0000024741

false

DEF 14A

CORNING INC /NY

0000024741

2022-01-01

2022-12-31

0000024741

2021-01-01

2021-12-31

0000024741

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseForServiceCostOrPriorServiceCostForPensionPlansMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:DeductionForStockAwardsMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForStockAwardsMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:DeductionForStockAwardsMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForStockAwardsMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:DeductionForStockAwardsMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForStockAwardsMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:DeductionForOptionAwardsMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForOptionAwardsMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:DeductionForOptionAwardsMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForOptionAwardsMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:DeductionForOptionAwardsMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionForOptionAwardsMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedRemainUnvestedMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseFairValueOfAwardsGrantedVestedMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedOutstandingAndUnvestedMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOrDeductionForAwardsGrantedDuringPriorVestedMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:DeductionOfFairValueOfAwardsGrantedDuringPriorForfeitedMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnDividendsOrOtherEarningsPaidMember

2020-01-01

2020-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2022-01-01

2022-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2022-01-01

2022-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2021-01-01

2021-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2021-01-01

2021-12-31

0000024741

ecd:PeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2020-01-01

2020-12-31

0000024741

ecd:NonPeoNeoMember

GLW:IncreaseOnIncrementalFairValueOfOptionsOrSARsMember

2020-01-01

2020-12-31

0000024741

1

2022-01-01

2022-12-31

0000024741

2

2022-01-01

2022-12-31

0000024741

3

2022-01-01

2022-12-31

0000024741

4

2022-01-01

2022-12-31

0000024741

5

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the

Registrant ☒ |

| Filed by a

party other than the Registrant ☐ |

| |

| Check the appropriate

box: |

| |

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive

Proxy Statement |

| ☐ |

|

Definitive

Additional Materials |

| ☐ |

|

Soliciting

Material under §240.14a-12 |

| |

CORNING INCORPORATED |

|

| |

(Name of Registrant as Specified In Its Charter) |

|

| |

|

|

| |

|

|

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

“Our corporate strategy enables us to navigate

through challenging periods like the present while maintaining an attractive long-term growth trajectory. Our distinctive capabilities

have allowed us to establish a deep relevance to secular trends as we become ever more vital to progress. And our actions reflect a longstanding

commitment to moving the world forward for all of our stakeholders.”

Dear Fellow Shareholder,

Corning Incorporated will host its 2023 virtual Annual Meeting on April

27 at noon Eastern Time.

During the meeting, shareholders will vote on the annual election of

directors, the advisory approval of our executive compensation, the ratification of Corning’s independent registered public accounting

firm for 2023, and the frequency with which we hold advisory votes on executive compensation.

I’ll also share details about Corning’s 2022 performance

and our expectations for the future. Our corporate strategy enables us to navigate through challenging periods like the present while

maintaining an attractive long-term growth trajectory. Our distinctive capabilities have allowed us to establish a deep relevance to secular

trends as we become ever more vital to progress. And our actions reflect a longstanding commitment to moving the world forward for all

of our stakeholders.

We practice sound corporate governance by following industry best practices

on executive pay, including tying compensation closely to company performance, and we communicate consistently and openly with our shareholders.

Furthermore, we continuously leverage our diverse board to ensure robust engagement and critical oversight.

We’re also maintaining our commitment to our people and communities.

Inside our walls, we’re focused on building a more inclusive work environment for our people – and we’re making steady

progress. Notably, we reached our highest levels of leadership diversity in 2022. A quarter of our corporate officers are women, and half

of our Corporate Management Group is diverse. Beyond our walls, the company provides broad-based support to global humanitarian efforts

as well as targeted local engagement to drive thriving communities in the areas where we live and work.

Importantly, every decision we make today is about tomorrow. With our

future stakeholders in mind, we published our second TCFD-aligned sustainability report in 2022, and we significantly improved our Corporate

Human Rights Benchmark score. And I’m pleased to report that we are well ahead of achieving our goal of 400 percent improvement

in our use of renewable energy.

I look forward to sharing more details at the Annual Meeting. You’ll

find the formal meeting notice and the proxy statement in the following pages. I encourage you to vote your proxy card by phone or online

by April 26 so your shares will be represented at the meeting.

Thank you for your investment in Corning and your participation in our

governance process.

Sincerely,

Wendell P. Weeks

Chairman of the Board and Chief Executive Officer

| |

Thursday,

April 27, 2023 |

|

| |

12

noon Eastern Time |

|

| |

To

be held virtually at:

virtualshareholdermeeting.com/

GLW2023 |

|

| |

|

|

| |

How to Attend Our

Annual Meeting:

Our 2023 Annual Meeting will

be held in a virtual-only format. You will not be able to attend the Annual Meeting physically.

You are entitled to participate

in the Annual Meeting if you were a shareholder as of the close of business on February 28, 2023. The live audio webcast of the meeting

will begin promptly at 12 noon Eastern Time. Online access to the meeting will open 30 minutes prior to its start. We encourage you to

access the meeting in advance of the designated start time.

To attend and vote your shares

during the Annual Meeting, you will need to log in to virtualshareholdermeeting. com/GLW2023 using, (i) for record holders, the control

number found on your proxy card or the notice you previously received, or (ii) for holders who own shares in street name through brokers,

the control number issued to you by your brokerage firm. You may vote during the Annual Meeting by following the instructions available

on the website during the meeting. If you do not have a control number, you may log in as a guest, although you will not be able to vote

during the meeting.

We urge you to vote and submit

your proxy in advance of the meeting using one of the methods described in the proxy materials whether or not you plan to attend the Annual

Meeting. You may vote your shares in advance at ProxyVote.com. |

|

ITEMS

OF BUSINESS

| 1. | Election of 15 directors to our Board of Directors for the coming year; |

| 2. | Advisory approval of our executive compensation (Say on Pay); |

| 3. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023; |

| 4. | Approval, on an advisory basis, of the frequency with which we hold advisory votes on our executive compensation (Say on Pay Frequency);

and |

| 5. | Any other business or action that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

WHO

CAN VOTE

You may vote at our 2023 Annual Meeting if you were a shareholder

of record at the close of business on February 28, 2023.

Your vote is important to us. Please exercise your right to vote.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting to be held on April 27, 2023: our proxy statement, our Annual Report on Form 10-K for the year ended December 31,

2022 and other materials are available on our website at corning.com/2023-proxy.

Sincerely,

Linda E. Jolly

Vice President and Corporate Secretary

March 17, 2023

VOTE

RIGHT AWAY

Your vote is very important. Please promptly submit your proxy or

voting instructions by Internet, telephone or mail to ensure the presence of a quorum. You may also vote during our Annual Meeting (subject

to the circumstances described in the box at left). If you are a shareholder of record, you may vote during the meeting using the control

number on the proxy card or the notice previously provided to you. If your shares are held in the name of a broker, nominee or other intermediary,

such party can provide the control number to you. Shareholders without a control number may still attend the meeting as guests.

|

|

|

|

|

| By telephone |

|

By mail |

|

By Internet |

Dial toll-free 24/7

1-800-690-6903 |

|

Cast your ballot,

sign the proxy card

and send by mail |

|

Visit 24/7

ProxyVote.com |

| 2 |

CORNING 2023 PROXY STATEMENT |

| CORNING 2023 PROXY STATEMENT |

3 |

Forward-Looking Statements and Materiality Disclaimer

The statements, estimates, projections, guidance or outlook contained

in this document include “forward-looking” statements that are intended to take advantage of the “safe harbor”

provisions of the federal securities law. The words “may,” “might,” “will,” “could,” “would,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,”

“hope,” “want,” “strive,” “aim,” “goal,” “target,” “estimate,”

“predict,” “potential,” “continue,” “contemplate,” “possible,” and similar

words are intended to identify forward-looking statements. These statements may contain information about financial prospects, economic

conditions and trends and involve risks and uncertainties. Our actual future results, including the achievement of our targets, goals

or commitments, could differ materially from our projected results as a result of changes in circumstances, assumptions not being realized,

or other risks, uncertainties and factors. Such risks, uncertainties and factors include but are not limited to unexpected delays, difficulties,

and expenses in executing against our environmental, climate, diversity and inclusion or other “ESG” targets, goals and commitments

outlined in this document, or our ability execute our strategies in the time frame expected or at all, changes in laws or regulations

affecting us, such as changes in data privacy, environmental, safety and health laws and the risk factors discussed in our filings with

the U.S. Securities and Exchange Commission, including our annual reports on Form 10-K and quarterly reports on Form 10-Q.

Historical, current, and forward-looking environmental and social-related

statements may be based on standards for measuring progress that are still developing, and internal controls and processes that continue

to evolve. Forward-looking and other statements in this document may also address our corporate responsibility and sustainability progress,

plans, and goals, and the inclusion of such statements is not an indication that these contents are necessarily material for the purposes

of complying with or reporting pursuant to the U.S. federal securities laws and regulations, even if we use the word “material”

or “materiality” in this document.

Website references throughout this document are provided for convenience

only, and the content on the referenced websites is not incorporated by reference into this document.

| 4 |

CORNING 2023 PROXY STATEMENT |

This summary highlights information contained elsewhere

in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire

proxy statement carefully before voting. As used in this proxy statement, “Corning,” the “Company” and “we”

may refer to Corning Incorporated itself, one or more of its subsidiaries, or Corning Incorporated and its consolidated subsidiaries.

Proposals That Require Your Vote

| Proposal |

Board Vote

Recommendation |

More

Information |

| 1 Election of 15 directors |

For Each Nominee |

page 36 |

| 2 Advisory approval of our executive compensation (Say on Pay) |

For |

page 57 |

| 3 Ratification of appointment of independent registered public accounting firm |

For |

page 98 |

| 4 Advisory approval of the frequency with which we hold advisory votes on our executive compensation |

Every Year |

page 102 |

| |

Annual Meeting of Shareholders |

|

| |

Date and Time: April 27, 2023, 12 noon Eastern Time |

|

| |

To be held virtually at: virtualshareholdermeeting. com/GLW2023 |

|

| |

Record Date: February 28, 2023 |

|

| |

Admission:

See the instructions contained in “Frequently Asked Questions about the Meeting and Voting” on page 103. On March

17, 2023, we posted this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022 on our website at

corning.com/2023-proxy and began mailing them to shareholders who requested paper copies. |

|

| CORNING 2023 PROXY STATEMENT |

5 |

Proxy Statement Summary

Business Information – Who We Are

Corning is one of the world’s leading innovators in materials science.

For more than 170 years, Corning has applied its unparalleled expertise in specialty glass, ceramics and optical physics to develop products

that have created new industries, transformed people’s lives and unleashed significant new capabilities. Our innovation approach

delivers long-term value for Corning and its shareholders.

Our 2022

Results

| |

Net Sales |

Earnings per Share |

Adjusted Free

Cash Flow* |

| 2022

GAAP Results |

$14,189

million |

$1.54

(diluted) |

$1,011**

million |

| 2022

Core Results |

$14,805

million

Core Net Sales |

$2.09

(diluted)

Core EPS |

$1,243

million

Core Free Cash Flow |

*Adjusted free cash flow is a Non-GAAP measure.

Refer to Appendix A for more information.

**Cash flows from operating activities less

capital expenditures. See Appendix A.

CORE

PERFORMANCE MEASURES

In managing the Company and assessing our financial performance, we adjust

certain measures provided by our consolidated financial statements to arrive at measures that are not calculated in accordance with accounting

principles generally accepted in the United States of America (“GAAP”) and exclude specific items that are non-recurring,

related to foreign exchange volatility, or unrelated to continuing operations. These measures are our Core Performance Measures. Our management

uses Core Performance Measures, along with financial measures in accordance with GAAP, to make financial and operational decisions. We

believe that sharing our Core Performance Measures with investors provides greater visibility into how we make business decisions. Accordingly,

these measures also form the basis for our compensation program metrics.

Items that are excluded from certain Core Performance calculations include:

the impact of translating Japanese yen-denominated debt, the impact of translated earnings contracts, acquisition-related costs, certain

discrete tax items and other tax-related adjustments, restructuring, impairment and other charges and credits, certain litigation, regulatory

and other legal matters, pension mark-to-market adjustments and other items which do not reflect on going operating results of the Company.

More information on these items can be found in Appendix A.

Corning utilizes constant-currency reporting for our Display Technologies,

Environmental Technologies, Specialty Materials and Life Sciences segments for the Japanese yen, South Korean won, Chinese yuan, new Taiwan

dollar, and the euro, as applicable to the segment. The Company believes that the use of constant-currency reporting allows investors

to understand our results without the volatility of currency fluctuations and reflects the underlying economics of the translated earnings

contracts used to mitigate the impact of changes in currency exchange rates on our earnings and cash flows.

These non-GAAP measures are not an alternative to, or a replacement for,

financial results determined in accordance with GAAP. Please see Appendix A to this proxy statement for a reconciliation of the non-GAAP

measures we use in this proxy statement to the most directly comparable GAAP financial measures.

| 6 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

Our reportable segments are as follows:

|

Reportable

Segments* |

2022 Core

Net Sales % |

Segments Description |

| Display Technologies |

|

manufactures glass substrates for flat panel liquid crystal displays and other high-performance display panels |

| Optical Communications |

|

manufactures carrier and enterprise network components and solutions for the telecommunications industry |

| Specialty Materials |

|

manufactures glass, glass ceramics and other advanced optics materials to meet a wide range of needs in diverse industries |

| Environmental Technologies |

|

manufactures ceramic substrates and filters for emission control systems |

| Life Sciences |

|

manufactures glass and plastic labware, equipment, media, serum and reagents to provide workflow solutions for drug discovery and bioproduction |

* All other businesses that do not meet the quantitative threshold for

separate reporting have been grouped as Hemlock and Emerging Growth Businesses. This group is primarily comprised of the results of Hemlock

Semiconductor Group (HSG), which produces polysilicon products. Hemlock and Emerging Growth Businesses also includes our pharmaceutical

technologies business, automotive glass solutions business, new product lines and development projects, as well as other businesses and

certain corporate investments. Hemlock and Emerging Growth Businesses represented 11% of our 2022 Core Net Sales.

2022 Performance Highlights: Strategic Resilience

in a Challenging External Environment

In 2022, Corning grew core net sales to $14.8 billion, driven by our

strong positions in the growing optical communications and solar markets and ongoing outperformance across our end markets. Corning continued

to deliver sales growth despite demand headwinds in markets constituting around half of our sales. At the same time, prioritizing our

commitment to fulfill our customer needs in a higher inflation environment caused profitability and cash flow to lag sales growth. The

Company took additional price and productivity improvement actions to preserve profitability, and improve margins and cash generation.

The Company’s focus on executing these priorities resulted in core net sales growth of 5% and core EPS growth of 1%, building on

our strong results of 2021.

Stepping back, our long-term growth drivers all remain intact. We are

well positioned to capture profitable multi-year growth as our end markets recover, and will continue to execute with discipline. Our

cohesive and diversified portfolio provides strategic resilience that has come to bear in the current economic environment. We have established

deep relevance to secular trends along with the proven ability to drive more content into our markets over time. We have been leading

in the automotive and life science markets for 100 years, display market for 80 years, telecommunications market for 50 years and mobile

consumer electronics since the inception of smart devices. The basis of our ongoing success is our distinctive set of capabilities and

long track record of life-changing and even life-saving inventions which, as in the past, is what enables us to power through moments

like the present while maintaining an attractive long-term growth trajectory.

Corning’s

Strategy in Action

Corning strives to be a catalyst for positive change and to help move

the world forward. The company drives profitable multiyear growth by inventing, making, and selling life-changing products while cultivating

deep, trust-based relationships with industry leaders, ultimately incorporating more content into customers’ offerings. To do so,

Corning takes a long-view approach, investing in a set of vital capabilities that are becoming increasingly relevant to profound transformations

that touch many facets of daily life. Today, Corning’s markets include optical communications, mobile consumer electronics, display,

automotive, solar, semiconductor, and life sciences.

| CORNING 2023 PROXY STATEMENT |

7 |

Proxy Statement Summary

2022 highlights include:

| • |

Delivering innovations that offer unprecedented performance to meet the rigorous demands put on smartphone cover materials and allow people to do more from their mobile devices by developing a new glass composition, Gorilla® Glass Victus® 2, that delivers improved drop performance on rough surfaces like concrete. Samsung Electronics Co., Ltd. will use the new composition as part of its next generation of Galaxy flagship smartphones. Additionally, Corning’s premium cover materials are also on the front and back of the Samsung Galaxy S22 devices and the company’s DX products are featured on all five rear cameras of the Samsung Galaxy S22 Ultra. |

| • |

Enabling enhanced experiences for drivers and making vehicles greener by providing sustainable glass solutions for innovative, curved interior displays. Corning collaborated with LG Electronics, a global technology and vehicle component solutions innovator, to advance in-car connectivity, and with CarUX, a leading car display company owned by Innolux, to enable the future of automotive displays. Corning also continued expanding its gasoline particulate filter business into new markets as India advances GPF implementation. |

| • |

Helping build a more connected world. Corning teamed up with Nokia and Wesco to address operators’ labor and supply challenges with products that accelerate and simplify rural deployment. To meet demand in Europe, Corning opened a new optical fiber manufacturing plant in Poland. Additionally, the company was joined by AT&T CEO John Stankey and U.S. Secretary of Commerce Gina Raimondo, whose leadership helped pass infrastructure legislation dedicated to connecting the unconnected, to announce a new optical cable manufacturing facility in Arizona to meet committed customer demand and address industry growth. |

| • |

Advancing the semiconductors that are fundamental to all of today’s technology by strengthening the United States’ leadership position in the growing industry. Sen. Charles Schumer and New York Gov. Kathy Hochul joined Corning to announce a government-backed expansion of its Advanced Optics facility in Fairport, New York, to bolster the supply chain. In Michigan, government funding is expected to allow the expansion of operations to meet the increasing global demand for hyperpure polysilicon in the semiconductor industry and address growing solar demand. |

| • |

Developing sustainable practices across its industries. Corning expanded its supply of critical materials to the solar industry, submitted carbon reduction goals to the Science Based Targets initiative, and extended its leadership in renewable energy use. Corning also pioneered chemical recycling methods with the potential to drastically reduce single-use plastic consumption and waste in the Life Sciences industry. |

| • |

Driving life-changing discovery – from clean energy to space exploration. Corning’s advanced optics technologies played a vital role in the first successful fusion-ignition experiment in history. The Company also applied its industry-leading solutions to enable the world’s deepest look into the universe by engineering and manufacturing key optical instruments for NASA’s James Webb Space Telescope. |

| • |

Building a more diverse, equitable, and inclusive work environment. Corning became a VETS Indexes Recognized Employer in recognition of the Company’s many employees who are veterans as well as its work to hire, retain, promote, and support veterans, and the National Business Inclusion Consortium named Corning among its Best-of-the-Best Corporations for Inclusion. |

| 8 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

Update on Our Leadership Priorities

In 2019, we outlined our leadership priorities for growth and shareholder

returns, highlighting significant opportunities to sell more Corning content through each of our Market-Access Platforms, which we call

our “More Corning” strategy.

The Company’s focused and cohesive portfolio and financial strength

provide strategic resilience. Corning has and will continue to use its cash to grow, extend its leadership and reward shareholders. Our

key growth drivers remain intact, and some are accelerating as key trends converge around Corning’s capabilities.

Corning continues to advance its leadership priorities and articulate

opportunities across its business. Our probability of success increases as we invest in our world-class capabilities. Corning is concentrating

approximately 80% of its research, development and engineering investment along with capital spending on a cohesive set of three core

technologies, four manufacturing and engineering platforms, and five Market-Access Platforms. This strategy allows us to quickly apply

our talents and repurpose our assets across the Company, as needed, to capture high-return opportunities.

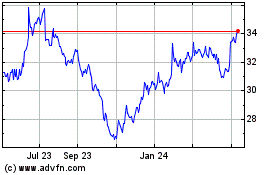

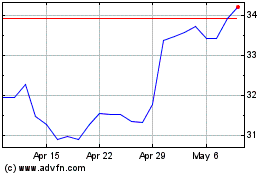

| Over the past five years, including 2022, Corning has returned $8.8 billion to shareholders through share repurchases and dividends. Corning is well-positioned to drive durable and profitable long-term growth through strategic investment decisions and a strong balance sheet. In February 2023, the Board increased our annual dividend 3.7% over 2022, to $1.12. |

| |

ANNUAL DIVIDENDS PER COMMON SHARE AND INCREASE OVER PRIOR YEAR |

|

| |

|

|

| CORNING 2023 PROXY STATEMENT |

9 |

Proxy Statement Summary

Sustainability Matters at Corning

We believe that our innovations have transformed industries, enhanced

people’s lives and addressed some of society’s biggest challenges. In accordance with Corning’s Values, we also believe

a commitment to positive environmental, social and governance-related business practices increases shareholder value, drives performance,

strengthens our Company, increases our connection with our shareholders, and helps us better serve our customers and the communities in

which our employees live and we operate. We see these commitments as new opportunities to deliver value to our shareholders, our employees,

our customers, and the wider world.

Sustainability and Climate Governance at Corning

|

|

BOARD

Our Board and its committees oversee matters related to Corning’s

environmental, social and governance (ESG) practices, performance and disclosures, and the Corporate Responsibility and Sustainability

Committee is charged with general oversight of environmental and social risk matters and annually reviews the Company’s sustainability

strategy. |

|

|

SUSTAINABILITY AND CLIMATE

INITIATIVES CENTER OF EXCELLENCE

The Sustainability and Climate Initiatives Center of Excellence oversees

and directs sustainability efforts, climate initiatives and related reporting. To further integrate our sustainability initiatives into

our core operating practices, in 2021 Corning appointed a Vice President of Sustainability and Climate Initiatives to drive sustainability

actions across the Company. |

|

|

SUSTAINABILITY LEADS, STEERING

AND WORKING COMMITTEES

Consisting of senior cross-functional business and sustainability leaders

that provide input on corporate social responsibility and sustainability matters and coordinate and implement initiatives to achieve the

Company’s short-and long-term sustainability goals and objectives. |

| 10 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

Our Sustainability Goals

In 2020, Corning adopted 12 sustainability goals to drive progress toward

those areas where we can achieve the greatest impact. Corning’s goals were adopted after an assessment that identified issues most

important to the Company and its stakeholders. Corning has committed to reduce its Scope 1 and 2 greenhouse gas (GHG) emissions by

30% (absolute basis) and relevant Scope 3 GHG emissions by 17.5% (absolute basis) by 2028 compared to a 2021 baseline. In 2021, we

set our first carbon reduction goals as part of our ongoing climate action plan. The goals align with the Sustainable Development Goals

(SDGs) adopted by the United Nations in 2015 as a “blueprint to achieve a better and more sustainable future for all.” Our

Sustainability Report is prepared in reference to the Global Reporting Initiative’s (GRI) standards, includes reporting in alignment

with the TCFD, and responds to the Hardware Sustainability Accounting Standard, the Sustainability Accounting Standards Board (SASB) sector-specific

standard most relevant for our business.

| Environmental |

|

Social |

|

Governance |

|

Greenhouse Gas Reduction – By 2028, Corning will reduce

Scope 1 and 2 greenhouse gas emissions by 30% (absolute basis) and relevant Scope 3 emissions by 17.5% (absolute basis), compared to a

2021 baseline.

Energy Management – By 2030, Corning will increase its use

of renewable energy by 400% from a 2018 baseline.

Water Conservation – Corning will enhance its water strategies

across Corning sites, prioritizing manufacturing plants and communities in high-risk water-scarce regions, by 2025.

Waste Management – Corning will enhance its waste strategies

across Corning sites, prioritizing manufacturing plants, by 2025. |

|

Sustainable Supply Chain – 100% of Corning’s high

risk suppliers and contract manufacturers will be certified as socially responsible by 2025.

Occupational Health and Safety – Corning will continue to

maintain our safety metrics in the top quartile of our industry benchmark values.

Community Involvement and Partnerships – Corning will encourage

increased volunteerism efforts year over year by supporting, rewarding, and recognizing employees’ efforts in the community. |

|

Board Diversity – Corning will continue to maintain a diverse

board.

Board Oversight of ESG Matters – The

Corporate Responsibility and Sustainability Committee will continue to review the sustainability program annually.

Risk Management – Environmental, Social, and Governance

issues will continue to be integrated into Corning’s Enterprise Risk Management Processes.

Ethical Business Practices – All employees will understand

Corning’s Code of Conduct, including how to report allegations of ethical or legal misconduct.

Transparency and Reporting – Corning issued its inaugural

sustainability report in 2021 and will continue to do so every year thereafter.

Environmental and Social Advocacy – Corning will continue

its advocacy for environmental and social issues. |

| CORNING 2023 PROXY STATEMENT |

11 |

Proxy Statement Summary

Our Commitment to Sustainability

Corning demonstrates its commitment to environmental, social, governance

and human capital matters, and its Values, in many ways that can be explored in our 2022 Sustainability Report and our Sustainability

website, both which can be found at corning.com/sustainability.

CLIMATE

|

• In

2021, Corning committed to reduce Scope 1 and 2 GHG emissions by 30% (absolute basis) and relevant Scope 3 GHG emissions by 17.5%

(absolute basis) by 2028 compared to a 2021 baseline. |

|

• In

furtherance of its Scope 1, 2 and 3 GHG emissions goals set in 2021, in 2022 Corning developed

a GHG inventory management plan and refined and broadened its strategies for emissions reduction,

as well as designed a strategy to engage suppliers on their emissions reductions.

• In

2022, Corning submitted targets for validation to the Science Based Targets initiative (SBTI), underscoring our commitment first

announced in 2021 to set near-term Company-wide emission reductions in line with climate science, and aligning with the goals of

the Partis Agreement to limit global warming to 1.5°C above pre-industrial levels. |

ENVIRONMENTAL STEWARDSHIP

|

• Corning

is committed to protecting the environment through the continuous improvement of our processes,

products and services. For example, Corning’s ceramic substrates and particulate filters

have prevented more than 4 billion tons of hydrocarbons, 4 billion tons of nitrogen oxides, and 40 billion tons of carbon monoxide

from entering the atmosphere since 1970.

• We’re

proud of our sustained participation and strong performance in the ENERGYSTAR® programs. In 2022, the EPA named Corning as

an ENERGYSTAR® Partner of the Year for the ninth consecutive year and recognized us for Sustained Excellence for the seventh

consecutive year.

• Since

2022, 13 Corning facilities have received the ENERGYSTAR® Challenge for Industry recognition by exceeding the goal of

improving energy efficiency by at least 10% in five years or less. More than 50 Corning sites received this designation in the last

decade. On average, these facilities achieved a 21% energy reduction in less than two years.

• Corning

is one of the largest users of solar energy in the United States; according to the 2022 Solar Energy Industries Association report,

Corning ranked 26th among U.S. businesses and fourth within the manufacturing sector for corporate solar usage.

In 2022, Corning signed four agreements for solar projects, which will add over 125MWdc of capacity to our renewable energy portfolio. |

|

HEALTH AND

SAFETY

|

• Corning

continues to maintain its best-in-class health and safety performance, ranking

in the top quartile of global, industry-leading company performance as measured by a total case incidence rate.

• Corning

achieved over 95% compliance with corporate health and safety standards at Corning sites in 2022.

• Global

recognition for health and safety excellence: In Stryków, Poland, our Optical Communications facility received second

place in a nationwide competition by the Polish National Labor Inspection group, based on working conditions and compliance with

regulations and labor laws within the manufacturing plant. And in Taiwan, Corning achieved the National Occupational Safety and Health

Benchmark Enterprise award for its efforts to help ensure a safe work environment for employees. |

| 12 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

DIVERSITY,

EQUITY

AND INCLUSION

|

• Diversity,

equity, and inclusion are integral to Corning’s belief in the fundamental dignity of The Individual – one of Corning’s

seven core Values. We are committed to providing an inclusive environment where all employees

can thrive. You can explore the Company’s Diversity, Equity and Inclusion Report at

https://www.corning.com/worldwide/en/sustainability/people/diversity.html.

• In

2022, Corning created the Building Generational Wealth Fund to support black homebuyers through its Office of Racial Equity

and Social Unity (ORESU).

• In

2022 we reached our highest levels of leadership diversity: a quarter of our corporate officers are women and half of our Corporate

Management Group is diverse. At the Board level, each of the last three most recent additions to the Board have been diverse candidates.

• In

2022 Corning was named a National Business Inclusion Consortium “Best-of-the-Best Corporation for Inclusion” for

the seventh consecutive year.

• Corning

received a 100% score on the Disability Equality Index® and was named a 2022 Best Place to Work for Disability Inclusion.

Corning also announced a three-year corporate partnership with Disability:IN focused on further integrating disability inclusion

best practices into employee recruiting. |

HUMAN

CAPITAL

MANAGEMENT

|

• In

2022, talent management oversight was formally added to the Compensation and Talent Management

Committee’s mandate to ensure top-level oversight of human capital.

• In

order to produce the innovative, industry-changing technologies for which we are known, it is critical that Corning continues to

attract and retain top talent. To facilitate talent attraction and retention, we strive to make Corning a diverse, inclusive and

safe workplace, with opportunities for our employees to grow and develop in their careers, supported by strong compensation,

benefits and health and wellness programs, and by programs that build connections between our employees and their communities.

• Corning

believes in equal pay for equal work and annually tracks and implements actions to maintain 100% pay equity globally. In 2022,

Corning maintained 100% gender pay equity amongst our global salaried workforce. In the U.S., we also maintained minority versus

majority pay equity.

• In

2022, Corning placed 2nd out of the 43 Information and Communication Technology companies assessed by the World Benchmarking Alliance

for the Corporate Human Rights Benchmark (CHRB), and 11th out of 127 companies assessed overall. Corning also improved

its Know The Chain rank to 9th out of 60 companies, notably rising to the top 2 companies in Purchasing Practices.

This significant improvement over prior years demonstrates Corning’s commitment to continuing efforts toward a more inclusive

and fairer world. In 2022, Corning also scored 100% on the Human Rights Campaign Corporate Equality Index.

• Corning

is focused on developing a strong, sustainable pipeline of female talent for leadership positions through talent development

programs, robust candidate slates, talent planning and mentoring, including through its Tough Women in Gorilla initiative, the Women

Leaders in Finance program, the Rising Together program of our Asia-Pacific region, and the EMEA Female Talent Pool Program.

• Corning

provides compensation that always meets, and very often significantly exceeds, minimum wage requirements in all the jurisdictions

we operate in. In 2022, we completed an analysis indicating that Corning provides compensation that would meet or exceed a higher

living wage standard in all the countries where we operate. We intend to review our findings every two to three years in the future

to ensure we continue to provide a living wage to our employees globally.

• Corning’s

2022 EEO-1 Report is available at corning.com/worldwide/en/sustainability/people/ diversity/eeo-1-report.html. |

| CORNING 2023 PROXY STATEMENT |

13 |

Proxy Statement Summary

Supply Chain Sustainability

Corning is committed to a strategic, integrated and socially responsible

supply chain – one that reflects our seven core Values, all the time, all around the world. Even when faced with a global pandemic,

our commitment has been unwavering. We are dedicated to not only living our Values ourselves, but holding our suppliers accountable to

do the same. Our Values are embedded in our Supplier Code of Conduct – enforcement of the Code is of utmost importance and we proactively

leverage tools and processes to manage our suppliers, holding them to the highest degree of ethical and socially responsible standards.

We work to ensure compliance to all laws and regulations, with particular focus on those which seek to put an end to forced labor and

human trafficking, and we continuously look for ways to expand the scope of our efforts to the benefit of all involved.

Our Supplier Code of Conduct can be viewed at https://www.corning.com/worldwide/en/sustainability/processes/supply-chain-social-responsibility/supplier-responsibility.html

| 14 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

Supporting Sustainable Communities

Throughout its history, Corning has routinely made contributions to civic,

educational, charitable, cultural and other institutions that improve the quality of life and increase the resources of the communities

in which it operates, making Corning more attractive to employees.

The Company undertakes its philanthropic activities directly through

corporate initiatives and initiatives of its Office of Racial Equity and Social Unity (ORESU), and indirectly through The Corning Incorporated

Foundation (the Foundation), a separate 501(c)(3) organization. We believe in being an active corporate citizen and both Corning and the

Foundation direct the vast majority of their grant-making and activities in the communities where Corning operates and its employees live.

In 2022, Corning donated $2 million to the Foundation, and the Foundation disbursed approximately $5.3 million in direct grants to non-profit

organizations which includes grants made under the Foundation’s Employee Programs (Employee Matching Gifts, Dollars for Doers, Vibrant

Community Grants and Excellence in Volunteerism Awards). A sampling of the ways that Corning and the Corning Foundation made an impact

in our communities in 2022 included:

| • |

Catalyst Grants - Corning established a new program to support entrepreneurship among women, minorities and veterans who often face more significant challenges obtaining business financing. In 2022, the Catalyst program helped six women, one South Asian, seven Black and two veteran entrepreneurs launch their businesses and secure ongoing financing. |

| • |

Edge for Tomorrow Future Teachers Scholarship – ORESU awarded the second annual Edge for Tomorrow Future Teachers Scholarship, which encourages diverse students from Edgecombe County Early College High School in North Carolina to pursue careers in teaching. Corning has committed to sponsoring ten students over six years. Each student receives a $30,000 scholarship to use at a North Carolina university of their choice, in exchange for a three-year commitment to teach in Edgecombe County after graduation. |

| • |

Corning Housing Partnership - Corning invested $200,000 in a multi-year private-public partnership with the City of Corning to combat blight in the city’s aging housing stock. |

| • |

Child Care Support – Corning invested $2.5 million in five child-care centers and a school age program serving more than 500 children daily in the Corning, NY area. |

| • |

Science Technology Entrepreneurship Leadership Academy - The Corning Foundation supported a free robotics camp for 350 students in the Corning, NY area through a $12,000 grant for robotics equipment. |

| • |

Massachusetts Biotechnology Education Foundation – The Corning Foundation granted $20,000 in support of life science literacy in grades 6-12 through teacher training, curriculum development, workshops, mentoring and lab-based lessons. |

| • |

Waccamaw Siouan Tribe STEM Studio – Corning provided funding for STEM supplies to this grassroots community-led program founded by members of the Waccamaw Siouan Tribe in STEM careers with a mission to increase their community’s understanding of STEM, while providing STEM opportunities to tribal youth and the community. |

| • |

New York Regional Equity Network of Educators – ORESU partnered with the Greater Southern Tier Board of Cooperative Educational Services to create the Regional Equity Network of Educators, supporting approximately 30,000 students. The network brings educators together with youth leaders to foster learning environments that affirm students’ racial, linguistic and cultural identities and empower students to be change makers. Teachers receive professional development credits for their participation. |

| • |

Monroe Community College Optics Program – The Corning Foundation awarded the college a $760,000 grant over five years (2018-2022) in support of its optics program, including a Technical Pipeline Program that includes for accepted students a two-year scholarship, an annual salary, and a full-time technician role upon graduation. |

Corning’s direct giving also includes annual contributions to both

local and international cultural and educational institutions. In particular, Corning is proud to support The Corning Museum of Glass

(CMOG) – the world’s leading glass museum. Beyond just a key cultural and community hub, CMOG also provides Corning with a

unique innovation crucible where our glass scientists and experts collaborate with glass artists and designers to creatively explore the

novel properties of glass and innovate new uses in an environment uninhibited by traditional commercial boundaries. In a small community,

| CORNING 2023 PROXY STATEMENT |

15 |

Proxy Statement Summary

our employees, including executives and their families, inevitably have

relationships with the non-profit organizations that receive such contributions from the Company. Wendell P. Weeks (chairman and CEO),

Jeffrey W. Evenson (executive vice president and chief strategy officer) and Edward A. Schlesinger (executive vice president and CFO)

serve on the CMOG board of trustees. In 2022, Corning provided cash and non-cash contributions of services to CMOG of approximately $42

million.

Corning provides financial support to the Alternative School for Math

and Science (ASMS), a private middle school located in Corning, New York, with an advanced curriculum focused on science and math. Currently,

children of Corning employees represent approximately 51% of its enrollment. In 2022, Corning’s non-cash contributions totaled approximately

$1.7 million and cash contributions totaled $346,000. Kim Frock Weeks (spouse of Wendell P. Weeks, our chairman and CEO) serves on the

ASMS board of trustees and also serves as executive head of school but receives no salary or benefits in this role.

2022 Executive Compensation Program

As shown below, in 2022 approximately 91% of our CEO’s

target total compensation and 81% of the other Named Executive Officers’ (NEOs) target total compensation (in both cases excluding

employee benefits and perquisites), was variable and dependent on Corning’s business, operating and financial performance or stock

price.

| 2022 Compensation

Components |

|

|

| CEO |

|

ALL

OTHER NEOs |

|

|

|

RSUs – Restricted Stock Units

PSUs – Performance Stock Units

CPUs – Cash Performance Units

| 16 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

2022 Pay

Components

| Pay

Component |

|

Form

and Payout

Method |

|

Purpose |

|

Award

Value |

| Base

Salary |

|

Cash

- fixed |

|

• Attract

and retain talent

• Provide

financial certainty |

|

• Value

of role to the Company

• Value

of role in competitive marketplace

• Skills

and performance

• Internal

equity |

| Short-Term

Incentives (STI) |

|

|

|

|

|

|

| • GoalSharing

Plan |

|

Cash

- variable |

|

• Focus

all employees on delivering annual unit and business scorecard objectives |

|

• Generally

targeted at 5% of base salary based on annual corporate performance and business unit objectives |

| • Performance

Incentive Plan (PIP) |

|

Cash

- variable |

|

• Provide

additional incentive to executives to deliver specific annual corporate and business financial plans |

|

• Target

awards are set individually based on the competitive marketplace and level of experience

• Payouts

for NEOs are based on a combination of corporate financial performance and the average financial performance of our five Market-Access

Platforms (MAPs) |

Long-Term

Incentives (LTI)

• Cash

Performance Units

• Performance

Stock Units

• Restricted

Stock Units |

|

25%

cash and 75% stock, 70% performance-based (CPUs and PSUs) and 30% time-based (RSUs) |

|

• Focus

executives on long-term results

• Align

the long-term interests of executives and shareholders

• Ensure

equity ownership for executive team

• Reward

achievement of long-term objectives over the three-year measurement period

• Retain

talent |

|

• Target

awards are based on competitive marketplace, level of executive, skills and performance

• Actual

units earned relative to target is based on corporate performance against pre-set goals

• Value

of PSUs and RSUs is tied directly to the price of our common stock |

All

Other:

• Benefits

• Perquisites

• Severance

Protection |

|

Ongoing

or Event-Driven |

|

• Support

the health and security of our executives, and their ability to plan for retirement

• Enhance

executive productivity |

|

• Employee health and safety

• Competitive marketplace

• Level of executive |

|

Our Metrics and Why We Use Them

Core Earnings per Share (Core EPS):

Core EPS is our key measure of profitability. (Note: Corning budgets

for share repurchases when establishing annual financial and compensation targets.)

Core Net Sales:

Growing core

net sales — both

organically through innovation and through acquisitions — remains

critical to our short-and long-term success. |

Adjusted

Free Cash Flow:

Strong

cash generation enables us to invest in future growth, sustain leadership in our markets and provide returns to shareholders,

and remain financially strong during periods of uncertainty. It also requires us to carefully manage our capital investments.

Return

on Invested Capital (ROIC):

We

focus on ROIC because it reflects our ability to generate returns from the capital we have deployed in our operations. The

Cash Performance Units (CPUs) payout and Performance Stock Units (PSUs) earned are increased or decreased up to 10% based on Corning’s

ROIC over the three-year performance period. |

Core net sales is a primary indicator of Corning’s long- and short-term

success. Evaluating performance against predetermined net sales metrics provides insight into how well the Company has retained sales

and met sales growth targets, accounting for both organic growth efforts and the impact of acquisitions. We use core net sales as a performance

measure in our annual bonus plans (GoalSharing and PIP) because Goalsharing impacts every employee and PIP impacts over 8,000 employees.

In this way, every employee has goal alignment with Corning’s sales growth goals. The LTI plan, which impacts approximately 350

senior executives and key employees responsible for driving the short- and long-term financial growth of the Company, also includes a

core net sales performance measure. Incorporating net sales into both the STI and LTI plans allows for a comprehensive evaluation of Corning’s

ability to establish sustainable sales growth while also addressing near-term market fluctuations. It is a “duplicate goal”

for only about 350 of our approximately 57,000 employees, and the Compensation and Talent Management Committee believes the increased

focus on core net sales growth is appropriate for that smaller group of executives given the importance of sales growth for Corning over

time.

| CORNING 2023 PROXY STATEMENT |

17 |

Proxy Statement Summary

2022 Compensation Plan Payout Percentages

The following table reflects our 2022 compensation plan’s payout

percentages based on our 2022 financial performance:

| |

SHORT

TERM INCENTIVE PLAN |

|

|

|

Long

Term Incentive Plan |

|

| |

ANNUAL

CASH BONUS – GOALSHARING |

|

|

|

CASH

PERFORMANCE UNITS AND PERFORMANCE STOCK UNITS (70% OF LTI TARGET — 2022 PERFORMANCE RESULTS) |

|

| |

Components |

|

Weighting |

|

%

of target

earned |

|

|

|

Components |

|

Weighting |

|

%

of target

earned |

|

| |

Corporate

financial performance |

|

25% |

|

66% |

|

|

|

Adj

Free Cash Flow |

|

70% |

|

30% |

|

| |

Average

of all unit plans (>100 units) |

|

75% |

|

128% |

|

|

|

Core

Net Sales |

|

30% |

|

93% |

|

| |

2022

payout (% of target) |

|

|

|

|

113%* |

|

|

|

2022

blended performance result |

|

|

|

49% |

|

| |

* Equal

to 5.65% of base salary for each NEO based on a 5% target. |

|

|

|

|

|

|

|

|

|

|

|

| |

ANNUAL

CASH BONUS – PIP |

|

|

|

LTI

PLAN PAYOUT FOR 3-YEAR PERIOD ENDING DECEMBER 31, 2022 |

|

| |

Components |

|

Weighting |

|

%

of target

earned |

|

|

|

Components |

|

|

|

%

of target

earned |

|

| |

Corporate

financial performance |

|

50% |

|

66% |

|

|

|

2020

performance result |

|

|

|

181% |

|

| |

Average

of 5 MAPs financial performance |

50% |

|

59% |

|

|

|

2021

performance result |

|

|

|

175% |

|

| |

2022

payout (% of target) |

|

|

|

|

62.5% |

|

|

|

2022

performance result |

|

|

|

49% |

|

| |

|

|

|

|

|

|

|

|

|

2020-2022

average performance |

|

|

|

135% |

|

| |

|

|

|

|

|

|

|

|

|

ROIC

MODIFIER |

|

|

|

|

|

+10% |

|

| |

|

|

|

|

|

|

|

|

|

2020-2022

average

performance |

×

|

ROIC

Modifier |

=

|

Final

% pay-out of 2020

target

CPUs and PSUs |

|

| |

|

|

|

|

|

|

|

|

|

135%

× 110% |

= |

148.5%

Final Payout

(%

of target) |

|

| 18 |

CORNING 2023 PROXY STATEMENT |

Proxy Statement Summary

Our Director Nominees

All director nominees are independent with the exception of Mr. Weeks.

| Name

and Primary Occupation |

Age |

Director

since |

Committee

Memberships* |

Other

Public

Company

Boards |

Donald

W. Blair

Retired

Executive Vice President and

Chief

Financial Officer, NIKE, Inc. |

64 |

2014 |

• Audit

• Finance |

1 |

Leslie

A. Brun

Chairman

and Chief Executive Officer, Sarr Group, LLC |

70 |

2018 |

• Audit

• Compensation |

1 |

Stephanie

A. Burns

Retired

Chairman and Chief Executive Officer,

Dow

Corning Corporation |

68 |

2012 |

• Audit

• Corporate

Responsibility (Chair) |

2 |

Richard

T. Clark, Lead Independent Director

Retired

Chairman, Chief Executive Officer

and

President, Merck & Co., Inc. |

77 |

2011 |

• Compensation

• Executive

• Governance |

0 |

Pamela

J. Craig

Retired

Chief Financial Officer, Accenture plc. |

66 |

2021 |

• Audit

• Corporate

Responsibility |

3 |

Robert

F. Cummings, Jr.

Retired

Vice Chairman of Investment Banking,

JPMorgan

Chase & Co. |

73 |

2006 |

• Executive

• Finance

(Chair)

• Governance |

0 |

Roger

W. Ferguson, Jr.

Retired

President and Chief Executive Officer,

TIAA |

71 |

2021 |

• Compensation

• Governance |

2 |

Deborah

A. Henretta

Retired

Group President of Global E-Business,

Procter

& Gamble Company |

61 |

2013 |

• Corporate

Responsibility

• Information

Technology |

3 |

Daniel

P. Huttenlocher

Dean,

MIT

Stephen A. Schwarzman College of Computing |

64 |

2015 |

• Finance

• Information

Technology |

1 |

Kurt

M. Landgraf

Retired

President,

Washington

College |

76 |

2007 |

• Audit

(Chair)

• Compensation

• Executive |

0 |

Kevin

J. Martin

Vice

President, US Public Policy,

Meta

Platforms, Inc. |

56 |

2013 |

• Corporate

Responsibility

• Governance |

0 |

Deborah

D. Rieman

Retired

Executive Chairman, Metamarkets Group |

73 |

1999 |

• Compensation

(Chair)

• Information

Technology |

0 |

Hansel

E. Tookes II

Retired

Chairman and Chief Executive Officer,

Raytheon

Aircraft Company |

75 |

2001 |

• Compensation

• Executive

• Governance

(Chair) |

1 |

Wendell

P. Weeks

Chairman

and Chief Executive Officer,

Corning

Incorporated |

63 |

2000 |

• Executive

(Chair) |

1 |

Mark

S. Wrighton

President,

George Washington University |

73 |

2009 |

• Finance

• Information

Technology (Chair) |

0 |

*Audit = Audit Committee; Compensation = Compensation and Talent Management

Committee; Corporate Responsibility = Corporate Responsibility and Sustainability Committee; Executive = Executive Committee; Finance

= Finance Committee; Governance = Nominating and Corporate Governance Committee; Information Technology = Information Technology Committee

| CORNING 2023 PROXY STATEMENT |

19 |

Proxy Statement Summary

Governance Highlights

Corning is committed to maintaining strong corporate governance as a

critical component of driving sustained shareholder value. The Board of Directors continually monitors emerging best practices in governance

to best serve the interests of the Company’s stakeholders.

The

following is a brief overview of some of our most notable corporate governance practices and policies:

• We

contacted holders of approximately 58% of our common stock during the 2022-2023 proxy season to discuss our executive compensation

programs and corporate governance practices and engaged with holders of approximately 43% of our common stock on these matters;

• We

ensure alignment of our corporate governance practices with the Investor Stewardship Group’s corporate governance Principles

for U.S. Listed Companies (see page 21);

• Our

Board, through its committees, provides direct oversight of environmental, social and governance risks and issues (see page 32);

• We

adopted the principles embodied in the Shareholder-Director Exchange (SDX) Protocol; and

• We

adopted proxy access whereby qualifying shareholders are permitted to include director nominees in the proxy statement. |

| The

Corporate Governance section beginning on page 21 describes our governance framework, which includes the following: |

✓ Annual

election of all directors

✓ Majority

vote standard for the election of directors in uncontested elections

✓ Active

shareholder engagement, including by directors, to directly gather investor perspectives

✓ Active,

engaged and experienced Lead Independent Director

✓ Independent

board committees, with all committees (except the Executive Committee) consisting entirely of independent directors |

✓ Regular

executive sessions of independent directors

✓ Market-competitive

director compensation program designed to support and reinforce our governance principles

✓ Robust

stock ownership guidelines for directors and key executive officers

✓ Prohibition

on pledging, hedging or trading in derivatives of the Company’s stock for directors and employees

✓ Clawback

policy for executive incentive compensation in the event of certain financial restatements |

Shareholder Communication

Communicating with shareholders, particularly about our strategic priorities,

is critically important to Corning. We communicate with our shareholders through a number of channels, including quarterly earnings calls,

U.S. Securities and Exchange Commission (SEC) filings, Investor Days, investor conferences, our website at corning.com

and other electronic communications. Our executives and Board members also routinely engage with investors through in-person meetings

and calls.

In addition to regular discussions regarding our strategic priorities,

we also conduct regular shareholder outreach to understand perspectives on our governance practices, including our sustainability initiatives,

Board composition, human capital management, and executive compensation. Members of our Board often participate in direct interaction

with our shareholders, and investor feedback is regularly shared with Board members to inform decision making.

As part of our shareholder governance outreach in the 2022-2023 proxy

season:

| • |

we contacted holders of approximately 58% of our outstanding shares and met with institutional shareholders representing approximately 43% of our outstanding shares; |

| • |

we discussed a variety of topics including our initiatives in the area of sustainability and environmental stewardship, executive compensation, and Board composition and experience; and |

| • |

investors were complimentary of our new GHG reduction goals, gender pay equity success, and board diversity,and continue to be pleased with our strategic priorities and business results. |

More information on our shareholder engagement can be found on page 65.

| 20 |

CORNING 2023 PROXY STATEMENT |

Corporate Governance

Our Board of Directors employs practices that foster effective Board

oversight of critical matters such as strategy, management succession planning, financial and other controls, risk management and compliance.

The Board reviews our major governance policies, practices and processes regularly in the context of current corporate governance trends,

investor feedback, regulatory changes and recognized best practices. Corning also aligns its corporate governance practices with the Investor

Stewardship Group’s (ISG) Corporate Governance Framework for U.S. Listed Companies.

The following sections provide an overview of our corporate governance

structure and processes, including key aspects of our Board operations, and how they align with the ISG Principles.

| Practice |

Description |

| ISG

Principle 1: Boards are accountable to shareholders |

| Annual

election of directors |

All directors are elected annually, which reinforces our Board’s accountability

to shareholders. |

| Majority

voting standard for director elections |

Our by-laws mandate that directors be elected under a “majority voting” standard in uncontested elections. Each director nominee must receive more votes “For” his or her election than votes “Against” in order to be elected. |

| Proxy

access |

Eligible shareholders may include their director nominees in our proxy materials. |

| No

poison pill |

Corning does not have a poison pill. |

| ISG

Principle 2: Shareholders should be entitled to voting rights in proportion to their economic interest |

| One-share,

One-vote |

Corning has one class of voting stock. Each share is entitled to one vote. |

ISG

Principle 3: Boards should be responsive to shareholders and be proactive in order to understand

their perspectives |

| Shareholder

engagement |

Our investor relations team maintains an ongoing dialogue with investors and portfolio managers year-round on matters of business performance and results. In the 2022-2023 proxy season, we reached out to investors representing approximately 58% of our outstanding shares and engaged with shareholders representing approximately 43% of our shares. Management and directors engage with our largest shareholders’ governance teams on topics such as governance, our strategic priorities, compensation, human capital management and sustainability. |

| ISG

Principle 4: Boards should have a strong, independent leadership structure |

| Lead

Independent Director |

Our Corporate Governance Guidelines require a Lead Independent Director with specific responsibilities to ensure independent oversight of management whenever our CEO is also the Chair of the Board. As former Chairman, Chief Executive Officer and President of Merck & Co., Inc., our Lead Independent Director, Richard T. Clark, brings deep leadership experience to the role. See page 23. |

| Annual

Evaluation of Leadership Structure |

The Board considers the appropriateness of its leadership structure annually and discloses in the proxy statement why it believes the current structure is appropriate. See page 23. |

| CORNING 2023 PROXY STATEMENT |

21 |

Corporate Governance and the Board of Directors

| Practice |

Description |

| ISG

Principle 5: Board should adopt structures and practices that enhance their effectiveness |

| Independence |

Our Corporate Governance Guidelines require a substantial majority of our directors to be independent. Currently, all directors but one (or 93%) are independent. Except for our Executive Committee, each of our Board committees consists entirely of independent directors. See page 29. |

| Skills

and qualifications |

Our Board is composed of accomplished professionals with deep experiences, skills, and knowledge relevant to our business, resulting in a high-functioning and engaged Board.

A matrix of relevant skills can be found on page 39. |

| Commitment

to Diversity |

The Board seeks to achieve diversity among its members and is committed to actively seeking out highly qualified women and minority candidates, as well as candidates with diverse backgrounds, skills and experiences, to include in the pool from which Board nominees are chosen. The Board’s definition of diversity explicitly includes gender and race/ethnic background. See pages 27-28. |

| Director

tenure |