Current Report Filing (8-k)

May 06 2022 - 5:11PM

Edgar (US Regulatory)

0001626644

false

0001626644

2022-05-03

2022-05-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

U.S. SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): May

3, 2022

ODYSSEY

HEALTH, INC.

(Exact name of small business

issuer as specified in its charter)

| Nevada |

000-56196 |

47-1022125 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer ID No.) |

2300

West Sahara Avenue, Suite 800 - #4012,

Las

Vegas, NV |

89102 |

| (Address of principal executive offices) |

(Zip Code) |

(702) 780-6559

(Issuer’s

Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Securities registered pursuant

to Section 12(g) of the Act:

| Title of each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Stock ($0.001 par value) |

ODYY |

OTC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b2 of the Securities Exchange Act of 1934 (§240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| |

Item 1.01 |

Entry into a Material Definitive Agreement. |

On February 24, 2022, Odyssey Health, Inc.,

formerly known as Odyssey Group International, Inc. (the “Company”) initiated a private placement of up to fourteen million

two hundred eighty-five thousand seven hundred fourteen (14,285,714) Units, with each unit consisting of one (1) share of the Company’s

common stock, par value one tenth of a cent ($0.001) per share (the “Common Stock” or “Shares”) and one-half of

an accompanying warrant (the “Investor Warrants”) to purchase one Share, at a combined purchase price per Unit of thirty-five

cents ($0.35) (the “Private Placement”). The Investor Warrants have a term of five (5) years, an exercise price of $0.70 per

share, may be exercised in certain circumstances on a cashless basis, and are exercisable immediately upon issuance.

The Share and Investor Warrant comprising each

Unit are immediately separable and are issued separately. The Private Placement is being made on a “Minimum” basis, and accordingly,

once the minimum gross proceeds of nine hundred ninety-nine thousand nine hundred ninety-nine and seventy cents ($999,999.70), before

deducting introducing broker placement fees and other offering expenses, has been raised, upon clearance of the funds on deposit and approval

of the subscription by the Company, the Units are to be promptly distributed to the investors. The maximum amount to be offered under

the Private Placement is four million nine hundred ninety-nine thousand nine hundred ninety-nine and ninety cents ($4,999,999.90).

On May 3, 2022, the second closing of the Private

Placement (the “Second Closing”) occurred, following the satisfaction of customary closing conditions, pursuant to which the

Company issued one million seven hundred eighty-one thousand three hundred fifty-eight (1,781,358) Units, consisting of one million one

hundred eighty-seven thousand five hundred seventy-two (1,187,572) shares of common stock and warrants to purchase five hundred ninety-three

thousand seven hundred eighty-six (593,786) shares of common stock, and received four hundred fifteen thousand six hundred fifty dollars

and twenty cents ($415,650.20) in gross proceeds before deducting introducing broker placement fees and other offering expenses.

In connection with the Second Closing, the Company

entered into the following agreements with nine accredited investors (the “Purchasers”):

| |

· |

A Subscription Agreement, dated May 3, 2022, by and between the Company and the certain purchasing security holders |

| |

· |

A Stock Purchase Agreement, dated April 14, 2022, by and between the Company and the certain purchasing security holders |

| |

· |

A Warrant Agreement, dated May 3, 2022, by and between the Company and the certain purchasing security holders |

| |

· |

A Registration Rights Agreement (the “Registration Rights Agreement”), dated May 3, 2022, by and among the Company and the certain purchasing security holders |

The Company will be required to (i) file within

sixty (60) calendar days of the date of the Final Closing of the Private Placement, a registration statement registering for resale all

shares of Common Stock issued or issuable upon exercise of the Investor Warrants issued, (ii) use its best efforts to have all such registration

statements declared effective within the periods set forth in the Registration Rights Agreement, and (iii) use its best efforts to keep

such registration statements effective during the periods set forth in the Registration Rights Agreement. In the event that such registration

statements are not declared effective within the periods set forth in the Registration Rights Agreement, any such effective registration

statements subsequently become unavailable, or use of the prospectus contained in such registration statements is suspended for certain

periods of time, we would be required to pay certain liquidated damages to the investors named therein.

The Company received net proceeds of three hundred

seventy-four thousand eighty-five dollars and eighteen cents ($374,085.18) from the Second Closing, after deduction for offering expenses.

The total net proceeds received by the Company

from the First Closing and Second Closing were one million two hundred twenty-three thousand three hundred eighty-seven dollars and eighteen

cents ($1,223,387.18).

| |

Item 3.02. |

Unregistered Sales of Equity Securities. |

The information set forth above under Item 1.01

is hereby incorporated by reference into this Item 3.02.

We issued and sold the Shares and Warrants and

may issue the shares of common stock issuable upon exercise of the Warrants in reliance on the exemption from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”) by virtue of Section 4(a)(2) thereof and Rule 506 of Regulation

D thereunder. In connection with the Purchasers’ execution of the Stock Purchase Agreement, the Purchasers represented to us that

they are each an “accredited investor” as defined in Regulation D of the Securities Act and that the securities to be purchased

by them will be acquired solely for their own account and not with a view to or for distributing or reselling such securities or any part

thereof in violation of the Securities Act or any applicable state securities law.

This Current Report on Form 8-K does not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities by any person in any jurisdiction

in which it is unlawful for the person to make the offer or solicitation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Odyssey Group International,

Inc. |

| |

|

| |

By: |

/s/ Joseph Michael Redmond |

| |

|

Joseph Michael Redmond

Chief Executive Officer |

Date: May

6, 2022

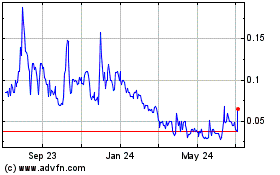

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

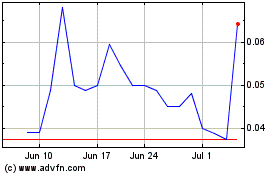

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Apr 2023 to Apr 2024