___________________________________________________________________

___________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE,

SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

[ ] TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission file number 001-13836

Full title of the plan and the address of the plan, if different from the issuer named below:

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

JOHNSON CONTROLS, INC.

5757 North Green Bay Avenue

Milwaukee, Wisconsin 53209

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

JOHNSON CONTROLS INTERNATIONAL PLC

One Albert Quay,

Cork, Ireland

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

YEARS ENDED DECEMBER 31, 2017 AND 2016

|

|

|

|

|

|

|

|

|

Contents

|

Page

|

|

|

|

|

Report of Independent Registered Public Accounting Firms

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2017 and 2016

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the year ended

December 31, 2017

|

|

|

|

|

|

Notes to the Financial Statements

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, Line 4i* - Schedule of Assets (Held at End of Year)

as of December 31, 2017**

|

|

|

|

|

|

Signature

|

|

|

|

|

|

Index to Exhibits

|

|

*Note: Refers to item number Form 5500 ("Annual Return/Report of Employee Benefit Plan") filed with the Department of Labor for the plan year ended December 31, 2017.

**Note: Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income and Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and Administrator of the

Tyco International Retirement Savings & Investment Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Tyco International Retirement Savings & Investment Plan (the “Plan”) as of December 31, 2017, and the related statement of changes in net assets available for benefits for the year then ended and the related notes and schedule (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2017, and the changes in net assets available for benefits for the year then ended in conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Supplemental Information

The Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2017 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Wipfli LLP

Wipfli LLP

We have served as the Plan’s auditor since 2018.

Milwaukee, Wisconsin

June 22, 2018

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator, Participants and Beneficiaries

of the Tyco International Retirement Savings and Investment Plan

We have audited the accompanying statement of net assets available for benefits of Tyco International Retirement Savings and Investment Plan (the “Plan”) as of December 31, 2016. The financial statement is the responsibility of the Plan’s management. Our responsibility is to express an opinion on this financial statement based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statement is free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statement referred to above presents fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

/s/ EisnerAmper LLP

EISNERAMPER LLP

Iselin, New Jersey

June 21, 2017

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2017

|

|

2016

|

|

Assets

|

|

|

|

|

Interest in investments of the Tyco International Management

Company Defined Contribution Plans Master Trust

|

$

|

—

|

|

|

$

|

2,163,609,028

|

|

|

Interest in notes receivable of the Tyco International Management

Company Defined Contribution Plans Master Trust

|

—

|

|

|

62,127,240

|

|

|

Total interest in the net assets of the Plans Master Trusts

|

—

|

|

|

2,225,736,268

|

|

|

|

|

|

|

|

Employer contributions receivable

|

—

|

|

|

6,104,972

|

|

|

Participants' contributions receivable

|

—

|

|

|

2,208,543

|

|

|

Total receivables

|

—

|

|

|

8,313,515

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

—

|

|

|

$

|

2,234,049,783

|

|

See the notes to the financial statements

3

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

December 31, 2017

|

|

|

|

|

Additions

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

Net investment income from Johnson Controls Inc. Savings and Investment Master Trust

|

$

|

211,755,036

|

|

|

Net investment income from Tyco International Management Company Defined Contribution Plans Master Trust

|

143,599,978

|

|

|

Interest on notes receivable from participants

|

2,130,310

|

|

|

|

357,485,324

|

|

|

Contributions:

|

|

|

Participants

|

99,250,408

|

|

|

Employer

|

51,239,450

|

|

|

|

150,489,858

|

|

|

|

|

|

Total additions

|

507,975,182

|

|

|

|

|

|

Deductions

|

|

|

|

|

|

Distributions and withdrawals

|

240,166,554

|

|

|

Administrative expenses

|

1,480,580

|

|

|

|

|

|

Total deductions

|

241,647,134

|

|

|

|

|

|

Transfers to other plans, net

|

(2,500,377,831

|

)

|

|

|

|

|

Net decrease in net assets available for benefits

|

(2,234,049,783

|

)

|

|

|

|

|

Net assets available for benefits, beginning of year

|

2,234,049,783

|

|

|

Net assets available for benefits, end of year

|

$

|

—

|

|

See the notes to the financial statements

4

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

NOTE 1 - DESCRIPTION OF THE PLAN

The Tyco International Retirement Savings and Investment Plan (the “Plan”) was established December 31, 1996 as a result of a spin-off of the hourly portion of the Kendall Employees’ Savings and Investment Plan (the “Kendall Plan”) and the merging of the Kendall Plan into a prior existing plan (prior to January 1, 2009, the Plan was known as Tyco International (US) Inc. Retirement Savings and Investment Plan III and for the period of January 1, 2009 through October 1, 2010, the Plan was known as Tyco International Retirement Savings and Investment Plan III). Effective October 1, 2010, the Plan name was changed to the Tyco International Retirement Savings and Investment Plan.

The Plan is a defined contribution plan sponsored by Tyco International Management Company, LLC (“TIMCO” or “Plan Sponsor”), and is available to certain salaried, union and non-union hourly employees of TIMCO and TIMCO affiliated companies. On September 2, 2016, Johnson Controls, Inc. ("JCI Inc.") and Tyco International plc (“Tyco”), TIMCO's parent company, completed a merger, with JCI Inc. being the surviving corporation in the merger and a wholly owned indirect subsidiary of Tyco. Following the merger, Tyco changed its name to "Johnson Controls International plc." The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”) and the Internal Revenue Code of 1986, as amended (the “Code”). Selected Plan provisions are described below. Participants should refer to the Plan document and summary plan description for more complete information regarding the terms of the Plan. On April 28, 2017, the Plan started participating in the Johnson Controls Inc. Savings and Investment Master Trust. As of that date, Johnson Controls, Inc. became the new Plan Sponsor.

PLAN MERGER

On December 31, 2017, the Plan was merged with and into the newly created Johnson Controls Retirement Savings and Investment Plan, another qualified plan of Johnson Controls, Inc, the Plan Sponsor. All participants in the Plan as of December 31, 2017 became participants in the Johnson Controls Retirement Savings and Investment Plan effective January 1, 2018.

ELIGIBILITY

Plan participants must be at least eighteen years old. Union employees may have different eligibility requirements. Refer to the Plan document for more details.

CONTRIBUTIONS

Contributions are subject to Code limitations. Contributions to the Plan are funded on a per pay period basis.

Participants’ contributions

- Participants may contribute a percentage of their eligible compensation up to a specified amount. During 2017, the following contribution limits applied: (i) non-highly compensated employees may contribute up to 35% of eligible compensation on a combined before-tax and/or after-tax basis; (ii) highly-compensated employees may contribute up to 16% of eligible compensation on a before-tax basis and up to an additional 10% on an after-tax basis; and (iii) highly-compensated employees who are eligible to participate in the Tyco Supplemental Savings and Retirement Plan, a non-qualified deferred compensation plan, may contribute up to 16% on a before-tax basis not to exceed $17,000 and such employees are not eligible to make after-tax contributions. Union employees may have different contribution limits. Refer to the Plan document for more details.

Employer contributions

- Certain participant contributions are eligible to receive matching contributions. Additionally, up until May 1, 2015 certain employees were eligible to receive “supplemental” matching contributions based on their years of service with Tyco and its affiliated companies. As of May 1, 2015, the "supplemental" matching contributions were discontinued, and employees who previously received this matching contribution were to receive a service-related transition benefit for the remainder of 2015, as well as for the 2016 calendar year, which would be credited to their account in the first quarter of the following plan year. To receive the transition benefit, an employee must have been employed by Tyco on the last day of the plan year. The level of matching contributions and supplemental matching contributions varies for each participating employer in the Plan. Union employees may have different contribution limits. Refer to the Plan document for more details.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

PARTICIPANT ACCOUNTS

Each participant’s account is credited with the participant’s deferral contributions, employer contributions, and an allocation of earnings or losses, and is charged with participant fees and his or her withdrawals, as applicable. Participants are entitled to the benefit in their respective accounts, to the extent vested.

VESTING

Participants are immediately vested in any contributions they make to the Plan, plus actual earnings thereon. Vesting with respect to any matching contributions, and any associated earnings, is based on a participant’s years of “vesting service.” Effective January 1, 2002, participants who perform an hour of service on or after that date are fully vested in all employer contributions following completion of three years of vesting service.

FORFEITURES

Upon termination of employment for reasons other than a distributable event, nonvested contributions are forfeited on the earlier of the date the participant receives a total distribution of his vested account balance or the date the participant incurs five consecutive breaks in service. Nonvested forfeitures may be used to reduce employer contributions or to pay Plan expenses. During the year ended December 31, 2017, forfeitures of approximately $3,355,900 were used to reduce employer contributions and pay Plan expenses. As of December 31, 2017 and 2016, forfeited nonvested accounts totaled $0 and $177,393, respectively.

INVESTMENT OPTIONS

Plan participants are able to direct the investment of their Plan holdings (employer and employee contributions) into various investment options offered under the Plan on a daily basis.

NOTES RECEIVABLE FROM PARTICIPANTS

Participants are allowed to borrow from their Plan accounts. The minimum amount that a participant may borrow is $1,000. The maximum amount that a participant may borrow is the lesser of: (i) 50% of the participant’s vested account balance; or (ii) $50,000 less the highest loan balance outstanding in the previous twelve months. Participants are allowed to have two loans outstanding at a time. Loans are adequately secured by the participant’s account balance and bear a reasonable interest rate. Loans must be repaid through payroll deductions. Upon termination of service, all loans must be repaid in full. As of December 31, 2017, interest rates on notes receivable from participants ranged from 3.25% to 9.50%. As of December 31, 2017 and 2016, notes receivable from participants totaled $0 and $62,127,240, respectively.

PAYMENT OF BENEFITS

Upon termination of service, death, disability or retirement, a participant may elect to receive either a lump sum distribution equal to the participant’s vested interest in his or her account, or to have an annuity purchased by the Plan with the vested interest in the participant’s account, in accordance with the terms of the Plan document.

ADMINISTRATIVE EXPENSES

At the present time, some of the expenses of administering the Plan, including the fees of the Plan trustee, consultants and auditor expenses, but excluding certain loan fees, hardship withdrawal fees and Qualified Domestic Relations Order processing fees, are paid by the Company and its affiliated employers and/or from Plan forfeitures. The costs associated with certain investment options such as management fees, brokerage fees and transfer taxes are deducted from the assets of the investment options and are generally assessed as a percentage of assets invested. Additionally, plan participants with account balances are assessed recordkeeping and administration fees. Fidelity Management Trust Company ("Fidelity"), the trustee for the Tyco International Management Company Defined Contribution Plans Master Trust and the Johnson Controls Inc. Savings and Investment Master Trust (the "Master Trusts"), automatically deducts these fees from participant accounts on a quarterly basis. The quarterly fees are subject to change and were $7.50 from January 1, 2017 to April 27, 2017 per account. On April 28, 2017, the quarterly fees increased to $8.75 per account.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

PLAN ADMINISTRATION

The Plan is administered by the Retirement Plans Investment Committee of Johnson Controls International plc. Fidelity Workplace Services LLC maintains the participant accounts as record keeper of the Plan.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying financial statements of the Plan are prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP").

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

NOTES RECEIVABLE FROM PARTICIPANTS

Notes receivable from participants are reported at their unpaid principal balance plus any accrued but unpaid interest, with no allowance for credit losses, as repayments of principal and interest are received through payroll deductions and the notes are collateralized by the participants’ account balances. Amounts are presented as other receivables in the Master Trusts.

INVESTMENT VALUATION AND INCOME RECOGNITION

The Plan participated in the Tyco International Management Company Defined Contribution Plans Master Trust which consisted of only the Tyco International Retirement Savings and Investment Plan for 2016 and from January 1, 2017 to April 27, 2017. On April 28, 2017, Tyco International Management Company Defined Contribution Plans Master Trust was terminated and the Plan started participating in the Johnson Controls Inc. Savings and Investment Master Trust.

The Plan’s interest in the investments of both Master Trusts are reported at fair value based on the fair values of the underlying investments held in the Master Trusts. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The Plan records its interest in the investments and notes receivable from participants held in the Master Trusts and investment income or loss from the Master Trusts (including interest, dividends, net unrealized and realized gains and losses) based upon each plan participants’ ownership in the underlying participant-directed investments and notes receivable comprising the Master Trusts. Expenses for participant loans and hardship withdrawals are allocated on a participant basis. Other expenses that are offset against forfeitures are specifically charged to the Plan, as applicable. Certain investment management fees are offset against investment income.

Accounting Standards Codification ("ASC") 820, "Fair Value Measurement," defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a three-level fair value hierarchy that prioritizes information used in developing assumptions when pricing an asset or liability as follows:

|

|

|

|

|

|

Level 1:

|

Observable inputs such as quoted prices in active markets;

|

|

Level 2:

|

Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

|

|

Level 3:

|

Unobservable inputs where there is little or no market data, which requires the reporting entity to develop its own assumptions.

|

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The fair values of the underlying investments of the Master Trusts are determined as follows:

Interest-bearing Cash:

Interest-bearing cash is composed of various money market funds. The fair values have been determined based upon their quoted redemption prices and recent transaction prices of $1.00 per share (level 2 inputs), with no discounts for credit quality or liquidity restrictions.

Mutual Funds:

The fair value for Mutual Funds is determined by direct quoted market prices. Mutual funds are open-ended investments that obtained proper registration from the Securities and Exchange Commission. The funds publish daily their Net Asset Value ("NAV") after the close of trading on regulated financial exchanges. The NAV represents the current market value of the fund's holdings after deducting the fund's liabilities. The Plan’s Mutual Funds include investment in equity, bond, balanced (equities and bonds) and money market funds.

Common Stock:

The fair value for the Johnson Controls International plc Stock Fund ("JCI plc Stock Fund"), formerly known as the Tyco International Stock Fund ("Tyco Stock Fund"), and the Adient Stock Fund is determined by indirect quoted market prices. The value of the funds are not published, but the investment manager reports daily the underlying holdings. The underlying holdings are direct quoted market prices on liquid and regulated financial exchanges. The fair value of the investments in the JCI plc Stock Fund and Adient Stock Fund reflect a unit value computed daily based on the share price and the value of the fund's short-term investments. At December 31, 2016, the Plan held 5,588,635 units of the JCI plc Stock Fund at a unit value of $8.43. At December 31, 2016, the Plan held 537,834 units of the Adient Stock Fund at a unit value of $12.48.

Separately Managed Accounts:

Separately managed accounts are valued based on the underlying net assets, which are primarily valued using quoted market prices (level 1 inputs). As of December 31, 2016, the Master Trust held one separately managed account, the T. Rowe Price Large Cap Value Fund. The separately managed account is a portfolio tailored and maintained by a portfolio manager. Participants receive units in the fund valued daily, representing a mix of the underlying assets. The fund seeks to provide long-term capital appreciation with income as a secondary objective by investing in attractively priced stocks of companies with market values greater than $10 billion with promising financial outlooks and the potential for improved investor perceptions. The common stock invested in by the fund are in various different market sectors, with the most predominant being financial services, industrials, healthcare, consumer cyclical, and energy.

Collective Trusts:

Collective trusts are valued based on their net asset values, as reported by custodians as of the financial statement dates and prices of recent transactions (level 2 inputs). The NAV is used as a practical expedient to estimate fair value. The investment objectives and underlying investments of the collective trusts vary. One of the collective trusts holds an interest in an underlying U.S. debt index fund and a money market fund which seeks investment results that correspond to the price and yield performance, before fees and expenses, of the Barclays U.S. Aggregate Bond Index. Another collective trust holds a portfolio of equity investments that seek to approximate the performance of the S&P Mid-Cap 400 Index, and another invests primarily in common stocks of domestic and foreign issuers which the collective trust manager believes offer the potential for above-average growth. A number of collective trusts seek to achieve a high total return through investments in a combination of domestic and international equity and debt based on the fund’s target retirement date. The target retirement date funds automatically reduce the equity allocation as the participant approaches the targeted retirement year and beyond. Each collective trust held through the Plan’s interest in the Master Trust provides for daily redemptions by the Plan at reported net asset values per share but retains the right to require up to 15 days of advance notice.

Other Separate Accounts:

The fair value for Other Separate Accounts is determined by indirect quoted market prices.

These investments are generally held in a commingled trust. The value of the trust is not published, but the investment

manager reports daily the underlying holdings. The underlying holdings are direct quoted market prices on liquid and

regulated financial exchanges.

Fixed Income Fund:

All investments of the Master Trust, except the Fixed Income Fund, are stated at fair market value based on quoted market prices. The Fixed Income Fund, a stable value fund, contains wrap contracts which are stated at contract value. Contract value, as reported to the Plan by Fidelity, represents contributions made under the contract, plus interest at the contract rate, less participant withdrawals and administrative expenses.

The wrap contracts are designed to allow a stable value fund, such as the Fixed Income Fund, to maintain a constant net asset value (NAV) and to protect the fund in extreme circumstances. The wrap issuer agrees to pay the fund the difference

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

between the contract value and the market value of the covered assets once the market value has been totally exhausted. Though relatively unlikely, this could happen if the fund experiences significant redemptions (redemption of most of the fund's shares) during a time when the market value of the fund's covered assets is below their contract value, and market value is ultimately reduced to zero. If that occurs, the wrap issuer agrees to pay the fund an amount sufficient to cover shareholder redemptions and certain other payments (such as fund expenses), provided that all of the terms of the wrap contract have been met. Purchasing wrap contracts is similar to buying insurance, in that the fund pays a relatively small amount to protect against a relatively unlikely event (the redemption of most of the shares of the fund). Fees the fund pays for wrap contracts are a component of the fund's expenses.

Wrap contracts accrue interest using a formula called the "crediting rate" which minimizes the difference between the market value and contract value of the covered assets over time. Using the crediting rate formula, an estimated future market value is calculated by compounding the fund's current market value at the fund's current yield to maturity for a period equal to the fund's duration. Crediting rates are reset quarterly. Although the crediting rate may be affected by many factors, including purchases and redemptions by shareholders, the wrap contracts provide a guarantee that the crediting rate will not fall below zero percent (0%).

The fund and the wrap contracts purchased by the fund are designed to pay all participant-initiated transactions at contract value. However, the wrap contracts limit the ability of the fund to transact at contract value upon the occurrence of certain events, which include, but are not limited to, the Plan's failure to qualify under Section 401(a) or Section 401(k) of the Internal Revenue Code (IRC), any substantive modification of the Plan or the administration of the Plan that is not consented to by the wrap issuer, complete or partial termination of the Plan, or any early retirement program, group termination, group layoff, facility closing or similar program. At this time, the occurrence of such an event is not probable.

A wrap issuer may terminate a wrap contract at any time. In the event that the market value of the fund's covered assets is below their contract value at the time of such termination, Fidelity may elect to keep the wrap contract in place until such time as the market value of the fund's covered assets is equal to their contract value. A wrap issuer may also terminate a wrap contract if Fidelity investment management authority over the fund is limited or terminated as well as if all of the terms of the wrap contract fail to be met. In the event that the market value of the fund's covered assets is below their contract value at the time of such termination, the terminating wrap provider would not be required to make a payment to the fund.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

BENEFIT PAYMENTS

Benefit payments to participants are recorded when distributed.

NEW ACCOUNTING PRONOUNCEMENTS

Recently Issued Accounting Pronouncements

In February 2017, the FASB issued Accounting Standards Update (ASU) No. 2017-06, "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting." ASU No. 2017-06 clarifies the presentation requirements by a plan's interest in a master trust and requires disclosure of the dollar amount of the plan's interest in each investment type held by a master trust, as well as disclosure of the master trust's other assets and liabilities, and the dollar amount of the plan's interest in each of those balances. ASU No. 2017-06 is effective for fiscal years beginning after December 15, 2018 with early adoption permitted, and will be applied retrospectively to all periods presented. The Company is currently evaluating the impact the adoption of the guidance will have on the Plan’s financial statements.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

NOTE 3 - INCOME TAX STATUS

The Plan was amended and restated effective January 1, 2016. On May 17, 2017, the Internal Revenue Service stated that the Plan, as then designed, was in compliance with the applicable requirements of the Code. Although the Plan has been amended since it was restated, Plan management believes that the Plan is designed and being operated in compliance with the applicable requirements of the Code. Therefore Plan management believes that the Plan was qualified and the related trust was tax-exempt as of the financial statement date.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2017 and 2016, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by the Department of Labor or Internal Revenue Service. There are currently no audits in progress.

NOTE 4 - PLAN TERMINATION

Although it has not expressed any intent to do so, the Plan Sponsor has the right under the Plan to discontinue its contributions at any time and to amend or terminate the Plan subject to the provisions of the Plan and ERISA. In the event of Plan termination, participants will become 100% vested in their accounts. In connection with the plan merger discussed in Note 1, all Plan assets were transferred to the Johnson Controls Retirement Savings and Investment Plan as of December 31, 2017.

NOTE 5 - RELATED PARTIES AND PARTIES-IN-INTEREST TRANSACTIONS

As discussed in Note 1, "Description of the Plan," of the notes to the financial statements, JCI Inc. and Tyco completed a Merger on September 2, 2016. Prior to the Merger, the underlying investments of the Master Trust included a unitized stock fund, the Tyco Stock Fund, which was comprised of a short-term investment fund component and ordinary shares of Tyco. As of the Merger Date, each Tyco share held within the Tyco Stock Fund was consolidated into 0.955 shares, Tyco International plc changed its name to Johnson Controls International plc and started trading on New York Stock Exchange under JCI Inc.’s existing ticker symbol “JCI”. The units held in the Tyco Stock Fund were exchanged to the new JCI plc Stock Fund, which is also a unitized stock fund.

For the period from January 1, 2016 to September 2, 2016, the Plan purchased units in the Tyco Stock Fund of approximately $7.4 million, sold units of approximately $6.1 million and had net appreciation in the fair value of investments of approximately $18.4 million. On the Merger Date, the units of the Tyco Stock Fund of approximately $57.1 million were exchanged into the JCI plc Stock Fund as described above, and the Tyco Stock Fund ceased to exist.

On October 31, 2016, Johnson Controls International plc completed the spin-off of its Automotive Experience business by way of transfer to Adient plc and the issuance of ordinary shares of Adient directly to holders of Johnson Controls ordinary shares on a pro rata basis. Each participant received one share of the new Adient Stock Fund for every ten shares of JCI plc Stock fund that they held in the Plan immediately preceding the spin-off. A new Adient Stock Fund was established in the Plan in order to hold distributed shares. The Adient Stock Fund is a closed investment in the Plan, which means balances can be taken out of the Adient Stock Fund but no new contributions or exchanges can be made into this Fund.

The units of JCI plc Stock Fund of approximately $5.6 million were distributed into the Adient Stock Fund units at the date of the spin-off. For 2017 and for the period from October 31, 2016 to December 31, 2016, the Plan sold units in the Adient Stock Fund of approximately $1.6 and $0.4 million, respectively and had net appreciation in the fair value of investments of approximately $2.1 and $1.5 million, respectively. The total value of the Plan’s investment in the Adient Stock Fund was approximately $0.0 and $6.7 million at December 31, 2017 and 2016, respectively.

For 2017 and for the period from September 2, 2016 to December 31, 2016, the Plan purchased units in the JCI plc Stock Fund of approximately $6.0 and $8.1 million, respectively. Also, for 2017 and for the period from September 2, 2016 to December 31, 2016, the Plan sold units of approximately $9.0 and $3.9 million, respectively and had net depreciation in the fair value of investments of approximately $2.5 and $8.6 million, respectively. The total value of the Plan’s investment in the JCI Plc Stock Fund was approximately $0.0 and $47.1 million at December 31, 2017 and 2016, respectively.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The unit values of the Tyco Stock Fund, JCI plc Stock Fund and Adient Stock Fund are recorded and maintained by Fidelity and the Plan. Plan participants may direct up to 25% of their employee and employer contributions to the JCI plc Stock Fund. In addition, participants may exchange a portion of their account balance into the JCI plc Stock Fund, provided the transaction does not cause the portion of their account balance invested in the JCI plc Stock Fund to exceed 25%.

Certain of the assets of the Master Trusts are invested in registered investment companies managed by Fidelity Investments, for which Fidelity Management & Research Company (“FMR Co.”) provides investment advisory services. FMR Co. is an affiliate of both Fidelity, and Fidelity Workplace Services, LLC, record keeper of the Plan. Expenses paid to FMR Co. and/or its affiliates by the Plan during the year ended December 31, 2017 was $1,323,083. These transactions and investments, as well as participant loans, qualify as exempt “party-in-interest” transactions, as “party-in-interest” is defined under Department of Labor regulations as any fiduciary of the Plan, any party rendering services to the Plan, the Company and certain others.

NOTE 6 - RISK AND UNCERTAINTIES

The Master Trusts, in which the Plan holds an interest, invests in various investments. Investments are exposed to various risks such as interest rate, market, liquidity, and credit risks. Due to the level of risk associated with certain investments and the sensitivity of certain fair value estimates to changes in valuation assumptions, it is at least reasonably possible that changes in the values of investments will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

Plan participants direct the investment of their Plan holdings into various investment options offered under the Plan and solely bear the risk of loss associated with the investment securities in which they are invested.

NOTE 7 - INVESTMENTS IN THE MASTER TRUSTS

As explained in Note 2, the Plan participated in the Tyco International Management Company Defined Contribution Plans Master Trust in 2016 and from January 1, 2017 to April 27, 2017. On April 28, 2017, the Plan started participating in the Johnson Controls Inc. Savings and Investment Master Trust. The Plan participated in the Tyco International Management Company Defined Contribution Plans Master Trust, which consisted of only the Tyco International Retirement Savings and Investment Plan as of December 31, 2016. Fidelity holds the Master Trusts' investment assets, provides administrative functions for the Plan and executes investment transactions as directed by participants.

The Plan’s relative share of ownership of the total net assets of the Johnson Controls Inc. Savings and Investment Master Trust was 0% as of December 31, 2017. The Plan's relative share of ownership of the total assets of the Tyco International Management Company Defined Contribution Plans Master Trust was 100% as of December 31, 2016. The following tables present net assets held in the Johnson Controls Inc. Savings and Investment Master Trust and the Tyco International Management Company Defined Contribution Plans Master Trust, including fair value of investments held in the Master Trusts, as of December 31, 2017 and 2016, respectively.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The following table presents net assets held in the Johnson Controls Inc. Savings and Investment Master Trust, including fair value of investments held in the Master Trust, as of December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2017

|

|

Assets

|

|

|

|

Investments at fair value as determined by quoted market price (direct):

|

|

|

|

Common Stock Funds

|

|

$

|

463,030,797

|

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (indirect):

|

|

|

|

Other Separate Accounts

|

|

5,239,217,280

|

|

|

Investments at fair value

|

|

5,702,248,077

|

|

|

|

|

|

|

Investments at contract value:

|

|

|

|

Fixed Income Fund:

|

|

|

|

At contract value

|

|

351,555,005

|

|

|

|

|

|

|

Notes receivable from participants

|

|

107,417,000

|

|

|

Net assets available for benefits

|

|

$

|

6,161,220,082

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The following table presents net assets held in the Tyco International Management Company Defined Contribution Plans Master Trust, including fair value of investments held in the Master Trust, as of December 31, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2016

|

|

Assets

|

|

|

|

Investments at fair value as determined by quoted market price (direct):

|

|

|

|

Interest-bearing Cash

|

|

$

|

3,850,617

|

|

|

Mutual Funds

|

|

724,106,003

|

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (indirect):

|

|

|

|

Common Stock Funds

|

|

53,166,055

|

|

|

Separately Managed Accounts

|

|

142,556,388

|

|

|

|

|

|

|

Notes receivable from participants

|

|

62,127,240

|

|

|

Net assets available for benefits at fair value

|

|

985,806,303

|

|

|

|

|

|

|

Investments measured at net asset value, as practical expedient:

|

|

|

|

Collective Trusts

|

|

1,239,929,965

|

|

|

Net assets available for benefits

|

|

$

|

2,225,736,268

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The following table presents changes in net assets held in the Tyco International Management Company Defined Contribution Plans Master Trust for the period from January 1, 2017 through April 27, 2017:

|

|

|

|

|

|

|

|

|

|

|

Additions

|

|

|

Additions to net assets attributed to:

|

|

|

Investment income:

|

|

|

Mutual Funds

|

$

|

131,410,035

|

|

|

Common Stock Funds

|

2,804,863

|

|

|

Other Separate Accounts

|

7,149,980

|

|

|

|

141,364,878

|

|

|

Contributions:

|

|

|

Participants

|

32,258,797

|

|

|

Employer

|

22,382,583

|

|

|

|

54,641,380

|

|

|

|

|

|

Other investment income

|

2,235,093

|

|

|

Interest on notes receivable from participants

|

654,711

|

|

|

Total additions

|

198,896,062

|

|

|

|

|

|

Deductions

|

|

|

Deductions from net assets attributed to:

|

|

|

Participant withdrawals

|

87,878,530

|

|

|

Administrative fees

|

707,487

|

|

|

Total deductions

|

88,586,017

|

|

|

|

|

|

Net increase prior to transfers from other plans

|

110,310,045

|

|

|

|

|

|

Transfers from other plans, net

|

77,298

|

|

|

Net increase in assets available for benefits

|

110,387,343

|

|

|

|

|

|

Net assets available for benefits, beginning of period

|

2,225,736,268

|

|

|

Net assets available for benefits, end of period

|

$

|

2,336,123,611

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The following table presents changes in net assets held in the Johnson Controls Inc. Savings and Investment Master Trust for the period from April 28, 2017 through December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

Additions

|

|

|

Additions to net assets attributed to:

|

|

|

Investment income (loss):

|

|

|

Other Separate Accounts

|

$

|

480,592,047

|

|

|

Common Stock Funds

|

(36,653,501

|

)

|

|

|

443,938,546

|

|

|

Contributions:

|

|

|

Participants

|

159,558,480

|

|

|

Employer

|

36,692,060

|

|

|

|

196,250,540

|

|

|

|

|

|

Other investment income

|

10,757,076

|

|

|

Interest on notes receivable from participants

|

2,517,078

|

|

|

Total additions

|

653,463,240

|

|

|

|

|

|

Deductions

|

|

|

Deductions from net assets attributed to:

|

|

|

Participant withdrawals

|

386,791,195

|

|

|

Administrative fees

|

2,358,660

|

|

|

Total deductions

|

389,149,855

|

|

|

|

|

|

Net increase prior to transfers from other plans

|

264,313,385

|

|

|

|

|

|

Transfers from other plans, net **

|

2,346,477,903

|

|

|

Net increase in assets available for benefits

|

2,610,791,288

|

|

|

|

|

|

Net assets available for benefits, beginning of period

|

3,550,428,794

|

|

|

Net assets available for benefits, end of period

|

$

|

6,161,220,082

|

|

** On April 28, 2017, the Tyco International Retirement Savings and Investment Plan transferred into the Johnson Controls, Inc. Savings and Investment Master Trust.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2017 AND 2016

The following table sets forth by level, within the fair value hierarchy, the Johnson Controls Inc. Savings and Investment Master Trust investments measured at fair value on a recurring basis as of December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2017

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common Stock Funds

|

|

$

|

463,030,797

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

463,030,797

|

|

|

Other Separate Accounts

|

|

—

|

|

|

5,239,217,280

|

|

|

—

|

|

|

5,239,217,280

|

|

|

Total investments at fair value

|

|

$

|

463,030,797

|

|

|

$

|

5,239,217,280

|

|

|

$

|

—

|

|

|

$

|

5,702,248,077

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table sets forth by level, within the fair value hierarchy, the Tyco International Management Company Defined Contribution Plans Master Trust investments measured at fair value on a recurring basis as of December 31, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2016

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Interest-bearing Cash

|

|

$

|

—

|

|

|

$

|

3,850,617

|

|

|

$

|

—

|

|

|

$

|

3,850,617

|

|

|

Mutual Funds

|

|

724,106,003

|

|

|

—

|

|

|

—

|

|

|

724,106,003

|

|

|

Common Stock Funds

|

|

53,166,055

|

|

|

—

|

|

|

—

|

|

|

53,166,055

|

|

|

Separately Managed Accounts

|

|

142,556,388

|

|

|

—

|

|

|

—

|

|

|

142,556,388

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments in the Fair Value Hierarchy

|

|

919,828,446

|

|

|

3,850,617

|

|

|

—

|

|

|

923,679,063

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments Measured at Net Asset Value, as Practical Expedient:

|

|

|

|

|

|

|

|

|

|

|

Collective Trusts *

|

|

|

|

|

|

|

|

1,239,929,965

|

|

|

Total Investments

|

|

|

|

|

|

|

|

$

|

2,163,609,028

|

|

* ASU No. 2015-07 allows investments measured at NAV as a practical expedient to be excluded from the fair value hierarchy. The fair value amounts presented herein are intended to permit reconciliation of total investments to the statement of net assets available for benefits.

For the year ended December 31, 2017 there were no transfers of investments between Level 1 and Level 2.

As of April 28, 2017, the plan assets of the Tyco International Management Company Defined Contribution Plans Master Trust were transferred to the surviving legacy Johnson Controls, Inc. Savings and Investment Master Trust.

During 2017, the Plan made substantial changes to the investment options year over year related to post-Merger harmonization activities. These changes included condensing the number of investment options, primarily though the elimination of duplicate offerings. In addition, the Plan implemented a white-label fund structure for its defined contribution investment options, aside from the JCI and Adient company Stock Funds. This structure places the individual fund offerings into unitized collective trusts for each asset class, which are valued at the NAV, published by Fidelity, based on the fair values of the underlying investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

|

|

SCHEDULE H, 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

PLAN #032, EIN: 20-5073412

|

|

DECEMBER 31, 2017

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

*

|

|

Notes receivable from participants

|

|

|

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Represents a party-in-interest

|

|

|

|

|

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Johnson Controls International PLC Employee Benefit Policy Committee have duly caused this annual report to be signed by the undersigned thereunto duly authorized.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

By:

/s/

Brian J. Stief

Brian J. Stief

Executive Vice President and Chief Financial Officer

JOHNSON CONTROLS INTERNATIONAL PLC

June 22, 2018

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23.1

|

|

|

|

23.2

|

|

|

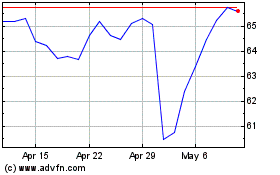

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024