Quhuo Limited (NASDAQ: QH) (“Quhuo,” the “Company,” “we” or “our”),

a leading tech-enabled workforce operational solution platform in

China, today announced its unaudited financial results for the

second quarter ended June 30, 2020.

Key Second Quarter 2020

Financial Highlights

- Revenues were

RMB547.6 million (US$77.5 million), representing a 33.5%

year-over-year increase and a 39.5% increase compared to the first

quarter of 2020.

- Gross profit was

RMB60.4 million (US$8.5 million), representing a 24.8%

year-over-year increase and a 441.7% increase compared to the first

quarter of 2020. Gross margin was 11.0%, relatively stable as

compared to 11.8% in the second quarter of 2019.

- Adjusted net

income was RMB21.0 million (US$3.0 million), compared with

an adjusted net loss of RMB20.3 million in the first quarter of

2020, and an adjusted net income of RMB29.9 million in the same

period last year.

- Adjusted EBITDA

was RMB40.3 million (US$5.7 million), relatively stable as compared

to the same period last year and representing a 487.7% increase

compared to the first quarter of 2020.

Second Quarter 2020 Operating

Highlights

- Sustained growth of

on-demand food delivery. The number of average monthly

delivery orders was 24.3 million, representing a 46.1% increase

from the same period last year and a 44.0% increase from the first

quarter of 2020. The Company’s core business has maintained growth

momentum throughout the COVID-19 pandemic.

- Expanded service

scope. The Company fulfilled a total of 345,000 delivery

orders for grocery and fresh food category, representing a 95.3%

increase the first quarter of 2020. The COVID-19 pandemic increased

demand for online grocery and fresh food shopping. In response, the

Company expanded its service scope to satisfy the increasing demand

for delivery service of grocery and fresh food for existing and new

industry customers.

- Continuing geographical

expansion. The number of delivery areas reached 952 by the

end of June 2020, representing a 62.2% increase from the same

period last year. The number of average monthly active workers was

40,721, representing a 57.6% increase from the same period last

year.

Leslie Yu, Chairman and Chief Executive Officer

of the Company, commented, “We are pleased to report strong

financial and operational growth for the second quarter of 2020, in

this our first earnings release as a public company. During the

second quarter, we increased the number of delivery areas to 952,

expanded our geographical coverage to 75 cities and extended our

service scope, all of which resulted in a larger customer base. As

the outbreak of COVID-19 intensified, we capitalized on the surge

in demand for local grocery and fresh food delivery services and

successfully penetrated a new market as we further diversify our

service offerings and maximize the efficiency of our platform. We

plan to explore more opportunities in other industries in which we

have existing operations, such as shared-bike maintenance,

housekeeping and ride-hailing, by cooperating with new blue-chip

industry customers.Going forward, we will continue to actively

expand our operations geographically, diversify our service

offerings and expand our industry customer base to lay a solid

foundation for future business growth. For example, we are

currently exploring partnership opportunities with hotel chains and

property management companies to provide them with housekeeping

solutions, and we expect to achieve significant business growth

through provision of those solutions in the third quarter.

Meanwhile, we will continue to focus on improving our operational

efficiency and flexibility in an effort to expand our margins as we

create long-term sustainable growth for shareholders.”

Second Quarter 2020 Financial Results

Revenues were RMB547.6 million (US$77.5

million), representing an increase of 33.5% year over year,

primarily due to the increase in revenues generated from on-demand

food delivery solutions.

- Revenues from on-demand food

delivery solutions were RMB541.3 million (US$76.6 million),

representing an increase of 34.8% from RMB401.7 million in the

second quarter of 2019, primarily due to the increase in delivery

orders fulfilled as a result of the continuing expansion into new

geographical markets and the rapid growth of new service offerings,

namely the grocery and fresh food delivery, which contributed

revenues of RMB2.6 million (US$362,000) in this quarter.

- Revenues from shared-bike

maintenance solutions were RMB4.6 million (US$651,000),

representing a decrease of 32.8% from RMB6.8 million in the second

quarter of 2019, primarily due to (1) the decrease in the

geographical coverage of the shared-bike maintenance solutions as

the Company strategically withdrew its operations from a few cities

where it underperformed, and (2) the adverse impact of the COVID-19

pandemic on the overall shared-bike business as a result of

government-mandated quarantine measures.

- Revenues from ride-hailing

solutions were RMB1.3 million (US$180,000), representing a decrease

of 16.7% from RMB1.5 million in the second quarter of 2019,

primarily due to the preferential rental policy the Company offered

to ride-hailing drivers on its platform during the COVID-19

outbreak, following the industry-wide relief measures.

- Revenues from housekeeping

solutions and other services were RMB379,000 (US$54,000),

representing an increase of 560.9% from RMB57,000 in the second

quarter of 2019, primarily due to the increases in the number of

the Company’s collaborated industry customers and service

offerings.

Cost of revenues were RMB487.2 million (US$69.0

million), representing an increase of 34.7% year over year,

primarily due to the increased cost of revenues from on-demand food

delivery solutions, ride-hailing solutions and housekeeping

solutions and other services.

- Cost of revenues related to

on-demand food delivery solutions was RMB480.3 million (US$68.0

million), representing an increase of 35.5% from RMB354.4 million

in the second quarter of 2019, primarily due to the increase in 1)

service fees paid to riders and team leaders in line with the

increase in the delivery orders fulfilled, 2) hiring expenses for

riders, 3) insurance expenses for riders and 4) rental fees paid to

lease the workplace for additional service stations.

- Cost of revenues related to

shared-bike maintenance solutions was RMB3.6 million (US$512,000),

representing a decrease of 39.4% from RMB6.0 million in the second

quarter of 2019, which was generally in line with the decline of

the business volume of shared-bike maintenance solutions.

- Cost of revenues related to

ride-hailing solutions was RMB2.9 million (US$409,000),

representing an increase of 121.8% from RMB1.3 million in the

second quarter of 2019, primarily due to the increase in the number

of vehicles leased from third parties.

- Cost of revenues related to

housekeeping solutions and other services increased significantly

to RMB459,000 (US$65,000) from RMB56,000 in the second quarter of

2019, primarily due to the increased service fees paid to workers

in line with the business growth.

Gross profit was RMB60.4 million (US$8.5

million), representing an increase of 24.8% year over year,

primarily due to the increase in gross profit of on-demand food

delivery solutions and shared-bike maintenance solutions.Gross

margin was 11.0%, compared with 11.8% for the second quarter of

2019.

- Gross margin of on-demand food

delivery solutions was 11.3%, a slight decrease compared with 11.8%

in the second quarter of 2019, primarily due to the increase in

hiring expenses, insurance expenses and rental fees as a percentage

of revenues.

- Gross margin of shared-bike

maintenance solutions was 21.4%, compared with 12.9% in the second

quarter of 2019, primarily because the Company withdrew its

operations from those cities where it underperformed.

- Gross margin of ride-hailing

solutions was negative 127.2%, compared with 14.6% in the second

quarter of 2019, primarily due to the reasons discussed above.

- Gross margin of house-keeping

solutions and other services was negative 21.1%, compared with 2.3%

in the second quarter of 2019, primarily due to the reasons

discussed above.

Operating expenses were RMB30.8 million (US$4.4

million), representing an increase of 38.0% year over year.

- General and administrative expenses

were RMB29.5 million (US$4.2 million) (including share-based

compensation of RMB1.3 million), representing an increase of 32.9%

from RMB22.2 million (including share-based compensation of RMB3.4

million) in the second quarter of 2019. The increase was primarily

due to the (1) the increase in staff costs as a result of an

increased number of operating staffs, (2) the increase in

professional service fees related to the Company’s IPO, and (3)

losses incurred relating to a law suit. Excluding the effect of

share-based compensation, professional service fees related to the

IPO and losses incurred relating to a law suit, the general and

administrative expenses would have increased by 25.6% from RMB 18.1

million in the second quarter of 2019 and, as a percentage of

revenues, would have declined to 4.1% from 4.4% in the second

quarter of 2019. As such, the Company obtained unit cost savings

along with business growth.

- Research and development expenses

were RMB2.7 million (US$387,000), which remained relatively stable

as compared to RMB2.7 million in the second quarter of 2019.

Income tax expense was RMB11.5 million (US$1.6

million), representing an increase of 43.7% from RMB8.0 million in

the second quarter of 2019, primarily due to the increase in the

taxable income generated from on-demand food delivery solutions.Net

income was RMB19.7 million (US$2.8 million), representing a

decrease of 25.6% from RMB26.4 million in the second quarter of

2019.Adjusted EBITDA was RMB40.3 million (US$5.7 million),

relatively stable as compared to RMB42.1 million in the second

quarter of 2019.(1)Adjusted net income was RMB21.0 million (US$3.0

million), representing a decrease of 29.8% from RMB29.9 million in

the second quarter of 2019.(1)

_____________

(1) See “Use of Non-GAAP Financial

Measures.”Balance SheetAs of June 30, 2020, the

Company had cash and short-term investments of RMB155.1 million

(US$22.0 million) and short-term debt of RMB113.3 million (US$16.0

million).

CONFERENCE CALL

Quhuo will hold a conference call on Thursday,

August 27, 2020 at 8:00 a.m. U.S. Eastern Time (8:00 p.m.

Beijing/Hong Kong time on the same day) to discuss the financial

results.

Participant can register for the conference call

by navigating to

http://apac.directeventreg.com/registration/event/3478235. Once

preregistration has been completed, participants will receive

dial-in numbers, a direct event passcode, and a unique registrant

ID.

To join the conference, please dial the number

you receive, enter the direct event passcode followed by your

unique registrant ID, and you will be joined to the conference

instantly.

A live and archived webcast of the conference

call will also be available at the Company's investor relations

website at https://ir.quhuo.cn/.

A replay will be accessible through 9:59 a.m.

Eastern Time on September 4, 2020 by dialing the following

numbers:

United States: +1-646-254-3697International:

+61-2-8199-0299China Domestic: 400-6322-162Hong Kong:

+852-3051-2780Conference ID: 3478235#

USE OF NON-GAAP FINANCIAL

MEASURES

Quhuo has provided in this press release financial

information that has not been prepared in accordance with generally

accepted accounting principles in the United States (GAAP).

Quhuo uses adjusted net income (loss) and adjusted

EBITDA, which are non-GAAP financial measures, in evaluating our

operating results and for financial and operational decision-making

purposes. Adjusted net income (loss) represents net income (loss)

before share-based compensation expenses. Adjusted EBITDA

represents adjusted net income(loss) before income tax

benefit(expense), amortization, depreciation and interest. Quhuo

believes that these non-GAAP financial measures help identify

underlying trends in its business that could otherwise be distorted

by the effect of share-based compensation expenses, income tax

benefits or expenses, amortization, depreciation and interest.

Quhuo believes that such non-GAAP financial measures also provide

useful information about its operating results, enhance the overall

understanding of its past performance and future prospects and

allow for greater visibility with respect to key metrics used by

its management in its financial and operational

decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

They should not be considered in isolation or construed as

alternatives to net loss or any other measure of performance or as

an indicator of Quhuo’s operating performance. Further, these

non-GAAP financial measures may not be comparable to similarly

titled measures presented by other companies. Other companies may

calculate similarly titled measures differently, limiting their

usefulness as comparative measures to the Company’s data. Quhuo

encourages investors and others to review the Company’s financial

information in its entirety and not rely on a single financial

measure. Investors are encouraged to compare the historical

non-GAAP financial measures with the most directly comparable GAAP

measures. Quhuo mitigates these limitations by reconciling the

non-GAAP financial measures to the most comparable U.S. GAAP

performance measures, all of which should be considered when

evaluating its performance. The following table sets forth a

reconciliation of our net income (loss) to adjusted net income and

adjusted EBITDA, respectively.

|

Reconciliation of GAAP and Non-GAAP Results |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

| |

|

June

30,2019 |

|

June

30,2020 |

|

June

30,2020 |

|

June

30,2019 |

|

June

30,2020 |

|

June

30,2020 |

| |

|

(RMB’000) |

|

(RMB’000) |

|

(US$’000) |

|

(RMB’000) |

|

(RMB’000) |

|

(US$’000) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

26,447 |

|

|

19,680 |

|

|

2,784 |

|

|

(19,920) |

|

|

(1,899) |

|

|

(269) |

|

| Less:

Share-based Compensation |

|

(3,443) |

|

|

(1,290) |

|

|

(183) |

|

|

(57,480) |

|

|

(2,580) |

|

|

(365) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income |

|

29,890 |

|

|

20,970 |

|

|

2,967 |

|

|

37,560 |

|

|

681 |

|

|

96 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Income

tax expense |

|

(8,017) |

|

|

(11,518) |

|

|

(1,630) |

|

|

(9,011) |

|

|

(14,436) |

|

|

(2,043) |

|

|

Depreciation |

|

(685) |

|

|

(2,640) |

|

|

(374) |

|

|

(1,325) |

|

|

(4,113) |

|

|

(582) |

|

|

Amortization |

|

(2,902) |

|

|

(2,977) |

|

|

(421) |

|

|

(5,485) |

|

|

(6,033) |

|

|

(854) |

|

|

Interest |

|

(648) |

|

|

(2,223) |

|

|

(315) |

|

|

(1,987) |

|

|

(4,663) |

|

|

(660) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

42,142 |

|

|

40,328 |

|

|

5,707 |

|

|

55,368 |

|

|

29,926 |

|

|

4,235 |

|

EXCHANGE RATE INFORMATION

This press release contains translations of certain RMB amounts

into U.S. dollars at a specified rate solely for the convenience of

the reader. Unless otherwise noted, all translations from RMB to

U.S. dollars are made at a rate of RMB 7.0651 to US$1.00, the rate

in effect as of June 30, 2020 as set forth in the H.10 statistical

release of the Federal Reserve Board. The Company makes no

representation that the RMB or US$ amounts referred could be

converted into US$ or RMB, as the case may be, at any particular

rate or at all.

SAFE HARBOR STATEMENT

This press release contains ‘‘forward-looking

statements’’ within the meaning of Section 27A of the Securities

Act of 1933, as amended and Section 21E of the Securities Exchange

Act of 1934, as amended and the Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical or current fact included in this press release are

forward-looking statements, including but not limited to statements

regarding Quhuo’s financial outlook, beliefs and expectations.

Forward-looking statements include statements containing words such

as “expect,” “anticipate,” “believe,” “project,” “will” and similar

expressions intended to identify forward-looking statements. Among

other things, the guidance on [the total revenues] of the third

quarter of 2020 in this press release contain forward-looking

statements. These forward-looking statements are based on Quhuo’s

current expectations and involve risks and uncertainties. Quhuo’s

actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a

result of these risks and uncertainties, which include, without

limitation, risks related to Quhuo’s abilities to (1) address any

or all of the risks and challenges in the future in light of its

limited operating history and evolving business portfolios, (2)

remain its competitive position in the on-demand food delivery

market or further diversify its solution offerings, (3) maintain

relationships with major customers and to find replacement

customers on commercially desirable terms or in a timely manner or

at all, (4) maintain relationship with existing industry customers

or attract new customers, (5) attract, retain and manage workers on

its platform, and (6) maintain its market shares to competitors in

existing markets and its success in expansion into new markets, as

well as the length and severity of the recent COVID-19 outbreak and

its impact on Quhuo’s business and industry. Other risks and

uncertainties are included under the caption “Risk Factors” and

elsewhere in the Company’s filings with the Securities and Exchange

Commission, including, without limitation, the final prospectus

related to the IPO filed with the SEC on July 10, 2020. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement, and Quhuo undertakes no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date hereof.

ABOUT QUHUO LIMITED

Quhuo Limited (NASDAQ: QH) was the largest

workforce operational solution platform in China in 2019*. Quhuo

provides tech-enabled, end-to-end operational solutions to

blue-chip on-demand consumer service businesses in industries with

significant e-commerce exposure, including food delivery,

ride-hailing, housekeeping and bike-sharing. Quhuo’s platform helps

its industry customers mobilize a large team of workers and

utilizes a combination of training, performance monitoring and

refinement, and incentives to transform them into skilled workers

who can follow industry-specific, standardized and highly efficient

service procedures. Within the on-demand consumer service

ecosystem, the Company plays a unique and indispensable role as the

link between consumer service businesses and the end consumers to

enable the delivery of goods, services and experiences to

consumers.

* According to an industry report prepared by

Frost & Sullivan in 2019, as measured by the number of average

monthly active workers in 2019.

For more information about Quhuo, please visit

https://ir.quhuo.cn/.

CONTACTS:

Investor RelationsQuhuo

LimitedAnnia SunE-mail: ir@meishisong.cn

ChristensenIn ChinaMr. Eric YuanPhone:

+86-13801110739E-mail: Eyuan@christensenir.com

In USMs. Linda BergkampPhone:

+1-480-614-3004E-mail: lbergkamp@christensenir.com

|

QUHUO LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”),

except for number of shares and per share data) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

As of December 31, 2019 |

|

As of June 30, 2020 |

|

|

|

(RMB) |

|

(RMB) |

|

(US$) |

|

Assets |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash |

|

126,779 |

|

107,676 |

|

15,241 |

|

Short-term investments |

|

56,275 |

|

47,428 |

|

6,713 |

|

Accounts receivable, net of allowance |

|

276,966 |

|

220,615 |

|

31,226 |

|

Prepayments and other current assets |

|

43,058 |

|

43,199 |

|

6,114 |

|

Amounts due from related parties |

|

18,392 |

|

- |

|

- |

|

Total current assets |

|

521,470 |

|

418,918 |

|

59,294 |

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Property and equipment, net |

|

25,632 |

|

28,462 |

|

4,029 |

|

Intangible assets, net |

|

66,818 |

|

70,745 |

|

10,013 |

|

Long-term investments |

|

1,715 |

|

1,065 |

|

151 |

|

Goodwill |

|

26,231 |

|

26,231 |

|

3,713 |

|

Deferred tax assets |

|

3,893 |

|

2,389 |

|

338 |

|

Other non-current assets |

|

98,137 |

|

85,987 |

|

12,171 |

|

Total non-current assets |

|

222,426 |

|

214,879 |

|

30,415 |

| |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

743,896 |

|

633,797 |

|

89,709 |

| |

|

|

|

|

|

|

|

Liabilities, mezzanine equity and shareholders’

deficit |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

232,276 |

|

156,016 |

|

22,083 |

|

Accrued expenses and other current liabilities |

|

75,825 |

|

74,196 |

|

10,504 |

|

Short-term debt |

|

143,979 |

|

113,348 |

|

16,043 |

|

Amounts due to a related party |

|

- |

|

3,134 |

|

444 |

|

Total current liabilities |

|

452,080 |

|

346,694 |

|

49,074 |

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

Deferred tax liabilities |

|

2,556 |

|

2,263 |

|

320 |

|

Long-term debt |

|

11,942 |

|

8,652 |

|

1,225 |

|

Other non-current liabilities |

|

22,766 |

|

20,244 |

|

2,865 |

|

Total non-current liabilities |

|

37,264 |

|

31,159 |

|

4,410 |

| |

|

|

|

|

|

|

|

Total liabilities |

|

489,344 |

|

377,853 |

|

53,484 |

| |

|

|

|

|

|

|

|

Total mezzanine equity |

|

1,031,001 |

|

1,031,001 |

|

145,928 |

| |

|

|

|

|

|

|

|

QUHUO LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(CONTINUED) |

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”),

except for number of shares and per share data) |

| |

|

|

|

|

|

|

| |

|

As of December 31, 2019 |

|

As of June 30, 2020 |

| |

|

(RMB) |

|

(RMB) |

|

(US$) |

|

Shareholders’ deficit |

|

|

|

|

|

|

|

Ordinary shares |

|

17 |

|

|

17 |

|

|

2 |

|

|

Additional paid-in capital |

|

434,151 |

|

|

436,731 |

|

|

61,815 |

|

|

Accumulated deficit |

|

(1,212,257) |

|

|

(1,211,200) |

|

|

(171,434) |

|

|

Accumulated other comprehensive loss |

|

(1,231) |

|

|

(520) |

|

|

(74) |

|

|

Total Quhuo Limited shareholders’ deficit |

|

(779,320) |

|

|

(774,972) |

|

|

(109,691) |

|

|

Non-controlling interests |

|

2,871 |

|

|

(85) |

|

|

(12) |

|

|

Total shareholders’ deficit |

|

(776,449) |

|

|

(775,057) |

|

|

(109,703) |

|

| |

|

|

|

|

|

|

|

Total liabilities, mezzanine equity and shareholders’

deficit |

|

743,896 |

|

|

633,797 |

|

|

89,709 |

|

|

|

|

|

|

|

|

|

|

|

|

|

QUHUO LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME(LOSS) |

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”),

except for number of shares and per share data) |

| |

|

|

|

|

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

| |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2020 |

| |

|

(RMB) |

|

(RMB) |

|

(US$) |

|

(RMB) |

|

(RMB) |

|

(US$) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

410,122 |

|

|

547,577 |

|

|

77,504 |

|

|

758,798 |

|

|

940,195 |

|

|

133,076 |

|

|

Cost of revenues |

|

(361,758) |

|

|

(487,224) |

|

|

(68,962) |

|

|

(687,131) |

|

|

(868,700) |

|

|

(122,957) |

|

|

Gross profit |

|

48,364 |

|

|

60,353 |

|

|

8,542 |

|

|

71,667 |

|

|

71,495 |

|

|

10,119 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

(22,189) |

|

|

(29,487) |

|

|

(4,174) |

|

|

(93,907) |

|

|

(57,014) |

|

|

(8,070) |

|

|

Research and development |

|

(2,732) |

|

|

(2,732) |

|

|

(387) |

|

|

(4,395) |

|

|

(5,317) |

|

|

(753) |

|

|

Gains on disposal of intangible assets, net |

|

2,610 |

|

|

1,437 |

|

|

203 |

|

|

3,663 |

|

|

1,292 |

|

|

183 |

|

|

Total operating expenses |

|

(22,311) |

|

|

(30,782) |

|

|

(4,358) |

|

|

(94,639) |

|

|

(61,039) |

|

|

(8,640) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

26,053 |

|

|

29,571 |

|

|

4,184 |

|

|

(22,972) |

|

|

10,456 |

|

|

1,479 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

8 |

|

|

254 |

|

|

36 |

|

|

10 |

|

|

515 |

|

|

73 |

|

|

Interest expense |

|

(648) |

|

|

(2,223) |

|

|

(315) |

|

|

(1,987) |

|

|

(4,663) |

|

|

(660) |

|

|

Other income, net |

|

9,062 |

|

|

3,601 |

|

|

510 |

|

|

13,918 |

|

|

6,930 |

|

|

981 |

|

|

Share of net income from equity method investees |

- |

|

|

- |

|

|

- |

|

|

162 |

|

|

- |

|

|

- |

|

|

Foreign exchange loss |

|

(11) |

|

|

(5) |

|

|

(1) |

|

|

(40) |

|

|

(701) |

|

|

(99) |

|

|

Income (loss) before income tax |

|

34,464 |

|

|

31,198 |

|

|

4,414 |

|

|

(10,909) |

|

|

12,537 |

|

|

1,774 |

|

|

Income tax expense |

|

(8,017) |

|

|

(11,518) |

|

|

(1,630) |

|

|

(9,011) |

|

|

(14,436) |

|

|

(2,043) |

|

|

Net income (loss) |

|

26,447 |

|

|

19,680 |

|

|

2,784 |

|

|

(19,920) |

|

|

(1,899) |

|

|

(269) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to non-controlling interests |

177 |

|

|

980 |

|

|

139 |

|

|

1,271 |

|

|

2,956 |

|

|

418 |

|

|

Net income (loss) attributable to ordinary shareholders of

Quhuo Limited |

26,624 |

|

|

20,660 |

|

|

2,923 |

|

|

(18,649) |

|

|

1,057 |

|

|

149 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

0.68 |

|

|

0.53 |

|

|

0.07 |

|

|

(1.25) |

|

|

0.03 |

|

|

0.00 |

|

|

Diluted |

|

0.59 |

|

|

0.53 |

|

|

0.07 |

|

|

(1.25) |

|

|

0.03 |

|

|

0.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in income (loss) per share

computation |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

14,972,760 |

|

|

14,972,760 |

|

|

14,972,760 |

|

|

14,972,760 |

|

|

14,972,760 |

|

|

14,972,760 |

|

|

Diluted |

|

44,872,963 |

|

|

39,103,860 |

|

|

39,103,860 |

|

|

14,972,760 |

|

|

39,103,860 |

|

|

39,103,860 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment: |

|

- |

|

|

63 |

|

|

9 |

|

|

- |

|

|

711 |

|

|

101 |

|

|

Comprehensive income (loss) |

|

26,447 |

|

|

19,743 |

|

|

2,793 |

|

|

(19,920) |

|

|

(1,188) |

|

|

(168) |

|

|

Less: Comprehensive loss attributable to non-controlling

interests |

177 |

|

|

980 |

|

|

139 |

|

|

1,271 |

|

|

2,956 |

|

|

418 |

|

|

Comprehensive income (loss) attributable to ordinary

shareholders of Quhuo Limited |

26,624 |

|

|

20,723 |

|

|

2,932 |

|

|

(18,649) |

|

|

1,768 |

|

|

250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

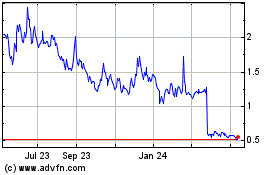

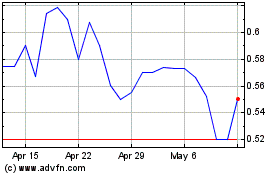

Quhuo (NASDAQ:QH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quhuo (NASDAQ:QH)

Historical Stock Chart

From Apr 2023 to Apr 2024