SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2018

Commission File Number: 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

Vertigo Naos Building 6,

Rue Eugene Ruppert,

L-2453, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

ADECOAGRO Announces Changes to Board of Directors and Committees

Luxembourg, May 14, 2018 -

ADECOAGRO S.A. (NYSE:AGRO), a leading agro-industrial company in South America, today announced the appointment of the Chairman of the Board of Directors and the composition of each of the Committees of the Board as follows:

Chairman of the Board:

Plinio Musetti.

Audit Committee:

Mark Schachter (Chairman), Andres Velasco and Ivo Sarjanovic

Commercial Committee

:

Alan Boyce (Chairman), Jim Anderson, Ivo Sarjanovic and Marcelo Vieira.

Strategy Committee:

Plinio Musetti (Chairman), Guillaume van der Linden, James Anderson and Daniel Gonzalez.

Compensation Committee:

Guillaume van der Linden (Chairman), Daniel Gonzalez, Plinio Musetti, and Andrés Velasco.

The Board of Directors and Senior Management would like to thank the outgoing member of the Board of Directors and former Chairman, Mr. Abbas F. (“Eddy”) Zuaiter for all of his valuable time, energy, insights and support throughout the years. We remain grateful for his contributions to Adecoagro, S.A. Mr. Zuaiter has been part of the corporate governance of the company since 2003, and will remain engaged with management and the board as an advisor to the Strategy Committee for the next 12 months.

Set forth below is a summary biographical information of each of the Board Members

Mark Schachter

. Mr. Schachter has been a member of the Company’s board of directors since 2009. Mr. Schachter has been a Managing Partner of Elm Park Capital Management since 2010. From 2004 to 2010, he was a Portfolio Manager with HBK Capital Management where he was responsible for the firm’s North American private credit activities. His responsibilities included corporate credit investments with a primary focus on middle-market lending and other special situation investment opportunities. From 2003 to 2004, Mr. Schachter worked for American Capital, a middle-market private equity and mezzanine firm and worked in the investment banking division of Credit Suisse Group from 2001 to 2003. Mr. Schachter received a degree in Business Administration from the Ivey Business School at the University of Western Ontario and completed the Program for Leadership Development at Harvard Business School. Mr. Schachter is a Canadian citizen and has permanent American residence.

Plínio Musetti

. Mr. Musetti has been a member of the Company’s board of directors since 2011 and an observer since 2010. Mr. Musetti is a Managing Partner of Janos Holding responsible for long term equity investments for family offices in Brazil, following his role as Partner of Pragma Patrimonio, since June 2010. From 2008 to 2009, Mr. Musetti served as the Chief Executive Officer of Satipel Industrial S.A., leading the company’s initial public offering process, expansion plan and merger with Duratex S.A. From 2002 to 2008, Mr. Musetti served as a partner at JP Morgan Partners and Chief Executive Officer of Vitopel S.A. (JP Morgan Partners’ portfolio company) where he led its private equity investments in Latin America. From 1992 to 2002, Mr. Musetti served as the Chief Executive Officer of Elevadores Atlas S.A. and Elevadores Atlas Schindler S.A., during which time he led the company’s operational restructuring, initial public offering process and the sale to the Schindler Group. Mr. Musetti has also served as a Director of Diagnósticos de America S.A. from 2002 to 2009. In addition, Mr. Musetti is currently serving as a Board member of Portobello S.A. and RaiaDrogasil S.A. Mr. Musetti graduated in Civil Engineering and Business Administration from Mackenzie University and attended the Program for Management Development at Harvard Business School in 1989. Mr. Musetti is a Brazilian citizen.

Daniel C. Gonzalez

. Mr. Gonzalez has been a member of the Company’s board of directions since April 16, 2014. Mr.

Gonzalez holds a degree in Business Administration from the Argentine Catholic University. He served for 14 years in the investment bank Merrill Lynch & Co in Buenos Aires and New York, holding the positions of Head of Mergers and Acquisitions for Latin America and President for the Southern Cone (Argentina, Chile, Peru and Uruguay), among

others. While at Merrill Lynch, Mr. Gonzalez played a leading role in several of the most important investment banking transactions in the region and was an active member of the firm’s global fairness opinion committee. He remained as a consultant to Bank of America Merrill Lynch after his departure from the bank. Previously, he was Head of Financial Planning and Investor Relations in Transportadora de Gas del Sur SA. Mr. Gonzalez is currently the Chief Executive Officer of YPF Sociedad Anónima, where he is also a member of its Executive Committee. Mr. González is an Argentine citizen

Andres Velasco Brañes.

Mr. Velasco has been a member of the Company’s board of directors since 2011. Mr. Velasco was the Minister of Finance of Chile between March 2006 and March 2010, and a presidential candidate in Chile in 2013. He was also the president of the Latin American and Caribbean Economic Association from 2005 to 2007. Prior to entering government, Mr. Velasco was Sumitomo-FASID Professor of Development and International Finance at Harvard University’s John F. Kennedy School of Government, an appointment he had held since 2000. From 1993 to 2000, he was Assistant and then Associate Professor of Economics and the director of the Center for Latin American and Caribbean Studies at New York University. Currently Mr. Velasco serves as Professor of Practice in International Development at Columbia University. He also performs consulting services on various economic matters rendering economic advice to an array of clients, including certain of our shareholders. Mr. Velasco holds a Ph.D. in economics from Columbia University and was a postdoctoral fellow in political economy at Harvard University and the Massachusetts Institute of Technology. He received a B.A. in economics and philosophy and an M.A. in international relations from Yale University. Mr. Velasco is a Chilean citizen.

Guillaume van der Linden

Mr. van der Linden has been a member of the Company’s board of directors since 2009. Since 2007, Mr. van der Linden is a senior investment manager at PGGM Vermogensbeheer B.V., responsible for investments in emerging markets credit. From 1993 to 2007, Mr. van der Linden worked for ING Bank in various roles, including in risk management and derivatives trading. From 1988 to 1993, Mr. van der Linden was employed as a management consultant for KPMG and from 1985 to 1988 as a corporate finance analyst for Bank Mees & Hope. Mr. van der Linden graduated with Masters degrees in Economics from Erasmus University Rotterdam and Business Administration from the University of Rochester. Mr. van der Linden is a Dutch citizen.

Alan Leland Boyce

. Mr. Boyce is a co-founder of Adecoagro and has been a member of the Company’s board of directors

since 2002. Since 2005, Mr. Boyce has been the Chief Executive Officer of Absalon, a joint venture between Soros and the financial system of Denmark that assists in organizing a standardized mortgage-backed securities market in Mexico. Mr. Boyce is cofounder and Chairman of Materra LLC, a California based farming company with a focus on growing and exporting animal forage. Since 2007, he has also been a consultant for Soros, where he works to implement the Danish mortgage system in the United States. Since 1985, Mr. Boyce has served as the Chief Financial Officer of Boyce Land Co. Inc., a farmland management company that runs 10 farmland limited partnerships in the U.S. Mr. Boyce formerly served as the director of special situations at Soros from 1999 to 2007, where he managed an asset portfolio of the Quantum Fund and had principal operational responsibilities for the bulk of the fund’s investments in South America. Mr. Boyce also served as managing director in charge of fixed-income arbitrage at Bankers Trust from 1986 to 1999, as senior managing director for investment strategy at Countrywide Financial from 2007 to 2008, and worked at the U.S. Federal Reserve Board from 1982 to 1984. He graduated with a degree in Economics from Pomona College, and has a Master in Business Administration from Stanford University. Mr. Boyce is an American citizen

James David Anderson

. Mr. Anderson currently serves as board member of Green Plains Inc, a vertically integrated ethanol producer based in Omaha, Nebraska. Mr. Anderson served as Chief Executive Officer & President of The Gavilon Group, a leading commodity management firm from October 2015 to February 2016, and previously as Chief Operating Officer Agriculture and COO Fertilizer since March 2010. Mr. Anderson also served United Malt Holdings ("UMH"), a producer of malt for use in the brewing and distilling industries, as Chief Executive Officer and member of the board of directors from September 2006 to February 2010. Prior to that, beginning in April 2003, he served as Chief Operating Officer / Executive Vice President of CT Malt, a joint venture between ConAgra Foods and Tiger Brands of South Africa. Mr. Anderson's experience in the agricultural processing and trading business includes serving as Senior Vice President and then President of ConAgra Grain Companies. His career also includes lead trading positions with Ferruzzi USA and as an Operations Manager for Pillsbury Company. Mr. Anderson has a Bachelor of Arts degree with a Finance emphasis from the University of Wisconsin Platteville. Mr. Anderson is an American citizen.

Marcelo Vieira

. Mr. Vieira is the President of Sociedade Rural Brasileira, the main agricultural organization in Brazil and the Vice President of the Brazil Specialty Coffee Association. He is currently a Board Member and was from 2005 to 2014 the Director of Ethanol, Sugar & Energy operations of Adecoagro. He has managed agricultural and agribusiness company for over 40 years, including Usina Monte Alegre, Alfenas Agricola and Alfenas Café. Mr. Vieira holds a degree in Mechanical Engineering from PUC University in Rio de Janeiro and graduate degree in Food Industry Management and Marketing from the University of London’s Imperial College. Mr. Vieira is a Brazilian citizen.

Ivo Andrés Sarjanovic.

Mr. Sarjanovic served for more than 25 years in Cargill International, starting as trader in the Grain and Oilseeds business. While in Cargill he held between years 2000-2011 the position of Vice-president and Global Trading Manager of Oilseeds in Geneva, coordinating worldwide trading and crushing activities, and between 2007-2011 he was also the Africa and Middle East General Manager of Agriculture. From 2011 to 2014 Mr. Sarjanovic held the position of Vice-president and World Manager of Cargill Sugar Operations, playing a leading role in the radical transformation of the organization that led to the strategic decision to spin-off in 2014 the sugar business of Cargill creating Alvean Sugar SL, a joint venture integrated with Copersucar, Brazil. Mr. Sarjanovic served as the Chief Executive Officer of Alvean until 2017, during which time he led the company to become the biggest sugar trader in the world. Mr. Sarjanovic is currently serving as non-executive Board member of Agflow S.A. and executive Board member of

Sophicom, and also lectures at the University of Geneva’s Master in Commodities. Mr. Sarjanovic holds a B.A. in Economic Sciences, major in Accounting, from the National University of Rosario, Argentina. Additionally, he completed executive studies at IMD in Lausanne, at Oxford University and at Harvard Business School, and was a PhD candidate in Economics at New York University. Mr. Sarjanovic is an Argentine/Italian/Swiss citizen.

Investor Relations Department

Charlie Boero Hughes

CFO

Juan Ignacio Galleano

IRO

Email:

ir@adecoagro.com

Tel:

+54 (11) 4836-8624

Forward-Looking Statements

This Form 6-K contains forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth in this Form 6-K.

The registrant’s forward-looking statements are based on the registrant’s current expectations, assumptions, estimates and projections about the registrant and its industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions.

The forward-looking statements included in this Form 6-K relate to, among others: (i) the registrant’s business prospects and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies governing the registrant’s business, including limitations on ownership of farmland by foreign entities in certain jurisdictions in which the registrant operate, environmental laws and regulations; (iv) the implementation of the registrant’s business strategy; (v) the registrant’s plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of the registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the registrant’s relationships with customers; (viii) the competitive nature of the industries in which the registrant operates; (ix) the cost and availability of financing; (x) future demand for the commodities the registrant produces; (xi) international prices for commodities; (xii) the condition of the registrant’s land holdings; (xiii) the development of the logistics and infrastructure for transportation of the registrant’s products in the countries where it operates; (xiv) the performance of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions with the United States Securities and Exchange Commission.

These forward-looking statements involve various risks and uncertainties. Although the registrant believes that its expectations expressed in these forward-looking statements are reasonable, its expectations may turn out to be incorrect. The registrant’s actual results could be materially different from its expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in the attached might not occur, and the registrant’s future results and its performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in this Form 6-K relate only to events or information as of the date on which the statements are made in this Form 6-K. The registrant undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

Adecoagro S.A.

|

|

|

|

|

|

|

Date: May 14, 2018.

|

|

By:

|

/s/ Carlos Boero Hughes

|

|

|

|

Name:

|

Carlos Boero Hughes

|

|

|

|

Title:

|

Chief Financial Officer

|

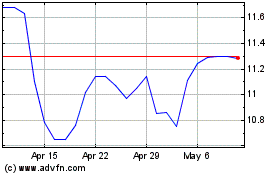

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Apr 2023 to Apr 2024