Seadrill Wins Confirmation of Chapter 11 Exit Plan

April 17 2018 - 6:19PM

Dow Jones News

By Peg Brickley

Norwegian billionaire John Fredriksen will remain in charge of

the Seadrill Ltd. international offshore fleet of heavy drilling

equipment under a chapter 11 plan confirmed Tuesday in a bankruptcy

court in Houston.

London-based Seadrill was swept into bankruptcy in September by

an overload of debt amid tough energy market conditions.

Mr. Fredriksen was the company's longtime leader and Seadrill's

largest shareholder at the time.

When the company leaves bankruptcy protection, expected sometime

in mid-July, Mr. Fredriksen will hold on to a stake in the company

and his seat on the reorganized company's board of directors, as

well as rights to appoint some other directors. Anton Dibowitz, who

stepped into the chief executive role in July, will remain CEO,

court papers say.

On Tuesday, Judge David Jones approved the turnaround plan,

which gives Seadrill more time to pay off $5.7 billion in

top-ranking bank loans, swaps $2.3 billion in bonds for equity in

the reorganized company and infuses more than $1 billion in new

cash into the business.

A large bloc of unsecured bondholders negotiated an improved

deal with Seadrill during the bankruptcy proceeding, winning the

right to participate in the capital raising effort, as well as cash

and 15% of the reorganized company.

After Seadrill entered bankruptcy with a deal that included only

Mr. Fredriksen, Centerbridge Partners as well as a handful of hedge

funds, creditors that were left out protested. Barclays Capital and

an ad hoc group of bondholders mounted rival deals for Seadrill,

triggering talks that were resolved when they were allowed to share

in the new investment opportunity.

Rank-and-file shareholders will see their stakes diluted under

the chapter 11 plan, which gives them only 2% of the equity in the

postbankruptcy company. Additionally, shareholders lose the right

to sue the company's leaders and advisers over the dealings that

slashed the value of their holdings.

Judge Jones, who confirmed Seadrill's chapter 11 plan, said

broad-ranging grants of legal immunity to leaders, lenders,

advisers and others were necessary to allow the company to focus on

"commercial success."

A lawyer for Seadrill said shareholders are "out of the money,"

meaning there isn't enough value in the company to cover the debts

and leave something for equity stakeholders.

Seadrill began addressing its financial troubles years ago,

opening talks with lenders. By the time Seadrill filed for chapter

11 bankruptcy protection, Mr. Fredriksen had come to terms with

Centerbridge and some hedge funds but didn't have sufficient

support to force the chapter 11 plan through court. Talks with

unsecured creditors followed.

The composition of the board of directors that will steer

Seadrill after bankruptcy reflects Mr. Fredriksen's continued

strong grip on the company's affairs. Including Mr. Fredriksen,

four of the seven board seats at the reorganized Seadrill will be

occupied by people linked to Hemen Holding Ltd., the Fredriksen

family holding company that owned the Seadrill stake, according to

court papers filed hours before Tuesday's court hearing in the U.S.

Bankruptcy Court in Houston.

Centerbridge has the right to appoint one member of the board of

the new Seadrill. Bondholders that are backing the plan also have

the right to name a board representative. The final member will be

named by Mr. Fredriksen, Centerbridge and allied bondholders.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

April 17, 2018 18:04 ET (22:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

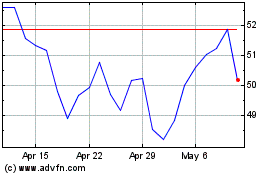

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

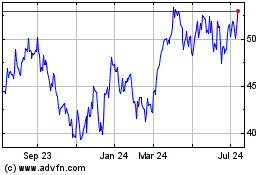

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Apr 2023 to Apr 2024