Absci Corporation (Nasdaq: ABSI), the drug and target discovery

company harnessing deep learning AI and synthetic biology to expand

the therapeutic potential of proteins, today reported financial and

operating results for the quarter ended June 30, 2022.

"As we pass the halfway point of 2022, our team

continues to make excellent progress toward our stated objectives,"

said Sean McClain, founder and CEO. "Since becoming a public

company one year ago, we have signed 13 discovery programs and

continue to see momentum with adoption of our technology, reflected

in the discovery deals we've signed each of the last three

quarters. With ten new Active Programs for drug discovery

activities signed year-to-date, we have already exceeded our

guidance for the year. Furthermore, in light of current market

conditions, we've recently undertaken a diligent strategic review

of our operations to refine our focus on drug discovery value

creation. This has led to some difficult staffing decisions as

we've prioritized activities, but it has afforded us an extended

cash runway and positioned us optimally to achieve our vision of

fully in silico protein-based drug discovery."

Recent Highlights

- Exceeded

annual guidance of at least eight new Active Programs for 2022 with

ten Active Programs for drug discovery activities signed

year-to-date, bringing the total current number of Active Programs

to 19.

- Entered

into a multi-program collaboration agreement with an undisclosed

biotech partner operating in stealth-mode. The partner is focused

on discovery and development of antibody-drug-conjugates initially

for oncology indications and has developed novel, proprietary

warhead linker chemistries that it will target to specified sites

on subject antibodies by exploiting Absci’s Bionic™ protein

non-standard amino acid incorporation technology.

-

Presented results of development of AI models for antibody

optimization in an oral talk at the PEGS conference in May; the

research was additionally selected for presentation at the 2022

International Conference on Machine Learning Workshop on

Computational Biology in July. This research, along with our plan

for continued manuscripts, further demonstrates our progress and

leading role in the field of AI/ML drug discovery.

- Strengthened

executive leadership team, adding Denise Dettore as Chief People

Officer and Jack Gold as Chief Marketing Officer.

Strategic Reorganization

Absci recently undertook a strategic review of

operations to refine our focus on drug discovery value creation,

yielding a comprehensive corporate reorganization. Absci is

focusing on initiatives that reinforce progress toward our business

inflection points, extending cash and cash equivalents sufficient

to fund our operations into late 2025.

Internal R&D efforts will prioritize

continued development of our AI-powered drug discovery platform and

enhancement of our Bionic™ protein non-standard amino acid

incorporation technology. As a result of this reorganization, Absci

has undertaken actions to streamline its workforce, resulting in a

reduction of headcount, in addition to the elimination of certain

planned hires and capital expenditures.

Second Quarter 2022 Financial

Results

Cash and cash equivalents as of June 30,

2022 was $206.0 million, as compared to $252.6 million as of

December 31, 2021.

Research and development expenses were $16.2

million for the second quarter of 2022, as compared to $11.0

million for the second quarter of 2021. This increase was primarily

driven by growth in our team and related personnel costs, increased

lab operation costs, and additional investments in platform

expansion, including data initiatives and AI capabilities.

Selling, general, and administrative expenses

were $10.5 million for the second quarter of 2022, as compared to

$5.2 million for the second quarter of 2021. This increase was

primarily due to personnel-related costs and other expenses related

to operating as a publicly traded company.

Net loss was $28.7 million for the second

quarter of 2022, as compared to $41.2 million for the second

quarter of 2021.

2022 Outlook

Absci now expects a net decrease in cash, cash

equivalents, and restricted cash of approximately $110 million for

2022. This includes one-time, time-based disbursements totaling

$10.5 million from restricted cash associated with the Denovium and

Totient acquisitions.

About Absci

Absci is the drug and target discovery company

harnessing deep learning AI and synthetic biology to expand the

therapeutic potential of proteins. We built our Integrated Drug

Creation™ Platform to identify novel drug targets, discover optimal

biotherapeutic candidates, and generate the cell lines to

manufacture them in a single efficient process. Biotech and pharma

innovators partner with us to create the next generation of

protein-based drugs, including those that may be impossible to make

with other technologies. Our goal is to enable the development of

better medicines by Translating Ideas into Drugs™. For more

information visit www.absci.com and follow us on social media:

Twitter: @Abscibio, LinkedIn: @absci, and subscribe to our Absci

YouTube channel.

Availability of Other Information About

Absci

Investors and others should note that we

routinely communicate with investors and the public using our

website (www.absci.com) and our investor relations website

(investors.absci.com), including without limitation, through the

posting of investor presentations, SEC filings, press releases,

public conference calls and webcasts on these websites. The

information that we post on these websites could be deemed to be

material information. As a result, investors, the media, and others

interested in Absci are encouraged to review this information on a

regular basis. The contents of our website, or any other website

that may be accessed from our website, shall not be deemed

incorporated by reference in any filing under the Securities Act of

1933, as amended.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements containing the words “will,” “pursues,”

“anticipates,” “plans,” “believes,” “forecast,” “estimates,”

“extends,” “expects,” and “intends,” or similar expressions. We

intend these forward-looking statements, including statements

regarding our expectations regarding business operations, financial

performance and results of operations, including our expectations

and guidance regarding cash, cash equivalents and restricted cash,

our projected cash usage, needs and runway, plans for hiring, our

expectations for the count of new Active Programs, technology

development efforts and the application of those efforts,

advancements toward in silico drug design, drug discovery and

development activities, internal research and publication efforts,

and research and technology development collaboration efforts, to

be covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act, and we make this

statement for purposes of complying with those safe harbor

provisions. These forward-looking statements reflect our current

views about our plans, intentions, expectations, strategies, and

prospects, which are based on the information currently available

to us and on assumptions we have made. We can give no assurance

that the plans, intentions, expectations, or strategies will be

attained or achieved, and, furthermore, actual results may differ

materially from those described in the forward-looking statements

and will be affected by a variety of risks and factors that are

beyond our control, including, without limitation, risks and

uncertainties relating to our ability to effectively collaborate on

research, drug discovery and development activities with our

partners or potential partners; along with those risks set forth in

our most recent periodic report filed with the U.S. Securities and

Exchange Commission, as well as discussions of potential risks,

uncertainties, and other important factors in our subsequent

filings with the U.S. Securities and Exchange Commission. Except as

required by law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Investor Contact:

investors@absci.com

Media Contact:

press@absci.com

Absci Corporation

Condensed Consolidated Statements of

Operations (unaudited)

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

(In thousands, except for share and per share

data) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

Technology development revenue |

|

$ |

636 |

|

|

$ |

592 |

|

|

$ |

1,090 |

|

|

$ |

1,532 |

|

|

Collaboration revenue |

|

|

366 |

|

|

|

136 |

|

|

|

731 |

|

|

|

259 |

|

| Total revenues |

|

|

1,002 |

|

|

|

728 |

|

|

|

1,821 |

|

|

|

1,791 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

16,241 |

|

|

|

11,040 |

|

|

|

32,068 |

|

|

|

18,090 |

|

|

Selling, general and administrative |

|

|

10,507 |

|

|

|

5,179 |

|

|

|

21,396 |

|

|

|

9,864 |

|

|

Depreciation and amortization |

|

|

3,141 |

|

|

|

1,201 |

|

|

|

6,047 |

|

|

|

1,677 |

|

| Total operating expenses |

|

|

29,889 |

|

|

|

17,420 |

|

|

|

59,511 |

|

|

|

29,631 |

|

| Operating loss |

|

|

(28,887 |

) |

|

|

(16,692 |

) |

|

|

(57,690 |

) |

|

|

(27,840 |

) |

| Other expense |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(211 |

) |

|

|

(2,009 |

) |

|

|

(406 |

) |

|

|

(2,464 |

) |

|

Other income (expense), net |

|

|

148 |

|

|

|

(28,114 |

) |

|

|

273 |

|

|

|

(27,950 |

) |

| Total other expense, net |

|

|

(63 |

) |

|

|

(30,123 |

) |

|

|

(133 |

) |

|

|

(30,414 |

) |

| Loss before income taxes |

|

|

(28,950 |

) |

|

|

(46,815 |

) |

|

|

(57,823 |

) |

|

|

(58,254 |

) |

| Income tax (expense)

benefit |

|

|

270 |

|

|

|

5,617 |

|

|

|

(351 |

) |

|

|

6,094 |

|

| Net loss |

|

|

(28,680 |

) |

|

|

(41,198 |

) |

|

|

(58,174 |

) |

|

|

(52,160 |

) |

| Cumulative undeclared

preferred stock dividends |

|

|

— |

|

|

|

(1,047 |

) |

|

|

— |

|

|

|

(2,042 |

) |

| Net loss applicable to common

stockholders |

|

$ |

(28,680 |

) |

|

$ |

(42,245 |

) |

|

$ |

(58,174 |

) |

|

$ |

(54,202 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders:Basic and diluted |

|

$ |

(0.32 |

) |

|

$ |

(2.39 |

) |

|

$ |

(0.64 |

) |

|

$ |

(3.13 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding:Basic and diluted |

|

|

90,669,499 |

|

|

|

17,641,147 |

|

|

|

90,471,950 |

|

|

|

17,312,437 |

|

|

|

|

|

|

|

|

|

|

|

Absci

CorporationCondensed Consolidated Balance Sheets

(unaudited)

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| (In

thousands, except for share and per share data) |

|

|

2022 |

|

|

|

2021 |

|

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

206,021 |

|

|

$ |

252,569 |

|

|

Restricted cash |

|

|

15,017 |

|

|

|

10,513 |

|

|

Receivables under development arrangements |

|

|

310 |

|

|

|

1,425 |

|

|

Prepaid expenses and other current assets |

|

|

6,540 |

|

|

|

8,572 |

|

|

Total current assets |

|

|

227,888 |

|

|

|

273,079 |

|

| Operating

lease right-of-use assets |

|

|

5,708 |

|

|

|

6,538 |

|

| Property and

equipment, net |

|

|

54,890 |

|

|

|

52,114 |

|

| Intangibles,

net |

|

|

53,308 |

|

|

|

54,992 |

|

| Goodwill |

|

|

21,335 |

|

|

|

21,335 |

|

| Restricted

cash, long-term |

|

|

1,845 |

|

|

|

16,844 |

|

| Other

long-term assets |

|

|

1,341 |

|

|

|

1,293 |

|

| TOTAL

ASSETS |

|

$ |

366,315 |

|

|

$ |

426,195 |

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

5,470 |

|

|

$ |

8,385 |

|

|

Accrued expenses |

|

|

17,054 |

|

|

|

17,434 |

|

|

Long-term debt, current |

|

|

2,135 |

|

|

|

2,400 |

|

|

Operating lease obligations |

|

|

1,584 |

|

|

|

1,502 |

|

|

Financing lease obligations |

|

|

2,651 |

|

|

|

2,785 |

|

|

Deferred revenue |

|

|

2,798 |

|

|

|

1,353 |

|

|

Total current liabilities |

|

|

31,692 |

|

|

|

33,859 |

|

| Long-term

debt - net of current portion |

|

|

7,125 |

|

|

|

1,124 |

|

| Operating

lease obligations - net of current portion |

|

|

8,175 |

|

|

|

8,969 |

|

| Finance lease

obligations - net of current portion |

|

|

1,818 |

|

|

|

3,231 |

|

| Deferred tax,

net |

|

|

1,085 |

|

|

|

743 |

|

| Other

long-term liabilities |

|

|

227 |

|

|

|

12,162 |

|

| TOTAL

LIABILITIES |

|

|

50,122 |

|

|

|

60,088 |

|

| Commitments

(See Note 8) |

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

| Preferred

stock, $0.0001 par value |

|

|

— |

|

|

|

— |

|

| Common stock,

$0.0001 par value |

|

|

9 |

|

|

|

9 |

|

| Additional

paid-in capital |

|

|

565,444 |

|

|

|

557,136 |

|

| Accumulated

deficit |

|

|

(249,199 |

) |

|

|

(191,025 |

) |

| Accumulated

other comprehensive loss |

|

|

(61 |

) |

|

|

(13 |

) |

| TOTAL

STOCKHOLDERS' EQUITY |

|

|

316,193 |

|

|

|

366,107 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

366,315 |

|

|

$ |

426,195 |

|

|

|

|

|

|

|

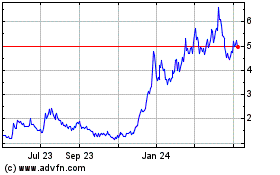

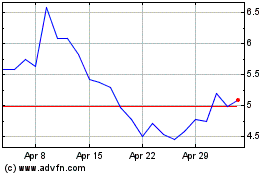

AbSci (NASDAQ:ABSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbSci (NASDAQ:ABSI)

Historical Stock Chart

From Apr 2023 to Apr 2024