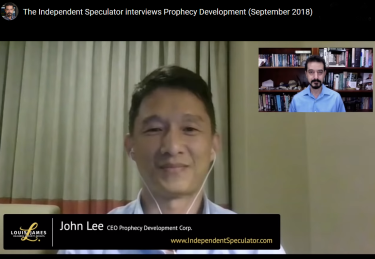

Independent Speculator Talks With Chairman of The Hottest Vanadium

Junior Miner (Vanadium up 900% since 2016)

October 24,

2018

Louis

James,

long

time Doug Casey's International

Speculator team

member, interviews

Prophecy's Chairman John Lee, about Prophecy's

flagship Gilbellini

Vanadium

Project, its progress, vanadium price and plans ahead. It has

gathered tens of thousands views and a can't miss.

https://independentspeculator.com/independent-speculator-interviews-john-lee-ceo-of-prophecy-development-corp

Prophecy Development Corp (TSX:

PCY) owns Gibellini project the only large-scale, open-pit,

heap-leach vanadium project of its kind in North America. Located

in Nevada, Gibellini has the largest NI 43-101 compliant measured

and indicated primary vanadium resource known in the USA and is

currently undergoing EPCM and EIS preparation. With global vanadium

supply declining and demand increasing, this is the right project

at the right time. Prophecy has approximately 78 million shares

outstanding.

Vanadium pentoxide price reached all time high of $31.5/lb

(www.vanadiumprice.com) from 2016 low of $2.5/lb due to

Chinese upgrade of vanadium intensity in steel re-enforcement bars

in the construction industry, as well as increasing vanadium usage

in the aerospace industry and large scale vanadium batteries in the

utility industry.

5

reasons to follow Prophecy's Gibellini

Vanadium

Project:

-

Located in

Nevada, premium location for mining- Ranked #1 for

North America mining investment (Fraser Institute)

-

Vanadium price

has increased by more than 900% since 2016 from

US$3/lb

to

US$31.5/lb

on

the back of strong demand and restricted supply

-

Low

Capex, Low Opex,

High IRR

-

Near

Term Production complete permitting in 2020, commence construction

in 2021, start vanadium production in 2022

-

Vanadium is key

to worlds energy future!

Highlights

of the interview:

"What

we see is the perfect storm in terms of restricted supply and

steady demand for

vanadium from all

sectors:

from

rebar to aerospace to batteries

I

would not be surprised if vanadium

price goes to

US$50/lb

or

even

US$100/lb"

"Key

drivers of demand for vanadium is: upgrade of high strength rebar

standards in China which will result in doubling of vanadium

addition to steel and increase vanadium consumption by 30%,

application of vanadium in aerospace industry,

and

batteries industry where vanadium batteries are ideally suited for

the solar and wind power which constitutes over 700 GW of

generation capacity"

"If

you look at the supply side there is not another greenfield

vanadium mine coming into production for another 5

years!"

"There is one

thing we really love, really passionate about operating in Nevada -

it is the best place for mining investment in all North America,

where all stakeholders respect the rule of law and share the common

objective of bringing the Gibellini

Vanadium Project

to production this is one of the beauties of operating in the

US!"

Nick Hodge of

the outsider Club (https://www.outsiderclub.com/) just issued an

alert to its subscribers with following

highlights:

"An updated,

2018 PEA pegged the after-tax NPV at US$338.3 million and the IRR

at 50.8%. Gibellini

contains

129.28 million pounds of vanadium pentoxide (V205) grading 0.294%.

The current mine plan envisions producing 9.65 million pounds

annually for over 13 years, paying back its capital cost of

US$116.8 million in 1.72 years. The after tax net present value of

the Gibellini

vanadium

project is north of US$338 million, meaning Prophecy is trading at

a significant discount to its project value.

That was all

done at a vanadium price of $12.73 per pound. Vanadium prices are

currently twice that.

Two weeks

after my March trip, Prophecy put out a news release that Northwest

Nonferrous had entered into a technical advisory and cooperation

agreement to advance the Gibellini

project. And

they may become an equity holder.

Couple this

with the fervor in vanadium that is expected to continue, including

China becoming a net importer, and the sector is ripe for increased

valuations from which I believe Prophecy will benefit.

Plus it has

the additional benefits of an experienced

Chinese partner, an oxidized black shale ore that doesn't need

roasting, and a streamlined permitting process with the tailwind of

a newly-supportive government.

Shares have

been as high at C$0.50 in the past year but now trade at

~C$0.285.

We

are buying Prophecy Development Corp. (TSX: PCY)(OTC: PRPCF) below

C$0.50."

And

Prophecy just

announced other

significant news:

Founder and Ex-CEO of Major

Producer Detour Gold joins Exciting Vanadium Start

Up

Gibellini

Video Footage

can be viewed at

https://www.youtube.com/watch?v=SA5Bt3ngIYg&t=12s

Trade Prophecy

at links below:

US

Brokers (OTCQX: PRPCF)

www.tdameritrade.com

www.etrade.com

www.fidelity.com

www.merrilledge.com

Canadian

Brokers (TSX: PCY)

www.Td.com

www.rbcdirectinvesting.com

www.qtrade.com

www.questrade.com

www.scotiabank.com/itrade

www.bmo.com/investorline