By Austen Hufford and Doug Cameron

Rising costs, a stronger dollar and concerns over growth in

China are posing new risks to U.S. manufacturers, sparking a

selloff Tuesday affecting shares in Caterpillar Inc., 3M Co. and

other industrial bellwethers.

Shares in Caterpillar fell 7.6% on Tuesday and 3M lost 4.4%.

Shares in Harley-Davidson Inc. fell 2.2% after the motorcycle maker

said it sold fewer Hogs in the third quarter than a year earlier.

The S&P machinery index is down 4.2% this week.

"There are chinks in the armor," for major U.S. manufacturers,

said Jefferies analyst Steve Volkmann.

Caterpillar said tariffs the Trump administration implemented

earlier this year on foreign steel and aluminum made parts for the

machinery it manufactures in the U.S. more expensive. Caterpillar

tariff-related costs for this year would likely come in at the low

end of the previous range of $100 million to $200 million it

forecast. 3M expects the tariffs to push up costs by about $20

million this year and $100 million next year.

3M also said sales of its face masks and other products in China

were dropping as economic growth there cools. Paint-and-coatings

maker PPG Industries Inc. said last week that demand in China was

falling due to lower spending on cars. China's economic growth of

6.5% in the third quarter was its weakest pace since the financial

crisis.

"We see other signs of slowing in China; the automotive build

rates are down significantly and that has a knock-on effect," 3M

Chief Executive Michael Roman said. 3M reported slower sales growth

across most of its business lines in the third quarter.

Still, the selloff belied some signs of strength for

manufacturers. Caterpillar reported higher profit in the third

quarter thanks to strong sales and its higher prices. Harley

reported higher revenue and profit, beating expectations.

"This sell-fest is coming in spite of generally solid results,"

said Nigel Coe at Wolfe Research LLC.

Caterpillar executives said they expect to do strong business in

China next year. Chinese officials have said Beijing is prepared to

spend more on infrastructure if growth slows, a development that

analysts say could boost Caterpillar's machinery sales there.

China's economic troubles are due in part to the trade fight

with Washington that has seen officials in both countries apply

tit-for-tat tariffs to hundreds of billions of dollars in bilateral

trade. Lennox International Inc., a maker of heating and cooling

systems, said Monday that it would move some production out of

China to avoid those hurdles.

"I'm not sure Chinese tariffs are going to be short-term and so

we are taking action to sort of avoid the tariffs by moving to

Southeast Asia and other low-cost countries that can meet our

requirements," Lennox Chief Executive Todd Bluedorn said.

Scott Wine, chief executive of boat-and-motorcycle maker Polaris

Industries Inc. this week warned of "more severe" costs if the

Trump administration implements more duties on Chinese goods.

Harley, meanwhile, said a stronger U.S. dollar had dented its

earnings from the international sales the company is increasingly

relying on to drive growth. Milwaukee-based Harley said the

stronger dollar cost it $7.4 million in the latest quarter.

3M and other manufacturers have raised prices to offset rising

costs. Caterpillar said it would raise prices on most machines and

engines by as much as 4% next year. Last week, paint maker PPG and

consumer goods giant Procter & Gamble Co. said they were

raising prices to reflect higher commodity costs. United

Technologies Corp., which makes Pratt & Whitney jet engines and

Otis elevators, said on Tuesday it would continue to raise prices

across its portfolio next year if tariffs were still in place.

"Ultimately, these tariffs can all get passed on to the consumer

in one form or another," United Technologies Chief Executive Greg

Hayes said. The company expects tariff costs of about $53 million

this year and $160 million next year.

The conglomerate said its third-quarter profit dropped 7% as

higher costs offset an increase in revenue.

Some manufacturers this week have said a nationwide shortage of

trucking capacity and rising oil prices are pushing up their

transport costs. Others are having trouble finding parts they need

to raise production. Heavy-duty truck maker Paccar Inc. on Tuesday

said its margin was hurt by parts shortages in North America.

"The sharp increase in demand has led to supply chain challenges

across the industry," Caterpillar said in a release.

Caterpillar reported adjusted earnings of $2.86 a share in its

third quarter, above last year's $1.95, 2 cents higher than the

$2.84 expected by analysts polled by FactSet, as higher prices and

increase volume offset rising costs.

That is the narrowest beat for Caterpillar since it missed

expectations by one cent in April 2016. Since that miss, reported

results have been 29% higher than expectations, compared with 0.8%

higher Tuesday.

The Deerfield, Ill.-based company reaffirmed its adjusted

earnings-per-share guidance for the year of $11 to $12.

3M said sales fell 0.2% from a year earlier to $8.15 billion.

The St. Paul-based company said it expects earnings for the year to

be between $8.78 and $8.93 a share, down from the range of $9.08 to

$9.38 a share it previously guided.

Harley, which also announced a recall on Tuesday of 238,300

motorcycles due to a clutch defect, said revenue from motorcycles

and related products rose 17% in the third quarter from the year

earlier to $1.12 billion. Analysts had predicted $1.07 billion.

Write to Austen Hufford at austen.hufford@wsj.com and Doug

Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 23, 2018 16:52 ET (20:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

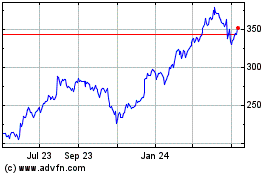

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

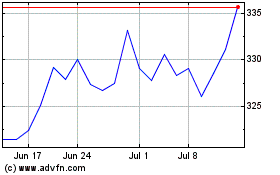

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024