Additional Proxy Soliciting Materials (definitive) (defa14a)

June 12 2018 - 5:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material under §240.14a-12

|

Trinseo S.A.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

|

Filing Party:

|

|

|

(4)

|

|

Date Filed:

|

SUPPLEMENT TO THE 2018

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS AND JOINT PROXY STATEMENT

DATED JUNE 12, 2018

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 20, 2018

Dear Shareholder,

With our annual general meeting of shareholders (“Annual General Meeting”) a little over a week away, I thought it important to engage with our shareholders regarding our say-on-pay proposal (Proposal 2 in our Proxy Statement and Item 2 on your proxy voting forms for the Annual General Meeting). We understand that the proxy advisory firm, Institutional Shareholder Services, Inc. (“ISS”) has recommended a vote against the Company’s annual advisory vote on say-on-pay primarily due to the inclusion of a 280G gross-up provision in the amended employment agreement for Christopher Pappas, the Company’s, President and Chief Executive Officer.

At the end of 2017, there was an amendment to Mr. Pappas’ agreement primarily to remove a term that would automatically terminate his agreement in 2018, along with removing certain historical references in the agreement to the Company’s previous private equity affiliation that were no longer relevant. The increase in salary Mr. Pappas received and cited by ISS is identical in amount to those he received in each of the last three years, under compensation programs previously approved by our shareholders. Additionally, after three years of record profitability and our focus on delivering value to shareholders through repurchase and dividend programs, the Company believed that it was necessary to keep this provision in order to retain Mr. Pappas’ services.

The Company’s Compensation Committee remains committed to not including 280G gross-up provisions in any new employment agreements or amendments to existing agreements with any other executive. This commitment was acknowledged by another proxy advisory firm, Glass Lewis & Co, LLC, which recommended that shareholders vote

FOR

our say-on-pay proposal. We agree that there is more to evaluating an effective executive compensation program than a single agreement provision for one employee. We believe that our compensation programs contain many positive elements that should be relevant to your vote, which include, among others:

|

|

·

|

|

Alignment of pay with performance;

|

|

|

·

|

|

Annual votes on say-on-pay;

|

|

|

·

|

|

Anti-hedging and clawback policies;

|

|

|

·

|

|

Stock ownership guidelines;

|

|

|

·

|

|

The appropriate balance between short-term and long-term incentives; and

|

|

|

·

|

|

Sufficient at-risk compensation, which includes the performance stock unit awards added in 2017.

|

We continue to believe our compensation policies and programs are cost effective and designed to attract, retain and motivate key executives to achieve business results that align with our shareholders’ interests.

Therefore, the Board continues to unanimously recommend that you vote “FOR” the Company’s say-on-pay proposal.

Each and every vote is important to us

.

Additional information regarding how to vote your shares, or revoke your proxy or voting instructions, is available in the Company’s Proxy Statement.

If you have already returned your proxy voting form or provided voting instructions, you may change your vote by executing and returning to the Company a later-dated proxy, by submitting a later-dated electronic vote through the Internet site, by using the toll-free telephone number or in person at the Annual General Meeting. The cut-off date for electronic voting is 11:59 p.m., Eastern Standard Time, June 18, 2018.

|

|

By Order of the Board of Directors

|

|

|

/s/ Stephen M. Zide

|

|

|

Chairman

|

|

|

June 12, 2018

|

Note on forward-looking statements: This proxy supplement may contain “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “remain,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements in this proxy supplement may include, without limitation, forecasts of growth, revenues, business activity, acquisitions, financings and other matters that involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, performance or achievements to differ materially from results expressed or implied by this proxy supplement.. As a result of the foregoing considerations, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy supplement. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

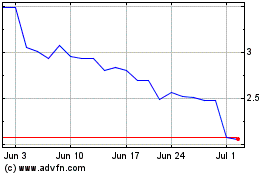

Trinseo (NYSE:TSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

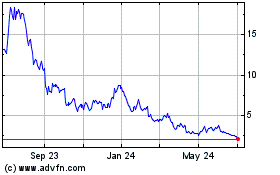

Trinseo (NYSE:TSE)

Historical Stock Chart

From Apr 2023 to Apr 2024