By Eric Morath

The Biden administration blocked a Trump-era regulation that

would have made it easier for businesses to categorize gig workers

and others as independent contractors, and signaled it would take a

tougher enforcement stance against employers on worker

classification.

The Labor Department said Wednesday it is nullifying a rule it

completed in early January that sought to make it more difficult

for a gig worker, such as an Uber or DoorDash driver, and other

workers to be counted as an employee under federal law. Having

status as an employee, rather than a contractor, means those

workers are covered by federal minimum-wage and overtime laws.

Jessica Looman, principal deputy administrator for the Labor

Department's Wage and Hour Division, said the Trump rule would have

narrowed which workers were counted as employees across the

economy, not only gig workers, allowing more employees to be

classified as contractors.

"Misclassification of employees as independent contractors

presents one of the most serious problems facing workers today,"

she said on a call with reporters.

The department recently took action against a restaurant

classifying its dishwashers as contractors and found 70 home-health

aides who were misclassified as contractors, Ms. Looman added. She

said the department will look for opportunities to enforce existing

laws, especially as they apply to lower-wage workers.

Ms. Looman said Wednesday's announcement shouldn't dramatically

change how the department regulates app-based services but said the

department is engaging with those companies and others about

labor-law enforcement.

The Biden administration is "just going backwards with what

they've done and not helping resolve the misclassification problem

to the extent they think it is one," said Maury Baskin, co-chairman

of the law firm Littler Mendelson PC's Workplace Policy Institute

and an attorney who represents businesses. "They're just leaving

the situation in the chaotic state it's been."

Mr. Baskin is serving as counsel to business groups, including

the Associated Builders and Contractors, which in March filed a

federal lawsuit against the Labor Department challenging the Biden

administration's plan to delay and withdraw the earlier Trump

action.

Gig-economy companies were among the most vocal proponents of

the Trump-era rule, seeking to cement drivers and similar workers

as contractors after California's legislature passed a law

requiring the companies to reclassify their drivers as employees,

eligible for broad employment benefits.

In November, voters in California exempted Uber Technologies

Inc., Lyft Inc., DoorDash Inc. and others from the state law.

While the exemption allowed the companies to preserve their

business models in the most populous U.S. state, they did concede

some new benefits such as health insurance for drivers who worked

15 hours or more a week, occupational-accident insurance coverage

and 30 cents for every mile driven.

At the time, the companies said they would lobby to make this

model -- flexibility for drivers with limited benefits -- the

national standard.

Uber spokesman Noah Edwardsen on Wednesday said the company

views the current federal employment system as outdated. Workers

must choose to be an employee with more benefits and less

flexibility, or an independent contractor with more flexibility and

limited protections, the spokesman said.

"Uber believes that we can combine the best of both worlds by

offering independent work opportunities to the hundreds of

thousands of workers that use the Uber platform while also

providing these workers with meaningful benefits," he said.

In January, Uber said the Trump rule recognized the flexibility

gig workers sought. Trump administration officials said their rule

made it easier for Americans to be self-employed and set their own

hours.

Elizabeth Jarvis-Shean, vice president for communications and

policy at DoorDash, said its drivers on average work fewer than

four hours a week and value flexible schedules.

"We look forward to continuing to work with the Biden

administration and lawmakers across the political spectrum to help

develop a new portable, proportional, and flexible benefits

framework," she said in a statement.

Lyft spokeswoman Julie Wood said the company sees the regulatory

action as an "opportunity to refocus the conversation on what

drivers need and want, which is independence plus benefits."

The Labor Department acted this week to block the rule before it

was implemented Friday, following a common practice of presidents

of different parties undoing the prior president's pending rules

early in a new administration.

Nullifying the Trump rule maintains the decadeslong status quo,

which has largely allowed app-based services to not count drivers

and other providers as employees. The Labor Department at this time

isn't planning to offer new regulations for independent

contractors, Ms. Looman said on a Tuesday call.

By blocking the Trump rule, the Labor Department will continue

to use its previous regulation to enforce the Fair Labor Standards

Act, which was enacted in 1938. While Wednesday's action doesn't

immediately change how gig workers are classified, it leaves

ambiguity about how a Depression-era law will be applied to a

smartphone economy.

Labor Secretary Marty Walsh, in an April interview with The Wall

Street Journal, said that legitimate independent contractors are an

important part of our economy, but the Trump-era rule made it too

easy to deny workers employee status. Employees are also better

positioned than contractors to organize into labor unions. The

Biden administration has made creating union jobs a priority.

"We've seen employers are increasingly misclassifying their

workers as independent contractors in order to reduce labor costs

and take a lot of protections away from workers, including minimum

wage and overtime," Mr. Walsh said.

Amara Omeokwe contributed to this article.

Write to Eric Morath at eric.morath@wsj.com

(END) Dow Jones Newswires

May 05, 2021 17:24 ET (21:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

DoorDash (NYSE:DASH)

Historical Stock Chart

From Apr 2024 to May 2024

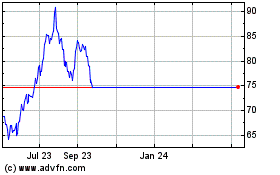

DoorDash (NYSE:DASH)

Historical Stock Chart

From May 2023 to May 2024