 158.8 | | | 152.8 | | | 152.3 | | | | | |

| Net Debt | 201.7 | | | 244.0 | | | 201.7 | | | | | |

| Net Leverage Ratio | 1.3 | | | 1.6 | | | 1.3 | | | | | |

(1) Net leverage ratio is defined as net debt divided by quarterly annualized adjusted EBITDA or adjusted EBITDA over the last twelve months

v3.23.2

Cover Page

|

Aug. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity Registrant Name |

KLX ENERGY SERVICES HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38609

|

| Entity Tax Identification Number |

36-4904146

|

| Entity Address, Address Line One |

3040 Post Oak Boulevard

|

| Entity Address, Address Line Two |

15th Floor

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

832

|

| Local Phone Number |

844-1015

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

KLXE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001738827

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

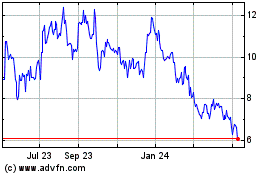

KLX Energy Services (NASDAQ:KLXE)

Historical Stock Chart

From Mar 2024 to Apr 2024

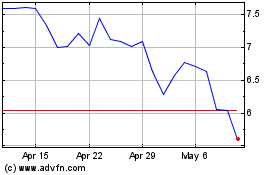

KLX Energy Services (NASDAQ:KLXE)

Historical Stock Chart

From Apr 2023 to Apr 2024