Current Report Filing (8-k)

April 14 2022 - 5:16PM

Edgar (US Regulatory)

0000351817falseApril 13, 202200003518172020-11-042020-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (or Date of Earliest Event Reported): April 13, 2022

SilverBow Resources, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-8754 | 20-3940661 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

920 Memorial City Way, Suite 850

Houston, Texas 77024

(Address of principal executive offices)

(281) 874-2700

(Registrant’s telephone number)

Not Applicable

(Former Name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☑ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | SBOW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement

Sundance Transaction

On April 13, 2022, SilverBow Resources, Inc. (the “Company”) and its operating subsidiary, SilverBow Resources Operating, LLC (“SilverBow Operating”), entered into a purchase and sale agreement (the “Sundance Purchase Agreement”) with Sundance Energy, Inc. (“Sundance”), Armadillo E&P, Inc. (“Armadillo”) and SEA Eagle Ford, LLC (“SEA”) (collectively, the “Sundance Sellers”) pursuant to which the Company will acquire oil and gas assets in the Eagle Ford formation for consideration of approximately $354 million, subject to customary adjustments, approximately $225 million to be paid as cash and the rest to be paid with 4,148,472 shares of common stock (“Shares”) of the Company (which were valued based on the 30-day volume weighted average price as of April 8, 2022), subject to customary adjustments (the “Sundance Transaction”). The Sundance Sellers may also receive up to $15 million in contingent cash consideration based on crude price levels in 2022 and 2023. The Sundance Transaction is expected to close on or before July 19, 2022 (“Sundance Closing”), subject to shareholder approval and satisfaction or waiver of certain customary closing conditions, including the accuracy of the representations and warranties of each party and compliance by each party in all material respects with its covenants.

The Company, SilverBow Operating and the Sundance Sellers made customary representations and warranties in the Sundance Purchase Agreement. Subject to certain limitations on liability contained in the Sundance Purchase Agreement, the Company and SilverBow Operating have agreed to indemnify the Sundance Sellers for breaches of representations and warranties, covenants and certain liabilities. The Sundance Purchase Agreement contains certain termination rights for both the Company and SilverBow Operating and the Sundance Sellers, including, but not limited to, the right to terminate the Sundance Purchase Agreement in the event that the Transaction has not been approved by shareholders and consummated on or before September 2, 2022, or under certain conditions, if there has been a breach of certain representations and warranties or a failure by the other party to perform a covenant. In connection with the Sundance Purchase Agreement, on April 13, 2022, an entity indirectly managed by Strategic Value Partners LLC (“SVP”), as holder of 26.6% of the Company’s common stock, entered into an agreement with the Company to vote its shares of common stock in favor of the issuance of the Shares in the Sundance Transaction in any shareholder vote thereon (the “Voting Agreement”), subject to the specified conditions. Each of the Sundance Sellers is a third party beneficiary of the Voting Agreement with respect to SVP’s performance thereunder.

The foregoing description of each of the Sundance Purchase Agreement and the Voting Agreement does not purport to be complete and is qualified in its entirety by reference to the full agreement, which is filed as Exhibit 10.1 and 10.2, respectively, to this Current Report on Form 8-K.

Item 3.02 Unregistered Sales of Equity Securities

Sundance Transaction

The issuance of the Shares as consideration at Sundance Closing pursuant to the Sundance Purchase Agreement described in Item 1.01 will be made in reliance upon the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof, which exempts transactions by an issuer not involving any public offering. Upon the Sundance Closing, SilverBow has agreed to use commercially reasonable efforts to prepare and file a registration statement under the Securities Act to permit the public resale of the Shares.

SandPoint Transaction

On April 13, 2022, the Company and SilverBow Operating, also entered into a separate purchase and sale agreement (the “SandPoint Purchase Agreement”) with SandPoint Operating, LLC, a subsidiary

of SandPoint Resources, LLC, (collectively, “SandPoint”) pursuant to which the Company will acquire oil and gas assets in the Eagle Ford and Olmos formations for consideration of approximately $71 million, subject to customary adjustments, with approximately $31 million to be paid in cash and the rest to be paid with 1.3 million Shares of the Company (which were valued based on the 30-day volume weighted average price as of April 8, 2022) (the “SandPoint Transaction”). The SandPoint Transaction is expected to close in May 2022 (the “SandPoint Closing”), subject to satisfaction or waiver of certain customary closing conditions, including the accuracy of the representations and warranties of each party and compliance by each party in all material respects with its covenants.

The issuance of the Shares as consideration at the SandPoint Closing pursuant to the SandPoint Purchase Agreement described in this Item 3.02 will be made in reliance upon the exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof, which exempts transactions by an issuer not involving any public offering. Upon the SandPoint Closing, the Company has agreed to use commercially reasonable efforts to prepare and file a registration statement under the Securities Act to permit the public resale of the Shares.

Item 7.01. Regulation FD Disclosure

On April 14, 2022, the Company issued a press release regarding the Sundance Transaction and the SandPoint Transaction. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

On April 14, 2022, the Company posted a corporate presentation titled Transaction Update to the “Investor Relations” page of its website at www.sbow.com. A copy of the corporate presentation is attached as Exhibit 99.2 to this Current Report on 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information furnished under this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or as otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit

Number | Description |

| 10.1 | |

| 10.2 | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

Portions of Exhibits 10.1 and 10.2 have been omitted in accordance with Item 601(b)(10)(iv) of Regulation S-K.

Additional Information and Where to Find It

This communication does not constitute an offer to buy, or solicitation of an offer to sell, any securities of SilverBow. This communication relates to a proposed transaction involving SilverBow and Sundance that will become the subject of a proxy statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”) that will provide full details of the proposed transaction and the attendant benefits and risk. This communication is not a substitute for the proxy statement or any other document that SilverBow may file with the SEC or send to its shareholders in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SILVERBOW AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. In addition, copies of the proxy statement and other relevant documents (when they become available) may be obtained free of charge by accessing SilverBow’s website at www.sbow.com by clicking on the “Investors” link, or upon written request to SilverBow, 920 Memorial City Way, Suite 850, Houston, Texas 77024, Attention: Investor Relations. Shareholders may also read and copy any reports, statements and other information filed by SilverBow with the SEC, at the SEC at 1-800-SEC-0330 or on the SEC’s website.

Participants in the Solicitation

SilverBow and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders in respect of the transaction under the rules of the SEC. Information regarding SilverBow’s directors and executive officers is available in its definitive proxy statement filed with the SEC on March 30, 2022 in connection with its 2022 annual meeting of shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in SilverBow’s proxy statement and other relevant materials to be filed with the SEC when they become available. Investors should read the proxy statement and other relevant documents carefully when they become available before making any voting or investment decisions.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 14, 2022

| | | | | | | | | | | | | | | | | |

| | | SilverBow Resources, Inc. |

| | | | By: | /s/ Christopher M. Abundis |

| | | | | Christopher M. Abundis

Executive Vice President, Chief Financial Officer and General Counsel |

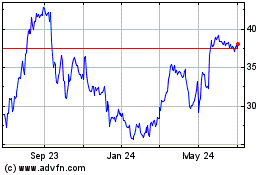

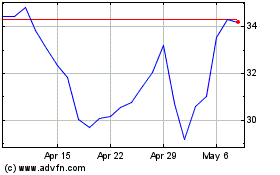

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Apr 2023 to Apr 2024