UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

|

|

|

|

|

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

|

Filed by the Registrant [X]

|

|

Filed by a Party other than the Registrant [ ]

|

|

Check the appropriate box:

|

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to §240.14a-12

|

STERLING CONSTRUCTION COMPANY, INC

.

(Name of Registrant as Specified In Its Charter)

______________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

|

[

X

]

|

|

No fee required.

|

|

[ ]

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

1

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4

|

|

Proposed aggregate value of transaction:

|

|

|

|

5

|

|

Total fee paid:

|

|

[ ]

|

|

Fee paid previously with preliminary materials.

|

|

[ ]

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

1

|

|

Amount previously paid:

|

|

|

|

2

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3

|

|

Filing Party:

|

|

|

|

4

|

|

Date Filed:

|

____________________

Notice of Annual Meeting

of Stockholders

May 2, 2018

____________________

Date:

Wednesday, May 2, 2018

Time:

8:30 a.m., local time

|

|

|

|

|

|

Place:

|

1800 Hughes Landing Boulevard

Suite 250

The Woodlands, Texas 77380

|

Purpose:

• To elect the seven director nominees named in the accompanying proxy statement;

|

|

|

|

•

|

To approve, on an advisory basis, the compensation of our named executive officers;

|

|

|

|

|

•

|

To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for

2018

;

|

|

|

|

|

•

|

To adopt the

2018

stock incentive plan; and

|

|

|

|

|

•

|

To transact such other business as may properly come before the annual meeting.

|

|

|

|

|

Record Date:

|

Only stockholders of record as of the close of business on

March 13, 2018

are entitled to notice of and to attend or vote at the annual meeting.

|

|

|

|

|

Proxy Voting:

|

It is important that your shares be represented at the annual meeting whether or not you are personally able to attend. Accordingly, after reading the accompanying proxy statement, please promptly submit your proxy and voting instructions via internet or mail as described on the proxy card.

|

By Order of the Board of Directors.

Richard E. Chandler, Jr.

Executive Vice President,

General Counsel & Secretary

March 20, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

May 2, 2018

.

This proxy statement and the company’s

2017

annual report to stockholders are available at

http://www.astproxyportal/com/ast/04770

Table of Contents

|

|

|

|

|

|

|

Page

|

|

Proxy Summary

|

|

|

2018 Annual Meeting of Stockholders

|

|

|

Agenda and Voting Recommendations

|

|

|

Director Highlights

|

|

|

2017 Performance Highlights

|

|

|

Executive Compensation Highlights

|

|

|

Corporate Governance Highlights

|

|

|

Corporate Governance

|

|

|

Board Governance Guidelines; Ethics and Business Conduct Policy

|

|

|

Board Composition and Leadership Structure

|

|

|

Board and Committee Meeting Attendance

|

|

|

Board Committees

|

|

|

Audit Committee

|

|

|

Compensation Committee

|

|

|

Corporate Governance and Nominating Committee

|

|

|

Special Committee

|

|

|

Board and Committee Independence; Financial Experts

|

|

|

Compensation Committee Procedures

|

|

|

Compensation Committee Interlocks and Insider Participation

|

|

|

Board Evaluation Process

|

|

|

Board’s Role in Oversight of Risk Management

|

|

|

Director and Executive Officer Stock Ownership Guidelines

|

|

|

Consideration of Director Nominees

|

|

|

Communications with the Board

|

|

|

Director Compensation

|

|

|

Cash Compensation

|

|

|

Equity-Based Compensation

|

|

|

2017 Director Compensation

|

|

|

Proposal No. 1: Election of Directors

|

|

|

Information about Nominees

|

|

|

Stock Ownership of Directors, Director Nominees and Executive Officers

|

|

|

Stock Ownership of Certain Beneficial Owners

|

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

|

|

Executive Officer Compensation

|

|

|

Compensation Discussion and Analysis

|

|

|

Compensation Committee Report

|

|

|

Executive Compensation Tables

|

|

|

2017 Summary Compensation Table

|

|

|

Grants of Plan-Based Awards in 2017

|

|

|

|

|

|

|

|

Outstanding Equity Awards at December 31, 2017

|

|

|

2017 Stock Vested

|

|

|

Potential Payments upon Termination or Change in Control

|

|

|

Pay Ratio

|

|

|

Proposal No. 2: Advisory Vote on the Compensation of Our Named Executive Officers

|

|

|

Audit Committee Report

|

|

|

Appointment of Independent Registered Public Accounting Firm; Financial Statement

Review

|

|

|

Independent Registered Public Accounting Firm

|

|

|

Fees and Related Disclosures for Accounting Services

|

|

|

Pre-Approval Policies and Procedures

|

|

|

Proposal No. 3: Ratification of the Appointment of Our Independent Registered Public Accounting Firm

|

|

|

Proposal No. 4: Adoption of the 2018 Stock Incentive Plan

|

|

|

Certain Transactions

|

|

|

Questions and Answers about the Proxy Materials, Annual Meeting and Voting

|

|

|

2019 Stockholder Proposals

|

|

|

|

|

|

Annex A: 2018 Stock Incentive Plan

|

A-1

|

Sterling Construction Company, Inc.

1800 Hughes Landing Boulevard

Suite 250

The Woodlands, Texas 77380

Proxy Summary

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. For more information regarding our 2017 financial and operational performance, please review our 2017 annual report to stockholders (2017 annual report). The 2017 annual report, including financial statements, is first being made available to stockholders together with this proxy statement and form of proxy on or about March 20, 2018.

2018 Annual Meeting of Stockholders

Time and Date:

8:30 a.m., local time, Wednesday, May 2, 2018

|

|

|

|

|

|

Place:

|

1800 Hughes Landing Boulevard

Suite 250

The Woodlands, Texas 77380

|

Record Date:

March 13, 2018

Voting:

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to

one vote for each director position and one vote for each of the other proposals to be voted on at the annual meeting.

Agenda and Voting Recommendations

|

|

|

|

|

|

|

|

|

|

|

Item

|

|

Description

|

|

Board Vote Recommendation

|

|

Page

|

|

1

|

|

Election of seven director nominees

|

|

FOR each nominee

|

|

|

|

2

|

|

Advisory vote to approve the compensation of our named executive officers

|

|

FOR

|

|

|

|

3

|

|

Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2018

|

|

FOR

|

|

|

|

4

|

|

Adoption of the 2018 stock incentive plan

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Director Since

|

|

Principal Occupation

|

|

Independent

|

|

Board

Committees

|

|

Joseph A. Cutillo

|

|

52

|

|

2017

|

|

Chief Executive Officer of Sterling Construction Company, Inc.

|

|

No

|

|

None

|

|

Marian M. Davenport

|

|

64

|

|

2014

|

|

Executive Director of Genesys Works – Houston

|

|

Yes

|

|

Compensation

Corporate Governance and Nominating*

|

|

Maarten D. Hemsley

|

|

68

|

|

1998

|

|

Founder, Chairman and President of New England Center for Arts & Technology, Inc.

|

|

Yes

|

|

Audit

Corporate Governance and Nominating

|

|

Raymond F. Messer

|

|

70

|

|

2017

|

|

Chairman Emeritus of Walter P Moore

|

|

Yes

|

|

Audit

Compensation

|

|

Charles R. Patton

|

|

58

|

|

2013

|

|

Executive Vice President — External Affairs American Electric Power Company, Inc.

|

|

Yes

|

|

Compensation

|

|

Richard O. Schaum

|

|

71

|

|

2010

|

|

General Manager, 3rd Horizon Associates LLC

|

|

Yes

|

|

Audit

Compensation*

|

|

Milton L. Scott**

|

|

61

|

|

2005

|

|

Chairman and Chief Executive Officer of the Tagos Group, LLC

|

|

Yes

|

|

Audit*

Corporate Governance and Nominating

|

|

|

|

|

|

|

|

|

|

|

|

|

* Committee Chairman

** Board Chairman

|

|

|

|

|

|

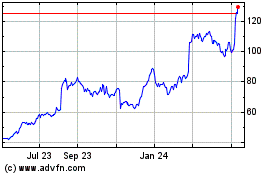

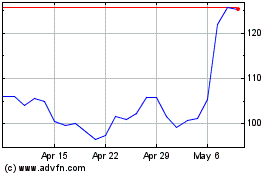

2017 Performance Highlights

|

(page 22)

|

|

|

|

|

•

|

Revenues increased

38.8%

, from

$690.1 million

in

2016

to

$958.0 million

in

2017

|

|

|

|

|

•

|

Operating income

for

2017

was

$26.2 million

, compared to an operating loss of

$4.7 million

in

2016

|

|

|

|

|

•

|

Gross margins increased

by

52.5%

, from

6.1%

in

2016

to

9.3%

in

2017

|

|

|

|

|

•

|

Stock price growth of

92%, from $8.46 per share at year end

2016

to $16.28 per share at year end

2017

|

|

|

|

|

•

|

Diluted net earnings per share

attributable to common stockholders for

2017

was

$0.43

, compared to a net loss per share of

$0.40

for

2016

|

|

|

|

|

•

|

Completed the

transformative acquisition

of Tealstone Residential Concrete, Inc. and Tealstone Commercial, Inc.

|

|

|

|

|

•

|

Secured

new $85 million credit facility

|

|

|

|

|

•

|

Relisted

on the Russell 3000

|

|

|

|

|

|

|

Executive Compensation Highlights

|

|

|

|

|

|

•

|

Awards under our annual incentive program are based on

achievement of performance metrics

.

|

|

|

|

|

•

|

Annual awards tied to continued service

, as 50% of annual incentive awards are paid in shares of restricted stock units vesting over three years.

|

|

|

|

|

•

|

Clawback policy

applicable to incentive awards.

|

|

|

|

|

•

|

Anti-hedging and anti-pledging policies

applicable to our executive officers.

|

|

|

|

|

•

|

Retention of an

independent compensation consultant

as necessary.

|

|

|

|

|

•

|

Stock ownership guidelines

applicable to executive officers.

|

|

|

|

|

•

|

No excise tax gross-ups

.

|

|

|

|

|

|

|

Corporate Governance Highlights

|

|

We are committed to strong and effective governance practices that promote and protect the interests of our stockholders. Our commitment to good corporate governance is illustrated by the following practices:

•

Board independence

(all of our non-employee director nominees are independent, which is 6 out

of our 7 director nominees).

•

100% independent

audit, compensation, and corporate governance and nominating committees.

•

The roles of Chairman and Chief Executive Officer are

separate

.

•

Directors

elected annually

.

•

Directors in an uncontested election are elected by a

majority vote

.

•

No stockholders rights plan (poison pill).

•

Stock ownership guidelines

for directors and executive officers.

•

Annual performance evaluations

of the board overseen by the corporate governance and

nominating committee.

•

Independent directors regularly meet in

executive sessions without management present

.

•

Robust

board governance guidelines

and

code of business conduct

.

•

Continued focus on

board diversity

.

Corporate Governance

Board Governance Guidelines; Ethics and Business Conduct Policy

We are committed to strong and effective governance practices that promote and protect the interests of our stockholders. Our board governance guidelines, along with the charters of the standing committees of our board, provide the framework for the governance of the company and reflect the board’s commitment to monitor the effectiveness of policy and decision making at both the board and management levels. Our board governance guidelines and our code of business conduct are available at

www.strlco.com

under Investor Relations–Corporate Governance. Both are available in print to any stockholder who requests a copy. Amendments to or waivers of our code of business conduct granted to any of our directors or executive officers will be published promptly on our website. Such information will remain on our website for at least 12 months.

Board Composition and Leadership Structure

Our board has the primary responsibility of oversight of the management of our business and affairs. Our board of directors consists of seven members, six of whom have been determined by our board to be independent, specifically Ms. Davenport and Messrs. Hemsley, Messer, Patton, Schaum and Scott. Mr. Cutillo, our chief executive officer, is our only non-independent director. Our board of directors recognizes the importance of having a strong independent board leadership structure to ensure accountability and to provide effective oversight of management.

Milton L. Scott serves as our chairman of the board of directors with responsibilities that include: (1) presiding at meetings of the board and executive sessions of its independent directors; (2) presiding at the annual meeting of stockholders; (2) serving as a liaison between the independent directors and senior management; and (3) approving the agendas for board meetings. The board of directors believes that the separation of the roles of chairman and chief executive officer, as required by our board governance guidelines, continues to be the appropriate leadership structure for the company at this time. The board believes this structure provides an effective balance between strong company leadership and appropriate safeguards and oversight by independent directors.

Board and Committee Meeting Attendance

Our board of directors held a total of nine meetings during

2017

. During

2017

, each director participated in 75% or more of the total number of meetings of our board and meetings of each committee on which such director served. Messrs. Cutillo and Messer did not join our board of directors until April of

2017

.

We expect our directors to attend the annual meetings of our stockholders. Our company policy is to schedule a regular meeting of the board of directors on the same day as the annual meeting of stockholders so that directors can attend the annual meeting without the company incurring the extra travel and related expenses of a separate meeting. All of our directors attended our

2017

annual meeting of stockholders.

Board Committees

To provide for effective direction and management of our business, our board has established three standing committees: an audit committee, a compensation committee and a corporate governance and nominating committee. Each of the audit, compensation and corporate governance and nominating committees are composed entirely of independent directors. Each committee operates under a written charter adopted by our board. All of the committee charters are available on our website at

www.strlco.com

under Investor Relations–Corporate Governance and are available in print upon request. The following table identifies the current committee members.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

*

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

Corporate Governance and Nominating Committee

|

|

Marian M. Davenport

|

|

—

|

|

X

|

|

Chair

|

|

Maarten D. Hemsley

|

|

X

|

|

—

|

|

X

|

|

Raymond F. Messer

|

|

X

|

|

X

|

|

—

|

|

Charles R. Patton

|

|

—

|

|

X

|

|

—

|

|

Richard O. Schaum

|

|

X

|

|

Chair

|

|

—

|

|

Milton L. Scott

|

|

Chair

|

|

—

|

|

X

|

* As a non-independent director, Mr. Cutillo does not serve as a member of any committee of the board, all of which are composed entirely of independent directors.

Audit Committee.

The audit committee assists the board in fulfilling its oversight responsibilities related to (1) the effectiveness of the company’s internal control over financial reporting; (2) the integrity of the company’s financial statements; (3) the qualifications and independence of the company’s independent registered public accounting firm; (4) the evaluation of the performance of the company’s independent registered public accounting firm; and (5) the review and approval or ratification of any transaction that would require disclosure under Item 404(a) of Regulation S-K of the Securities Exchange Act of 1934 (the Exchange Act). Please refer to the “Audit Committee Report” included in this proxy statement for more information. The audit committee held six meetings in

2017

.

Compensation Committee.

The compensation committee assists the board in fulfilling its oversight responsibilities by (1) discharging the board’s responsibilities relating to the compensation of our executive officers, and (2) administering our cash-based and equity-based incentive compensation plans. Please refer to “Compensation Committee Procedures” included in this proxy statement for more information. The compensation committee held ten meetings in

2017

.

Corporate Governance and Nominating Committee.

The corporate governance and nominating committee assists the board in fulfilling its oversight responsibilities by (1) identifying, considering and recommending to the board qualified candidates for directorship; (2) monitoring the composition of the board and its committees and making recommendations to the board on the membership of the committees; (3) maintaining our board governance guidelines and recommending to the board any desirable changes; (4) evaluating the effectiveness of the board and its committees; (5) with input from the chair of our compensation committee, determining the compensation of our directors; and (6) addressing any related matters required by the federal securities laws or the NASDAQ Stock Market (NASDAQ). The corporate governance and nominating committee held six meetings in

2017

.

Special Committee.

During

2017

, the board of directors authorized a special committee of independent directors, comprised of Ms. Davenport and Messrs. Hemsley, Patton, Schaum and Scott, with the power and authority to oversee the company’s efforts to evaluate potential strategic alternatives, including the acquisition of Tealstone and related financing. As previously disclosed, on March 8, 2017, we entered into a stock purchase agreement with the sellers named therein to acquire 100% of the outstanding stock of Tealstone Residential Concrete, Inc. and Tealstone Commercial, Inc. (collectively, Tealstone) for cash, shares of our common stock and promissory notes. The company completed its acquisition of Tealstone on April 3, 2017. The special committee held two meetings in

2017

.

Board and Committee Independence; Financial Experts

On the basis of information solicited from each director, and upon the advice and recommendation of the corporate governance and nominating committee, our board of directors has determined that Ms. Davenport and Messrs. Hemsley, Messer, Patton, Schaum and Scott each have no material relationship with the company and are independent as defined in the director independence standards of NASDAQ listing standards, as currently in effect. In making these determinations, our board, with assistance from the company’s legal counsel, evaluated responses to a questionnaire completed annually by each director

regarding relationships and possible conflicts of interest between each director, the company and management. In its review of director independence, our board and legal counsel considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the company or management.

Our board of directors has determined that each of the members of the audit, compensation and corporate governance and nominating committees has no material relationship with the company and satisfies the independence criteria (including the enhanced criteria with respect to members of the audit and compensation committees) set forth in the applicable NASDAQ listing standards and SEC rules. In addition, our board of directors has determined that each of Messrs. Hemsley and Scott qualifies as an “audit committee financial expert,” as such term is defined by the rules of the SEC.

Compensation Committee Procedures

The compensation committee has the sole authority to set annual compensation amounts and annual incentive plan criteria for our executive officers, evaluate the performance of our executive officers, and make awards to our executive officers under our incentive plans and programs. The compensation committee also has authority to approve any plan or arrangement, including employment agreements, providing for incentive, severance, retirement, change-in-control or other compensation to our executive officers. The compensation committee oversees our assessment of whether our compensation policies and practices are likely to expose the company to material risks.

In exercising its authority and carrying out its responsibilities, the compensation committee meets to discuss the structure of executive compensation, proposed employment agreements, salaries, cash and equity incentive awards, and the achievement and the setting of financial and individual performance goals on which executive incentive compensation is based, using information circulated in advance of the meeting by the chair of the compensation committee. The compensation committee may delegate any of its responsibilities to one or more members of the committee, except to the extent such delegation is prohibited by law or the listing standards of NASDAQ. When the compensation committee discusses an executive officer's compensation, he or she is not permitted to be present.

The compensation committee engaged an independent executive compensation consultant to advise the compensation committee on matters related to executive compensation. Please refer to the section titled “Executive Officer Compensation—Compensation Discussion and Analysis” for more information related to the independent executive compensation consultant.

Compensation Committee Interlocks and Insider Participation

During

2017

, Ms. Davenport and Messrs. Messer, Schaum and Patton served as members of our compensation committee. None of the members of the compensation committee is or has been an executive officer of our company. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, an executive officer of which served as one of our directors or as a member of our compensation committee during

2017

.

Board Evaluation Process

The corporate governance and nominating committee is responsible for overseeing the annual performance evaluation of the board. Annually, each director completes an evaluation of the full board and each committee upon which the director serves, which is intended to provide each director with an opportunity to evaluate performance for the purpose of improving board and committee processes and effectiveness. The detailed questionnaire seeks quantitative ratings and subjective comments in key areas of board practices, and asks each director to evaluate how well the board or the committee, as applicable, operates and to make suggestions for improvements. Replies are anonymous and are collected and summarized by the chair of the corporate governance and nominating committee. The summary is then discussed by the independent directors in an executive session held for such purpose. In addition, the chair of the corporate governance and nominating committee conducts one-on-one interviews with each director to solicit additional feedback on the overall operation of the board and its committees, as well as specific feedback on the effectiveness of individual directors. The board chair or the chair of the corporate governance and nominating committee

discusses the individual feedback with each board member. Any areas of board or committee performance that are identified as needing improvement or change are considered by the corporate governance and nominating committee, which then makes a recommendation to the board on the matter.

Board’s Role in Oversight of Risk Management

Our board of directors as a whole is responsible for risk oversight, with reviews of certain areas being conducted by the relevant board committees that report to the full board. In its risk oversight role, our board of directors reviews, evaluates and discusses with appropriate members of management whether the risk management processes designed and implemented by management are adequate in identifying, assessing, managing and mitigating material risks facing the company. Throughout the year, the board of directors receives briefings and assessments of the company's risks as they relate to:

Our board believes that full and open communication between executive management and our board is essential to effective risk oversight. Our chairman meets regularly with executive management to discuss a variety of matters including business strategies, opportunities, key challenges and risks facing the company, as well as risk mitigation strategies. Executive management attends all regularly scheduled board meetings where they make presentations to our board on various strategic matters involving our operations and are available to address any questions or concerns raised by our board on risk management or any other matters. Our board of directors oversees the strategic direction of the company, and in doing so considers the potential rewards and risks of the company’s business opportunities and challenges, and monitors the development and management of risks that impact our strategic goals.

Each standing committee of the board of directors assists the board in fulfilling its risk oversight responsibility with respect to the following:

|

|

|

|

|

|

|

|

|

Audit Committee

|

|

Compensation Committee

|

|

Corporate Governance and Nominating Committee

|

|

•

Financial liquidity

|

|

•

Executive compensation

|

|

•

Board organization

|

|

•

Covenant compliance

•

Financial reporting

|

|

•

Incentive compensation

(cash and equity)

|

|

•

Board membership

•

Board self-evaluations

|

|

•

Independent registered public accounting firm

•

Internal controls

|

|

|

|

•

Board governance

|

|

•

Related-party transactions

|

|

|

|

|

The audit committee assists our board in fulfilling its oversight responsibilities with respect to certain areas of risk. The audit committee is responsible for reviewing and discussing with management and our independent registered public accounting firm any guidelines and policies relating to risk assessment and risk management, and the measures management has taken to monitor, control and minimize the company’s major financial risk exposures. The audit committee also discusses with our independent registered public accounting firm the results of their processes to assess risk in the context of its audit engagement. The audit committee also assists our board in fulfilling its oversight responsibilities by monitoring the effectiveness of the company’s internal control over financial reporting and legal and regulatory compliance. Our independent registered public accounting firm meets regularly in executive session with the audit committee. The audit committee regularly reports on these matters to the full board. Finally, in furtherance of its risk oversight responsibility, the audit committee provides for the confidential, anonymous submission by employees and others of concerns regarding questionable accounting, auditing and any other matters. These submissions are collected by an independent organization specializing in those services, and are conveyed to the chair of the audit committee, our chief compliance officer, and our general counsel.

The compensation committee assists our board in fulfilling its oversight responsibilities with respect to the company’s assessment of whether its compensation policies and practices are likely to expose the company to material risks, including the company’s compensation of executives and incentive compensation awarded to officers. Also, in consultation with management, the compensation committee is responsible for overseeing the company’s compliance with regulations governing executive compensation.

The corporate governance and nominating committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks associated with our board leadership structure, including committee appointments, size of board and nomination of board members, and corporate governance matters. The corporate governance and nominating committee addresses some of its risk oversight responsibilities by identifying and recommending for nomination well-qualified independent directors, periodically reviewing of our board governance guidelines, and conducting annual board self-evaluations and individual director evaluations (through the chair of the committee).

Director and Executive Officer Stock Ownership Guidelines

In January 2018, our board of directors revised the stock ownership guidelines applicable to our non-employee directors and our executive officers. The board of directors believes that it is in the best interests of the company and its stockholders that directors and executive officers have a meaningful proprietary stake in the company so that their interests are aligned with the interests of stockholders. The stock ownership guidelines are administered by the corporate governance and nominating committee.

Under our stock ownership guidelines, (i) each non-employee director is expected to acquire and maintain ownership of our common stock valued at five times his or her annual cash retainer, which is currently $50,000, (ii) our chief executive officer is expected to acquire and maintain ownership of our common stock valued at five times his or her base salary, and (iii) each of our other executive officers is expected to acquire and maintain ownership of our common stock valued at three times his or her base salary. The value of the shares is based on the greater of the then current market price or the grant date fair value. Shares of our common stock owned individually or jointly, shares held by members of the director or executive’s immediate family or by a trust for the director or executive or his or her immediate family, as well as shares subject to unvested restricted stock and restricted stock units are counted for purposes of the stock ownership guidelines.

As of

March 13, 2018

, all of our current non-employee directors except Mr. Messer exceeded their target ownership levels. Under the stock ownership guidelines, directors have five years from the date of appointment or election to comply with the stock ownership guidelines. Mr. Messer, who was first elected to the board at the 2017 annual meeting, is required to reach his stock ownership target within five years from the date of election and, thus, is currently in compliance with the guidelines. Our executive officers have five years from the date of their respective appointments (or from January 17, 2018, the date upon which the guidelines were revised, whichever is later) to attain their required ownership levels. All of our executive officers have all been in their respective positions with the company for less than three years, so each has until January 17, 2023 to reach his target ownership level and, thus, each of our executive officers is currently in compliance with the guidelines.

Consideration of Director Nominees

In evaluating nominees for membership on our board of directors, the corporate governance and nominating committee has not specified any minimum qualifications for serving on the board, but seeks to achieve a board that is composed of individuals who have experience that is relevant to the needs of the company, who have a high level of professional and personal integrity, who have the ability and willingness to work cooperatively with other members of our board and with senior management, and who contribute to the cognitive diversity of the board taking into account many factors, including business experience, public sector experience, professional training, public and private offices held, geographical representation, race, gender and age, among other considerations. Experience in the construction industry and in one or more of engineering, transportation, finance and accounting, corporate governance, senior management, and public sector matters are considered particularly valuable. An independent director candidate is expected to be committed to enhancing stockholder value, and to have sufficient time to carry out the duties of a director,

both on the full board and on one or more of its standing committees. In selecting nominees, the corporate governance and nominating committee will seek to have a board of directors that represents a diverse range of perspectives and experience relevant to the company. The corporate governance and nominating committee will also evaluate each individual in the context of our board as a whole, with the objective of recommending nominees who can best perpetuate the success of the business, be an effective director in conjunction with the full board, and represent stockholder interests through the exercise of sound judgment using his or her diversity of experience in these various areas. In determining whether to recommend a director for re-election, the corporate governance and nominating committee will also consider the director’s age, tenure, past attendance at meetings and participation in and contributions to the activities of our board.

The corporate governance and nominating committee will regularly assess whether the size of our board is appropriate, and whether any vacancies on our board are expected due to retirement or otherwise. In addition, the corporate governance and nominating committee periodically assesses the experience, qualifications, attributes and skills of the independent directors to determine if there are gaps that the board should seek to fill. In the event that vacancies are anticipated, or otherwise arise, the corporate governance and nominating committee will consider various potential candidates, who may come to the corporate governance and nominating committee’s attention through professional search firms, stockholders or other persons. Alternatively, the corporate governance and nominating committee may recommend a reduction in the size of the board. Each candidate brought to the attention of the corporate governance and nominating committee, regardless of who recommended such candidate, will be considered on the basis of the criteria set forth above.

The corporate governance and nominating committee will consider candidates proposed for nomination by our stockholders. Stockholders may propose candidates for consideration by the corporate governance and nominating committee by submitting the names and supporting information to: c/o Corporate Secretary, Sterling Construction Company, Inc., 1800 Hughes Landing Blvd. — Suite 250, The Woodlands, Texas 77380.

In addition, our bylaws permit stockholders to nominate candidates for consideration at next year’s annual stockholder meeting. Any nomination must be in writing and received by our corporate secretary at our principal executive offices no later than February 1,

2019

. If the date of next year’s annual meeting is moved to a date more than 30 days before or 90 days after the anniversary of this year’s annual meeting, the nomination must be received no later than 90 days prior to the date of the

2019

annual meeting or 10 days following the public announcement of the date of the

2019

annual meeting. Any stockholder submitting a nomination under our bylaws must comply with the requirement provided in the bylaws including providing: (a) all information relating to the nominee that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such nominee’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected); and (b) the name and address (as they appear on the company’s books) of the nominating stockholder and the class and number of shares beneficially owned by such stockholder.

Communications with the Board

Stockholders or other interested parties may communicate directly with one or more members of our board, or the non-employee directors as a group, by writing to the director or directors at the following address: c/o Corporate Secretary, Sterling Construction Company, Inc., 1800 Hughes Landing Blvd. — Suite 250, The Woodlands, Texas 77380; or by e-mail to the corporate secretary at: Reports@Lighthouse-Services.com. The communication will be forwarded to the appropriate director or directors, unless it is frivolous. If the communication is voluminous, the corporate secretary will summarize it and furnish a summary to the appropriate director or directors.

Director Compensation

In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required to be an effective member of our board. We also seek to align the directors’ compensation with our stockholders’ interest by delivering a substantial portion of that compensation in the form of equity-based compensation. The corporate governance and nominating committee reviews the form and amount of director compensation and, with the advice of the chair of the compensation committee, makes recommendations to the full board. We use a combination of cash and equity-based incentive compensation to compensate our non-employee directors, as described below.

Cash Compensation

Effective May 1, 2017, each non-employee director receives an annual fee paid monthly consisting of, as applicable:

|

|

|

|

•

|

$50,000 for serving on our board (including the chairman of the board of directors), increased from $30,000;

|

|

|

|

|

•

|

$25,000 for serving as chair of the audit committee (including if performed by the chairman of the board of directors);

|

|

|

|

|

•

|

$15,000 for serving as chair of the compensation committee (unless performed by the chairman of the board of directors);

|

|

|

|

|

•

|

$10,000 for serving as chair of the corporate governance and nominating committee (unless performed by the chairman of the board of directors); and

|

|

|

|

|

•

|

$100,000 for serving as chairman of the board of directors.

|

Also, each director receives reimbursement for reasonable out of pocket expenses incurred in attending board and committee meetings, as well as investor conferences and education programs attended at the request of the company.

In addition to the annual director fees, each non-employee-director (other than the chairman) receives a fee of $1,500 for attending each board meeting in person, and a fee for attending any committee meeting (of which he or she is a member) in person:

|

|

|

|

•

|

$1,000 per audit committee meeting (in connection with a board meeting) or $1,500 per audit committee meeting (not in connection with a board meeting); and

|

|

|

|

|

•

|

$500 per compensation or corporate governance and nominating committee meeting (in connection with a board meeting) or $750 per compensation or corporate governance and nominating committee meeting (not in connection with a board meeting).

|

For participation at a board or committee meeting by telephone, each non-employee director (other than the chairman) instead receives $500 (if less than an hour) or $750 (if over an hour) per meeting attended by telephone. In connection with their service on the special committee of the board in 2017, Ms. Davenport and each of Messrs. Hemsley, Patton, Schaum and Scott received additional fees in the amount of $1,500.

Equity-Based Compensation

Each non-employee director also receives equity-based compensation under our stockholder-approved stock incentive plan consisting of annual grants of restricted stock. Each year on the day of annual meeting of stockholders, each non-employee director is awarded shares of restricted stock with an aggregate grant date value of $50,000. The restricted stock vests the day prior to the following year’s annual meeting of stockholders, with potential accelerated vesting in the event that the non-employee director dies or becomes

permanently disabled, or in the event there is a qualifying change of control of the company. The restricted stock is forfeited if prior to vesting, the director ceases to be a director for any other reason.

2017

Director Compensation

The table below summarizes the total compensation paid to or earned by our non-employee directors during

2017

. The amount included in the “Stock Awards” column reflects the aggregate grant date fair value of the restricted stock, and does not necessarily reflect the income that will ultimately be realized by the director for these stock awards. Mr. Cutillo did not receive any compensation for his service on our board of directors, and Mr. Varello did not begin receiving compensation for service on our board of directors until April 28, 2017, when he ceased serving as an officer of the company. The compensation paid to Messrs. Cutillo and Varello, including compensation received in Mr. Varello’s capacity as a director, during 2017 is reflected in the "2017 Summary Compensation" table on page

29

.

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Fees Earned or Paid in Cash

|

|

Stock Awards

(1)

|

|

Total

|

|

Marian M. Davenport

|

|

$72,083

|

|

$49,994

|

|

$122,077

|

|

Maarten D. Hemsley

|

|

$70,167

|

|

$49,994

|

|

$120,161

|

|

Raymond F. Messer

(2)

|

|

$43,833

|

|

$49,994

|

|

$93,827

|

|

Charles R. Patton

|

|

$56,583

|

|

$49,994

|

|

$106,577

|

|

Richard O. Schaum

|

|

$79,083

|

|

$49,994

|

|

$129,077

|

|

Milton L. Scott

|

|

$168,333

|

|

$49,994

|

|

$218,327

|

_____________________

|

|

|

|

(1)

|

Amounts reflect the aggregate grant date fair value of the restricted stock, which is valued on the date of grant at the closing sale price per share of our common stock in accordance with Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 718, disregarding the effect of forfeitures. On April 28, 2017, each non-employee director was granted 5,257 shares of restricted stock, which had a grant date fair value of $9.51 per share. As of

December 31, 2017

, each non-employee director had 5,257 shares of restricted stock outstanding.

|

|

|

|

|

(2)

|

Mr. Messer was first elected as a director at the 2017 annual meeting, and was appointed to the audit and compensation committees on April 28, 2017.

|

_____________________

Proposal No. 1: Election of Directors

In accordance with our bylaws, effective as of the annual meeting, our board of directors has fixed the current number of directors at seven. Upon recommendation of our corporate governance and nominating committee, our board of directors has nominated Joseph A. Cutillo, Marian M. Davenport, Maarten D. Hemsley, Raymond F. Messer, Charles R. Patton, Richard O. Schaum and Milton L. Scott to serve as our directors, each until the next annual meeting and election of their successor. All of the nominees are current directors. Each nominee has consented to being named as a nominee in this proxy statement and to serve as a director if elected. The persons named as proxies intend to vote your shares of our common stock for the election of each of the director nominees, unless otherwise directed. If, contrary to our present expectations, any of the nominees is unable to serve, the proxy holders may vote for a substitute nominee. The board has no reason to believe that any of the nominees will be unable to serve.

Our board and the corporate governance and nominating committee are considering the expansion of our board and are in the process of identifying qualified candidates with highly additive skills and relevant experience to maximize the Board’s effectiveness. We believe that nominating a director to serve the company is a significant undertaking that requires a thoughtful and diligent process, both in the identification of a pool of potential candidates and in determining which specific candidate will best serve the company. Although this process was not completed in time to nominate a new director at the annual meeting, we hope to select a candidate soon, and will follow the election procedures set forth in our bylaws. In selecting a nominee to serve as a member of our board, the corporate governance and nominating committee will adhere to the principles outlined in our board governance guidelines and will be mindful of the Board’s desire to increase Board diversity. See “Consideration of Director Nominees” for more information.

Vote Required to Elect Director Nominees

Under our bylaws, in an uncontested election, our directors are elected by a majority of the votes cast. In contested elections where the number of nominees exceeds the number of directors to be elected, directors are elected by a plurality vote, with the director nominees who receive the most votes being elected.

As a condition to nomination for election or reelection to the Board, each incumbent director or director nominee submits to the board in advance of the annual meeting an executed irrevocable letter of resignation that is deemed tendered if the director fails to receive the votes required for election or reelection. Such resignation shall only be effective upon acceptance by the board of directors, which effective time may be deferred until a replacement director is identified and appointed to the board.

If an incumbent director fails to achieve a majority of the votes cast in an uncontested election, the corporate governance and nominating committee will make a recommendation to the board of directors on whether to accept or reject the resignation, or whether other action should be taken. The board of directors will act promptly on the corporate governance and nominating committee's recommendation, considering all factors that the Board of Directors believes to be relevant, and will publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. For more information on the voting requirements, see “Questions and Answers about the Proxy Materials, Annual Meeting and Voting.”

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR

EACH OF THE SEVEN DIRECTOR NOMINEES.

Information about Nominees and Continuing Directors

The table below provides certain information as of

March 13, 2018

, with respect to the director nominees. The biography of each of the directors contains information regarding the person’s business experience, director positions with other public companies held currently or at any time during the last five years, and the experiences, qualifications, attributes and skills that caused our board to determine that the person should be nominated to serve as a director of the company. Unless otherwise indicated, each person has been engaged in the principal occupation shown for the past five years.

The table below shows certain information about the nominees.

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

|

|

|

|

|

|

|

|

Joseph A. Cutillo

|

|

52

|

|

Mr. Cutillo has served as the Chief Executive Officer of the company since 2017. He joined the company in October 2015 as Vice President, Strategy & Business Development. In May 2016, he was promoted to Executive Vice President and Chief Business Development Officer. In February 2017, he was promoted to President of the company and in April 2017 he was promoted to Chief Executive Officer. Prior to joining the company, Mr. Cutillo was President and Chief Executive Officer of Inland Pipe Rehabilitation LLC, a $200 million private equity-backed trenchless pipe rehabilitation company, from August 2008 to October 2015.

Experience, Qualifications, Attributes & Skills.

Mr. Cutillo brings to the board his thirty years of managerial experience and a deep understanding of emerging opportunities in heavy civil construction, industrial, and water infrastructure markets. In addition, Mr. Cutillo’s knowledge and understanding of the Company’s operational strategy and organizational structure, together with his operational and leadership experience at various levels of management contribute to the breadth and depth of the board’s deliberations. Mr. Cutillo holds a Bachelor of Science in Mechanical Engineering from Northeastern University.

|

|

2017

|

|

|

|

|

|

|

|

|

Chief Executive Officer of Sterling Construction Company, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marian M. Davenport

(

Independent)

|

|

64

|

|

Ms. Davenport has served on the Board of Directors and as Executive Director of Genesys Works - Houston, a nationally-recognized nonprofit organization that trains and employs high school seniors from underserved communities to work as professionals in major corporations, since April 2013. Ms. Davenport was associated with Big Brothers Big Sisters, a non-profit organization that provides one-to-one mentoring for children from September 2004 to April 2013. During this period, she held various positions in its affiliated organizations, including serving as President & Chief Executive Officer of Big Brothers Big Sisters of Greater Houston from September 2004 to June 2010, and Senior Vice President, Operations and Capacity Building of Big Brothers Big Sisters Lone Star from June 2010 to March 2013. Ms. Davenport was employed by Dynegy Inc., a publicly-traded company in the business of power distribution, marketing and trading of gas, power and other commodities, midstream services and electric distribution from April 1997 to December 2013. She joined Dynegy as General Counsel, Commercial Development and rose to the position of Senior Vice President, Legislative and Regulatory Affairs.

|

|

2014

|

|

|

|

|

|

|

|

|

Executive Director, Genesys Works - Houston

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

Ms. Davenport (cont.)

Committees:

Corporate Governance and Nominating (

Chair

)

Compensation

|

|

|

|

Experience, Qualifications, Attributes & Skills.

Ms. Davenport brings to the board her background as a lawyer, with experience in corporate governance and securities compliance, having served as general counsel of a public company. Ms. Davenport gained extensive leadership and managerial experience as an executive in the energy industry while employed with Dynegy, where she managed the development of large natural gas-fired power plants and played a pivotal role in improving the performance of critical company functions, including human resources. Ms. Davenport's more recent career in the non-profit sector providing mentoring and workforce development opportunities for disadvantaged youth brings a new perspective and expertise to the Company, which operates in an industry where finding competent candidates for employment at all levels is more and more competitive. In sum, Ms. Davenport's extensive background in both the for-profit and non-profit sectors brings cognitive diversity to the board and the committees on which she serves. Ms. Davenport holds a Bachelor of Arts degree, Liberal Arts and Sciences, from The Colorado College, of Colorado Springs, Colorado, and a Juris Doctorate from the University of Denver, College of Law, in Denver, Colorado. Ms. Davenport is a member of the Texas State Bar.

|

|

|

|

|

|

|

|

|

|

|

|

Maarten D. Hemsley

(

Independent

)

|

|

68

|

|

Mr. Hemsley founded New England Center for Arts & Technology, Inc. (NECAT), a career-directed educational non-profit serving resource-limited adults in Boston, Massachusetts, in 2010 and currently serves as its Chairman and President. Prior to founding NECAT, he served as the Company's President and Chief Operating Officer from 1988 until 2001, and its Chief Financial Officer from 1998 until 2007. From 2001 until retiring in March 2012, Mr. Hemsley was engaged by Harwood Capital LLP (Harwood) (formerly JO Hambro Capital Management Limited), an investment management company based in the United Kingdom. During that period, Mr. Hemsley served as a Fund Manager, Senior Fund Manager and Senior Advisor to several investment funds managed by Harwood.

Other Directorships.

From 2003 until February 2016, Mr. Hemsley was a director of Sevcon, Inc., a public company (during his term) that manufactures electronic controls for electric vehicles and other equipment. He has also served on the boards of a number of privately-held companies in the United Kingdom.

Experience, Qualifications, Attributes & Skills.

Mr. Hemsley has extensive financial experience and managerial skills gained over many years managing investment funds, serving the Company, including nine years as Chief Financial Officer and thirteen years as President, and serving as the chief financial officer of several medium-sized public and private companies in a variety of business sectors in the U.S. and Europe. His knowledge of the Company, derived from more than twenty-five years of service, as well as his analytical skills honed as a fund manager responsible for making investment decisions and overseeing the management of a wide range of portfolio companies, enable him to contribute to the board's oversight of the Company's business, its financial risks, its executive compensation arrangements, the risks inherent in its acquisition program and in post-acquisition integration issues. Mr. Hemsley is a Fellow of the Institute of Chartered Accountants in England and Wales.

|

|

1998

|

|

|

|

|

|

|

|

|

Founder, Chairman and President of New England Center for Arts & Technology, Inc.

Committees:

Audit

Corporate Governance and Nominating

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

|

|

|

|

|

|

|

|

Raymond F. Messer

(

Independent

)

|

|

70

|

|

Mr. Messer is Chairman Emeritus of Walter P Moore, a private international company that provides structural, diagnostic, civil, traffic, parking, transportation, water resources and Intelligent Transportation Systems (ITS) engineering services. Mr. Messer served as the Director of Design-Build and Senior Principal of from January 2015 until his retirement in June 2017. Mr. Messer served as President and Chief Executive Officer of Walter P Moore from July 1993 until January 2015, when he implemented the company’s leadership transition plan and assumed the position of Director of Design-Build, both to remain available for consultation with his successor and to establish a better presence for the firm in the design-build construction market. Mr. Messer joined Walter P. Moore in November 1981 as the Director of Pre-stressed Concrete Design. In February 1984, he was named the Manager of Walter P Moore’s Tampa, Florida office, and held that position until assuming the role of President and Chief Executive Officer. Mr. Messer served on Walter P Moore's board of directors from April 1986, until April 2015, and served as chairman of the board from June 1998 to April 2015 Prior to joining Walter P Moore, Mr. Messer served in various roles of increasing responsibility at Exxon Research and Engineering, HNTB Corporation, Bechtel Corporation, and VSL International Ltd.

Other Directorships

. Mr. Messer serves on the board of Kennedy/Jenks Consultants, a private environmental and water resources engineering company, where he chairs the nominating and compensation committees. He also serves on the board of Braun Intertec, a private materials testing and geotechnical engineering firm, where he serves on the compensation/human resources and nominating committees. He serves on the boards of not-for-profits Texas Higher Education Foundation, Stages Theatre, Genesys Works. He has also served on the national executive committee of the American Council of Engineering Companies.

Experience, Qualifications, Attributes & Skills

. In addition to his engineering degrees, Mr. Messer brings to the board over 40 years of practical experience in engineering design, project management and construction, all matters that relate directly to the Company's construction businesses. During his tenure as President and Chief Executive Officer of Walter P. Moore, he acquired leadership, managerial and corporate governance skills that contribute to the board’s industry-specific expertise and ability to fulfill its responsibilities. In addition, the variety of his private and not-for-profit board experience enables him to bring to the Company valuable strategic insights into board matters generally. Mr. Messer is a Licensed Professional Engineer in Texas, Florida and New York. He holds a Bachelor of Arts in Mathematics from Carroll College, Helena Montana and a Bachelor of Science in Civil Engineering and a Master of Science in Engineering Mechanics from Columbia University.

|

|

2017

|

|

|

|

|

|

|

|

|

Chairman Emeritus, Walter P Moore

Committees:

Audit

Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

|

|

|

|

|

|

|

|

Charles R. Patton

(

Independent

)

|

|

58

|

|

Mr. Patton has served as the Executive Vice President, External Affairs, of American Electric Power Company, Inc. (AEP) one of the largest electric utilities in the U.S., serving nearly 5.4 million customers in 11 states, since January 2017. In this role, Mr. Patton is responsible for leading AEP's customer services, regulatory, communications, federal public policy and corporate sustainability initiatives. Mr. Patton served as President and Chief Operating Officer of Appalachian Power Company, an electric utility serving approximately one million customers in West Virginia, Virginia and Tennessee from June 2010 until January 2017, As President and Chief Operating Officer of Appalachian Power Company, a unit of AEP, Mr. Patton was responsible for distribution operations and a wide range of customer and regulatory relationships. From June 2008 to June 2010, Mr. Patton served as Senior Vice President of Regulatory Policy before transitioning to the role of Executive Vice President of AEP's Western Utilities where he was responsible for oversight of utilities in Texas, Louisiana, Arkansas and Oklahoma. From May 2004 to June 2008, Mr. Patton held various executive positions with AEP, including the position of President and Chief Operating Officer of AEP Texas, where he was responsible for external affairs in Texas and in the Southwestern region of AEP. Before joining AEP in December 1995, Mr. Patton spent nearly 11 years in the energy and telecommunications business with Houston Lighting & Power Company.

Other Directorships.

Mr. Patton served as a director of the Richmond Federal Reserve Bank from January 2014 through 2016.

Experience, Qualifications, Attributes & Skills.

Mr. Patton brings to the board his extensive experience in the utilities industry considerable high-level management experience, both of which benefit the board in its deliberations by bringing a different perspective than any other director. Mr. Patton received a bachelor’s degree (cum

laude)

from Bowdoin College in Brunswick, Maine, and a master’s degree from the LBJ School of Public Policy at the University of Texas in Austin.

|

|

2013

|

|

|

|

|

|

|

|

|

Executive Vice President - External Affairs American Electric Power Company, Inc.

Committee:

Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

Richard O. Schaum

(

Independent

)

|

|

71

|

|

Mr. Schaum has served as the General Manager of 3rd Horizon Associates LLC, a technology assessment and development company since May 2003. From October 2003 until June 2005, he was also Vice President and General Manager of Vehicle Systems for WaveCrest Laboratories, Inc., where he led the company’s vehicle systems development group. Prior to that, Mr. Schaum spent more than thirty years with DaimlerChrysler Corporation, and its predecessor, Chrysler Corporation, where he served as Executive Vice President, Product Development from January 2000 until his retirement in March 2003.

Other Directorships.

Mr. Schaum is currently a director of BorgWarner Inc., a publicly-traded company that manufactures and sells technologies for automotive propulsion systems, and Gentex Corporation, a publicly-traded company that manufactures and sells automotive electro-chromic dimming mirrors, windows, camera-based driver assist systems, and commercial fire protection products.

Experience, Qualifications, Attributes & Skills.

Mr. Schaum brings to the board his extensive executive and management experience at all levels in a Fortune 100 company, and knowledge of, and interest in, corporate governance matters, gained while on the board of a Fortune 500 company. In addition, his technical background and his operating experience at all levels of management contribute to the breadth and depth of the board's deliberations. Mr. Schaum is a fellow of the Society of Automotive Engineers and served as its President from 2007 to 2008. He earned a B.S. in Mechanical Engineering from Drexel University and an M.S. in Mechanical Engineering from the University of Michigan.

|

|

2010

|

|

|

|

|

|

|

|

|

General Manager, 3rd Horizon Associates LLC

Committees:

Audit

Compensation (Chair)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Milton L. Scott

(

Independent

)

Chairman of the Board of Directors of Sterling Construction Company, Inc.

|

|

61

|

|

Mr. Scott has served as the Chairman and Chief Executive Officer of the Tagos Group, LLC (Tagos), which holds an investment in cement technology and provides expertise in Supply Chain Advisory Services and Anti-Corrosion Technology, since April 2007. From October 2012 to November 2013, Mr. Scott was also the Chairman and Chief Executive Officer of CorrLine International, LLC (CorrLine), a private company that manufactured CorrX, a surface decontamination product that treats and destroys the primary cause of premature coating failures. CorrLine was placed into involuntary Chapter 7 bankruptcy in August 2014, and in October 2014, Tagos purchased the assets of CorrLine and placed them in a subsidiary of Tagos, TGS Solutions, LLC, of which Mr. Scott is Chairman and Chief Executive Officer. Mr. Scott was previously associated with Complete Energy Holdings, LLC, a company of which he was Managing Director until January 2006, and which he co-founded in January 2004 to acquire, own and operate power generation assets in the United States. From March 2003 to January 2004, Mr. Scott was a Managing Director of The StoneCap Group, an entity formed to acquire, own and operate power generation assets. From October 1999 to November 2002, Mr. Scott served as Executive Vice President and Chief Administrative Officer at Dynegy Inc., a public company in the business of power distribution, marketing and trading of gas, power and other commodities, midstream services and electric distribution. From July 1977 to October 1999,

|

|

2005

|

|

|

|

|

|

|

|

|

Chairman and Chief Executive Officer of the Tagos Group, LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Principal Occupation, Business Experience and

Other Public Company Directorships

|

|

Director Since

|

|

Mr. Scott (cont.)

Committees:

Audit (Chair)

Corporate Governance and Nominating

|

|

|

|

Mr. Scott was a partner with the Houston office of Arthur Andersen LLP, a public accounting firm, where from 1996 to 1999, he served as partner in charge of the Southwest Region Technology and Communications practice. Mr. Scott was elected chairman of the Company’s board of directors in March 2015.

Other Directorships.

Mr. Scott is Chairman and Chief Executive Officer of TGS Solutions, LLC, a private company that manufactures Corrx, a surface decontamination product that treats and destroys the primary cause of premature coating failures. He is also Chairman of Inea International, Ltd. (Inea), a private company that through its wholly-owned subsidiary, VHSC Cement, LLC, has developed a technology that enables the creation of a product that competes with Portland Cement. Tagos has an equity investment in Inea

.

Past Directorships.

Mr. Scott was lead director of W-H Energy Services, Inc. (then a publicly-traded company in the oilfield services industry) from October 2000 until the company was sold in August 2008.

Experience, Qualifications, Attributes & Skills.

Mr. Scott

brings to the board his

many years of experience as an audit partner at a large public accounting firm as well as leadership, managerial and corporate governance skills acquired during his tenure as a senior executive at a Fortune 500 company, and entrepreneurial skills developed through the founding of several companies in the energy service and technology sectors. He has also served as a chief executive officer of private companies and as the lead director at a public company. Mr. Scott's background and experience enable him to bring to the board and its deliberations a broad range and combination of valuable insights as well as leadership skills, particularly in his role as chairman of the board. Mr. Scott holds a Bachelor of Science in Accounting from Southern University.

|

|

|

Stock Ownership of Directors, Director Nominees and Executive Officers

We believe that it is important for our directors and executive officers to align their interests with the long-term interests of our stockholders. We encourage stock accumulation through the grant of equity incentives to our directors and executive officers and through our stock ownership guidelines applicable to our directors and executive officers.

The table below shows the amount of our common stock beneficially owned as of the record date,

March 13, 2018

, by each of our director nominees, our named executive officers and our current directors and executive officers as a group. Unless otherwise indicated, all shares shown are held with sole voting and investment power.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Number of Shares Not Subject to Unvested Awards

|

|

Number of Unvested Shares of Restricted Stock

(1)

|

|

Total Number of Shares Beneficially Owned

|

|

Percent of Outstanding Shares

(2)

|

|

Marian M. Davenport

|

|

30,186

|

|

|

5,257

|

|

|

35,443

|

|

|

|

*

|

|

Maarten D. Hemsley

|

|

175,969

|

|

|

5,257

|

|

|

181,226

|

|

|

|

*

|

|

Raymond F. Messer

|

|

—

|

|

|

5,257

|

|

|

5,257

|

|

|

|

*