As filed with the Securities and Exchange Commission

on July 18, 2023

Registration No. 333-261888

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

POST-EFFECTIVE AMENDMENT NO. 3

TO

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

SORRENTO THERAPEUTICS, INC.

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction of incorporation

or organization)

33-0344842

(I.R.S. Employer Identification No.)

4955 Directors Place

San Diego, CA 92121

(858) 203-4100

(Address, including zip code, and telephone

number,

including area code, of registrant’s

principal executive offices)

Dr. Henry Ji

Chairman of the Board of Directors, President

and Chief Executive Officer

Sorrento Therapeutics, Inc.

4955 Directors Place

San Diego, CA 92121

(858) 203-4100

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copies to:

Jeffrey T. Hartlin, Esq.

Samantha H. Eldredge, Esq.

Paul Hastings LLP

1117 S. California Avenue

Palo Alto, CA 94304

(650) 320-1804 |

Approximate date of commencement of proposed

sale to the public:

From time to time after the effective date of

this registration statement

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ¨

If any of the securities

being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer x |

Accelerated

filer ¨ |

Non-accelerated

filer ¨ |

Smaller

reporting company ¨ |

Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file

a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting

pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment

No. 3 to the Registration Statement on Form S-3 (Commission File No. 333-261888) (the “Registration Statement”)

of Sorrento Therapeutics, Inc. (the “Registrant”) is being filed because the Registrant no longer qualifies as a well-known

seasoned issuer (as such term is defined in Rule 405 of the Securities Act) upon the filing of its Annual Report on Form 10-K

for the fiscal year ended December 31, 2022. This Post-Effective Amendment No. 3 adds disclosure to the Registration Statement

required for a registrant other than a well-known seasoned issuer, makes certain other amendments and is being filed using EDGAR submission

type POS AM to convert the Registration Statement to the proper EDGAR submission type for a non-automatic shelf registration statement.

This Post-Effective Amendment No. 3 contains:

| |

· |

A base

prospectus, which covers the offering, issuance and sale by us of up to $3,832,831,691 of the securities identified therein from

time to time in one or more offerings; and |

| |

· |

A sales

agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $3,000,000,000

of our common stock that may be issued and sold under an Amended and Restated Sales Agreement, as amended, with H.C. Wainwright &

Co., LLC (the “Sales Agreement”). |

The base prospectus immediately

follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in

a prospectus supplement to the base prospectus. The sales agreement prospectus immediately follows the base prospectus.

The $3,000,000,000 of our

common stock that may be offered, issued and sold under the sales agreement prospectus is included in the $3,832,831,691 of securities

that may be offered, issued and sold by us under the base prospectus.

Upon termination of the Sales

Agreement, any portion of the $3,000,000,000 included in the sales agreement prospectus that is not sold pursuant to the Sales Agreement

will be available for sale in other offerings pursuant to the base prospectus and a corresponding prospectus supplement, and if no shares

are sold under the Sales Agreement, the full $3,000,000,000 securities may be sold in other offerings pursuant to the base prospectus

and a corresponding prospectus supplement.

As previously disclosed,

on February 13, 2023, we and our wholly owned direct subsidiary, Scintilla Pharmaceuticals, Inc. (together, the “Debtors”),

filed voluntary petitions seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in

the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Chapter 11 proceedings

are jointly administered by the Bankruptcy Court under the caption In re Sorrento Therapeutics, Inc., et al. (Case No. 23-90085)

(the “Chapter 11 Cases”). For the duration of our Chapter 11 Cases, our operations and our ability to develop and execute

our business plan, our financial condition, our liquidity and our continuation as a going concern are subject to a high degree of risk

and uncertainty associated with our Chapter 11 Cases. The outcome of the Chapter 11 Cases is dependent upon factors that are outside

of our control, including actions of the Bankruptcy Court. These risks and uncertainties could affect our business and operations in

various ways. For example, negative events or publicity associated with our Chapter 11 Cases could adversely affect our relationships

with our suppliers, service providers, customers, employees and other third parties, which in turn could adversely affect our operations

and financial condition. Any trading in our securities during the pendency of our Chapter 11 Cases is highly speculative and poses substantial

risks to purchasers of our securities, as the price of our securities may decrease in value or become worthless. Recoveries in the Chapter

11 Cases for holders of our securities, if any, will depend upon, among other things, our ability to confirm and consummate a plan of

reorganization with respect to the Chapter 11 Cases and the value of our assets. Although we cannot predict how our securities will be

treated under a plan, we expect that holders of all or some of our securities would not receive a recovery through any plan unless the

holders of more senior claims and interests, such as secured and unsecured indebtedness, are paid in full. Consequently, there is a risk

that the holders of our securities will receive no recovery under the Chapter 11 Cases and that our securities will be worthless. In

general, for so long as the Chapter 11 Cases are ongoing, we are required to obtain the approval of the Bankruptcy Court prior to engaging

in activities or transactions outside the ordinary course of business. As a result, we must first obtain Bankruptcy Court approval prior

to any offer and sale of our securities pursuant to this Registration Statement, including any prospectus herein and any prospectus supplement

thereto. See “Risk Factors” beginning on page 6 of the base prospectus and page S-9 of the sales agreement prospectus for

a further discussion of certain of the risks and uncertainties associated with the Chapter 11 Cases.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the U.S. Bankruptcy Court administering

the case under chapter 11 of title 11 of Sorrento Therapeutics, Inc., which is hereinafter

described, gives us approval to do so and the U.S. Securities and Exchange Commission declares our

registration statement effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these

securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

JULY 18, 2023

PROSPECTUS

Sorrento Therapeutics, Inc.

$3,832,831,691

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We

may offer and sell up to $3,832,831,691 in the aggregate of securities identified above from time to time in one or more offerings, either

individually or in combination with other securities. We may also offer common stock or preferred stock upon conversion of debt securities,

common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants. This

prospectus provides you with a general description of the securities that we may offer. Because we are in the process of a reorganization

under chapter 11 of title 11 of the United States Code, the offer and sale of any securities described in this prospectus and any prospectus

supplement must first be approved by the United States Bankruptcy Court for the Southern District of Texas, where our chapter 11 proceeding

is pending.

Each

time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering

and the amounts, prices and terms of the securities. We may also authorize one or more free writing prospectuses to be provided to you

in connection with these offerings. The prospectus, prospectus supplement and any related free writing prospectuses may also add, update

or change information contained or incorporated by reference in this prospectus with respect to that offering. You should carefully read

this prospectus and the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated

by reference, before you invest in any of our securities.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading

“Risk Factors” beginning on page 6 of this prospectus, any applicable prospectus supplement and in any applicable free

writing prospectuses, and under similar headings in the documents that are incorporated by reference into this prospectus.

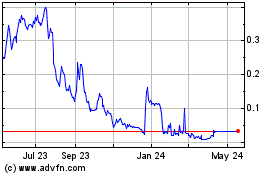

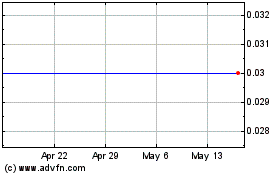

Our

common stock is currently quoted on the Pink Open Market under the symbol “SRNEQ”. On July 17, 2023, the last reported sale

price for our common stock was $0.365 per share. The applicable prospectus supplement will contain information, where applicable, as to

any other quotation on the Pink Open Market or listing on any securities market or other exchange of the securities, if any, covered

by the applicable prospectus supplement.

Our Chapter 11 process

has caused and may continue to cause our common stock and other securities to decrease in value, and may eventually render our common

stock or other securities worthless.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. We urge you to read the entire

prospectus, any amendments or supplements, any free writing prospectuses, and any documents incorporated by reference carefully before

you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Whenever we refer to “Sorrento,”

“we,” “our” or “us” in this prospectus, we mean Sorrento Therapeutics, Inc. and its consolidated

subsidiaries, unless the context suggests otherwise. When we refer to “you” or “yours,” we mean the holders of

the applicable series of securities.

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration

process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or

more offerings up to a total amount of $3,832,831,691. This prospectus provides you with a general description of the securities we may

offer. Each time we offer to sell securities under this prospectus, we will provide a prospectus supplement that will contain specific

information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this

prospectus. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus,

the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. You should read

both this prospectus and any prospectus supplement and any free writing prospectus prepared by or on behalf of us, together with the

additional information described under the heading “Where You Can Find More Information.”

You should rely only on the

information contained in this prospectus, in an accompanying prospectus supplement or incorporated by reference herein or therein. We

have not authorized anyone to provide you with information or make any representation that is different. If anyone provides you with

different or inconsistent information, you should not rely on it. This prospectus and any accompanying prospectus supplement do not constitute

an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and this

prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or solicitation. You should not assume that

the information contained in this prospectus and any accompanying prospectus supplement is correct on any date after the respective dates

of the prospectus and such prospectus supplement or supplements, as applicable, even though this prospectus and such prospectus supplement

or supplements are delivered or securities are sold pursuant to the prospectus and such prospectus supplement or supplements at a later

date. Since the respective dates of the prospectus contained in this registration statement and any accompanying prospectus supplement,

our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

We may only sell securities pursuant to this prospectus if this prospectus is accompanied by a prospectus supplement.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the

purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

There must be a current

state blue sky registration or exemption from such registration for you to purchase or sell these securities as our common stock is currently

quoted on the Pink Open Market.

Each state has its own securities

laws, often called “blue sky” laws, which (i) limit sales of securities to a state’s residents unless the securities

are registered in that state or qualify for an exemption from registration, and (ii) govern the reporting requirements for broker-dealers

doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover

the transaction, or the transaction must be exempt from registration. The applicable broker of such transaction must also be registered

in that state. Since our common stock is currently quoted on the Pink Open Market, a determination regarding registration will be made

by those broker-dealers, if any, who agree to serve as the market-makers for our common stock.

We cannot guarantee that

we will be able to effect any required blue sky registrations or qualifications. You will have the ability to purchase these securities

only if such securities have been qualified for sale under the laws of the state where the offer and sale is to occur, or if they fall

within an exemption from registration. We will not knowingly sell any securities to purchasers in jurisdictions in which such sales are

not registered or otherwise qualified for issuance or exempt from registration. As a result, there may be significant state blue sky

law restrictions on the ability of investors to sell, and on purchasers to buy, our securities.

SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all

of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, any

applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities discussed

under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any related free

writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should

also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits

to the registration statement of which this prospectus forms a part. Unless otherwise mentioned or unless the context requires otherwise,

all references in this prospectus to “Sorrento”, “the Company”, “we”, “us”, “our”

or similar references mean Sorrento Therapeutics, Inc. together with its consolidated subsidiaries.

Sorrento Therapeutics, Inc.

Overview

Sorrento Therapeutics, Inc.

(together with its subsidiaries, “Sorrento”, the “Company”, “we”, “us” and “our”)

is a clinical and commercial stage biopharmaceutical company developing a portfolio of next-generation treatments for three major therapeutic

areas: cancer, infectious disease and pain. We are focused on transforming science into Saving Life Medicines™ by advancing innovative

product programs into focused commercial entities, like Scilex Holding Company (Nasdaq: SCLX) (“Scilex Holding”). As of March

31, 2023, we held approximately 42.5% of the outstanding voting common stock of Scilex Holding, and our total ownership interest in total

Scilex Holding’s common stock (assuming conversion of Scilex Holding Series A preferred stock into common stock) was 52.06%.

Cancer.

Our proprietary fully human G-MAB™ antibody library and ACEA small molecule library are the engines driving an innovative

pipeline of new solutions for cancer. These molecular entities are then enhanced by leveraging our extensive proprietary immuno-oncology

platforms such as immuno-cellular therapies (“DAR-T™”), antibody-drug conjugates (“ADCs”), oncolytic virus

(“Seprehvec™”) and lymphatic drug delivery (“Sofusa™”).

Infectious

Disease. We are focused on preventing, detecting and treating in the fight against COVID-19 today, and aim to be positioned

to address the pandemic threats of tomorrow. We have applied our antibody and small molecule capability to develop highly sensitive and

rapid diagnostics, and multi-modal treatments for the SARS-CoV-2 virus and its variants.

Our diagnostics platforms

include the COVIMARK™ lateral flow antigen test (launched as COVISTIX™ in Mexico and Brazil) and the VIREX™ platform,

which leverages existing worldwide manufacturing infrastructure for glucometers and glucose strip tests to provide affordable and highly

scalable, next-generation diagnostic solutions for infectious diseases, liver cancer and other biomarkers. Therapeutic solutions include

a next-generation mRNA Omicron vaccine (STI-1557), a next-generation protease inhibitor

antiviral pill (STI-1558) as a stand-alone treatment (not requiring the Ritonavir booster) and a variant agnostic mesenchymal stromal

cell therapy for people with “long” COVID. We also continue to evaluate neutralizing antibody approaches effective against

emerging variants of concern.

Pain.

In November 2022, we announced the Nasdaq debut of Scilex Holding following the completion of its business combination

with Vickers Vantage Corp. I, a special purpose acquisition company. Scilex Holding, with two commercial products and a robust pipeline,

is focused on becoming the global pain management leader committed to social, environmental, economic and ethical principles to responsibly

develop pharmaceutical products to maximize quality of life. Scilex Holding is an innovative revenue-generating company with its flagship

product, ZTlido®, launched in October 2018 as a prescription lidocaine topical product, which has demonstrated superior adhesion

and bioavailability compared to current lidocaine patches. In 2022, Scilex Holding also entered into an exclusive agreement with Romeg

Therapeutics, LLC to market and distribute U.S. Food and Drug Administration (the “FDA”)-approved Gloperba® in the U.S.

for painful gout flares. Scilex Holding has built a commercial organization focused on neurologists and pain specialists and intends

to leverage this capability for the potential launch of next-generation products that are currently in development. The first of these

product candidates, SEMDEXA™, is an injectable viscous gel formulation of a widely used corticosteroid designed to address the

limitations associated with off label corticosteroid epidural injections. SEMDEXA™ has completed its pivotal study and Scilex Holding

is preparing for its new drug application submission.

We are also developing Resiniferatoxin

(“RTX”), a naturally occurring non-opioid ultra-potent transient receptor potential vanilloid-1 agonist. When injected peripherally,

a sustained desensitization occurs, resulting in reduction of noxious chronic pain symptoms that can last for months. RTX has the potential

to be a multi-indication franchise asset and is nearing pivotal studies in intractable pain associated with cancer and moderate to severe

knee osteoarthritis pain.

Voluntary Filing Under Chapter 11

As previously reported in

our Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 13,

2023, we and our wholly owned direct subsidiary, Scintilla Pharmaceuticals, Inc. (together with us, the “Debtors”),

commenced voluntary proceedings under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United

States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Chapter 11 proceedings are jointly

administered by the Bankruptcy Court under the caption In re Sorrento Therapeutics, Inc., et al. (the “Chapter 11 Cases”).

We continue to operate our business in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy

Court.

Chapter 11 is the principal

business reorganization chapter of the Bankruptcy Code. Under Chapter 11, a debtor is authorized to reorganize its business for the benefit

of itself, its creditors and its equity security holders, which includes a debtor’s shareholders. The goal of the Chapter 11 bankruptcy

process is to provide a breathing spell to the company so that it can address its debts in a controlled, organized and central forum

without disruption from creditors or other stakeholders. Another goal of Chapter 11 is to promote equality of treatment for similarly

situated creditors and equality of treatment for similarly situated equity security holders, in each case, with respect to the distribution

of a debtor’s value or assets.

The commencement of a Chapter

11 case creates an estate that is comprised of all of the legal and equitable interests of the debtor as of the filing date. The Bankruptcy

Code generally provides that the debtor may continue to operate its business in the ordinary course and remain in possession of its property

as a “debtor in possession.”

The Chapter 11 bankruptcy

process typically concludes with a sale of the company or a plan of reorganization, which sets forth the means for satisfying claims

against and equity interests in a debtor. Confirmation and consummation of a plan of reorganization by the bankruptcy court makes the

plan binding upon the debtor, any issuer of securities under the plan, any person or entity acquiring property under the plan and any

creditor of, or equity security holder in, the debtor, whether or not such creditor or equity security holder (i) is impaired under or

has accepted the plan or (ii) receives or retains any property under the plan. Subject to certain limited exceptions and other than as

provided in the plan itself or the order of the bankruptcy court approving the plan (a “confirmation order”), the confirmation

order discharges the debtor from any debt that arose prior to the date of confirmation of the plan and substitutes therefore the obligations

specified under the confirmed plan, and terminates all rights and interests of existing equity security holders.

Equity

securities in a debtor are subject to a high risk of being cancelled through a Chapter 11 plan of reorganization without receiving any

consideration or otherwise receiving any value. The reason for this high risk of cancellation is because equity securities in a debtor

generally sit last in line of priority in bankruptcy. This is referred to as the “absolute priority rule.” Under the absolute

priority rule, unless holders of more senior claims otherwise agree, holders of equity securities are generally precluded from receiving

any value unless and until holders of allowed claims or interests senior to them are paid in full; there are, however, circumstances

where this is not the case.

Debtors

often need funding to cover ongoing operating expenses and the expenses of a Chapter 11 case. It is common for a debtor to meet such

need through a debtor-in-possession (“DIP”) loan. A DIP loan often takes the form of a new secured debt facility that has

priority over pre-bankruptcy secured and unsecured creditors and a claim with super-priority over administrative expenses (including

vendor and employee claims) incurred during the Chapter 11 case and over all other claims. While a DIP loan offers the benefit of a source

of funding that is well-established in the market and under the Bankruptcy Code, its priority over other claims reduces the recovery

available to other junior creditors and interest holders, including equity security holders. Additionally, it is common for a DIP loan

to contain certain, sometimes significant, restrictions on the ability of the debtor to operate its business during bankruptcy.

It

is not common for a debtor to seek equity financing during a bankruptcy case. Investing in the equity securities of any company, including

the Company, while it is in bankruptcy involves significant risks, as the equity financing would have a lower priority of repayment and

may ultimately be worthless. On the other hand, equity financing, unlike a DIP loan, does not impose restrictions on a debtor’s

operations and does not take priority over other creditors and equity security holders, thereby potentially improving the possibility

that equity security holders could receive a recovery in a plan of reorganization, as compared to raising financing through a DIP loan

that would be senior to any equity securities in the Debtors. And just like outside of Chapter 11, an equity investment can provide for

more potential upside for the investor, as compared to debt financing (which is limited to repayment of principal and interest).

Below

is additional information regarding certain details related to the Chapter 11 Cases. Additional information about the Chapter 11 Cases,

including access to documents filed with the Bankruptcy Court (the “Bankruptcy Docket”), is available online at https://cases.stretto.com/sorrento,

a website administered by Stretto, a third-party bankruptcy claims and noticing agent. The information on that website is not incorporated

by reference into, and does not constitute part of, this registration statement. For a full description of the Chapter 11 Cases and the

proceedings therein, you may review the Bankruptcy Docket.

Arbitration

Prior to commencing the Chapter

11 Cases, we had been engaged in arbitration before the American Arbitration Association against NantPharma, LLC (“NantPharma”)

relating to breaches of the May 14, 2015 Stock Sale and Purchase Agreement entered into between us and NantPharma related to the

development of the cancer drug Cynviloq™ (the “Cynviloq Arbitration”). In April 2019, we filed an action in the

Los Angeles Superior Court (the “Court”) derivatively on behalf of Immunotherapy NANTibody LLC (“NANTibody”)

against NantCell, Inc. (“NantCell”) and Patrick Soon-Shiong, among others, related to alleged breaches of the June 11,

2015 Limited Liability Company Agreement for NANTibody entered into between us and NantCell (the “Derivative Action”). The

suit alleges breaches of fiduciary duties and seeks, among other things, a declaration that the Assignment Agreement entered into on

July 2, 2017, between NantPharma and NANTibody is void and an equitable unwinding of the Assignment Agreement. The suit calls for

the restoration of $90.05 million to the NANTibody capital account, thereby restoring our equity method investment in NANTibody to our

invested amount as of June 30, 2017 of $40.0 million.

Additionally, in 2020, we

filed a legal action against Patrick Soon-Shiong in the Court, asserting claims for fraudulent inducement and common law fraud alleging

that, among other things, Dr. Soon-Shiong acquired the drug Cynviloq for the purpose of halting its progression to the market. This

action is pending.

We had also been engaged

in arbitration before the American Arbitration Association against NantCell and NANTibody relating to alleged breaches of the April 21,

2015 Exclusive License Agreement entered into between us and NantCell and the June 11, 2015 Exclusive License Agreement entered

into between us and NANTibody (the “NantCell/NANTibody Arbitration”).

On December 2, 2022,

the arbitrator in the NantCell/NANTibody Arbitration issued an award granting contractual damages and pre-award interest in the amounts

of $156,829,562 to NantCell and $16,681,521 to NANTibody, exclusive of post-award, prejudgment interest, which will accrue at 9% per

annum (the “Nant Award”). On December 20, 2022, the arbitrator in the Cynviloq Arbitration issued an award granting

contractual damages of $125 million to us, reflecting the value of lost milestone payments for the approval of Cynviloq for the treatment

of breast and lung cancers (the “Cynviloq Award”).

On February 7, 2023,

the Court confirmed the Nant Award and issued a 70-day stay of enforcement of the judgment beyond $50 million (i.e., the difference between

the amount of the Nant Award and amount of the Cynviloq Award). Following such confirmation, we believed that NantCell and NANTibody,

in an attempt to satisfy the unstayed $50 million portion of the Nant Award, would imminently take steps to levy our assets, which would

cause significant disruption and harm to our business, including our ability to continue developing life-saving and cutting-edge drugs.

To protect our business and maximize its value, on February 13, 2023, we commenced the Chapter 11 Cases.

On March 16, 2023, the

Court granted our motion to confirm the award in the Cynviloq Arbitration over NantPharma’s opposition. On April 7, 2023,

the Court entered final judgment (“Final Judgment”) upon the confirmed award in our favor in the amount of $127,686,210,

which includes arbitration costs and accrued interest on the award since December 20, 2022. The Final Judgment is accruing interest

at the rate of 10 percent per annum, from March 16, 2023.

Mediation Settlement

Following mediation in

the Chapter 11 Cases, Sorrento reached a settlement with NantPharma, NantCell, and NANTibody (along with their related parties) (collectively,

the “Nant Parties”) regarding the Nant Award, the Cynviloq Award, and other legal causes of action (the “Nant Settlement”)—subject

to Bankruptcy Court approval. Under the settlement, either (i) Sorrento will pay NantCell and NANTIbody in full in cash by August 31,

2023 to satisfy the Nant Award (the “Nant Settlement Payment”) and Sorrento and the Nant Parties will retain all their other

respective causes of action, joint venture interests, and royalty rights, or (ii) if Sorrento does not make the Nant Settlement Payment,

then Sorrento and the Nant Parties will mutually release each other from any and all claims, Sorrento will transfer its joint venture

interests in certain Nant Parties to the Nant Parties, and Sorrento will receive $1.5 million from the Nant Parties in exchange for a

release of Sorrento’s royalty rights to PD-L1 (and address certain rights and obligations related thereto). In the interim, Sorrento

and the Nant Parties have agreed to stay all litigation matters until August 31, 2023. A hearing for the Bankruptcy Court to consider

approval of the settlement is currently expected for August 2023.

Even if the Company successfully

reorganizes through a chapter 11 plan of reorganization, pending litigation brought by the Company against other parties would generally

continue after the Chapter 11 Cases, unless specifically released by the Company (including the potential release of claims described

above).

Senior Debtor-in-Possession Financing

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on February 22, 2023 (the “February 22 Form 8-K”),

on February 19, 2023, the Debtors executed that certain Debtor-In-Possession Term Loan Facility Summary of Terms and Conditions

(the “Senior DIP Term Sheet”) with JMB Capital Partners Lending, LLC (“JMB Capital” or the “Senior DIP

Lender”), pursuant to which JMB Capital (or its designees or its assignees) provided the Debtors with a non-amortizing super-priority

senior secured term loan facility in an aggregate principal amount not to exceed $75,000,000 in term loan commitments (the “Senior

DIP Facility”), subject to the terms and conditions set forth in the Senior DIP Term Sheet.

As previously disclosed in

the February 22 Form 8-K, at a hearing before the Bankruptcy Court on February 21, 2023, the Bankruptcy Court entered

an interim order (the “Interim Senior DIP Order”) approving the Senior DIP Facility on an interim basis and providing the

Debtors with the necessary liquidity to continue to operate during the Chapter 11 process. Upon entry of the Interim Senior DIP Order and satisfaction

of all applicable conditions precedent, as set forth in the Senior DIP Term Sheet, the Debtors were authorized to make a single, initial

draw of $30,000,000 on the Senior DIP Facility (the “Initial Draw”). The Debtors then negotiated definitive financing documentation,

including a Senior Secured, Super-Priority Debtor-in-Possession Loan and Security Agreement (the “Senior DIP Credit Agreement”)

and other documents evidencing the Senior DIP Facility (collectively with the Senior DIP Credit Agreement, the “Senior DIP Documents”).

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on March 31, 2023, after a hearing before the Bankruptcy Court on March 29,

2023, the Bankruptcy Court entered a final order (the “Final Senior DIP Order”) approving the Senior DIP Facility on a final

basis and providing the Debtors with access to the remaining $45,000,000 of the Senior DIP Facility (subject to the terms, conditions,

and covenants set forth in the Senior DIP Documents), through additional draws of no less than $5,000,000, each upon five business days’

written notice to the Senior DIP Lender, and the Debtors and Senior DIP Lender proceeded to enter into the Senior DIP Documents on March 30,

2023. Among other terms, the Senior DIP Facility bears interest at a per annum rate equal to 14% payable in cash on the first day of

each month in arrears (and a default interest rate that shall accrue at an additional per annum rate of 3% plus the non-default interest,

payable in cash on the first day of each month). The Debtors are required to pay to the Senior DIP Lender a commitment fee equal to 2.5%

of the total amount of the DIP Commitment (which was paid out of the Initial Draw), a funding fee equal to 2.5% of the amount of each

draw and upon repayment or satisfaction of the DIP Loans (in whole or in part), an exit fee equal to 7% of the total amount of the DIP

Commitments and other fees and charges as described in the Senior DIP Documents. The Senior DIP Facility is secured by first-priority

liens on substantially all of the Debtors’ unencumbered assets, subject to certain enumerated exceptions, and second-priority liens

on those assets of the Debtors that are encumbered by certain permitted liens (as set forth in the Final Senior DIP Order).

The Senior DIP Facility matures

on the earliest of: (i) July 31, 2023; (ii) the effective date of any chapter 11 plan of reorganization with respect to

the Debtors; (iii) the consummation of any sale or other disposition of all or substantially all of the assets of the Debtors pursuant

to section 363 of the Bankruptcy Code; (iv) the date of the acceleration of the DIP Loans and the termination of the DIP Commitments

in accordance with the Senior DIP Documents (each as defined in the Senior DIP Term Sheet); and (v) the dismissal of the Chapter

11 Cases or conversion of the Chapter 11 Cases into cases under chapter 7 of the Bankruptcy Code. The Senior DIP Facility does not contain

a roll-up or cross-collateralization of prepetition debt or otherwise dictate how prepetition claims will be addressed in a chapter 11

plan.

As

of March 31, 2023, the total outstanding principal balance on the Senior DIP Facility was

$30.0 million. Upon receipt of the Initial Draw, we recorded certain lender fees as described

above of $7.9 million. We also recorded $0.4 million in interest expense relating to the

per annum rate equal to 14% payable in cash during the three months ended March 31, 2023.

Subsequent to March 31, 2023, we received additional draws from the Senior DIP Facility in

the aggregate amount of $45.0 million.

However, for the duration

of our Chapter 11 Cases, our operations and our ability to develop and execute our business plan, our financial condition, our liquidity

and our continuation as a going concern are subject to a high degree of risk and uncertainty associated with our Chapter 11 Cases. The

outcome of the Chapter 11 Cases is dependent upon factors that are outside of our control, including actions of the Bankruptcy Court.

Junior Debtor-in-Possession Financing

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on July 10, 2023, after a hearing before the Bankruptcy Court, the Bankruptcy Court

entered an interim order (the “Interim Junior DIP Order”) approving the Junior DIP Facility (as defined below) on an interim

basis and providing Sorrento with the necessary liquidity to continue to operate during the Chapter 11 process. Upon entry of the Interim Junior DIP

Order and satisfaction of all applicable conditions precedent, as set forth in the Junior DIP Term Sheet, Sorrento was authorized to

make (and did make) a single draw of the Junior DIP Facility (the “Draw”), which is subject to a certain intercreditor and

subordination agreement entered into by and among the Senior DIP Lender and the Junior DIP Lender (the “Subordination Agreement”).

Other definitive financing documentation, including a credit agreement, will be negotiated and executed as soon as possible following

the Draw on the Junior DIP Facility, by no later than the earlier of (i) 15 business days from the entry of the Interim DIP Order, and

(ii) entry of the Final Junior DIP Order (as defined below).

On July 5, 2023, Sorrento

executed that certain Debtor-in-Possession Term Loan Facility Summary of Terms and Conditions (the “Junior DIP Term Sheet”)

with its subsidiary Scilex Holding Company (“Scilex” or the “Junior DIP Lender”), pursuant to which Scilex (or

its designees or its assignees) has provided Sorrento with a non-amortizing super-priority junior secured term loan facility in an aggregate

principal amount not to exceed the sum of (i) $20,000,000 (the “Base Amount”), plus (ii) the amount of the commitment fee

and the funding fee, each equal to 1% of the Base Amount, plus (iii) the amount of the DIP Lender Holdback (as defined in the Interim

Junior DIP Order) (the “Junior DIP Facility” and together with the Senior DIP Facility, the “DIP Facilities”),

subject to the terms and conditions set forth in the Junior DIP Term Sheet. The Junior DIP Term Sheet grants to Scilex a right of first

refusal to provide any debtor-in-possession financing during the course of the Chapter 11 Cases to Sorrento occurring after the date

of the Interim Junior DIP Order until the Chapter 11 Cases are concluded. In connection with the Junior DIP Term Sheet, Scilex entered

into the Subordination Agreement with the Senior DIP Lender, which specifies that the Junior DIP Facility is subordinated in right of

payment to the Senior DIP Facility as more fully set forth therein.

The Junior DIP Facility will

bear interest at a per annum rate of 12.00% payable in kind on the first day of each month in arrears and on the DIP Termination Date

(as defined in the Junior DIP Term Sheet). Upon the occurrence and during the continuance of an event of default as defined in the Junior

DIP Term Sheet, the interest rate on outstanding DIP Loans (as defined in the Junior DIP Term Sheet) would increase by 2.00% per annum.

The commitment fee and the funding fee described above shall be payable upon the funding of the DIP Loans (as defined in the Junior DIP

Term Sheet), in each case as set forth in the Junior DIP Term Sheet. Upon repayment or satisfaction of the DIP Loans (as defined in the

Junior DIP Term Sheet) in whole or in part, Sorrento shall pay to Scilex in cash an exit fee equal to 2% of the aggregate principal amount

of the Junior DIP Facility on the date of the Draw.

The Junior DIP Facility matures

on the earliest of: (i) September 30, 2023; (ii) the effective date of any chapter 11 plan of reorganization with respect to the Debtors;

(iii) the consummation of any sale or other disposition of all or substantially all of the assets of the Debtors pursuant to section

363 of the Bankruptcy Code; (iv) the date of the acceleration of the DIP Loans and the termination of the DIP Commitments in accordance

with the Junior DIP Documents (each as defined in the Junior DIP Term Sheet); (v) dismissal of the Chapter 11 Cases or conversion of

the Chapter 11 Cases into cases under chapter 7 of the Bankruptcy Code; and (vi) July 31, 2023, unless the Final Junior DIP Order has

been entered by the Bankruptcy Court on or prior to such date. Further, in no event shall the Junior DIP Facility mature before the maturity

date of the Senior DIP Facility obligations as in effect on the date of the Interim DIP Order. Pursuant to the terms of the Subordination

Agreement, the Debtors’ obligations to the Junior DIP Lender under the Junior DIP Facility are subordinated to the obligations

of the Debtors to the Senior DIP Lender on the terms and conditions set forth therein. The Debtors anticipate seeking final approval

(the “Final Junior DIP Order”) of the Junior DIP Facility at a final hearing on the DIP Motion on July 24, 2023.

Creditor and Equity Holder Committees

On February 28, 2023,

the Office of the United States Trustee (the “U.S. Trustee”) appointed an Official Committee of Unsecured Creditors, which

was reconstituted on March 28, 2023 and June 7, 2023. The purpose of the Official Committee of Unsecured Creditors is to represent

the interests of our unsecured creditors. On April 10, 2023, the U.S. Trustee appointed an Official Committee of Equity Security

Holders, which was reconstituted on April 14, 2023. The purpose of the Official Committee of Equity Security Holders is to represent

the interests of our equity security holders.

Bid Procedures

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on April 20, 2023, on April 14, 2023, the Bankruptcy Court entered an

order approving procedures for the Debtors to conduct a dual-track (i) financing process for the potential raising of debt, equity,

or hybrid financing or consummation of a restructuring transaction through a chapter 11 plan of reorganization and (ii) marketing

process for the sale or disposition of all or any portion of the Debtors’ assets under section 363 of the Bankruptcy Code, including

(x) the Debtors’ equity interests in its non-debtor subsidiaries, including, but not limited to, Scilex Holding, and (y) the

Debtors’ other assets. The sale and financing process remains ongoing.

On June 12, 2023, the Bankruptcy

Court entered an order approving certain sale procedures for the Debtors to sell certain “de minimis” assets (up to $10 million

in the aggregate) on an expedited basis and subject to certain notice and consent requirements (as applicable depending on the type of

de minimis asset or stock). As of the date hereof, the Debtors have not consummated any such de minimis asset sales.

Block Trades

On April 27, 2023, the Bankruptcy

Court entered an order providing that we may consummate one or more block sales of our shares of common stock of Scilex Holding without

requiring any further approval from the Bankruptcy Court, subject to certain other conditions set forth in the order (namely, the prior

approval from the Debtors’ lender in their Chapter 11 Cases, the Official Committee of Unsecured Creditors, and the Official Committee

of Equity Security Holders). As of the date hereof, the Debtors have not consummated any such block sales.

Chapter 11 Plan

As of the date hereof, the

Debtors have not filed a chapter 11 plan of reorganization or liquidation, as the Debtors are continuing to evaluate and formulate the

potential terms of such a plan. On July 6, 2023, the Bankruptcy Court entered an order extending the period in which the Debtors have

the exclusive right to file a chapter 11 plan through August 11, 2023, subject to further extensions thereof.

Restricted Stock

As previously disclosed,

on or around January 19, 2023, we distributed shares of common stock of Scilex Holding to our stockholders (the “Distributed Stock”),

which shares were restricted from being further transferred until May 11, 2023 (the “Lock-up”) as reflected in a restrictive

legend.

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on April 25, 2023 (the “April 25 Form 8-K”), on April 24, 2023, the Official

Committee of Unsecured Creditors filed a motion seeking the Bankruptcy Court’s extension of the application of the automatic stay

to continue the restricted trading period for the Distributed Stock.

As previously disclosed in

the April 25 Form 8-K, on April 25, 2023, the Bankruptcy Court entered an order extending the Lock-up period for the Distributed Stock

until September 1, 2023 (or an otherwise earlier date to be determined, as set forth in the order). Accordingly, any shares of the Distributed

Stock (including any such shares held by brokerage firms) may not be sold, transferred or otherwise disposed of and the holders of Distributed

Stock are prohibited from causing or encouraging any third party to do the same. This extension applies only to the Distributed Stock,

and does not apply to any securities of Scilex Holding held by Sorrento or any other Scilex Holding securities.

As previously disclosed in

our Current Report on Form 8-K filed with the SEC on May 15, 2023, on May 12, 2023, the Bankruptcy Court entered an order compelling

certain brokerage firms to credit all shares of the Distributed Stock to their customers’ accounts on or before May 23, 2023. In

addition, the Bankruptcy Court ordered the brokerage firms to file a report with the Bankruptcy Court detailing as to each customer's

account, on an anonymous basis, the number of shares of Distributed Stock credited and the quoted price of such stock on a marked-to-market

basis.

Automatic Stay

Subject to certain specific

exceptions under the Bankruptcy Code, the Bankruptcy Petitions automatically stayed most judicial or administrative actions against the

Debtors and efforts by creditors to collect on or otherwise exercise rights or remedies with respect to pre-petition claims. Absent an

order from the Bankruptcy Court, substantially all of the Debtors’ pre-petition liabilities are subject to settlement under the

Bankruptcy Code.

Executory Contracts

Subject to certain exceptions,

under the Bankruptcy Code, the Debtors may assume, amend or reject certain executory contracts and unexpired leases subject to the approval

of the Bankruptcy Court and certain other conditions. Generally, the rejection of an executory contract or unexpired lease is treated

as a pre-petition breach of such executory contract or unexpired lease and, subject to certain exceptions, relieves the Debtors from

performing their future obligations under such executory contract or unexpired lease but entitles the contract counterparty or lessor

to a prepetition general unsecured claim for damages caused by such deemed breach. Generally, the assumption of an executory contract

or unexpired lease requires the Debtors to cure existing monetary defaults under such executory contract or unexpired lease and provide

adequate assurance of future performance. Accordingly, any description of an executory contract or unexpired lease with the Debtors in

this document, including, where applicable, a quantification of the Company’s obligations under any such executory contract or

unexpired lease of the Debtors, is qualified by any overriding rejection rights the Company has under the Bankruptcy Code. As of the

date hereof, no motions were filed with the Bankruptcy Court (and none remain on the Bankruptcy Docket) to assume, amend or reject certain

executory contracts; the Debtors did, however, file certain agreed stipulations to reject certain unexpired leases, which the Bankruptcy

Court approved and entered on April 13, 2023 and April 24, 2023.

Claims Reconciliation

The Debtors are in the process of reviewing,

investigating, and reconciling proofs of claims filed against the Debtors with the amounts reflected in their books and records. The

Debtors will continue the claims reconciliation process and object, as necessary, to asserted claims, including on the basis that they

have been amended or superseded by subsequently filed proofs of claims, are without merit, have already been paid, are overstated or

should be adjusted or expunged for other reasons. As a result of this process, the Debtors may identify additional liabilities that will

need to be recorded or reclassified to liabilities subject to compromise. As part of its ongoing review, the Company is not aware of

any claims that may require a material adjustment to the accounts and balances as reported as of March 31, 2023.

Bankruptcy Court Approval

Required

To the extent we want to

offer and sell the securities described in this prospectus and any prospectus supplement, we must first obtain approval from the Bankruptcy

Court.

Listing

On February 13, 2023,

we received written notice (the “Delisting Notice”) from the staff of The Nasdaq Stock Market LLC (“Nasdaq”)

notifying us that, as a result of the Chapter 11 Cases and in accordance with Nasdaq Listing Rules 5101, 5110(b) and IM-5101-1,

the staff of Nasdaq had determined that our common stock would be delisted from Nasdaq, effective February 23, 2023. In the Delisting

Notice, the staff of Nasdaq referenced the Chapter 11 Cases and associated public concerns raised by them, concerns regarding the residual

equity interest of the existing listed securities holders and concerns about our ability to sustain compliance with all requirements

for continued listing on Nasdaq. In accordance with the Delisting Notice, trading of our common stock on Nasdaq was suspended at the

opening of business on February 23, 2023, and at such time, our common stock commenced trading on the Pink Open Market under the

symbol “SRNEQ”.

For

a complete description of our business, financial condition, results of operations and other important information, we refer you to our

filings with the SEC that are incorporated by reference in this prospectus, including our Annual

Report on Form 10-K for the year ended December 31, 2022 and our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2023, each as amended, supplemented or superseded from time to time by other

reports we file with the SEC in the future, which are incorporated by reference into this prospectus. For instructions on how to find

copies of these documents, see “Where You Can Find More Information”.

See the section entitled

“Risk Factors” in this prospectus for a discussion of some of the risks relating to the execution of our business strategy.

Corporate Information

On September 21, 2009,

QuikByte Software, Inc., a Colorado corporation and shell company, or QuikByte, consummated its acquisition of Sorrento Therapeutics, Inc.,

a Delaware corporation and private concern, or STI, in a reverse merger, or the Merger. We were originally incorporated as San Diego

Antibody Company in California in 2006 and were renamed “Sorrento Therapeutics, Inc.” and reincorporated in Delaware

in 2009, prior to the Merger. QuikByte was originally incorporated in Colorado in 1989. Following the Merger, on December 4, 2009,

QuikByte reincorporated under the laws of the State of Delaware, or the Reincorporation. Immediately following the Reincorporation, on

December 4, 2009, we merged with and into QuikByte, the separate corporate existence of STI ceased and QuikByte continued as the

surviving corporation, or the Roll-Up Merger. Pursuant to the certificate of merger filed in connection with the Roll-Up Merger, QuikByte’s

name was changed from “QuikByte Software, Inc.” to “Sorrento Therapeutics, Inc.”

Principal Executive Offices and Additional Information

Our principal executive offices

are located at 4955 Directors Place, San Diego, CA 92121, and our telephone number at that address is (858) 203-4100.

Our website is www.sorrentotherapeutics.com. Any information contained on, or that can be accessed through, our website is not

incorporated by reference into, nor is it in any way part of this prospectus and should not be relied upon in connection with making

any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy statements

and other information with the SEC. You may obtain any of the documents filed by us with the SEC at no cost from the SEC’s website

at http://www.sec.gov.

RISK FACTORS

Investing in any securities

offered pursuant to this prospectus, the applicable prospectus supplement and any related free writing prospectus involves a high degree

of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in

any applicable prospectus supplement, any related free writing prospectus and in our most recent Annual Report on Form 10-K, or

in any updates in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by

reference into this prospectus and any applicable prospectus supplement and any related free writing prospectus, before deciding whether

to purchase any of the securities being offered. Our business, financial condition or results of operations could be materially adversely

affected by any of these risks. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered

securities.

We are in the process of Chapter 11 reorganization

cases under the United States Bankruptcy Code, which may cause our common stock to decrease in value and may eventually render our common

stock worthless. For a full description of the terms and conditions of the DIP Facilities, you should refer to the Bankruptcy Docket.

As previously disclosed,

on February 13, 2023, we and our wholly owned direct subsidiary, Scintilla Pharmaceuticals, Inc. (together, the “Debtors”),

filed voluntary petitions seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in

the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Chapter 11 proceedings

are jointly administered under the caption In re Sorrento Therapeutics, Inc., et al. (Case No. 23-90085) (the “Chapter

11 Cases”).

Any trading in our securities

during the pendency of our Chapter 11 Cases is highly speculative and poses substantial risks to purchasers of our securities, as the

price of our securities may decrease in value or become worthless. Recoveries in the Chapter 11 Cases for holders of securities, if any,

will depend upon, among other things, our ability to confirm and consummate a plan of reorganization with respect to the Chapter 11 Cases

and the value of our assets. Although we cannot predict how our securities will be treated under a plan, we expect that holders of all

or some of our securities would not receive a recovery through any plan unless the holders of more senior claims and interests, such

as secured and unsecured indebtedness, are paid in full. Consequently, there is a risk that the holders of our securities will receive

no recovery under the Chapter 11 Cases and that our securities will be worthless.

Equity

securities in a debtor are subject to a high risk of being cancelled through a Chapter 11 plan of reorganization without receiving any

consideration or otherwise receiving any value. The reason for this high risk of cancellation is because equity securities in a debtor

generally sit last in line of priority in bankruptcy. This is referred to as the “absolute priority rule.” Under the absolute

priority rule, unless holders of more senior claims otherwise agree, holders of equity securities are generally precluded from receiving

any value unless and until holders of allowed claims or interests senior to them are paid in full; there are, however, circumstances

where this is not the case.

Debtors

often need funding to cover ongoing operating expenses and the expenses of a Chapter 11 case. It is common for a debtor to meet such

need through a debtor-in-possession (“DIP”) loan. A DIP loan often takes the form of a new secured debt facility that has

priority over pre-bankruptcy secured and unsecured creditors and a claim with super-priority over administrative expenses (including

vendor and employee claims) incurred during the Chapter 11 case and over all other claims. While a DIP loan offers the benefit of a source

of funding that is well-established in the market and under the Bankruptcy Code, its priority over other claims reduces the recovery

available to other junior creditors and interest holders, including equity security holders. Additionally, it is common for a DIP loan

to contain certain, sometimes significant, restrictions on the ability of the debtor to operate its business during bankruptcy.

It is not common for a debtor

to seek equity financing during a bankruptcy case. Investing in the equity securities of any company, including the Company, while it

is in bankruptcy involves significant risks, as the equity financing would have a lower priority of repayment and may ultimately be worthless.

On the other hand, equity financing, unlike a DIP loan, does not impose restrictions on a debtor’s operations and does not take

priority over other creditors and equity security holders, thereby potentially improving the possibility that equity security holders

could receive a recovery in a plan of reorganization, as compared to raising financing through a DIP loan that would be senior to any

equity securities in the Debtors. And just like outside of Chapter 11, an equity investment can provide for more potential upside for

the investor, as compared to debt financing (which is limited to repayment of principal and interest).

We are subject to other risks and uncertainties

associated with our Chapter 11 cases.

Our operations and ability

to develop and execute our business plan, our financial condition, our liquidity and our continuation as a going concern are subject

to the risks and uncertainties associated with our Chapter 11 Cases. These risks include the following:

| |

· |

our ability to confirm and consummate a plan of reorganization

with respect to the Chapter 11 Cases; |

| |

· |

the high costs of bankruptcy cases and related fees; |

| |

· |

our ability to obtain sufficient

financing to allow us to emerge from bankruptcy and execute our business plan post-emergence; |

| |

· |

our ability to maintain our relationships with our

suppliers, service providers, customers, employees and other third parties; |

| |

· |

our ability to maintain contracts that are critical

to our operations; |

| |

· |

our ability to execute

competitive contracts with third parties; |

| |

· |

our ability to attract, motivate and retain key employees; |

| |

· |

the ability of third parties to seek and obtain court

approval to terminate contracts and other agreements with us; |

| |

· |

our ability to retain our current management

team; |

| |

· |

the ability of third parties

to seek and obtain court approval to convert the Chapter 11 Cases to a Chapter 7 proceeding; and |

| |

· |

the actions

and decisions of our stockholders, creditors and other third parties who have interests in our Chapter 11 Cases that may be inconsistent

with our plans. |

Delays in our Chapter 11 Cases increase

the risks of us being unable to reorganize our business and emerge from bankruptcy and increase our costs associated with the bankruptcy

process.

These risks and uncertainties

could affect our business and operations in various ways. For example, negative events or publicity associated with our Chapter 11 Cases

could adversely affect our relationships with our suppliers, service providers, customers, employees and other third parties, which in

turn could adversely affect our operations and financial condition. Also, pursuant to the Bankruptcy Code, we need the prior approval

of the Bankruptcy Court for transactions outside the ordinary course of business, which may limit our ability to respond timely to certain

events or take advantage of certain opportunities. Because of the risks and uncertainties associated with our Chapter 11 Cases, we cannot

accurately predict or quantify the ultimate impact that events that occur during our Chapter 11 Cases will have on our business, financial

condition and results of operations, and there is no certainty as to our ability to continue as a going concern.

We are required to pay

the fees and expenses of estate professionals retained in the Chapter 11 Cases, which includes the legal and financial advisors to

the Company, the Official Committee of Unsecured Creditors, and the Official Committee of Equity Security Holders, subject to

certain budget restrictions under the DIP Facilities (the “DIP Budget”), other agreements, and approval by the

Bankruptcy Court. Our current DIP Budget includes approximately $35.0 million in fees and expenses for Chapter 11 professionals,

from the commencement of the Chapter 11 Cases (February 13, 2023) through July 29, 2023, of which there were $32.0 million in fees

and expenses budgeted through July 14, 2023.

We may not be able to obtain confirmation

of a Chapter 11 plan of reorganization.

To emerge successfully from

chapter 11 protection as a viable entity, we must meet certain statutory requirements with respect to the adequacy of disclosure with

respect to a Chapter 11 plan of reorganization, solicit and obtain the requisite acceptances of such a reorganization plan and fulfill

other statutory conditions for confirmation of such a plan.

Even if a Chapter 11 plan of reorganization

is consummated, it will be based in large part upon assumptions and analyses developed by us. If these assumptions and analyses prove

to be incorrect, we may not be able to achieve our stated goals and continue as a going concern.

Any plan of reorganization

may affect both our capital structure and the ownership, structure and operation of our business and will reflect assumptions and analyses

based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors

that we consider appropriate under the circumstances. In addition, a plan of reorganization will rely upon financial projections developed

by us with the assistance of our financial advisor/investment banker, including with respect to fees, revenues, debt service, and cash

flow. Financial forecasts are necessarily speculative, and it is likely that one or more of the assumptions and estimates that are the

basis of these financial forecasts may not be accurate. Whether actual future results and developments will be consistent with our expectations

and assumptions depends on a number of factors, including but not limited to (1) our ability to substantially change our capital

structure, (2) our ability to obtain adequate liquidity and financing sources, (3) our ability to maintain clients’,

investors’ and strategic partners’ confidence in our viability as a continuing enterprise and to attract and retain sufficient

business from and partnership endeavors with them, (4) our ability to retain key employees and (5) the overall strength and

stability of general economic conditions. The failure of any of these factors could materially adversely affect the successful reorganization

of our business. Consequently, there can be no assurance that the results or developments that may be contemplated by a plan of reorganization,

even if confirmed by the Bankruptcy Court and implemented by us, will occur or, even if they do occur, that they will have the anticipated

effects on us and our subsidiaries or our businesses or operations. The failure of any such results or developments to materialize as

anticipated could materially adversely affect the successful execution of any plan of reorganization.

Even if a plan of reorganization is consummated,

we may not be able to achieve our stated goals and continue as a going concern.

Even if a plan of reorganization

is consummated, we may continue to face a number of risks that are beyond our control, such as changes in economic conditions, changes

in the financial markets, changes in investment values or the industry in general, changes in demand for our products and increasing

expenses. Some of these risks typically become more acute when a case under the Bankruptcy Code continues for a protracted period of

time without indication of how or when the transactions under a Chapter 11 plan of reorganization will close. As a result of these and

other risks, we cannot guarantee that any plan of reorganization would achieve our stated goals. Furthermore, even if our debts were

reduced or discharged through any plan of reorganization, we may need to raise additional funds through one or more public or private

debt or equity financings or other means to fund our business after the completion of the Chapter 11 Cases. Our access to additional

capital may be limited, if it is available at all. Therefore, adequate funds may not be available when needed or may not be available

on favorable terms. As a result, any plan of reorganization may not become effective and, thus, we cannot assure you of our ability to

continue as a going concern, even if a plan of reorganization is confirmed.

We have substantial liquidity needs and

may not be able to obtain sufficient liquidity to confirm a plan of reorganization and exit bankruptcy.

Although we have lowered

our capital budget and plan to reduce the scale of our operations, our business remains capital intensive. In addition to the cash requirements

necessary to fund ongoing operations, we have incurred significant professional fees and other costs in connection with our Chapter 11

Cases and expect that we will continue to incur significant professional fees and costs throughout our Chapter 11 Cases. There are no

assurances that our current liquidity is sufficient to allow us to satisfy our obligations related to the Chapter 11 Cases, allow us

to proceed with the confirmation of a Chapter 11 plan of reorganization and allow us to emerge from bankruptcy. We can provide no assurance

that we will be able to secure additional postpetition financing or exit financing sufficient to meet our liquidity needs or, if sufficient

funds are available, offered to us on acceptable terms.

On April 14, 2023, the

Bankruptcy Court entered an order approving procedures for the Debtors to conduct a dual-track (i) financing process for the potential

raising of debt, equity, or hybrid financing or consummation of a restructuring transaction through a Chapter 11 plan of reorganization

and (ii) marketing process for the sale or disposition of all or any portion of the Debtors’ assets under section 363 of the

Bankruptcy Code, including (x) the Debtors’ equity interests in their non-debtor subsidiaries, including, but not limited

to, Scilex Holding, and (y) the Debtors’ other assets. The sale and financing process remains ongoing.

On April 27, 2023, the Bankruptcy

Court entered an order providing that we may consummate one or more block sales of shares of common stock of Scilex Holding without requiring

any further approval from the Bankruptcy Court. As a result, we are authorized at any time to enter into one or more sales of shares

of common stock of Scilex Holding; however, there can be no assurance that we will be able to consummate such sales on favorable terms

to the Company or at all. Furthermore, any such sales, or the perception that such sales could occur, may cause the trading price of

common stock of Scilex Holding to decline, including the shares we continue to hold after such sales have been consummated. Sales of

such shares of common stock of Scilex Holding may need to be sold at a discount to the market price prevailing at the time of such sale

and such discount could be substantial. As of the date hereof, we have not consummated any such block sales.

The DIP Facilities have substantial restrictions

and financial covenants and if we are unable to comply with the covenant requirements under the DIP Facilities, it could have a material

adverse impact on our financial condition, operating results and cash flows.

In connection with the Chapter

11 Cases and in order to provide required liquidity during the Chapter 11 process, on February 19, 2023, the Debtors executed that

certain Debtor-In-Possession Term Loan Facility Summary of Terms and Conditions (the “Senior DIP Term Sheet”) with JMB Capital

Partners Lending, LLC (“JMB Capital” or the “Senior DIP Lender”), pursuant to which JMB Capital (or its designees

or its assignees) are providing the Debtors with a non-amortizing super-priority senior secured term loan facility in an aggregate principal

amount not to exceed $75,000,000 in term loan commitments (the “Senior DIP Facility”), subject to the terms and conditions

set forth in the Senior DIP Term Sheet. After a hearing before the Bankruptcy Court on March 29, 2023, the Bankruptcy Court entered

a final order (the “Final Senior DIP Order”) approving the Senior DIP Facility on a final basis.

In connection with the Chapter