Bitcoin price rises after CPI data

Bitcoin (COIN:BTCUSD) price rose to $31,000 after the

release of US inflation data for June, which came in below

expectations. The leading cryptocurrency has seen an increase

of almost 18% over the last month. While slowing inflation may

not stop the Federal Reserve from raising interest rates this

month, some analysts believe that rate cuts are already being

priced in for early 2024. Regulatory uncertainty is seen as a major

factor driving price of Bitcoin at the moment. However, at the

time of writing, Bitcoin is trading at $30,450, down -0.55% over

the last 24 hours.

Aptos token price drops slightly after unlocking

Despite a large token unlock, the price of the native Aptos

token (COIN:APTUSD) dropped slightly (-1.42%) around

$6.94. Around 4.54 million tokens were unlocked, worth nearly

$32 million, with some being distributed to the Aptos community and

foundations. While this unlock represented a small percentage

of the total supply, the dollar value was

significant. However, the quasi-stability of APT can be

attributed to Aptos’ proposed plan to improve its blockchain.

ARK Invest sells part of its shares on Coinbase

ARK Invest (AMEX:ARKK), led by Cathie Wood, has sold some of its

shares in Coinbase (NASDAQ:COIN). The sale was for 135,152

COIN, worth $12 million. While Coinbase share prices are

rising, ARK Invest has decided to liquidate part of its

stake. Coinbase shares dropped over 80% in 2022, but have

recently recovered.

Coinbase Wallet launches messaging feature with Ethereum identities

Coinbase Wallet has launched a new feature that allows users to

send instant messages using their Ethereum identities. Using

the Extensible Message Transport Protocol (XMTP), messages are

end-to-end encrypted to ensure privacy. Users can block

unwanted addresses and the functionality is gradually being rolled

out. Coinbase Wallet aims to reduce fraud in the crypto

community and provide seamless communication between users,

eliminating dependence on separate platforms. Furthermore, the

company points out that the use of XMTP promotes decentralization

and provides the ability to access message histories even if the

company ceases to exist.

Gate.io creates two platforms for launching tokens and airdrops

Gate.io, a cryptocurrency service provider, has launched two new

platforms in the Gate Web3 ecosystem. The first is Gate Web3

Startup, a token launchpad that helps innovative projects reach

early adopters through free airdrops. The second is Airdrop

Blitz, a platform that provides information about airdrop projects

in an organized way. These platforms aim to provide

opportunities for projects to connect with a wider audience and

provide users with a secure way to explore legitimate token

launches and airdrops. These initiatives are part of the Gate

Web3 ecosystem, which encompasses a range of applications and tools

for participating in the world of Web3 and decentralized

finance.

Starknet implements Quantum Leap update to increase throughput

The Starknet team implemented the Quantum Leap – Starknet V12.0

update on the Ethereum mainnet, resulting in an increase in

throughput. During testing, the update averaged 37

transactions per second (TPS), with peaks of up to 90 TPS. In

addition to the increase in speed, the update also improved

latency, reducing the time to enter transactions to less than 10

seconds. StarkWare plans to release versions 13.0 and 14.0 in

the future to reduce transaction costs and allow developers to

prioritize transactions with additional payment.

HIVE Blockchain is rebranded and focuses on revenue opportunities

HIVE Digital Technologies Ltd., formerly known as HIVE

Blockchain (NASDAQ:HIVE), communicated along with its rebranding

that it is focusing on revenue opportunities with its Nvidia

(NASDAQ:NVDA) graphics processing unit (GPU) cards for cloud

computing technology. The company plans to utilize 38,000 GPUs for

computational tasks, enter the GPU server cluster rental market and

launch its new service, HIVE Cloud. The company remains

committed to innovation and ethics, while its bitcoin mining

operations remain ongoing.

EBA advises stablecoin issuers to prepare for future regulations

The European Banking Authority (EBA) has advised stablecoin

issuers to prepare for upcoming Markets in Crypto-Assets (MiCA)

regulations, which will take effect next year. The financial

regulator has urged issuers to voluntarily adhere to consumer

protection and risk management principles before mandatory rules

are implemented. The EBA highlighted the importance of

disclosure to buyers, sound governance, proportionate risk

management, reserve and redemption arrangements, as well as

constant communication with authorities. In addition, the EBA

plans to issue draft rules on stress redemptions and capital

requirements. The MiCA regulation aims to license stablecoin

issuers to ensure financial stability and consumer protection.

BIS report highlights structural flaws of cryptocurrencies as money

A recent Bank for International Settlements (BIS) report pointed

to inherent structural flaws in cryptocurrency as the reason it

will never become money. The report highlighted stability,

efficiency, accountability and integrity issues in

cryptography. While acknowledging the rise of cryptocurrencies

and some elements of genuine innovation, the report stated that

cryptocurrency has failed to harness innovation for the benefit of

society and is inadequate to play a meaningful role as money.

Chinese tourists buy cryptocurrencies in Hong Kong

According to a report by the Financial Times, more Chinese

tourists are buying cryptocurrencies during their visits to Hong

Kong, due to strict cryptocurrency regulations in mainland

China. Hong Kong has become a draw for Chinese tourists due to

its crypto stores and more relaxed regulations. The city is

looking to establish itself as a hub for virtual assets, and the

number of Chinese visitors interested in cryptocurrencies has been

on the rise. Hong Kong recently adopted a new regulatory

regime for cryptocurrencies, highlighting its progressive approach

towards cryptocurrencies in contrast to China’s stance.

Bank of China tests offline payment system for digital yuan

The Bank of China is testing a new offline payment system using

SIM cards, specifically designed for the digital yuan, the Chinese

central bank’s digital currency. In partnership with operators

China Telecom and China Unicom, the bank plans to allow payments by

phone using special SIM cards. This integration will allow

transactions even when the phone is turned off. Trials are

only available on specific Android phones in some regions of

China.

South Korean companies will be required to report cryptocurrency

transactions

Starting next year, South Korean companies involved in

cryptocurrencies will be required to disclose information about

their transactions to the country’s financial regulator. The

Financial Services Commission (FSC) announced new accounting rules

that will take effect in January 2024, requiring full disclosure of

data such as the number and characteristics of cryptographic

tokens, business models and accounting policies related to the sale

of cryptocurrencies. Authorities aim to increase accounting

transparency in digital asset transactions and protect

investors. These measures are in line with new legislation

recently passed to oversee cryptocurrency companies and impose

penalties for breaking the law.

Central Bank of Russia proposal for digital ruble advances in

parliament

As interest around the “digital ruble” grows, the Central Bank

of Russia’s proposal for a Central Bank Digital Currency (CBDC) is

making headway in the Russian parliament. On July 11, the

State Duma passed the bill on its third reading, sending it to the

upper houses. If passed, the legislation will move on to

presidential approval. The bill establishes that the Bank of

Russia will be responsible for the issuance and security of the

CBDC infrastructure. In addition, it defines key concepts and

seeks to regulate the sector. Russia also plans to start a

digital ruble pilot in August, for its implementation.

Cryptocurrency scams slow, but ransomware attacks are on the rise

According to a recent report by blockchain intelligence firm

Chainalysis, cryptocurrency scams decreased by 77%, from $3.3

billion to $1.1 billion in the first six months of 2023. However,

ransom attacks are on the rise, with perpetrators earning 62.4%

more revenue compared to the same period in 2022. The decrease in

scams can be attributed to increased victim caution and risk

awareness campaigns. On the other hand, ransom attacks are

targeting bigger and wealthier organizations looking to get as much

money as possible. Ransomware revenue increased to $449.1

million in the first six months of 2023. It is important to note

that these figures are only minimum estimates and do not include

crimes involving the use of cryptocurrencies as a form of

payment.

Former engineer arrested for cryptocurrency theft on decentralized

exchange

A former security engineer for an international tech company has

been arrested and accused of stealing around $9 million worth of

cryptocurrency from a Solana-based decentralized exchange

(COIN:SOLUSD). The attack involved exploiting a bug in the

exchange’s smart contracts to generate inflated fees. The

accused, Shakeeb Ahmed, was arrested and charged with wire fraud

and money laundering. He returned most of the stolen funds,

except for $1.5 million. The case is believed to be the first

involving an attack on a smart contract operated by a DEX.

Investigation into possible campaign finance act violation by

former FTX executive and congressional candidate

Ryan Salame, a former FTX executive, and his girlfriend Michelle

Bond, a former congressional candidate, are being investigated for

possible violations of the campaign finance law. Federal

prosecutors in Manhattan are looking into whether the couple

illegally exceeded federal contribution limits during Bond’s 2022

campaign for the Republican primary in New York’s 1st congressional

district. The investigation focuses on Salami’s donations to

Bond and the loans she took out for her campaign. It is

separate from the ongoing case against FTX founder Sam

Bankman-Fried, who has been accused of embezzlement.

Celsius sues Stakehound for failing to return assets after

bankruptcy

Bankrupt cryptocurrency lender Celsius has taken legal action

against Stakehound for failing to return $150 million in digital

assets entrusted to the staking platform in 2021. Celsius alleges

that Stakehound refused to return the funds after its bankruptcy

and filed with an arbitration agreement against it. Celsius

argues that the arbitration violates the US Bankruptcy Code and

seeks to compel Stakehound to return funds and pay damages for

breach of contract. Stakehound has not yet filed a defense

against the allegations.

Spielworks teams up with Mycelium Network for NFT refunds

Spielworks has partnered with the Mycelium Network to launch a

program that allows for full refunds on NFT purchases called

“Reverties”. Users who purchase these NFTs will be eligible to

receive a full refund in USDC (COIN:USDCUSD). Additionally,

NFTs will come in handy in the Dungeon Worlds game, providing

mining power and material delivery. The USDC coinage

transaction will be transferred to a DeFi pool on the Aave

protocol, and the interest earned will be used to buy back

Spielworks tokens and support the community.

OnChain Studios integrates chatbot for children’s NFTs

OnChain Studios, the company behind Cryptoys non-fungible tokens

(NFTs), plans to integrate an artificial intelligence (AI) chatbot

into its character-based digital collectibles. The AI

software, called ChatGuardian, will allow parents to customize a

chat filter to ensure safe and child-appropriate conversations with

NFT characters. Cryptoys hopes this integration will make

children’s experiences more engaging and fun by allowing them to

talk to their favorite digital toys. The company is committed

to providing a safe platform and reassuring parents about using

AI.

7-Eleven launches NFTs in partnership with Polygon

7-Eleven entered the world of non-fungible tokens (NFTs) in

partnership with the Polygon network (COIN:MATICUSD). Through

“Find Your Slurpee Vibe” NFTs, 7-Eleven combines the Slurpee

experience with blockchain technology. Using Polygon’s

scalability and low transaction costs, the company will distribute

these digital collectibles to its customers. However,

7-Eleven’s NFTs take a unique approach to ownership, being

exclusively licensed to the buyer.

Jackson Pollock Studio launches collection of NFTs in collaboration

with Iconic Moments

The Jackson Pollock Studio, museum of the 20th century painter,

is releasing a collection of non-fungible tokens (NFTs) in

collaboration with art collective Web3 Iconic Moments. Called

“Beyond the Edge,” the collection digitizes and revitalizes

Pollock’s artwork, featuring four perspectives of the studio where

he created his iconic paintings. The collection includes 100

NFTs accompanied by a corresponding physical print, plus a series

of Bitcoin-based Ordinals and a gamified experience. The

initiative seeks to bring new life to Pollock’s work and bring

buyers closer to the artist’s artistic process.

Sound raises $20 million to support sustainable artist income

Web3 music platform Sound has raised $20 million in funding with

the aim of helping artists earn a sustainable income throughout

their careers. The Series A funding round was led by

Andreessen Horowitz (a16z) and featured the likes of Snoop Dogg and

Ryan Tedder. Sound aims to disrupt the traditional revenue

models of web2 streaming services like Spotify and Apple Music by

allowing artists to create their music as non-fungible tokens

(NFTs) and sell them directly to fans. The platform has

already generated $5.5 million in music sales since its beta launch

in 2022 and is now open to the public to help more artists earn

sustainable income from their work. Sound will use the funding

to expand its teams and open its platform to the general

public.

LunarCrush raises $5 million in a Series A funding round

LunarCrush, a platform that leverages social media trends to aid

cryptocurrency investors, has raised $5 million in a Series A

funding round co-led by Draper Round Table and INCE

Capital. Other investors included Draper Associates,

WWVentures, TRGC, Bitcoin Frontier Fund, among others. The

company plans to launch a beta version of the Social Search tool

soon, which will allow users to search for any topic on social

media for relevant content. The aim is to provide users with

the ability to create their own algorithms and extract important

information.

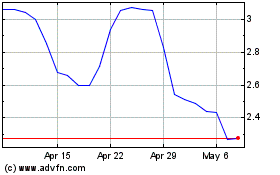

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Apr 2023 to Apr 2024