SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive Information Statement

|

|

MMEX RESOURCES CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing is calculated and state how it was determined.):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

MMEX Resources Corporation

3616 Far West Blvd., #117-321

Austin, Texas 78731

NOTICE OF ACTION TAKEN WITHOUT A SHAREHOLDER MEETING

*************

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY. No action is required by you. This Information

Statement is furnished only to inform our shareholders of the actions described herein in

accordance with Rule 14c-2 promulgated under the Securities Act of 1934.

THIS IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS’

MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

*************

To the Shareholders of MMEX Resources Corporation:

The attached Information Statement is being delivered by MMEX Resources Corporation (the “Company” or “MMEX”) in connection with the approval by our shareholders of an amendment to our Amended and Restated Articles of Incorporation (the “Charter Amendment”) to effect a 1-for-10,000 reverse stock split of the Company’s Common Stock (the “Reverse Split”) by which each shareholder of MMEX shall receive one share of Common Stock for every 10,000 shares of Common Stock of the Company that such shareholder presently owns. The text of the proposed amendment is set forth as Annex A to this Information Statement.

This Information Statement is being mailed to the shareholders of record as of May 28, 2021 and is being mailed to shareholders on June 7, 2021. We anticipate that the Charter Amendment will become effective on or after June 29, 2021. Each of these actions was approved by the holders of a majority of the outstanding voting power of the shareholders of MMEX by a written consent to action taken without a meeting, dated June 7, 2021.

QUESTIONS AND ANSWERS REGARDING THE INFORMATION STATEMENT

What is the purpose of the Information Statement?

Section 78.320 of the Nevada Revised Statutes (“NRS”) provides that the written consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted can approve an action in lieu of conducting a special shareholders’ meeting convened for the specific purpose of such action.

This Information Statement is being furnished to you pursuant to Section 14C of the Securities Exchange Act of 1934 (“Exchange Act”) to notify our shareholders of certain corporate actions taken by the holders of shares of voting securities representing approximately 70% of the voting power of the total issued and outstanding shares of voting common stock of the Company (the “Majority Holders”) pursuant to action by written consent. In order to eliminate the costs and management time involved in obtaining proxies and in order to effect the Reverse Split as early as possible to accomplish the purposes hereafter described, our board of directors elected to seek the written consent of the Majority Holders to reduce the costs and implement the Reverse Split in a timely manner.

The Majority Holders consist of affiliates of Jack W. Hanks and Bruce N. Lemons, the sole members of the board of directors of the Company. The Majority Holders beneficially own 100% of our Series A Preferred Stock and approximately 18.99 % of our outstanding Common Stock, which results in their ownership of approximately 69.99% of the voting power of our voting securities. The Majority Holders have voted in favor of the Reverse Split thereby satisfying the requirement under the NRS that at least a majority of the voting equity vote in favor of a corporate action by written consent. Therefore, no other shareholder consents will be obtained in connection with this Information Statement.

What capital stock is authorized and outstanding?

We are currently authorized to issue 37,010,000,000 shares of capital stock, which consists of 37 billion shares of Common Stock, $0.001 par value per share, and 10 million shares of Preferred Stock, $0.001 par value per share. As of May 18, 2021, there were 32,516,406,176 shares of Common Stock outstanding. We also had 1,000 shares of preferred stock, designated as Series A Preferred Stock, outstanding as of such date. The Series A Preferred Stock has no redemption, conversion or dividend rights; however, the holders of the Series A Preferred Stock, voting separately as a class, has the right to vote on all shareholder matters equal to 51% of the total vote.

What is the purpose of the Reverse Split?

Our business plan is to develop clean energy solutions powered by solar energy with carbon capture. We are developing hydrogen production to advance in the hydrogen economy in tandem with cleaner transportation fuels for the transition. Our initial focus is to produce potentially clean energy in three segments:

|

|

·

|

hydrogen production utilizing natural gas as a feedstock with steam methane reformer technology

|

|

|

·

|

hydrogen production with electrolyzer technology

|

|

|

·

|

ultra low sulfur transportation fuels utilizing low sulfur crude oil and condensates as feedstock.

|

Consummation of this business plan will require access to significant equity and debt financing, which is not assured. In our discussions with prospective financing sources, we have been advised that the low per share price and lack of listing of our Common Stock on a national securities exchange are significant impediments to pursuing equity financing. Accordingly, we have been advised to effect the Reverse Split in order to attempt to meet the minimum bid requirements for the listing of our Common Stock on the OTCQB and therefore enhance our ability to attract new equity financing.

Notwithstanding the foregoing, there can be no assurance that, if the price of the Common Stock does increase as a result of the Reverse Split, such increase will be proportionate to the decrease in the amount of outstanding shares of Common Stock resulting from the Reverse Split. There can be no assurance that a higher price per share level of the Common Stock immediately after the Reverse Split will be maintained for any period of time. Further, liquidity could be adversely affected rather than enhanced by the reduced number of shares outstanding after the proposed Reverse Split.

What is the effect of the Reverse Split on Authorized and Outstanding Shares

As a result of the Reverse Split, every holder of Common Stock shall receive one share of Common Stock for every 10,000 shares of Common Stock held by such holder as of the effective date of the Reverse Split. Immediately following the effectiveness of the Reverse Split, assuming there are 32,516,406,176 shares outstanding on the effective date of the Reverse Split, there would be approximately 3,251,641 shares of our Common Stock outstanding. The proposed Charter Amendment will reduce our authorized number of shares of Common Stock from 37 billion to 3,700,000 million shares.

With the exception of the number of shares of Common Stock outstanding, the rights and preferences of shares of our Common Stock subsequent to the Reverse Split will remain the same. We do not anticipate that our financial condition, the percentage of our stock owned by management, the number of our shareholders, or any aspect of our current business will materially change as a result of the Reverse Split.

The Reverse Split will affect all of our shareholders uniformly and will not affect any shareholder’s percentage ownership interests in our Company, except to the extent that the Reverse Split results in any of our shareholders owning a fractional share. The Common Stock issued and outstanding after the Reverse Split will remain fully paid and non-assessable.

The proposed amendment will not affect the transferability of shares of Common Stock or any present restriction on the sale thereof. Therefore, for purposes of determining the relevant holding period as prescribed by Rule 144 under the Securities Act of 1933, as amended, the shares of Common Stock to be issued to each shareholder after the effective date of the Reverse Split will be deemed to have been acquired on the date on which the shareholder acquired the shares of Common Stock held immediately prior to the effective date.

What is the effect of the Reverse Split on Market Price?

We cannot predict the actual effect of the Reverse Split on the market price. If the market price of our Common Stock does increase as anticipated, it may not increase in proportion to the reduction in the number of shares outstanding as a result of the Reverse Split. Furthermore, the Reverse Split may not lead to a sustained increase in the market price of our Common Stock. The market price of our Common Stock may also change as a result of other unrelated factors, including our operating performance and other factors related to our business, as well as general market conditions.

How will MMEX account for the Reverse Split?

The Reverse Split will not affect the par value of our Common Stock. As a result, on the effective date of the Reverse Split, the stated par value capital on our balance sheet attributable to our Common Stock will be reduced and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per-share net income or loss and net book value per share of our Common Stock will be increased because there will be fewer shares of our Common Stock outstanding.

How will MMEX Handle Fractional Share Interests?

On the effective date of the Reverse Split, each 10,000 shares of our Common Stock will automatically be changed into one share of Common Stock. No additional action on the part of any shareholder will be required in order to effect the Reverse Split. Shareholders will not be required to exchange any certificates representing shares of Common Stock held prior to the Reverse Split for new certificates representing shares of Common Stock.

In the Reverse Split, no fractional share interest in our post-split shares will be issued. Instead, all fractional shares will be rounded up, so that a holder of pre-split shares will receive, in lieu of any fraction of a post-split share to which the holder would otherwise be entitled, an entire post-split share of Common Stock. No cash payment will be made to reduce or eliminate any fractional share interest. The result of this “rounding-up” process will increase slightly the holdings of those shareholders who currently hold a number of pre-split shares that would otherwise result in a fractional share after consummating the Reverse Split.

When will the Reverse Split Become Effective?

The Reverse Split will take effect upon the filing of the Charter Amendment with the Secretary of State of Nevada, which will occur no sooner than 20 calendar days following the date on which this Information Statement is first mailed to our shareholders.

Who is entitled to notice?

Each outstanding share of common stock as of record on May 28, 2021 is entitled to notice of the action taken pursuant to the written consent of the Majority Holders.

Are there dissenter’s rights in connection with the Reverse Split?

MMEX shareholders have no right under Nevada corporate law, the Company’s Amended and Restated Articles of Incorporation or Bylaws to dissent from any of the provisions of the Reverse Split.

Are there federal income tax consequences arising from the Reverse Split?

The following discussion is a summary of the federal income tax consequences of the Reverse Split. The discussion is based on the present federal income tax law. The discussion is not, and should not be relied on as, a comprehensive analysis of the tax issues arising from or relating to the proposed amendment. Accordingly, shareholders are urged to consult their personal tax advisors for an analysis of the effect of the Reverse Split on their respective tax situations, including consequences under applicable state tax laws.

|

|

·

|

The Reverse Split will be deemed to be a tax-free recapitalization to the Company and its shareholders to the extent that outstanding shares of Common Stock are exchanged for a reduced number of shares of Common Stock. Therefore, neither the Company nor its shareholders will recognize any gain or loss for federal income tax purposes as a result thereof.

|

|

|

|

|

|

|

·

|

The shares of Common Stock to be issued to each shareholder will have an aggregate basis, for computing gain or loss, equal to the aggregate basis of the shares of Common Stock held by such shareholder immediately prior to the Effective Date. A shareholder’s holding period for the shares of Common Stock to be issued will include the holding period for shares of Common Stock exchanged therefore, provided, that such outstanding shares of Common Stock were held by the shareholder as capital assets on the Effective Date.

|

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of May 18, 2021, the name and number of shares of the Company’s common stock beneficially owned by (i) each of the directors and named executive officers of the Company, (ii) beneficial owners of 5% or more of our common stock; and (iii) all the officers and directors as a group. Pursuant to the rules and regulations of the SEC, shares of common stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the table.

SEC rules provide that, for purposes hereof, a person is considered the “beneficial owner” of shares with respect to which the person, directly or indirectly, has or shares the voting or investment power, irrespective of his/her/its economic interest in the shares. Unless otherwise noted, each person identified possesses sole voting and investment power over the shares listed, subject to community property laws.

The percentages in the table below are based on 32,516,406,176 shares of common stock outstanding as of May 18, 2021. Shares of common stock subject to options and warrants that are exercisable within 60 days of May 18, 2021 are deemed beneficially owned by the person holding such options for the purposes of calculating the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage of any other person.

|

Name and Address of Beneficial Owners (1)

|

|

Shares

|

|

|

Percentage

Ownership

of Class

|

|

|

Voting

Power (4)

|

|

|

Jack W. Hanks (2)

|

|

|

5,529,008,278

|

|

|

|

17

|

%

|

|

|

68

|

%

|

|

Bruce N. Lemons (3)

|

|

|

507,336,843

|

|

|

|

2

|

%

|

|

|

2

|

%

|

|

All directors and officers as a group (two persons)

|

|

|

|

|

|

|

19

|

%

|

|

|

70

|

%

|

_______________

|

(1)

|

Unless otherwise noted, the business address for each of the individuals set forth in the table is c/o MMEX Resources Corporation, 3616 Far West Blvd, #117-321, Austin, Texas 78731.

|

|

(2)

|

Common shares for Mr. Hanks include: (i) 5,529,008,278 shares held by The Maple Gas Corporation, (ii) 1,000,000 shares held by Maple Resources Corporation (after giving effect to the assumed exercise of the option described in clause (iii) of footnote 3 shares to be received by Maple Resources Corporation upon its exercise of an option to purchase such shares at a price of $0.08 per share. The option expires in December 2028. Mr. Hanks disclaims any beneficial ownership of shares held of record by his spouse or other family members.

|

|

(3)

|

Common shares for Mr. Lemons Include: (i) 365,540,728 shares held by BNL Family Trust, (ii) 327,369 shares held by AAM Investments, LLC; (iii) 1,000,000 shares to be received by BNL Family Trust upon its exercise of an option to purchase such shares from Maple Resources Corporation at a price of $0.08 per share (the option expires in December 2028) and 200,000 shares to be received by BNL Family Trust upon its exercise of an option expiring in March 2022 to purchase such shares from Maple Resources Corporation at a price of $0.20 per share. Mr. Lemons and his family are the beneficiaries of BNL Family Trust. AAM Investments, LLC is indirectly owned by BNL Family Trust, a trust established for the benefit of Mr. Lemons and his family.

|

|

(4)

|

The holders of Series A Preferred Stock have 51% of the voting power of the outstanding shares of capital stock of the Company.

|

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934 and in accordance with that act, we file periodic reports, documents and other information with the SEC relating to our business, financial statements and other matters. These reports and other information may be inspected and are available for copying at the offices of the SEC, 100 F. Street NE, Washington, DC 20549, or may be accessed at www.sec.gov.

MULTIPLE SHAREHOLDERS SHARING ONE ADDRESS

Some banks, brokers and other nominee record holders participate in the practice of “householding” proxy statements, annual reports and information statements. This means that only one copy of this Information Statement may have been sent to multiple shareholders in each household. We will promptly deliver a separate copy of this Information Statement to any shareholder upon written or oral request. To make such a request, please contact us at 3616 Far West Blvd., #117-321, Austin, Texas 78731. Any shareholder who wants to receive separate copies of our information statements or other reports in the future, or any shareholder who is receiving multiple copies and would like to receive only one copy per household, should contact his or her bank, broker, or other nominee record holder, or he or she may contact us at the above address and phone number.

PROPOSALS BY SECURITY HOLDERS

No security holder has asked the Company to include any proposal in this Information Statement. The deadline for submitting a shareholder proposal for inclusion in our proxy statement and form of proxy for our next annual meeting of shareholders pursuant to Rule 14a-8 of the Securities and Exchange Commission will be at least sixty (60) days before the date which the Company begins to print and mail its proxy materials for its next annual meeting.

EXPENSE OF THIS INFORMATION STATEMENT

The expenses of this Information Statement will be borne by us, including expenses in connection with the preparation and sending of this Information Statement and all related materials. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries will be requested to forward this Information Statement to the beneficial owners of our common stock held of record by such person and that we will reimburse them for their reasonable expenses incurred in connection therewith.

FORWARD-LOOKING STATEMENTS

This Information Statement contains forward-looking statements regarding our intentions to effectuate the Reverse Split. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events or otherwise.

By Order of the Board of Directors

Jack W. Hanks, President and CEO

Austin, Texas

June 7, 2021

Annex A

PROPOSED AMENDMENT TO AMENDED AND RESTATED ARTICLES OF INCORPORATION

ARTICLE IV

CAPITAL STOCK

The total number of shares of stock which the Corporation shall have authority to issue is Eleven Million (11,000,000) shares, which shall consist of (i) Ten Million (10,000,000) shares of common stock, par value $0.001 per share (the “Common Stock”), and (ii) One Million (1,000,000) shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). The voting powers, designations, preferences, privileges and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions of each class or series of capital stock of the Corporation, shall be as provided in this Article IV.

A. PREFERRED STOCK.

The Preferred Stock may be issued from time to time by the Board of Directors as shares of one or more classes or series. The designations, powers, preferences and relative, optional, conversion and other special rights, and the qualifications, limitations and restrictions thereof, of Preferred Stock of each class or series shall be such as are stated and expressed herein and, to the extent not stated and expressed herein, shall be such as may be fixed by the Board of Directors (authority so to do being hereby expressly granted) and stated and expressed in a resolution or resolutions adopted by the Board of Directors providing for the issue of Preferred Stock of such class or series. Such resolution or resolutions shall (a) specify the class or series to which such Preferred Stock shall belong, (b) fix the dividend rate therefor, (c) fix the amount which the holders of Preferred Stock of such class or series shall be entitled to be paid in the event of a voluntary liquidation, dissolution or winding up of the Corporation, (d) state whether or not Preferred Stock of such class or series shall be redeemable and at what times and under what conditions and the amount or amounts payable thereon in the event of redemption, (e) fix the voting powers of the holders of Preferred Stock of such class or series, whether full or limited, or without voting powers, but in no event shall the holders of Preferred Stock of such class or series be entitled to more than one vote for each share held at all meetings of the shareholders of the Corporation; and may, in a manner not inconsistent with the provisions of this Article 4, (i) limit the number of shares of such class or series which may be issued, (ii) provide for a sinking or purchase fund for the redemption or purchase of shares of such class or series and the terms and provisions governing the operation of any such fund and the status as to reissuance of shares of Preferred Stock purchased or otherwise reacquired or redeemed or retired through the operation thereof, (iii) impose conditions or restrictions upon the creation of indebtedness of the Corporation or upon the issue of additional Preferred Stock or other capital stock ranking equally therewith or prior thereto as to dividends or distribution of assets on liquidation, and (iv) grant such other special rights to the holders of Preferred Stock of such class or series as the Board of Directors may determine and which are not inconsistent with the provisions of this Article 4. The term “fix for such class or series” and similar terms shall mean stated and expressed in a resolution or resolutions adopted by the Board of Directors providing for the issue of Preferred Stock of the class or series referred to therein. No further action or vote of the shareholders shall be required for any action taken by the Board of Directors pursuant to this Article 4.

The Board of Directors has previously designated the Series A Preferred Stock, consisting of 1,000 shares and having the rights and preferences set forth in the Certificate of Designations of the Series A Preferred Stock.

B. COMMON STOCK.

The holder of each share of Common Stock shall be entitled to one vote for each such share as determined on the record date for the vote or consent of shareholders and shall vote together with the holders of Series A Preferred Stock of the Company as a single class upon any items submitted to a vote of shareholders, except with respect to matters requiring a separate series or class vote.

C. REVERSE SPLIT

The Corporation does, by Amendment to these Amended and Restated Articles of Incorporation effective June 29, 2021 (the “Effective Date”), does effect a reverse split of its outstanding shares of Common Stock (“Old Common Stock”). Each 10,000 shares of Old Common Stock outstanding immediately before the Effective Date, and each 10,000 shares of Old Common Stock issuable pursuant to an instrument exercisable for shares of Old Common Stock, shall, on the Effective Date, be reclassified and converted into, and become a right to receive, and the holders of the outstanding Old Common Stock or instruments exercisable for such Old Common Stock shall be entitled to receive therefore upon surrender of the certificates representing such shares of Old Common Stock to the Corporation, or upon exercise of such instrument, one share of Common Stock, $0.001 par value of the Corporation, subject to the treatment of fraction shares set forth herein.

No scrip or fraction certificates will be issued. Fractional shares will be rounded up, so that a holder of shares of Old Common Stock will receive, in lieu of any fraction of a post-split share to which the holder would otherwise be entitled, an entire post-split share of Common Stock. No cash payment will be made to reduce or eliminate any fractional share interest.

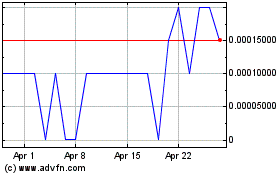

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Apr 2024 to May 2024

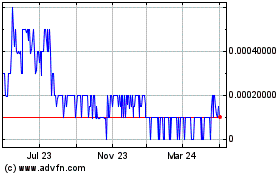

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From May 2023 to May 2024