EnviroStar, Inc. to Acquire Industrial Laundry Services, Inc.

August 06 2018 - 9:00AM

Business Wire

EnviroStar, Inc. (NYSE American: EVI) announced today that it

executed a definitive purchase agreement to acquire substantially

all the assets and assume certain liabilities of Orlando, Florida

based Industrial Laundry Services, Inc. (ILS) using a combination

of cash and EVI stock.

Industrial Laundry Services is a premier provider of commercial

laundry installation and maintenance services to customers in the

hospitality, healthcare, institutional, and for-profit sectors in

central Florida. The addition of ILS is consistent with EVI’s

growth strategy to build the industry’s largest distributor of

commercial and vended laundry products, supported by the most

advanced service organization that best serves laundry customers

across the country.

ILS will continue to operate as it has historically, under the

leadership of Troy and Erin Piper, using the same name, executing

with the same people, and with the support and resources of Steiner

Atlantic Corp., an EVI business unit based in Miami, FL. Troy

Piper, President of Industrial Laundry Services said: “By joining

EVI, we will have the opportunity to collaborate with Steiner

Atlantic and other EVI business units in the pursuit of

opportunities to grow and enhance our service operations across the

state of Florida and beyond.”

Henry M. Nahmad, EVI’s Chairman and Chief Executive Officer,

commented: “Our growing service operations provide us the

opportunity to generate new revenues and profits from the sale and

or lease of equipment, the delivery and installation of replacement

parts, and the execution of long-term comprehensive service

agreements. We welcome Troy and Erin Piper to the EVI Family and

look forward to fulfilling our growth objectives.”

The transaction is expected to close upon the satisfaction of

customary closing conditions. EVI expects the addition of

Industrial Laundry Services to be accretive to its fiscal year

ended June 30, 2019.

About EnviroStar

EnviroStar, Inc. is a distributor of commercial, industrial, and

vended laundry products and industrial boilers, including related

parts and supplies. Through its subsidiaries, EVI sells its

products and provides installation and maintenance services to

thousands of customers across the United States, the Caribbean, and

Latin America. EVI seeks to grow its North American market share

through the execution of its buy-and-build strategy. In that

pursuit, EVI intends to focus on buying market-leading laundry and

commercial cleaning products businesses, and building them through

the implementation of a growth culture that focuses on adding new

locations, offering a more expansive and complimentary product

line, and delivering a vast array of technical services.

Forward-Looking Statements

Except for the historical matters contained herein, statements

in this press release are forward- looking and are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are subject to a

number of known and unknown risks and uncertainties that may cause

actual results, trends, performance or achievements of EnviroStar,

or industry trends and results, to differ from the future results,

trends, performance or achievements expressed or implied by such

forward-looking statements. These risks and uncertainties include,

among others, that the proposed acquisition of Industrial Laundry

Services may not be accretive to EnviroStar’s earnings or otherwise

have a positive impact on EnviroStar’s operating results or

financial condition to the extent anticipated or at all,

integration risks, risks related to the business, operations and

prospects of Industrial Laundry Services and EnviroStar’s plans

with respect thereto, the risk that the conditions to closing the

proposed acquisition may not be satisfied and that the proposed

acquisition may not otherwise be consummated when expected, in

accordance with the contemplated terms, or at all, and the risks

related to EnviroStar’s operations, results, financial condition,

financial resources, and growth strategy, including EnviroStar’s

ability to find and complete other acquisition opportunities, and

the impact of any such acquisitions on EnviroStar’s operations,

results and financial condition. Reference is also made to other

economic, competitive, governmental, technological and other risks

and factors discussed in EnviroStar’s filings with the Securities

and Exchange Commission, including, without limitation, those

disclosed in the “Risk Factors” section of EnviroStar’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2017 filed

with the SEC on September 28, 2017. Many of these risks and factors

are beyond EnviroStar’s control. In addition, past performance and

perceived trends may not be indicative of future results.

EnviroStar cautions that the foregoing factors are not exclusive.

The reader should not place undue reliance on any forward- looking

statement, which speaks only as of the date made. EnviroStar does

not undertake to, and specifically disclaims any obligation to,

update or supplement any forward-looking statement, whether as a

result of changes in circumstances, new information, subsequent

events or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180806005304/en/

EnviroStar, Inc.Henry M. Nahmad, 305-754-8676

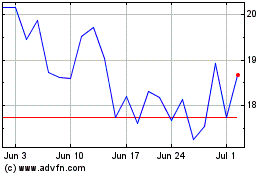

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

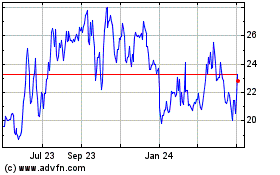

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Apr 2023 to Apr 2024