|

Amendment No. 1 dated June 22, 2018

to Prospectus Supplement dated March 10, 2017

(To the Prospectus dated March 10, 2017)

|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-215444

|

19,016,282 Shares of Common Stock

|

URANIUM ENERGY CORP.

|

$33,754,586

This Amendment No. 1 to Prospectus Supplement (the "

Amendment

") amends the Prospectus Supplement dated March 10, 2017 and should be read in conjunction with such Prospectus Supplement and the prospectus dated March 10, 2017, each of which are to be delivered with this Amendment. This Amendment amends only those sections of the Prospectus Supplement listed in this Amendment; all other sections of the Prospectus Supplement remain as is.

We are only filing this Amendment because we agreed with the holders of 2,850,000 of our common share purchase warrants (the "

2015 Warrants

") to extend the exercise period of the 2015 Warrants an additional ninety-one (91) days to September 24, 2018. The 2015 Warrants originally allowed an exercise period of three years for the purchase of up to 2,850,000 shares of our common stock (each, a "

2015 Warrant Share

") at an exercise price of $2.35 per 2015 Warrant Share. This Amendment extends the expiry date of the 2015 Warrants to allow an additional ninety-one (91) days for the exercise of the 2015 Warrants.

Our shares of common stock are traded on the NYSE American LLC (which we refer to as the "

NYSE American

") under the symbol "UEC." On June 21, 2018, the closing price of our shares of common stock on the NYSE American was $1.67 per share of common stock.

Our principal offices are located at 500 North Shoreline Boulevard, Suite 800N, Corpus Christi, Texas 78401 and 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia, Canada V6E 2Y3, and our web site address is www.uraniumenergy.com.

Investing in our securities involves a high degree of risks. Before buying any of our securities, you should read the discussion of material risks of investing in our Warrant Shares in the "Risk Factors" section beginning on page A-5 of this Amendment, the "Risk Factors" section beginning on page S-9 of the prospectus supplement and the "Risk Factors" section beginning on page 8 of the related base prospectus and in the documents incorporated by reference herein and therein.

Neither the United States Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the related base prospectus. Any representation to the contrary is a criminal offense.

The date of this Amendment No. 1 to prospectus supplement is June 22, 2018

You should rely only on the information contained in or incorporated by reference into this Amendment No. 1 to prospectus supplement, the prospectus supplement and the related base prospectus and any filed free writing prospectus, if any, relating to this offering. We have not authorized any other person to provide you with additional or different information. If anyone provides you with additional or different information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this Amendment No. 1 to prospectus supplement, the prospectus supplement, the related base prospectus, any free writing prospectus and the documents incorporated by reference herein and therein is accurate only as of the respective dates of such documents. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this Amendment No. 1 to prospectus supplement updates and modifies the information in the prospectus supplement and the related base prospectus and information incorporated by reference herein and therein. To the extent that any statement made in this Amendment No. 1 to prospectus supplement or any free writing prospectus (unless otherwise specifically indicated therein) differs from those in the prospectus supplement or the related base prospectus, the statements made in the prospectus supplement and the related base prospectus and the information incorporated by reference herein and therein are deemed modified or superseded by the statements made by this Amendment No. 1 to prospectus supplement.

ii

TABLE OF CONTENTS

AMENDMENT NO. 1 TO PROSPECTUS SUPPLEMENT

|

ABOUT THIS AMENDMENT NO. 1 TO PROSPECTUS SUPPLEMENT

|

A-1

|

|

WHERE TO FIND ADDITIONAL INFORMATION

|

A-2

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

A-2

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

A-4

|

|

RISK FACTORS

|

A-5

|

|

DESCRIPTION OF SECURITIES

|

A-5

|

|

PLAN OF DISTRIBUTION

|

A-8

|

__________

iii

ABOUT THIS AMENDMENT NO. 1 TO PROSPECTUS SUPPLEMENT

On June 24, 2015, we filed a prospectus supplement (which we refer to as the "

2015 Unit Supplement

") with the United States Securities and Exchange Commission (which we refer to herein as the "

SEC

") and an MJDS prospectus supplement with the securities commission or similar regulatory authority in each of the provinces of Canada, except Quebec, relating to the offering (which we refer to herein as the "

2015 Unit Offering

") by us to the public in Canada and the United States of 5,000,000 units (which we refer to as the "

2015 Units

") each consisting of one share of the Company's common stock (which we refer to as a "

2015 Unit Share

") and one-half of one 2015 Warrant, each whole 2015 Warrant exercisable to purchase one 2015 Warrant Share at a price of $2.35 per 2015 Warrant Share for a period of three years from the date of issuance. The 2015 Units were sold at a negotiated price of $2.00 per 2015 Unit. The 2015 Unit Shares and 2015 Warrants were issued separately but could only be purchased together in the 2015 Unit Offering. In connection with the 2015 Unit Offering, the Company also issued 350,000 common share purchase warrants to the placement agents and financial advisors (the "

2015 Agent Warrants

", which together with the 2015 Warrants forming part of the 2015 Units are collectively, the 2015 Warrants), which have the same terms as the 2015 Warrants. The 2015 Unit Offering was completed on June 25, 2015. The exercise price of the 2015 Warrants was determined by negotiation between us and the placement agents for the 2015 Unit Offering.

Since our shelf registration statement on Form S-3, which was declared effective on January 10, 2014 (the "

2014 Shelf

") (Registration File No. 333-193104) was expiring, we filed a new shelf registration statement on Form S-3 on January 5, 2017, which was declared effective on March 10, 2017 (the "

2017 Shelf

") (Registration File No. 333-215444). On March 10, 2017 we filed a propsectus supplement in acordance with Rule 424(b)(2) of the Securities Act of 1933, as amended, whereby we offered for sale to the public cerain shares of our common stock underlying warrants that were offered pursuant to registered offerings in 2015, 2016 and 2017, which included the 2015 Warrant Shares.

The sole purpose of this Amendment No. 1 to the March 10, 2017 Prospectus Supplement is to disclose the extension of the exercise period of the 2015 Warrants by ninety-one (91) days.

The prospectus supplement relates to a registration statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration process, we may, from time to time, offer, sell and issue any of the securities or any combination of the securities described in the related base prospectus in one or more offerings. The related base prospectus provides you with a general description of the securities we may offer.

In this prospectus supplement we provide you with specific information about the securities we sold in the 2015 Unit Offering, and about the amendment to the exercise period of the 2015 Warrants issued in the 2015 Unit Offering. This Amendment No. 1 to prospectus supplement and any free writing prospectus filed by us (unless otherwise specifically stated therein) may add, update or change information contained in the prospectus supplement and the related base prospectus and the documents incorporated by reference herein and therein. You should read this prospectus supplement, the related base prospectus and any free writing prospectus filed by us together with the information described under the sections entitled "Incorporation of Certain Information by Reference" in this prospectus supplement and any additional information you may need to make your investment decision. We have also filed this Amendment No. 1 to prospectus supplement with the securities regulatory authorities in each of the provinces of Canada, except Quebec, pursuant to the multi-jurisdictional disclosure system (which the Canadian-filed prospectus supplement and the related prospectus we refer to as the "Canadian Prospectus").

Prospective investors should be aware that the acquisition of the Warrant Shares described herein may have tax consequences both in the United States and Canada, as applicable. Such consequences for investors who are resident in, or citizens of, the United States or Canada may not be described fully in the prospectus supplement, the related base prospectus or the Canadian Prospectus. See "Material U.S. Federal Income Tax Consequences" in the related base prospectus.

Unless otherwise stated, currency amounts in this Amendment No. 1 to prospectus supplement are stated in United States dollars. The financial statements incorporated by reference in this Amendment No. 1 to prospectus supplement, the prospectus supplement and the related base prospectus, and the selected consolidated financial data derived therefrom included in the prospectus supplement, are presented in United States dollars. The financial statements incorporated by reference in this Amendment No. 1 to prospectus supplement, the prospectus supplement and the related base prospectus, and the selected consolidated financial data derived therefrom included in the prospectus supplement, have been prepared in accordance with United States Generally Accepted Accounting Principles.

A-1

The registration statement that contains the related base prospectus (Registration File No. 333-215444) (including the exhibits filed with and the information incorporated by reference into the registration statement) contains additional important business and financial information about us and the securities offered hereby that is not presented or delivered with this Amendment No. 1 to prospectus supplement. That registration statement, including the exhibits filed with the registration statement and the information incorporated by reference into the registration statement, can be read at the SEC's website,

www.sec.gov

, or at the SEC office mentioned under the section of this prospectus supplement entitled "Where to Find Additional Information" below.

WHERE TO FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy materials we have filed with the SEC at the SEC's public reference room at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of its public reference room. Our SEC filings also are available to the public on the SEC's Internet site at www.sec.gov. In addition, we maintain a website that contains information about us, including our SEC filings, at

www.uraniumenergy.com

. The information contained on our website does not constitute a part of this prospectus supplement, the related base prospectus, the Canadian Prospectus or any other report or documents we file with or furnish to the SEC or with the securities regulatory authorities in Canada.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Amendment No. 1 to prospectus supplement, the prospectus supplement and the related base prospectus and the documents incorporated herein and therein by reference contain "forward-looking-statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (which we refer to as the "Securities Act"), Section 21E of the Securities Exchange Act of 1934, as amended (which we refer to as the "Exchange Act") and Canadian securities laws. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Forward-looking statements, and any estimates and assumptions upon which they are based, are made in good faith and reflect our views and expectations for the future as of the date of such statements, which can change significantly. Furthermore, forward-looking statements are subject to known and unknown risks and uncertainties which may cause actual results, performance, achievements or events to be materially different from any future results, performance, achievements or events implied, suggested or expressed by such forward-looking statements. Accordingly, forward-looking statements in this prospectus supplement, the related base prospectus or in any documents incorporate herein and therein by reference should not be unduly relied upon.

Forward-looking statements may be based on a number of material estimates and assumptions, of which any one or more may prove to be incorrect. Forward-looking statements may be identifiable by terminology concerning the future, such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "intend", "goal", "likely", "may", "might", "outlook", "plan", "predict", "potential", "project", "should", "schedule", "strategy", "target", "will" or "would", and similar expressions or variations thereof including the negative use of such terminology. Examples in this prospectus supplement, the related base prospectus or in any documents incorporated herein and therein by reference include, but are not limited to, such forward-looking statements reflecting or pertaining to:

A-2

-

our overall strategy, objectives, plans and expectations for Fiscal 2018 and beyond;

-

our expectations for worldwide nuclear power generation and future uranium supply and demand, including long-term market prices for uranium oxide (commonly referred to as "U

3

O

8

");

-

our belief and expectations of in-situ recovery (or "ISR") mining for our uranium projects, where applicable;

-

our estimation of mineralized materials, which are based on certain estimates and assumptions, and the economics of future production for our uranium projects including the Palangana Mine;

-

our plans and expectations including anticipated expenditures relating to exploration, pre-extraction, extraction and reclamation activities for our uranium projects including the Palangana Mine;

-

our ability to obtain, maintain and amend, within a reasonable period of time, required rights, permits and licenses from landowners, governments and regulatory authorities;

-

our ability to obtain adequate additional financing including access to the equity and credit markets;

-

our ability to remain in compliance with the terms of our indebtedness; and

-

our belief and expectations including the possible impact of any legal proceedings or regulatory actions against us.

Forward-looking statements, and any estimates and assumptions upon which they are based, are made as of the date of this prospectus supplement, the date of the related base prospectus or the date of any documents incorporated herein or therein by reference, as applicable, and we do not intend or undertake to revise, update or supplement any forward-looking statements to reflect actual results, future events or changes in estimates and assumptions or other factors affecting such forward-looking statements, except as required by applicable securities laws. Should one or more forward-looking statements be revised, updated or supplemented, no inference should be made that we will revise, update or supplement any other forward looking statements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, but not limited to the following:

-

our limited financial and operating history;

-

our need for additional financing;

-

our limited uranium extraction and sales history;

-

our operations are inherently subject to numerous significant risks and uncertainties, many are beyond our control;

-

our exploration activities on our mineral properties may not result in commercially recoverable quantities of uranium;

-

limits to our insurance coverage;

-

the level of government regulation, including environmental regulation;

-

changes in governmental regulation and administrative practices;

-

nuclear incidents;

-

the marketability of uranium concentrates;

-

the competitive environment in which we operate;

-

our dependence on key personnel; and

-

conflicts of interest of our directors and officers.

A-3

For a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those in such forward-looking statements please see the section entitled "Risk Factors" beginning on page A-9 of this Amendment No. 1 to prospectus supplement and the section entitled "Risk Factors" beginning on page S-9 of the prospectus supplement and on page 9 of the related base prospectus and, to the extent applicable, the "Risk Factors" sections in our annual reports on Form 10-K and our quarterly reports on Form 10-Q as filed with the SEC and the Canadian securities authorities that are incorporated by reference herein. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that these statements will prove to be accurate as actual results and future events could differ materially from those anticipated in the statements.

Investors should review our subsequent reports filed with the SEC on Forms 10-K, 10-Q and 8-K and with the Canadian securities authorities, and any amendments thereto. We qualify all forward-looking statements by these cautionary statements.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

This prospectus supplement is deemed, as of the date hereof, to be incorporated by reference into the related base prospectus solely for the purpose of offering the 2015 Warrant Shares. Other documents are also incorporated, or are deemed to be incorporated, by reference into the related base prospectus, and reference should be made to the related base prospectus for full particulars thereof.

The following documents which have been filed by us with the SEC and with securities commissions or similar authorities in Canada, are also specifically incorporated by reference into, and form an integral part of the related base prospectus, as supplemented by this prospectus supplement (excluding, unless otherwise provided therein or herein, information furnished pursuant to Item 2.02 and Item 7.01 of any Current Report on Form 8-K):

(a) our Annual Report on Form 10-K for the fiscal year ended July 31, 2017 that we filed with the SEC on October 16, 2017;

(b) our Current Report on Form 8-K that we filed with the SEC on November 6, 2017;

(c) our Quarterly Report on Form 10-Q for our fiscal quarter ended October 31, 2017, that we filed with the SEC on March 12, 2018;

(d) our Current Report on Form 8-K that we filed with the SEC on March 12, 2018;

(e) our Current Report on Form 8-K that we filed with the SEC on May 4, 2018;

(f) our proxy statement on Schedule 14A that we filed with the SEC on June 7, 2018;

(g) our Quarterly Report on Form 10-Q for our fiscal quarter ended April 30, 2018, that we filed with the SEC on June 11, 2018; and

(h) the description of our common stock contained in the Registration Statement on Form 8-A, as filed with the SEC on December 12, 2005, as updated in the Company's Current Report on Form 8-K, as filed with the SEC on February 9, 2006, which disclosed the increase in the Company's authorized share capital to 750,000,000 shares of common stock.

All documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus supplement but before the end of the offering of the securities made by this prospectus supplement and the related base prospectus shall be incorporated by reference in the related base prospectus, as supplemented by this prospectus supplement, from the date of filing of such documents. Information that we file later with the SEC and prior to the completion of the offering of securities made by this prospectus supplement and the related base prospectus will automatically update information in this prospectus supplement and the related base prospectus. In all cases, you should rely on the information we file later with the SEC over different information included in this prospectus supplement and the related base prospectus.

A-4

You may obtain copies of any of these documents by contacting us at the address and telephone number indicated below or by contacting the SEC as described under the section entitled "Where to Find Additional Information." You may request a copy of these documents, and any exhibits that have specifically been incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part, at no cost, by writing to or telephoning:

Uranium Energy Corp.

Amir Adnani, President and Chief Executive Officer

1030 West Georgia Street, Suite 1830

Vancouver, British Columbia, Canada, V6E 2Y3

Telephone: (604) 682-9775

You should rely only on the information provided or incorporated by reference in this prospectus supplement, the related base prospectus and any free writing prospectus. You should not assume that the information in this prospectus supplement, the related base prospectus, any free writing prospectus or any document incorporated herein or therein, is accurate as of any date other than the date on the front cover of the applicable document.

RISK FACTORS

Investing in our securities involves significant risks. Please see the risk factors under the heading "Risk Factors" in our most recent Annual Report on Form 10-K, as revised or supplemented by our Quarterly Reports on Form 10-Q and reports on Form 8-K filed with the SEC since the filing of our most recent Annual Report on Form 10-K, each of which are on file with the SEC and are incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any prospectus supplement. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations, results of operation, financial condition or prospects.

DESCRIPTION OF

SECURITIES

Warrant Shares

The Warrant Shares, which include the 2015 Warrant Shares, 2016 Warrant Shares and 2017 Warrant Shares, will have all of the characteristics, rights and restrictions of our shares of common stock. We are authorized to issue 750,000,000 shares of common stock, of which 160,397,532 shares are issued and outstanding. Our shares of common stock are entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law, the holders of our shares of common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by holders of our common stock that are present in person or represented by proxy. Holders of our shares of common stock representing 33 1/3% of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares of common stock is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

The holders of our shares of common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefor.

Upon liquidation, dissolution or winding up, the holders of our shares of common stock will be entitled to receive pro rata all assets available for distribution to such holders.

A-5

In the event of any merger or consolidation with or into another company in connection with which our shares of common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our shares of common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our shares of common stock have no pre-emptive rights or conversion rights and there are no redemption provisions applicable to our shares of common stock.

Warrants

The material terms and provisions of the 2015 Warrants, 2016 Warrants, and 2017 Warrants are summarized below. This summary is subject to and qualified in its entirety by the forms of warrant, which were filed as exhibits to Current Reports on Form 8-K on June 25, 2015 in connection with the 2015 Unit Offering, March 10, 2016 in connection with the 2016 Unit Offering and January 17, 2017 in connection with the 2017 Unit Offering, which are incorporated by reference herein.

General Terms of the Warrants

The 2015 Warrants represent the right to purchase up to 2,850,000 Warrant Shares at an initial exercise price of $2.35 per Warrant Share until September 24, 2018. The 2016 Warrants represent the right to purchase up to 6,594,348 Warrant Shares at an initial exercise price of $1.20 per Warrant Shares for a period of three years from the date of issuance. The 2017 Warrants represent the right to purchase up to 9,571,934 Warrant Shares at an initial exercise price of $2.00 per Warrant Share for a period

starting six (6) months from the date of issuance until three years from the date of issuance. For purposes of the discussion below in this section "Description of Securities", the term "Warrants" should be read to include the 2015 Warrants, 2016 Warrants and 2017 Warrants.

Exercise

Holders of the Warrants may exercise their Warrants to purchase Warrant Shares by delivering (i) notice of exercise, appropriately completed and duly signed, and (ii) if such holder is not utilizing the cashless exercise provisions with respect to the Warrants, payment of the exercise price for the number of Warrant Shares with respect to which the Warrant is being exercised. Warrants may be exercised in whole or in part, but only for full shares of common stock.

The Warrant holders are entitled to a "cashless exercise" option if, at any time of exercise, there is no effective registration statement registering, or no current prospectus available for, the issuance or resale of the Warrant Shares. This option entitles the Warrant holders to elect to receive fewer shares of common stock without paying the cash exercise price. The number of shares to be issued would be determined by a formula based on the total number of shares with respect to which the Warrant is being exercised, the volume weighted average of the prices per share of our common stock on the trading date immediately prior to the date of exercise, and the applicable exercise price of the Warrant.

The Warrant Shares will be, when issued and paid for in accordance with the Warrants, duly and validly authorized, issued and fully paid and non-assessable. We have authorized and reserved at least that number of Warrant Shares equal to the number of Warrant Shares issuable upon exercise of all outstanding Warrants.

Delivery of Warrant Shares

Upon the holder's exercise of a Warrant, we will promptly, but in no event later than the third trading day after the exercise date, issue and deliver, or cause to be issued and delivered, the Warrant Shares. We will, if the holder provides the necessary information to us, issue and deliver the shares electronically by crediting the account of the Warrant holder's prime broker with the Depository Trust Company through its Deposit or Withdrawal at Custodian system (commonly referred to as "DWAC").

Rescission and Buy-In Rights

We provide certain rescission rights and buy-in compensation to a holder if we fail to deliver the Warrant Shares by the third trading day after the date on which we receive notice of exercise of such Warrants.

A-6

With respect to the rescission rights, the holder has the right to rescind the exercise if the Warrant Shares are not timely delivered.

The buy-in compensation rights apply if, due to our failure to make timely delivery of the Warrant Shares, the Warrant holder purchases (in an open market transaction or otherwise) shares of our common stock to deliver in satisfaction of a sale by the holder of the Warrant shares that the holder anticipated receiving from us upon exercise of the Warrant. In this event, we will:

-

pay in cash to the holder the amount equal to the excess (if any) of the buy-in price over the product of (A) such number of Warrant Shares that we were required to deliver to the holder, times (B) the price at which the sell order giving rise to holder's purchase obligation was executed; and

-

at the election of holder, either (A) reinstate the portion of the Warrant as to such number of shares of common stock, or (B) deliver to the holder such number of shares of common stock.

Fundamental Transactions

If, at any time while the Warrants are outstanding, we (1) consolidate or merge with or into another corporation, (2) sell, lease, license, assign, transfer or otherwise dispose of all or substantially all of our assets, (3) are subject to or complete a tender or exchange offer pursuant to which holders of our common stock are permitted to tender or exchange their shares for other securities, cash or property, and which has been accepted by the holders of 50% or more of our outstanding common stock, (4) effect any reclassification of our common stock or any compulsory share exchange pursuant to which our common stock is converted into or exchanged for other securities, cash or property, or (5) engage in one or more transactions with another party that results in that party acquiring more than 50% of our outstanding shares of common stock (each, a "

Fundamental Transaction

"), then the Warrant holder shall have the right thereafter to receive, upon exercise of the Warrant, the same amount and kind of securities, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of the number of Warrant Shares then issuable upon exercise of the Warrant, and any additional consideration payable as part of the Fundamental Transaction. We must cause any successor to us, or any surviving entity, to assume the obligations under the Warrants.

Certain Adjustments

The exercise price and the number of shares of common stock purchasable upon the exercise of the Warrants are subject to adjustment upon the occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common stock.

Notice of Corporate Action

We will provide notice to holders of the Warrants to provide them with the opportunity to exercise their Warrants and hold common stock in order to participate in or vote on the following corporate events:

-

if we shall take a record of the holders of our common stock for the purpose of entitling them to receive (1) a dividend or other distribution, (2) a special nonrecurring cash dividend on or a redemption of our common stock, or (3) any right to subscribe for or purchase any shares of stock of any class or any other right;

-

if we shall take a record of the holders of our common stock for the purpose of entitling them to vote on (1) any reclassification of our capital stock, or (2) any consolidation or merger with, or any sale or transfer of all or substantially all of our assets to, another party; or

-

a voluntary or involuntary dissolution, liquidation or winding up of our Company.

Limitations on Exercise

The number of Warrant Shares that may be acquired by any holder upon any exercise of the Warrant shall be limited to the extent necessary to insure that, following such exercise (or other issuance), the total number of shares of common stock then beneficially owned by such holder and its affiliates and any other persons whose beneficial ownership of common stock would be aggregated with the holder's for purposes of Section 13(d) of the Exchange Act, does not exceed 4.99% of the total number of issued and outstanding shares of common stock (including for such purpose the shares of common stock issuable upon such exercise), or beneficial ownership limitation. The holder may elect to change this beneficial ownership limitation from 4.99% to 9.99% of the total number of issued and outstanding shares of common stock (including for such purpose the shares of common stock issuable upon such exercise) upon 61 days' prior written notice.

A-7

Additional Provisions

We are not required to issue fractional shares upon the exercise of the Warrants. No holders of the Warrants will possess any rights as a stockholder under those Warrants until the holder exercises those Warrants, except as set forth in the Warrants. The Warrants may be transferred independent of the common stock they were issued with, on a form of assignment, subject to all applicable laws.

PLAN OF DISTRIBUTION

This prospectus supplement and the related base prospectus relate to: (i) up to 2,850,000 Warrant Shares issuable from time to time on exercise of the 2015 Warrants issued by the Company on June 25, 2015 as part of the 2015 Unit Offering; (ii) up to 6,594,348 Warrant Shares issuable from time to time on exercise of the 2016 Warrants issued by the Company on March 10, 2016 as part of the 2016 Unit Offering; and (iii) up to 9,571,934 Warrant Shares issuable from time to time on exercise of the 2017 Warrants issued by the Company on January 20, 2017 as part of the 2017 Unit Offering.

Each whole 2015 Warrant entitles the holder to purchase one Warrant Share, subject to adjustment, until September 24, 2018 at a price of $2.35. Each whole 2016 Warrant entitles the holder to purchase one Warrant Share, subject to adjustment, for a period of three years from the date of issuance at a price of $1.20. Each whole 2017 Warrant entitles the holder to purchase one Warrant Share, subject to adjustment, for a period starting

six (6) months from the date of issuance until three years from the date of issuance at a price of $2.00.

On March 10, 2017, we filed the related base prospectus with the SEC as part of a registration statement on Form S-3 (File No. 333-215444), as amended (the "Registration Statement"), with the SEC relating to the offering by us from time to time of up to $100,000,000 of shares of common stock, debt securities, equity or debt warrants, subscription receipts or units comprising any combination of the foregoing securities. The Registration Statement was declared effective by the SEC on March 10, 2017.

On June 24, 2015, we filed the 2015 Unit Supplement with the SEC relating to the offering by us to the public in Canada and the United States of 5,000,000 2015 Units, each 2015 Unit consisting of one 2015 Unit Share and one-half of one 2015 Warrant. The 2015 Units were sold at a negotiated price of $2.00 per 2015 Unit. In connection with the 2015 Unit Offering, the Company also issued 350,000 2015 Agent Warrants, which together with the 2015 Warrants are collectively, the 2015 Warrants, which have the same terms as the 2015 Warrants. The 2015 Unit Offering was completed on June 25, 2015. The exercise price of the 2015 Warrants was determined by negotiation between us and the placement agents for the 2015 Unit Offering.

On March 10, 2016, we filed the 2016 Unit Supplement with the SEC relating to the offering by us to the public in Canada and the United States of 12,364,704 2016 Units, each 2016 Unit consisting of one 2016 Unit Share and one-half of one 2016 Warrant. The 2016 Units were sold at a negotiated price of $0.85 per 2016 Unit. In connection with the 2016 Unit Offering, the Company also issued 411,997 2016 Agent Warrants, which together with the 2016 Warrants are collectively, the 2016 Warrants, which have the same terms as the 2016 Warrants. The 2016 Unit Offering was completed on March 10, 2016. The exercise price of the 2016 Warrants was determined by negotiation between us and the placement agents for the 2016 Unit Offering.

On January 17, 2017, we filed the 2017 Unit Supplement with the SEC relating to the offering by us to the public in Canada and the United States of 2017 Units, each 2017 Unit consisting of one 2017 Unit Share and one-half of one 2017 Warrant. In connection with the 2017 Unit Offering, the Company entered into an underwriting agreement dated January 17, 2017 with the underwriters for the 2017 Unit Offering, pursuant to which we agreed to sell and the underwriters agreed to purchase 17,330,836 2017 Units, at a negotiated price of $1.50 per 2017 Unit. In connection with the 2017 Unit Offering, the Company also issued 906,516 2017 Compensation Warrants, which together with the 2017 Warrants are collectively, the 2017 Warrants, which have the same terms as the 2017 Warrants. The 2017 Unit Offering was completed on January 20, 2017. The exercise price of the 2017 Warrants was determined by negotiation between us and the co-representatives for the underwriters for the 2017 Unit Offering.

A-8

The Warrant Shares to which this prospectus supplement relates will be sold directly by the Company to holders of the 2015 Warrants, 2016 Warrants and/or 2017 Warrants, as applicable, on the exercise of such 2015 Warrants, 2016 Warrants and/or 2017 Warrants. No underwriters, dealers or agents will be involved in these sales.

No underwriter, dealer or agent has been involved in the preparation of, or has performed any review of, this Amendment No. 1 to prospectus supplement, the prospectus supplement or the related base prospectus.

A-9

URANIUM ENERGY CORP.

$33,754,586

AMENDMENT NO. 1 TO PROSPECTUS SUPPLEMENT

June 22, 2018

__________

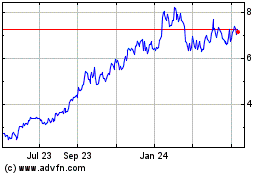

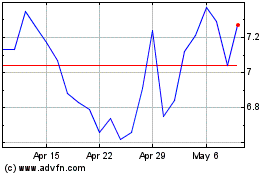

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Apr 2023 to Apr 2024