Prologis Beats 1Q Consensus Estimates For Key Rent, Earnings Measurements

April 19 2021 - 9:06AM

Dow Jones News

By Micah Maidenberg

Prologis Inc. said demand for its properties was strong in the

first quarter, reflecting the broader economic recovery from the

Covid-19 pandemic.

The owner of warehouses and logistics properties said net income

attributable to controlling interests in the company fell to $367.3

million for the fourth quarter from $491.1 million for the

year-earlier period. Profit for common stockholders decreased to 49

cents from 70 cents on a per-share basis, the company said.

Core funds from operations increased to 97 cents a share from 83

cents a share, Prologis said. Analysts polled by FactSet predicted

94 cents a share for that earnings metric, which excludes gains and

losses from property sales and excludes depreciation, among other

adjustments.

Rental revenue increased to $1.02 billion from $879 million, the

company said, therefore beating the $987 million consensus

estimate.

Total revenue increased to $1.15 billion from $978 million.

Average occupancy in Prologis's properties stood at 95.4% in the

first quarter, down a bit from 95.8% in the fourth quarter. Rents

increased 27% in the latest quarter on a net-effective basis.

The company started another 43.9 million square feet of leases

during the quarter.

"The robust demand from the fourth quarter has carried into 2021

and is as strong as I have seen in my career. Global supply chains

are pushing to keep pace with accelerating economic activity,

retooling for faster fulfillment and resilience," Chief Executive

Hamid Moghadam said in a statement.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 19, 2021 08:51 ET (12:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

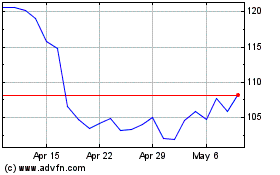

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

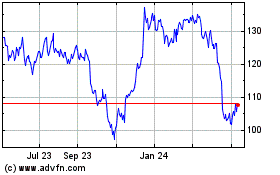

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024