Ecolab 3Q Profit Declines 47%

October 27 2020 - 9:38AM

Dow Jones News

By Micah Maidenberg

Ecolab Inc. said results for the third quarter picked up

compared with earlier this year when Covid-19-related lockdowns led

to a recession, but warned a new wave of virus infections likely

means slower growth in the current period.

The provider of a wide-range of cleaning products, sanitizers,

disinfectants and related items on Tuesday said third-quarter net

income fell 47% to $246.2 million, or 85 cents a share, from $464.2

million, or $1.59, in the same period a year earlier. The company

said it recorded $44 million in special charges in the quarter tied

to an efficiency initiative, weighing on profit.

Adjusted earnings fell to $1.15 a share for the quarter, 3 cents

higher than forecast by analysts polled by FactSet.

Sales fell 6% to $3.02 billion from $3.22 billion a year earlier

and were a bit ahead of the consensus estimate.

Sales, after adjusting for currency fluctuations, were down 2%

in its industrial unit, and 22% in its global-institutional

business, which offers cleaners and other products to restaurants,

laundries and other companies.

But Ecolab reported a 32% sales increase after adjusting for

currency moves for its global healthcare and life sciences

division, helped along by demand stoked by the pandemic.

"We expect the improvement to continue in our fourth quarter,

though likely at a slower rate as the second Covid-19 wave impacts

reopenings," Chief Executive Douglas Baker said in a statement. "At

the same time, the opportunities and challenges created by Covid-19

are much clearer."

The company has been pushing to invest more in hand care and

sanitizer capacity, Mr. Baker said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 27, 2020 09:23 ET (13:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

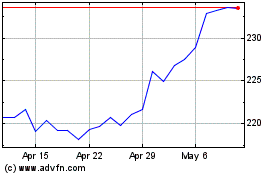

Ecolab (NYSE:ECL)

Historical Stock Chart

From Mar 2024 to Apr 2024

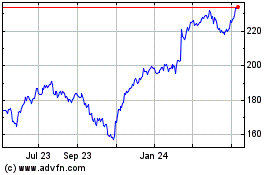

Ecolab (NYSE:ECL)

Historical Stock Chart

From Apr 2023 to Apr 2024