UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. _)

| Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy

Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy

Statement |

| ☐ | Definitive Additional

Materials |

| ☐ | Soliciting Material

under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

Name of Person(s) Filing Proxy Statement, if other than the Registrant

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously

with preliminary materials. |

| ☐ | Fee computed on

table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NUZEE,

INC.

NOTICE

OF THE SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON DECEMBER 9, 2022

To

the Stockholders of NuZee, Inc.:

You

are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting”) of NuZee, Inc., a Nevada corporation

(the “Company”), to be held virtually via live webcast at www.virtualshareholdermeeting.com/NUZE2022SM at 5:00 p.m., Eastern

Time, on December 9, 2022, in order to:

| |

1. | Approve an amendment

to the Company’s Articles of Incorporation, and authorize the Company’s Board of Directors (the “Board”), to

effect a reverse stock split of the Company’s issued and outstanding Common Stock, par value $0.00001 per share, within a range

from 1-for-10 to 1-for-50, with the exact ratio of the reverse stock split to be determined by the Board; |

| |

2. | Approve an amendment

to the Company’s Articles of Incorporation to reincorporate into the Company’s Articles of Incorporation the “Additional

Articles,” which, due to a clerical error were erroneously and inadvertently separated from the record at an indeterminable date

after they were originally filed as part of the Company’s Articles of Incorporation filed with the Nevada Secretary of State on

July 15, 2011; |

| |

3. | Approve one or

more adjournments of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there

are insufficient votes to approve any of the preceding proposals at the time of the Special Meeting, or in the absence of a quorum. This

would authorize the Board to adjourn the Special Meeting to solicit votes on the approval of any of the above proposals; and |

| |

4. | Transact such other

business as may properly come before the Special Meeting. |

The

board of directors of the Company (the “Board”) has fixed the close of business on November 2, 2022 as the record date for

determining the stockholders of the Company entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponements

thereof. Please review in detail the proxy statement for a more complete statement of matters to be considered at the Special Meeting.

The

Special Meeting will be held entirely online in a virtual meeting format only, with no physical in-person meeting, to allow greater participation.

Stockholders attending the Special Meeting virtually will be afforded the same rights and opportunities to participate as they would

at an in-person meeting. We encourage you to attend online and participate in the Special Meeting, where you will be able to listen to

the meeting live, submit questions and vote. Stockholders may participate in the Special Meeting by visiting the following website: www.virtualshareholdermeeting.com/NUZE2022SM.

To participate in the Special Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that

accompanied your proxy materials. We recommend that you log in a few minutes before the Special Meeting to ensure you are logged in when

the Special Meeting starts.

Your

vote is very important to us regardless of the number of shares you own. Whether or not you are able to virtually attend the Special

Meeting, please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed form

of proxy in the mail, by completing, dating, signing and returning the enclosed proxy card in order to assure representation of your

shares at the Special Meeting. Granting a proxy will not limit your right to vote if you wish to virtually attend the Special Meeting

and vote online during the Special Meeting.

| |

By order of the Board of Directors, |

| |

|

| |

Patrick Shearer |

| |

Chief Financial Officer |

Plano,

Texas

[●],

2022

You

are cordially invited to virtually attend the Special Meeting. Whether or not you expect to virtually attend the Special Meeting,

PLEASE VOTE YOUR SHARES IN ADVANCE. You may vote your shares in advance of the Special Meeting via the internet, by telephone or,

by mailing the completed proxy card. Voting instructions are printed on your proxy card.

If

you were a stockholder of record as of November 2, 2022, you may vote online during the Special Meeting. If, on November 2, 2022,

your shares of our common stock were held, not in your name, but rather in an account at a brokerage firm, bank or other similar

organization, you are also invited to attend the Special Meeting and may vote online during the Special Meeting. However, even if

you plan to attend the Special Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted

if you later decide not to attend the Special Meeting.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 9, 2022

Our

proxy statement for the Special Meeting and proxy card are also available free of charge at

www.proxyvote.com. |

NuZee,

Inc.

1401

Capital Avenue, Suite B

Plano,

Texas 75074

Special

Meeting of Stockholders

PROXY

STATEMENT

This

proxy statement and the accompanying form of proxy are being furnished to the stockholders of NuZee, Inc., a Nevada corporation (the

“Company”, “we”, “us”, or “our”), on or about [●], 2022, in connection with the

solicitation of proxies by the Company’s Board of Directors (the “Board”) of the Company for use at the Special Meeting

of Stockholders (the “Special Meeting”) to be held virtually via live webcast at www.virtualshareholdermeeting.com/NUZE2022SM

at 5:00 p.m., Eastern Time, on December 9, 2022, and any adjournment or postponements thereof.

The

Special Meeting will be held entirely online to allow greater participation. Stockholders may participate in the Special Meeting by visiting

the following website: www.virtualshareholdermeeting.com/NUZE2022SM. To participate in the Special Meeting, you will need the 16-digit

control number included on your proxy card or on the instructions that accompanied your proxy materials.

The

cost of soliciting proxies will be borne by the Company. Following the mailing of this proxy statement, the Company may conduct further

solicitations personally, telephonically or by facsimile through its officers, directors and employees, none of whom will receive additional

compensation for assisting with any such solicitations. The Company does not intend to retain a proxy solicitor in connection with the

Special Meeting. Brokerage houses, nominees, custodians and fiduciaries will be requested to forward soliciting material to beneficial

owners of stock held of record by them, and the Company, upon request, will reimburse such persons for their reasonable out-of-pocket

expenses in doing so.

Only

holders of record of outstanding shares of the Company’s common stock, par value $0.00001 per share, (“Common Stock”)

of the Company at the close of business on November 2, 2022 (the “record date”), are entitled to notice of, and to vote at,

the Special Meeting or any adjournment or postponements thereof. Each holder of Common Stock is entitled to one vote for each share of

Common Stock held on the record date. There were [●] shares of Common Stock outstanding and entitled to vote on November 2, 2022.

If you plan to attend the Special Meeting online, please see the instructions below.

How

do I attend, participate in, and ask questions during the virtual Special Meeting?

The

Company will be hosting the Special Meeting via live webcast only. All stockholders as of the record date may attend the Special Meeting

live online at www.virtualshareholdermeeting.com/NUZE2022SM. The Special Meeting will start at 5:00 p.m., Eastern Time, on Friday,

December 9, 2022. Stockholders attending the Special Meeting virtually will be afforded the same rights and opportunities to participate

as they would at an in-person meeting.

In

order to enter the Special Meeting, you will need the control number, which is included on your proxy card if you are a stockholder of

record, or included with your voting instruction card and voting instructions received from your broker, bank or other agent if you hold

your shares in “street name.” Instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/NUZE2022SM.

We recommend that you log in a few minutes before the scheduled start time to ensure you are logged in when the Special Meeting starts.

The webcast will open 15 minutes before the start of the Special Meeting.

To

help ensure that we have a productive and efficient meeting, and in fairness to all stockholders in attendance, you will also find posted

our rules of conduct for the Special Meeting when you log in prior to its start. These rules of conduct will include the following guidelines:

| |

● | You may submit

questions and comments electronically through the meeting portal during the Special Meeting. If you wish to submit a question during

the Special Meeting, you may do so by logging in to the virtual meeting platform at www.virtualshareholdermeeting.com/NUZE2022SM and

typing your question into the “Ask a Question” field, and clicking “Submit”. |

| |

| |

| |

● | Only stockholders

as of the record date for the Special Meeting and their proxy holders may submit questions at the Special Meeting. |

| |

| |

| |

● | Please direct all

questions to the Secretary of the Company. |

| |

| |

| |

● | Please include

your name and affiliation, if any, when submitting a question or comment. |

| |

| |

| |

● | Limit your remarks

to one brief question or comment that is relevant to the Special Meeting and/or our business. |

| |

| |

| |

● | Questions may be

grouped by topic by our management. |

| |

| |

| |

● | Questions may also

be ruled as out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation, disorderly,

repetitious of statements already made, or in furtherance of the speaker’s own personal, political or business interests. |

| |

| |

| |

● | Be respectful of

your fellow stockholders and Special Meeting participants. |

| |

| |

| |

● | No audio or video

recordings of the Special Meeting are permitted. |

If

you encounter any difficulties accessing the virtual Special Meeting during login or in the course of the meeting, please contact the

phone number found on the login page at www.virtualshareholdermeeting.com/NUZE2022SM.

Who

can vote at the Special Meeting?

Only

stockholders of our Common Stock at the close of business on the record date will be entitled to vote at the Special Meeting. On the

record date, there were [●] shares of Common Stock outstanding and entitled to vote.

Stockholder

of Record: Shares Registered in Your Name

If,

on the record date, your shares of Common Stock were registered directly in your name with our transfer agent, V Stock Transfer, LLC,

then you are a stockholder of record. As a stockholder of record, you may vote (i) through the internet before or at the Special Meeting,

using the instructions on the proxy card and those posted at www.virtualshareholdermeeting.com/NUZE2022SM; (ii) by telephone from

the United States, using the number on the proxy card; or (iii) by completing and returning the enclosed printed proxy card. Whether

or not you plan to virtually attend the Special Meeting, we urge you to vote your shares by proxy in advance of the Special Meeting electronically

through the internet, by telephone or by completing and returning the enclosed printed proxy card. To help us keep our costs low,

please vote through the internet, if possible.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If,

on the record date, your shares of Common Stock were held, not in your name, but rather in an account at a brokerage firm, bank or other

similar organization, then you are the beneficial owner of shares held in “street name”. The organization holding your account

is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right

to direct your broker (or bank or other nominee) regarding how to vote the shares in your account. You may so instruct your broker (or

bank or other nominee) through the internet or by telephone as described in the applicable instructions your broker has provided with

these proxy materials. You may also vote by completing the voting instruction card your broker provides to you. To help us keep our

costs low, please vote through the internet, if possible. As a beneficial owner, you are also invited to virtually attend the Special

Meeting at www.virtualshareholdermeeting.com/NUZE2022SM by entering the 16-digit control number provided by your broker (or bank

or other nominee) and vote your shares of Common Stock online during the Special Meeting.

Can

I revoke my proxy and change my vote?

Any

stockholder of record who executes and delivers a proxy may revoke it at any time prior to its use by (i) giving written notice of revocation

to the Secretary of the Company, (ii) executing and delivering a proxy bearing a later date, or (iii) virtually attending the Special

Meeting and voting online during the Special Meeting. Simply attending the Special Meeting will not, by itself, revoke your proxy. Even

if you plan to virtually attend the Special Meeting, we recommend that you also submit your proxy or voting instructions in advance of

the Special Meeting so that your vote will be counted if you later decide not to virtually attend the Special Meeting.

If

you are a beneficial owner, you will need to revoke or resubmit your proxy through your broker (or bank or other nominee) and in accordance

with its procedures.

What

are the recommendations of the Board?

Each

of the recommendations of the Board is set forth together with the description of each item in this proxy statement. In summary, the

Board recommends a vote “FOR” each of Proposal One, Proposal Two and Proposal Three. If you sign and return your proxy card

but do not specify how you want your shares voted, the persons named as proxy holders on the proxy card will vote in accordance with

the recommendations of the Board.

The

Board does not know of any other matters that may be brought before the Special Meeting. In the event that any other matter should properly

come before the Special Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in accordance

with their best judgment.

What

constitutes a quorum?

The

presence, by virtual attendance or by proxy, of the holders of shares of Common Stock entitled to vote at the Special Meeting representing

a majority of the outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Special Meeting. For

more information, see “What are the effects of broker non-votes” below.

What

vote is required to approve each item?

Proposal

One — Amendment to the Company’s Articles of Incorporation to effect and authorize a reverse stock split of the Company’s

issued and outstanding Common Stock, within a range from 1-for-10 to 1-for-50, with the exact ratio of the reverse stock split to be

determined by the Board. The affirmative vote from the holders of a majority of the outstanding shares of the Common Stock as of

the record date for the Special Meeting is required to approve this proposal.

Proposal

Two — Amendment to the Company’s Articles of Incorporation to reincorporate into the Company’s Articles of Incorporation

the “Additional Articles,” which, due to a clerical error, were erroneously and inadvertently separated from the record at

an indeterminable date after they were originally filed as part of the Company’s Articles of Incorporation filed with the Nevada

Secretary of State on July 15, 2011 (the “Separated Pages”). The affirmative vote from the holders of a majority of the

outstanding shares of the Common Stock as of the record date for the Special Meeting is required to approve this proposal.

Proposal

Three — Approval of one or more adjournments of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit

additional proxies if there are insufficient votes to approve any of the preceding proposals at the time of the Special Meeting, or in

the absence of a quorum. The affirmative vote from holders of a majority of the shares represented at the meeting is required to

approve this proposal.

Other

Matters. For each other matter, the proposal will be approved if affirmative votes equal to at least a majority of the votes of Common

Stock entitled to vote and present by virtual attendance or by proxy at the Special Meeting are cast in favor of the action.

What

are the effects of broker non-votes?

A

broker “non-vote” generally occurs when a broker or other nominee holding shares for a beneficial owner does not vote on

a proposal because the broker or other nominee has not received instructions as to such proposal from the beneficial owner and does not

have discretionary powers as to such proposal. These proposals are referred to as “non-routine” matters. If you are a beneficial

owner and do not provide your broker or other nominee with instructions on how to vote your street name shares, your broker or nominee

will not be permitted to vote them on “non-routine” matters (a broker non-vote).

The

Company believes that all of the proposals to be considered at the Special Meeting are non-routine matters under applicable rules. Accordingly,

without your specific voting instructions, your brokerage firm may not vote your shares on any of the proposals to be considered at the

Special Meeting. If you hold your shares in street name, it is therefore particularly important that you instruct your brokers on how

you wish to vote your shares so that your vote can be counted. We encourage you to provide instructions to your broker regarding the

voting of your shares.

Shares

subject to a broker non-vote will have the effect of a vote against each of Proposals One and Two. Shares subject to a broker non-vote

will not be considered entitled to vote with respect to Proposal Three and will not affect its outcome.

How

are abstentions treated?

Abstentions

will have the effect of votes against all the proposals.

PROPOSAL

1 – AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION AND

AUTHORIZATION OF THE BOARD OF DIRECTORS TO EFFECT A REVERSE

STOCK SPLIT

On

October 14, 2022, the Board adopted a resolution approving, and recommending that the Company’s stockholders approve, this

proposal to grant the Board the authority to file an amendment (the “Reverse Split Amendment”) to the Company’s Articles

of Incorporation, as amended (the “Articles”), to effect a reverse stock split (the “Reverse Stock Split”) at

any ratio at the Board’s discretion, from 1-for-10 to 1-for-50, in order to reduce the number of shares of Common Stock outstanding.

Pursuant to the proposed Reverse Split Amendment, the form of which is attached to this proxy statement as Exhibit A, no changes

will be made to the total number of shares of Common Stock authorized for issuance under the Articles.

Purposes

and Effect of the Reverse Split Amendment

The

Board has determined that it is in the best interests of the Company and its stockholders to implement the Reverse Stock Split in order

to reduce the number of shares of Common Stock outstanding. The Board believes that approval of a proposal providing the Board with this

generalized grant of authority with respect to setting the split ratio, rather than mere approval of a pre-defined reverse stock split,

will give the Board flexibility to set the ratio in accordance with current market conditions and therefore allow the Board to act in

the best interests of the Company and our stockholders. The Board intends to implement the Reverse Stock Split as soon as practicable

if approved at the Special Meeting. In any event, the Reverse Stock Split must be implemented at any time before the one-year anniversary

of the Special Meeting. The Reverse Stock Split proposal is not part of a going-private transaction.

The

Reverse Stock Split is intended to provide the capital structure that may facilitate further potential business and financing transactions

and also increase the trading price of the Company’s Common Stock and provide us with greater liquidity and a stronger investor

base.

Our

Common Stock is listed on the Nasdaq Capital Market. On September 20, 2022, we received a notification letter (the “Notice”)

from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“NASDAQ”) indicating that we failed to comply

with the minimum bid price requirement for continued listing set forth in Nasdaq Listing Rule 5550(a)(2). Nasdaq Listing Rule 5550(a)(2)

requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a

failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. The

Notice provided that we have 30 days from the date of the Notice, or until March 20, 2023, to regain compliance.

If

we do not regain compliance during the compliance period ending March 20, 2023, then NASDAQ may in its discretion determine to grant

us an additional 180 calendar day period to regain compliance, provided that we on March 20, 2023 meet the continued listing requirement

for market value of publicly held shares and all other applicable initial listing standards for The Nasdaq Capital Market, with the exception

of the minimum bid price requirement, and will need to provide NASDAQ written notice of our intent to cure the deficiency during the

second compliance period.

If

we do not regain compliance within the allotted compliance period or periods, including any extensions that NASDAQ may determine to grant,

NASDAQ will provide notice that our Common Stock will be subject to delisting. We would then be entitled to appeal that determination

to a NASDAQ hearings panel. There can be no assurance that the Company will regain compliance with the minimum bid price requirement

during the 180-day compliance period, secure a second period of 180 days to regain compliance or maintain compliance with the other NASDAQ

listing requirements.

The

Reverse Stock Split would decrease the total number of shares of our Common Stock outstanding and should, absent other factors, proportionately

increase the market price of our Common Stock, which would be above $1.00 per share. Therefore, the Board believes that the Reverse Stock

Split is an effective means for us to regain compliance with NASDAQ’s minimum bid price requirement.

After

the Reverse Stock Split is effected, if at all, we will continue to be subject to the periodic reporting requirements of the Exchange

Act. By itself, the Reverse Stock Split will not have any impact on the market in which our common stock is traded; however, our common

stock would be identified with a new CUSIP number following any Reverse Stock Split.

Certain

Risks Associated with the Reverse Stock Split

The

effect of the Reverse Stock Split upon the market price for our common stock cannot be accurately predicted, and the history of similar

stock split combinations for companies in like circumstances is varied. In particular, while we expect that the Reverse Stock Split will

result in an increase in the per share price of our Common Stock, there is no assurance that the price per share of our Common Stock

after the Reverse Stock Split is implemented will be ten, fifteen, twenty, thirty, forty or fifty times, as applicable, the price per

share of our Common Stock immediately prior to the Reverse Stock Split. Furthermore, there can be no assurance that the market price

of our Common Stock immediately after the Reverse Stock Split will be maintained for any period of time. This will depend on many factors,

including our performance, prospects and other factors that may be unrelated to the number of shares outstanding.

Even

if an increased share price can be maintained, the Reverse Stock Split may not achieve the other desired results which have been outlined

above. In particular, we cannot assure you that the reverse stock split will increase our stock price and have the desired effect of

maintaining compliance with the initial and continued listing requirements of NASDAQ or any other national securities exchange. Moreover,

because some investors may view a Reverse Stock Split negatively, there can be no assurance that the Reverse Split Amendment will not

adversely impact the market price of our Common Stock or, alternatively, that the market price following the Reverse Stock Split will

either exceed or remain in excess of the current market price.

In

addition, although we believe the Reverse Stock Split may enhance the desirability of our Common Stock to certain potential investors,

we cannot assure you that, if implemented, our Common Stock will be more attractive to institutional and other long-term investors or

that the liquidity of our Common Stock will increase since there would be a reduced number of shares outstanding after the Reverse Stock

Split.

Stockholders

should recognize that if the Reverse Stock Split is effected, they will own a smaller number of shares than they currently own (a number

equal to the number of shares owned immediately prior to the Reverse Stock Split divided by ten, fifteen, twenty, thirty, forty or fifty,

as applicable). Therefore, if the Reverse Stock Split is implemented, some stockholders may consequently own less than one hundred shares

of our common stock. A purchase or sale of less than one hundred shares (an “odd lot” transaction) may result in incrementally

higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own

less than one hundred shares following the reverse stock split may be required to pay modestly higher transaction costs should they then

determine to sell their shares in the Company.

However,

the Board has determined that these negative factors are outweighed by the potential benefits.

Mechanics

of the Reverse Stock Split

No

Fractional Shares

Stockholders

will not receive fractional shares of Common Stock in connection with the Reverse Stock Split. Instead, stockholders who would have been

entitled to a fractional share will instead receive such additional fraction of a share of Common Stock as is necessary to increase the

fractional share to which they were entitled to a full share.

Effect

on Stock Options and Warrants

| |

● | The per share exercise

price of any outstanding stock options would be increased proportionately, and the number of shares issuable under outstanding stock

options and all other outstanding equity-based awards would be reduced proportionately; |

| |

| |

| |

● | The number of shares

of Common Stock authorized for future issuance under our stock incentive plans would be proportionately reduced and other similar adjustments

would be made under the stock incentive plans to reflect the Reverse Stock Split; and |

| |

| |

| |

● | The exercise, exchange

or conversion price of all other outstanding securities that are exercisable or exchangeable for or convertible into shares of our Common

Stock would be proportionately adjusted and the number of shares of Common Stock issuable upon such exercise, exchange or conversion

would be proportionately adjusted. |

The

table below provides examples of a Reverse Stock Split at various ratios between 1-for-10 and 1-for-50:

Shares Outstanding

as of October 7, 2022 | | |

Reverse Stock Split Ratio | |

Shares Outstanding

After Reverse Stock Split | | |

Reduction in

Shares Outstanding | |

| 23,668,017 | | |

1-for-10 | |

| 2,366,802 | | |

| 21,301,215 | |

| 23,668,017 | | |

1-for-15 | |

| 1,577,868 | | |

| 22,090,149 | |

| 23,668,017 | | |

1-for-20 | |

| 1,183,401 | | |

| 22,484,616 | |

| 23,668,017 | | |

1-for-30 | |

| 788,934 | | |

| 22,879,083 | |

| 23,668,017 | | |

1-for-40 | |

| 591,701 | | |

| 23,076,317 | |

| 23,668,017 | | |

1-for-50 | |

| 473,361 | | |

| 23,194,656 | |

The

Reverse Stock Split will affect all holders of the Company’s Common Stock uniformly and will not change the proportionate equity

interests of such stockholders, nor will the respective voting rights and other rights of holders of the Company’s Common Stock

be altered, except for possible changes due to the treatment of fractional shares resulting from the Reverse Stock Split.

The

Reverse Stock Split will not affect total stockholders’ equity on the Company’s balance sheet. As a result of the Reverse

Stock Split, the stated capital component attributable to the Company’s Common Stock will be reduced to an amount equal to one-tenth

to one-fiftieth of its present amount, in accordance with the range selected by the Board, and the additional paid-in capital component

will be increased by the amount by which the Common Stock is reduced. Amounts for earnings (loss) per common share will be restated for

the effects of the Reverse Stock Split and will be higher than the previously disclosed amounts because there will be fewer shares of

the Company’s Common Stock outstanding.

Authorized

Shares of Common Stock

Because

the number of authorized shares of Common Stock will not be reduced proportionately, the Reverse Stock Split will increase the ability

of the Board to issue authorized and unissued shares without further stockholder action. We currently do not have any plans, arrangements

or understandings to issue any of the authorized but unissued shares that would become available as a result of the Reverse Stock Split.

However, as we have previously disclosed in our filings with the SEC, the development of our business will require substantial additional

capital, and continued operations depend on our ability to raise additional funding, which could occur through fundraising transactions

that involve issuance of shares of Common Stock or securities convertible into or exercisable for Common Stock; depending on several

factors including the number of shares that are issued or issuable in any such transaction, such shares could include authorized but

unissued shares that would become available as a result of the Reverse Stock Split.

Appraisal

Rights

Under

the Nevada Revised Statutes, stockholders will not be entitled to exercise appraisal rights in connection with the Reverse Stock Split,

and the Company will not independently provide stockholders with any such right.

Interest

of Certain Persons in Matters to be Acted Upon

No

officer or director has any interest that differs from our stockholders with regard to the treatment of any securities of the Company

that they own in the event that the Reverse Stock Split is effected.

Certain

U.S. Federal Income Tax Consequences of the Reverse Stock Split

The

following is a summary of certain U.S. federal income tax consequences of the Reverse Stock Split generally applicable to beneficial

holders of shares of the Common Stock and does not purport to be a complete discussion of all possible tax consequences. This discussion

does not address all U.S. federal income tax considerations that may be relevant to particular stockholders in light of their individual

circumstances or to stockholders that are subject to special rules such as financial institutions, tax-exempt organizations, insurance

companies, dealers in securities, holders subject to the alternative minimum tax, regulated investment companies or real estate investment

trusts, partnerships (or other flow-through entities for U.S. federal income tax purposes and their partners or members), traders in

securities that elect to use a mark-to-market method of accounting for their securities holdings, persons holding the Company’s

Common Stock as a position in a hedging transaction, straddle, conversion transaction or other risk reduction transaction; persons who

acquire shares of the Company’s Common Stock in connection with employment or other performance of services; persons who hold Company

Common Stock as qualified small business stock within the meaning of Section 1202 of the Code, U.S. expatriates and foreign stockholders.

The following summary is based on the provisions of the Internal Revenue Code (the “Code”), applicable Treasury Regulations

thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly

on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should

consult his, her or its own tax advisor as to the particular facts and circumstances that may be unique to such stockholder and also

as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Stock Split.

We

have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service (“IRS”) regarding

the United States federal income tax consequences of the Reverse Stock Split and there can be no assurance the IRS will not challenge

the statements and conclusions set forth in this discussion or that a court would not sustain any such challenge. EACH HOLDER OF COMMON

STOCK SHOULD CONSULT SUCH HOLDER’S TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH

HOLDER.

The

federal income tax consequences of the Reverse Stock Split to a stockholder may depend upon whether such stockholder receives solely

a reduced number of shares of common stock in exchange for its old shares of common stock or whether such stockholder also receives an

additional fraction of a share of Common Stock (a “Round-Up Fractional Share”) as is necessary to increase the fractional

share the shareholder would have received to a full share.

The

Company believes that the Reverse Stock Split should constitute a recapitalization pursuant to IRC § 368(a)(1)(E).

Subject

to the discussion below addressing the receipt by certain shareholders of a Round up Fractional Share, a stockholder should not recognize

gain or loss for federal income tax purposes as a result the Reverse Stock Split. In the aggregate, such stockholder’s basis in

the reduced number of shares of Common Stock (aside from any Round-Up Fractional Share) should equal the stockholder’s basis in

its old shares of Common Stock and such stockholder’s holding period in the reduced number of shares should include its holding

period in its old shares exchanged therefore.

The

federal income tax treatment to stockholders who receive a Round-Up Fractional Share is unclear. The IRS may take the position that the

receipt of an additional portion of a share results in a distribution, that it results in gain or that no income or gain is recognized.

Any income or gain recognized should not exceed the excess of the fair market value of such full share over the fair market value of

the fractional share to which such stockholder was otherwise entitled. Stockholders are urged to consult their own tax advisors as to

the possible tax consequences of receiving a Round-Up Fractional Share in the Reverse Stock Split.

The

Company should not recognize any gain or loss as a result of the Reverse Stock Split.

The

above discussion is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. Federal tax

penalties. It was solely written in connection with the proposed Reverse Stock Split of the Company’s Common Stock.

THE

BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE

REVERSE SPLIT AMENDMENT TO THE COMPANY’S ARTICLES

OF INCORPORATION AND

AUTHORIZATION OF THE BOARD OF DIRECTORS TO EFFECT A REVERSE STOCK SPLIT.

PROPOSAL

2 – AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO

REINCORPORATE THE SEPARATED PAGES

On

October 14, 2022, the Board adopted a resolution approving, and recommending that the Company’s stockholders approve, this

proposal to grant the Board the authority to file an amendment (the “Restoration Amendment”) to the Articles, to reincorporate

the Separated Pages, in the form attached hereto as Exhibit B.

Purpose

and Effect of the Restoration Amendment

The

Articles, including the Separated Pages, were originally filed with the Nevada Secretary of State on July 15, 2011. For reasons not known

to the Company or the Board, the Separated Pages originally included with the Articles were subsequently (at an indeterminable date)

separated from the record maintained by the Nevada Secretary of State. To rectify this clerical error, the Restoration Amendment would

reincorporate the language from the Separated Pages into the Articles. The Separated Pages were included with the Articles filed as Exhibit

3.1 to the Company’s Registration Statement on Form S-1 filed on September 6, 2011 and, therefore, the Separated Pages have been

publicly on file with the Securities and Exchange Commission since that time. The Board has determined that it is in the best interests

of the Company and its stockholders to rectify the clerical error and reincorporate the language from the Separated Pages into the record

maintained by the Nevada Secretary of State.

THE

BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE

RESTORATION AMENDMENT TO THE COMPANY’S ARTICLES

OF INCORPORATION.

PROPOSAL

3 – APPROVAL OF one or more adjournments of the Special Meeting to

a later date or dates,

if necessary or appropriate, to solicit additional

proxies.

If

the Special Meeting is convened and a quorum is present, but there are not sufficient votes to approve Proposal One or Proposal Two,

or if there are insufficient votes to constitute a quorum, our proxy holders may move to adjourn the Special Meeting at that time in

order to enable the Board to solicit additional proxies.

In

this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning

the Special Meeting to another time and place, if necessary or appropriate (as determined in good faith by the Board), to solicit additional

proxies in the event there are not sufficient votes to approve Proposal One or Two. If our stockholders approve this proposal, we could

adjourn the Special Meeting and any adjourned or postponed session of the Special Meeting and use the additional time to solicit additional

proxies, including the solicitation of proxies from our stockholders that have previously voted. Among other things, approval of this

proposal could mean that, even if we had received proxies representing a sufficient number of votes to defeat Proposal One or Two, we

could adjourn the Special Meeting without a vote on such proposal and seek to convince our stockholders to change their votes in favor

of such proposal.

If

it is necessary or appropriate (as determined by the Board) to adjourn the Special Meeting, no notice of the adjourned meeting is required

to be given to our stockholders, other than an announcement at the Special Meeting of the time and place to which the Special Meeting

is adjourned, so long as no new record date is fixed for the adjourned meeting. The Board must fix a new record date if the adjourned

meeting is a date more than 60 days later than December 9, 2022. At the adjourned meeting, we may transact any business which might have

been transacted at the original meeting.

THE

BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF one

or more adjournments

of the Special Meeting to a later date or dates, if

necessary or appropriate, to solicit additional proxies.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

The

following table sets forth, as of October 7, 2022, the beneficial ownership of our Common Stock by:

| |

● | each person, or

group of affiliated persons, known by us to beneficially own more than 5% of our Common Stock; |

| |

● | each of our named

executive officers; |

| |

● | each of our directors;

and |

| |

● | all executive officers

and directors as a group. |

Except

as otherwise indicated, all shares are owned directly, and the percentage shown is based on 23,668,017 shares of Common Stock issued

and outstanding on October 7, 2022.

Except

as otherwise indicated below, information with respect to beneficial ownership has been furnished by each director, officer or beneficial

owner of more than five percent (5%) of Common Stock. We have determined beneficial ownership in accordance with the rules of the SEC.

These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power

with respect to those securities. In addition, the rules include shares of our Common Stock issuable pursuant to the exercise of stock

options that are either immediately exercisable or exercisable within 60 days of October 7, 2022. These shares are deemed to be outstanding

and beneficially owned by the person holding those options for the purpose of computing the percentage ownership of that person, but

they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated,

the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially

owned by them, subject to applicable community property laws.

Except

as otherwise indicated below, the address of each person listed in the table below is 1401 Capital Avenue, Suite B, Plano, Texas 75074.

| Name of Beneficial Owner |

|

Shares of Common Stock Beneficially Owned |

|

|

Percentage of Shares of Common Stock Beneficially Owned (2) |

|

| Directors and Named Executive Officers |

|

|

|

|

|

|

| Masateru Higashida(1) |

|

|

5,265,376 |

|

|

|

21.8 |

% |

| Patrick Shearer |

|

|

80,000 |

|

|

|

* |

|

| Jose Ramirez |

|

|

10,000 |

|

|

|

* |

|

| Tomoko Toyota(2) |

|

|

10,000 |

|

|

|

* |

|

| Kevin J. Conner(3) |

|

|

194,827 |

|

|

|

* |

|

| Tracy Ging(3) |

|

|

194,827 |

|

|

|

* |

|

| J. Chris Jones(4) |

|

|

251,908 |

|

|

|

1.1 |

% |

| Nobuki Kurita(3) |

|

|

194,827 |

|

|

|

* |

|

| David G. Robson(4) |

|

|

251,908 |

|

|

|

1.1 |

% |

| All Executive Officers and Directors as a group (9 persons)(5) |

|

|

7,113,674 |

|

|

|

28.0 |

% |

| All other 5% Stockholders |

|

|

|

|

|

|

|

|

| Entities affiliated with Sabby Management, LLC(6) |

|

|

2,520,244 |

(6) |

|

|

4.99 |

%(7) |

| Sooncha Kim |

|

|

2,119,916 |

(8) |

|

|

8.81 |

% |

| * | Represents less

than 1% of our outstanding Common Stock. |

| (1) |

Includes (a) 14,164 shares of Common Stock owned by NuZee Co., Ltd., an entity 100% owned by Mr. Higashida, and (b) options to purchase 506,667 shares of Common Stock that may be exercised within 60 days of October 7, 2022. |

| |

|

| (2) |

As of September 27, 2022, Ms. Toyota is no longer employed by the Company. |

| |

|

| (3) |

Includes options to purchase 171,243 shares of Common Stock that may be exercised within 60 days of October 7, 2022. |

| |

|

| (4) |

Includes options to purchase 228,324 shares of Common Stock that may be exercised within 60 days of October 7, 2022. |

| |

|

| (5) |

Includes options to purchase 1,730,378 shares of Common Stock that may be exercised within 60 days of October 7, 2022. |

| |

|

| (6) |

Includes, subject to a 4.99% beneficial ownership limitation provision (“Blocker”) described below, 1,670,244 shares of Common Stock issuable upon exercise of the Company’s Series A Warrants, and 850,000 shares of Common Stock issuable upon exercise of the Company’s Series B Warrants. Number of shares based on information reported on Amendment No. 1 to the Schedule 13G/A filed with the SEC on January 4, 2022, reporting beneficial ownership by (a) Sabby Volatility Warrant Master Fund, Ltd., (b) Sabby Management, LLC (“Sabby Management”), and (c) Hal Mintz, and certain additional information known to the Company. As more fully described in the following footnote (6), the Company’s Series A Warrants and Series B Warrants are subject to a 4.99% Blocker. However, the 2,520,244 shares of Common Stock reported in this table for Sabby Management includes the number of shares of Common Stock that would be issuable upon full conversion and exercise of the Company’s Series A Warrants and Series B Warrants and do not give effect to such Blocker. |

| |

|

| (7) |

Pursuant to the terms of the Company’s Series A Warrants and Series B Warrants, Sabby Management cannot exercise the Series A Warrants and Series B Warrants to the extent Sabby Management would beneficially own, after any such exercise, more than 4.99% of the outstanding shares of our Common Stock (again, the “Blocker”). The 4.99% percentage set forth herein for Sabby Management gives effect to the Blocker. |

| |

|

| (8) |

Number of shares based on information reported on Schedule 13G filed with the SEC on April 22, 2022, reporting beneficial ownership by Sooncha Kim and certain additional information known to the Company. According to the report, Mr. Kim has sole voting and dispositive power over 1,220,084 shares. In addition to those shares included on the report, Mr. Kim has since purchased 899,832 additional shares. |

STOCKHOLDER

PROPOSALS

The

Company intends to hold a regular annual meeting in 2023 regardless of the outcome of the matters to be submitted at the Special Meeting.

If any stockholder intends to present a proposal to be considered for inclusion in our proxy materials for the 2023 annual meeting of

stockholders, the proposal must comply with the requirements of Rule 14a-8 of Regulation 14A of the Exchange Act and must have been received

by the Company no later than September 29, 2022, unless the date of our 2023 annual meeting is changed by more than 30 days from March

17, 2023, in which case, the proposal must be received a reasonable time before we begin to print and mail our proxy materials. If any

stockholder intends to present a proposal to be considered for inclusion in our proxy materials for the 2024 annual meeting of stockholders,

the proposal must be received by the Company no later than 120 calendar days prior to the date of our proxy statement released to stockholders

in connection with the 2023 annual meeting, unless the date of our 2024 annual meeting is changed by more than 30 days from the meeting

date, in which case, the proposal must be received a reasonable time before we begin to print and mail our proxy materials. All proposals

must comply with the applicable requirements or conditions established by the SEC and the Company’s bylaws, which requires among

other things, certain information to be provided in connection with the submission of stockholder proposals. All proposals must be directed

to the Secretary of the Company at 1401 Capital Avenue, Suite B, Plano, Texas 75074. The persons designated as proxies by the Company

in connection with the 2023 annual meeting of stockholders will have discretionary voting authority with respect to any stockholder proposal

for which the Company does not receive timely notice.

OTHER

MATTERS

The

Company knows of no other matters to be submitted at the Special Meeting. If any other matters properly come before the Special Meeting,

the enclosed proxy card confers discretionary authority on the persons named in the enclosed proxy card to vote as they deem appropriate

on such matters. It is the intention of the persons named in the enclosed proxy card to vote the

shares in accordance with their best judgment.

HOUSEHOLDING

In

some cases, only one copy of our proxy statement is being delivered to multiple stockholders sharing an address unless the Company has

received contrary instructions from one or more of the stockholders. Upon written or oral request, the Company will promptly deliver

a separate copy of this document to a stockholder at a shared address to which a single copy has been delivered. A stockholder can notify

the Company at the address indicated below if the stockholder wishes to receive separate copies in the future. In addition, stockholders

sharing an address who are currently receiving multiple copies may also notify the Company at such address if they wish to receive only

a single copy. Direct your written request to NuZee, Inc., 1401 Capital Avenue, Suite B, Plano, Texas 75074; Attention: Investor Relations

or by telephone at 760-295-2408.

EXHIBIT

A

The

Articles of Incorporation of NuZee, Inc. are hereby amended by adding the following new paragraphs:

Section

1A. Capital Stock – Reverse Stock Split

Upon

the filing and effectiveness (the “Effective Time”) pursuant to the Nevada Revised Statutes of this amendment to the Company’s

Articles of Incorporation, as amended, each [_________(_)] shares of Common Stock either issued and outstanding or held by the Corporation

in treasury stock immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders

thereof, be combined and converted into one (1) share of Common Stock (the “Reverse Stock Split”). No fractional shares shall

be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common

Stock shall be entitled to receive such additional fraction of a share of Common Stock as is necessary to increase the fractional shares

to a full share. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”),

shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate

shall have been combined, subject to the treatment of fractional shares as described above.

No

changes are being made to the number of authorized shares.

EXHIBIT

B

The

Articles of Incorporation of NuZee, Inc. are hereby amended by inserting the following paragraphs:

Section

1. Capital Stock

The

aggregate number of shares that the Corporation will have authority to issue is Two Hundred Million (200,000,000) of which One Hundred

Million (100,000,000) shares will be common stock, with a par value of $0.00001 per share, and One Hundred Million (100,000,000) shares

will be preferred stock, with a par value of $0.00001 per share.

The

Preferred Stock may be divided into and issued in series. The Board of Directors of the Corporation is authorized to divide the authorized

shares of Preferred Stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the

shares of all other series and classes. The Board of Directors of the Corporation is authorized, within any limitations prescribed by

law and this Article, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares

of any series of Preferred Stock including but not limited to the following:

| |

a) | The rate of dividend,

the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue; |

| |

| |

| |

b) | Whether shares

may be redeemed, and, if so, the redemption price and the terms and conditions of redemption; |

| |

| |

| |

c) | The amount payable

upon shares in the event of voluntary or involuntary liquidation; |

| |

| |

| |

d) | Sinking fund or

other provisions, if any, for the redemption or purchase of shares; |

| |

| |

| |

e) | The terms and conditions

on which shares may be converted, if the shares of any series are issued with the privilege of conversion; |

| |

| |

| |

f) | Voting powers,

if any, provided that if any of the Preferred Stock or series thereof shall have voting rights, such Preferred Stock or series shall

vote only on a share for share basis with the Common Stock on any matter, including but not limited to the election of directors, for

which such Preferred Stock or series has such rights; and, |

| |

| |

| |

g) | Subject to the

foregoing, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences,

if any, of shares or such series as the Board of Directors of the Corporation may, at the time so acting, lawfully fix and determine

under the laws of the State of Nevada. |

The

Corporation shall not declare, pay or set apart for payment any dividend or other distribution (unless payable solely in shares of Common

Stock or other class of stock junior to the Preferred Stock as to dividends or upon liquidation) in respect of Common Stock, or other

class of stock junior the Preferred Stock, nor shall it redeem, purchase or otherwise acquire for consideration shares of any of the

foregoing, unless dividends, if any, payable to holders of Preferred Stock for the current period (and in the case of cumulative dividends,

if any, payable to holder of Preferred Stock for the current period and in the case of cumulative dividends, if any, for all past periods)

have been paid, are being paid or have been set aside for payments, in accordance with the terms of the Preferred Stock, as fixed by

the Board of Directors.

In

the event of the liquidation of the Corporation, holders of Preferred Stock shall be entitled to received, before any payment or distribution

on the Common Stock or any other class of stock junior to the Preferred Stock upon liquidation, a distribution per share in the amount

of the liquidation preference, if any, fixed or determined in accordance with the terms of such Preferred Stock plus, if so provided

in such terms, an amount per share equal to accumulated and unpaid dividends in respect of such Preferred Stock (whether or not earned

or declared) to the date of such distribution. Neither the sale, lease or exchange of all or substantially all of the property and assets

of the Corporation, nor any consolidation or merger of the Corporation, shall be deemed to be a liquidation for the purposes of this

Article.

Section

2. Acquisition of Controlling Interest.

The

Corporation elects not to be governed by NRS 78.378 to 78.3793, inclusive.

Section

3. Combinations with Interest Stockholders.

The

Corporation elects not to be governed by NRS 78.411 to 78.444, inclusive.

Section

4. Liability.

To

the fullest extent permitted by NRS 78, a director or officer of the Corporation will not be personally liable to the Corporation or

its stockholders for damages for breach of fiduciary duty as a director or officer, provided that this article will not eliminate or

limit the liability of a director or officer for:

a)

Acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or

b)

The payment of distributions in violation of NRS 78.300, as amended.

Any

amendment or repeal of this Section 4 will not adversely affect any right or protection of a director of the Corporation existing immediately

prior to such amendment or repeal.

Section

5. Indemnification

| |

a) | Right to Indemnification.

The Corporation will indemnify to the fullest extent permitted by law any person (the “Indemnitee”) made or threatened to

be made a party to any threatened, pending or completed action or proceeding, whether civil, criminal, administrative or investigative

(whether or not by or in the right of the Corporation) by reason of the fact that he or she is or was a director of the Corporation or

is or was serving as a director, officer, employee or agent of another entity at the request of the Corporation or any predecessor of

the Corporation against judgments, fines, penalties, excise taxes, amounts paid in settlement and costs, charges and expenses (including

attorneys’ fees and disbursements) that he or she incurs in connection with such action or proceeding. |

| |

| |

| |

b) | Inurement. The

right to indemnification will inure whether or not the claim asserted is based on matters that predate the adoption of this Section 5,

will continue as to an Indemnitee who has ceased to hold the position by virtue of which he or she was entitled to indemnification, and

will inure to the benefit of his or her heirs and personal representatives. |

| |

| |

| |

c) | Non-exclusivity

of Rights. The right to indemnification and to the advancement of expenses conferred by this Section 5 are not exclusive of any other

rights that an Indemnitee may have or acquire under any statue, bylaw, agreement, vote of stockholders or disinterested directors, the

Articles of Incorporation or otherwise. |

| |

| |

| |

d) | Other Sources.

The Corporation’s obligation, if any, to indemnify or to advance expenses to any Indemnitee who was or is serving at the request

as a director, officer employee or agent of another corporation, partnership, joint venture, trust, enterprise or other entity will be

reduced by any amount such Indemnitee may collect as indemnification or advancement or expenses from such other entity. |

| |

| |

| |

e) | Advancement of

Expenses. The Corporation will, from time to time, reimburse or advance to any Indemnitee the funds necessary for payment of expenses,

including attorneys’ fees and disbursements, incurred in connection with defending any proceeding from which he or she is indemnified

by the Corporation, in advance of the final disposition of such proceeding; provided that the Corporation has received the undertaking

of such director or officer to repay any such amount so advanced if it is ultimately determined by a final and unappealable judicial

decision that the director or officer is not entitled to be indemnified for such expenses. |

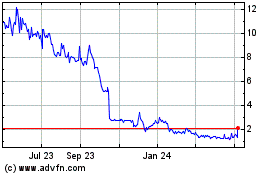

NuZee (NASDAQ:NUZE)

Historical Stock Chart

From Mar 2024 to Apr 2024

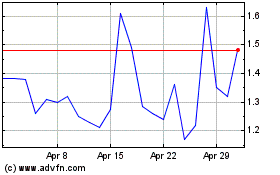

NuZee (NASDAQ:NUZE)

Historical Stock Chart

From Apr 2023 to Apr 2024