Additional Proxy Soliciting Materials (definitive) (defa14a)

March 22 2018 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

|

|

|

|

|

Filed by the Registrant

þ

|

|

Filed by a Party other than the Registrant

¨

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

þ

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under Rule 14a-12

|

|

|

|

|

|

|

|

|

THE E.W. SCRIPPS COMPANY

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

þ

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

|

Filing Party:

|

|

(4)

|

|

Date Filed:

|

On March 22, 2018, the following communication was sent to certain employees of The E.W. Scripps Company (“Scripps”) and the same or substantially similar communications may in the future be sent to Scripps employees from time to time:

FAQs

|

|

|

|

•

|

Who is the activist shareholder and what does it want?

|

The principal shareholder’s name is Mario Gabelli, chairman and chief executive officer of GAMCO Investors, Inc. (together with certain of his and its affiliates, “GAMCO”). GAMCO has not articulated a consistent or compelling reason for mounting this ‘proxy fight’ or contested board campaign or expressed specific dissatisfaction with company strategy.

|

|

|

|

•

|

Has our leadership team spoken to GAMCO about our strategy?

|

Yes, the CEO and others have spoken with GAMCO periodically about company strategy and performance.

|

|

|

|

•

|

How many shares does GAMCO hold compared to the Scripps family?

|

Scripps is a public company with two classes of stock: Common voting shares that are generally owned by the Scripps family and Class A shares that are held by public shareholders, including employees, and some Scripps family members. After the Scripps family, who collectively own approximately 17.5 percent of the outstanding Class A shares, GAMCO is our biggest Class A shareholder, collectively owning approximately 16.5 percent of the outstanding Class A shares.

|

|

|

|

•

|

How many people make up our board? Who gets to vote on them?

|

For the 2018 board, we will have 10 directors. Seven of the directors are voted on by the holders of common voting shares (which are generally held by the Scripps family). Three directors are voted on by Class A shareholders. GAMCO has nominated a slate of three director nominees in opposition to the three directors that the board has nominated for the Class A shareholders’ vote. Any shareholder of record as of the close of business on March 16, 2018, will receive a proxy statement and other solicitation materials. The Scripps board of directors is encouraging all shareholders to vote for Lauren R. Fine, Roger L. Ogden and Kim Williams, which means voting the WHITE proxy card that they receive.

|

|

|

|

•

|

When does the vote take place?

|

The vote will take place at our annual shareholder meeting on May 10, 2018.

|

|

|

|

•

|

Will employees be asked to vote?

|

Employees who are shareholders have one vote per share and we hope they will vote.

|

|

|

|

•

|

Can some of GAMCO’s board candidates and some of ours be voted to the board?

|

Yes, the three candidates with the most votes in favor of their election will be elected.

Forward-Looking Statements

Certain statements in this communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature and which may be identified by the use of words like “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, are forward-looking statements. These forward-looking statements are based on management's current expectations, and are subject to certain risks, trends and uncertainties, including changes in advertising demand and other economic conditions that could cause actual results to differ materially from the expectations expressed in such forward-looking statements. Such forward-looking statements are made as of the date of this communication and should be evaluated with the understanding of their inherent uncertainty. A detailed discussion of principal risks and uncertainties which may cause actual results and events to differ materially from such forward-looking statements is included in the Company’s Form 10-K on file with the SEC in the section titled “Risk Factors”. The Company undertakes no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date the statement is made.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A and form of associated WHITE proxy card with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2018 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). The Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2018 Annual Meeting. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Definitive Proxy Statement. Details concerning the nominees of the Company’s Board of Directors for election at the 2018 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC,

INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING WHITE PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at http://www.scripps.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

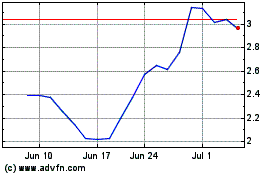

EW Scripps (NASDAQ:SSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

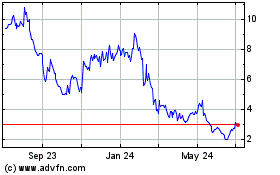

EW Scripps (NASDAQ:SSP)

Historical Stock Chart

From Apr 2023 to Apr 2024