Barnwell Industries, Inc. (NYSE American: BRN) today reported net

earnings of $2,052,000, $0.21 per share, and $3,125,000, $0.33 per

share, for the three and six months ended March 31, 2022,

respectively, as compared to net losses of $856,000, $0.10 per

share, and $272,000, $0.03 per share, for the three and six months

ended March 31, 2021, respectively.

Mr. Alexander C. Kinzler, Chief Executive

Officer of Barnwell, commented, “We are pleased to report that our

quarterly oil and natural gas revenues more than doubled as well as

a significant increase in land segment revenues, which contributed

to our increase in earnings as compared to last year’s three months

ended March 31, 2021.

“Our oil and natural gas operating margins

improved as prices increased for all products; oil, natural gas,

and natural gas liquids increasing 75%, 53%, and 95%, respectively,

for our second quarter as compared to the prior year’s quarter.

Notably, our new Oklahoma oil production accounted for 22% of our

second quarter production on a barrel of oil equivalent basis, as

compared to none in the prior year’s quarter. Also, quarterly

production of all petroleum products increased from last year’s

quarter.

“While our oil and natural gas segment improved

the most this quarter, our land investment segment also performed

well as three lots were sold within Phase II of Increment I by the

Kukio Resort Development Partnerships at Kaupulehu, North Kona,

Hawaii, with the Company receiving $695,000 in percentage of sales

payments and $1,568,000 in net cash distributions in our second

quarter. These real estate sales also significantly increased our

reported earnings of affiliates by $1,136,000, in this quarter as

compared to last year’s quarter ended March 31, 2021.

“For the six months ended March 31, 2022 as

compared to last year’s six months ended March 31, 2021, the

increase in earnings was also largely due to oil and natural gas

segment operating results which reported a $3,724,000 improvement.

This was due to increases in production and prices in all products

and partially to an asset impairment charge of $630,000 in the

prior year period as compared to no impairment charge in the

current six-month period. The land investment segment had a

$1,289,000 increase in earnings of affiliates due to improved real

estate sales, which also led to the Company receiving $1,295,000 in

percentage of sales payments and $2,643,000 in net cash

distributions. Contract drilling operating results decreased

$897,000 due to the completion of a significant drilling contract

in the prior year period.

“Our Oklahoma operations generated $727,000

(30%) and $1,464,000 (37%) of our oil and natural gas segment

operating profits for the three and six months ended March 31,

2022, respectively. Our Oklahoma production is from shale oil wells

that as a rule have steep production declines.

“The Company participated in the drilling of one

operated and two non-operated wells for a total of three gross (1.6

net) wells in the Twining area of Alberta, Canada. The wells were

completed and began producing in the three months ended March 31,

2022 and are currently producing approximately 400 barrel of oil

equivalents before royalties per day on an aggregate basis. We

anticipate these wells will continue to increase our production in

the third quarter. Capital expenditures incurred for the drilling

of these wells in the six months ended March 31, 2022 totaled

approximately $4,258,000. In addition, in January 2022, the Company

acquired additional working interests in oil and natural gas

properties located in the Twining area of Alberta, Canada for

consideration of $1,246,000. Barnwell also assumed $1,500,000 in

long-term asset retirement obligations associated with the

acquisition.

“The Company’s liquidity remains strong as a

result of our operations and the Company’s sale of 509,467 shares

of common stock, resulting in net proceeds of $2,356,000 after

expenses of $97,000 during the three months ended March 31, 2022.

Barnwell ended the quarter with $11,026,000 in working capital,

which includes $9,626,000 in cash and cash equivalents.”

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

|

COMPARATIVE OPERATING RESULTS |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three months

ended |

|

Six months

ended |

|

|

|

March 31, |

|

March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

6,679,000 |

|

$ |

3,998,000 |

|

$ |

12,133,000 |

|

$ |

8,385,000 |

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) attributable to

Barnwell Industries, Inc. |

|

$ |

2,052,000 |

|

$ |

(856,000) |

|

$ |

3,125,000 |

|

$ |

(272,000) |

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per |

|

|

|

|

|

|

|

|

|

share – basic and diluted |

|

$ |

0.21 |

|

$ |

(0.10) |

|

$ |

0.33 |

|

$ |

(0.03) |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares and |

|

|

|

|

|

|

|

|

equivalent shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

9,570,989 |

|

|

8,277,160 |

|

|

9,507,955 |

|

|

8,277,160 |

| |

|

|

|

|

|

|

|

|

|

CONTACT: |

Alexander C. Kinzler Chief Executive Officer and PresidentRussell

M. GiffordExecutive Vice President and Chief Financial OfficerTel:

(808) 531-8400 |

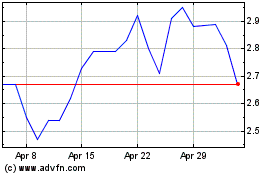

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

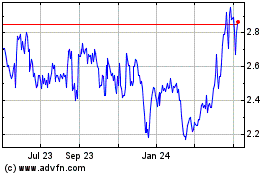

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Apr 2023 to Apr 2024