Company Announces Quarterly Cash Dividend of $0.10 Per

Share

CPSI (NASDAQ: CPSI):

Highlights for Second Quarter 2018:

- Revenues of $67.9 million;

- Recurring revenues up 1% sequentially,

7% year over year;

- 12-month backlog of $267 million;

- Quarterly bookings of $23.5

million;

- GAAP earnings per diluted share of

$0.02 and non-GAAP earnings per diluted share of $0.34;

- GAAP net income of $0.3 million and

non-GAAP net income of $4.7 million;

- Adjusted EBITDA of $8.1 million;

- Cash provided by operations of $4.7

million; and

- Quarterly dividend of $0.10 per

share.

CPSI (NASDAQ: CPSI), a community healthcare solutions company,

today announced results for the second quarter and six months ended

June 30, 2018.

The Company also announced that its Board of Directors has

declared a quarterly cash dividend of $0.10 per share, payable on

August 31, 2018, to stockholders of record as of the close of

business on August 16, 2018.

Total revenues for the second quarter ended June 30, 2018, were

$67.9 million, compared with total revenues of $67.7 million for

the prior-year period. Net income for the quarter ended

June 30, 2018, was $0.3 million, or $0.02 per diluted share,

compared with net income of $1.6 million, or $0.11 per diluted

share, for the quarter ended June 30, 2017. Cash provided by

operations for the second quarter was $4.7 million, compared with

cash provided by operations of $6.2 million for the prior-year

period.

Total revenues for the six months ended June 30, 2018, were

$138.8 million, compared with total revenues of $131.8 million for

the prior-year period. Net income for the six months ended June 30,

2018, was $4.3 million, or $0.31 per diluted share, compared with

$1.8 million, or $0.13 per diluted share, for the six months ended

June 30, 2017. Cash provided by operations for the first six months

of 2018 was $7.8 million, compared with cash provided by operations

of $15.9 million for the prior-year period.

“Our second quarter of 2018 was led again by nice growth from

our services, business consulting and IT business, TruBridge,” said

Boyd Douglas, president and chief executive officer of CPSI. “These

results include a 13% increase in TruBridge services revenue

compared with the second quarter last year and record quarterly

bookings for our Revenue Cycle Management solution. This top line

growth for CPSI was accompanied by the addition of 15 new clients,

which included 11 community hospitals and four skilled nursing

facilities, bringing the total number of new clients to 29 for the

year. While total revenue this quarter was weaker than expected, we

expect to recapture it before year end.”

Commenting on the Company’s financial performance for the

quarter, Matt Chambless, chief financial officer of CPSI, stated,

“As we shared during our first quarter conference call, the

proposed ruling from CMS allows for a 90-day stage 3 meaningful use

(MU3) attestation period in 2019 instead of the full year. This

ruling effectively delayed the need for hospitals to be prepared

for MU3 attestation from the end of 2018 to October 2019, at the

latest. With this relief in timing, it is clear our clients feel

less urgency to install applications purchased before the end of

2018. As a result, much of the remaining revenue associated with

MU3 will extend into 2019. This shift in MU3 revenue recognition

and a delayed new system implementation, along with a period of

naturally higher general and administrative costs, affected both

our top and bottom line results this quarter. However, we view

these as typical dynamics that are not uncommon in an industry

bound by heavy government regulations.”

Douglas added, “Closing out the first half of 2018, we already

have 18 implementations scheduled in the second half of the year,

which has created a very healthy pipeline of revenue and an

expected strong finish for the year. In addition, our continued

efforts of closely managing our combined company operations and

leveraging synergies that enhance our business and support our

clients will help drive efficiencies. Based on the 2018 expense

exit run rate, we expect an estimated $10 million incremental

benefit to our bottom line in 2019, supporting our goal of

returning to 20% EBITDA margins in 2020.”

CPSI will hold a live webcast to discuss second quarter 2018

results today, Thursday, August 2, 2018, at 4:30 p.m. Eastern

time. A 30-day online replay will be available approximately one

hour following the conclusion of the live webcast. To listen to the

live webcast or access the replay, visit the Company’s website,

www.cpsi.com.

About CPSI

CPSI is a leading provider of healthcare solutions and services

for community hospitals, their clinics and post-acute care

facilities. Founded in 1979, CPSI is the parent of three

companies – Evident, LLC, TruBridge, LLC and American

HealthTech, Inc. Our combined companies are focused on helping

improve the health of the communities we serve, connecting

communities for a better patient care experience, and improving the

financial operations of our customers. Evident provides

comprehensive EHR solutions for community hospitals and their

affiliated clinics. American HealthTech is one of the nation’s

largest providers of EHR solutions and services for post-acute care

facilities. TruBridge focuses on providing business, consulting and

managed IT services, along with its complete RCM solution for all

care settings. For more information, visit www.cpsi.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified generally by the use of

forward-looking terminology and words such as “expects,”

“anticipates,” “estimates,” “believes,” “predicts,” “intends,”

“plans,” “potential,” “may,” “continue,” “should,” “will” and words

of comparable meaning. Without limiting the generality of the

preceding statement, all statements in this press release relating

to estimated and projected earnings, leverage ratio, margins,

costs, expenditures, cash flows, growth rates, the Company’s level

of recurring and non-recurring revenue and backlog, the Company’s

shareholder returns and future financial results are

forward-looking statements. We caution investors that any such

forward-looking statements are only predictions and are not

guarantees of future performance. Certain risks, uncertainties and

other factors may cause actual results to differ materially from

those projected in the forward-looking statements. Such factors may

include: overall business and economic conditions affecting the

healthcare industry, including the potential effects of the federal

healthcare reform legislation enacted in 2010, and implementing

regulations, on the businesses of our hospital customers;

government regulation of our products and services and the

healthcare and health insurance industries, including changes in

healthcare policy affecting Medicare and Medicaid reimbursement

rates and qualifying technological standards; changes in customer

purchasing priorities, capital expenditures and demand for

information technology systems; saturation of our target market and

hospital consolidations; general economic conditions, including

changes in the financial and credit markets that may affect the

availability and cost of credit to us or our customers; our

substantial indebtedness, and our ability to incur additional

indebtedness in the future; our potential inability to generate

sufficient cash in order to meet our debt service obligations;

restrictions on our current and future operations because of the

terms of our senior secured credit facilities; market risks related

to interest rate changes; our ability to successfully integrate the

businesses of Healthland, American HealthTech and Rycan with our

business and the inherent risks associated with any potential

future acquisitions; competition with companies that have greater

financial, technical and marketing resources than we have; failure

to develop new technology and products in response to market

demands; failure of our products to function properly resulting in

claims for medical and other losses; breaches of security and

viruses in our systems resulting in customer claims against us and

harm to our reputation; failure to maintain customer satisfaction

through new product releases free of undetected errors or problems;

interruptions in our power supply and/or telecommunications

capabilities, including those caused by natural disaster; our

ability to attract and retain qualified customer service and

support personnel; failure to properly manage growth in new markets

we may enter; misappropriation of our intellectual property rights

and potential intellectual property claims and litigation against

us; changes in accounting principles generally accepted in the

United States of America; significant charge to earnings if our

goodwill or intangible assets become impaired; fluctuations in

quarterly financial performance due to, among other factors, timing

of customer installations; and other risk factors described from

time to time in our public releases and reports filed with the

Securities and Exchange Commission, including, but not limited to,

our most recent Annual Report on Form 10-K. Relative to our

dividend policy, the payment of cash dividends is subject to the

discretion of our Board of Directors and will be determined in

light of then-current conditions, including our earnings, our

leverage, our operations, our financial conditions, our capital

requirements and other factors deemed relevant by our Board of

Directors. In the future, our Board of Directors may change our

dividend policy, including the frequency or amount of any dividend,

in light of then-existing conditions. We also caution investors

that the forward-looking information described herein represents

our outlook only as of this date, and we undertake no obligation to

update or revise any forward-looking statements to reflect events

or developments after the date of this press release.

COMPUTER PROGRAMS AND SYSTEMS, INC.

Unaudited Condensed Consolidated

Statements of Income

(In thousands, except per share

data)

Three Months EndedJune

30,

Six Months EndedJune 30,

2018 2017 2018

2017 Sales revenues: System sales and support $ 42,746 $

45,474 $ 88,498 $ 88,897 TruBridge 25,159

22,203 50,290 42,854 Total sales

revenues 67,905 67,677 138,788 131,751 Costs of sales:

System sales and support 19,528 19,753 37,946 39,540 TruBridge

13,531 11,933 26,910

23,520 Total costs of sales 33,059

31,686 64,856 63,060

Gross profit 34,846 35,991 73,932 68,691 Operating

expenses: Product development 9,314 8,414 18,071 16,492 Sales and

marketing 7,518 7,607 15,232 14,734 General and administrative

13,188 12,921 25,552 24,581

Amortization of acquisition-related

intangibles

2,601 2,601 5,203

5,203 Total operating expenses 32,621

31,543 64,058 61,010

Operating income 2,225 4,448 9,874 7,681 Other income

(expense): Other income 194 70 392 140 Interest expense

(1,807 ) (1,938 ) (3,785 ) (3,745 ) Total

other expense (1,613 ) (1,868 ) (3,393 )

(3,605 ) Income before taxes 612 2,580 6,481 4,076

Provision for income taxes 284 993

2,185 2,243 Net income $ 328 $

1,587 $ 4,296 $ 1,833

Net income per common share – basic and

diluted

$ 0.02 $ 0.11 $ 0.31 $ 0.13

Weighted average shares outstanding used

in per common share computations – basic and diluted

13,561 13,420 13,518 13,397

COMPUTER PROGRAMS AND

SYSTEMS, INC.

Condensed Consolidated Balance

Sheets

(In thousands, except per share

data)

June 30,2018

Dec. 31,2017

(Unaudited) ASSETS Current assets: Cash and cash

equivalents $ 1,492 $ 520 Accounts receivable, net of allowance for

doubtful accounts of $3,213 and $2,654, respectively 41,216 38,061

Financing receivables, current portion, net 14,788 15,055

Inventories 1,478 1,417 Prepaid income taxes 651 - Prepaid expenses

and other 6,038 2,824

Total current assets

65,663 57,877 Property and equipment, net 11,042 11,692

Financing receivables, net of current portion 13,025 11,485 Other

assets, net of current portion 1,155 - Intangible assets, net

91,510 96,713 Goodwill 140,449 140,449

Total assets $ 322,844 $ 318,216

LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities:

Accounts payable $ 5,814 $ 7,620 Current portion of long-term debt

5,830 5,820 Deferred revenue 12,300 8,707 Accrued vacation 4,702

3,794 Income taxes payable - 810 Other accrued liabilities

10,160 14,098 Total current liabilities 38,806

40,849 Long-term debt, less current portion 133,151 136,614

Deferred tax liabilities 6,646 4,667

Total liabilities 178,603 182,130 Stockholders’ Equity:

Common stock, $0.001 par value; 30,000 shares authorized; 14,086

and 13,760 shares issued and outstanding 14 14 Additional paid-in

capital 159,770 155,078 Retained earnings (15,543 )

(19,006 ) Total stockholders’ equity 144,241

136,086 Total liabilities and stockholders’ equity $ 322,844

$ 318,216

COMPUTER PROGRAMS AND

SYSTEMS, INC.

Unaudited Condensed Consolidated

Statements of Cash Flows

(In thousands)

Six Months EndedJune 30,

2018 2017 Operating activities: Net

income $ 4,296 $ 1,833 Adjustments to net income: Provision for bad

debt 1,695 473 Deferred taxes 1,404 1,920 Stock-based compensation

4,692 2,967 Depreciation 1,067 1,419 Intangible amortization 5,203

5,203 Amortization of deferred finance costs 173 365 Changes in

operating assets and liabilities: Accounts receivable (4,453 )

(3,013 ) Financing receivables (1,669 ) (4,241 ) Inventories (62 )

622 Prepaid expenses and other (594 ) (1,014 ) Accounts payable

(1,806 ) 4,588 Deferred revenue 2,363 2,724 Other liabilities

(3,030 ) 2,236 Income taxes payable (1,461 ) (191 )

Net cash provided by operating activities 7,818 15,891

Investing activities: Purchases of property and equipment

(417 ) (465 ) Net cash used in investing activities (417 )

(465 ) Financing activities: Dividends paid (2,803 ) (6,135

) Proceeds from long-term debt 7,300 - Payments of long-term debt

(10,926 ) (9,771 ) Proceeds from exercise of stock options -

1 Net cash used in financing activities (6,429

) (15,905 ) Net increase (decrease) in cash and cash

equivalents 972 (479 ) Cash and cash equivalents, beginning

of period 520 2,220 Cash and cash

equivalents, end of period $ 1,492 $ 1,741

COMPUTER PROGRAMS AND SYSTEMS, INC.

Unaudited Other Supplemental

Information

Consolidated Bookings

(In thousands)

Three Months EndedJune

30,

Six Months EndedJune 30,

2018 2017 2018

2017 System sales and support(1) $ 17,125 $ 24,998 $ 35,357

$ 41,953 TruBridge(2) 6,371 8,699 10,189

15,293 Total $ 23,496 $ 33,697 $ 45,546 $ 57,246 (1)

Generally calculated as the total contract price (for system sales)

and annualized contract value (for support). (2) Generally

calculated as the total contract price (for non-recurring,

project-related amounts) and annualized contract value (for

recurring amounts).

COMPUTER PROGRAMS AND SYSTEMS,

INC.

Unaudited Reconciliation of Non-GAAP

Financial Measures

(In thousands)

Adjusted EBITDA

Three Months EndedJune

30,

Six Months EndedJune 30,

2018 2017 2018

2017 Net income, as reported $ 328 $ 1,587 $ 4,296 $ 1,833

Depreciation expense 538 701 1,067 1,419 Amortization of

acquisition-related intangible assets 2,601 2,601 5,203 5,203

Stock-based compensation 2,753 1,685 4,692 2,967

Transaction-related costs - 4 - 9 Non-recurring severance - 1,669 -

2,066 Interest expense and other, net 1,613 1,868 3,393 3,605

Provision for income taxes 284 993 2,185

2,243 Adjusted EBITDA $ 8,117 $ 11,108 $ 20,836 $ 19,345

The performance measure of Adjusted EBITDA, as presented above,

excludes the cash benefits derived from the utilization of net

operating loss carryforwards acquired in the Healthland acquisition

(“NOL Utilization”), which is included as an adjustment to net

income in order to calculate Consolidated EBITDA per the terms of

our credit facility. NOL Utilization was approximately $0.8

million and $1.6 million for the three and six months

ended June 30, 2018, respectively, compared with $2.1

million and $3.4 million for the three and six months

ended June 30, 2017, respectively.

COMPUTER PROGRAMS AND SYSTEMS, INC.

Unaudited Reconciliation of Non-GAAP

Financial Measures

(In thousands, except per share

data)

Non-GAAP Net Income and Non-GAAP

Earnings Per Share (“EPS”)

Three Months EndedJune

30,

Six Months EndedJune 30,

2018 2017 2018

2017 Net income, as reported $ 328 $ 1,587 $ 4,296 $ 1,833

Pre-tax adjustments for Non-GAAP EPS: Amortization of

acquisition-related intangible assets 2,601 2,601 5,203 5,203

Stock-based compensation 2,753 1,685 4,692 2,967

Transaction-related costs - 4 - 9 Non-recurring severance - 1,669 -

2,066 Non-cash interest expense 86 183 172 365 After-tax

adjustments for Non-GAAP EPS: Tax-effect of pre-tax adjustments, at

21% and 35%, respectively (1,142 ) (2,150 ) (2,114 ) (3,714 ) Tax

shortfall from stock-based compensation 32 157

394 921 Non-GAAP net income $

4,658 $ 5,736 $ 12,643 $ 9,650 Weighted

average shares outstanding, diluted 13,561

13,420 13,518 13,397 Non-GAAP

EPS $ 0.34 $ 0.43 $ 0.94 $ 0.72

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with accounting

principles generally accepted in the United States of America, or

“GAAP.” However, management believes that, in order to properly

understand our short-term and long-term financial and operational

trends, investors may wish to consider the impact of certain

non-cash or non-recurring items, when used as a supplement to

financial performance measures that are prepared in accordance with

GAAP. These items result from facts and circumstances that vary in

frequency and impact on continuing operations. Management uses

these non-GAAP financial measures in order to evaluate the

operating performance of the Company and compare it against past

periods, make operating decisions, and serve as a basis for

strategic planning. These non-GAAP financial measures provide

management with additional means to understand and evaluate the

operating results and trends in our ongoing business by eliminating

certain non-cash expenses and other items that management believes

might otherwise make comparisons of our ongoing business with prior

periods more difficult, obscure trends in ongoing operations, or

reduce management’s ability to make useful forecasts. In addition,

management understands that some investors and financial analysts

find these non-GAAP financial measures helpful in analyzing our

financial and operational performance and comparing this

performance to our peers and competitors.

As such, to supplement the GAAP information provided, we present

in this press release the following non-GAAP financial measures:

Adjusted EBITDA, Non-GAAP net income, and Non-GAAP earnings per

share (“EPS”).

We calculate each of these non-GAAP financial measures as

follows:

- Adjusted

EBITDA – Adjusted EBITDA consists of GAAP net income (loss)

as reported and adjusts for: (i) depreciation; (ii) amortization of

acquisition-related intangible assets; (iii) stock-based

compensation; (iv) transaction-related costs; (v) non-recurring

severance; (vi) interest expense and other, net; and (vii) the

provision for income taxes.

- Non-GAAP net

income – Non-GAAP net income consists of GAAP net income

(loss) as reported and adjusts for (i) amortization of

acquisition-related intangible assets; (ii) stock-based

compensation; (iii) transaction-related costs; (iv) non-recurring

severance; (v) non-cash charges to interest expense and other; and

(vi) the total tax effect of items (i) through (v).

- Non-GAAP

EPS – Non-GAAP EPS consists of Non-GAAP net income, as

defined above, divided by weighted average shares outstanding

(diluted) in the applicable period.

Certain of the items excluded or adjusted to arrive at these

non-GAAP financial measures are described below:

- Amortization of

acquisition-related intangible assets – Acquisition-related

amortization expense is a non-cash expense arising primarily from

the acquisition of intangible assets in connection with

acquisitions or investments. We exclude acquisition-related

amortization expense from non-GAAP financial measures because we

believe (i) the amount of such expenses in any specific period may

not directly correlate to the underlying performance of our

business operations and (ii) such expenses can vary significantly

between periods as a result of new acquisitions and full

amortization of previously acquired intangible assets. Investors

should note that the use of these intangible assets contributed to

revenue in the periods presented and will contribute to future

revenue generation, and the related amortization expense will recur

in future periods.

- Stock-based

compensation – Stock-based compensation expense is a

non-cash expense arising from the grant of stock-based awards. We

exclude stock-based compensation expense from non-GAAP financial

measures because we believe (i) the amount of such expenses in any

specific period may not directly correlate to the underlying

performance of our business operations and (ii) such expenses can

vary significantly between periods as a result of the timing and

valuation of grants of new stock-based awards, including grants in

connection with acquisitions. Investors should note that

stock-based compensation is a key incentive offered to employees

whose efforts contributed to the operating results in the periods

presented and are expected to contribute to operating results in

future periods, and such expense will recur in future periods.

- Non-recurring

expenses and transaction-related costs – Non-recurring

expenses relate to certain severance and other charges incurred in

connection with activities that are considered one-time.

Transaction-related costs are the non-recurring costs related to

specific acquisitions (such as the Healthland acquisition). We

exclude non-recurring expenses and transaction-related costs from

non-GAAP financial measures because we believe (i) the amount of

such expenses in any specific period may not directly correlate to

the underlying performance of our business operations and (ii) such

expenses can vary significantly between periods.

- Non-cash charges

to interest expense and other – Non-cash charges to interest

expense and other includes amortization of deferred debt issuance

costs. We exclude non-cash charges to interest expense and other

from non-GAAP financial measures because we believe these non-cash

amounts relate to specific transactions and, as such, may not

directly correlate to the underlying performance of our business

operations.

- Tax shortfall

(excess tax benefit) from stock-based compensation –

ASU 2016-09, Improvements to Employee Share-Based Payment

Accounting, became effective for the Company during the first

quarter of 2017 and changes the treatment of tax shortfall and

excess tax benefits arising from stock-based compensation

arrangements. Prior to ASU 2016-09, these amounts were recorded as

an increase (for excess benefits) or decrease (for shortfalls) to

additional paid-in capital. With the adoption of ASU 2016-09, these

amounts are now captured in the period’s income tax expense. We

exclude this component of income tax expense from non-GAAP

financial measures because we believe (i) the amount of such

expenses or benefits in any specific period may not directly

correlate to the underlying performance of our business operations;

(ii) such expenses or benefits can vary significantly between

periods as a result of the valuation of grants of new stock-based

awards, the timing of vesting of awards, and periodic movements in

the fair value of our common stock; and (iii) excluding these

amounts assists in the comparability between current period results

and results during periods prior to the adoption of ASU

2016-09.

Management considers these non-GAAP financial measures to be

important indicators of our operational strength and performance of

our business and a good measure of our historical operating trends,

in particular the extent to which ongoing operations impact our

overall financial performance. In addition, management may use

Adjusted EBITDA, Non-GAAP net income and/or Non-GAAP EPS to measure

the achievement of performance objectives under the Company’s stock

and cash incentive programs. Note, however, that these non-GAAP

financial measures are performance measures only, and they do not

provide any measure of cash flow or liquidity. Non-GAAP financial

measures are not alternatives for measures of financial performance

prepared in accordance with GAAP and may be different from

similarly titled non-GAAP measures presented by other companies,

limiting their usefulness as comparative measures. Non-GAAP

financial measures have limitations in that they do not reflect all

of the amounts associated with our results of operations as

determined in accordance with GAAP. Additionally, there is no

certainty that we will not incur expenses in the future that are

similar to those excluded in the calculations of the non-GAAP

financial measures presented in this press release. Investors and

potential investors are encouraged to review the “Unaudited

Reconciliation of Non-GAAP Financial Measures” above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180802005855/en/

CPSITracey Schroeder, 251-639-8100Chief Marketing

OfficerTracey.Schroeder@cpsi.com

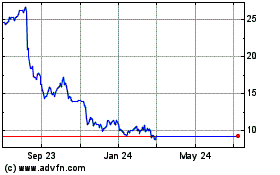

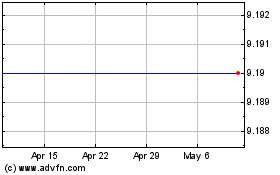

Computer Programs and Sy... (NASDAQ:CPSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Computer Programs and Sy... (NASDAQ:CPSI)

Historical Stock Chart

From Apr 2023 to Apr 2024