00016106822023--12-31Q2FALSE611110611110611110P4Y00016106822023-01-012023-06-3000016106822023-07-28xbrli:shares0001610682usdp:TerminallingServicesMemberus-gaap:NonrelatedPartyMember2023-04-012023-06-30iso4217:USD0001610682usdp:TerminallingServicesMemberus-gaap:NonrelatedPartyMember2022-04-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:NonrelatedPartyMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:NonrelatedPartyMember2022-01-012022-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMember2023-04-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMember2022-04-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMember2023-01-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMember2022-01-012022-06-300001610682us-gaap:NonrelatedPartyMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682us-gaap:NonrelatedPartyMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682us-gaap:NonrelatedPartyMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682us-gaap:NonrelatedPartyMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-3000016106822023-04-012023-06-3000016106822022-04-012022-06-3000016106822022-01-012022-06-300001610682usdp:SubcontractedRailServicesMember2023-04-012023-06-300001610682usdp:SubcontractedRailServicesMember2022-04-012022-06-300001610682usdp:SubcontractedRailServicesMember2023-01-012023-06-300001610682usdp:SubcontractedRailServicesMember2022-01-012022-06-300001610682usdp:PipelineFeesMember2023-04-012023-06-300001610682usdp:PipelineFeesMember2022-04-012022-06-300001610682usdp:PipelineFeesMember2023-01-012023-06-300001610682usdp:PipelineFeesMember2022-01-012022-06-300001610682usdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682usdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682usdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682usdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682us-gaap:NonrelatedPartyMember2023-04-012023-06-300001610682us-gaap:NonrelatedPartyMember2022-04-012022-06-300001610682us-gaap:NonrelatedPartyMember2023-01-012023-06-300001610682us-gaap:NonrelatedPartyMember2022-01-012022-06-300001610682srt:AffiliatedEntityMember2023-04-012023-06-300001610682srt:AffiliatedEntityMember2022-04-012022-06-300001610682srt:AffiliatedEntityMember2023-01-012023-06-300001610682srt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:CasperTerminalMember2023-04-012023-06-300001610682usdp:CasperTerminalMember2022-04-012022-06-300001610682usdp:CasperTerminalMember2023-01-012023-06-300001610682usdp:CasperTerminalMember2022-01-012022-06-300001610682usdp:CommonUnitsMember2023-04-012023-06-30iso4217:USDxbrli:shares0001610682usdp:CommonUnitsMember2022-04-012022-06-300001610682usdp:CommonUnitsMember2023-01-012023-06-300001610682usdp:CommonUnitsMember2022-01-012022-06-3000016106822022-12-3100016106822021-12-3100016106822023-06-3000016106822022-06-300001610682us-gaap:NonrelatedPartyMember2023-06-300001610682us-gaap:NonrelatedPartyMember2022-12-310001610682srt:AffiliatedEntityMember2023-06-300001610682srt:AffiliatedEntityMember2022-12-310001610682usdp:CommonUnitsMember2023-06-300001610682usdp:CommonUnitsMember2022-12-310001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2023-03-310001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2022-03-310001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2023-04-012023-06-300001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2022-04-012022-06-300001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2023-06-300001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2022-06-300001610682us-gaap:GeneralPartnerMember2023-03-310001610682us-gaap:GeneralPartnerMember2022-03-310001610682us-gaap:GeneralPartnerMember2022-04-012022-06-300001610682us-gaap:GeneralPartnerMember2023-06-300001610682us-gaap:GeneralPartnerMember2022-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2022-12-310001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2021-12-310001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2023-01-012023-06-300001610682us-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2022-01-012022-06-300001610682us-gaap:GeneralPartnerMember2022-12-310001610682us-gaap:GeneralPartnerMember2021-12-310001610682us-gaap:LimitedPartnerMember2022-01-012022-06-300001610682us-gaap:GeneralPartnerMember2023-01-012023-06-300001610682us-gaap:GeneralPartnerMember2022-01-012022-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001610682us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001610682usdp:CasperTerminalMember2023-03-310001610682us-gaap:SoftwareDevelopmentMember2023-06-300001610682usdp:HardistySouthTerminalMember2022-04-06xbrli:pure0001610682usdp:HardistySouthTerminalMember2022-04-062022-04-060001610682usdp:HardistySouthTerminalMember2022-04-012022-04-01usdp:railcarutr:bblutr:D0001610682usdp:CasperTerminalMember2023-03-312023-03-31usdp:tankutr:bbl0001610682us-gaap:GeneralPartnerMember2023-04-012023-06-3000016106822022-01-012022-03-310001610682us-gaap:PhantomShareUnitsPSUsMember2022-04-012022-06-300001610682us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-30usdp:segment0001610682country:USusdp:ThirdPartyCustomerMember2023-04-012023-06-300001610682country:CAusdp:ThirdPartyCustomerMember2023-04-012023-06-300001610682usdp:ThirdPartyCustomerMember2023-04-012023-06-300001610682country:USsrt:AffiliatedEntityMember2023-04-012023-06-300001610682country:CAsrt:AffiliatedEntityMember2023-04-012023-06-300001610682country:USusdp:ThirdPartyCustomerMember2022-04-012022-06-300001610682country:CAusdp:ThirdPartyCustomerMember2022-04-012022-06-300001610682usdp:ThirdPartyCustomerMember2022-04-012022-06-300001610682country:USsrt:AffiliatedEntityMember2022-04-012022-06-300001610682country:CAsrt:AffiliatedEntityMember2022-04-012022-06-300001610682country:USusdp:ThirdPartyCustomerMember2023-01-012023-06-300001610682country:CAusdp:ThirdPartyCustomerMember2023-01-012023-06-300001610682usdp:ThirdPartyCustomerMember2023-01-012023-06-300001610682country:USsrt:AffiliatedEntityMember2023-01-012023-06-300001610682country:CAsrt:AffiliatedEntityMember2023-01-012023-06-300001610682country:USusdp:ThirdPartyCustomerMember2022-01-012022-06-300001610682country:CAusdp:ThirdPartyCustomerMember2022-01-012022-06-300001610682usdp:ThirdPartyCustomerMember2022-01-012022-06-300001610682country:USsrt:AffiliatedEntityMember2022-01-012022-06-300001610682country:CAsrt:AffiliatedEntityMember2022-01-012022-06-3000016106822023-07-01usdp:TerminallingServicesMember2023-06-300001610682usdp:TerminallingServicesMember2024-01-012023-06-3000016106822025-01-01usdp:TerminallingServicesMember2023-06-300001610682usdp:TerminallingServicesMember2026-01-012023-06-3000016106822027-01-01usdp:TerminallingServicesMember2023-06-3000016106822028-01-01usdp:TerminallingServicesMember2023-06-300001610682usdp:TerminallingServicesMember2023-06-30iso4217:USDiso4217:CAD0001610682usdp:EstimatedBreakageAssociatedwiththeMakeuprightoptionsMember2023-06-300001610682usdp:EstimatedBreakageAssociatedwiththeMakeuprightoptionsMember2022-12-310001610682us-gaap:OtherCurrentLiabilitiesMember2022-12-310001610682us-gaap:OtherCurrentLiabilitiesMember2023-01-012023-06-300001610682us-gaap:OtherCurrentLiabilitiesMember2023-06-300001610682us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001610682us-gaap:OtherNoncurrentLiabilitiesMember2023-01-012023-06-300001610682us-gaap:OtherNoncurrentLiabilitiesMember2023-06-300001610682usdp:ThirdPartyCustomerMember2022-01-012022-12-310001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2022-12-310001610682usdp:FleetLeasesMembersrt:AffiliatedEntityMember2023-06-3000016106822023-07-01usdp:FleetServicesMember2023-06-300001610682usdp:FleetServicesMember2024-01-012023-06-3000016106822025-01-01usdp:FleetServicesMember2023-06-3000016106822026-01-01usdp:FleetServicesMember2023-06-3000016106822027-01-01usdp:FleetServicesMember2023-06-3000016106822028-01-01usdp:FleetServicesMember2023-06-3000016106822023-07-012023-06-3000016106822024-01-012023-06-3000016106822025-01-012023-06-3000016106822026-01-012023-06-3000016106822027-01-012023-06-3000016106822028-01-012023-06-300001610682usdp:CasperTerminalMember2023-06-300001610682us-gaap:LandMember2023-06-300001610682us-gaap:LandMember2022-12-310001610682us-gaap:ManufacturingFacilityMember2023-06-300001610682us-gaap:ManufacturingFacilityMember2022-12-310001610682srt:MinimumMemberus-gaap:ManufacturingFacilityMember2023-06-300001610682us-gaap:ManufacturingFacilityMembersrt:MaximumMember2023-06-300001610682us-gaap:PipelinesMember2023-06-300001610682us-gaap:PipelinesMember2022-12-310001610682srt:MinimumMemberus-gaap:PipelinesMember2023-06-300001610682srt:MaximumMemberus-gaap:PipelinesMember2023-06-300001610682us-gaap:EquipmentMember2023-06-300001610682us-gaap:EquipmentMember2022-12-310001610682srt:MinimumMemberus-gaap:EquipmentMember2023-06-300001610682us-gaap:EquipmentMembersrt:MaximumMember2023-06-300001610682us-gaap:FurnitureAndFixturesMember2023-06-300001610682us-gaap:FurnitureAndFixturesMember2022-12-310001610682srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-06-300001610682srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-06-300001610682usdp:TerminallingServicesMember2023-04-012023-06-300001610682usdp:TerminallingServicesMember2022-04-012022-06-300001610682usdp:TerminallingServicesMember2023-01-012023-06-300001610682usdp:TerminallingServicesMember2022-01-012022-06-300001610682us-gaap:CustomerRelatedIntangibleAssetsMember2023-06-300001610682us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310001610682us-gaap:OtherIntangibleAssetsMember2023-06-300001610682us-gaap:OtherIntangibleAssetsMember2022-12-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMember2021-10-012021-10-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2021-10-3100016106822022-01-012022-12-310001610682srt:ScenarioForecastMember2023-07-012023-09-3000016106822023-01-012023-03-3100016106822023-02-012023-06-300001610682usdp:CreditFacilityMember2023-01-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMember2023-01-012023-06-300001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-06-300001610682us-gaap:StandbyLettersOfCreditMemberusdp:CreditFacilityMemberus-gaap:SecuredDebtMember2023-06-300001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMemberusdp:SwinglineSubfacilityMember2023-06-300001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001610682usdp:CreditFacilityMember2023-06-300001610682usdp:CreditFacilityMember2022-12-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMember2023-06-300001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMember2022-12-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMember2022-01-012022-12-310001610682usdp:CreditFacilityMemberusdp:CovenantsMemberus-gaap:SecuredDebtMember2023-06-300001610682usdp:CreditFacilityMemberusdp:CovenantsMemberus-gaap:SecuredDebtMember2022-12-310001610682usdp:CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-06-300001610682usdp:SupplierFinancingAgreementMember2023-06-300001610682usdp:SupplierFinancingAgreementMember2022-12-310001610682us-gaap:LimitedPartnerMemberusdp:USDGMemberusdp:CommonUnitsMember2023-06-300001610682usdp:USDGMemberus-gaap:LimitedPartnerMember2023-01-012023-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2023-04-012023-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2022-04-012022-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2023-01-012023-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2022-01-012022-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2023-06-300001610682usdp:USDGMemberusdp:OmnibusAgreementMemberus-gaap:LimitedPartnerMember2022-12-310001610682usdp:USDServicesAgreementMembersrt:AffiliatedEntityMemberusdp:HardistySouthEntitiesMember2022-01-012022-06-300001610682usdp:USDServicesAgreementMembersrt:AffiliatedEntityMemberusdp:HardistySouthEntitiesMember2023-01-012023-06-300001610682usdp:USDServicesAgreementMembersrt:AffiliatedEntityMemberusdp:HardistySouthEntitiesMember2023-04-012023-06-300001610682srt:SubsidiariesMemberusdp:USDCFMemberusdp:MarketingServicesAgreementMember2021-06-012021-06-300001610682srt:SubsidiariesMemberusdp:USDMMemberusdp:MarketingServicesAgreementMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberusdp:USDMMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:TerminallingServicesMemberusdp:USDMMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:TerminallingServicesMemberusdp:USDMMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberusdp:USDMMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:USDMMemberusdp:FleetLeasesMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:USDMMemberusdp:FleetLeasesMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:USDMMemberusdp:FleetLeasesMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:USDMMemberusdp:FleetLeasesMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:USDMMemberusdp:FleetServicesMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:USDMMemberusdp:FleetServicesMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:USDMMemberusdp:FleetServicesMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:USDMMemberusdp:FleetServicesMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:USDMMemberusdp:FreightAndOtherReimbursablesMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:USDMMemberusdp:FreightAndOtherReimbursablesMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:USDMMemberusdp:FreightAndOtherReimbursablesMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:USDMMemberusdp:FreightAndOtherReimbursablesMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:USDMMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:USDMMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:USDMMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:USDMMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:LeaseRevenuesMemberusdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMember2023-06-300001610682usdp:LeaseRevenuesMemberusdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMember2022-12-310001610682usdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMember2023-06-300001610682usdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMember2022-12-310001610682usdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMemberusdp:CustomerPrepaymentsMember2023-06-300001610682usdp:TerminallingandFleetsServicesAgreementsMembersrt:AffiliatedEntityMemberusdp:CustomerPrepaymentsMember2022-12-310001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2023-04-012023-06-300001610682srt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMemberusdp:TerminallingServicesSegmentMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMember2023-04-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMemberus-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2023-04-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMemberus-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001610682us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:SubcontractedRailServicesMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:SubcontractedRailServicesMember2023-04-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:SubcontractedRailServicesMember2023-04-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:PipelineFeesMember2023-04-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:PipelineFeesMember2023-04-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:PipelineFeesMember2023-04-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2022-04-012022-06-300001610682srt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMemberusdp:TerminallingServicesSegmentMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMember2022-04-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMemberus-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2022-04-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMemberus-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001610682us-gaap:CorporateNonSegmentMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:SubcontractedRailServicesMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:SubcontractedRailServicesMember2022-04-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:SubcontractedRailServicesMember2022-04-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:PipelineFeesMember2022-04-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:PipelineFeesMember2022-04-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:PipelineFeesMember2022-04-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2023-01-012023-06-300001610682srt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMemberusdp:TerminallingServicesSegmentMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMember2023-01-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMemberus-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2023-01-012023-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMemberus-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001610682us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:SubcontractedRailServicesMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:SubcontractedRailServicesMember2023-01-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:SubcontractedRailServicesMember2023-01-012023-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:PipelineFeesMember2023-01-012023-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:PipelineFeesMember2023-01-012023-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:PipelineFeesMember2023-01-012023-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682usdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberusdp:TerminallingServicesMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682usdp:TerminallingServicesMembersrt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMember2022-01-012022-06-300001610682srt:AffiliatedEntityMemberus-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMemberusdp:TerminallingServicesSegmentMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FleetServicesMember2022-01-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FleetServicesMemberus-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:TerminallingServicesSegmentMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMembersrt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMember2022-01-012022-06-300001610682srt:AffiliatedEntityMemberusdp:FreightAndOtherReimbursablesMemberus-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001610682us-gaap:CorporateNonSegmentMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:SubcontractedRailServicesMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:SubcontractedRailServicesMember2022-01-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:SubcontractedRailServicesMember2022-01-012022-06-300001610682us-gaap:OperatingSegmentsMemberusdp:TerminallingServicesSegmentMemberusdp:PipelineFeesMember2022-01-012022-06-300001610682usdp:FleetServicesSegmentMemberus-gaap:OperatingSegmentsMemberusdp:PipelineFeesMember2022-01-012022-06-300001610682us-gaap:CorporateNonSegmentMemberusdp:PipelineFeesMember2022-01-012022-06-300001610682us-gaap:InterestRateSwapMember2022-10-012022-10-310001610682us-gaap:InterestRateSwapMember2022-10-310001610682us-gaap:OtherCurrentAssetsMember2023-06-300001610682us-gaap:OtherCurrentAssetsMember2022-12-310001610682us-gaap:ShareBasedCompensationAwardTrancheOneMemberusdp:LongTermIncentivePlanMemberus-gaap:LimitedPartnerMemberus-gaap:PhantomShareUnitsPSUsMember2023-01-012023-06-300001610682us-gaap:ShareBasedCompensationAwardTrancheOneMemberusdp:LongTermIncentivePlanMemberus-gaap:LimitedPartnerMemberusdp:CommonUnitsMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberus-gaap:PhantomShareUnitsPSUsMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberus-gaap:PhantomShareUnitsPSUsMember2023-06-300001610682us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-06-300001610682us-gaap:PhantomShareUnitsPSUsMembersrt:DirectorMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMemberusdp:DirectororIndependentConsultantMember2022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSUEquityClassifiedMember2022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-12-310001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-01-012023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2023-06-300001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2021-12-310001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-01-012022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:DirectororIndependentConsultantMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:EmployeeMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-06-300001610682usdp:LongTermIncentivePlanMemberusdp:PhantomShareUnitsPSULiabilityClassifiedMember2022-06-300001610682us-gaap:PhantomShareUnitsPSUsMember2023-04-012023-06-300001610682us-gaap:PhantomShareUnitsPSUsMember2023-06-300001610682usdp:DistributionEquivalentRightMember2023-04-012023-06-300001610682usdp:DistributionEquivalentRightMember2022-04-012022-06-300001610682usdp:DistributionEquivalentRightMember2023-01-012023-06-300001610682usdp:DistributionEquivalentRightMember2022-01-012022-06-300001610682usdp:PhantomShareUnitsPSUEquityClassifiedMember2023-04-012023-06-300001610682usdp:PhantomShareUnitsPSUEquityClassifiedMember2023-01-012023-06-300001610682usdp:PhantomShareUnitsPSUEquityClassifiedMember2022-04-012022-06-300001610682usdp:PhantomShareUnitsPSUEquityClassifiedMember2022-01-012022-06-300001610682usdp:NewOrExtendedLeaseAgreementsMember2023-06-300001610682usdp:NewOrExtendedLeaseAgreementsMember2022-06-300001610682us-gaap:GeneralPartnerMember2022-03-012022-03-310001610682us-gaap:SubsequentEventMember2023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36674

USD PARTNERS LP

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | |

| Delaware | | 30-0831007 |

(State or Other Jurisdiction of Incorporation

or Organization) | | (I.R.S. Employer

Identification No.) |

811 Main Street, Suite 2800

Houston, Texas 77002

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Telephone Number, Including Area Code): (281) 291-0510

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

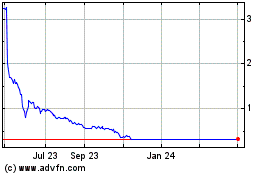

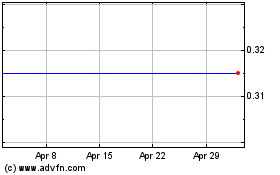

| Common Units Representing Limited Partner Interests | USDP | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 28, 2023, there were 33,758,607 common units outstanding.

Unless the context otherwise requires, all references in this Quarterly Report on Form 10-Q, or this “Report,” to “USD Partners,” “USDP,” “the Partnership,” “we,” “us,” “our,” or like terms refer to USD Partners LP and its subsidiaries.

Unless the context otherwise requires, all references in this Report to (i) “our general partner” refer to USD Partners GP LLC, a Delaware limited liability company; (ii) “USD” refers to US Development Group, LLC, a Delaware limited liability company, and where the context requires, its subsidiaries; (iii) “USDG” and “our sponsor” refer to USD Group LLC, a Delaware limited liability company and currently the sole direct subsidiary of USD; (iv) “Energy Capital Partners” refers to Energy Capital Partners III, LP and its parallel and co-investment funds and related investment vehicles; and (v) “Goldman Sachs” refers to The Goldman Sachs Group, Inc. and its affiliates.

Cautionary Note Regarding Forward-Looking Statements

This Report includes forward-looking statements, which are statements that frequently use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “projection,” “should,” “strategy,” “target,” “will” and similar words. Although we believe that such forward-looking statements are reasonable based on currently available information, such statements involve risks, uncertainties and assumptions and are not guarantees of performance. Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Any forward-looking statement made by us in this Report speaks only as of the date on which it is made, and we undertake no obligation to publicly update any forward-looking statement. Many of the factors that will determine these results are beyond our ability to control or predict. Specific factors that could cause actual results to differ from those in the forward-looking statements include: (1) our ability to continue as a going concern; (2) the impact of world health events, epidemics and pandemics, such as the novel coronavirus (COVID-19) pandemic; (3) changes in general economic conditions and commodity prices, including as a result of the invasion of Ukraine by Russia and its regional and global ramifications, inflationary pressures, slowing growth or recession or instability of financial institutions; (4) the effects of competition, in particular, by pipelines and other terminal facilities; (5) shut-downs or cutbacks at upstream production facilities, refineries or other related businesses; (6) government regulations regarding oil production, including if the Alberta Government were to resume setting production limits; (7) the supply of, and demand for, terminalling services for crude oil and biofuels; (8) the price and availability of debt and equity financing, whether through capital markets, lending or sale of assets; (9) actions by third parties, including customers, potential customers, construction-related services providers, potential transaction counterparties, our sponsors and our lenders, including with respect to rights and remedies or modifications to or waivers under our credit agreement; (10) our ability to comply with the terms under our credit agreement and to refinance, extend or replace our credit agreement on or prior to the end of the forbearance period on October 10, 2023; (11) our ability to obtain additional sources of capital, improve liquidity through strategic initiatives and maintain sufficient liquidity; (12) our ability to enter into new contracts for uncontracted capacity, to renew expiring contracts and to replace expired contracts; (13) hazards and operating risks that may not be covered fully by insurance; (14) disruptions due to equipment interruption or failure at our facilities or third-party facilities on which our business is dependent; (15) natural disasters, weather-related delays, casualty losses and other matters beyond our control; (16) changes in laws or regulations to which we are subject, including compliance with environmental and operational safety regulations, that may increase our costs or limit our operations; (17) our ability to successfully identify and finance potential acquisitions, development projects and other growth opportunities; and (18) our pursuit of and ability to develop

a plan to regain compliance with the New York Stock Exchange listing standards. For additional factors that may affect our results, see “Risk Factors” and the other information included elsewhere in this Report, our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, which are available to the public over the Internet at the website of the U.S. Securities and Exchange Commission, or SEC, (www.sec.gov) and at our website (www.usdpartners.com).

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

USD PARTNERS LP

CONSOLIDATED STATEMENTS OF OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited; in thousands of US dollars, except per unit amounts) |

| Revenues | | | | | | | |

| Terminalling services | $ | 18,364 | | | $ | 31,704 | | | $ | 38,103 | | | $ | 65,527 | |

| Terminalling services — related party | 732 | | | 662 | | | 1,446 | | | 1,317 | |

| | | | | | | |

| | | | | | | |

| Fleet leases — related party | 287 | | | 913 | | | 570 | | | 1,825 | |

| | | | | | | |

| Fleet services — related party | 86 | | | 299 | | | 171 | | | 598 | |

| Freight and other reimbursables | — | | | 163 | | | 190 | | | 260 | |

| Freight and other reimbursables — related party | 2 | | | — | | | 117 | | | — | |

| Total revenues | 19,471 | | | 33,741 | | | 40,597 | | | 69,527 | |

| Operating costs | | | | | | | |

| Subcontracted rail services | 2,323 | | | 3,604 | | | 5,608 | | | 7,595 | |

| Pipeline fees | 5,834 | | | 8,389 | | | 11,307 | | | 16,890 | |

| Freight and other reimbursables | 2 | | | 163 | | | 307 | | | 260 | |

| Operating and maintenance | 1,015 | | | 3,090 | | | 2,776 | | | 6,576 | |

| Operating and maintenance — related party | — | | | 127 | | | — | | | 258 | |

| Selling, general and administrative | 2,358 | | | 4,830 | | | 6,758 | | | 8,252 | |

| Selling, general and administrative — related party | 1,795 | | | 2,565 | | | 3,979 | | | 7,889 | |

| | | | | | | |

| Gain on sale of business | — | | | — | | | (6,202) | | | — | |

| Depreciation and amortization | 1,723 | | | 5,765 | | | 3,629 | | | 11,604 | |

| Total operating costs | 15,050 | | | 28,533 | | | 28,162 | | | 59,324 | |

| Operating income | 4,421 | | | 5,208 | | | 12,435 | | | 10,203 | |

| Interest expense | 4,479 | | | 2,097 | | | 8,920 | | | 3,599 | |

| Gain associated with derivative instruments | (4,755) | | | (812) | | | (2,905) | | | (6,896) | |

| Foreign currency transaction loss | 48 | | | 143 | | | 102 | | | 1,790 | |

| Other income, net | (82) | | | (4) | | | (116) | | | (27) | |

| Income before income taxes | 4,731 | | | 3,784 | | | 6,434 | | | 11,737 | |

| Provision for (benefit from) income taxes | 96 | | | (21) | | | (176) | | | 459 | |

| Net income | $ | 4,635 | | | $ | 3,805 | | | $ | 6,610 | | | $ | 11,278 | |

| Net income attributable to limited partner interests | $ | 4,635 | | | $ | 3,805 | | | $ | 6,610 | | | $ | 12,647 | |

| Net income per common unit (basic and diluted) | $ | 0.14 | | | $ | 0.12 | | | $ | 0.20 | | | $ | 0.42 | |

| Weighted average common units outstanding | 33,759 | | | 33,378 | | | 33,663 | | | 30,426 | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

1

USD PARTNERS LP

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited; in thousands of US dollars) |

Net income | $ | 4,635 | | | $ | 3,805 | | | $ | 6,610 | | | $ | 11,278 | |

| Other comprehensive income (loss) — foreign currency translation | 1,183 | | | (1,788) | | | 1,269 | | | (1,194) | |

Comprehensive income | $ | 5,818 | | | $ | 2,017 | | | $ | 7,879 | | | $ | 10,084 | |

The accompanying notes are an integral part of these consolidated financial statements.

2

USD PARTNERS LP

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| (unaudited; in thousands of US dollars) |

| Cash flows from operating activities: | | | |

| Net income | $ | 6,610 | | | $ | 11,278 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 3,629 | | | 11,604 | |

| Gain associated with derivative instruments | (2,905) | | | (6,896) | |

| Settlement of derivative contracts | 611 | | | (608) | |

| Unit based compensation expense | 1,912 | | | 2,520 | |

| Gain on sale of business | (6,202) | | | — | |

| Loss associated with disposal of assets | — | | | 3 | |

| Deferred income taxes | 1 | | | (114) | |

| Amortization of deferred financing costs | 658 | | | 628 | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (4) | | | 398 | |

| Accounts receivable — related party | 91 | | | 1,717 | |

| Prepaid expenses, inventory and other assets | 1,032 | | | (2,727) | |

| | | |

| Accounts payable and accrued expenses | (97) | | | 3,361 | |

| Accounts payable and accrued expenses — related party | (526) | | | (1,038) | |

| Deferred revenue and other liabilities | (6,747) | | | (5,044) | |

| Deferred revenue and other liabilities — related party | 49 | | | 366 | |

| Net cash provided by (used in) operating activities | (1,888) | | | 15,448 | |

| Cash flows from investing activities: | | | |

| Additions of property and equipment | (375) | | | (288) | |

| | | |

| Internal-use software development costs | (55) | | | — | |

| Net proceeds from the sale of business | 32,650 | | | — | |

| Acquisition of Hardisty South entities from Sponsor | — | | | (75,000) | |

| Net cash provided by (used in) investing activities | 32,220 | | | (75,288) | |

| Cash flows from financing activities: | | | |

| Distributions | (2,154) | | | (7,154) | |

| Payments for deferred financing costs | (203) | | | (13) | |

| Vested phantom units used for payment of participant taxes | (671) | | | (1,091) | |

| | | |

| Proceeds from long-term debt | — | | | 75,000 | |

| Repayments of long-term debt | (19,100) | | | (12,396) | |

| | | |

| Net cash provided by (used in) financing activities | (22,128) | | | 54,346 | |

| Effect of exchange rates on cash | 90 | | | 1,057 | |

| Net change in cash, cash equivalents and restricted cash | 8,294 | | | (4,437) | |

Cash, cash equivalents and restricted cash — beginning of period | 5,780 | | | 12,717 | |

Cash, cash equivalents and restricted cash — end of period | $ | 14,074 | | | $ | 8,280 | |

The accompanying notes are an integral part of these consolidated financial statements.

3

USD PARTNERS LP

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| (unaudited; in thousands of US dollars, except unit amounts) |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 10,291 | | | $ | 2,530 | |

| Restricted cash | 3,783 | | | 3,250 | |

| Accounts receivable, net | 1,766 | | | 2,169 | |

| Accounts receivable — related party | 318 | | | 409 | |

| Prepaid expenses | 2,566 | | | 3,188 | |

| Assets held for sale | 19,141 | | | — | |

| | | |

| Other current assets | 2,560 | | | 1,746 | |

| | | |

| Total current assets | 40,425 | | | 13,292 | |

| Property and equipment, net | 62,847 | | | 106,894 | |

| Intangible assets, net | 55 | | | 3,526 | |

| | | |

| Operating lease right-of-use assets | 1,578 | | | 1,508 | |

| Other non-current assets | 1,303 | | | 1,556 | |

| | | |

| Total assets | $ | 106,208 | | | $ | 126,776 | |

| | | |

| LIABILITIES AND PARTNERS’ CAPITAL | | | |

| Current liabilities | | | |

| Accounts payable and accrued expenses | $ | 2,852 | | | $ | 3,389 | |

| Accounts payable and accrued expenses — related party | 631 | | | 1,147 | |

| | | |

| Deferred revenue | 1,746 | | | 3,562 | |

| Deferred revenue — related party | — | | | 128 | |

| Long-term debt, current portion | 195,447 | | | 214,092 | |

| Operating lease liabilities, current | 847 | | | 700 | |

| Liabilities held for sale | 221 | | | — | |

| Other current liabilities | 3,182 | | | 7,907 | |

| Other current liabilities — related party | 55 | | | 11 | |

| Total current liabilities | 204,981 | | | 230,936 | |

| | | |

| | | |

| | | |

| | | |

| Operating lease liabilities, non-current | 702 | | | 688 | |

| Other non-current liabilities | 5,894 | | | 7,556 | |

| Other non-current liabilities — related party | 133 | | | — | |

| Total liabilities | 211,710 | | | 239,180 | |

| Commitments and contingencies | | | |

| Partners’ capital | | | |

Common units (33,758,607 and 33,381,187 outstanding at June 30, 2023 and December 31, 2022, respectively) | (102,630) | | | (108,263) | |

| | | |

| Accumulated other comprehensive loss | (2,872) | | | (4,141) | |

| Total partners’ capital | (105,502) | | | (112,404) | |

| Total liabilities and partners’ capital | $ | 106,208 | | | $ | 126,776 | |

The accompanying notes are an integral part of these consolidated financial statements.

4

USD PARTNERS LP

THREE MONTHS CONSOLIDATED STATEMENTS OF PARTNERS’ CAPITAL

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2023 | | 2022 |

| Units | | Amount | | Units | | Amount |

| (unaudited; in thousands of US dollars, except unit amounts) |

| Common units | | | | | | | |

Beginning balance at April 1, | 33,758,607 | | | $ | (108,130) | | | 27,619,909 | | | $ | 21,835 | |

| | | | | | | |

| Common units issued for vested phantom units | — | | | — | | | 8,386 | | | (39) | |

| | | | | | | |

| Net income | — | | | 4,635 | | | — | | | 3,805 | |

| Unit based compensation expense | — | | | 865 | | | — | | | 1,205 | |

| Distributions | — | | | — | | | — | | | (3,636) | |

| Acquisition of Hardisty South entities from Sponsor and conversion of General Partner units | — | | | — | | | 5,751,136 | | | (52,543) | |

Ending balance at June 30, | 33,758,607 | | | (102,630) | | | 33,379,431 | | | (29,373) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| General Partner units | | | | | | | |

Beginning balance at April 1, | — | | | — | | | 461,136 | | | 22,457 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Acquisition of Hardisty South entities from Sponsor and conversion of General Partner units | — | | | — | | | (461,136) | | | (22,457) | |

Ending balance at June 30, | — | | | — | | | — | | | — | |

| Accumulated other comprehensive income (loss) | | | | | | | |

Beginning balance at April 1, | | | (4,055) | | | | | 416 | |

| Cumulative translation adjustment | | | 1,183 | | | | | (1,788) | |

Ending balance at June 30, | | | (2,872) | | | | | (1,372) | |

Total partners’ capital at June 30, | | | $ | (105,502) | | | | | $ | (30,745) | |

The accompanying notes are an integral part of these consolidated financial statements.

5

USD PARTNERS LP

SIX MONTHS CONSOLIDATED STATEMENTS OF PARTNERS’ CAPITAL

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Units | | Amount | | Units | | Amount |

| (unaudited; in thousands of US dollars, except unit amounts) |

| Common units | | | | | | | |

| Beginning balance at January 1, | 33,381,187 | | | $ | (108,263) | | | 27,268,878 | | | $ | 16,355 | |

| | | | | | | |

| Common units issued for vested phantom units | 377,420 | | | (671) | | | 359,417 | | | (1,091) | |

| | | | | | | |

| Net income | — | | | 6,610 | | | — | | | 12,647 | |

| Unit based compensation expense | — | | | 1,848 | | | — | | | 2,354 | |

| Distributions | — | | | (2,154) | | | — | | | (7,095) | |

| Acquisition of Hardisty South entities from Sponsor and conversion of General Partner units | — | | | — | | | 5,751,136 | | | (52,543) | |

Ending balance at June 30, | 33,758,607 | | | (102,630) | | | 33,379,431 | | | (29,373) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| General Partner units | | | | | | | |

| Beginning balance at January 1, | — | | | — | | | 461,136 | | | 5,678 | |

| Non-cash contribution to Hardisty South entities from Sponsor prior to acquisition | — | | | — | | | — | | | 18,207 | |

| Net loss | — | | | — | | | — | | | (1,369) | |

| | | | | | | |

| Distributions | — | | | — | | | — | | | (59) | |

| Acquisition of Hardisty South entities from Sponsor and conversion of General Partner units | — | | | — | | | (461,136) | | | (22,457) | |

Ending balance at June 30, | — | | | — | | | — | | | — | |

| Accumulated other comprehensive income (loss) | | | | | | | |

| Beginning balance at January 1, | | | (4,141) | | | | | (178) | |

| Cumulative translation adjustment | | | 1,269 | | | | | (1,194) | |

Ending balance at June 30, | | | (2,872) | | | | | (1,372) | |

Total partners’ capital at June 30, | | | $ | (105,502) | | | | | $ | (30,745) | |

The accompanying notes are an integral part of these consolidated financial statements.

6

USD PARTNERS LP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. ORGANIZATION AND BASIS OF PRESENTATION

USD Partners LP and its consolidated subsidiaries, collectively referred to herein as we, us, our, the Partnership and USDP, is a fee-based, growth-oriented master limited partnership formed in 2014 by US Development Group, LLC, or USD, through its wholly-owned subsidiary, USD Group LLC, or USDG. We were formed to acquire, develop and operate midstream infrastructure and complementary logistics solutions for crude oil, biofuels and other energy-related products. We generate substantially all of our operating cash flows from multi-year, take-or-pay contracts with primarily investment grade and other high credit quality customers, including major integrated oil companies, refiners and marketers. Our network of crude oil terminals facilitate the transportation of heavy crude oil from Western Canada to key demand centers across North America. Our operations include railcar loading and unloading, storage and blending in onsite tanks, inbound and outbound pipeline connectivity, truck transloading, as well as other related logistics services. We also provide one of our customers with leased railcars and fleet services to facilitate the transportation of liquid hydrocarbons by rail. We do not generally take ownership of the products that we handle, nor do we receive any payments from our customers based on the value of such products.

A substantial amount of the operating cash flows related to the terminal services that we provide are generated from take-or-pay contracts with minimum monthly commitment fees and, as a result, are not directly related to actual throughput volumes at our crude oil terminals. Throughput volumes at our terminals are primarily influenced by the difference in price between Western Canadian Select, or WCS, and other grades of crude oil, commonly referred to as spreads, rather than absolute price levels. WCS spreads are influenced by several market factors, including the availability of supplies relative to the level of demand from refiners and other end users, the price and availability of alternative grades of crude oil, the availability of takeaway capacity, as well as transportation costs from supply areas to demand centers.

On March 31, 2023, we completed our divestiture of all of the equity interests in our Casper Terminal, which included the Casper Crude to Rail, LLC and CCR Pipeline, LLC entities, for approximately $33 million in cash, subject to customary adjustments. Refer to Note 3. Acquisition and Dispositions — Casper Terminal Divestiture for additional details regarding this disposition. The Casper Terminal was included in our Terminalling Services segment. Basis of Presentation

Our accompanying unaudited interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, for interim consolidated financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all the information and disclosures required by GAAP for complete consolidated financial statements.

In the opinion of our management, our unaudited interim consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments, which our management considers necessary to present fairly our financial position as of June 30, 2023, our results of operations for the three and six months ended June 30, 2023 and 2022, and our cash flows for the six months ended June 30, 2023 and 2022. We derived our consolidated balance sheet as of December 31, 2022, from the audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Our results of operations for the three and six months ended June 30, 2023 and 2022 should not be taken as indicative of the results to be expected for the full year due to fluctuations in the supply of and demand for crude oil and biofuels, timing and completion of acquisitions, if any, changes in the fair market value of our derivative instruments and the impact of fluctuations in foreign currency exchange rates. These unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and accompanying notes thereto presented in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Going Concern

We evaluate at each annual and interim period whether there are conditions or events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern within one year after the date that the consolidated financial statements are issued. Our evaluation is based on relevant conditions and events that are known and reasonably knowable at the date that the consolidated financial statements are issued. The maturity date of our Credit Agreement (as defined below) is November 2, 2023. As a result of the maturity date being within 12 months after the date that these financial statements were issued, the amounts due under our Credit Agreement have been included in our going concern assessment. Our ability to continue as a going concern is dependent on the refinancing or the extension of the maturity date of our Credit Agreement. If we are unable to refinance or extend the maturity date of our Credit Agreement, we do not currently have sufficient cash on hand or available liquidity to repay the maturing credit facility debt as it becomes due, nor do we expect cash flow from our current operations to provide sufficient funds for such repayment.

In addition, there is uncertainty in our ability to remain in compliance with the covenants contained in our amended Credit Agreement for a period of 12 months after the date these financial statements were issued. Although we continue to focus on renewing, extending or replacing expired or expiring customer agreements at the Hardisty and Stroud Terminals, based on our current expectations regarding timing of any renewals, extensions or replacement of such agreements and the related pricing environment, we currently do not expect that we will be able to remain in compliance with the total leverage ratio and interest coverage covenants in the Credit Agreement for the third quarter of 2023. If we fail to comply with such covenants in the Credit Agreement, we would be in default under the terms of the Credit Agreement, which would entitle our lenders to declare all outstanding indebtedness thereunder to be immediately due and payable. We are currently not projected to have sufficient cash on hand or available liquidity to repay the Credit Agreement should the lenders not agree to a forbearance or provide a further waiver or amendment and declare all outstanding indebtedness thereunder to be immediately due and payable. In August 2023, we entered into an amendment to our Credit Agreement, pursuant to which, among other things, the lenders have agreed to forbear through and including October 10, 2023, from exercising any rights or remedies arising from certain defaults or events of default asserted by the Administrative Agent, which we disputed, or certain prospective defaults or events of default under the Credit Agreement and other loan documents arising from, among other things, any failures to disclose certain events that give or may give rise to a Material Adverse Effect, as defined in the Credit Agreement. Refer to Note 19. Subsequent Events — Credit Agreement Amendment for more information. The conditions described above raise substantial doubt about our ability to continue as a going concern for the next 12 months.

We are currently in discussions with our lenders and other potential capital providers and pursuing plans to refinance or replace our Credit Agreement or extend and amend the current obligations under the Credit Agreement; however, we cannot make assurances that we will be successful in these efforts, or that any refinancing, extension or replacement would be on terms favorable to us. Moreover, our ability to refinance our outstanding indebtedness under, or extend the maturity date of, our Credit Agreement is expected to be negatively impacted to the extent we are unable to renew, extend or replace our customer agreements at the Hardisty and Stroud Terminals or experience further prolonged delays in doing so.

Due to the substantial doubt about our ability to continue as a going concern discussed above, as of June 30, 2023, we have recorded a valuation allowance against our deferred tax asset that is associated with our Canadian entities. These consolidated financial statements do not include any other adjustments that might result from the outcome of this uncertainty, nor do they include adjustments to reflect the possible future effects of the recoverability and classification of recorded asset amounts and classifications of liabilities that might be necessary should we be unable to continue as a going concern.

Comparative Amounts

We have made certain reclassifications to the amounts reported in the prior year to conform with the current year presentation. None of these reclassifications have an impact on our operating results, cash flows or financial position.

Foreign Currency Translation

We conduct a substantial portion of our operations in Canada, which we account for in the local currency, the Canadian dollar. We translate most Canadian dollar denominated balance sheet accounts into our reporting currency, the U.S. dollar, at the end of period exchange rate, while most accounts in our statement of operations accounts are translated into our reporting currency based on the average exchange rate for each monthly period. Fluctuations in the exchange rates between the Canadian dollar and the U.S. dollar can create variability in the amounts we translate and report in U.S. dollars.

Within these consolidated financial statements, we denote amounts denominated in Canadian dollars with “C$” immediately prior to the stated amount.

US Development Group, LLC

USD and its affiliates are engaged in designing, developing, owning and managing large-scale multi-modal logistics centers and energy-related infrastructure across North America. USD is the indirect owner of our general partner through its direct ownership of USDG and is currently owned by Energy Capital Partners, Goldman Sachs and certain of USD’s management team.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Assets Held For Sale

We classify long-lived assets intended to be sold as held for sale in the period in which all of the following criteria are met: (1) management, having the authority to approve the action, commits to a plan to sell the asset or disposal group; (2) the asset or disposal group is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets; (3) an active program to locate a buyer and other actions required to complete the plan to sell the asset or disposal group have been initiated; (4) the sale of the asset or disposal group is probable, and transfer of the asset or disposal group is expected to qualify for recognition as a completed sale within one year, except if events or circumstances beyond our control extend the period of time required to sell the asset or disposal group beyond one year; (5) the asset is being actively marketed for sale at a price that is reasonable in relation to its current fair value; and (6) actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn.

We initially measure a long-lived asset or disposal group that is classified as held for sale at the lower of carrying value or fair value less any costs to sell. Any loss resulting from this measurement is recognized in the period in which the held for sale criteria are met. Conversely, gains are not recognized on the sale of a long-lived asset or disposal group until the date of sale. We assess the fair value of a long-lived asset or disposal group less any costs to sell each reporting period it remains classified as held for sale and report any subsequent changes as an adjustment to the carrying value of the asset or disposal group, as long as the new carrying value does not exceed the carrying value of the asset at the time it was initially classified as held for sale. For the three and six months ended June 30, 2023 and 2022, there were no losses recorded on our held for sale assets.

Upon determining that a long-lived asset or disposal group meets the criteria to be classified as held for sale, we discontinue depreciation and amortization and report long-lived assets and liabilities of the disposal group in the line items “Assets held for sale” and “Liabilities held for sale” in our consolidated balance sheets.

Internal-use Software

We capitalize certain internal-use software costs in accordance with Accounting Standard Codification, or ASC, 350-40, which are included in intangible assets. ASC 350-40 requires assets to be recorded at the cost to develop the asset and requires an intangible asset to be amortized over its useful life and for the useful life to be evaluated every reporting period to determine whether events or circumstances warrant a revision to the remaining period of amortization. If the estimate of useful life is changed, the remaining carrying amount of the intangible asset is amortized prospectively over the revised remaining useful life. We currently are amortizing these assets over a useful life of five years in the line item “Depreciation and amortization” in our consolidated statement of operations. Maintenance of and minor upgrades to internal-use software are classified as selling, general, and administrative expenses as incurred.

Recently Adopted Accounting Pronouncements

Liabilities — Supplier Finance Programs (ASU 2022-04)

In September 2022, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update No. 2022-04, or ASU 2022-04, which amends Accounting Standards Codification Topic 405 to require that a buyer in a supplier finance program disclose sufficient information about the program to allow a user of financial statements to understand the program’s nature, activity during the period, changes from period to period, and potential magnitude. To achieve that objective, the buyer should disclose qualitative and quantitative information about its supplier finance programs. In each annual reporting period, the buyer should disclose the key terms of the program, including a description of the payment terms and assets pledged as security or other forms of guarantees provided for the committed payment to the finance provider or intermediary. For the obligations that the buyer has confirmed as valid to the finance provider or intermediary the amount outstanding that remains unpaid by the buyer as of the end of the annual period, a description of where those obligations are presented in the balance sheet and a rollforward of those obligations during the annual period, including the amount of obligations confirmed and the amount of obligations subsequently paid should be disclosed. In each interim reporting period, the buyer should disclose the amount of obligations outstanding that the buyer has confirmed as valid to the finance provider or intermediary as of the end of the interim period. The pronouncement is effective for fiscal years beginning after December 15, 2022 including interim periods within those fiscal years, except for the amendment on rollforward information, which is effective for fiscal years beginning after December 15, 2023. Early adoption was permitted.

We adopted all the provisions of ASU 2022-04 on January 1, 2023. Refer to Note 10. Debt for additional details regarding our adoption of ASU 2022-04. 3. ACQUISITIONS AND DISPOSITIONS

Hardisty South Terminal Acquisition

On April 6, 2022, we completed the acquisition of 100% of the entities owning the Hardisty South Terminal assets from USDG, exchanged our sponsor’s economic general partner interest in us for a non-economic general partner interest and eliminated our sponsor’s incentive distribution rights, or IDRs, for a total consideration of $75 million in cash and 5,751,136 common units representing non-cash consideration, that was made effective as of April 1, 2022. The cash portion was funded with borrowings from our Credit Agreement. The Hardisty South Terminal, which commenced operations in January 2019, primarily consists of railcar loading facilities with capacity of one and one-half 120-railcar unit trains of transloading capacity per day, or approximately 112,500 barrels per day, of takeaway capacity.

We accounted for our acquisition of the Hardisty South Terminal as a business combination under common control, whereby we recognized the acquisition of identifiable assets at historical costs and recast our prior financial statements for all periods presented.

Casper Terminal Divestiture

On March 31, 2023 we completed our divestiture of 100% of the equity interests in our Casper Terminal, which included the Casper Crude to Rail, LLC and CCR Pipeline, LLC entities, for approximately $33.0 million in cash, subject to customary adjustments.

The Casper Terminal entities had a carrying value of $26.8 million at the time of sale. The Casper Terminal was included in our Terminalling services segment. The Casper crude oil terminal, located in Casper, Wyoming, primarily consists of unit train-capable railcar loading capacity in excess of 100,000 barrels per day, six customer-dedicated storage tanks with 900,000 barrels of total capacity and a six-mile, 24-inch diameter pipeline with a direct connection from the Express Pipeline. We recognized a gain of $6.2 million from the sale of the terminal which we recorded as “Gain on sale of business” in our consolidated statement of operations. The gain on sale of business that resulted from the sale of the Casper Terminal was not subject to income tax as the entity is included within our partnership structure. Therefore, no impact was reflected within the “Provision for (benefit from) income taxes” recognized in the six months ended June 30, 2023 in our consolidated statements of operations.

In connection with our divestiture of the Casper terminal, we entered into a transition services agreement with the buyer, pursuant to which we will provide certain administrative, customer support and information technology support services to the Casper terminal for not more than three months following the closing date, while the buyer transitions such services to their management.

4. NET INCOME PER LIMITED PARTNER INTEREST

Our net income is attributed to limited partners, in accordance with their respective ownership percentages. For periods prior to the cancellation of the IDRs and conversion of the General Partner units to a non-economic General Partner interest that resulted from the acquisition of the Hardisty South entities that became effective April 1, 2022, we used the two-class method when calculating the net income per unit applicable to limited partners, because we had more than one type of participating securities. For the prior periods, the classes of participating securities included Common Units, General Partner Units and IDRs. Prior to the acquisition, our net earnings were allocated between the limited and general partners in accordance with our partnership agreement. As a result of the Hardisty South Terminal acquisition, the general partner units no longer participate in earnings or distributions, including IDRs.

We determined basic and diluted net income per limited partner unit as set forth in the following tables:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2023 |

| | Common

Units | | | | | | General

Partner

Units | | Total |

| | (in thousands, except per unit amounts) |

| Net income attributable to limited partner interests in USD Partners LP | | $ | 4,635 | | | | | | | $ | — | | | $ | 4,635 | |

Less: Distributable earnings (1) | | — | | | | | | | — | | | — | |

| Excess net income | | $ | 4,635 | | | | | | | $ | — | | | $ | 4,635 | |

Weighted average units outstanding (2) | | 33,759 | | | | | | | — | | | 33,759 | |

Distributable earnings per unit (3) | | $ | — | | | | | | | | | |

Underdistributed earnings per unit (4) | | 0.14 | | | | | | | | | |

Net income per limited partner unit (basic and diluted) (5) | | $ | 0.14 | | | | | | | | | |

(1) There were no distributions payable for the three months ended June 30, 2023. Refer to Note 16. Partners’ Capital for further information. (2) Represents the weighted average units outstanding for the period.

(3) Represents the total distributable earnings divided by the weighted average number of units outstanding for the period.

(4) Represents the additional amount per unit necessary to distribute the excess net income for the period among our limited partners.