By Anora M. Gaudiano and Victor Reklaitis, MarketWatch

Dick's Sporting Goods jumps, Michael Kors skids

U.S. stocks rose sharply on Wednesday, rebounding from the

previous day's rout, as energy shares bounced back amid a rally for

oil prices and worries over Italy's political crisis faded.

See:Italy's crisis may be a buying opportunity for stock

investors

(http://www.marketwatch.com/story/why-italys-crisis-could-be-a-buying-opportunity-for-stock-investors-2018-05-29)

What did the main benchmarks do?

The Dow Jones Industrial Average rose 306.33 points, or 1.3%, to

close at 24,667.78, taking back most of Tuesday's 392-point drop.

Shares of Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX), were the

blue-chip gauge's best performers amid reports that OPEC will keep

crude production curbs in place until at least the end of the

year.

The S&P 500 added 34.15 points, or 1.3%, to 2,724.01

recovering all of the losses from Tuesday's drop. Gains were

broad-based with all 11 main sectors finishing higher. Energy

shares led the gains, up 3.1% thanks to rising oil prices. The

financial sector rebounded 1.9%, while health-care shares rose

1.4%.

The Nasdaq Composite advanced 65.86 points, or 0.9%, to

7,462.45.

The Russell 2000 index of small stocks closed at an all-time

high, rising 22.70 points, or 1.4%, to 1,646.36.

Read:Why bulls are betting on small-cap stocks to continue their

winning ways

(http://www.marketwatch.com/story/why-bulls-are-betting-on-small-cap-stocks-to-continue-their-winning-ways-2018-05-30)

A measure of volatility -- the Cboe Volatility Index , or VIX --

fell 13% to 14.88, after spiking 29% on Tuesday.

What's driving markets?

A Reuters report

(https://www.fxstreet.com/news/saudi-arabia-opec-and-non-opec-producers-to-continue-cooperation-until-end-of-2018-reuters-201805301453)indicated

that output cuts implemented by members of the Organization of the

Petroleum Exporting Countries and nonmembers led by Russia will

remain in place

(http://www.marketwatch.com/story/oil-prices-rally-on-reports-that-opec-will-keep-its-output-curbs-in-place-2018-05-30),

sending oil prices sharply higher. Prices had been pressured in

recent sessions amid expectations that OPEC would decide to lift

production to help offset output losses from Iran and

Venezuela.

Global equities and other assets generally perceived as risky

found their footing Wednesday, as traders focus on what Italy's

politicians might deliver next. Italy's stocks and bonds, as well

as the euro, are rose.

A coalition government led by antiestablishment parties might be

in the cards again for Italy

(http://www.marketwatch.com/story/italys-antiestablishment-parties-revive-coalition-talks-reports-2018-05-30),

after it was blocked

(http://www.marketwatch.com/story/italys-new-government-hits-wall-over-choice-of-euroskeptic-economic-minister-2018-05-27)

earlier in the week.

Read:What's the latest in Italy's political drama?

(http://www.marketwatch.com/story/whats-the-latest-in-italys-political-drama-2018-05-30)

What are strategists saying?

"The fact that the market is shrugging off Italy's political

drama suggests that maybe it was a crowded trade that was being

unwound and not something more serious," said Michael Antonelli,

equity sales trader at Robert W. Baird & Co.

Antonelli said that recent spikes in volatility should remind

market participants that capital markets are very fragile.

"Anything coming from the left field can shatter markets

nowadays, so we have to brace for a long summer grind," Antonelli

said.

Which stocks were in focus?

Shares in Salesforce.com Inc.(CRM)rose 1.9% after the maker of

software for customer relationship management posted quarterly

results and an annual outlook that beat forecasts

(http://www.marketwatch.com/story/salesforce-rises-after-hours-as-earnings-yearly-outlook-top-street-views-2018-05-29).

But Michael Kors Holdings Ltd.'s stock (KORS) skidded 11% after

the fashion house posted its results but investors are more

concerned with weak sales growth going forward

(http://www.marketwatch.com/story/michael-kors-shares-sink-13-on-shaky-jimmy-choo-sales-and-weak-guidance-2018-05-30).

HP Inc.'s stock (HPQ) rallied 4% after the maker of computers

and printers posted a revenue beat late Tuesday

(http://www.marketwatch.com/story/hp-shares-fall-after-revenue-beat-2018-05-29),

but earnings just matched forecasts.

Dick's Sporting Goods Inc.(DKS)stock jumped 26%

(http://www.marketwatch.com/story/dicks-profit-jumps-as-gun-policy-has-muted-impact-2018-05-30)

after the retailer reported first-quarter earnings and revenue that

beat expectations and raised its guidance.

DSW Inc.(DSW) shares dropped 5.6%, pulling back from the

previous session's 2-year closing high, after the discount shoe and

accessories retailer reported better-than-expected fiscal

first-quarter earnings and revenue, while keeping its outlook

unchanged.

Which economic reports are on tap?

The U.S. added 178,000 private-sector jobs in May

(http://www.marketwatch.com/story/us-jobs-growth-continues-in-may-as-labor-market-tightens-adp-says-2018-05-30),

payrolls processor ADP said Wednesday. April's figure, meanwhile,

was reduced by 41,000 to 163,000.

Meanwhile, the first revision of gross domestic product

(http://www.marketwatch.com/story/us-economy-grew-slightly-slower-22-in-first-quarter-revised-gdp-figures-show-2018-05-30)data

showed the U.S. economy grew a touch softer in the first quarter

than originally reported, mainly because of a slower buildup in

inventories. GDP was trimmed to an annual 2.2% pace from 2.3%.

The trade gap in goods--

(http://www.marketwatch.com/story/us-trade-deficit-falls-slightly-in-april-2018-05-30)services

are excluded--fell 0.6% to $68.2 billion from $68.6.

Check out:MarketWatch's Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

The Federal Reserve

(http://www.marketwatch.com/story/upbeat-beige-book-prognosis-of-economy-keeps-fed-on-track-for-june-rate-hike-2018-05-30)

said the U.S. grew "moderately" from late April to early May in its

latest evaluation of the economy, indicating the central bank

remains firmly on track to raise interest rates next month.

What did other markets do?

Italy's FTSE MIB stock benchmark was recently up about 2%

(http://www.marketwatch.com/story/italian-stocks-stage-recovery-bid-as-political-drama-rumbles-on-2018-05-30),

while the pan-European Stoxx Europe 600 Index edged up.

The euro rose to $1.1663

(http://www.marketwatch.com/story/euro-rebounds-from-10-month-low-as-italian-political-crisis-stays-in-focus-2018-05-30)

from $1.1541 late Tuesday in New York, helping to send the ICE U.S.

Dollar Index 0.8% lower to 94.102.

The yield on the 10-year Treasury note rose 7 basis points to

2.84%. On Tuesday, the U.S. benchmark rate tumbled 16 basis points

to 2.77%

(http://www.marketwatch.com/story/treasurys-rally-pushing-down-yields-as-italy-turmoil-rocks-markets-2018-05-29),

in its largest one-day drop since the U.K.'s Brexit vote in June

2016.

Gold futures

(http://www.marketwatch.com/story/gold-slips-as-risk-on-trade-returns-to-favor-stocks-2018-05-30)settled

higher

(http://www.marketwatch.com/story/gold-slips-as-risk-on-trade-returns-to-favor-stocks-2018-05-30),

while U.S. oil futures ended with a gain

(http://www.marketwatch.com/story/us-oil-rises-attempts-to-avoid-longest-skid-in-nearly-4-months-2018-05-30)

of 2.2%.

--Barbara Kollmeyer contributed to this article

(END) Dow Jones Newswires

May 30, 2018 16:27 ET (20:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

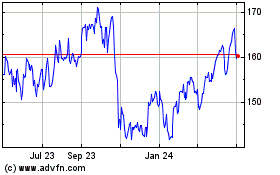

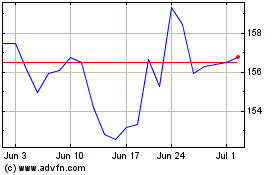

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024