UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

|

NextDecade Corporation

|

|

(Name of Issuer)

|

|

Common Stock, par value $0.0001 per share

|

|

(Title of class of securities)

|

Halcyon Capital Management L.P.

477 Madison Avenue, 8th Floor

New York, New York 10022

212-303-9400

With copies to:

Jackie Cohen

Weil Gotshal & Manges, LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000

|

(Name, address and telephone number of person authorized to receive notices and communications)

|

|

April 11, 2018

|

|

(Date of event which requires filing of this statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Halcyon Mount Bonnell Fund LP

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION .

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

2,641,178

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

2,641,178

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

2,641,178

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

2.48%

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

HCN LP

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

3.82%

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

HCN GP LLC

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

4,076,894

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

3.82%*

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

*

Includes shares owned by HCN LP.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Halcyon Energy, Power and Infrastructure Capital Holdings LLC

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

1,743,592

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

1,743,592

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

1.64%

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

OO

|

|

|

|

|

|

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

First Series of HDML Fund I LLC

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

641,581

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

641,581

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

641,581

|

|

|

|

|

|

|

12.

|

CHECKIF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

0.60%

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

OO

|

|

|

|

|

|

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

HDML Asset LLC

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

3,282,759

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

3,282,759

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

3,282,759

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

3.08%

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

OO

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnel Fund LP and First Series of HDML Fund I LLC.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Halcyon Solutions Master Fund LP

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

432,665

†

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

432,665

†

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

432,665

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

0.41%

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Halcyon Solutions GP LLC

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS .

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

432,665*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

432,665*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

432,665*

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

0.41%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Solutions Master Fund LP

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Avinash Kripalani

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS.

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.94%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

IN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnell Fund LP, HCN LP, Halcyon Energy, Power and Infrastructure Capital Holdings LLC, First Series of I HDML Fund LLC and Halcyon Solutions Master Fund, L.P.

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Jason Dillow

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS .

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.94%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

IN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnell Fund LP, HCN LP, Halcyon Energy, Power and Infrastructure Capital Holdings LLC, First Series of HDML Fund I LLC and Halcyon Solutions Master Fund, L.P.

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Kevah Konner

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS .

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.94%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

IN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnell Fund LP, HCN LP, Halcyon Energy, Power and Infrastructure Capital Holdings LLC, First Series of HDML Fund I LLC and Halcyon Solutions Master Fund, L.P.

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

John Bader

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS .

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

9,535,910,*

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.94%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON .

|

|

|

|

IN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnell Fund LP, HCN LP, Halcyon Energy, Power and Infrastructure Capital Holdings LLC, First Series of HDML Fund I LLC and Halcyon Solutions Master Fund, L.P.

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

|

Schedule 13D

|

|

CUSIP No. 65342K105

|

|

|

|

|

|

|

|

1.

|

NAME OF REPORTING PERSON.

|

|

|

|

Halcyon Capital Management LP

|

|

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP.

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3.

|

SEC USE ONLY.

|

|

|

|

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS .

|

|

|

|

OO

|

|

|

|

|

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E).

|

|

☐

|

|

|

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION.

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER.

|

|

|

|

0

|

|

|

|

|

|

|

8.

|

SHARED VOTING POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

9.

|

SOLE DISPOSITIVE POWER.

|

|

|

|

0

|

|

|

|

|

|

|

10.

|

SHARED DISPOSITIVE POWER.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON.

|

|

|

|

9,535,910*

†

|

|

|

|

|

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.94%*

†

|

|

|

|

|

|

|

14.

|

TYPE OF REPORTING PERSON.

|

|

|

|

PN

|

|

|

|

|

|

*

Includes shares owned by Halcyon Mount Bonnell Fund LP, HCN LP, Halcyon Energy, Power and Infrastructure Capital Holdings LLC, First Series of HDML Fund I LLC and Halcyon Solutions Master Fund, L.P.

†

Includes 107,500 Shares underlying Warrants that are currently exercisable.

This Amendment No. 3 (“Amendment No. 3”) amends the Schedule 13D originally filed with the U.S. Securities and Exchange Commission (the “Commission”) on August 3, 2017, as amended (as amended, the “Statement”), and is filed by the Reporting Persons with respect to the common stock, $0.0001 par value per share (“Shares”), of NextDecade Corporation (the “Issuer”). Capitalized terms used herein but not defined shall have the meaning given to them in the Statement.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 is amended and supplemented as follows:

On April 11, 2018 (the “Backstop Agreement Date”), Halcyon Management entered into a backstop commitment agreement with the Issuer (the “Backstop Agreement”), pursuant to which Halcyon Management or its designated affiliates (as described below), agreed to purchase in the aggregate, at the Issuer’s election, up to approximately $3.845 million in, or approximately 3,845 shares of, convertible preferred stock with detached warrants (such commitment, the “Halcyon Backstop Amount”) in connection with the Issuer’s convertible preferred equity offering (“preferred offering”) previously disclosed in the Issuer’s Form 8-K filed with the SEC on April 12, 2018 (the “Backstop 8-K”).

Pursuant to the Backstop Agreement, in exchange for Halcyon Management’s commitment under the Backstop Agreement, the Issuer agreed to issue to Halcyon Management, or its designated affiliates, at the closing of the preferred offering (the “Closing”), an aggregate of 24,007 Shares if the Closing occurs within 30 days after the Backstop Agreement Date and additional Shares if the Closing occurs at a later date (as set forth in the Backstop Agreement). In addition, the Issuer agreed to issue to Halcyon Management, or its designated affiliates, an amount equal to 2.75% of the portion of the Halcyon Backstop Amount drawn on by the Issuer, which will be paid at the Closing in Shares priced at $4.8047 per share.

|

Item 5.

|

Interests in the Securities of the Issuer.

|

Item 5 is amended and supplemented as follows:

The responses set forth on rows 7 through 13 of the cover pages of this Statement, as of the date hereof, are incorporated by reference in this Item 5.

(a) and (b) The following responses are Shares (based on (i) 106,397,602 outstanding Shares as of March 1, 2018, as reported in the Issuer’s Form 10-K filed with the SEC on March 8, 2018, plus (ii) 218,534 Shares, representing the minimum aggregate number of Shares to be issued by the Issuer as backstop fees in connection with the convertible preferred offering (see Item 4) (the “Outstanding Shares”), or, where so indicated, 106,723,636 Shares (“Outstanding Shares Including Warrants”), which amount includes 107,500 warrants owned by Solutions that are currently exercisable at an exercise price of $11.50 per Share (“Warrants”).

As of the date hereof, the Reporting Persons beneficially own, in the aggregate 9,535,910 Shares including the 107,500 Warrants, which represent approximately 8.94% of the Outstanding Shares Including Warrants.

As of the date hereof, Mount Bonnell directly owns 2,641,178 Shares, which represents approximately 2.48% of the Outstanding Shares; HDML directly owns 641,581 Shares, which represents approximately 0.60% of the Outstanding Shares; HCN directly owns 4,076,894 Shares, which represents approximately 3.82% of the Outstanding Shares; HEPI directly owns 1,743,592 Shares, which represents approximately

1.64% of the Outstanding Shares

; and Solutions directly owns 325,165 Shares and 107,500 Warrants, which represent approximately 0.41% of the Outstanding Shares Including Warrants.

HDML Asset is the general partner of Mount Bonnell and HCN GP is the general partner of HCN and is the investment member of HDML. Halcyon Management is the investment manager for each of Mount Bonnell, HCN, HEPI and HDML. Investment decisions of Halcyon Management are made by a three person Halcyon Management committee, including Jason Dillow and Kevah Konner, each of whom has individual decision-making authority. John Bader is the CEO of Halcyon Management. Avinash Kripalani is a Principal at Halcyon Management.

The aggregate number and percentage of the Shares beneficially owned by each Reporting Person and, for each Reporting Person, the number of shares as to which there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition, or shared power to dispose or to direct the disposition are set forth on rows 7 through 11 and row 13 of the cover pages of this Schedule 13D.

(c) Except as set forth in this Item 3, none of the Reporting Persons has effected any transaction in the Shares in the 60 days prior to filing this Statement, except that the Share ownership amounts reported herein reflect the receipt of the Backstop Grant as set forth below:

|

Halcyon Affiliate

|

Backstop Grant Shares

|

|

HEPI

|

2,243

|

|

HDML

|

6,868

|

|

HCN

|

14,896

|

(d) To the knowledge of the Reporting Persons, no person other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities of the Issuer reported on this Statement.

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

The responses to Item 4 and Item 5 are incorporated herein by reference.

|

Item 7.

|

Material to Be Filed as Exhibits

|

Item 7 is amended and supplemented as follows:

|

10.7

|

Backstop Agreement, dated April 11, 2018, between Issuer and Reporting Person (incorporated herein by reference to the Issuer’s Current Report on Form 8-K filed with the SEC on April 12, 2018).

|

|

2*

|

Joint Filing Agreement as required by Rule 13d-1(k)(1) under the Exchange Act.

|

* Filed herewith.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: April 13, 2018

|

|

|

|

|

|

|

|

|

|

|

Halcyon Mount Bonnell Fund LP

|

|

|

|

|

|

By: Halcyon Capital Management LP, its Manager

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

|

|

HDML Asset LLC

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

HCN LP

|

|

|

By: Halcyon Capital Management LP, its Manager

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

HCN GP LLC

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

Halcyon Energy, Power and Infrastructure Capital Holdings LLC

|

|

|

By: Halcyon Capital Management LP, its Manager

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

First Series of HDML Fund I LLC

|

|

|

By: Halcyon Capital Management LP, its Manager

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

HDML Asset LLC

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

Halcyon Solutions Master Fund LP

|

|

|

By: Halcyon Solutions GP LLC, its General Partner

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

Halcyon Solutions GP LLC

|

|

|

|

|

|

|

|

/s/ Suzanne McDermott

|

|

/s/ John Freese

|

|

|

Name: Suzanne McDermott

|

|

Name: John Freese

|

|

|

Title: Chief Compliance Officer

|

|

Title: Senior Corporate Counsel

|

|

|

|

|

|

|

|

April 13, 2018

|

|

April 13, 2018

|

|

|

Date

|

|

Date

|

|

|

|

|

|

|

|

|

/s/ Avinash Kripalani

|

|

|

|

Name:

|

Avinash Kripalani

|

|

|

|

|

|

|

|

April 13, 2018

|

|

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

/s/ Jason Dillow

|

|

|

|

Name:

|

Jason Dillow

|

|

|

|

|

|

|

|

|

April 13, 2018

|

|

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

/s/ Kevah Konner

|

|

|

|

Name

|

Kevah Konner

|

|

|

|

|

|

|

|

|

April 13, 2018

|

|

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

/s/ John Bader

|

|

|

|

Name:

|

John Bader

|

|

|

|

|

|

|

|

|

April 13, 2018

|

|

|

|

Date

|

|

|

Exhibit Index

|

1

|

Backstop Agreement, dated April 11, 2018, between Issuer and Reporting Person (incorporated herein by reference to the Issuer’s Current Report on Form 8-K filed with the SEC on April 12, 2018).

|

|

|

Joint Filing Agreement as required by Rule 13d-1(k)(1) under the Exchange Act.

|

* Filed herewith.

20

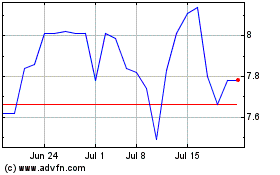

NextDecade (NASDAQ:NEXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextDecade (NASDAQ:NEXT)

Historical Stock Chart

From Apr 2023 to Apr 2024