Current Report Filing (8-k)

September 20 2019 - 8:25AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 20, 2019

CALUMET

SPECIALTY PRODUCTS PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51734

|

|

35-1811116

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

2780 Waterfront Pkwy E. Drive

Suite 200

Indianapolis, Indiana 46214

(Address of principal executive office and Zip Code)

(317) 328-5660

(Registrants’ telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common units representing limited partner interests

|

|

CLMT

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

On September 20, 2019, Calumet Specialty Products Partners, L.P. (the

“Partnership”) announced that West Griffin, Executive Vice President and Chief Financial Officer

(“CFO”) of the Partnership, would be leaving his role as CFO of the Partnership by the end of the year. Mr.

Griffin has agreed to serve in a consulting role with the Partnership through the closing of the financial process for the

2019 fiscal year. His departure is not the result of any disagreement with the Partnership or any of its affiliates on any

matter relating to the Partnership’s operations, policies or practices.

|

|

Item

7.01

|

Regulation

FD Disclosure.

|

On

September 20, 2019, the Partnership issued a press release announcing the matter described above. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

Further,

on September 20, 2019, the Partnership announced its intent, subject to market conditions, to offer, with its wholly-owned subsidiary

Calumet Finance Corp., a Delaware corporation, $550 million in aggregate principal amount of senior unsecured notes due 2025 (the

“Notes”) in a private placement to eligible purchasers. In connection with the Notes offering, the Partnership is

providing certain data regarding the Partnership to prospective investors in a preliminary offering memorandum, dated September

20, 2019, which such information is furnished as Exhibit 99.2 to this Current Report on Form 8-K. The Partnership intends to use

the net proceeds from the offering of the Notes, together with borrowings under its revolving credit facility and cash on hand,

to redeem all of its outstanding 6.50% senior notes due 2021 and pay related expenses.

The

information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed to be

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to

the liabilities of that section and shall not be deemed to be incorporated by reference into any registration statement or

other document filed pursuant to the Securities Act of 1933, as amended (the “Securities Act”), regardless of any general

incorporation language in such filing, except as shall be expressly set forth by specific reference in such

filing.

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of federal securities laws. Such

forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Partnership’s

control. All statements, other than historical facts included in this Current Report on Form 8-K, are forward-looking statements.

All forward-looking statements speak only as of the date of this Current Report on Form 8-K. Although the Partnership believes

that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there

is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially

differ from what is expressed, implied or forecast in such statements.

|

|

Item

8.01

|

Other

Information.

|

On

September 20, 2019, the Partnership issued a press release, a copy of which is attached hereto as Exhibit 99.3 and incorporated

herein by reference, announcing the offering of the Notes.

This

press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these

securities in any state in which the offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of any such state. The Notes will not initially be registered under the Securities Act or any state

securities law and may not be offered or sold in the United States absent registration or an applicable exemption from registration

under the Securities Act and applicable state securities laws.

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

|

|

|

|

|

|

|

By:

|

CALUMET GP, LLC,

|

|

|

|

its General Partner

|

|

|

|

|

|

Date: September 20, 2019

|

By:

|

/s/ D. West Griffin

|

|

|

Name:

|

D. West Griffin

|

|

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

3

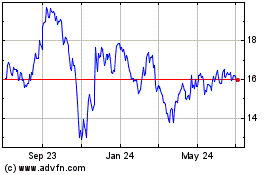

Calument (NASDAQ:CLMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

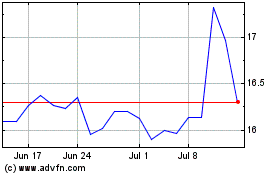

Calument (NASDAQ:CLMT)

Historical Stock Chart

From Sep 2023 to Sep 2024