Current Report Filing (8-k)

October 10 2019 - 4:31PM

Edgar (US Regulatory)

0000887905

false

0000887905

2019-10-09

2019-10-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13

OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: October 10, 2019

(Date of earliest event reported)

LTC PROPERTIES, INC.

(Exact name of Registrant as specified in

its charter)

|

Maryland

|

|

1-11314

|

|

71-0720518

|

|

(State or other jurisdiction of

|

|

(Commission file number)

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

|

|

Identification No)

|

2829 Townsgate Road, Suite 350

Westlake Village, CA 91361

(Address of principal executive offices)

(805) 981-8655

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $.01 par value

|

LTC

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.03. — Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On October 10, 2019, LTC Properties,

Inc. (the “Company”) sold $100.0 million aggregate principal amount of 3.85% senior unsecured notes due October

20, 2031 to affiliates and managed accounts of PGIM, Inc. (the investment management business of Prudential Financial, Inc.,

individually and collectively, “Prudential”). The Company expects to use the proceeds of the notes to pay down

its unsecured revolving line of credit. The sale of notes was made pursuant to the Company’s Third Amended and Restated

Note Purchase and Private Shelf Agreement, as amended (“Agreement”), with Prudential dated April 28, 2015.

The notes sold under the Agreement are

subject to covenants that are substantially similar to the covenants in the Company’s existing credit facility, including

requirements to maintain financial ratios such as debt to asset value ratios. Under the Agreement, maximum total indebtedness shall

not exceed 50% of total asset value as defined in the Agreement. Borrowings under the Agreement are limited by reference to the

value of unencumbered assets and maximum unsecured debt shall not exceed 60% of the unencumbered asset value as defined in the

Agreement. Other similar covenants include limitations on the Company’s and its subsidiaries’ abilities to (i) incur

liens, (ii) make investments, (iii) engage in mergers or consolidations or sell its properties, and (iv) enter agreements that

restrict its subsidiaries’ ability to make dividend payments or loans to the Company. The Company’s assets, whether

or not owned by subsidiaries, are subject to the Company’s obligations.

The foregoing description of the Agreement

is qualified in its entirety by reference to the provisions of the Agreement, which was filed as an exhibit to the Company’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, and to which a first amendment was filed as an exhibit to the

Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015 and a second amendment was filed as an exhibit

to the Company’s Annual Report on Form 10-K (File No. 1-11314) for the year ended December 31, 2016.

SIGNATURE

Pursuant to the requirements of Section

13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned, hereunto duly authorized.

|

|

LTC PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

|

Dated: October 10, 2019

|

By:

|

/s/ WENDY L. SIMPSON

|

|

|

|

Wendy L. Simpson

|

|

|

|

Chairman, CEO & President

|

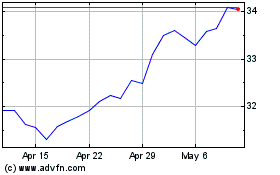

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

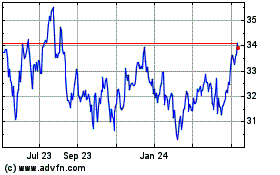

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Apr 2023 to Apr 2024