UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021, OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ____________ TO ________________

Commission File Number: 001-13595

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

METTLER-TOLEDO, LLC

ENHANCED RETIREMENT SAVINGS PLAN

1900 POLARIS PARKWAY

COLUMBUS, OHIO 43240-4035

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

METTLER-TOLEDO INTERNATIONAL INC.

IM LANGACHER

P.O. BOX MT-100

CH8606 GREIFENSEE, SWITZERLAND

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Financial Statements and Supplemental Schedule

December 31, 2021 and 2020

with Report of Independent Registered Public Accounting Firm

METTLER-TOLEDO, LLC

ENHANCED RETIREMENT SAVINGS PLAN

INDEX TO ANNUAL REPORT ON FORM 11-K

| | | | | | | | |

| Table of Contents | | Page |

| | |

| | |

| | |

| Annual Financial Statements: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Supplemental Schedules: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Report of Independent Registered Public Accounting Firm

To the Pension Committee and Participants of

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Columbus, Ohio

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits (modified cash basis) of the Mettler-Toledo, LLC Enhanced Retirement Savings Plan (the Plan) as of December 31, 2021 and 2020, and the related statements of changes in net assets available for benefits (modified cash basis) for the years ended December 31, 2021 and 2020, and the related notes and schedule (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits (modified cash basis) of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits (modified cash basis) for the years ended December 31, 2021, in conformity with the modified cash basis of accounting.

As described in Note 2, the accompanying financial statements and supplemental schedule were prepared on a modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of assets held at end of year has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental

information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Clark, Schaefer, Hackett & Co.

We have served as the Plan’s auditor since December 31, 2003.

Columbus, Ohio

June 28, 2022

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Statements of Net Assets Available for Benefits (Modified Cash Basis)

As of December 31, 2021 and 2020

| | | | | | | | | | | |

| 2021 | | 2020 |

| Assets | | | |

| Investments at fair value | $ | 698,711,139 | | | $ | 613,082,299 | |

| Participant loan receivables | 5,850,067 | | | 5,990,982 | |

Net assets available for benefits | $ | 704,561,206 | | | $ | 619,073,281 | |

See accompanying notes to the financial statements.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Statements of Changes in Net Assets Available for Benefits (Modified Cash Basis)

For the Years Ended December 31, 2021 and 2020

| | | | | | | | | | | |

| 2021 | | 2020 |

| Additions | | | |

| | | |

| Investment Activity | | | |

Dividends and interest | $ | 17,159,662 | | | $ | 11,423,189 | |

| Net appreciation in fair value of investments | 70,456,462 | | | 69,412,912 | |

| 87,616,124 | | | 80,836,101 | |

| Participant Loan Receivable Activity | | | |

Interest | 280,307 | | | 314,299 | |

| Contributions | | | |

Employer | 13,972,198 | | | 11,779,985 | |

Participants' deferrals | 22,674,638 | | | 20,329,763 | |

Participants' rollovers | 3,024,997 | | | 1,981,473 | |

| 39,671,833 | | | 34,091,221 | |

| | | |

| Assets transferred in | — | | | 2,060,545 | |

| 127,568,264 | | | 117,302,166 | |

| Deductions | | | |

Benefits paid to participants or beneficiaries | 41,872,867 | | | 39,249,039 | |

Administrative expenses | 207,472 | | | 202,010 | |

| 42,080,339 | | | 39,451,049 | |

| | | |

| Net increase in net assets | 85,487,925 | | | 77,851,117 | |

| Net assets available for benefits, beginning of year | 619,073,281 | | | 541,222,164 | |

| Net assets available for benefits, end of year | $ | 704,561,206 | | | $ | 619,073,281 | |

See accompanying notes to the financial statements.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

1. Description of Plan

The following description of the Mettler-Toledo, LLC Enhanced Retirement Savings Plan (the Plan) provides only general information. Participants should refer to the Summary Plan Description for a more complete description of the Plan's provisions.

General

The Plan is a qualified defined contribution plan covering eligible employees of adopting units (wholly-owned subsidiaries) and a safe harbor 401(k)/401(m) plan under IRC 401(k)(12) and 401(m)(11). It is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA), as amended. Employees become eligible to participate in the Plan on the first day of a payroll period following the date the employee meets the eligibility requirements, as defined.

Mettler-Toledo, LLC (a wholly-owned subsidiary of Mettler-Toledo International Inc.) is both the Plan Sponsor and Administrator and is responsible for keeping accurate and complete records with regard to the Plan, informing participants of changes or amendments to the Plan, and ensuring that the Plan conforms to applicable laws and regulations. Vanguard Fiduciary Trust Company (VFTC) is the trustee and maintains the Plan assets.

Contributions

Each year, participants may contribute up to 60% of pretax annual compensation, as defined by the Plan. Participants who reach age 50 may elect to make catch-up contributions. Participants may also contribute rollover contributions representing distributions from other qualified plans. Forfeitures may be used by the Plan Sponsor to reduce future contributions and/or to pay reasonable Plan expenses.

The Plan Sponsor contributes:

Safe Harbor Matching Contributions - 100% of the first 3% of each participant's deferred compensation and 50% of the next 3% of each participant's deferred compensation. All participants who make contributions are eligible for the matching contributions.

Discretionary Contributions - Employees become eligible on their one-year anniversary of employment. Participants must be employed on the last day of the Plan year to receive this discretionary contribution, with the exceptions of death, retirement, disability, or authorized leave.

Participant Accounts

Each participant’s account is credited with the contributions made to the Plan on behalf of the participant and adjusted for earnings and losses thereon. Allocations of Plan earnings are based on the investment options selected by the participant and their related account balance and allocated to each participant’s account on a daily basis. The benefit to which a participant is entitled is the vested amount that is in such participant’s account at any given time.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

Vesting

Participants are immediately vested in the Plan Sponsor's Safe Harbor Matching Contributions and the Plan Sponsor's Discretionary Contributions.

Investment Options

Upon enrollment in the Plan, a participant can direct employee and employer contributions in 1% increments among the various investment options offered through VFTC, or into a self-directed brokerage option. This is a self-directed program that allows participants to invest their account balances in mutual funds that are outside the current plan options. A participant may elect to transfer amounts between investment options as of any business day. Certain investment options offered within the VFTC may not be directly transferred to the self-directed brokerage option for a period of 90 days.

Company Stock Fund

The Plan invests in an employer stock fund consisting of Mettler-Toledo International Inc. Common Stock (Company Stock). The fund may also hold cash or cash equivalents as necessary to satisfy obligations of the fund.

Payment of Benefits

A participant's vested account may be distributed upon retirement, termination, disability or death. Distributions are made in lump-sum or equal annual installments not to exceed the employee's life expectancy. Upon death, the remaining balance shall be distributed in a lump sum within five years. Forfeitures, if any, are used to reduce the Plan Sponsor's contributions or pay Plan expenses. Participants may make a withdrawal during employment due to hardship as well as other allowable situations defined in the Plan document. Hardship withdrawals must meet the criteria for hardship under Section 401(k) of the Internal Revenue Code (IRC).

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

2. Summary of Significant Accounting Policies

The following are the significant accounting policies followed by the Plan.

Basis of Presentation

The accompanying financial statements of the Plan have been prepared on the modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America (U.S. GAAP). The difference between the modified cash basis and accounting principles generally accepted in the United States of America is that contributions and interest and dividend income are recognized when received and administrative expenses are recognized when paid.

Investment Valuation and Income Recognition

Under the terms of a trust agreement between the Plan Sponsor and VFTC, the trustee invests trust assets at the direction of the plan participants. The trustee has reported to the Plan Sponsor the trust fund investments and the trust transactions at fair value. Shares of registered investment companies are valued at quoted market prices, which represent the net asset value of shares held by the Plan at year-end. The Plan's interest in the units of a common collective trust are based on information reported by VFTC using audited financial statements of the collective trust at the end of 2021 and 2020. The Company stock fund is valued at its year-end unit closing price (comprised of year-end market price plus uninvested cash position). Realized and unrealized gains and losses are reflected as net appreciation (depreciation) in fair value of investments in the statements of changes in net assets available for benefits.

Purchases and sales of securities are recorded on a trade-date basis. Interest and dividend income is recognized when received. Capital gain distributions are included in dividend income.

Participant Loan Receivables

Participant loan receivables are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recognized when received. The interest rate for the life of the loan is set quarterly at the prime rate plus 1% as of the beginning of the quarter. Loans may not exceed the lesser of 50% of a participant's vested account balance or $50,000. The repayment period may not exceed five years. Each loan is secured by the remaining balance in the participant's account. A loan is considered delinquent after 60 days of not receiving a payment. The Plan reviews delinquent loans on a quarterly basis. As of December 31, 2021 and 2020, no loans were considered delinquent.

Contributions

Participant and Plan Sponsor contributions are recognized when received by the trustee.

Payment of Benefits

Benefits are recognized when paid.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

Administrative Expenses

Fees for portfolio management of VFTC funds are paid directly from fund earnings. Administration fees and fees related to the administration of participant loan receivables are charged to the participant's account. Audit fees are either paid by the Plan Sponsor or from the forfeiture account. Should the Plan Sponsor elect not to pay all or part of such expenses, the trustee then pays these expenses from the Plan assets. Expenses are recognized when paid.

Use of Estimates

The preparation of the Plan's financial statements in conformity with a modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America, requires the Plan Administrator to make certain estimates and assumptions that affect the reported amounts of net assets available for benefits and, when applicable, disclosure of contingent assets and liabilities at the date of the financial statements and the amounts of changes in net assets available for benefits during the reporting period. Actual results could differ significantly from those estimates.

Risk and Uncertainties

The Plan provides various investment options in any combination of stocks, mutual funds, and other investment securities. Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits.

New Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13: Financial Instruments - Credit Losses. The ASU requires the allowance for doubtful accounts to be estimated based on an incurred loss model, which considers historical and forecasted conditions. The guidance became effective for the Plan January 1, 2020 on a prospective basis and did not have an impact on the consolidated financial statements.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

3. Fair Value Measurements

Under U.S. GAAP, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value measurement consists of observable and unobservable inputs that reflect the assumptions that a market participant would use in pricing an asset or liability.

A fair value hierarchy has been established that categorizes these inputs into three levels:

Level 1: Quoted prices in active markets for identical assets and liabilities

Level 2: Observable inputs other than quoted prices in active markets for identical assets

and liabilities

Level 3: Unobservable inputs

Investments consist of various mutual funds, common collective trusts and a Company stock fund. The plan invests in shares of open-ended mutual funds that trade in active markets and produce a daily net asset value, equal to the fair value of the shares at year-end. Units of the common collective trusts are valued at net asset value at the end of the year. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported NAV. Participant transactions (purchases and sales) may occur daily. If the Plan were to initiate a full redemption of the collective trusts, the investment advisor reserves the right to temporarily delay withdrawal from the trusts in order to ensure the securities liquidations will be carried out in an orderly business manner. There are no unfunded commitments related to the common collective trusts and units of the common collective trusts are redeemable at net asset value. Company stock is valued at its year-end unit closing price (comprised of year-end market price plus uninvested cash position).

The following tables present for each of these hierarchy levels, the Plan assets that are measured at fair value on a recurring basis at December 31:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2021 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Company stock fund | $ | 36,673,680 | | | $ | 36,673,680 | | | $ | — | | | $ | — | |

| Mutual funds | 274,727,694 | | | 274,727,694 | | | — | | | — | |

| Self-Directed Brokerage accounts | 8,264,335 | | | 8,264,335 | | | — | | | — | |

| Total assets in the fair value hierarchy | $ | 319,665,709 | | | $ | 319,665,709 | | | $ | — | | | $ | — | |

Investments measured at net asset value(a) | 379,045,430 | | | — | | | — | | | — | |

| Investments at fair value | $ | 698,711,139 | | | $ | 319,665,709 | | | $ | — | | | $ | — | |

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Notes to the Financial Statements

For the Years Ended December 31, 2021 and 2020

| | | | | | | | | | | | | | | | | | | | | | | |

| 2020 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Company stock fund | $ | 25,914,698 | | | $ | 25,914,698 | | | $ | — | | | $ | — | |

| Mutual funds | 239,422,828 | | | 239,422,828 | | | — | | | — | |

| Self-Directed Brokerage accounts | 8,597,802 | | | 8,597,802 | | | — | | | — | |

| Total assets in the fair value hierarchy | $ | 273,935,328 | | | $ | 273,935,328 | | | $ | — | | | $ | — | |

Investments measured at net asset value(a) | 339,146,971 | | | — | | | — | | | — | |

| Investments at fair value | $ | 613,082,299 | | | $ | 273,935,328 | | | $ | — | | | $ | — | |

(a) Represents common collective trusts. Investments are measured using the net asset value (NAV) per share practical expedient have not been categorized in the fair value hierarchy. The amounts presented above are intended to permit reconciliation of the fair value hierarchy to the fair value of total plan assets in order to determine the amounts included in the Statement of Net Assets Available for Benefits.

4. Transactions with Parties-in-Interest

The Plan invests in shares of mutual funds and a common collective trust managed by an affiliate of VFTC. VFTC acts as trustee for only those investments as defined by the Plan. Transactions in such investments qualify as party-in-interest transactions which are exempt from the prohibited transaction rules.

Participants may select Company stock as an investment option. The amount of Company stock held at December 31, 2021 and 2020 was $36,673,680 and $25,914,698, respectively. The Company stock appreciated $12,258,028 and $8,090,872 in 2021 and 2020, respectively.

5. Plan Termination

Although it has not expressed any intent to do so, the Plan Sponsor has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of plan termination, participants will immediately become 100% vested in their accounts.

6. Tax Status

The Plan adopted its current volume submitter plan which has received an opinion letter from the Internal Revenue Service ("IRS") dated March 31, 2014, which indicates the plan was designed and in compliance with the applicable requirements of the Internal Revenue Code ("IRC"). Although The Plan has been amended since receiving the opinion letter, The Plan Administrator and the Plan's tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code, and therefore, believe that the plan is qualified and the related trust is tax-exempt.

7. Withdrawing Participants

As of December 31, 2021 and 2020, there were no vested benefits that were allocated to accounts of terminated participants who had elected to withdraw from the Plan but had not been paid.

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

EIN:34-1538688; PN:031

Schedule of Assets (Held at End of Year) (Modified Cash Basis)

Form 5500, Schedule H, Line 4(i)

December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) | | (c) | | (d) | | (e) |

| | Identity of issuer, borrower, lessor, or similar party | | Description of investment, including maturity date, rate of interest, collateral, par or maturity value | | Cost | | Fair Value |

| * | | Vanguard | | Institutional Index Fund | | ** | | 93,597,281 | |

| * | | Vanguard | | International Value Fund | | ** | | 4,763,334 | |

| * | | Vanguard | | Mid-Cap Index Fund | | ** | | 23,049,153 | |

| * | | Vanguard | | International Growth Fund Adm. | | ** | | 18,254,554 | |

| * | | Vanguard | | U.S. Growth Adm | | ** | | 49,608,256 | |

| * | | Vanguard | | Small-Cap Index Fund | | ** | | 18,855,268 | |

| * | | Vanguard | | Target Retirement 2015 Trust II | | ** | | 12,249,653 | |

| * | | Vanguard | | Target Retirement 2020 Trust II | | ** | | 35,070,073 | |

| * | | Vanguard | | Target Retirement 2025 Trust II | | ** | | 55,177,565 | |

| * | | Vanguard | | Target Retirement 2030 Trust II | | ** | | 51,451,586 | |

| * | | Vanguard | | Target Retirement 2035 Trust II | | ** | | 46,410,376 | |

| * | | Vanguard | | Target Retirement 2040 Trust II | | ** | | 37,817,442 | |

| * | | Vanguard | | Target Retirement 2045 Trust II | | ** | | 30,348,548 | |

| * | | Vanguard | | Target Retirement 2050 Trust II | | ** | | 18,131,873 | |

| * | | Vanguard | | Target Retirement 2055 Trust II | | ** | | 11,692,265 | |

| * | | Vanguard | | Target Retirement 2060 Trust II | | ** | | 4,801,903 | |

| * | | Vanguard | | Target Retirement 2065 Trust II | | ** | | 1,565,230 | |

| * | | Vanguard | | Target Retirement Income Trust II | | ** | | 8,469,066 | |

| * | | Vanguard | | Total Bond Market Index Fund | | ** | | 20,544,525 | |

| * | | Vanguard | | Total International Stock Index Fund | | ** | | 9,845,175 | |

| * | | Vanguard | | Treasury Money Market Fund | | ** | | 146,800 | |

| * | | Vanguard | | Windsor II Fund Adm. | | ** | | 26,184,797 | |

| * | | Western Asset | | Western Asset Core Pl IS Plus Bond Fund | | ** | | 9,878,551 | |

| * | | Vanguard | | Participant Self-Directed Brokerage Account | | ** | | 8,264,335 | |

| * | | Vanguard | | Retirement Savings Trust III | | ** | | 65,859,850 | |

| * | | Mettler-Toledo International Inc. | | Mettler - Toledo Stock Fund - 22,739 shares | | ** | | 36,673,680 | |

| * | | Participant Loan Receivables | | Various ranging from 3.25% to 8.25% | | -0- | | 5,850,067 | |

| | | | Total | | | | $ | 704,561,206 | |

| * | | Denotes party-in-interest | | | | | | |

| ** | | Cost omitted for participant directed investments | | | | |

| | | | | | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on the Plan's behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Mettler-Toledo, LLC |

| | | Enhanced Retirement Savings Plan |

| | | | | |

| Date: | June 28, 2022 | | By: | /s/ Jeffrey T. Ward | |

| | | | | | |

| | | | Jeffrey T. Ward | |

| | | | Treasurer | |

Mettler-Toledo, LLC Enhanced Retirement Savings Plan

Annual Report On Form 11-K For Fiscal Year Ended

December 31, 2021

| | | | | | | | | | | | | | |

| INDEX TO EXHIBIT |

| Exhibit No | | Description | | |

| | | | |

| | | | |

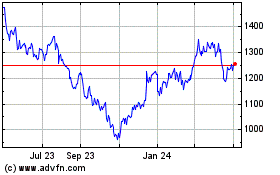

Mettler Toledo (NYSE:MTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

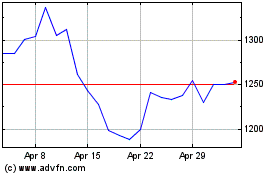

Mettler Toledo (NYSE:MTD)

Historical Stock Chart

From Apr 2023 to Apr 2024