Co-Diagnostics, Inc. (Nasdaq: CODX), a molecular

diagnostics company with a unique, patented platform for the

development of molecular diagnostic tests, announced today the

filing of its operating results on SEC Form 10-Q for the 3 month

period ending March 31, 2019 and provided updates on corporate

developments.

Q1 2019 Financial

Results:

- Revenue for the quarter totaled $3,400;

however, the Company’s Joint Venture in India also recognized

approximately $56,000 in revenue from the sale of the Company’s

primers and probes, which is anticipated to represent the beginning

of sales in the joint venture.

- The Company ended the quarter with cash

and equivalents of $5.42 million and no long-term debt. This

followed the sale of $3 million of preferred shares in January 2019

(which consisted of negotiating the conversion of a $2M note to

preferred stock, and an additional sale of $1M of preferred shares

for cash) leaving the Company debt-free.

- The Company completed a registered

direct offering in the quarter pursuant to its S-3 shelf

registration and sold 3,925,716 common shares, realizing gross

proceeds of approximately $5.5 million.

- Total liabilities and shareholder’s

equity at the end of the quarter was $6.12 million, compared with

$1.55 million at the end of the previous quarter.

- The Company reported a net loss for the

quarter of $1,368,389 compared with a net loss for the same quarter

in 2018 of $1,310,233. Of the increase in net loss of $58,156,

$29,687 was primarily the result of the increased operating

expenses for sales/marketing and R&D (itself offset by a

substantial decrease in general and administrative expenses), and

the remainder resulted from a loss on extinguishment of debt and

interest expense partially offset by a decrease in the loss on

investment related to the joint venture.

Management Discussion

Dwight Egan, Chairman and CEO of Co-Diagnostics, commented, “We

are pleased to report that our momentum has continued throughout

the first quarter of 2019. Co-Diagnostics closed the quarter on

substantially stronger financial footing than it began, and showed

a marked improvement from the same quarter last year as well. This

is evident in the first sales from our joint venture in India,

complete elimination of long-term debt, and a healthy balance sheet

to support our existing revenue-producing initiatives and product

development pipeline.

“This momentum is also evident in our technology and regulatory

milestones. In Q1 the Company received the CE mark for our highly

specific Zika/dengue/chikungunya multiplex assay, built on our

patented CoPrimer™ platform to address the needs of areas where

those diseases are found to occur together but are often

misdiagnosed. More recently we announced the patent filing for our

next-generation sequencing technology that will reduce NGS

preparation and hands-on user time, in an innovative PCR

application that the Company anticipates should provide near-term

revenue opportunities in the US and abroad.

“The Company’s CoPrimer platform was featured at the PAG XXVII

Conference in January 2019, which coincided with the announcement

of the first private label CoPrimer product, manufactured and

marketed by an international leader in the life sciences sector.

The manufacturer has since launched the product in a world-wide

marketing campaign, which we believe affords us the opportunity to

expand the footprint of CoPrimers to the manufacturer’s domestic

and international client base.

“In addition to the Company’s progress in AgBio, infectious

disease, and liquid biopsy, this quarter saw strong demand for our

mosquito vector products following the first distributor conference

hosted in our facilities. The conference was well-attended by

distributors of Co-Diagnostics’ products, and government,

environmental testing and private laboratory customers. The Company

looks forward to making announcements in the near future related to

product roll-outs and sales agreements.

“We expect our financial strength and technological and

regulatory advancements to continue to drive sales growth both

domestically and in India—where the joint venture manufacturing

facility was recently inaugurated—throughout this current quarter

and beyond.”

About Co-Diagnostics, Inc.:

Co-Diagnostics, Inc., a Utah corporation, is a molecular

diagnostics company that develops, manufactures and markets a new,

state-of-the-art diagnostics technology. The Company’s technology

is utilized for tests that are designed using the detection and/or

analysis of nucleic acid molecules (DNA or RNA). The Company also

uses its proprietary technology to design specific tests to locate

genetic markers for use in industries other than infectious disease

and license the use of those tests to specific customers.

Forward-Looking Statements:

This press release contains forward-looking statements.

Forward-looking statements can be identified by words such as

"believes," "expects," "estimates," "intends," "may," "plans,"

"will" and similar expressions, or the negative of these words.

Such forward-looking statements are based on facts and conditions

as they exist at the time such statements are made and predictions

as to future facts and conditions. Forward-looking

statements in this release include statements regarding the (i) use

of funding proceeds, (ii) expansion of product distribution, (iii)

acceleration of initiatives in liquid biopsy and SNP detection,

(iv) use of the Company’s liquid biopsy tests by laboratories, (v)

capital resources and runway needed to advance the Company’s

products and markets, (vi) increased sales in the near-term, (vii)

flexibility in managing the Company’s balance sheet, (viii)

anticipation of business expansion, and (ix) benefits in research

and worldwide accessibility of the CoPrimer technology and its

cost-saving and scientific advantages. Forward-looking statements

are subject to inherent uncertainties, risks and changes in

circumstances. Actual results may differ materially from

those contemplated or anticipated by such forward-looking

statements. Readers of this press release are cautioned not to

place undue reliance on any forward-looking statements. The Company

does not undertake any obligation to update any forward-looking

statement relating to matters discussed in this press release,

except as may be required by applicable securities laws.

CO – DIAGNOSTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

March 31, 2019 December 31, 2018

ASSETS: Current

Assets Cash and cash equivalents $ 5,412,593 $ 950,237 Accounts

receivables, net 42,557 13,420 Inventory 18,153 18,153 Prepaid

expenses 103,827 70,103 Total current assets

5,577,130 1,051,913 Other Assets Property and equipment, net

135,820 156,138 Investment in joint venture 408,393

345,121 Total other assets 544,213 501,259

Total assets $ 6,121,343 $ 1,553,172

LIABILITIES AND

STOCKHOLDERS’ EQUITY (DEFICIT): Current Liabilities

Accounts payable $ 96,305 $ 148,967 Accrued expenses 121,206

174,444 Accrued expenses (related party) 120,000 120,000 Notes

payable net of discount of $0 and $91,428 — 1,908,572

Total current liabilities 337,511 2,351,983 Long-term Liabilities,

net of current portion Accrued expenses-long-term (related party)

220,000 260,000 Total long-term liabilities, net of

current portion 220,000 260,000 Total liabilities

557,511 2,611,983 Commitments and

contingencies STOCKHOLDERS’ EQUITY (DEFICIT): Convertible

preferred stock, $.001 par value; 5,000,000 shares authorized,

28,000 and no shares issued and outstanding, respectively 28 —

Common stock, $.001 par value, 100,000,000 shares

authorized; 17,015,766 and 12,923,373 shares issued and

outstanding, respectively. 17,016 12,923 Additional paid-in capital

25,609,344 17,622,433 Accumulated deficit (20,062,556 )

(18,694,167 ) Total stockholders’ equity (deficit)

5,563,832 (1,058,811 ) Total liabilities and

stockholders’ equity (deficit) $ 6,121,343 $ 1,553,172

CO – DIAGNOSTICS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited) For the

Three MonthsEnded March 31, 2019

2018 Net sales $ 3,400 $ 9,696 Cost of sales 452

— Gross profit 2,948 9,696 Operating expenses: Sales and

marketing 256,103 95,263 Administrative and general 640,363 882,046

Research and development 347,306 297,415 Depreciation and

amortization 13,668 12,403 Total operating expenses

1,257,440 1,287,127 Loss from operations

(1,254,492 ) (1,277,431 ) Other expense: Interest income 408

7,561 Interest expense (106,427 ) — Gain on disposition of assets

850 — Loss on equity method investment in joint venture

(8,728 ) (40,363 ) Total other expense (113,897 )

(32,802 ) Loss before income taxes (1,368,389 ) (1,310,233 )

Provision for income taxes — — Net loss $ (1,368,389

) $ (1,310,233 ) Basic and diluted income (loss) per common

share $ (0.09 ) $ (0.11 ) Weighted average common shares

outstanding, basic and diluted 16,066,633 12,319,030

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190515005316/en/

Andrew BensonHead of Investor Relations+1

801-438-1036investors@codiagnostics.com

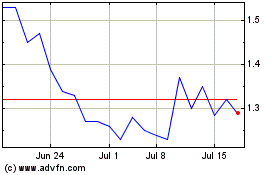

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Apr 2023 to Apr 2024