Current Report Filing (8-k)

October 27 2020 - 4:31PM

Edgar (US Regulatory)

0001298675false8-K2020-10-215 Old Lancaster RoadMalvernPA19355610535-5000falsefalsefalsefalse0001300485false0001298675cube:CubesmartL.p.Member2020-10-212020-10-2100012986752020-10-212020-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 27, 2020 (October 21, 2020)

CUBESMART

CUBESMART, L.P.

(Exact Name of Registrant as Specified in Its Charter)

|

Maryland (CubeSmart)

|

001-32324

|

20-1024732

|

|

Delaware (CubeSmart, L.P.)

|

000-54462

|

34-1837021

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

5 Old Lancaster Road

|

|

Malvern,

|

|

Pennsylvania

|

|

19355

|

|

(Address of Principal

|

|

Executive Offices)

|

(610) 535-5000

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Shares, $0.01 par value per share, of CubeSmart

|

|

CUBE

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging Growth Company (CubeSmart) ☐

Emerging Growth Company (CubeSmart, L.P.) ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CubeSmart ☐

CubeSmart, L.P. ☐

Item 3.02 Unregistered Sales of Equity Securities.

On October 21, 2020, CubeSmart, L.P. (the “Operating Partnership”), the operating partnership through which CubeSmart (“CubeSmart”, the “Company” or “we”) owns all of its assets and conducts its operations, entered into a purchase and contribution agreement (the “Purchase Agreement”) to acquire a portfolio of eight open and operating self-storage properties from certain affiliates of Storage Deluxe that contain an aggregate of approximately 780,425 rentable square feet. The properties are located in Brooklyn, NY, Long Island City (Queens), NY, Flushing (Queens), NY, College Point (Queens), NY and Bronx, NY. We refer to this acquisition as the “Storage Deluxe Acquisition.”

As discussed further in Item 8.01 of this Current Report, which Item 8.01 is incorporated herein by reference, approximately $183.7 of the purchase price for the Storage Deluxe Acquisition will be payable in the form of common units of the Operating Partnership, designated as “Class B Units.” Subject to a restriction of 12-months from the date of issuance of the Class B Units, a holder of Class B Units may tender its Class B Units for redemption by the Operating Partnership for a cash amount per unit equal to the market value of an equivalent number of common shares of the Company. The Company has the right, but not the obligation, to assume and satisfy the redemption obligation of the Operating Partnership by issuing one common share in exchange for each unit tendered for redemption.

The Class B Units are being offered and will be sold without being registered with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”), in reliance upon the exemption under Section 4(2) of the Act. Each of the Storage Deluxe affiliates has represented that it is an “accredited investor,” as that term is defined in Rule 501(a) of Regulation D under the Act.

Item 7.01 Regulation FD Disclosure.

On October 27, 2020, the Company and the Operating Partnership (i) issued a press release announcing the execution of the Purchase Agreement, a copy of which press release is furnished as Exhibit 99.1 hereto and (ii) posted to the Company’s corporate website a slide presentation that may be used in presentations to investors from time to time, a copy of which slide presentation is furnished as Exhibit 99.2 hereto.

Item 8.01 Other Events.

As stated above, on October 21, 2020, the Operating Partnership entered into the Purchase Agreement with respect to the Storage Deluxe Acquisition for an aggregate purchase price of approximately $540 million. Consideration for the properties in the Storage Deluxe Acquisition will consist of approximately $201.7 million payable in cash, approximately $183.7 million payable in Class B Units, and the assumption of approximately $154.6 million of existing fixed-rate secured debt (the “Assumed Debt”). In connection with the execution of the Purchase Agreement, we have deposited $27.0 million in escrow as earnest money. This escrow amount (excluding interest thereon) will be credited towards payment of the purchase price at the closing of the initial tranche of the acquisition. We expect to finance the balance of the cash portion of the purchase price at closing through cash on hand and borrowings under our unsecured revolving credit facility. The Class B Units issuable as part of the purchase price will be valued at the greater of (x) the average share price per common share of CubeSmart’s common shares on the New York Stock Exchange during the 90 days prior to seven (7) days prior to closing of the initial tranche of the acquisition, and (y) the consensus net asset value of the Operating Partnership as reported by SNL (“Spot NAV”) as of seven (7) days prior to such closing. We are not an affiliate of Storage Deluxe or any of its affiliates, and the terms of the Storage Deluxe Acquisition were determined through arm’s-length negotiation.

We expect to consummate the acquisition in two tranches during the fourth quarter of 2020. We anticipate closing on the purchase of six properties, with a purchase price of approximately $432 million, including the assumption of the Assumed Debt, immediately following completion of the loan assumption process. We also expect to consummate the closing on the remaining two properties, with a purchase price of approximately $108 million, during the fourth quarter of 2020.

The consummation of the Storage Deluxe Acquisition is subject to satisfaction of certain conditions, primarily with respect to certain title requirements for the properties, receipt of estoppels from lessors related to the leases to be assigned, deliverables from the association and the board of managers with respect to a condominium property, consents to the assumption of the Assumed Debt by the lenders of such Assumed Debt and other customary closing conditions. We cannot assure you that we will be able to complete the Storage Deluxe Acquisition on the terms contemplated, or at all.

We may elect to terminate the acquisition without penalty if consent of lenders to our assumption of the Assumed Debt has not been received by December 15, 2020. We may also elect to terminate the Purchase Agreement without penalty if certain title deficiencies are not remedied by the sellers. In the event that the sellers materially breach their obligations to consummate the Storage Deluxe Acquisition, we may either (i) terminate the Purchase Agreement, in which case we will be entitled to the return of the earnest money or (ii) specifically enforce the Purchase Agreement within 30 days of the breach. If the sellers breach any of their representations or

warranties, our sole and exclusive remedy is to pursue a claim against the sellers within 30 days of closing for actual damages, which may not exceed $1.25 million, subject to minimum damages of $25,000 and other limitations. We have the right to terminate the Purchase Agreement if the sellers intentionally or willfully breach or default on certain of their obligations and the breach or default results in the failure of the lenders to approve the assumption of the Assumed Debt. We will have no right to terminate the Purchase Agreement if any of the properties are damaged or destroyed by fire or other casualty. If we breach our representations and warranties or fail to comply with our covenants in a material respect, the sellers may terminate the Purchase Agreement, in which case any remaining earnest money that has not been used in a prior closing will be paid to them as liquidated damages.

Cautionary Notice Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as “expect,” “intend” and similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the expected closing of the Storage Deluxe Acquisition, if at all. Forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and the Company’s other filings with the Securities and Exchange Commission for a more complete discussion of the risks and other factors that could affect any forward-looking statement. Except as required by law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changing circumstances or any other reason after the date of this report.

Item 9.01 Financial Statements and Exhibits.

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CUBESMART

|

|

|

|

|

Date: October 27, 2020

|

By:

|

/s/ Jeffrey P. Foster

|

|

|

Name:

|

Jeffrey P. Foster

|

|

|

Title:

|

Chief Legal Officer & Secretary

|

|

|

|

|

|

CUBESMART, L.P.

|

|

|

|

|

Date: October 27, 2020

|

By:

|

CUBESMART, its general partner

|

|

|

|

|

|

By:

|

/s/ Jeffrey P. Foster

|

|

|

Name:

|

Jeffrey P. Foster

|

|

|

Title:

|

Chief Legal Officer & Secretary

|

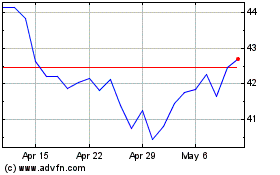

CubeSmart (NYSE:CUBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

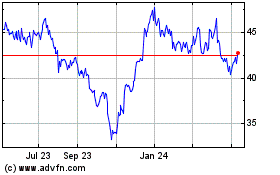

CubeSmart (NYSE:CUBE)

Historical Stock Chart

From Apr 2023 to Apr 2024