Amended Current Report Filing (8-k/a)

August 13 2019 - 11:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 22, 2019

|

SHIFTPIXY, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Wyoming

|

|

47-4211438

|

|

(State of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

1 Venture, Suite 150, Irvine CA

|

|

92618

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

888-798-9100

(Registrant’s telephone number, including area code)

Commission File No.

001-37954

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

EXPLANATORY NOTE

This Form 8-K/A is being filed as management inadvertently left out language that should have been included in the Form 8-K that was originally filed with the SEC on July 22, 2019 and the Form 8-K/A filed July 23, 2019. This Form 8-K/A is being filed with that language included, as it should have been filed, below. The Company has also reviewed the break-down in its reporting and has taken steps to strengthen its controls around its financial reporting.

|

Item 4.02.

Non-Reliance On Previously Issued Financial Statements or A Related Audit Report Or Completed Interim Review

|

With respect to the Form 8-K/A filed on July 23, 2019, an authorized officer discussed with the Audit Committee of the Board of Directors and with registrant’s independent accountant the matters disclosed in the filing pursuant to this Item 4.02(a). The registrant’s independent accountant advised the registrant that it had no disagreement with the matters disclosed in the filing pursuant to this Item 4.02(a).

On July 18, 2019, we determined that the following financial statements of our Company should not be relied upon:

|

|

·

|

Unaudited financial statements included in our quarterly report on Form 10-Q for the quarterly period ended February 28, 2019, filed on April 15, 2019 with SEC.

|

On June 4, 2018, the Company entered into securities purchase agreement (the “Purchase Agreement) with certain institutional investors (the “investors”) for the sale by the Company of $10,000,000 of 8% senior secured convertible notes due September 4, 2019 (the “Notes”). The Notes are repaid monthly commencing on first day of the month after the date that is the earlier of the date that a registration statement covering the shares underlying the Notes has been declared effective by the Securities and Exchange Commission or 180 days after the original issue date. The Notes provide that at any time after the original issuance date, the Notes are convertible into shares of common stock, at the option of the holder. The conversion price in effect on any conversion date is equal to $2.49, subject to adjustment, mainly related to standard anti-dilution adjustments and subsequent issuances of equity securities at effective prices that are lower than the initial conversion price (“down round”). The Notes state that “from and after the maturity date, the conversion price should be equal to the lesser of (i) the then conversion price and (ii) 85% of the volume weighted average price (“VWAP”), which is immediately prior to the applicable conversion date”.

A registration statement covering the shares underlying the Notes was declared effective by the Securities and Exchange Commission on October 29, 2018. Since that date and prior to Maturity Date, the Company honored conversion requests from the investors not at $2.49 price as provided in the Notes but at a fifteen percent (15%) discount to the lowest VWAP in excess of the securities issuable pursuant to the original conversion terms, creating an induced conversion under U.S. GAAP.

U.S. GAAP requires that the additional shares issued in the conversion be treated as an inducement with an expense recognized equal to the fair value of the additional shares of common stock transferred in the transaction, with such fair value being measured as of the date of the inducement offer is accepted by the convertible debt holder. Accordingly, the Company recognized a non-cash debt conversion expense of $1.6 million for the three and six months ended February 28, 2019.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

|

|

SHIFTPIXY, INC.

|

|

|

|

|

|

|

|

Date: August 13, 2019

|

By:

|

/s/ Scott W. Absher

|

|

|

|

|

Scott W. Absher

|

|

|

|

|

Chief Executive Officer

|

|

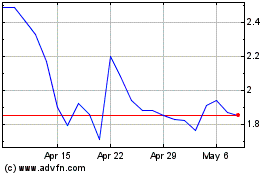

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

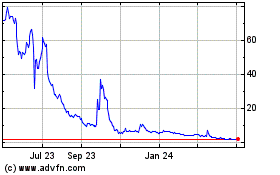

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024