Stocks Open Mixed After J&J Vaccine Halted and Inflation Uptick

April 13 2021 - 10:01AM

Dow Jones News

By Anna Hirtenstein

U.S. stocks wobbled Tuesday as investors tried to gauge the

impact of a halt in rolling out Johnson & Johnson vaccines and

an uptick in inflation.

The S&P 500 opened less than 0.1% higher after futures on

the index wavered between gains and losses. The broad market index

on Monday was hovering near its recent record closing high. The

technology-heavy Nasdaq-Composite Index climbed 0.4%, while the Dow

Jones Industrial Average fell 0.2%.

Health authorities recommended a pause in using the Johnson

& Johnson vaccine following reports of blood clotting. The Food

and Drug Administration and the Centers for Disease Control and

Prevention are reviewing data involving six reported cases of

clotting.

"It means the pace at which you reach herd immunity is

decreased, and it will take longer for the reopening of the

economy," said Sebastien Galy, a macro strategist at Nordea Asset

Management.

Fresh data also showed that U.S. consumer prices picked up

sharply in March as the economic recovery gained momentum, partly

reflecting higher gasoline prices. The Labor Department reported

that the consumer-price index jumped 2.6% in the year ended

March.

Investors in both stocks and bonds are seeking to assess whether

the projected U.S. economic recovery will trigger a sharp rise in

inflation that may remain for a protracted period. Policy makers

have repeatedly said they expect any increase over the next few

months will prove to be fleeting. An uptick in inflation

expectations earlier this year led to a rise in bond yields, and

damped appetite for richly valued technology stocks last month.

"The equity market is a bit stretched in valuation," Ludovic

Subran, chief economist at Allianz, said before the inflation data

was released. "If yields are going a bit higher on the back of

stronger inflation, a lot of institutional investors could rotate

their portfolios out of very risky equities to less risky bonds and

still get quite a comfortable margin."

In bond markets, the yield on the 10-year Treasury note ticked

down to 1.666%, from 1.674% on Monday. Yields rise when bond prices

fall. The 10-year yield shot up as high as 1.749% at the end of

March, from 0.915% near the start of the year.

Monica Defend, global head of research at asset manager Amundi,

said she expects more volatility in the bond market this year.

"This is what we worry about the most," Ms. Defend said.

"Inflation expectations will play a role at the same time as growth

will be tested, in terms of the robustness of the recovery."

Higher bond yields could weigh on equity markets by creating a

more attractive alternative to stocks, she said. But stocks will

probably continue to climb as long as the economy grows, even if

inflation moves higher, she added.

Brent crude, the international gauge for oil, climbed 1% to

$63.92 a barrel. A brightening outlook and stimulus packages will

boost economic activity and oil demand this year, the Organization

of the Petroleum Exporting Countries said Tuesday.

Overseas, the pan-continental Stoxx Europe 600 was relatively

flat.

In Asia, most major benchmarks rose by the close of trading.

Japan's Nikkei 225 Index added 0.7% and Hong Kong's Hang Seng Index

advanced 0.2%.

The Shanghai Composite Index retreated 0.5% after data showed

that Chinese exports in March had risen less than economists had

expected, resulting in a smaller trade surplus than

anticipated.

Bitcoin rose over 4% to a record, trading above $63,000 apiece,

according to data from CoinDesk. Coinbase, the largest U.S.

cryptocurrency exchange, is planning to go public on Wednesday.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

April 13, 2021 09:46 ET (13:46 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

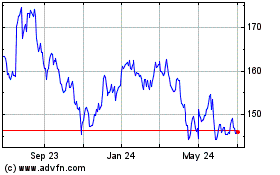

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

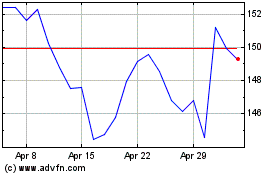

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024